Juice Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431337 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Juice Product Market Size

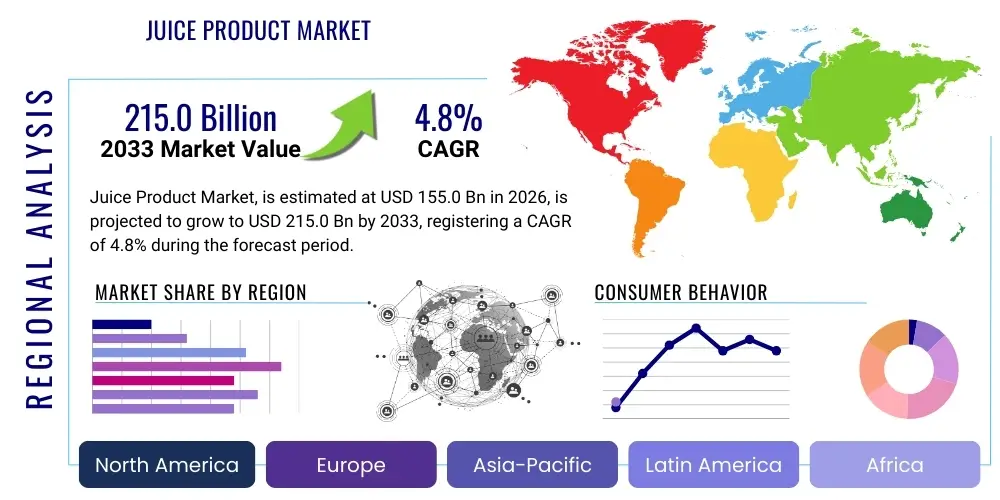

The Juice Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 155.0 Billion in 2026 and is projected to reach USD 215.0 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by evolving consumer preferences toward health-focused and naturally derived beverages, particularly in emerging economies where disposable income and awareness of nutrition are increasing.

Market expansion is also heavily influenced by innovation within product categories, such as the rise of cold-pressed juices, functional juices fortified with vitamins and probiotics, and the sustained demand for 100% natural fruit extracts without added sugars or artificial sweeteners. Manufacturers are focusing on extending shelf life while preserving nutritional integrity, leveraging advanced processing technologies like High-Pressure Processing (HPP) to meet the premium consumer segment's stringent quality expectations.

Juice Product Market introduction

The Juice Product Market encompasses all commercially available liquid extracts derived from fruits and vegetables, ranging from 100% pure juice to nectars, concentrates, and juice drinks that often contain added ingredients such as water, sweeteners, and preservatives. These products serve as a significant source of vitamins, minerals, and antioxidants, appealing to consumers seeking convenient nutritional intake and refreshment. Major applications span daily consumption, dietary supplementation, ingredient use in cocktails and smoothies, and specialized health and wellness programs. Key benefits include improved hydration, immune support, and essential nutrient delivery.

Driving factors for the market include a global surge in health consciousness, particularly post-pandemic, leading consumers to seek immune-boosting beverages. Furthermore, rapid urbanization and busy lifestyles increase the demand for ready-to-drink (RTD) and convenient refreshment options. Product innovation, focusing on exotic flavors, vegetable blends, and low-sugar formulations, is continuously revitalizing the market, attracting younger demographics and sustaining mature markets. The transition away from carbonated soft drinks further accelerates the shift towards perceived healthier alternatives like natural fruit juices.

However, the industry faces ongoing challenges related to sustainability, sourcing ethics, and the public perception of sugar content. Companies are actively responding by investing in sustainable farming practices, implementing transparent labeling, and reformulating products to minimize naturally occurring sugars, often substituting them with natural, low-glycemic alternatives or leveraging intense sweetness from ingredients like stevia. This balance between nutritional optimization and appealing flavor profiles defines the competitive landscape.

Juice Product Market Executive Summary

The Juice Product Market is characterized by robust business trends centered on health and sustainability, driving significant investment in premium and functional segments. Key business trends include aggressive mergers and acquisitions aimed at integrating innovative cold-chain technologies and expanding organic sourcing capabilities. Furthermore, digitalization is enhancing supply chain traceability, allowing consumers to verify product origins and ethical production practices, which directly influences purchasing decisions, particularly among Gen Z and millennial consumers who prioritize corporate social responsibility.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive population growth, expanding middle-class income, and increasing Western influence on dietary habits. North America and Europe remain mature but highly innovative markets, focusing heavily on 'no added sugar' claims and advanced fortifications. The segment trends highlight a clear divergence: while low-cost, ambient juice drinks still hold volume share, the highest value growth is concentrated in the chilled, 100% fruit or vegetable juice segment, reflecting a willingness among affluent consumers to pay a premium for perceived superior quality and freshness.

Looking forward, market participants are positioning themselves for long-term resilience by diversifying beyond traditional fruit juices into botanical extracts and plant-based milk blends, effectively blurring the lines between beverage categories. The focus on transparency, specifically regarding ingredient sourcing and processing methods, is no longer a differentiator but a fundamental requirement for maintaining consumer trust and ensuring compliance with increasingly stringent global food safety and labeling regulations. This strategic shift towards holistic wellness offerings secures future market relevance.

AI Impact Analysis on Juice Product Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning can enhance flavor profiling, predict consumer demand swings, and optimize agricultural yields in the volatile juice supply chain. Key concerns revolve around AI's role in ensuring ingredient traceability from farm to bottle and mitigating risks associated with climate change impacting fruit harvests. The consensus expectation is that AI will revolutionize operational efficiency, moving the industry towards predictive quality control and hyper-personalized product development. Specifically, users are keen to understand how AI-driven analysis of social media sentiment and purchasing patterns can inform the rapid deployment of new, targeted flavor combinations, thereby minimizing product failure rates in a highly competitive retail environment.

- AI-driven Predictive Analytics: Optimizing fruit harvesting schedules and yield forecasts based on environmental data and historical performance, reducing waste and ensuring consistent raw material supply.

- Flavor Formulation Optimization: Utilizing machine learning algorithms to analyze sensory panel data and consumer preferences to create precise flavor profiles and natural sugar reduction strategies.

- Supply Chain Traceability: Implementing AI-powered blockchain solutions to provide real-time, immutable tracking of ingredients, ensuring authenticity and ethical sourcing claims.

- Automated Quality Control: Employing computer vision and AI systems on production lines to detect defects, contaminants, or deviations in color and consistency faster and more reliably than human inspectors.

- Demand Forecasting: Enhancing accuracy in inventory management and production planning by integrating complex variables like weather, promotional activities, and regional consumption trends.

- Personalized Nutrition Recommendations: Developing AI interfaces that recommend specific juice formulations based on individual user biometric data and stated health goals.

DRO & Impact Forces Of Juice Product Market

The dynamics of the Juice Product Market are fundamentally shaped by a confluence of driving factors, restrictive pressures, and nascent opportunities, all interacting to form powerful impact forces. Key drivers include escalating consumer demand for natural and functional beverages that support immunity and holistic wellness, fueled by heightened public health awareness. Opportunities lie primarily in the premiumization trend, specifically the market acceptance of high-cost, cold-pressed, organic, and limited-edition seasonal juices, which offer superior profit margins and cater to niche health demands. However, these positive forces are constrained by significant restraints, namely regulatory scrutiny over sugar content, which necessitates constant reformulation, and the persistent volatility in global fruit commodity prices, driven by climate variability and geopolitical factors.

Impact forces dictate the strategic priorities for market players. The force of buyer power is high, as consumers have vast alternatives, demanding transparent labeling and verifiable health claims, thus compelling manufacturers to invest heavily in brand trust and sustainable sourcing. Supplier power is also significant, particularly for specialized, high-quality organic fruits, leading to vertical integration strategies or long-term contractual agreements to secure supply. Competitive rivalry is fierce, intensified by cross-category entrants like specialized functional water and ready-to-drink tea manufacturers, forcing juice companies to aggressively innovate both in product and packaging design to maintain shelf prominence and consumer engagement.

The overarching impact force remains regulatory pressure regarding health mandates. As governments globally impose taxes or strict advertising restrictions on high-sugar beverages, the emphasis shifts entirely to 100% vegetable juices, blended low-glycemic options, and innovative formulations utilizing non-nutritive natural sweeteners. Successfully navigating this regulatory landscape while maintaining palatability is crucial. Consequently, companies that leverage technological advancements in processing to preserve nutritional integrity without relying on artificial additives are best positioned to capitalize on emerging opportunities.

Segmentation Analysis

The Juice Product Market is extensively segmented across multiple dimensions, allowing manufacturers to precisely target diverse consumer groups based on sourcing, product formulation, physical form, and preferred purchasing channels. Understanding these segments is critical for developing effective market penetration strategies and optimizing product portfolios. The core differentiators today center around the naturalness of ingredients—specifically the distinction between 100% pure juice, which generally commands the highest price point due to its perceived health benefits, and juice drinks that offer flavor variety and lower cost, often at the expense of higher sugar or additive content. Geographic segmentation remains vital, with specific flavor preferences (e.g., tropical fruits in APAC, traditional citrus in North America) dictating local product mixes.

The Form segment, distinguishing between Chilled, Ambient (Shelf-Stable), and Frozen, reflects key supply chain decisions and consumer convenience needs. Chilled juices appeal to freshness seekers willing to pay more and purchase frequently, while ambient products dominate large-scale distribution networks and bulk purchasing due to their extended shelf life. The fastest growth, however, is observed in the functional sub-segments, particularly cold-pressed juices that offer perceived minimal nutrient loss, despite the high associated logistical costs for chilled distribution. This premium tier is driving innovation in packaging design and preservation technology to ensure quality maintenance throughout the supply chain.

Furthermore, segmentation by Distribution Channel highlights the ongoing shift towards digital purchasing. While supermarkets and hypermarkets remain the primary volume drivers, online retail is demonstrating exponential growth, particularly for niche, high-value functional juice subscriptions and bulk orders. Foodservice channels, including cafes and restaurants, offer a vital platform for brand visibility and immediate consumption, often showcasing premium, freshly prepared options that influence broader retail trends. Strategic focus across all channels involves tailored packaging sizes and promotional strategies optimized for the unique purchasing behavior of each channel.

- Source:

- Fruits (Citrus, Berries, Tropical, Orchard Fruits)

- Vegetables (Carrot, Beetroot, Greens, Tomato)

- Blends (Fruit and Vegetable Combinations, Functional Blends)

- Product Type:

- 100% Juice

- Nectars (Contains 25-99% juice content)

- Juice Drinks (Less than 25% juice content, often sweetened)

- Concentrates (Frozen and Ambient)

- Form:

- Chilled (Refrigerated)

- Ambient/Shelf-Stable (Aseptic Packaging)

- Frozen (Concentrates and Ready-to-Blend Smoothies)

- Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Foodservice/HoReCa (Hotels, Restaurants, Cafes)

Value Chain Analysis For Juice Product Market

The value chain for the Juice Product Market begins with intricate upstream activities, dominated by raw material sourcing, which includes fruit and vegetable cultivation, procurement, and initial processing into pulp or concentrates. This stage is characterized by high volatility, dependent on agricultural yields, climatic conditions, and logistical complexity. Key upstream considerations involve implementing sustainable farming practices, securing fair trade certifications, and ensuring stringent quality control measures right at the farm gate to maximize the nutrient density and purity of the primary ingredients. Strategic partnerships with local farming cooperatives are crucial for large manufacturers to stabilize pricing and ensure consistent, high-quality input.

The middle segment of the value chain involves manufacturing, encompassing blending, pasteurization (or HPP), fortification, and packaging. Advanced technology deployment, such as aseptic processing and cold-chain management, is vital here to minimize degradation, extend shelf life, and comply with safety standards. Downstream analysis focuses on distribution and retailing. Due to the perishable nature of many premium juice products, especially chilled variants, efficient cold-chain logistics networks are paramount. The distribution channel is complex, involving direct sales to large retailers (indirect) and direct sales via proprietary online platforms or company-owned physical stores (direct).

Direct distribution often provides higher control over branding and customer experience, particularly for high-end, personalized subscription services. Conversely, the indirect channel, leveraging massive global and regional retail partnerships (supermarkets, hypermarkets), handles the majority of the market volume. Successful companies integrate these elements by investing in real-time inventory tracking and demand forecasting across both direct and indirect channels to minimize spoilage, enhance product availability, and optimize pricing strategies based on regional consumer demand fluctuations.

Juice Product Market Potential Customers

The primary target market for juice products includes a broad spectrum of consumers, yet specific potential customers are delineated by health priorities, lifestyle, and willingness to pay. Health-conscious Millennials and Gen Z are crucial end-users, seeking functional benefits such as immune support, digestive health, and energy boosts from high-quality, cold-pressed vegetable and fruit blends. These consumers prioritize transparency, organic certifications, and sustainable packaging, often opting for premium, specialized brands over mass-market offerings. Their purchasing decisions are heavily influenced by digital content and influencer recommendations, making online engagement essential for brand success.

Another significant customer segment comprises families with young children, focusing on 100% fruit juices as a nutrient-rich, convenient alternative to water or sugary sodas. For this demographic, packaging convenience (e.g., single-serve boxes) and affordability are key determinants, although rising concerns about childhood obesity are increasingly shifting demand towards diluted options and natural fruit nectars with lower sugar profiles. Furthermore, the athletic and fitness community represents a high-growth segment, utilizing juices for post-workout recovery, electrolyte replenishment, and immediate carbohydrate loading, often preferring functional blends fortified with proteins or specialized botanical extracts.

Finally, elderly populations represent a stable consumer base, relying on juices for essential vitamin intake and easy consumption, particularly in regions with established traditions of morning juice consumption. Market strategies targeting this group often focus on easily digestible ingredients, fortification with calcium and Vitamin D, and clear health claims related to bone and cognitive health. Companies are increasingly tailoring products—from premium, organic single-source juices to economical, shelf-stable options—to meet the distinct nutritional needs and purchase motivations across these diverse end-user demographics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Billion |

| Market Forecast in 2033 | USD 215.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coca-Cola (Minute Maid, Simply), PepsiCo (Tropicana, Naked), Keurig Dr Pepper (Mott's), Nestlé, Danone, Hain Celestial Group, Ocean Spray Cranberries, Del Monte Foods, Welch's, Suntory Holdings, Döhler Group, Citrus World, B Natural, Patanjali Ayurved, Raue GmbH, Bolthouse Farms, Suja Life. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Juice Product Market Key Technology Landscape

The technological landscape of the Juice Product Market is undergoing rapid transformation, moving beyond conventional thermal pasteurization towards preservation methods that minimize heat exposure and maximize nutrient retention. High-Pressure Processing (HPP) stands as a paramount technology, leveraging extreme hydrostatic pressure to inactivate pathogens and extend shelf life without compromising the fresh flavor, color, or vitamin content of the juice. HPP is critical for the premium chilled juice segment, allowing for 'clean label' products devoid of chemical preservatives, thereby aligning perfectly with consumer demand for minimally processed, natural foods. The widespread adoption of HPP requires significant capital investment in specialized equipment and robust cold chain infrastructure, creating a competitive barrier to entry for smaller manufacturers.

Another crucial technological area is aseptic processing and packaging, which enables the production of shelf-stable (ambient) juices while maintaining superior quality compared to traditional canning or hot-fill methods. Aseptic technology sterilizes the product and package separately before filling in a sterile environment, resulting in ambient products that retain better flavor and color over long periods, facilitating global export and distribution in regions lacking comprehensive cold chain infrastructure. Simultaneously, advanced separation and filtration techniques, such as microfiltration and reverse osmosis, are being increasingly utilized to adjust Brix levels, reduce natural sugar content without artificial sweeteners, and manage the concentration of specific components like pulp or sediment, offering manufacturers greater control over the final product specification.

Furthermore, technology integration extends heavily into smart manufacturing and sustainability. The deployment of Internet of Things (IoT) sensors throughout the supply chain facilitates real-time monitoring of temperature, humidity, and inventory levels, which is crucial for perishable chilled goods. Moreover, research into biodegradable and plant-based packaging materials is a significant technological focus. Companies are actively investing in recycling infrastructure and bio-plastics derived from renewable sources, responding to both consumer pressure and regulatory requirements aimed at reducing the industry's environmental footprint and enhancing the circular economy of packaging materials.

Regional Highlights

The market exhibits distinct growth patterns influenced by regional economic development, consumer traditions, and regulatory environments.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC is driven by rapid urbanization, increasing disposable incomes, and the adoption of convenient ready-to-drink beverages. Countries like China, India, and Indonesia show immense potential, with high demand for tropical fruit flavors and, increasingly, functional juices targeting immunity and digestion. Market players are focusing on expanding their distribution reach in tier-two and tier-three cities.

- North America: This region is characterized by high maturity and strong segmentation, with fierce competition focused on premiumization. The market here is highly sensitive to health trends, witnessing a strong decline in high-sugar nectars and a significant surge in demand for organic, cold-pressed, 100% vegetable juices, and fortified blends aimed at specific health outcomes. Regulatory pressures regarding sugar labeling are highest here.

- Europe: Europe maintains a strong focus on sustainability and ethical sourcing. Western European countries exhibit high consumption rates, favoring locally sourced fruits and stringent standards for organic certification. The market is defined by innovation in low-calorie and low-glycemic index products, driven by proactive health legislation and high consumer awareness regarding diet and wellness.

- Latin America (LATAM): Abundant natural resources provide a strong base for local production, particularly of citrus and tropical fruit juices. The market is primarily driven by affordability and availability of 100% juices, though economic volatility remains a challenge. Brazil and Mexico are leading consumers, showing emerging trends towards functional and packaged vegetable juices.

- Middle East and Africa (MEA): Growth is steady, fueled by increasing expatriate populations and high dependence on imported high-quality brands. Consumption patterns are shifting towards healthier options, especially in the GCC countries, with strong demand for exotic blends and premium packaged goods, necessitating robust and efficient distribution networks to handle extreme temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Juice Product Market.- Coca-Cola Company (Minute Maid, Simply)

- PepsiCo, Inc. (Tropicana, Naked Juice)

- Keurig Dr Pepper (Mott's)

- Nestlé S.A.

- Danone S.A.

- Hain Celestial Group

- Ocean Spray Cranberries, Inc.

- Del Monte Foods, Inc.

- Welch's

- Suntory Holdings Limited

- Döhler Group

- Citrus World, Inc.

- B Natural (ITC Limited)

- Patanjali Ayurved Ltd.

- Raue GmbH

- Bolthouse Farms (Campbell Soup Company)

- Suja Life, LLC

- Califia Farms, LLC

- V8 (Campbell Soup Company)

- Fresh Del Monte Produce Inc.

Frequently Asked Questions

Analyze common user questions about the Juice Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the premium juice market?

Growth in the premium juice market is driven by increasing consumer health awareness, preference for functional beverages, and the demand for clean-label products such as cold-pressed juices and organic blends with verifiable sourcing, which are perceived as superior in quality and nutrient retention compared to conventional options.

How is the Juice Product Market addressing concerns regarding high sugar content?

The market addresses sugar concerns through rigorous product reformulation, focusing on 100% fruit and vegetable blends, utilizing natural low-glycemic sweeteners (like stevia or monk fruit), increasing the proportion of low-sugar vegetables, and marketing products explicitly as 'no added sugar' or reduced-calorie options to align with global health mandates.

Which geographical region is expected to demonstrate the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid economic development, increasing purchasing power, shifting dietary habits influenced by Western trends, and large-scale population growth in emerging economies such as India and China.

What role does High-Pressure Processing (HPP) play in juice manufacturing?

HPP is a crucial non-thermal pasteurization technology used primarily for premium, chilled juices. It uses intense pressure to neutralize pathogens and extend shelf life significantly while preserving the raw flavor, color, and essential vitamins, enabling manufacturers to offer preservative-free products.

What are the primary restraints impacting market expansion?

The key restraints include stringent regulatory pressure and consumer skepticism regarding sugar levels, high volatility and dependence on agricultural commodity prices (fruits/vegetables), and intense cross-category competition from emerging beverage formats like functional water, fortified teas, and energy drinks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager