Kids Retail Fitness Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433961 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Kids Retail Fitness Market Size

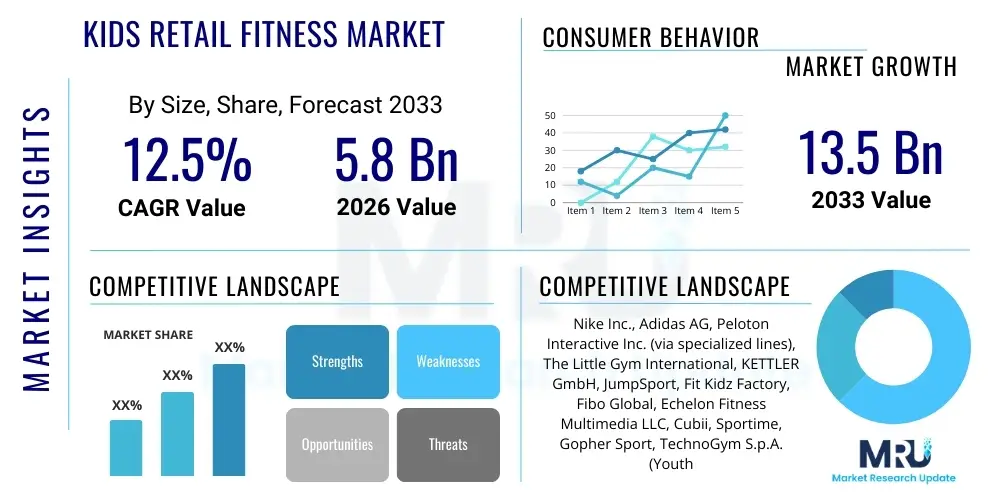

The Kids Retail Fitness Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $13.5 Billion by the end of the forecast period in 2033.

Kids Retail Fitness Market introduction

The Kids Retail Fitness Market encompasses specialized equipment, apparel, accessories, and digital services designed specifically for children and adolescents to promote physical activity outside of mandated school programs. This market addresses the global health crisis characterized by rising childhood obesity rates and sedentary lifestyles, positioning fitness retail products as essential tools for early physical development and long-term health maintenance. The offerings range from small-scale residential gym equipment and tailored sports gear to subscription services providing interactive, gamified workout content designed to appeal to younger demographics. The fundamental shift in parental focus toward holistic wellness, coupled with increased disposable income in developed economies, serves as a powerful foundational driver for market expansion.

The primary applications of products within this sector include structured sports training, general wellness and endurance building, rehabilitation, and competitive preparation. Retail fitness products for kids emphasize safety, ergonomics, and engagement, ensuring that devices and programs are scaled appropriately for different developmental stages. Key benefits realized by consumers include enhanced motor skills, improved cardiovascular health, better mental clarity, and the cultivation of lifelong positive habits regarding physical activity. The retail aspect is crucial, as distribution channels are rapidly evolving to include sophisticated omnichannel models, blending traditional brick-and-mortar sports stores with highly personalized direct-to-consumer e-commerce platforms, often featuring augmented reality (AR) product trials.

Major driving factors sustaining the market's robust growth trajectory include governmental and non-profit initiatives promoting youth health, the accelerated adoption of smart fitness technology that integrates gaming mechanics (gamification) into exercise routines, and the pervasive influence of social media trends showcasing active family lifestyles. Furthermore, the decentralization of fitness—moving activity away from traditional institutional settings (schools, dedicated gyms) into homes and local community centers—has amplified the retail demand for accessible, high-quality, and child-safe fitness apparatus. Continuous product innovation focused on sustainability and modularity also contributes significantly to market vitality and consumer acceptance.

Kids Retail Fitness Market Executive Summary

The Kids Retail Fitness Market is currently defined by disruptive business trends focusing heavily on digital integration and hyper-personalization. Subscription models for interactive training content, often bundled with proprietary smart equipment like smaller-scale treadmills, climbing walls, or resistance training apparatus, are gaining significant traction. Manufacturers are strategically partnering with educational technology firms to integrate fitness data tracking with academic performance metrics, creating a holistic view of child development. A key trend involves modular fitness solutions that can adapt as a child grows, reducing the replacement cycle frequency and appealing to cost-conscious parents seeking long-term value. Furthermore, the retail landscape is characterized by the establishment of specialized boutique fitness studios focused exclusively on youth, acting as important physical touchpoints for retail product demonstration and sales.

Regionally, North America maintains the dominant market share, primarily driven by high consumer awareness regarding pediatric health risks and substantial healthcare spending allocated to preventative measures. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, expanding middle-class populations with higher disposable incomes, and cultural shifts increasingly valuing Western-style sports and fitness regimes. Within APAC, countries like China and India are seeing a surge in demand for international sports apparel and digitally enabled home fitness devices. European markets are characterized by stringent safety regulations for children's equipment and a strong preference for outdoor and team sports gear, driving demand for high-durability and performance-focused apparel and accessories.

Segmentation analysis reveals that the Equipment category, specifically smart interactive equipment (e.g., interactive boxing bags, gamified cycling units), represents the fastest-growing segment, propelled by technology adoption and the desire for engaging, independent exercise. The Services segment, encompassing personalized coaching and subscription platforms, holds substantial growth potential, capitalizing on the demand for structured, expert-led fitness routines accessible from home. Distribution channels show a clear pivot towards online platforms (DTC and e-tailers), driven by convenience and the ability of digital channels to offer broader product specifications and integrated user reviews, crucial for parental purchasing decisions. Successful companies are those mastering the convergence of physical retail experience with scalable digital content delivery, often utilizing virtual reality to enhance workout engagement.

AI Impact Analysis on Kids Retail Fitness Market

Analysis of common user questions regarding AI's influence in the Kids Retail Fitness Market primarily centers on the efficacy of personalized training, the security of biometric data collected from minors, and the ethical implications of using AI to monitor physical activity. Users frequently inquire how AI can accurately gauge a child's developmental stage and customize exercises without overexertion, demonstrating a keen interest in safety and developmental appropriateness. There is high expectation that AI-powered applications will provide truly adaptive coaching, making fitness more engaging through dynamic gamification algorithms that constantly adjust difficulty based on real-time performance and motivation levels. Conversely, concerns about data privacy, compliance with regulations like COPPA (Children's Online Privacy Protection Act), and the potential for AI algorithms to unintentionally promote unhealthy body image standards are central themes requiring clear, trustworthy operational guidelines from market participants.

AI's role is transformative, primarily by enabling sophisticated data analytics for behavioral coaching and predictive modeling of engagement. AI systems analyze usage patterns, progress metrics, and interaction data to generate bespoke fitness paths, turning generic equipment into personalized training tools. This personalization drastically increases adherence rates among children, who are typically difficult to keep engaged in long-term fitness routines. Furthermore, AI contributes significantly to the operational side of retail by optimizing inventory management based on regional health trends and seasonal sport participation, ensuring that the right mix of fitness products is available through both digital and physical stores, thus improving the overall retail supply chain efficiency.

The retail interface benefits from AI through enhanced customer support, intelligent product recommendations, and virtual fitting rooms for apparel, reducing return rates and enhancing the buying experience. Predictive maintenance for smart fitness equipment is another crucial application, ensuring longevity and safety. Ultimately, AI shifts the market from merely selling products to selling measurable, personalized health outcomes, establishing long-term customer relationships through continuous digital service delivery rather than one-time transactions. The successful integration of AI requires a delicate balance between maximizing engagement and ensuring strict compliance with child protection and data security protocols.

- AI-Driven Personalization: Tailoring workout intensity, duration, and type based on real-time physiological and performance data for optimal safety and effectiveness.

- Adaptive Gamification: Utilizing machine learning algorithms to adjust game difficulty and reward structures dynamically, maximizing sustained user engagement in exercise.

- Predictive Safety Monitoring: AI systems detecting signs of fatigue, improper form, or potential injury risks in real-time, providing immediate corrective feedback.

- Intelligent Inventory Management: Forecasting regional demand for specific equipment and apparel based on local sports seasons, demographics, and health statistics.

- Automated Customer Support: Deployment of AI chatbots to handle common parental inquiries regarding product specifications, safety certifications, and subscription details.

- Data Privacy Compliance Audits: Using AI tools to ensure all data collection and processing methods strictly adhere to global child privacy laws (e.g., GDPR, COPPA).

- Virtual Coaching and Feedback: AI vision systems analyzing movement patterns via camera to provide virtual coaching feedback, mimicking the presence of a human trainer.

DRO & Impact Forces Of Kids Retail Fitness Market

The dynamics of the Kids Retail Fitness Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively exerting significant impact forces on market trajectory. The core driver is the escalating global concern over childhood obesity, Type 2 diabetes, and mental health issues related to sedentary lifestyles, which pushes governmental bodies, schools, and parents to invest proactively in preventative fitness solutions. This driver is amplified by increased media exposure of fitness influencers and professional athletes, creating aspirational goals for younger consumers. Technology adoption, particularly the ease of integrating fitness tracking with educational and entertainment devices, reduces friction for participation. However, the market faces significant restraints, primarily the high initial cost of specialized smart fitness equipment designed for children, which limits accessibility for lower- and middle-income families. Furthermore, the fragmented regulatory landscape across different regions concerning child data privacy and product safety standards complicates international market entry and scaling for manufacturers.

Opportunities within this market are immense, particularly in leveraging immersive technologies such as Augmented Reality (AR) and Virtual Reality (VR) to create compelling, engaging, and location-agnostic fitness experiences. The shift towards hybrid learning and remote physical education presents an opening for vendors to supply integrated hardware and content solutions directly to educational institutions and homeschooling networks. Another critical opportunity lies in developing adaptive and inclusive equipment designed for children with physical or developmental disabilities, addressing an underserved niche. Strategic partnerships between established toy manufacturers and fitness technology firms can also unlock new distribution channels and consumer segments, blending play and exercise seamlessly. These external factors define the operational environment and growth potential for retailers and manufacturers.

The collective impact forces are predominantly positive, characterized by high innovation intensity and strong consumer willingness to spend on proven health outcomes for their children. Socio-cultural forces heavily influence purchasing decisions, with peer and parental advocacy for fitness acting as a powerful multiplier. Economic forces, while constrained by equipment costs, are mitigated by the rising tide of subscription-based models that lower the entry barrier. The regulatory environment imposes a mandatory focus on safety and data protection, forcing companies to maintain exceptionally high manufacturing and ethical standards, which ultimately builds long-term consumer trust, distinguishing premium offerings from mass-market substitutes. This constant pressure to innovate safely and ethically ensures sustainable market evolution.

Segmentation Analysis

The Kids Retail Fitness Market is strategically segmented based on product type, distribution channel, and the age group of the end-user, reflecting the diverse developmental needs and purchasing behaviors within the youth demographic. Segmentation provides clarity on consumer preferences, allowing manufacturers to tailor product design and marketing strategies effectively, ranging from simple, durable outdoor equipment to sophisticated, sensor-laden indoor training systems. Analyzing these segments is crucial for identifying high-growth areas, particularly the rapid adoption rate of subscription-based digital services and the expanding scope of specialized athletic apparel.

- By Product Type:

- Fitness Equipment (Treadmills, Cycles, Rowing Machines, Climbing Walls - scaled for kids)

- Sports Apparel and Footwear (Technical gear, general athletic wear)

- Accessories (Activity Trackers, Resistance Bands, Yoga Mats, Water Bottles)

- Services and Content (Subscription-based interactive classes, personalized coaching, fitness apps)

- By Distribution Channel:

- Online Channels (E-commerce Retailers, Direct-to-Consumer (DTC) Websites)

- Offline Channels (Specialty Sports Stores, Large Retail Chains, Fitness Centers, Educational Institutions)

- By Age Group:

- Early Childhood (Ages 3-6)

- Mid Childhood (Ages 7-12)

- Adolescence (Ages 13-17)

Value Chain Analysis For Kids Retail Fitness Market

The value chain for the Kids Retail Fitness Market begins with upstream activities heavily focused on specialized material sourcing, ergonomic design, and stringent safety certification processes. Unlike standard fitness equipment, children's products require non-toxic, highly durable materials and designs that eliminate pinch points and sharp edges, demanding rigorous quality control at the manufacturing level. Key upstream players include specialized component suppliers (for sensors, plastics, and non-slip rubber), industrial design firms specializing in child psychology and motor skills development, and technology providers supplying proprietary AI and IoT frameworks essential for smart equipment functionality. Manufacturing processes are often geographically dispersed, with key innovation centers in North America and Europe, but bulk production concentrated in Asia Pacific regions to leverage cost efficiencies, always adhering to international safety standards (e.g., ASTM, CE).

The midstream activities center on efficient logistics, warehousing, and inventory management. Due to the rapid pace of technological upgrades and seasonal demand spikes (e.g., back-to-school or holiday sales), agile supply chain management is crucial. Downstream activities involve distribution and retail, where omnichannel strategy dominates. Direct channels (DTC via brand websites) are becoming increasingly important, offering higher margins and direct consumer data access, crucial for personalization. Indirect channels include large, established sports retailers (e.g., Dick's Sporting Goods, specialty athletic chains), and specialized children's retail boutiques, which provide hands-on experience and professional product consultation necessary for high-value purchases like fitness equipment.

The final stage of the value chain involves after-sales service, digital content delivery, and community building, which are vital for customer retention and brand loyalty in the service-centric economy. For smart equipment, this includes software updates, technical support, and the continuous release of new interactive workout content, forming a recurring revenue stream. The distribution channel selection significantly impacts profitability; while traditional retail offers wide accessibility, direct sales facilitate stronger brand-consumer relationships and allow manufacturers to capture the full economic value of their innovations. Successful market participants optimize this chain by vertically integrating technology development and service delivery, ensuring a cohesive user experience from purchase to daily use.

Kids Retail Fitness Market Potential Customers

The primary consumers driving demand in the Kids Retail Fitness Market are high-income, health-conscious parents, predominantly those residing in urban and suburban areas of developed nations. These buyers view fitness equipment and structured programs not as discretionary purchases but as crucial long-term investments in their child's physical and mental well-being, often driven by anxiety over academic pressure, digital device overuse, and public health narratives surrounding childhood inactivity. This segment demands premium, technology-integrated products that offer verifiable safety credentials, educational value, and seamless integration into the family's digital ecosystem. They prioritize products endorsed by pediatricians or certified fitness professionals and often seek out subscription services that provide curated, age-appropriate content, minimizing the parental need to constantly structure physical activity.

A significant institutional segment includes private educational institutions and specialized pediatric fitness centers. Private schools, keen on offering holistic curricula and competitive advantages, frequently invest in commercial-grade, scaled fitness equipment and custom-designed sports facilities to integrate physical education with technology-assisted training. Pediatric centers and physical therapy clinics represent another critical B2B customer base, purchasing specialized equipment designed for rehabilitation, motor skill development, and addressing specific neurodevelopmental conditions. These institutional customers often require bulk purchasing, specialized training for staff, and robust durability that exceeds typical residential requirements, thus necessitating a different sales and service approach compared to direct-to-consumer retail.

Emerging potential customer groups include community youth organizations and multi-family residential developers. Community centers often seek affordable, durable, and versatile equipment packages to support after-school programs and subsidized fitness initiatives, focusing on accessibility and ease of maintenance. Residential developers are increasingly integrating high-tech, kid-friendly fitness amenities into common areas of new housing projects as a key selling point for young families. Targeting these diverse customer groups requires manufacturers to maintain a broad portfolio, ranging from high-end personalized home solutions to robust, scalable, and cost-effective commercial units, necessitating customized distribution and pricing strategies for each segment of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $13.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike Inc., Adidas AG, Peloton Interactive Inc. (via specialized lines), The Little Gym International, KETTLER GmbH, JumpSport, Fit Kidz Factory, Fibo Global, Echelon Fitness Multimedia LLC, Cubii, Sportime, Gopher Sport, TechnoGym S.p.A. (Youth Division), Tonal Systems Inc. (Family Focus), SoulCycle (Youth Programs), My Gym Children's Fitness Center, Huffy Corporation (Specialty Bikes), Decathlon S.A. (Kids Sports), Bowflex (Jr. Equipment), NordicTrack (Kids Line). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kids Retail Fitness Market Key Technology Landscape

The technology landscape in the Kids Retail Fitness Market is predominantly shaped by the Internet of Things (IoT), artificial intelligence (AI), and immersive media integration (AR/VR). IoT sensors are embedded within fitness equipment, apparel, and wearables tailored for minors, providing real-time data on movement, heart rate, and caloric expenditure. This data collection is fundamental to the personalized coaching models delivered via proprietary applications. Crucially, the technology prioritizes user engagement through gamification frameworks, translating exercise into interactive adventures or competitive challenges, moving away from repetitive, traditional workout formats. Biometric tracking technology, while carefully regulated for minors, is used to ensure exercise intensity remains within safe, developmental parameters, automatically adjusting workout parameters through smart algorithms embedded in the equipment.

Augmented Reality (AR) and Virtual Reality (VR) platforms represent a high-growth technological frontier. AR overlays interactive content onto the real-world environment, transforming living rooms into fitness playgrounds (e.g., chasing digital characters while running in place), requiring minimal specialized hardware beyond a smartphone or tablet. VR, conversely, offers fully immersive experiences, placing children in virtual fitness classes or competitive environments, often linked to specially designed child-safe stationary bikes or treadmills. These immersive tools are pivotal for combating screen time concerns by actively linking digital consumption to physical movement, effectively making exercise a preferred form of interactive entertainment.

Furthermore, cloud computing infrastructure is essential for hosting the vast quantities of performance data and for delivering scalable, high-definition interactive content on demand via subscription services. The retail technology stack also includes sophisticated digital tools for parents, such as secure dashboards that aggregate fitness progress, nutritional information, and compliance logs, all governed by robust encryption and adherence to stringent data privacy mandates. The market's technological evolution is driven by the need for solutions that are safe, scientifically sound, highly engaging, and easily integrated into contemporary home and school environments, necessitating continuous R&D investment in battery life, sensor accuracy, and resilient software design suitable for active children.

Regional Highlights

The Kids Retail Fitness Market exhibits distinct growth patterns across major global regions, reflecting economic maturity, cultural attitudes toward physical education, and regulatory frameworks. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to high household incomes, a well-established retail infrastructure for sporting goods, and pervasive public health campaigns addressing high rates of childhood obesity. Consumers in this region are rapid adopters of smart home fitness equipment and digital subscription services, driving strong demand for high-value, technology-integrated products. The competitive landscape is mature, with strong penetration from both global fitness giants and specialized pediatric wellness brands.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This accelerated growth is fueled by massive demographic expansion, increasing urbanization, and a significant rise in middle-class disposable income, particularly in emerging economies like China, India, and Southeast Asian nations. Cultural shifts are leading to greater acceptance of structured, commercial fitness outside of traditional martial arts or team sports. Governments in several APAC countries are implementing mandatory physical activity programs, boosting demand for standardized retail equipment and technical apparel. However, the market in this region is characterized by a strong price sensitivity, driving demand for locally manufactured, cost-effective alternatives and digital content platforms translated into local languages.

Europe represents a stable and moderately growing market, highly regulated by the European Union's strict CE marking standards for safety and the GDPR for data protection. Western European countries, such as Germany, the UK, and France, exhibit strong demand for environmentally sustainable and ethically sourced fitness apparel and durable, high-quality outdoor equipment. The emphasis here is often on integrating fitness with outdoor play and maintaining strong links between school physical education and retail purchases. In contrast, Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by high growth potential but hindered by varying levels of economic instability and underdeveloped specialized retail channels. Growth in MEA is concentrated in high-net-worth urban centers, where consumers are increasingly seeking out imported premium fitness brands.

- North America: Dominant market share; rapid adoption of smart fitness tech; high consumer spending on preventative health; mature distribution networks.

- Asia Pacific (APAC): Highest projected CAGR; fueled by urbanization and rising disposable income; strong government focus on youth sports infrastructure; emphasis on localized digital content.

- Europe: Stable growth; stringent regulatory environment (GDPR, CE standards); high demand for sustainable and high-quality outdoor/team sports equipment.

- Latin America: Growing awareness of pediatric health; market constrained by import duties and economic fluctuations; strong focus on affordable, versatile home equipment.

- Middle East & Africa (MEA): Growth concentrated in GCC nations; demand for premium, imported brands driven by wealthy urban demographics; limited local manufacturing base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kids Retail Fitness Market.- Nike Inc.

- Adidas AG

- Puma SE

- The Little Gym International

- My Gym Children's Fitness Center

- KETTLER GmbH

- JumpSport

- Fibo Global

- Echelon Fitness Multimedia LLC

- Gopher Sport

- TechnoGym S.p.A. (Youth Division)

- Peloton Interactive Inc. (via specialized lines and content)

- Cubii

- Tonal Systems Inc. (Family Focus)

- Decathlon S.A. (Kids Sports Division)

- Huffy Corporation (Specialty Bikes and Mobility)

- Life Fitness (Youth Equipment)

- Garmin Ltd. (Kids Wearables)

- Under Armour, Inc.

- Sportime LLC

Frequently Asked Questions

Analyze common user questions about the Kids Retail Fitness market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety standards governing specialized fitness equipment for children?

Primary safety standards include those set by the American Society for Testing and Materials (ASTM F2412/F2413), the European Union’s CE marking requirements, and regional governmental bodies that mandate specific criteria for equipment stability, weight capacity, material non-toxicity, and the elimination of potential pinch or entrapment hazards. Compliance with these rigorous international benchmarks is essential for retail market acceptance and minimizing product liability risk.

How is technology, such as AI and gamification, influencing kids' adherence to fitness programs?

AI and gamification significantly boost adherence by providing real-time, personalized feedback and transforming repetitive exercise into engaging, goal-oriented play. AI algorithms dynamically adjust workout difficulty to maintain the 'flow state,' preventing frustration or boredom, while gamification utilizes elements like points, badges, and leaderboards to drive extrinsic and intrinsic motivation, ensuring sustained engagement well beyond initial novelty.

What are the current trends regarding data privacy and the collection of biometric data from children using fitness wearables?

The primary trend involves strict adherence to privacy laws such as COPPA in the US and GDPR in Europe, mandating explicit parental consent for data collection and requiring advanced anonymization and encryption protocols. Manufacturers must minimize the collection of personally identifiable information (PII) and ensure transparent data usage policies, focusing data analysis primarily on aggregated performance metrics rather than individual physiological tracking to mitigate legal and ethical risks.

Which distribution channels are most effective for reaching the modern kids retail fitness consumer?

The most effective strategy is an omnichannel approach, balancing the convenience of Direct-to-Consumer (DTC) e-commerce websites—which allow for direct content subscription bundles and customized purchasing—with the necessity of physical specialty sports retailers. Brick-and-mortar stores remain crucial for high-value equipment purchases, offering parents the opportunity for hands-on product inspection, professional consultation, and safety demonstration before commitment.

What is the impact of specialized athletic apparel and footwear on the overall market growth?

Specialized apparel and footwear are major growth drivers, moving beyond simple sizing to incorporate advanced technical fabrics that enhance comfort, moisture wicking, and thermoregulation tailored for smaller bodies. The growth is also fueled by lifestyle branding and the athleisure trend, where fitness-focused clothing is adopted for everyday wear, turning apparel into both a functional and aspirational retail segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager