Key Person Income Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433592 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Key Person Income Insurance Market Size

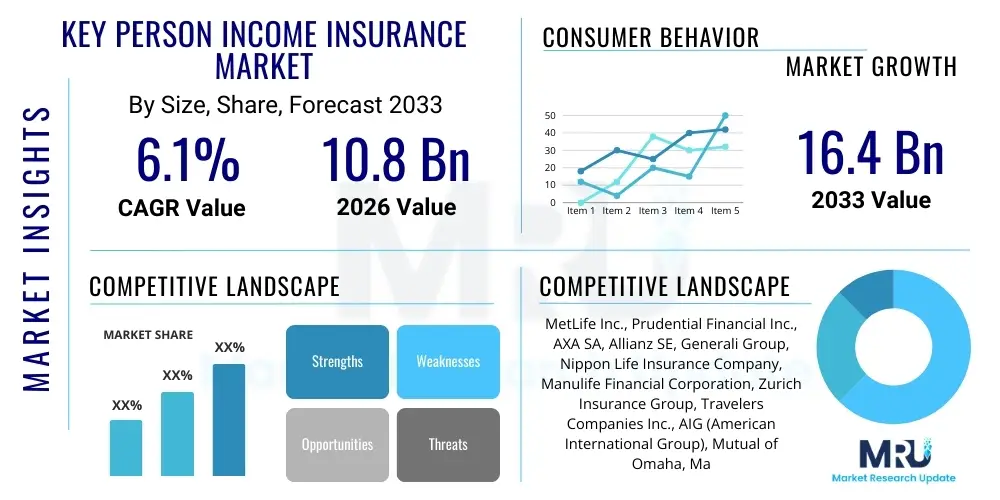

The Key Person Income Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 10.8 Billion in 2026 and is projected to reach USD 16.4 Billion by the end of the forecast period in 2033.

Key Person Income Insurance Market introduction

The Key Person Income Insurance Market encompasses specialized insurance products designed to protect businesses against financial losses resulting from the temporary or permanent disability, critical illness, or death of an individual deemed crucial to the company's operations, revenue generation, or strategic direction. This type of insurance ensures business continuity by providing compensation to cover operational expenses, the cost of finding and training a replacement, or mitigating lost income that would have been generated by the key individual. Unlike standard life or disability insurance, Key Person Income Insurance is a business asset protection strategy, securing the company's financial stability rather than the individual's family.

Major applications of Key Person Income Insurance span across small and medium-sized enterprises (SMEs) to large corporations, particularly those reliant on specialized expertise, proprietary client relationships, or unique leadership skills. Businesses in high-value services sectors such as finance, technology, professional consulting, and specialized manufacturing frequently utilize these policies. The primary benefit lies in risk mitigation, safeguarding shareholder value, and ensuring immediate liquidity following an unforeseen loss, thereby maintaining investor confidence and creditworthiness. The insurance proceeds are typically paid directly to the company, offering essential working capital during periods of disruption.

Driving factors for market growth include the increasing global recognition of intangible assets, such as human capital, as critical components of business valuation. Regulatory requirements in specific industries and the growing complexity of global supply chains, making businesses more vulnerable to personnel disruption, further accelerate demand. Furthermore, the rise in entrepreneurial ventures and the concentration of critical knowledge within founders or highly specialized technical teams in startup ecosystems necessitate robust risk transfer mechanisms like Key Person Income Insurance to secure future viability and attract investment.

Key Person Income Insurance Market Executive Summary

Current business trends indicate a strong shift towards comprehensive risk management frameworks, propelling the demand for Key Person Income Insurance products that are highly customized based on the specific role and financial contribution of the insured key employee. Insurers are innovating by integrating wellness programs and preventive health benefits into their policies to mitigate risks proactively, moving beyond traditional reactive compensation models. Furthermore, the digitalization of the underwriting and claims process is improving efficiency and reducing turnaround times, making these specialized products more accessible to the burgeoning SME segment globally, which traditionally faced higher transactional barriers.

Regionally, North America maintains market dominance due to high insurance penetration rates, stringent corporate governance standards, and a mature financial services infrastructure that emphasizes robust corporate protection. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, driven by rapid industrialization, the proliferation of tech startups, and increasing regulatory awareness among local businesses regarding the importance of human capital protection. Europe shows steady, stable growth, fueled by highly specialized manufacturing and technology sectors, coupled with favorable tax treatments for specific types of key person policies.

Segmentation trends reveal significant traction in policies covering small and medium-sized enterprises, reflecting the high dependency of SMEs on a limited number of individuals. In terms of distribution, hybrid models combining digital platforms with traditional broker consultation are gaining prominence, offering clients personalized advice alongside digital convenience. The technology and healthcare sectors are emerging as primary end-users, given the substantial investment in specialized R&D talent and the critical nature of their intellectual property, making key personnel irreplaceable in the short term. The preference for Term policies over Permanent ones remains dominant due to their lower premium cost and alignment with specific project timelines or tenure of key contracts.

AI Impact Analysis on Key Person Income Insurance Market

User queries regarding AI's influence predominantly center on three core themes: first, how AI-driven predictive analytics can refine underwriting models and risk assessment for key personnel; second, the potential displacement or augmentation of key roles by AI, affecting the insurable value of human capital; and third, the efficiency gains in policy administration and claims processing through automation. Users are seeking clarity on whether AI adoption will lead to reduced premiums due to better risk identification or increased complexity in valuing human roles that are increasingly supported by sophisticated algorithms. There is a general expectation that AI will streamline the user experience but also a concern about the accuracy and bias inherent in automated risk scoring, especially when determining the health and professional stability of high-value corporate individuals.

The immediate impact of Artificial Intelligence involves transforming actuarial science within this niche market. AI algorithms can analyze vast datasets, including corporate financial health, industry risk profiles, employee health records (if permissible), and macroeconomic indicators, offering a much more precise quantification of the financial loss associated with losing a key employee. This level of granular risk modeling allows insurers to offer dynamically priced, customized policies that better match the actual exposure of the business, moving away from generalized industry benchmarks. AI-powered chatbots and virtual assistants are also enhancing customer service, providing 24/7 policy management access and preliminary claim guidance.

Furthermore, AI facilitates enhanced fraud detection and policy adherence monitoring. By analyzing patterns in claims data and policyholder behavior, machine learning models can flag suspicious activity with higher accuracy than traditional methods. However, the long-term strategic impact is more complex, particularly concerning job roles. As AI assumes routine and analytical tasks, the "key person" designation shifts increasingly towards individuals possessing unique cognitive skills, complex decision-making abilities, and creative leadership—skills harder for algorithms to replicate. This potentially increases the insurable value of these high-level human roles, driving demand for specialized, high-limit policies tailored to intellectual capital risk rather than mere operational dependency.

- AI enhances predictive underwriting, enabling personalized premium pricing based on granular corporate and health risk data.

- Automation streamlines claims processing and policy issuance, reducing administrative costs and improving speed.

- AI tools facilitate advanced fraud detection by analyzing behavioral and financial claim patterns.

- Integration of AI shifts the focus of 'key person' valuation towards irreplaceable cognitive and leadership skills.

- Generative AI supports personalized customer interaction and dynamic policy modification advice.

DRO & Impact Forces Of Key Person Income Insurance Market

The Key Person Income Insurance market is fundamentally shaped by a dynamic interplay of macroeconomic stability, corporate governance standards, and technological advancements in risk assessment. Drivers (D) include the escalating cost of specialized human capital and the growing reliance on specific talent in knowledge-based economies, which necessitates financial protection against loss. Restraints (R) primarily involve the high premium costs associated with specialized policies, particularly for small businesses with tight margins, and the inherent difficulty in accurately quantifying the true financial value of a key individual, leading to underinsurance or reluctance to purchase coverage. Opportunities (O) emerge from tapping into underserved emerging markets where regulatory frameworks are maturing and integrating advanced data analytics (AI/ML) to develop novel parametric insurance solutions based on defined corporate loss events. These forces collectively dictate the market trajectory, driving innovation in risk transfer mechanisms and expanding the adoption base.

Key drivers include the global expansion of venture capital-backed startups, which often require key person coverage as a condition for investment, and the increasing trend of employee mobility, which heightens the risk of losing irreplaceable talent. Furthermore, changing demographics and the aging workforce in developed nations elevate the risk of illness or disability among senior management, stimulating proactive risk mitigation strategies. Conversely, a major restraint is the perception among some business owners that insurance is an unnecessary overhead cost, coupled with complexity in tax treatment across different jurisdictions which can deter multinational corporations from implementing standardized global policies.

Impact forces acting on the market include economic volatility, which can influence premium affordability and the perceived need for financial buffers. Regulatory shifts, such as changes in corporate tax laws regarding premium deductibility, can significantly affect demand. Societal trends, including greater awareness of mental health issues leading to increased disability claims, necessitate policy adjustments and more inclusive risk assessment methods. The market is constantly adjusting to these external pressures, focusing efforts on educating the SME sector about the strategic value of human capital protection and developing flexible products that cater to gig economy executives and highly specialized contractors, thereby capitalizing on existing gaps in traditional coverage.

Segmentation Analysis

The Key Person Income Insurance Market is comprehensively segmented based on various critical parameters, including the type of coverage offered, the size of the enterprise procuring the policy, the industry vertical, and the distribution channel utilized for sales and servicing. Understanding these segmentations is vital for both insurers and corporate buyers, as it dictates product design, pricing strategy, and market access points. Coverage types differentiate based on the risk covered, such as disability or critical illness, whereas enterprise size dictates the policy limit and administrative complexity. Vertical segmentation reveals sectors with the highest inherent risk and dependency on specialized talent, informing targeted marketing efforts.

The segmentation structure reflects the diverse needs of the global business landscape, where a startup's requirement for a founder's income protection differs significantly from a multinational corporation's need to insure its top engineering team. This specialization ensures that insurance providers can tailor risk transfer solutions effectively, aligning the policy benefits with the specific financial vulnerability of the insured organization. The dominance of the SME segment in volume is balanced by the higher average premium value associated with large enterprises, creating a dual-market focus for insurance providers seeking sustainable growth across different economic strata.

- By Coverage Type:

- Key Person Disability Income Insurance

- Key Person Critical Illness Insurance

- Key Person Term Life Insurance (used often in conjunction with income protection)

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Distribution Channel:

- Brokers and Agents (Intermediaries)

- Bancassurance

- Direct Sales (Online Platforms/Company Portals)

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology and Telecom

- Healthcare and Pharmaceuticals

- Manufacturing and Automotive

- Professional Services (Legal, Consulting, Accounting)

Value Chain Analysis For Key Person Income Insurance Market

The value chain for Key Person Income Insurance begins with upstream activities centered on capital management and actuarial development. Upstream stakeholders include reinsurers, who mitigate large-scale systemic risks taken on by primary insurers, and specialized data providers, who supply the historical health, financial, and industry-specific data necessary for precise risk modeling. The primary insurers then use this infrastructure to develop and price the highly specific Key Person products, defining policy terms, coverage limits, and premium structures. The efficiency of this upstream phase, particularly the reinsurance capacity available and the accuracy of actuarial data, directly impacts the affordability and availability of coverage in the market.

The midstream phase focuses on policy distribution, sales, and underwriting. This is where distribution channels—including independent brokers, captive agents, and increasingly, direct-to-consumer digital platforms—play a crucial role in reaching potential customers. Brokers provide essential consultative services, explaining the complex tax and legal implications of key person policies to business owners. Robust underwriting, often leveraging advanced analytics and medical exams, assesses the health and financial contribution of the key individual, determining the final risk profile and premium. The smooth flow of information between the sales team and the underwriters is critical for maintaining efficiency and customer satisfaction.

Downstream activities involve policy servicing, claims management, and regulatory compliance. Effective claims management is the most critical component, as it validates the value proposition of the insurance product; prompt and fair settlement is essential for maintaining trust and brand reputation. Direct channels utilize automated processing for routine claims, while complex, high-value claims require expert human adjusters. Regulatory bodies across different regions impose strict compliance requirements related to data privacy and financial solvency, impacting how policies are administered and how reserves are managed throughout the entire forecast period.

Key Person Income Insurance Market Potential Customers

The primary end-users and buyers of Key Person Income Insurance are commercial entities seeking to mitigate business interruption risk associated with the temporary or permanent loss of indispensable employees. This demographic spans a broad spectrum, from high-growth technology startups that rely entirely on the expertise of a single founder or chief technology officer, to established multinational corporations where specific C-suite executives or highly skilled operational managers possess unique knowledge or crucial relationships that drive significant revenue. The decision to purchase is usually driven by the corporate finance department, shareholders, or sometimes mandated by lending institutions or venture capitalists.

Specific high-potential customer groups include firms involved in proprietary intellectual property development, such as biotechnology and software companies, where the loss of a lead scientist or engineer can halt research and development efforts, costing millions in sunk investment. Furthermore, professional service firms, including top-tier legal, accounting, and consulting partnerships, are extremely reliant on the reputation and client relationships held by senior partners; these businesses often purchase key person policies to stabilize income during partner transitions. The focus is shifting towards SMEs globally, which constitute the largest segment of potential buyers but require simplified, cost-effective product offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.8 Billion |

| Market Forecast in 2033 | USD 16.4 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MetLife Inc., Prudential Financial Inc., AXA SA, Allianz SE, Generali Group, Nippon Life Insurance Company, Manulife Financial Corporation, Zurich Insurance Group, Travelers Companies Inc., AIG (American International Group), Mutual of Omaha, MassMutual, New York Life Insurance Company, Sun Life Financial Inc., Lincoln National Corporation, Principal Financial Group, Guardian Life, Unum Group, Swiss Re, Munich Re. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Key Person Income Insurance Market Key Technology Landscape

The Key Person Income Insurance market is undergoing a significant technological transformation, moving away from manual, paper-intensive underwriting processes towards digital and data-driven platforms. The core technology involves advanced data analytics and predictive modeling, utilizing machine learning (ML) algorithms to assess the long-term risk profile of key individuals based on vast datasets encompassing public health information, economic indicators, and corporate performance metrics. This shift enables insurers to offer instantaneous, data-validated quotes, drastically improving the speed of policy issuance, which is a key competitive differentiator, especially when serving fast-moving startups and time-sensitive corporate risk reviews.

Insurtech adoption plays a crucial role, with specialized platforms offering Application Programming Interfaces (APIs) for seamless integration with corporate Human Resources (HR) and Enterprise Resource Planning (ERP) systems. This integration allows for real-time monitoring of key personnel status (where legally permissible) and automated adjustments to policy coverage as the insured individual's role or the company's valuation changes. Furthermore, the use of blockchain technology is being explored to enhance data security, streamline the verification of medical and financial records, and ensure transparent, immutable records of policy terms and claims history, mitigating disputes and enhancing regulatory compliance across borders.

The distribution landscape is heavily reliant on Customer Relationship Management (CRM) systems integrated with sophisticated modeling tools that help brokers and agents illustrate the complex financial need for key person coverage through scenario planning and visualization. For claims processing, Optical Character Recognition (OCR) and Natural Language Processing (NLP) technologies automate the intake and initial assessment of claim documents, speeding up the verification phase. Telematics and personalized wellness programs, often linked to wearable technology, are also emerging, offering the potential for proactive risk reduction and rewarding policyholders who demonstrate commitment to health management, although data privacy regulations remain a critical barrier to widespread adoption of personalized health data integration.

Regional Highlights

North America, comprising the United States and Canada, stands as the global leader in the Key Person Income Insurance market, characterized by high corporate awareness of human capital risk and a mature, competitive insurance sector. The region benefits from robust regulatory frameworks, such as strict corporate governance rules, that often necessitate key person policies for stability, particularly in publicly traded companies. The high concentration of technology, biotechnology, and financial services firms in areas like Silicon Valley and Wall Street creates substantial demand for high-limit policies covering intellectual property risk. Premiums are generally higher here due to comprehensive coverage expectations and the elevated valuations placed on top-tier talent. Innovation in Insurtech, especially AI-driven underwriting, is most pronounced in this region, driving market efficiency and product complexity to new levels.

Europe represents a stable and highly regulated market, with significant demand originating from specialized manufacturing sectors in Germany and high-value financial centers in the UK and Switzerland. The market exhibits slower but consistent growth, driven by legal mandates related to employee benefits and partnership agreements. A notable feature is the strong preference for broker and agent distribution channels, where long-term relationships and personalized tax advice are paramount due to varying national tax treatments of insurance proceeds. Regulatory divergence across the EU and UK presents a minor constraint, requiring insurers to tailor products precisely to local legal and taxation regimes. The focus here is often on mitigating the income loss from partners or specialized technical experts crucial for niche industrial outputs.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This accelerated growth is fueled by massive economic expansion, particularly in China, India, and Southeast Asian nations, leading to the rapid proliferation of startups and SMEs. As these economies mature, corporate entities are increasingly adopting Western-style risk management practices, recognizing the strategic importance of key personnel. While insurance penetration remains lower than in North America, government initiatives to promote business stability and foreign direct investment (FDI) often drive the adoption of key person policies. The challenge in APAC lies in adapting complex policies to highly diverse cultural expectations and fragmented regulatory landscapes, requiring localization of product offerings and distribution strategies, often relying heavily on Bancassurance channels.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging markets with high untapped potential. In LATAM, economic instability and fluctuating exchange rates necessitate policies that offer flexible payout mechanisms, attracting demand from resource-intensive industries and large family-owned businesses. MEA growth is concentrated in financial hubs like Dubai and emerging markets like Saudi Arabia, driven by major governmental diversification projects that rely heavily on expatriate key talent. Insurers entering these regions focus on building relationships with major corporate entities and addressing unique regional risks, such as political instability or sudden regulatory changes, by incorporating specialized clauses in the policy contracts.

- North America: Market leader; driven by high corporate governance standards, technology sector concentration, and advanced Insurtech adoption.

- Asia Pacific (APAC): Fastest-growing region; accelerated by SME growth, economic maturity, and increasing regulatory awareness in countries like China and India.

- Europe: Stable growth market; strong demand from specialized manufacturing and financial services; reliance on traditional broker channels for tax complexity management.

- Latin America and MEA: Emerging potential; characterized by demand from large family businesses and resource sectors, requiring flexible, customized coverage solutions addressing political and economic volatility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Key Person Income Insurance Market.- MetLife Inc.

- Prudential Financial Inc.

- AXA SA

- Allianz SE

- Generali Group

- Nippon Life Insurance Company

- Manulife Financial Corporation

- Zurich Insurance Group

- Travelers Companies Inc.

- AIG (American International Group)

- Mutual of Omaha

- MassMutual

- New York Life Insurance Company

- Sun Life Financial Inc.

- Lincoln National Corporation

- Principal Financial Group

- Guardian Life

- Unum Group

- Swiss Re

- Munich Re

Frequently Asked Questions

Analyze common user questions about the Key Person Income Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Key Person Income Insurance and how does it differ from standard life insurance?

Key Person Income Insurance (KPII) is a business insurance policy designed to compensate the company for financial losses incurred if an essential employee becomes disabled or critically ill and cannot work, thereby protecting the company's revenue stream or operations. Standard life insurance typically pays benefits to the deceased person's family (beneficiary). In KPII, the company is the owner, premium payer, and sole beneficiary, and the proceeds cover business expenses or lost profits, not personal financial needs. This distinction is crucial for understanding corporate risk management strategies and tax implications.

Are premiums paid for Key Person Income Insurance tax-deductible for the business?

Generally, premiums paid for Key Person Income Insurance are not tax-deductible if the policy is structured such that the company is the beneficiary and the proceeds are intended to replace lost income or cover capital expenses. Conversely, the benefit payout received by the company upon a claim is typically not considered taxable income. However, specific tax treatments vary significantly by jurisdiction (e.g., U.S. vs. EU) and depend heavily on how the policy is precisely structured and whether the premiums are deemed compensation. Businesses must consult a specialized tax advisor before implementation to ensure compliance and optimize financial structure.

How is the financial value of a key person determined for calculating coverage limits?

The financial value of a key person is calculated using several methods, focusing on the potential financial loss to the business. Common methodologies include the Multiple of Salary method (often 5 to 10 times the annual compensation), the Replacement Cost method (covering recruitment and training costs), and the Contribution to Profits method (quantifying the specific percentage of revenue directly attributable to the key person). Advanced underwriting increasingly uses discounted cash flow analysis or proprietary actuarial models, sometimes incorporating AI, to determine a robust and justifiable coverage amount that mitigates specific corporate financial risk without triggering excessive premiums.

Which industry verticals have the highest demand for Key Person Income protection?

The highest demand for Key Person Income protection originates primarily from knowledge-intensive and specialized sectors where intellectual capital is the main driver of value. These include Information Technology and Telecommunications (insuring lead developers or architects), Healthcare and Pharmaceuticals (protecting chief research scientists), and Professional Services (covering senior partners in legal or consulting firms). Small and medium-sized enterprises (SMEs) across all sectors also represent significant demand, as their operation is often critically dependent on the physical and cognitive health of one or two founders or key operational managers.

What is the role of technology and Insurtech in modern Key Person Income policy administration?

Technology, particularly Insurtech solutions and AI/ML, revolutionizes policy administration by enabling rapid risk assessment and precise underwriting, moving away from slow, manual processes. Insurtech platforms offer digital policy management, automated renewal processes, and streamlined claims filing, significantly improving customer experience and operational efficiency. Furthermore, data analytics help insurers monitor risk exposure in real-time and offer highly customized policy riders, making specialized key person products more flexible and accessible to the broader commercial market, particularly the tech-savvy SME segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager