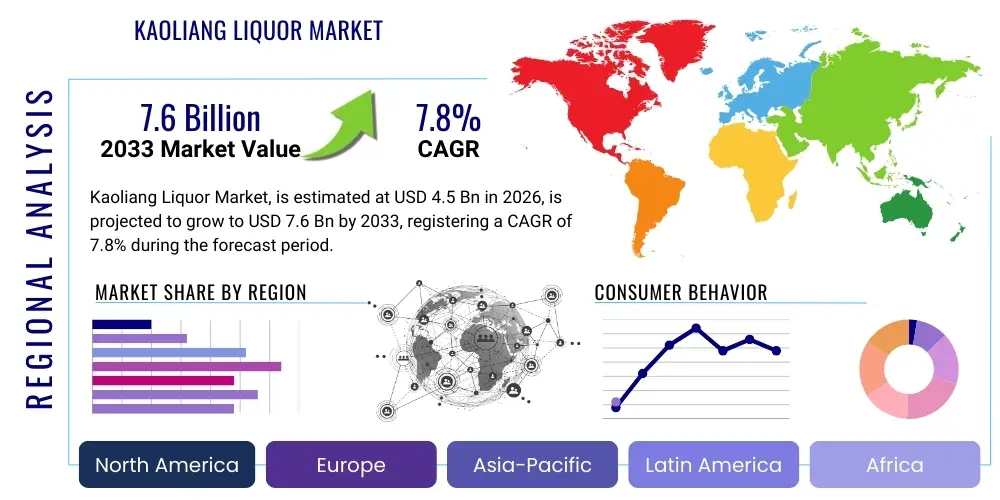

Kaoliang Liquor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435869 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Kaoliang Liquor Market Size

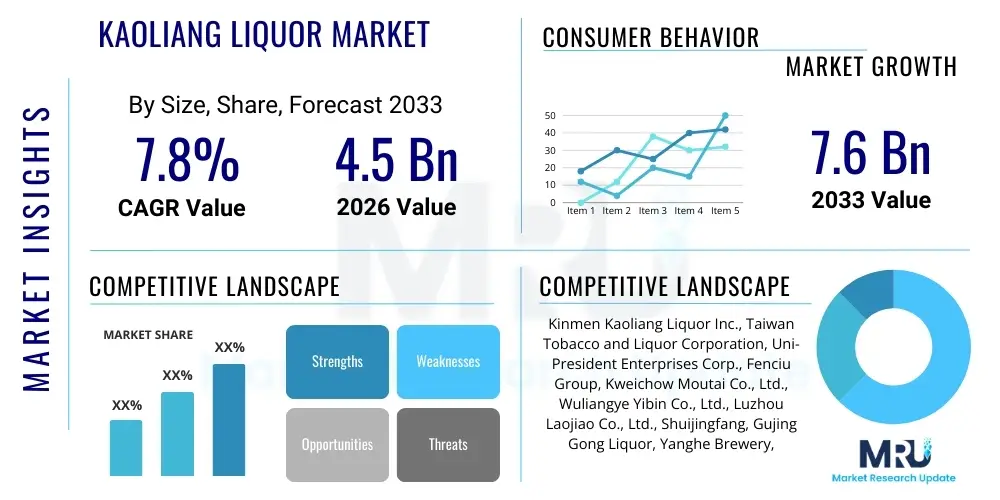

The Kaoliang Liquor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Kaoliang Liquor Market introduction

Kaoliang Liquor, a prominent East Asian spirit distilled primarily from fermented sorghum, holds a significant position within the global spirits industry, particularly due to its deep cultural roots in regions such as Taiwan, mainland China, and the surrounding territories. This high-proof, clear distilled beverage, often characterized by its unique aroma profile, is transitioning from a traditional beverage consumed predominantly during festive and ceremonial occasions to a recognized premium spirit category sought after by a broader consumer base. The market's foundational strength lies in its established consumer base in Asia Pacific, where generational consumption habits and increasing disposable income levels sustain consistent demand. The primary appeal of Kaoliang rests on its authenticity and the meticulous traditional processes involved in its creation, distinguishing it from mass-produced spirits.

The product is consumed across various major applications, ranging from social gatherings and traditional banquets to modern cocktail creation, reflecting its increasing versatility. Key applications include direct consumption, often warmed or at room temperature, and incorporation into high-end culinary experiences as an accompaniment. Furthermore, the market benefits substantially from ongoing trends toward premiumization and diversification, where producers are introducing aged Kaoliang variants and lower ABV options to capture younger, experimental consumers. The robust growth trajectory is significantly driven by enhanced export activities, as major Asian brands successfully penetrate international markets, particularly in North America and Europe, capitalizing on the rising global interest in unique ethnic spirits.

Driving factors influencing market expansion include effective marketing strategies that emphasize the product's heritage and craftsmanship, coupled with improved governmental support for regional liquor industries. The perceived health benefits associated with certain traditional fermentation methods, although often anecdotal, also subtly contribute to consumer preference in core markets. The market’s sustainability is underpinned by continuous product innovation, such as the introduction of flavored Kaoliang and specialized limited editions, which cater to modern palate demands while retaining the spirit’s core identity. This strategic balance between tradition and innovation is crucial for sustained long-term growth and competitiveness against established global spirit categories like whiskey and vodka.

Kaoliang Liquor Market Executive Summary

The Kaoliang Liquor market is experiencing a dynamic shift defined by converging business trends, pronounced regional disparities in growth, and evolving segment demands. Business trends highlight a significant pivot towards premiumization, where consumers increasingly favor ultra-premium and aged Kaoliang bottles, driven by status consumption and a desire for high-quality, authentic experiences. This shift is motivating manufacturers to invest heavily in specialized aging facilities and sustainable sourcing of high-grade sorghum. Furthermore, the expansion of e-commerce and digital distribution channels is transforming market access, allowing smaller, craft producers to reach global consumers directly, thereby intensifying competitive dynamics and rewarding brands that prioritize digital engagement and transparent provenance reporting.

Regional trends unequivocally confirm the Asia Pacific region’s dominance, particularly mainland China and Taiwan, which serve as the epicenter of both production and consumption. However, the most significant growth opportunities are emerging from international markets. North America and Europe, while having lower overall volume, show the highest year-on-year growth rates due to increasing Asian diaspora populations and a burgeoning trend among non-Asian consumers seeking specialized, traditional spirits. This international demand necessitates careful adaptation of packaging and marketing narratives to resonate with diverse regulatory environments and consumer expectations regarding taste profiles and serving suggestions. Successful regional strategies involve partnerships with local distributors who possess deep knowledge of importing complexities and retail positioning.

Segmentation trends indicate strong performance in the high-proof segment (above 50% ABV) for traditional consumption and collector markets, while the emergence of lower ABV and flavored varieties is capturing the attention of younger demographics and consumers new to the category. The distribution segment is witnessing rapid growth through specialized liquor stores and online platforms, challenging traditional retail dominance. The shift toward smaller batch, craft production is also a notable segment trend, emphasizing traditional methodologies over industrial scale, appealing to consumers focused on traceability and heritage. Overall, the market remains robust, underpinned by cultural loyalty and energized by targeted innovation aimed at global expansion and generational transition.

AI Impact Analysis on Kaoliang Liquor Market

Analysis of common user questions regarding AI's influence on the Kaoliang Liquor market reveals key themes centered around enhancing traditional production precision, optimizing complex supply chains, and driving personalized consumer experiences. Users frequently inquire about how AI can maintain the authenticity of traditional fermentation processes while improving yield and consistency. Concerns revolve around whether automation might dilute the cultural value or craftsmanship of the spirit. Expectations are high regarding AI's ability to unlock new flavor profiles through predictive modeling of aging processes and to provide sophisticated tools for fraud detection and quality assurance, ensuring product authenticity from distillery to consumer. The consensus points towards AI being an augmentation tool rather than a replacement for human expertise, primarily focusing on data-driven decision- making in traditionally manual operations.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize several critical facets of the Kaoliang liquor industry, starting with the agricultural phase. AI can analyze climatic data, soil composition, and historical yield patterns to optimize sorghum cultivation, ensuring higher quality raw material consistency which is paramount for flavor development in distilled spirits. In the distillation and fermentation processes, AI models monitor real-time sensor data—such as temperature, pH levels, and microbial activity—to predict optimal fermentation endpoints and distillation cuts, leading to unprecedented consistency in batch quality, a historic challenge for traditional Kaoliang production.

Furthermore, AI is crucial for market penetration and consumer engagement. Advanced predictive analytics are utilized to forecast regional demand fluctuations, enabling producers to optimize inventory levels and distribution logistics, particularly for complex international shipping routes. On the consumer-facing side, machine learning algorithms analyze purchasing behavior and demographic data to recommend specific Kaoliang expressions or cocktail recipes, significantly enhancing personalized marketing campaigns. This data-driven personalization improves consumer retention and facilitates the introduction of niche or limited-edition products to the right audience, driving premium sales and increasing overall market engagement in a highly competitive global spirits landscape.

- AI-driven optimization of sorghum yield and quality based on climatic modeling.

- Machine Learning for real-time monitoring and control of complex fermentation kinetics, ensuring flavor consistency.

- Predictive analytics utilized in aging and blending processes to simulate and achieve desired flavor profiles faster.

- Automated quality control systems employing computer vision for inspecting bottling and labeling accuracy, reducing errors.

- Advanced fraud detection and supply chain traceability via AI-powered blockchain integration for anti-counterfeiting measures.

- Personalized marketing and product recommendation engines enhancing consumer engagement and market penetration.

DRO & Impact Forces Of Kaoliang Liquor Market

The market dynamics of Kaoliang Liquor are governed by a robust interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces shaping its future trajectory. A principal driver is the deeply embedded cultural significance of Kaoliang in East Asia, ensuring sustained domestic demand, particularly during traditional celebrations and governmental functions. This cultural loyalty provides a stable foundation often insulated from global economic volatility. Concurrently, the burgeoning trend of premiumization globally acts as a powerful driver, encouraging brands to elevate their quality perception, marketing their spirits as luxury items comparable to high-end whiskies or cognacs. The opportunity for significant global expansion, capitalizing on the increasing consumer interest in authentic, non-Western spirits, represents a high-impact force that can fundamentally alter the market size and geographical reach within the forecast period.

However, the market faces inherent restraints that temper rapid expansion. The potent flavor profile and high alcohol content of traditional Kaoliang can pose a significant barrier to entry for Western consumers accustomed to smoother, lower-proof spirits, necessitating substantial investment in consumer education and product reformulation (e.g., lower ABV versions). Additionally, navigating the complex and often stringent regulatory frameworks governing alcohol distribution and advertising across diverse international jurisdictions represents a considerable logistical and cost restraint. Competitive pressure from established global spirit categories, which benefit from colossal marketing budgets and extensive distribution networks, further challenges Kaoliang's global market share growth. Overcoming these restraints requires strategic market segmentation and persistent brand storytelling.

Opportunities for exponential growth are concentrated in product innovation, particularly the development of craft and flavored Kaoliang variants that appeal to experimental, younger consumers. Furthermore, leveraging sustainability and ethical sourcing claims—focused on traditional farming methods and eco-friendly distillation practices—can enhance brand value in environmentally conscious markets. The strategic development of Kaoliang-based cocktails and collaborations with globally recognized mixologists offer a powerful route to integrate the spirit into modern nightlife and bar culture outside Asia. The aggregate impact of these forces suggests a period of moderate but geographically diversified growth, transitioning the product from a regional staple to an internationally recognized specialized spirit category.

Segmentation Analysis

The Kaoliang Liquor market is effectively segmented across several key dimensions including Product Type, Distribution Channel, and Alcohol Content, reflecting the diversity of consumer preferences and operational strategies adopted by producers. Analysis by Product Type differentiates between Aged Kaoliang, Standard/Traditional Kaoliang, and Flavored Kaoliang, with Aged Kaoliang commanding higher price points and appealing to collectors and the premium market segment, while flavored variants drive volume among new and younger consumers. Segmentation by Distribution Channel, encompassing both Off-Trade (supermarkets, specialty liquor stores) and On-Trade (restaurants, bars, hotels), highlights the importance of traditional retail channels in Asia, juxtaposed with the rapid expansion of digital and e-commerce platforms globally, particularly for niche and premium offerings. Understanding these segmentation nuances is crucial for developing targeted marketing campaigns and optimizing inventory management based on regional demand characteristics.

- By Product Type:

- Aged Kaoliang

- Standard/Traditional Kaoliang

- Flavored and Craft Kaoliang

- By Alcohol Content:

- High Proof (Above 50% ABV)

- Medium Proof (38% to 50% ABV)

- Low Proof (Below 38% ABV)

- By Distribution Channel:

- On-Trade (Hotels, Bars, Restaurants)

- Off-Trade (Supermarkets, Retail Stores, Specialty Liquor Stores)

- Online Retail (E-commerce Platforms)

- By End-User:

- Individual Consumers

- Commercial Buyers (Hospitality)

- By Geography:

- Asia Pacific (APAC)

- North America

- Europe

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Kaoliang Liquor Market

The Value Chain for the Kaoliang Liquor Market begins with upstream activities centered on the rigorous sourcing and preparation of raw materials, primarily high-quality sorghum grains, along with essential inputs like specialized yeasts and water sources. Given that the quality and terroir of the sorghum significantly impact the final spirit profile, meticulous agricultural practices and secure supply contracts are essential components of cost control and quality assurance. This initial phase involves cultivation, harvesting, and initial processing (malting or milling) of the grain, often adhering to strict geographical indications or traditional methods. Investment in sustainable farming practices at this stage not only ensures supply consistency but also bolsters brand narratives related to environmental responsibility and authentic heritage, adding perceived value downstream.

The core midstream activity involves the complex multi-stage distillation process, a defining characteristic of Kaoliang production, followed by aging, blending, and bottling. Distilleries focus on optimizing fermentation duration and temperature control, often leveraging traditional techniques combined with modern analytical tools (including AI and sensor technology) to achieve desired flavor consistency and purity. Aging, which can span several years for premium variants, represents a significant cost and time investment, substantially enhancing the final market price. Packaging and bottling operations must adhere to global safety and labeling standards, particularly for export markets, requiring high levels of precision and quality control to maintain the integrity and presentation of the product, which is often crucial for premium pricing.

Downstream activities encompass distribution channels, marketing, and final retail sales. Distribution networks are bifurcated into direct sales channels (important for high-volume domestic markets) and complex indirect channels involving importers, distributors, wholesalers, and specialized retailers for international reach. Effective marketing is paramount, requiring nuanced strategies that balance the spirit’s traditional Asian heritage with modern global consumer trends. Direct distribution channels, particularly through proprietary online stores and flagship retail locations, offer higher margin capture and greater control over brand presentation. The final step involves engagement with potential customers—both the traditional consumer base and emerging international buyers—through on-trade and off-trade outlets, establishing the product’s position within the competitive retail environment and generating sustained sales volume.

Kaoliang Liquor Market Potential Customers

Potential customers for Kaoliang Liquor are diverse and can be broadly categorized into three distinct groups: Traditional Consumers, Experimental Millennial and Gen Z Consumers, and International Spirit Enthusiasts. Traditional consumers, primarily located in mainland China, Taiwan, and other core Asian markets, represent the bedrock of the market. This segment values heritage, consistency, and ceremonial use, often preferring high-proof, aged, and highly recognized heritage brands for banquets, gifting, and status consumption. Their purchasing decisions are heavily influenced by brand loyalty and cultural affirmation, making them sensitive to authenticity claims and established reputations rather than purely price considerations, especially in the premium segments. This group requires minimal product education but demands impeccable quality assurance and adherence to traditional flavor profiles.

The second critical group comprises younger, domestically based consumers (Millennials and Gen Z) who are actively seeking new experiences, moving away from previous generational habits, but still valuing authenticity and local culture. This segment is highly receptive to product innovation, including flavored Kaoliang, lower ABV options, and unique, aesthetically pleasing packaging. They are primarily reached through social media, digital marketing, and modern on-trade establishments (cocktail bars). These buyers are often entry-level consumers for the category and require strategic engagement focusing on taste versatility, mixability, and integration into modern social settings, contrasting the spirit's traditional ceremonial image.

Finally, International Spirit Enthusiasts and the Asian diaspora community outside of APAC form the high-growth potential customer base. International enthusiasts are affluent consumers in North America and Europe who are actively exploring specialized, non-Western spirit categories like baijiu, shochu, and Kaoliang. Their motivation is driven by curiosity, connoisseurship, and a desire for unique flavors and compelling stories. For this group, marketing must focus heavily on the distillation story, flavor notes (translated into universally understandable terms), and premium positioning, often through specialized import liquor stores and high-end restaurants. The Asian diaspora acts as an influential bridge, maintaining cultural consumption habits while introducing the spirit to non-Asian friends and contributing to its mainstream adoption in Western markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kinmen Kaoliang Liquor Inc., Taiwan Tobacco and Liquor Corporation, Uni-President Enterprises Corp., Fenciu Group, Kweichow Moutai Co., Ltd., Wuliangye Yibin Co., Ltd., Luzhou Laojiao Co., Ltd., Shuijingfang, Gujing Gong Liquor, Yanghe Brewery, Xifeng Group, Jiangsu Yanghe Brewery Joint-Stock Co., Ltd., Beijing Red Star Co., Ltd., Jiannanchun Group, Langjiu Group, Swellfun Co., Ltd., Golden Gate Kaoliang Liquor, Dongjiu, Tsang Nien Distillers, Gaoliang King Distillery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kaoliang Liquor Market Key Technology Landscape

The Kaoliang Liquor market is increasingly integrating advanced technological solutions to standardize quality, enhance efficiency, and innovate product offerings, moving beyond purely traditional, manual processes. A critical area of technological application is fermentation science, where controlled environment technologies are employed to precisely manage microbial activity and temperature profiles. Modern distilleries utilize sophisticated bioreactors and monitoring systems, often incorporating IoT sensors, to track chemical reactions and volatile organic compounds (VOCs) in real-time. This precision engineering minimizes batch variations, a common challenge in large-scale traditional fermentation, ensuring a consistent and high-quality base spirit, which is fundamental for both domestic consumption and rigorous international quality standards required for export.

Further technological integration is evident in distillation and aging. Contemporary Kaoliang producers are adopting advanced distillation columns and filtering technologies to fine-tune the purity and aroma characteristics of the spirit. While traditional earthenware pots remain essential for aging premium lines to impart unique earthy flavors, modern technology contributes through environmental controls, such as humidity and temperature management systems, ensuring optimal conditions for long-term maturation with reduced spoilage risk. Moreover, the implementation of Mass Spectrometry and Gas Chromatography allows analysts to dissect the chemical composition of aged Kaoliang, providing crucial data for sophisticated blending decisions and replicating successful flavor profiles with scientific accuracy, significantly accelerating the R&D cycle for new products.

Beyond production, technology plays a vital role in supply chain integrity and consumer trust. Blockchain technology is emerging as a critical tool for creating immutable records of a bottle’s journey, from the sorghum field to the consumer’s hand, effectively combating counterfeiting—a major concern for high-value spirits. Additionally, automated packaging and labeling systems, leveraging robotics and computer vision, ensure high throughput and flawless presentation, crucial for maintaining premium brand image. These technological advancements not only streamline operations and reduce operational costs but also provide transparent provenance information, satisfying the modern consumer's demand for traceability and authenticity, thereby significantly enhancing brand competitiveness in the highly regulated and discerning global spirits market.

Regional Highlights

The global Kaoliang Liquor market exhibits pronounced regional concentration, yet demonstrates strong signs of international diffusion. The Asia Pacific (APAC) region fundamentally dominates the market in both consumption volume and production capacity. Within APAC, the primary markets are mainland China and Taiwan, where Kaoliang is intrinsically linked to cultural identity and social customs. The stability and growth in this region are driven by high domestic consumption rates, supported by an increasing number of middle-to-high-income earners who drive demand for premium and aged spirits, viewing them as essential luxury or investment assets. Regulatory environments in these core markets often favor local producers, but also impose strict quality standards, promoting continuous improvement in local manufacturing processes. Significant investment in domestic marketing and brand development further solidifies APAC's unchallenged leading role.

North America and Europe represent the most critical high-growth opportunity regions for the Kaoliang market. While current consumption volumes are comparatively modest, the year-on-year growth rates are robust, fueled by the expansion of the Asian diaspora and a broader consumer trend toward exploring niche and authentic ethnic spirits. In North America, cities with large Asian populations serve as initial penetration points, leveraging specialty liquor stores and high-end Asian restaurants. The European market, particularly the UK, Germany, and France, is showing emerging interest, driven by mixologists and craft spirit aficionados looking for novel ingredients for premium cocktail creation. For successful penetration in these regions, brands must overcome logistical hurdles, adapt flavor profiles where necessary, and invest heavily in educational marketing to demystify the spirit's strong taste and serving traditions to non-Asian consumers.

Latin America, the Middle East, and Africa (MEA) currently hold marginal shares but offer long-term potential, primarily focused on targeted urban centers or areas with substantial tourism and luxury hospitality sectors. In the Middle East, high-end hotel chains and duty-free shops serving international tourists represent key distribution points, constrained by local alcohol regulations. Latin America offers nascent potential, dependent on local regulatory easing and the growing affluence of urban populations interested in international luxury goods. Strategic market entry in these regions must be highly selective and focused on leveraging existing import infrastructures established for other high-end global spirits, primarily targeting the HORECA sector (Hotel, Restaurant, Catering) to maximize brand visibility and prestige within limited distribution constraints.

- Asia Pacific (APAC): Dominates the market, driven by mainland China and Taiwan. Growth fueled by cultural adherence, premiumization, and high disposable incomes leading to increased consumption of luxury aged variants.

- North America: High growth potential, propelled by the expanding Asian diaspora and increasing interest among Western consumers in unique, authentic global spirits. Focus on specialty retail and on-trade establishments for market entry.

- Europe: Emerging market with growing interest from craft spirit enthusiasts and mixologists seeking new bases for cocktails. Growth concentrated in Western European countries with established luxury import channels.

- Latin America: Marginal current presence; potential long-term growth tied to rising middle-class consumption and targeted distribution in luxury urban areas.

- Middle East & Africa (MEA): Limited market activity, primarily restricted to international tourist hubs and duty-free retail, due to stringent regulatory environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kaoliang Liquor Market.- Kinmen Kaoliang Liquor Inc.

- Taiwan Tobacco and Liquor Corporation

- Uni-President Enterprises Corp.

- Fenciu Group

- Kweichow Moutai Co., Ltd.

- Wuliangye Yibin Co., Ltd.

- Luzhou Laojiao Co., Ltd.

- Shuijingfang

- Gujing Gong Liquor

- Yanghe Brewery

- Xifeng Group

- Jiangsu Yanghe Brewery Joint-Stock Co., Ltd.

- Beijing Red Star Co., Ltd.

- Jiannanchun Group

- Langjiu Group

- Swellfun Co., Ltd.

- Golden Gate Kaoliang Liquor

- Dongjiu

- Tsang Nien Distillers

- Gaoliang King Distillery

Frequently Asked Questions

Analyze common user questions about the Kaoliang Liquor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Kaoliang Liquor and where is it primarily consumed?

Kaoliang is a high-proof, clear distilled spirit traditionally made from fermented sorghum. It is primarily consumed in East Asian markets, with Taiwan and mainland China representing the largest production and consumption bases due to its deep cultural and ceremonial significance.

What factors are driving the recent growth of the Kaoliang Liquor market?

Market growth is significantly driven by premiumization trends, increased demand for aged and specialty variants, successful penetration into international export markets (North America and Europe), and sustained cultural loyalty among core Asian consumer demographics.

How is technology, specifically AI, influencing the production of Kaoliang?

AI and IoT technologies are being utilized to optimize sorghum cultivation, provide real-time monitoring of complex fermentation processes to ensure consistency, predict optimal aging results, and enhance supply chain traceability to combat product counterfeiting.

What are the key restraints affecting the global expansion of Kaoliang Liquor?

Key restraints include the challenge of introducing its strong, unique flavor profile to Western palates, intense competition from globally dominant spirit categories (e.g., vodka, whiskey), and the complexity of navigating diverse international alcohol regulatory frameworks and excise taxes.

Which product segment is expected to show the fastest growth rate?

The Flavored and Craft Kaoliang segment is anticipated to exhibit the fastest growth, appealing to younger generations and international consumers seeking lower ABV options and versatility for use in modern cocktails, thereby broadening the consumer base beyond traditional drinkers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager