Kenaf Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433572 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Kenaf Market Size

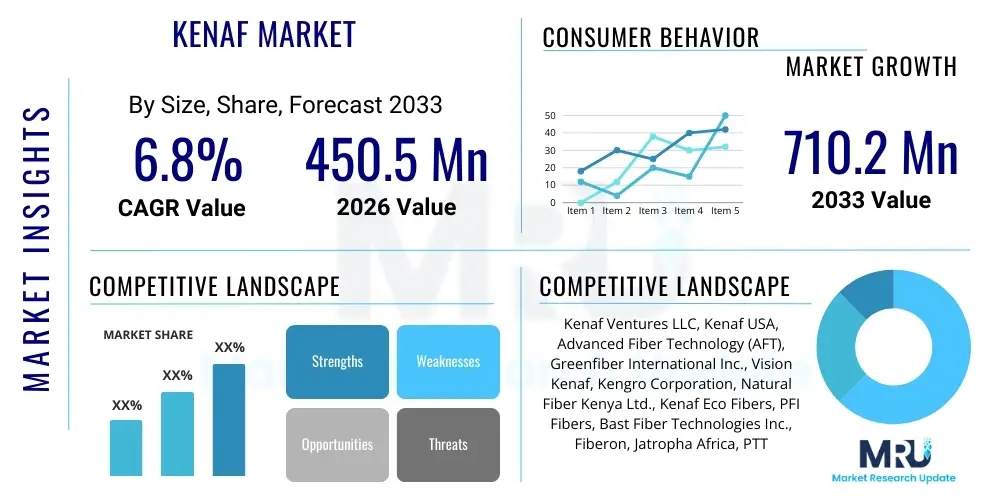

The Kenaf Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.2 Million by the end of the forecast period in 2033.

Kenaf Market introduction

The Kenaf Market encompasses the global commercial ecosystem dedicated to the cultivation, processing, and application of products derived from the Kenaf plant (Hibiscus cannabinus), a highly efficient annual cash crop belonging to the Malvaceae family. Recognized for its exceptionally rapid growth cycle—often maturing in 4 to 6 months—and its ability to thrive in varied climates with minimal water and input requirements, Kenaf stands out as a preeminent source of sustainable natural fibers. The plant yields two distinct and commercially valuable fiber types: the strong, durable bast (outer) fiber, which accounts for approximately 30-40% of the stalk biomass and is prized for its high cellulose content and mechanical strength; and the lightweight, porous core (inner woody) fiber, which is known for its high absorbency and insulation capabilities. This dual utility positions Kenaf as a strategic replacement material across multiple resource-intensive industries, directly addressing global pressures for decarbonization and resource efficiency.

The product description highlights Kenaf's versatility across industrial applications. Bast fibers are critical inputs for the manufacturing of high-quality paper products, specialized geotextiles, ropes, and, most significantly, natural fiber reinforced composites (NFRCs) used extensively in the automotive and construction sectors. These fibers offer a compelling blend of low density and high specific strength, contributing to vehicle lightweighting efforts and reducing the energy consumption of buildings. The core material, often referred to as hurds, serves as a superior absorbent for industrial spills, hazardous waste remediation, and premium animal bedding, surpassing many conventional materials due to its large internal surface area and excellent capillary action. Furthermore, Kenaf seeds yield a nutritious oil rich in unsaturated fatty acids, increasingly sought after by the nutraceutical and cosmetic industries, adding another high-value dimension to the crop’s economic profile and reinforcing the viability of whole-plant utilization models, thereby enhancing the economic attractiveness for cultivators and processors.

The primary driving factors sustaining and accelerating Kenaf market expansion are deeply rooted in global legislative changes and evolving consumer preferences favoring sustainability. Specifically, mandates imposed by regulatory bodies in North America and Europe concerning vehicle emissions and building energy efficiency create mandatory demand for Kenaf-based lightweight materials and high-performance insulation, as companies seek alternatives to carbon-intensive synthetic materials. The inherent benefits, including Kenaf’s low embodied energy, its non-abrasive nature (reducing equipment wear in processing), and complete biodegradability, render it a highly attractive option compared to glass or carbon fibers in many non-structural applications. Increased investment in agricultural research focused on developing superior Kenaf cultivars with enhanced yield and uniform fiber quality, alongside advancements in dry mechanical decortication technology that lowers processing costs and enhances fiber purity, collectively reduce market entry barriers and expand the applicability of Kenaf across a wider array of technically demanding industrial uses, ensuring long-term market competitiveness.

Kenaf Market Executive Summary

The Kenaf market is experiencing dynamic growth driven by systemic shifts in global manufacturing practices towards bio-based circular economic models. Current business trends indicate a strong move toward vertical integration within the Kenaf value chain, where leading market players are securing large-scale cultivation agreements and simultaneously investing in specialized, decentralized processing hubs. This strategic approach minimizes transportation costs of bulky raw material and ensures stable, localized supply chains capable of meeting the rigorous demands of industrial buyers, particularly in the automotive and construction industries which require just-in-time delivery of standardized components. Furthermore, significant research and development expenditure is being directed towards engineering novel composite matrices that optimize the performance of Kenaf fibers, moving beyond simple reinforcement to fully functional, structural applications, thus attracting new high-value industrial consumers seeking to incorporate renewable resources without sacrificing performance metrics.

Regional trends distinctly delineate consumption patterns and technological maturity. North America and Europe collectively dominate the high-value segment, characterized by stringent quality controls and deep integration of Kenaf composites into manufactured goods, propelled by robust governmental support for green initiatives and high levels of consumer awareness regarding sustainable sourcing. These regions lead in the adoption of specialized fiber treatments and composite molding techniques. Conversely, Asia Pacific maintains its lead in overall market volume, largely due to its unparalleled capacity for bulk cultivation and established use of Kenaf in traditional industries, notably pulp and paper and basic textiles. This region is critical for supplying raw material inputs globally, though its transition to high-end composite applications is still developing, contingent upon technology transfer and standardization of processing protocols suitable for export markets.

Analysis of segment trends confirms the overwhelming commercial importance of the Kenaf Fiber segment, which commands the largest market share due to its wide applicability as a versatile input material across composites, paper, and textiles. However, the Kenaf Core segment is exhibiting the fastest growth trajectory, buoyed by the escalating need for environmentally friendly industrial absorbents, specialized filtration media, and natural insulation materials aligned with stringent building energy codes demanding improved thermal performance and non-toxicity. Furthermore, the Automotive application segment, while currently smaller than Pulp & Paper, generates disproportionately high revenue due to the premium pricing associated with certified, high-performance biocomposite components. Continuous innovation in enzymatic and mechanical processing is improving the quality and cost-effectiveness of both fiber and core products, ensuring competitive viability against synthetic alternatives and sustaining segment momentum throughout the forecast period, thereby attracting further institutional investment.

AI Impact Analysis on Kenaf Market

User inquiries regarding the role of Artificial Intelligence in the Kenaf industry frequently revolve around how predictive modeling can mitigate the inherent risks associated with agricultural commodity markets, specifically focusing on yield stabilization and quality consistency across varied growing conditions. Stakeholders are keen to understand the application of AI in analyzing multivariate datasets—including satellite imagery, localized climate data, historical harvest records, and soil nutrient levels—to formulate highly precise, dynamic irrigation and fertilization schedules tailored to Kenaf's rapid growth cycle. A major theme in user questions concerns the practical deployment of AI-powered computer vision for rapid, automated sorting and grading of harvested fibers, which is essential for ensuring the uniformity required by demanding composite manufacturers and streamlining the classification of bast and core materials after decortication.

Concerns often raised involve the financial viability of integrating advanced AI systems into the often low-margin agricultural phase of the Kenaf value chain, especially in developing regions where access to necessary computational infrastructure and skilled data scientists is limited, creating a potential technology gap. There is also an expectation that AI must address the complex challenge of forecasting price volatility, which is influenced not only by Kenaf specific harvest yields but also by the fluctuating prices of competing synthetic fibers (like fiberglass) and traditional wood pulp. Successful AI adoption is expected to move the Kenaf market closer to a digitized, precision agriculture model, where resource inputs (water, energy) are minimized while outputs (both quantity and specific quality parameters) are maximized. This transformation is viewed as necessary to maintain a strong competitive edge against entrenched, highly standardized traditional materials that benefit from long-established supply chains.

Ultimately, the successful implementation of AI algorithms, particularly those based on deep learning and reinforcement learning, promises to redefine efficiency across the entire Kenaf supply chain, from the field to the factory floor. By predicting optimal harvest timing—a critical factor for maximizing fiber strength and minimizing post-harvest degradation—AI can ensure the highest material quality reaches industrial users. Furthermore, in the composite manufacturing stage, AI can optimize complex production parameters such as thermal compression cycles, fiber volume fraction, and mixing ratios of Kenaf fibers and polymer matrices, guaranteeing final product performance and reducing manufacturing defects, thereby speeding up the industrial acceptance and rapid adoption rate of Kenaf-based sustainable solutions across global automotive and construction industries.

- AI-Driven Agronomy: Predictive modeling of soil health, weather patterns, and pest infestation using machine learning algorithms to optimize Kenaf planting and fertilization schedules, maximizing fiber yield per hectare and ensuring sustainable resource management.

- Automated Quality Assessment: Utilizing computer vision systems and AI to rapidly inspect harvested fibers for defects, moisture content, lignin ratio, and uniformity, ensuring the consistent quality required for high-end applications like automotive composites and specialized technical textiles.

- Supply Chain Optimization: Employing predictive analytics to forecast industrial demand for Kenaf fiber across different segments (pulp vs. composites) based on economic indicators and regulatory changes, leading to optimized inventory holding, reduced post-harvest waste, and improved logistics planning.

- Processing Efficiency Enhancement: AI integration in decortication and refining machinery to dynamically adjust processing parameters (speed, moisture extraction, chemical concentration) based on real-time fiber input characteristics, minimizing energy consumption, reducing operational costs, and maintaining structural integrity.

- Market Price Forecasting: Developing sophisticated models leveraging global commodity indices, agricultural output data, energy prices, and policy changes to provide accurate price predictions, enabling better long-term contract negotiation and robust financial risk management for both Kenaf suppliers and industrial buyers.

DRO & Impact Forces Of Kenaf Market

The acceleration of the Kenaf market is profoundly influenced by powerful environmental and regulatory drivers that favor sustainable sourcing. Global legislative frameworks, such as the European Union’s ambitious climate targets, mandatory waste reduction policies, and stringent material safety standards (like REACH), compel major manufacturers, particularly in the automotive and construction sectors, to integrate certified bio-based materials. Kenaf’s superior performance as a carbon capture crop, coupled with its status as a rapidly renewable, non-food source fiber, provides companies with a crucial mechanism to meet corporate sustainability goals and reduce their measured Scope 3 emissions. This regulatory push, combined with increasing consumer demand for transparent and eco-friendly product provenance, acts as the primary market driver, establishing Kenaf as a necessary input rather than a mere alternative in future manufacturing strategies that prioritize circularity and low embodied energy materials.

Conversely, the scaling and standardization of the supply chain present significant restraints hindering widespread adoption. Unlike established agricultural commodities (e.g., cotton or timber), the Kenaf industry lacks universally adopted standardized grades and specifications for fiber quality, making bulk procurement challenging for multinational manufacturers who require guaranteed consistency across batches and geographies. Furthermore, the specialized nature of Kenaf harvesting and processing equipment, particularly high-efficiency decorticators and retting facilities, requires substantial upfront capital investment that smaller agricultural operations often cannot afford. This high barrier to entry restricts expansion in developing regions and often necessitates logistical compromises, such as transporting bulky raw stalks over long distances, which negates some of the crop’s environmental benefits and increases final product cost, thereby challenging price competitiveness against cheaper, albeit less sustainable, synthetic alternatives such as glass fiber and petrochemical plastics.

Significant growth opportunities exist through technological convergence and material diversification, particularly into high-value applications. The development of advanced Kenaf-based bioplastics and bio-resins offers a high-value pathway to replace traditional petroleum-derived plastics in packaging and durable goods. Furthermore, the emerging bio-refinery model—where waste material from fiber extraction is utilized to produce valuable lignin, bio-oils, and high-quality biochar (for soil enrichment)—promises to drastically improve the economic yield per hectare, stabilizing farmer incomes and making Kenaf a more financially attractive crop than competing options. The expansion of Kenaf core applications into environmental remediation, particularly in developing nations facing large-scale industrial pollution, presents a specialized niche market with high impact and growth potential, driven by global stewardship initiatives and industrial cleanup mandates, reinforcing Kenaf’s dual environmental and commercial value proposition.

Segmentation Analysis

Segmentation analysis of the Kenaf market reveals a complex structure driven by the technical specifications required by end-use industries and the distinct utilization of the plant's various components. The segmentation by Product Type (Fiber, Core, Seed) is fundamental, reflecting the diverse material properties. The Fiber segment (bast and whole stalk fiber) is highly sensitive to price and quality, catering mainly to large-scale industrial processes like pulp making and high-end composite formation, where consistency in length, strength, and low contamination levels is paramount. The Core segment, conversely, targets markets valuing high surface area and absorbency, such as agricultural businesses and environmental clean-up services, often requiring pelletization or specialized bagging. The analysis indicates that market participants must develop highly tailored processing technologies to maximize the yield and quality of each component, as cross-contamination reduces value significantly across all high-grade applications.

Within the Application segmentation, the shift toward sustainable infrastructure drives the exceptional growth observed in the Building & Construction sector. Kenaf insulation products offer superior R-values, excellent acoustic dampening, and effective moisture regulation compared to traditional fiberglass or mineral wool, aligning perfectly with passive house standards and energy-efficient construction trends prevalent across North America and Europe. The Automotive application segment, though characterized by slower volume growth, demands the highest quality fiber, often requiring chemical or plasma pre-treatment to ensure compatibility with automotive-grade resins. This segment is characterized by long qualification periods, strict performance criteria for crash safety and fire resistance, making market entry challenging but highly rewarding for certified suppliers who can guarantee material reliability and long-term supply agreements with global vehicle manufacturers adhering to stringent lightweighting objectives.

The processing method segmentation (Mechanical vs. Chemical vs. Enzymatic) highlights the industry's strategic move toward cleaner technologies. While traditional chemical retting is efficient for fiber separation, environmental concerns and disposal regulations are driving widespread adoption of dry mechanical decortication, often integrated with steam explosion, which is cleaner but requires more sophisticated capital equipment. This transition significantly impacts regional supply dynamics: regions with greater access to advanced technology (Europe, North America) can produce higher-grade, cleaner fiber suitable for biocomposites, whereas regions relying on traditional, less regulated methods (parts of APAC, MEA) often supply material suitable for lower-grade pulp or basic cordage. Understanding these segmented dynamics is essential for strategic planning, determining where to invest capital expenditure for processing improvement versus where to focus on raw material aggregation and logistics optimization to meet global demand efficiently.

- By Product Type:

- Fiber (Bast Fiber, Whole Stalk Fiber, Non-woven Mats, Roving)

- Core (Core Fiber/Hurds, Pellets, Industrial Absorbents, Insulation Batts)

- Seed

- Seed Oil (Edible Grade, Industrial Grade, Cosmetic Grade)

- Lignin and Hemicellulose Extracts

- By Application:

- Pulp and Paper (Specialty Paper, Cardboard, Corrugated Packaging, Security Paper)

- Building and Construction (Thermal and Acoustic Insulation, Lightweight Panels, Bio-concrete Reinforcement, Roofing Felt)

- Automotive (Interior Trim Components, Door Panels, Headliners, Acoustic Damping Materials, Seat Backs)

- Textile and Cordage (Technical Textiles, Geotextiles for erosion control, Ropes, Burlap substitutes)

- Animal Care and Feed (Pet and Livestock Bedding, Specialty Forage, Feed Additives)

- Absorption Materials and Filtration (Oil Spill Cleanup, Chemical Containment, Air/Water Filters, Heavy Metal Filtration)

- Nutraceuticals and Cosmetics (Topical applications, Dietary Supplements, Bio-pharmaceutical carriers)

- By Processing Method:

- Chemical Retting (Caustic Soda Treatment, Acid Treatment)

- Water Retting (Traditional retting)

- Mechanical Decortication (Dry & Wet Separation, Mobile Decortication Units)

- Enzymatic Treatment (For high-purity fiber modification and enhanced separation)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe, Scandinavian Countries)

- Asia Pacific (APAC) (China, India, Japan, Southeast Asia, Australia, Rest of APAC)

- Latin America (LATAM) (Brazil, Argentina, Chile, Rest of LATAM)

- Middle East and Africa (MEA) (South Africa, GCC Countries, Turkey, Rest of MEA)

Value Chain Analysis For Kenaf Market

The Kenaf value chain is initiated at the upstream agricultural phase, involving seed production, propagation of superior genetic lines, contract farming, cultivation, and sophisticated mechanized harvesting. Crucial upstream analysis focuses on optimizing yield per hectare, selecting appropriate drought-resistant cultivars, and implementing precision agriculture technologies to manage inputs (irrigation, nutrients) effectively and sustainably. The efficiency of this stage is fundamentally reliant on specialized agricultural machinery designed to handle the tall, rigid Kenaf stalks without damaging the delicate bast fiber, which differs significantly from conventional crop harvesting. Success in the upstream segment requires close collaboration between agricultural researchers, biotechnology firms developing specialized seeds, and machinery manufacturers to ensure reliable, high-volume production of the raw stalk material, minimizing variability caused by environmental factors and ensuring cost-effective procurement for industrial processors.

The central and most complex phase is primary processing, which includes decortication—the physical separation of the bast fiber from the core hurds—and secondary refining (e.g., degumming, carding, cutting, pelletizing, or non-woven mat formation). Advanced processing techniques, such as mobile dry mechanical decortication integrated with steam explosion, are increasingly favored over traditional water retting due to environmental regulations and the critical need for immediate, standardized fiber separation and drying. Distribution channels bifurcate significantly at this point: Direct channels involve integrated fiber processing companies supplying large, high-volume manufacturers (e.g., Tier 1 automotive suppliers or major insulation panel producers) with highly customized, semi-finished goods like non-woven mats or pre-mixed composite compounds. This direct route offers competitive advantages through shorter lead times, stringent adherence to customized material specifications, and streamlined quality assurance protocols necessary for high-specification industrial use.

Conversely, indirect distribution utilizes commodity traders, specialized brokers, and chemical/material distributors to supply standardized raw or bulk-processed Kenaf material (e.g., dried hurds, baled fiber) to a fragmented downstream market. This includes numerous smaller manufacturers in the textile, packaging, animal care, and localized construction industries where volume flexibility is prioritized over high technical specification. Downstream analysis reveals that end-user demand is heavily influenced by regional regulations, such as building energy codes and automotive lightweighting mandates, as well as specific material certifications. The final application stage involves customers converting the processed Kenaf material into finished products, requiring specialized fabrication expertise in molding, weaving, or extrusion. The continuous optimization of the value chain, from seed research (upstream) to certified product delivery (downstream), is imperative for Kenaf to solidify its position as a mainstream industrial raw material capable of competing effectively with established, high-volume synthetic and wood-based alternatives globally.

Kenaf Market Potential Customers

The diversity of Kenaf’s applications translates into a broad spectrum of potential customers spanning heavy industry, consumer goods manufacturing, and specialized environmental services. Primary end-users include multinational Automotive Original Equipment Manufacturers (OEMs) and their network of Tier 1 and Tier 2 suppliers, such as those supplying components to major vehicle producers like Daimler, Tesla, and General Motors. These companies are committed to using natural fibers in interior components (door panels, dashboards, luggage compartments) to achieve mandated vehicle weight reductions, improve acoustic performance, and demonstrate adherence to circular economy principles. These premium buyers prioritize suppliers who can guarantee high quality, non-abrasive, and reliably sourced fiber inputs in continuous high volumes, often necessitating complex long-term supply contracts.

In the construction sector, potential customers encompass large-scale commercial and residential developers, specialized insulation material producers (seeking high R-value, breathable, and non-toxic insulation alternatives), and manufacturers of bio-concrete or earth construction additives designed to enhance thermal performance and sustainability. These customers are primarily driven by the attainment of high-level sustainability ratings (e.g., LEED Platinum, BREEAM Outstanding) and the growing public preference for natural building materials that enhance indoor air quality and drastically reduce a structure’s total embodied energy. Furthermore, the pulp and paper industry, including major producers of specialized packaging materials, security papers, and high-strength cardboard, remains a high-volume customer group, valuing Kenaf fiber for its rapid renewability, high opacity, and ability to produce high-strength paper grades that reduce reliance on virgin timber.

A rapidly expanding segment of potential customers includes environmental service contractors and large industrial facilities (chemical processing plants, oil refineries, manufacturing sites) requiring high-efficiency, non-leaching absorbent materials for managing oil, chemical, and solvent spills, adhering to strict environmental compliance regulations. The Kenaf core’s superior absorption capacity and ease of disposal make it the preferred bio-based solution for these specialized industrial buyers. Finally, large-scale commercial farming operations (poultry, equestrian, and livestock) represent major buyers of Kenaf core for animal bedding, valuing its low dust content, exceptional moisture absorption, and proven ability to neutralize harmful ammonia odors, contributing to improved animal welfare and reduced veterinary costs. Effective market penetration across these diverse customer segments requires tailored product specifications, certified performance data, and clear articulation of Kenaf’s quantifiable sustainability and performance advantages over competing synthetic and traditional materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kenaf Ventures LLC, Kenaf USA, Advanced Fiber Technology (AFT), Greenfiber International Inc., Vision Kenaf, Kengro Corporation, Natural Fiber Kenya Ltd., Kenaf Eco Fibers, PFI Fibers, Bast Fiber Technologies Inc., Fiberon, Jatropha Africa, PTT Global Chemical Public Company Limited, NAFCO Industries, Agri-Tech Producers LLC, Bio-Kenaf International Co., Limited, New Climate Technologies, Shanghai Kenaf Fiber Products Co., Ltd., Hemp Inc., Vastex, Flexform Technologies, Bcomp Ltd., Kenaf Development Association (KDA), Eco-Fibers LLC, Cordenka GmbH, Tecnaro GmbH, DuPont (in natural fiber composites research), BASF SE (material science focusing on bio-polymers). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kenaf Market Key Technology Landscape

The contemporary technology landscape for the Kenaf market is defined by intensive research into optimizing post-harvest handling and enhancing fiber-polymer compatibility to elevate Kenaf from a low-cost filler to a high-performance material suitable for demanding engineering applications. A primary focus is on refining mechanical decortication processes to achieve superior fiber separation efficiency and purity. The industry is witnessing a definitive shift from stationary, centralized decorticators to mobile, high-capacity field units. This technological shift allows for immediate separation of bast and core fibers at the harvest site, substantially minimizing the logistical challenge and cost associated with transporting the bulky whole stalks, while simultaneously ensuring the rapid drying necessary to preserve fiber quality and prevent microbial degradation. Further technological innovation includes the integration of spectroscopic sensors (e.g., near-infrared spectroscopy) into processing lines, allowing for non-destructive, real-time assessment and quality control of fiber properties such as lignin content and moisture levels, which is vital for providing standardized batches to composite manufacturers.

Material science breakthroughs are heavily concentrated on effective fiber surface modification to overcome the fundamental incompatibility between hydrophilic natural fibers and commonly used hydrophobic polymer matrices. Advanced techniques such as silane treatments, maleated anhydride coupling agents, and low-temperature plasma polymerization are being engineered to chemically alter the hydroxyl groups on the Kenaf fiber surface, significantly improving interfacial adhesion and, consequently, the mechanical performance (flexural modulus, impact strength) and hydrothermal stability of the resulting biocomposites. Furthermore, researchers are actively developing sustainable, bio-based resin systems (e.g., those derived from lignin or vegetable oils) specifically designed to pair seamlessly with Kenaf, enabling the production of fully bio-degradable or bio-compostable structural materials. This pursuit of wholly green composites is a critical technology driver in the European and North American markets where achieving circularity and simplified end-of-life material management are strategic imperatives.

The realization of a sustainable and profitable Kenaf industry depends significantly on the maturation of advanced bio-refinery platforms. These platforms represent integrated technological complexes capable of sequentially fractionating the Kenaf stalk into multiple high-value outputs beyond primary fiber. Key technologies within this system include hydrothermal processing and enzymatic hydrolysis, which efficiently break down residual lignocellulosic biomass into high-value platform chemicals, bio-oils, and intermediates for the production of bio-polymers and bio-fuels. This comprehensive utilization model significantly reduces waste streams, maximizing the value extraction from every component of the harvested plant and enhancing the overall return on investment for Kenaf cultivation. The successful implementation of these multi-product processing technologies will dictate the long-term economic scalability and resilience of the entire Kenaf value chain, ensuring its competitiveness against established, optimized industrial feedstocks.

Regional Highlights

The global Kenaf market segmentation by geography reveals a complex mosaic of supply and demand characterized by distinct regional strengths in cultivation, technological processing, and end-use industrial applications. This differentiation is critical for market players developing global supply strategies and tailored product offerings.

- Asia Pacific (APAC): APAC is the epicenter of global Kenaf cultivation, driven by vast agricultural resources, highly favorable climates, and established low-cost labor structures, particularly in major producing countries like China, India, and Vietnam. The region accounts for the largest volume of Kenaf fiber supply, primarily catering to the massive domestic pulp and paper industry for packaging, newsprint, and specialty papers. While historically focused on low-value, high-volume applications, APAC is rapidly investing in processing technology, spurred by increasing environmental regulations in its industrial sectors, leading to a visible shift towards utilizing Kenaf in construction materials and intermediate automotive components, particularly in established manufacturing hubs like Japan and South Korea, aiming to enhance product sustainability profiles.

- North America: North America represents a technologically advanced consumer market characterized by a strong regulatory push for sustainable manufacturing and high consumer acceptance of green products. The U.S. and Canada are leaders in the high-value application segments, particularly in the automotive interior components and advanced industrial absorbents derived from the Kenaf core. The region focuses heavily on technological standardization, certified supply chains, and the integration of Kenaf composites into high-performance applications, demanding consistent, contaminant-free fiber. Research institutions and private companies are continuously innovating in biocomposite formulation, lightweight acoustic materials, and specialized Kenaf seed oil applications in the nutraceutical and cosmetic industries.

- Europe: Europe is the undeniable vanguard of the Kenaf market in terms of both policy influence and technological application maturity, driving global best practices. Driven by ambitious carbon neutrality goals, stringent waste management regulations, and promotional frameworks for natural fiber composites, the region exhibits the highest concentration of high-performance Kenaf usage in sustainable building insulation, specialized acoustic dampening materials, and complex molded automotive components. European manufacturers excel in advanced surface treatment, enzymatic purification, and bio-polymer compounding technologies, ensuring Kenaf fibers meet the demanding performance standards required by major German, French, and Italian manufacturing bases, establishing Europe as the fastest-growing region in terms of value generated per ton of Kenaf material.

- Latin America (LATAM): LATAM possesses significant untapped agricultural potential for high-yield Kenaf cultivation, especially in countries like Brazil, Argentina, and Mexico, due to their vast land availability and amenable climates. The current market penetration is low, focusing primarily on localized uses such as animal feed, basic bedding, and initial trials of bio-composite applications for local markets. Growth in this region is fundamentally dependent on attracting foreign direct investment to develop modern, industrial-scale processing infrastructure (mobile and stationary decortication facilities) and establishing standardized, internationally compliant supply chains that can serve the developing regional automotive and construction sectors currently reliant on imported, less sustainable materials.

- Middle East and Africa (MEA): Kenaf cultivation in MEA is strategically important due to the crop’s inherent drought resistance and low water requirement, offering a sustainable agricultural alternative in water-scarce environments and potentially improving soil health. The region's market is characterized by emerging demand, driven by large government-backed infrastructure and construction projects emphasizing sustainable and locally sourced materials. Key applications include the use of Kenaf core as high-efficiency absorbent materials for localized oil and gas industrial spills and for soil stabilization and remediation projects. While the cultivation base is expanding, the local, industrial-scale processing capability remains nascent, requiring significant technological transfer and infrastructural development to move beyond raw commodity export and realize local economic benefits.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kenaf Market.- Kenaf Ventures LLC

- Kenaf USA

- Advanced Fiber Technology (AFT)

- Greenfiber International Inc.

- Vision Kenaf

- Kengro Corporation

- Natural Fiber Kenya Ltd.

- Kenaf Eco Fibers

- PFI Fibers

- Bast Fiber Technologies Inc.

- Fiberon

- Jatropha Africa

- PTT Global Chemical Public Company Limited

- NAFCO Industries

- Agri-Tech Producers LLC

- Bio-Kenaf International Co., Limited

- New Climate Technologies

- Shanghai Kenaf Fiber Products Co., Ltd.

- Hemp Inc.

- Vastex

- Flexform Technologies

- Bcomp Ltd.

- Kenaf Development Association (KDA)

- Eco-Fibers LLC

- Cordenka GmbH

- Tecnaro GmbH

- DuPont (in natural fiber composites research)

- BASF SE (material science focusing on bio-polymers)

Frequently Asked Questions

What are the primary commercial uses of Kenaf fiber and core?

Kenaf bast fiber is primarily used in high-strength pulp and paper manufacturing, natural fiber reinforced plastics (biocomposites) for the automotive industry, and technical textiles. The inner woody core fiber is highly valued for its exceptional absorption capabilities, extensively used in industrial spill cleanup, animal bedding, and sustainable building insulation materials due to its porous structure and low density.

How does Kenaf contribute to environmental sustainability and carbon reduction?

Kenaf is highly sustainable due to its rapid growth cycle (reaching commercial maturity in 4–6 months) and low input requirements, making it an ideal substitute for slow-growing wood pulp and petroleum-based materials. Critically, Kenaf is an efficient carbon sink, capable of sequestering substantial amounts of atmospheric CO2 during its short lifespan, providing measurable benefits for corporate and national decarbonization goals and improving soil health.

What major sectors are driving the demand for Kenaf biocomposites globally?

The primary sectors driving demand for Kenaf biocomposites are Automotive and Building & Construction. The automotive industry utilizes Kenaf for lightweight interior components to meet fuel efficiency standards and improve acoustic performance, while the construction sector employs Kenaf in insulation and paneling for energy-efficient, sustainable green building certifications in accordance with stringent regional energy codes and material toxicity requirements.

What are the main technical challenges facing Kenaf adoption in composite materials?

The chief technical challenge is overcoming the inherent hydrophilic (water-absorbing) nature and variability of natural Kenaf fibers, which necessitates advanced and consistent surface modification techniques (chemical, enzymatic, or plasma treatments) to ensure reliable adhesion and compatibility with hydrophobic polymer matrices, critical for maintaining mechanical integrity and long-term durability in high-stress applications.

Which region currently leads the global Kenaf market in terms of technological processing and high-value application?

Europe currently leads the market in technological processing, particularly in advanced decortication, fiber purification, and composite application development. This leadership is fueled by stringent environmental regulations (like REACH) and significant strategic investment in R&D aimed at producing certified, high-performance Kenaf materials for the premium automotive and specialized sustainable construction industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Jute And Kenaf Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Jute, Kenaf), By Application (Medical, Paper, Charcoal, Cellulose, Resin, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Moringa and Kenaf Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Moringa, Kenaf), By Application (Online, Offline), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager