Kidney & Renal Cancer Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436479 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Kidney & Renal Cancer Drugs Market Size

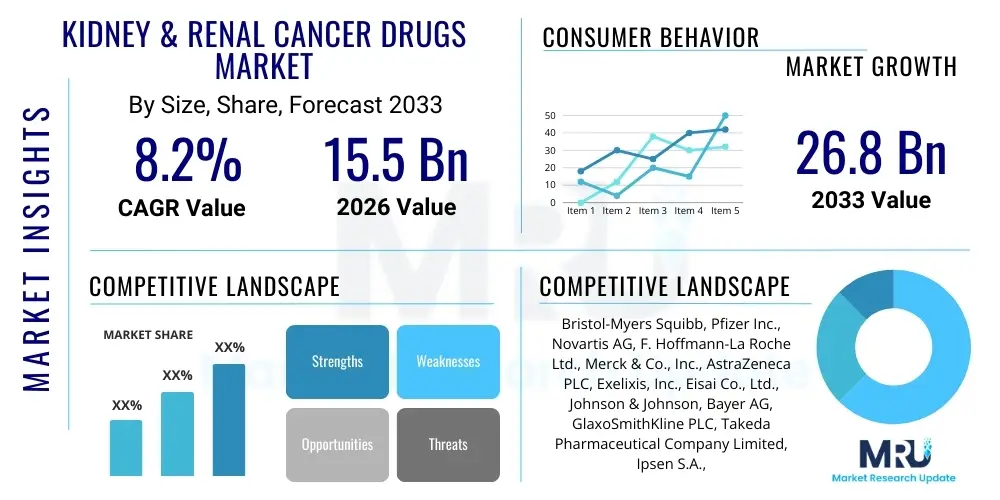

The Kidney & Renal Cancer Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 26.8 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global incidence of renal cell carcinoma (RCC), the dominant form of kidney cancer, coupled with significant advancements in systemic therapeutic options, particularly immune checkpoint inhibitors (ICIs) and novel targeted therapies. The high unmet need in treating advanced metastatic disease continues to fuel investment in pipeline development and regulatory approvals for combination regimens.

Kidney & Renal Cancer Drugs Market introduction

The Kidney & Renal Cancer Drugs Market encompasses pharmaceuticals used for the systemic treatment of kidney malignancies, predominantly Renal Cell Carcinoma (RCC) and Urothelial Carcinoma of the renal pelvis. These drugs target specific molecular pathways involved in tumor growth, angiogenesis, and immune evasion. Products range from traditional chemotherapies, though less effective in RCC, to modern targeted therapies like Vascular Endothelial Growth Factor (VEGF) inhibitors and Tyrosine Kinase Inhibitors (TKIs), which have significantly improved progression-free survival rates in the past decade. The introduction of immunotherapy, specifically PD-1/PD-L1 checkpoint inhibitors, represents a paradigm shift, establishing these agents as first-line standards of care, either as monotherapies or in combination with TKIs, offering durable responses in a subset of patients.

Major applications of these pharmaceuticals include neoadjuvant therapy, adjuvant therapy following nephrectomy, and most critically, the treatment of advanced or metastatic RCC (mRCC). The therapeutic benefits include prolonging overall survival (OS), improving patient quality of life by managing disease burden, and delaying tumor progression. Drug development is highly concentrated on overcoming primary and acquired resistance mechanisms, optimizing dosing schedules, and reducing treatment-related toxicities. The increasing diagnosis rates of kidney cancer, particularly in developed regions due to aging populations and improved diagnostic screening techniques, ensure a continuous demand for effective systemic treatments.

Key driving factors accelerating market expansion include the substantial uptake of premium-priced biological drugs, such as ICIs, in the first-line setting, favorable regulatory landscapes accelerating fast-track approvals for breakthrough therapies, and a growing emphasis on personalized medicine approaches based on biomarker identification. Furthermore, robust clinical trial activities exploring novel combination strategies, particularly involving dual checkpoint blockade or combinations with novel targeted agents, contribute significantly to market buoyancy. Patent expiration of several first-generation TKIs is leading to the entry of biosimilars/generics, which, while potentially lowering overall treatment costs, simultaneously increases market access and penetration in emerging economies, thereby expanding the overall market volume.

Kidney & Renal Cancer Drugs Market Executive Summary

The Kidney & Renal Cancer Drugs Market is defined by intense competition and rapid therapeutic innovation, transitioning from an era dominated by interferon and interleukin-2 to highly specific targeted and immuno-oncology therapies. Business trends indicate a strong focus on strategic mergers, acquisitions, and licensing agreements aimed at consolidating control over cutting-edge immuno-oncology assets and next-generation TKIs. Pharmaceutical giants are investing heavily in Phase III trials comparing ICI/TKI combinations against existing standards of care, seeking label expansions and establishing market dominance in early-stage and difficult-to-treat patient subsets. Price sensitivity remains a concern, particularly in Europe and APAC, prompting manufacturers to employ risk-sharing and value-based pricing models to secure formulary access, thus balancing profitability with public health requirements.

Regionally, North America maintains the largest market share, driven by high prevalence, sophisticated healthcare infrastructure, and favorable reimbursement policies supporting the use of expensive novel biologics. Europe follows, characterized by stringent regulatory processes (EMA) but high public expenditure on cancer treatment. The Asia Pacific region is projected to exhibit the highest growth rate, fueled by improving access to advanced treatments, rising awareness, and a significant increase in healthcare expenditure, particularly in China, Japan, and India. Latin America and MEA face challenges related to pricing and market access variability but represent long-term potential due to expanding healthcare systems and increasing oncology focus.

Segment trends highlight the dominance of the Targeted Therapy segment, though the Immunotherapy segment is witnessing the fastest expansion due to its superior efficacy profile in metastatic settings. Within indication, Renal Cell Carcinoma (RCC) accounts for the overwhelming majority of market revenue. By distribution channel, Hospital Pharmacies remain the primary channel due to the requirement for specialist administration and patient monitoring for most advanced oncological treatments. The trend toward oral targeted therapies, however, is gradually shifting some volume toward Retail and Specialty Pharmacies, improving patient convenience and facilitating decentralized care models globally.

AI Impact Analysis on Kidney & Renal Cancer Drugs Market

Users frequently inquire about AI's role in accelerating drug discovery for novel kidney cancer targets, optimizing clinical trial design for complex combination regimens, and improving diagnostic precision through enhanced imaging analysis. Key themes revolve around leveraging AI to predict patient response to specific immunotherapy combinations, thereby reducing unnecessary toxicity and maximizing therapeutic benefit in clear cell and non-clear cell RCC subtypes. Concerns often center on data privacy, the validation standards required for AI-derived biomarkers, and the equitable accessibility of these advanced computational tools across diverse clinical settings. Expectations are high that AI will significantly reduce the time and cost associated with identifying effective treatment paths, specifically by analyzing vast genomic, proteomic, and real-world evidence datasets that underpin personalized medicine strategies in nephro-oncology.

- AI-driven identification of novel drug targets and pathways specific to kidney cancer resistance mechanisms, accelerating pre-clinical development phases.

- Optimization of clinical trial recruitment by predicting eligible patients and ensuring trial diversity, reducing overall duration and cost.

- Enhanced biomarker discovery using machine learning algorithms to analyze genomics and histopathology data for predicting response to PD-1/PD-L1 inhibitors.

- AI-powered diagnostic assistance, improving the early detection and characterization of renal masses through automated analysis of CT scans and MRIs.

- Personalized dosing and treatment regimen selection through predictive modeling based on individual patient characteristics and pharmacokinetics/pharmacodynamics (PK/PD) data.

- Improved drug manufacturing processes through predictive quality control and supply chain management for complex biological kidney cancer therapeutics.

- Computational pathology integrating vast image databases to aid pathologists in grading and staging renal tumors with greater consistency and speed.

DRO & Impact Forces Of Kidney & Renal Cancer Drugs Market

The Kidney & Renal Cancer Drugs Market is profoundly shaped by a dynamic interplay of propelling drivers, systemic restraints, and opportunistic avenues for growth, collectively moderated by high-impact forces such as regulatory stringency and technological advancements. Key drivers include the escalating global prevalence of kidney cancer, the successful integration of immune checkpoint inhibitors into standard treatment paradigms, and the continuously favorable regulatory designations (e.g., Breakthrough Therapy status) granted by agencies like the FDA and EMA to promising pipeline candidates. The shift towards combination therapies, offering synergistic efficacy, further necessitates high investment in novel agents. These drivers significantly elevate market valuation and treatment accessibility, pushing the boundaries of therapeutic expectations and survival outcomes for patients with advanced renal malignancy.

However, the market faces significant restraints, primarily centered around the extraordinarily high cost of novel biological and targeted therapies, which creates market access barriers in low and middle-income countries and strains even well-funded public healthcare systems globally. The development of acquired resistance to currently approved VEGF inhibitors and ICIs remains a major biological hurdle, necessitating constant R&D investment into overcoming these resistance pathways, often without immediate success. Furthermore, the complexities associated with managing immune-related adverse events (irAEs) linked to immunotherapy necessitate specialized clinical expertise and costly monitoring, which can limit broader adoption outside of specialized cancer centers.

Opportunities abound in the development of therapies for non-clear cell RCC subtypes, which currently lack standardized, effective treatments, offering a lucrative niche for targeted research. Expanding the application of existing ICIs into the adjuvant and neoadjuvant settings, potentially curing more patients and delaying recurrence, presents a massive market potential. The ongoing efforts to identify precise predictive biomarkers for treatment response represent a significant opportunity to personalize care, reduce healthcare costs associated with ineffective treatment cycles, and enhance therapeutic efficacy, driving the development of companion diagnostics that integrate seamlessly with drug regimens. Impact forces, driven by evolving standards of care and payer decisions, continuously re-shape competitive dynamics, particularly concerning the reimbursement of expensive first-line combination regimens.

Segmentation Analysis

The Kidney & Renal Cancer Drugs Market segmentation provides a granular view of therapeutic dominance and emerging trends, crucial for strategic market positioning. The market is primarily segmented based on Drug Class, which reflects the mechanism of action (e.g., immunotherapy versus targeted therapy); Indication, detailing the specific cancer type treated (e.g., RCC stages); and Distribution Channel, outlining the pathway through which the medication reaches the patient. This structure allows stakeholders to analyze utilization patterns, pricing sensitivities, and pipeline gaps across different therapeutic modalities and patient populations. Understanding these segments is vital for predicting future market share shifts, especially as immunotherapy combinations continue to challenge the dominance of traditional targeted monotherapies in early lines of treatment.

The segmentation by Drug Class is the most insightful, illustrating the shift from older cytokines and traditional TKIs to sophisticated immune modulators. The growth in the checkpoint inhibitor segment is astronomical, reflecting its groundbreaking clinical success. Simultaneously, the TKI segment, though experiencing competition, maintains a strong base due to its established use and integration into combination regimens, serving as a critical backbone for many modern therapies. Segmentation by Indication highlights the overwhelming focus on Renal Cell Carcinoma (RCC), while sub-segments like Papillary RCC and Chromophobe RCC represent areas of high unmet clinical need and emerging research interest.

- By Drug Class

- Tyrosine Kinase Inhibitors (TKIs)

- VEGF/VEGFR Inhibitors

- mTOR Inhibitors

- Immune Checkpoint Inhibitors (ICIs)

- PD-1 Inhibitors

- PD-L1 Inhibitors

- CTLA-4 Inhibitors

- Cytokines (Interleukin-2, Interferon)

- Other Novel Targets (HIF-2α Inhibitors)

- By Indication

- Renal Cell Carcinoma (RCC)

- Clear Cell RCC (ccRCC)

- Non-Clear Cell RCC (nccRCC)

- Urothelial Carcinoma of the Renal Pelvis

- Other Kidney Malignancies

- Renal Cell Carcinoma (RCC)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By Line of Therapy

- First-Line Treatment

- Second-Line Treatment

- Third-Line and Later Treatments

Value Chain Analysis For Kidney & Renal Cancer Drugs Market

The value chain for the Kidney & Renal Cancer Drugs Market is complex, beginning with extensive upstream R&D activities and culminating in the highly regulated delivery to the patient. Upstream analysis focuses on drug discovery, involving academic institutions, biotech startups, and large pharmaceutical companies collaborating to identify and validate novel therapeutic targets specific to kidney tumor biology, such as HIF-2α or specific molecular signatures of immune resistance. This stage is capital-intensive and high-risk, requiring significant investment in basic science, preclinical testing, and early-stage clinical trials (Phase I/II) to ensure safety and preliminary efficacy before progressing to pivotal trials. Manufacturing, particularly for complex biological ICIs, demands specialized facilities, stringent quality control protocols, and robust supply chain management to maintain drug integrity.

Downstream analysis focuses heavily on clinical trials (Phase III), regulatory approval processes (FDA, EMA, PMDA), market access negotiation, and commercialization strategies. Obtaining regulatory approval requires demonstration of superior efficacy and a favorable risk-benefit profile compared to existing standards of care, often necessitating large, multi-national trials. Distribution channels are highly controlled: direct channels involve pharmaceutical companies supplying drugs directly to specialized oncology centers or government tenders, ensuring traceability for high-cost, high-risk medications. Indirect channels rely on specialty distributors and wholesalers who handle cold chain logistics and inventory management before dispensing to hospital or retail pharmacies, particularly for oral TKIs.

The distribution of kidney cancer drugs is overwhelmingly skewed towards hospital pharmacies and specialized cancer centers due to the need for intravenous administration and close patient monitoring, especially for ICIs and high-dose targeted therapies. Retail and specialty pharmacies play a growing role for oral formulations, facilitating patient compliance and convenience. Payer negotiations (both governmental and private insurance) exert immense influence over the entire downstream segment, determining formulary placement, pricing tiers, and reimbursement coverage, thereby dictating market penetration and commercial success. Effective stakeholder engagement across the entire value chain—from researchers to patients—is crucial for maximizing therapeutic reach and ensuring timely availability of these life-saving drugs.

Kidney & Renal Cancer Drugs Market Potential Customers

The primary end-users and buyers of Kidney & Renal Cancer Drugs are institutions and individuals involved in the diagnosis, treatment, and management of renal malignancies. Oncologists, specifically those specializing in genitourinary cancers, are the key prescribers, dictating the choice of drug based on disease staging, patient risk factors, and institutional guidelines. The most significant direct customers are large hospital systems, comprehensive cancer centers, and specialized oncology clinics, which procure large volumes of these high-cost pharmaceuticals, manage inventory, and administer treatments, particularly intravenous agents, within their outpatient infusion units. These institutions prioritize drugs with demonstrated overall survival benefits, manageable toxicity profiles, and strong payer coverage.

Governmental and private third-party payers, including national health services (like the NHS in the UK) and major insurance carriers in the US, represent the largest financial buyers and decision-makers, as they control reimbursement policies and formulary inclusions. Their purchasing decisions are heavily influenced by cost-effectiveness analyses, health technology assessments (HTAs), and budget impact models, often driving intense price negotiation with pharmaceutical manufacturers. This segment requires robust real-world evidence and pharmacoeconomic data to justify the high investment associated with novel combination regimens, ensuring that treatment is financially sustainable within the overall healthcare ecosystem.

Furthermore, specialty pharmacies and mail-order pharmacies act as key purchasers and distributors, particularly for the oral targeted therapies, facilitating direct access to patients who manage their treatment at home. Research institutions and academic centers are also significant customers, acquiring drugs for clinical trials, translational research, and comparative effectiveness studies, further validating the utility and mechanism of action of current and pipeline drugs. Ultimately, the patient suffering from kidney cancer is the indirect beneficiary, utilizing these drugs under the guidance of healthcare professionals to achieve improved disease control and quality of life.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 26.8 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bristol-Myers Squibb, Pfizer Inc., Novartis AG, F. Hoffmann-La Roche Ltd., Merck & Co., Inc., AstraZeneca PLC, Exelixis, Inc., Eisai Co., Ltd., Johnson & Johnson, Bayer AG, GlaxoSmithKline PLC, Takeda Pharmaceutical Company Limited, Ipsen S.A., Amgen Inc., Sanofi S.A., Genentech (Roche subsidiary), Seattle Genetics, Mirati Therapeutics, Aveo Pharmaceuticals, EMD Serono. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kidney & Renal Cancer Drugs Market Key Technology Landscape

The technological landscape of the Kidney & Renal Cancer Drugs market is characterized by a strong convergence of precision oncology, targeted drug delivery systems, and sophisticated immunotherapeutic modalities. The core technology involves molecular targeting, specifically the development of small molecule inhibitors that selectively block kinases critical for tumor angiogenesis and proliferation (like VEGFR and mTOR pathways). These targeted therapies, exemplified by drugs such as pazopanib and cabozantinib, rely on complex medicinal chemistry techniques and rigorous structure-activity relationship studies to achieve high potency and selectivity, minimizing off-target effects and toxicity. Continuous advancements focus on developing next-generation TKIs capable of overcoming established drug resistance mechanisms through novel binding profiles or dual inhibition capabilities, thereby ensuring sustained clinical response in metastatic settings.

A second crucial technological pillar is immuno-oncology, centering on the development and production of monoclonal antibodies (mAbs) that act as Immune Checkpoint Inhibitors (ICIs). These biological drugs, such as nivolumab and pembrolizumab, require advanced biotechnology processes, including cell line development, large-scale fermentation, purification, and rigorous quality assurance to ensure batch consistency and high yield. The technology extends beyond the antibody itself to the complementary diagnostics required to identify PD-L1 expression levels in tumors, utilizing immunohistochemistry (IHC) and other molecular testing platforms. Future innovations in this area are exploring bispecific antibodies and novel co-stimulatory molecule agonists to further enhance anti-tumor immunity without causing excessive systemic toxicity.

Emerging technologies hold significant promise, notably the development of Hypoxia-Inducible Factor 2-alpha (HIF-2α) inhibitors, a novel mechanism of action highly relevant to clear cell RCC, which is genetically characterized by VHL mutation leading to HIF stabilization. This represents a paradigm shift away from traditional TKI and ICI combinations, offering a truly targeted metabolic intervention. Furthermore, high-throughput screening, genomic sequencing (e.g., whole-exome sequencing of kidney tumors), and advanced computational biology are being leveraged to identify patients most likely to respond to highly specific personalized therapies, driving the integration of pharmacogenomics into routine clinical practice for treatment selection and prognosis prediction in renal oncology.

Regional Highlights

The global Kidney & Renal Cancer Drugs Market demonstrates significant regional variation in terms of prevalence, regulatory environment, and market access capabilities, which directly influence treatment adoption rates and revenue generation across major geographic areas. North America, specifically the United States, commands the largest share due to high healthcare expenditure, rapid adoption of expensive, cutting-edge therapies (especially ICI combinations), robust research and development activities, and a well-established reimbursement structure that minimizes patient out-of-pocket costs for specialist drugs. The high prevalence of risk factors such as obesity and hypertension further contributes to a large patient pool, maintaining the region's position as the primary revenue generator and global benchmark for treatment protocols.

Europe represents the second-largest market, characterized by stringent HTA processes and centralized pricing negotiations, particularly in major markets like Germany, France, and the UK. While adoption of novel therapies is generally slower than in the US due to cost containment measures, once formulary access is secured, broad population coverage ensures stable market growth. The EU's concerted effort toward oncology research and clinical trial harmonization supports ongoing therapeutic innovation. However, disparities exist between Western and Eastern European countries regarding drug availability and affordability, impacting market homogeneity.

The Asia Pacific (APAC) region is forecasted to achieve the highest CAGR, propelled by the rising prevalence of kidney cancer, often linked to lifestyle changes and environmental factors, alongside massive investments in modernizing healthcare infrastructure in high-growth economies such as China and India. Japan and South Korea already possess advanced oncology standards, comparable to Western nations, but require localized clinical evidence. The expansion of medical insurance coverage and increasing awareness among healthcare professionals regarding combination therapy protocols are critical drivers of future market expansion in this geographically vast and economically diverse region. Latin America and the Middle East and Africa (MEA) remain emerging markets, where growth is constrained by economic volatility and uneven distribution networks, yet represent significant long-term opportunities as health systems mature and access programs are implemented for cost-effective treatments.

- North America: Dominance driven by early and broad adoption of ICI/TKI combinations; high pricing environment; leading number of ongoing clinical trials for RCC.

- Europe: Strong demand stabilized by public health funding; focus on cost-effectiveness studies (HTA); centralized regulatory approval (EMA) impacting time-to-market.

- Asia Pacific (APAC): Fastest growth region; increasing prevalence rates; improving access to specialty care in China and India; Japan leading in adoption of personalized medicine techniques.

- Latin America: Market growth dependent on government tenders and economic stability; challenges in widespread reimbursement for premium-priced therapies.

- Middle East and Africa (MEA): Emerging market with potential concentrated in high-income Gulf Cooperation Council (GCC) countries; significant reliance on imported pharmaceuticals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kidney & Renal Cancer Drugs Market, analyzing their product portfolios, R&D expenditure, strategic alliances, and regional presence.- Bristol-Myers Squibb

- Pfizer Inc.

- Novartis AG

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- AstraZeneca PLC

- Exelixis, Inc.

- Eisai Co., Ltd.

- Johnson & Johnson

- Bayer AG

- GlaxoSmithKline PLC

- Takeda Pharmaceutical Company Limited

- Ipsen S.A.

- Amgen Inc.

- Sanofi S.A.

- Genentech (Roche subsidiary)

- Seattle Genetics

- Mirati Therapeutics

- Aveo Pharmaceuticals

- EMD Serono

Frequently Asked Questions

Analyze common user questions about the Kidney & Renal Cancer Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant advancement impacting the kidney cancer drug market currently?

The most significant advancement is the successful integration of Immune Checkpoint Inhibitors (ICIs), particularly PD-1/PD-L1 antibodies, often used in combination with Tyrosine Kinase Inhibitors (TKIs). This combination therapy has become the standard first-line treatment for metastatic Renal Cell Carcinoma (RCC), significantly improving both overall survival and progression-free survival compared to monotherapy approaches.

Which drug class is projected to experience the fastest growth in the market?

The Immune Checkpoint Inhibitors (ICIs) segment, within the larger Immunotherapy class, is projected to exhibit the fastest growth. This is due to continued label expansion into earlier lines of therapy (adjuvant and neoadjuvant settings), successful clinical trial results for novel dual checkpoint blockade strategies, and the high premium pricing associated with these biological agents.

What are the primary factors restraining the growth of the Kidney & Renal Cancer Drugs Market?

The primary restraining factors include the extremely high cost of combination immunotherapies and targeted agents, creating access and affordability issues, particularly in developing economies. Additionally, the challenge of acquired drug resistance following initial successful treatment and the necessity of managing complex immune-related adverse events limit broader application.

How is AI influencing the future of kidney cancer treatment development?

AI is fundamentally influencing treatment development by accelerating target identification, refining drug repurposing strategies, and optimizing clinical trial design through predictive modeling. Crucially, AI is enhancing biomarker discovery to predict which patients will respond best to specific immunotherapies, driving personalized medicine in nephro-oncology.

Which region holds the largest market share for kidney cancer pharmaceuticals?

North America currently holds the largest market share. This dominance is attributed to high disease prevalence, advanced healthcare infrastructure that supports specialized care, aggressive adoption of innovative and costly treatment regimens, and established, favorable reimbursement policies for novel oncology drugs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager