Keyhole Orthopedic Surgery Instruments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434858 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Keyhole Orthopedic Surgery Instruments Market Size

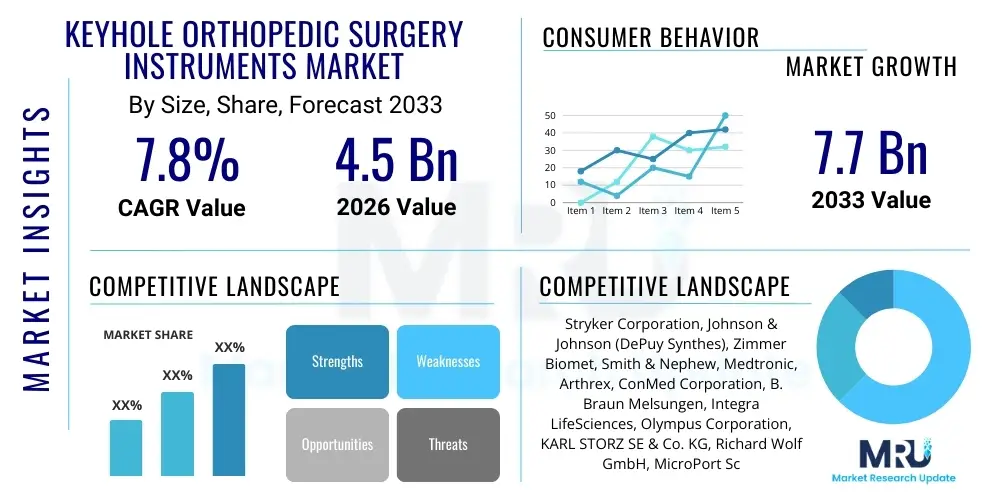

The Keyhole Orthopedic Surgery Instruments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global incidence of sports injuries, degenerative joint conditions, and the growing elderly population who require minimally invasive surgical interventions to ensure quicker recovery times and reduced healthcare costs. The continued penetration of advanced arthroscopic techniques, particularly in developing economies, further catalyzes this market trajectory, establishing keyhole surgery as the preferred standard of care for numerous musculoskeletal ailments.

Keyhole Orthopedic Surgery Instruments Market introduction

The Keyhole Orthopedic Surgery Instruments Market encompasses a sophisticated array of specialized tools and devices utilized in minimally invasive orthopedic procedures, primarily arthroscopy. These instruments, designed for precision and minimal tissue damage, facilitate complex surgeries through small incisions, dramatically reducing patient trauma compared to traditional open surgery. Key product categories include arthroscopes (optical systems), powered shaver systems, radiofrequency (RF) ablation devices, and specialized instruments for tissue resection, fixation, and repair within joints such as the knee, shoulder, hip, and spine. The paramount benefit of these instruments lies in enabling surgeons to visualize and repair internal joint damage effectively with enhanced clarity and maneuverability.

Major applications of keyhole orthopedic instruments span reconstructive surgery, trauma management, and joint preservation. Procedures involving meniscus repair, ligament reconstruction (like ACL reconstruction), rotator cuff repair, and articular cartilage restoration are heavily reliant on these precise tools. The inherent advantages, including shorter hospital stays, reduced post-operative pain, lower infection rates, and accelerated return to activity, have positioned minimally invasive techniques as the gold standard in elective orthopedic procedures. This rising demand reflects a global shift towards value-based healthcare, where patient outcomes and efficiency are prioritized, thereby consistently fueling instrument adoption.

Driving factors for sustained market growth are multifold. Firstly, technological innovation, particularly the integration of high-definition (HD) and 3D imaging systems, provides superior visualization capabilities, enhancing surgical accuracy. Secondly, the increasing prevalence of obesity and sedentary lifestyles contributes to a higher incidence of orthopedic conditions requiring intervention. Furthermore, the expansion of healthcare infrastructure, coupled with favorable reimbursement policies for minimally invasive procedures in mature markets, provides a robust economic framework supporting continuous investment in advanced keyhole surgical instrument portfolios by leading manufacturers.

Keyhole Orthopedic Surgery Instruments Market Executive Summary

The Keyhole Orthopedic Surgery Instruments Market is undergoing a rapid transition characterized by innovation and strategic expansion, focusing heavily on enhancing surgical precision and workflow efficiency. Business trends indicate a strong move toward consolidated procedural kits and single-use instruments to mitigate sterilization concerns and streamline surgical processes. Leading market players are strategically engaging in mergers, acquisitions, and collaborations to broaden their geographic reach and integrate niche technological capabilities, such as robotic assistance components and advanced visualization platforms, ensuring a competitive edge in offering comprehensive solutions rather than isolated devices.

Regionally, North America maintains its dominance due to high healthcare expenditure, sophisticated infrastructure, and early adoption of novel technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by improving access to orthopedic care, a large patient demographic suffering from age-related orthopedic issues, and rapid establishment of modern Ambulatory Surgical Centers (ASCs). European markets continue steady growth, emphasizing regulatory compliance and quality assurance in instrument manufacturing, driven by universal healthcare systems prioritizing effective, minimally invasive treatment protocols.

Segment trends highlight the dominance of arthroscopes and related visualization systems due to their foundational role in keyhole surgery, although the fastest growth is anticipated in specialized devices like RF ablation and powered shaver systems, which offer enhanced tissue removal and hemostasis capabilities. Among applications, knee and shoulder surgeries remain the largest segments, reflecting the high volume of sports-related injuries and degenerative joint disease treatments. The End-User segment shows a marked shift towards ASCs, driven by cost-effectiveness and operational efficiency for routine orthopedic procedures, placing pressure on manufacturers to develop instruments suitable for high-throughput outpatient environments.

AI Impact Analysis on Keyhole Orthopedic Surgery Instruments Market

Users frequently inquire about how Artificial Intelligence (AI) will transcend traditional instrument manufacturing and utilization in keyhole orthopedic surgery, focusing intensely on concerns regarding surgical autonomy, predictive maintenance, and enhanced navigation systems. The core themes revolve around the expectation that AI can drastically improve surgical planning, reduce operative time, and personalize instrument calibration based on real-time intraoperative data. Users are particularly interested in AI algorithms that can analyze imaging data (MRI, CT) pre-operatively to select the optimal instrument size and trajectory, and how machine learning will integrate into robotic platforms that utilize keyhole instruments to increase accuracy in drilling and tissue resection, minimizing human error and variability. The overall consensus points toward AI becoming an indispensable layer of intelligence supporting complex arthroscopic procedures.

The integration of AI, machine learning, and computer vision technologies is profoundly influencing the design, functionality, and surgical application of keyhole orthopedic instruments. For manufacturers, AI is instrumental in optimizing supply chain logistics and predicting equipment failure, thus ensuring instrument availability and reliability in critical surgical environments. Clinically, AI enhances the utility of instruments by enabling real-time feedback; algorithms can instantaneously assess tissue tension, instrument force, and proximity to sensitive structures, transmitting this data back to the surgeon or the robotic system controlling the instrument. This immediate, data-driven assistance represents a significant leap forward from purely mechanical instrument design, offering unprecedented safety and precision, particularly in deep joint spaces.

Furthermore, AI is driving the development of next-generation surgical training simulators. These advanced simulators use machine learning models trained on thousands of surgical videos to provide realistic tactile feedback and objective performance metrics, allowing surgeons to practice using keyhole instruments in a controlled virtual environment. This enhances proficiency and standardizes surgical skills globally before the instruments are used on patients. As AI systems become more integrated into intraoperative navigation and robotic guidance systems specifically designed for keyhole access, the complexity of procedures that can be safely performed minimally invasively will expand, directly fueling demand for AI-compatible instruments that feature embedded sensors and data transmission capabilities.

- AI-powered image analysis optimizes pre-operative planning and instrument selection.

- Machine learning enhances robotic control systems for precise instrument manipulation during surgery.

- Real-time sensor data feedback improves surgical accuracy and reduces tissue damage risk.

- AI aids in predictive maintenance of powered instruments, minimizing downtime.

- Computer vision systems assist in enhanced surgical visualization and instrument tracking within the joint cavity.

DRO & Impact Forces Of Keyhole Orthopedic Surgery Instruments Market

The dynamics of the Keyhole Orthopedic Surgery Instruments Market are shaped by powerful Drivers and significant Restraints, balanced by emerging Opportunities, all synthesized into critical Impact Forces. Key Drivers include the undeniable global shift toward minimally invasive surgery (MIS) due to superior patient outcomes, the demographic bulge of the aging population prone to orthopedic issues, and continuous technological miniaturization leading to high-definition arthroscopic systems. However, formidable Restraints exist, notably the high initial cost of sophisticated instrumentation and robotic systems, which limits adoption in resource-constrained settings, coupled with the steep learning curve and specialized training required for surgeons to master these advanced keyhole techniques, posing a significant bottleneck to widespread utilization.

Opportunities for growth are concentrated in untapped emerging markets, where rapid healthcare infrastructure development is creating new demand pathways, and the development of specialized instruments for previously complex MIS procedures, such as advanced spinal and hip arthroscopy. The ongoing trend toward outpatient care, particularly in Ambulatory Surgical Centers (ASCs), also provides a massive opportunity for reusable and disposable instrument kits optimized for efficiency and rapid turnover. Impact forces derived from these dynamics show a high positive influence from technology and patient demand, counteracted by moderate negative pressures from stringent regulatory frameworks and cost sensitivity, necessitating manufacturers to focus on cost-effective innovation that still meets the highest standards of safety and efficacy.

The collective impact forces strongly favor market expansion, driven primarily by innovation and patient preference for less invasive options. The rising incidence of sports injuries worldwide, particularly among younger and active demographics, ensures a constant demand base for reparative keyhole procedures. Furthermore, increased investment in research and development dedicated to bioresorbable fixation devices and next-generation optics ensures that the instruments portfolio remains cutting-edge. Regulatory scrutiny, while a restraint, simultaneously forces standardization and quality, ultimately enhancing market credibility and patient trust in keyhole surgical outcomes. The necessity to continuously train surgical staff globally to manage these evolving instruments is perhaps the most critical long-term structural challenge.

Segmentation Analysis

The Keyhole Orthopedic Surgery Instruments Market is comprehensively segmented based on Product Type, Application, and End-User, allowing for granular analysis of market penetration and growth vectors across distinct categories. The stratification reflects the diverse range of tools required to perform complex arthroscopic and minimally invasive orthopedic interventions efficiently. Product type segmentation helps in understanding the revenue contribution of visualization components versus operational tools, while application segmentation highlights procedural volume trends across major joints. End-user analysis is critical for assessing purchasing power and infrastructure readiness across hospitals and increasingly prevalent outpatient facilities, guiding strategic sales efforts.

The Product Type segment is dominated by instruments that provide visualization and access, such as arthroscopes and portals, but the operational segments, particularly powered instruments (shavers and burrs), are crucial for tissue debridement and bony work. Application segmentation reveals that high-volume procedures like knee arthroscopy, covering meniscus and ligament repair, account for the largest share, followed closely by shoulder surgery. This pattern reflects the anatomical structures most frequently subject to traumatic and degenerative wear and tear. Furthermore, as techniques for hip and spinal arthroscopy mature, these application segments are projected to demonstrate accelerated growth rates, driving demand for specialized, elongated, or angled instruments.

The strategic differentiation of segments aids both market analysts and manufacturers in targeting research and development expenditures toward the most profitable and high-growth areas. For instance, the robust growth in the End-User segment of Ambulatory Surgical Centers (ASCs) dictates a design trend favoring compact, easily sterilized, or disposable instrument sets suitable for high-turnover procedures, contrasting with the hospital segment which might prioritize high-capital, integrated robotic systems. Understanding these segmentation nuances is fundamental to developing effective commercial strategies and forecasting future technological requirements in the orthopedic space.

- By Product Type: Arthroscope, Shaver Systems, RF Ablation Systems, Fluid Management Systems, Tissue Repair Devices, Handheld Instruments, Others.

- By Application: Knee Surgery, Shoulder Surgery, Hip Surgery, Spine Surgery, Extremities Surgery (Ankle, Wrist).

- By End-User: Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics.

Value Chain Analysis For Keyhole Orthopedic Surgery Instruments Market

The value chain for the Keyhole Orthopedic Surgery Instruments Market begins with upstream activities focused on the procurement of high-grade raw materials—primarily medical-grade stainless steel, titanium alloys, advanced plastics, and precision optical components. Success in the upstream segment relies heavily on maintaining stringent quality control, material traceability, and managing complex relationships with specialized component suppliers, especially those providing advanced optics and miniaturized electronic sensors crucial for modern arthroscopes and powered instruments. Manufacturing involves highly technical processes, including micro-machining, sterilization validation, and assembly in ISO-certified cleanroom environments, where intellectual property related to proprietary device design and ergonomics is paramount to market competitiveness.

Downstream activities involve extensive distribution channels, which are bifurcated into direct sales forces managed by major orthopedic companies and indirect distribution networks utilizing specialized medical device distributors or group purchasing organizations (GPOs). The complexity of keyhole instruments often necessitates a direct sales model in key markets to provide technical support, product training, and clinical demonstration, particularly for new and highly integrated systems like robotic arms used in conjunction with these instruments. Indirect channels are more frequently utilized for commodity instruments and lower-cost consumables, ensuring broad market reach across smaller hospitals and clinics globally.

The efficiency of the distribution channel is directly linked to timely product availability and reducing inventory costs for end-users. Direct channels offer enhanced customer intimacy and feedback loops essential for product iteration, while indirect channels provide rapid market penetration, especially in geographically fragmented regions like APAC. Ultimately, the successful delivery of value is realized at the point of use, where the instruments enable surgeons to perform successful minimally invasive procedures, justifying the premium associated with precision, high-quality instrumentation and generating value for the payer, provider, and patient through improved clinical outcomes and cost efficiencies related to faster recovery.

Keyhole Orthopedic Surgery Instruments Market Potential Customers

The primary consumers and end-users of keyhole orthopedic surgery instruments are institutions dedicated to surgical care, particularly those specializing in trauma, sports medicine, and reconstructive orthopedics. Hospitals, especially large tertiary and university medical centers, represent the largest segment of potential customers due to their capacity to handle high volumes of complex cases, their adoption of high-capital equipment (such as robotics and integrated operating room systems), and their critical role in treating multi-joint injuries. These institutions prioritize instrument durability, seamless integration with existing imaging platforms, and comprehensive service contracts offered by major vendors to ensure continuous operational readiness and minimize long-term total cost of ownership.

Ambulatory Surgical Centers (ASCs) constitute the fastest-growing customer segment. ASCs focus predominantly on elective, less complex orthopedic procedures suitable for outpatient settings, such as basic arthroscopies and soft tissue repairs. For ASCs, the buying criteria emphasize cost-efficiency, speed of setup, and the preference for disposable or easily managed instrument kits that reduce sterilization burdens and quicken patient turnover times. Manufacturers are increasingly tailoring instrument portfolios—often promoting single-use arthroscopes and disposable accessory kits—specifically to meet the operational demands and economic constraints characteristic of the ASC environment, recognizing their expanding procedural volume.

Specialty Orthopedic Clinics and Sports Medicine Institutes also serve as vital, albeit smaller, customers. These centers often maintain a highly focused inventory of instruments designed for specific procedures (e.g., knee or shoulder specialists) and demand the latest, most specialized tools to maintain a competitive edge and attract professional athletes or high-performance patients. Procurement decisions in these specialized settings are often influenced directly by leading orthopedic surgeons who champion specific brands or technological advancements, driving the adoption of niche, high-precision instruments and contributing significantly to the demand for highly specialized training and support services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, Smith & Nephew, Medtronic, Arthrex, ConMed Corporation, B. Braun Melsungen, Integra LifeSciences, Olympus Corporation, KARL STORZ SE & Co. KG, Richard Wolf GmbH, MicroPort Scientific Corporation, DJO Global, Inc., Vilex, Inc., Globus Medical, NuVasive, Inc., Ossur, Misonix, Inc., Acumed LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Keyhole Orthopedic Surgery Instruments Market Key Technology Landscape

The technology landscape governing the Keyhole Orthopedic Surgery Instruments Market is centered around enhanced visualization, miniaturization, and integration with advanced surgical platforms. High-definition (HD), 4K, and 3D arthroscopic imaging systems represent the foundational technology, providing surgeons with superior clarity and depth perception necessary for navigating the confined joint spaces. This evolution in optics is complemented by Chip-on-Tip (COT) camera technology, where the image sensor is placed directly at the distal end of the scope, eliminating the need for traditional fiber optics and resulting in brighter, clearer images and enabling the development of smaller, disposable arthroscopes that significantly reduce cross-contamination risk and reprocessing costs, thereby improving patient safety and operational efficiency.

In addition to imaging, powered instrumentation utilizes sophisticated motor and blade technology. Modern shaver systems incorporate oscillating and reciprocating motion profiles coupled with enhanced aspiration control to efficiently remove damaged tissue while minimizing thermal injury. Radiofrequency (RF) ablation and plasma-based technologies are critical for soft tissue removal, hemostasis, and contouring, offering precise energy delivery to control bleeding and ablate tissue with reduced collateral damage compared to mechanical cutting. The advancement in these energy-based instruments focuses on developing smarter, feedback-driven systems that adjust energy output in real-time based on tissue impedance, enhancing safety and surgical effectiveness within the joint capsule.

Crucially, the market is witnessing the rapid proliferation of integrated robotic and navigation systems tailored for keyhole orthopedic procedures, especially in spine and hip applications. These systems leverage optical tracking and pre-operative planning software to guide keyhole instruments, ensuring highly accurate placement of implants, screws, and fixation devices. Technologies such as haptic feedback mechanisms integrated into instrument handles provide the surgeon with tactile information about tissue density and proximity to critical structures, transforming the conventional mechanical instrument into a smart, digitally augmented tool. This technological convergence defines the future of minimally invasive orthopedic surgery, emphasizing automation, predictability, and improved long-term functional outcomes for patients undergoing keyhole intervention.

Regional Highlights

Geographic analysis of the Keyhole Orthopedic Surgery Instruments Market reveals substantial disparities in market maturity, technological adoption, and growth potential across major global regions.

- North America (U.S. and Canada): This region is characterized by market maturity, high penetration of advanced technologies (including robotics and 3D imaging), and significant healthcare spending. The large patient pool with access to advanced insurance coverage ensures continuous adoption of high-cost, high-precision instruments. The U.S. remains the epicenter of R&D and strategic investment, driven by the presence of key industry leaders and a focus on advanced sports medicine procedures.

- Europe (Germany, U.K., France, Italy): Europe is a substantial market driven by robust governmental initiatives promoting minimally invasive surgery and standardized quality of care. Regulatory harmonization across the EU facilitates market access for innovative instruments. Germany and the U.K., in particular, show high adoption rates, supported by well-established universal healthcare systems that prioritize efficient, quick-recovery treatments.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is projected to be the fastest-growing region, presenting vast untapped potential. Growth is fueled by rapid expansion of healthcare infrastructure, rising medical tourism, increasing disposable income, and a large, aging demographic increasingly seeking orthopedic interventions. China and India are focal points for investment, although price sensitivity remains a key factor influencing product choices and favoring local manufacturing.

- Latin America (LATAM) (Brazil, Mexico): The LATAM market is experiencing steady growth, driven by improvements in healthcare access and increasing awareness of MIS benefits. Market growth is often volatile due to economic fluctuations, but high demand, particularly in private healthcare sectors in Brazil and Mexico, ensures continuous demand for established, cost-effective keyhole instruments.

- Middle East and Africa (MEA): This region offers nascent opportunities, particularly in wealthy Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which invest heavily in high-end medical technologies and advanced surgical centers. Growth in Africa is slow but stable, concentrating primarily on essential keyhole instruments in metropolitan areas, supported often by international aid or specialized medical facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Keyhole Orthopedic Surgery Instruments Market.- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet

- Smith & Nephew

- Medtronic

- Arthrex

- ConMed Corporation

- B. Braun Melsungen

- Integra LifeSciences

- Olympus Corporation

- KARL STORZ SE & Co. KG

- Richard Wolf GmbH

- MicroPort Scientific Corporation

- DJO Global, Inc.

- Vilex, Inc.

- Globus Medical

- NuVasive, Inc.

- Ossur

- Misonix, Inc.

- Acumed LLC

Frequently Asked Questions

Analyze common user questions about the Keyhole Orthopedic Surgery Instruments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of utilizing keyhole orthopedic surgery instruments?

The primary advantages include reduced patient trauma, smaller incisions, significantly shorter hospital stays, decreased post-operative pain, lower infection rates, and accelerated patient recovery time compared to traditional open surgical techniques.

Which technology is driving the most significant innovation in arthroscopic instrument design?

The most significant innovation is driven by enhanced visualization systems, specifically the integration of 4K and 3D imaging, alongside the development of smart instruments featuring embedded sensors and haptic feedback for use with robotic guidance platforms.

How is the shift toward Ambulatory Surgical Centers (ASCs) affecting the market for these instruments?

The shift to ASCs is increasing demand for cost-effective, high-efficiency instrument solutions, particularly disposable arthroscopes and single-use accessory kits, which minimize sterilization requirements and support high patient turnover in outpatient settings.

What major restraints impede the widespread adoption of advanced keyhole surgical instruments?

Major restraints include the high capital investment required for purchasing advanced systems (like robotic assistance), the complexity of ensuring effective sterilization and reprocessing, and the intensive specialized training necessary for surgeons to achieve proficiency.

Which application segment holds the largest share in the Keyhole Orthopedic Surgery Instruments Market?

Knee surgery, encompassing high-volume procedures such as meniscus repair and ACL reconstruction, currently holds the largest share of the market, followed closely by shoulder arthroscopy, due to the high global incidence of sports injuries and degenerative joint disease.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager