Kids Toys Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433652 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Kids Toys Market Size

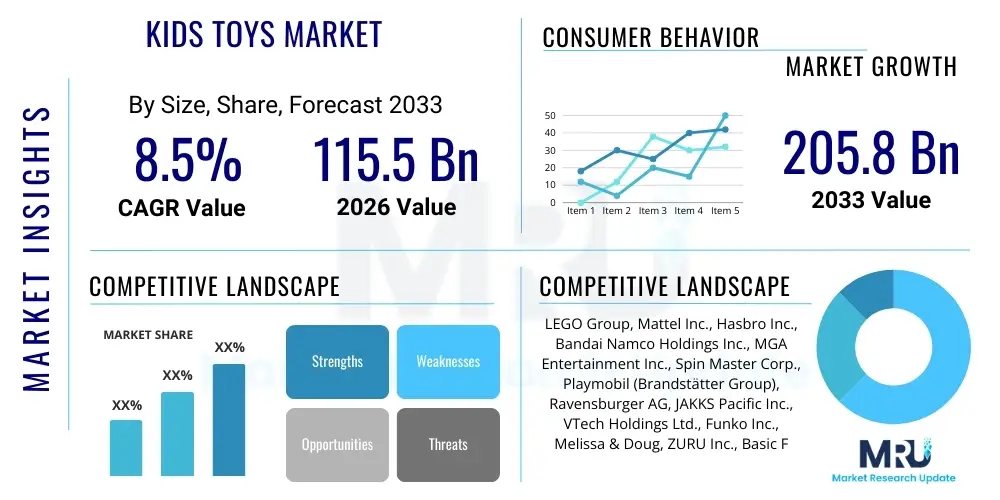

The Kids Toys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 115.5 Billion in 2026 and is projected to reach USD 205.8 Billion by the end of the forecast period in 2033.

Kids Toys Market introduction

The Kids Toys Market encompasses a wide range of products designed for entertainment, education, and development of children across various age groups. This diverse market includes traditional items like dolls, building blocks, and board games, alongside modern segments such as interactive electronic toys, STEM-focused kits, and digitally integrated playthings. The primary application of these products is to facilitate physical, cognitive, and social development through play, serving both recreational and educational purposes. Market expansion is fundamentally driven by rising disposable incomes globally, increasing emphasis on early childhood education, and technological advancements that enable highly engaging and personalized play experiences. Furthermore, shifts in parenting styles, prioritizing developmental milestones and engaging in co-play activities, significantly boost demand for specialized and high-quality toys.

Product description in the modern context often emphasizes connectivity and safety. Contemporary toys frequently incorporate features like augmented reality (AR), near-field communication (NFC) chips, and cloud-based functionality, blurring the lines between physical and digital play. Major applications span educational settings (preschools, primary education), home entertainment, and therapeutic aids. The benefits derived from these products are substantial, including enhanced motor skills, improved problem-solving capabilities, creativity stimulation, and emotional regulation. Toys are increasingly viewed not merely as recreational tools but as crucial investments in a child’s developmental journey, leading to higher average spending per child, particularly in developed economies.

Driving factors propelling market growth include the robust global birth rate, effective marketing strategies utilizing digital media and influencer endorsements, and the consistent innovation cycle within the toy manufacturing industry, leading to frequent introduction of new franchises and licensed products. The convergence of media content (movies, streaming services) with physical toy lines creates strong demand synergy. Moreover, sustained consumer interest in sustainable and eco-friendly toy options, responding to growing environmental awareness among parents, presents a critical long-term growth trajectory for manufacturers committed to ethical sourcing and production practices.

Kids Toys Market Executive Summary

The Kids Toys Market is experiencing significant dynamic shifts driven by technological integration and changing consumer values, positioning it for robust expansion throughout the forecast period. Key business trends include the strong performance of digitally enhanced toys, such as smart robots and AR gaming platforms, which are effectively capturing the attention of tech-savvy younger generations and their parents. Furthermore, a major trend involves market consolidation among large multinational corporations seeking to acquire niche brands specializing in high-growth areas like sustainable materials and educational (STEAM/STEM) toys. Supply chain resilience and diversification, particularly post-global disruptions, have become paramount, pushing manufacturers to invest heavily in localized production and automated warehousing solutions to meet volatile demand patterns efficiently.

Regionally, the Asia Pacific (APAC) market is projected to demonstrate the fastest growth rate, fueled by substantial population bases, rapid urbanization, and a burgeoning middle class with greater purchasing power and a strong cultural emphasis on educational development. North America and Europe maintain dominance in terms of market value, acting as primary hubs for innovation and high-value product launches, particularly within licensed merchandise and high-tech segments. The regulatory landscape in these Western regions, focusing heavily on safety standards (e.g., CPSIA, EN 71), dictates the quality benchmarks for global manufacturers. Emerging markets in Latin America and the Middle East and Africa (MEA) are also showing promising upward trajectories, driven by increasing internet penetration and the expansion of organized retail channels.

Segment trends reveal that the Educational Toys and Games segment is witnessing exponential growth, reflecting parental prioritization of learning through play. Within distribution channels, e-commerce platforms continue to gain market share, providing consumers with greater choice, convenience, and competitive pricing, although specialized brick-and-mortar toy stores remain critical for experiential shopping and high-touch customer service. The material segment is undergoing a transformation, with wood and sustainably sourced alternatives capturing increasing market attention away from conventional plastics, driven by conscious consumerism. This necessitates manufacturers to reformulate their product lines, often incurring initial higher production costs but gaining significant brand loyalty and competitive differentiation in the long term.

AI Impact Analysis on Kids Toys Market

User queries regarding the impact of Artificial Intelligence (AI) on the Kids Toys Market center primarily on personalized play, data privacy concerns, and the future of educational toys. Users frequently ask how AI can tailor play experiences to a child's individual learning pace, what steps manufacturers are taking to secure children's data collected by connected toys, and whether AI-powered tutors will replace traditional educational methods. The central themes emerging from this analysis include the expectation for hyper-personalized, adaptive learning narratives, the critical necessity for robust cybersecurity standards (especially concerning microphone and camera integration), and the shift towards AI as a collaborative play partner rather than a static product. Consumers expect tangible benefits such as improved engagement and sophisticated developmental feedback, but remain highly vigilant about ethical implications and screen time management related to connected, AI-enabled devices.

- AI enhances personalized play experiences by adapting toy functionality and narrative complexity based on real-time user interaction data.

- Implementation of sophisticated natural language processing (NLP) allows smart toys to engage in more meaningful, contextualized conversations with children.

- AI is utilized in developmental assessments, providing parents and educators with granular insights into a child's skill progression and learning gaps.

- Manufacturing processes benefit from AI optimization in supply chain management, demand forecasting, and automated quality control, speeding up time-to-market.

- Safety and security protocols are being bolstered by AI-driven anomaly detection to identify and mitigate unauthorized data access in connected play environments.

- AI facilitates the creation of unique, procedurally generated content for interactive digital games integrated with physical toys, extending product longevity and replayability.

- The rise of AI-powered companions and robotic pets offers advanced emotional intelligence simulation, catering to socio-emotional learning needs.

- Ethical AI design necessitates transparent data collection practices and the implementation of safeguards specifically mandated by child protection laws (e.g., COPPA compliance).

DRO & Impact Forces Of Kids Toys Market

The dynamics of the Kids Toys Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Major drivers include the increasing global emphasis on early childhood development and STEAM education, prompting parents to invest in premium-priced educational toys. Simultaneously, aggressive digitalization and licensing partnerships—where popular movie or game franchises are rapidly translated into physical toys—create significant revenue spikes and drive consumer demand. The influence of digital marketing, targeted advertising via social media, and the rise of unboxing culture further accelerate purchasing decisions across varied consumer demographics, sustaining the demand momentum throughout the product lifecycle. These forces collectively establish a high-growth environment, contingent on continuous product innovation.

Restraints primarily revolve around stringent safety regulations, particularly concerning material composition (e.g., phthalates, heavy metals) and choking hazards, which increase production complexity and compliance costs, particularly for smaller manufacturers. Furthermore, growing parental concern over excessive screen time associated with digital and connected toys acts as a constraint on the growth rate of specific high-tech segments, prompting a counter-demand for traditional, unplugged play options. Economic volatility and fluctuating commodity prices, particularly for plastics and specialized electronics, present cost management challenges that can affect pricing strategies and ultimately, market accessibility in price-sensitive regions. These restraints necessitate innovative material science and responsible design frameworks from industry leaders.

Opportunities for future expansion are predominantly centered on sustainability and technological integration. The shift towards circular economy models, utilizing recycled, biodegradable, or plant-based materials, offers significant market differentiation and aligns with modern consumer environmental ethics. Additionally, capitalizing on emerging technologies like Augmented Reality (AR) and Virtual Reality (VR) to create truly hybrid physical-digital play experiences provides lucrative avenues for innovation. Penetrating untapped rural and emerging markets through localized distribution strategies and affordable product lines represents a scalable opportunity. The impact forces indicate a market trending toward higher quality, ethical production, and seamless digital integration, requiring strategic investment in R&D and supply chain transparency to succeed.

Segmentation Analysis

The Kids Toys Market segmentation provides a granular view of consumer preferences and manufacturer specialization, crucial for targeted marketing and product development. Key segmentation factors include product type, which distinguishes between traditional categories such as dolls and action figures versus modern segments like electronic and remote-control toys. Material composition, spanning plastics, wood, plush, and eco-friendly alternatives, reflects evolving consumer choices regarding durability and environmental impact. The distribution channel segment highlights the ongoing shift from traditional retail to e-commerce dominance, while the Age Group categorization ensures products meet the specific developmental milestones and safety requirements pertinent to infants, preschoolers, and older children. Analyzing these segments is vital for understanding market dynamics and identifying underserved niches for future growth exploitation.

- Product Type: Action Figures, Building Sets, Dolls and Accessories, Games and Puzzles, Infant and Preschool Toys, Ride-Ons, Vehicles (Remote Control and Die-Cast), Electronic/Interactive Toys, Outdoor and Sports Toys, Art and Craft Kits.

- Material: Plastic, Wood, Plush/Fabric, Metal (Die-Cast), Paper/Cardboard, Bio-based and Recycled Materials.

- Distribution Channel: Specialty Toy Stores, Supermarkets and Hypermarkets, Department Stores, Online Retail (E-commerce Platforms and Company Websites), Other Retail Channels (Discount Stores, etc.).

- Age Group: 0-3 Years (Infant and Toddler), 4-7 Years (Preschool), 8-12 Years (Preteen), 13+ Years (Hobbyists and Collectors).

Value Chain Analysis For Kids Toys Market

The value chain for the Kids Toys Market initiates with upstream activities, focusing heavily on raw material sourcing and design. Upstream analysis involves the procurement of materials such as specialized polymers (plastics), sustainable wood, electronic components (microchips, batteries), and plush fabrics. Key considerations at this stage include supplier auditing for ethical labor practices, ensuring material safety compliance (non-toxic standards), and managing the volatility of commodity prices. R&D and product design form a critical upstream component, where innovative concepts, safety engineering, and intellectual property development (licensing agreements for popular characters) transform raw materials into market-ready prototypes. Efficiency and cost optimization in material sourcing directly influence the final profitability margins across the entire chain.

Midstream activities primarily encompass manufacturing, assembly, and quality assurance. Production often involves complex processes ranging from injection molding for plastic parts to textile sewing and electronics integration. Large manufacturers frequently operate globalized supply chains, utilizing production facilities in Asia Pacific countries (such as China and Vietnam) for cost efficiencies, although there is a growing trend toward regionalizing production (nearshoring) to mitigate geopolitical risks and shorten lead times. Rigorous quality control checks at this stage are essential to ensure adherence to international safety standards, which are non-negotiable for consumer acceptance and legal compliance, thus adding significant procedural complexity to the manufacturing phase.

Downstream analysis focuses on distribution and sales, covering both direct and indirect channels. The indirect distribution network relies on extensive partnerships with major retail chains (Supermarkets, Hypermarkets), specialized toy stores, and third-party e-commerce giants (Amazon, Alibaba). Direct channels are gaining importance through manufacturer-owned online stores and flagship retail outlets, which offer greater control over branding and customer data. Effective logistics, warehousing, and inventory management are paramount downstream to handle seasonal spikes in demand, especially during holidays. Successful market penetration depends heavily on robust distribution capabilities, localized marketing efforts, and strong merchandising strategies that resonate with regional consumer buying habits and cultural preferences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Billion |

| Market Forecast in 2033 | USD 205.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LEGO Group, Mattel Inc., Hasbro Inc., Bandai Namco Holdings Inc., MGA Entertainment Inc., Spin Master Corp., Playmobil (Brandstätter Group), Ravensburger AG, JAKKS Pacific Inc., VTech Holdings Ltd., Funko Inc., Melissa & Doug, ZURU Inc., Basic Fun!, Clementoni S.p.A., Moose Toys, Goliath Games, Tomy Company, Simba Dickie Group, Silverlit Toys Manufactory |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kids Toys Market Potential Customers

The primary customers in the Kids Toys Market are diverse and categorized based on their roles in the purchasing process: end-users (the children) and buyers/influencers (parents, grandparents, educators, and gift-givers). Parents constitute the largest buying segment, driven by the desire to foster their children’s educational development, meet social expectations regarding popular franchises, and provide recreational tools. Modern parents are increasingly research-intensive, seeking toys endorsed by educators or those that align with STEAM curricula, making them high-value targets for premium, developmentally focused products. Grandparents and extended family also represent a significant customer base, often purchasing during seasonal holidays, prioritizing nostalgia, durability, and safety, frequently opting for classic or heirloom-quality toys.

Beyond the family unit, educational institutions—including preschools, kindergartens, and primary schools—are crucial bulk buyers. These institutions purchase toys and educational aids not just for recreation, but as mandatory tools for classroom teaching, specifically favoring products that promote collaborative play, literacy, and foundational mathematical concepts. Their purchasing decisions are heavily influenced by pedagogical requirements, budget constraints, and compliance with institutional standards. Furthermore, hobbyists and adult collectors represent a growing niche, particularly within segments like high-end action figures, specialized building sets, and limited-edition memorabilia, often seeking products with long-term collectible value rather than immediate play utility.

Understanding the varied motivations of these customer groups is essential. While the child (end-user) dictates the desire for popular, trend-driven products heavily influenced by media, the buyer (parent/educator) applies filters related to budget, educational value, safety, and brand reputation. Successful market strategies must address both emotional appeal to the child and rational justification to the buyer. This dual-focus necessitates sophisticated marketing campaigns that highlight both the entertainment factor and the cognitive benefits, ensuring that product positioning meets the increasingly sophisticated demands of the modern buyer concerned with both developmental outcomes and ethical sourcing.

Kids Toys Market Key Technology Landscape

The technological landscape of the Kids Toys Market is rapidly evolving, driven by the convergence of physical objects with digital connectivity, transforming traditional play into interactive, adaptive experiences. A cornerstone of this evolution is the integration of advanced electronics and software, including embedded microprocessors, sensors (motion, touch, light), and low-power connectivity options like Bluetooth Low Energy (BLE) and Wi-Fi. These technologies enable basic toys to offer features such as recorded voice responses, customized light patterns, and rudimentary control via smartphone applications. This shift necessitates specialized expertise in hardware miniaturization and efficient power management to ensure safety and longevity, differentiating basic electronic toys from complex smart systems.

The rise of sophisticated smart toys is characterized by the implementation of Artificial Intelligence (AI) and Machine Learning (ML). These capabilities allow toys to learn from interaction patterns, personalize responses, and even guide children through adaptive educational curricula, moving beyond pre-programmed responses. Augmented Reality (AR) technology is another significant disruptor, primarily through mobile device integration, allowing physical toys (like action figures or building sets) to unlock corresponding digital content, interactive games, or storytelling extensions. This seamlessly bridges the physical play space with the virtually enhanced screen environment, offering richer storytelling and extended engagement, crucially extending the perceived lifespan of the product through continuous content updates.

Furthermore, technology is revolutionizing the production side, with 3D printing and advanced rapid prototyping being increasingly utilized in the design phase to accelerate the development cycle and test complex mechanical components rapidly. On the consumer side, robotics and coding kits (STEAM toys) are utilizing user-friendly programming interfaces and modular hardware designs to demystify complex computational concepts, turning programming into a play activity. Data security remains a paramount technological consideration, requiring robust encryption and authentication protocols to protect user data collected by internet-connected toys, ensuring compliance with strict global data privacy regulations.

Regional Highlights

The global Kids Toys Market exhibits significant regional disparities in terms of market maturity, growth rate, and product preference, necessitating localized strategies for global manufacturers. North America, encompassing the United States and Canada, represents a mature market characterized by high consumer spending power, a strong emphasis on licensed merchandise, and rapid adoption of high-tech and smart toys. The region is a primary innovation hub, where trends often originate and quickly disseminate globally. Stringent safety standards and high brand consciousness drive demand for premium-priced, trusted brands, making marketing expenditures substantial but necessary for market penetration.

Europe mirrors North America in terms of maturity and high disposable incomes but places a noticeably higher cultural emphasis on sustainability, wooden toys, and educational content that conforms to rigorous EU safety directives (EN 71). Countries like Germany and the Nordic nations are leaders in promoting eco-friendly, durable, and pedagogical toys. The fragmented regulatory and linguistic landscape across the EU, however, poses complexity for pan-European distribution and marketing efforts, requiring meticulous localization and compliance management for every member state.

Asia Pacific (APAC) is the engine of future market expansion, primarily driven by China, India, and Southeast Asian nations. This region benefits from the largest population base, fast-growing urbanization, and an emerging middle class that allocates substantial income towards children's education and leisure activities. While traditional toys remain popular, the rapid proliferation of smartphones and high-speed internet is catalyzing explosive growth in connected toys and digital gaming platforms. The APAC market is characterized by price sensitivity alongside a high appreciation for educational value, demanding a strategic balance between affordability and perceived quality, often leading to dual-market product strategies.

Latin America (LATAM) and the Middle East and Africa (MEA) are dynamic emerging markets facing high volatility but offering long-term growth potential. LATAM demand is often influenced by US trends, particularly licensed franchises, but faces challenges related to currency fluctuations and underdeveloped retail infrastructure outside major metropolitan areas. MEA, particularly the GCC countries, shows high per capita spending in the luxury segment and a strong affinity for tech-driven, sophisticated toys, driven by high disposable incomes. However, market development in broader Africa is constrained by lower penetration of organized retail and lower average disposable incomes, making entry strategies focused on mass-market affordability and localized relevance critical.

- North America: Dominant market value share; high demand for licensed, electronic, and tech-driven toys; strict consumer safety expectations (e.g., CPSIA).

- Europe: High focus on sustainability, educational value, and classic/wooden toys; stringent safety and ethical manufacturing standards (e.g., EU REACH, EN 71).

- Asia Pacific (APAC): Fastest-growing region driven by large populations, rising disposable income, and increasing adoption of STEAM education products, requiring cost-effective innovation.

- Latin America (LATAM): Growth tied to urbanization and expanding middle class; cultural preference for globally popular franchises; logistical challenges in distribution.

- Middle East and Africa (MEA): High growth potential in GCC countries for luxury and imported high-tech toys; varying income levels require segmented product offerings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kids Toys Market.- LEGO Group

- Mattel Inc.

- Hasbro Inc.

- Bandai Namco Holdings Inc.

- MGA Entertainment Inc.

- Spin Master Corp.

- Playmobil (Brandstätter Group)

- Ravensburger AG

- JAKKS Pacific Inc.

- VTech Holdings Ltd.

- Funko Inc.

- Melissa & Doug

- ZURU Inc.

- Basic Fun!

- Clementoni S.p.A.

- Moose Toys

- Goliath Games

- Tomy Company

- Simba Dickie Group

- Silverlit Toys Manufactory

Frequently Asked Questions

Analyze common user questions about the Kids Toys market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Kids Toys Market?

Key drivers include the global prioritization of early childhood development and STEAM learning, increasing disposable incomes, substantial investment in digital marketing and licensed intellectual property (IP), and continuous technological advancements enabling interactive and smart play experiences that appeal to modern families.

How is sustainability impacting product development in the toy industry?

Sustainability is a major trend, driving manufacturers to increasingly utilize recycled plastics, bio-based materials (e.g., sugarcane plastics), and certified sustainable wood. This shift addresses parental demand for eco-friendly products and reduces the industry's environmental footprint, offering a significant competitive advantage to ethical brands.

Which segments of the Kids Toys Market are showing the fastest adoption of digital technology?

The fastest technological adoption is seen in Electronic/Interactive Toys and STEAM/Educational Kits. These segments leverage AI for personalized learning, Augmented Reality (AR) for hybrid play, and app-connectivity to extend product utility and engagement, appealing to the tech-savvy generation.

What are the main distribution channel trends in the Kids Toys Market?

Online retail, driven by major e-commerce platforms, is the fastest-growing distribution channel, offering convenience and vast selection. However, physical retail remains crucial, especially specialty toy stores and hypermarkets, which provide experiential shopping and allow consumers to physically interact with products before purchasing.

What are the major challenges facing the global Kids Toys Market?

Major challenges include navigating stringent and complex international safety regulations, managing consumer concerns regarding excessive screen time associated with digital toys, mitigating the impact of volatile raw material costs, and ensuring robust data security and privacy compliance for connected products.

The Kids Toys Market stands at the intersection of consumer psychology, technological innovation, and educational philosophy. The market's stability is underpinned by the universal need for child development tools and entertainment, while its growth trajectory is dictated by the industry’s capacity to adapt to rapid technological shifts. The strategic deployment of Augmented Reality (AR) and Artificial Intelligence (AI) is transforming traditional play patterns, moving the industry toward a hybrid, personalized experience. Manufacturers are currently heavily focused on addressing the dual demands of digital sophistication and ethical, sustainable production. This balancing act requires significant investment in advanced material science research to reduce dependence on non-renewable plastics, alongside developing stringent cybersecurity protocols to protect young users interacting with connected devices. The competitive landscape is defined by continuous intellectual property renewal and aggressive marketing campaigns that leverage influencer culture and digital media to capture consumer attention in a saturated environment.

The regional dynamics reinforce the necessity for localized strategies, particularly in Asia Pacific, which demands high volume, affordable educational products, contrasting with the premium, high-margin niche in North America and Europe. Supply chain optimization remains a critical operational focus, requiring greater transparency and flexibility to manage global logistics complexities and unexpected external disruptions. Companies are increasingly diversifying their manufacturing footprints away from single-country reliance to ensure continuous product availability and mitigate risk. Furthermore, the segmentation analysis highlights the continued resilience of classic, open-ended play categories (like building sets and puzzles), even amidst the digital revolution, demonstrating that parental trust in foundational developmental benefits remains a persistent purchasing driver, ensuring a healthy diversity in product offerings.

Future market leaders will be those who successfully navigate the regulatory hurdles associated with digital ethics and product safety while maintaining a steady flow of creative, developmentally appropriate, and media-aligned products. The emphasis on STEAM (Science, Technology, Engineering, Arts, and Mathematics) education is not just a trend but a fundamental structural shift, integrating learning objectives into entertainment seamlessly. The collector market, particularly among adults, also continues to provide a valuable high-margin segment, encouraging manufacturers to invest in limited-edition, high-quality manufacturing runs. Overall, the market is poised for significant value growth, underpinned by demographic stability and a consumer base that views toys as essential investments in their children’s future well-being and cognitive development, ensuring sustained demand throughout the forecast period.

The market environment necessitates a proactive approach to intellectual property management, protecting key character franchises and innovative technological mechanisms against rapid imitation, especially in competitive APAC markets. Retail strategies are evolving to embrace 'phygital' experiences, where the physical store offers interactive demonstrations that seamlessly link to the online purchase and content ecosystem. This integrated approach maximizes customer engagement and captures sales across multiple touchpoints. Furthermore, specialized market niches, such as toys for children with special needs or those tailored for specific cultural educational outcomes, are gaining traction, presenting focused opportunities for small-to-medium enterprises (SMEs) to establish strong brand loyalty through targeted product development and specialized marketing efforts that address specific societal requirements often overlooked by mass-market producers. Innovation must therefore be driven by both mass appeal and specialized necessity.

Capitalizing on the 'kidult' trend—adults purchasing toys for themselves or collecting—is strategically important, as this segment exhibits high loyalty and resilience to economic downturns, focusing on nostalgia, limited-edition runs, and high-fidelity representations of popular culture icons. This demographic often consumes premium products, offsetting the pressure on margins often experienced in the high-volume, mass-market infant toy segment. The role of influencer marketing has also matured, moving beyond simple product placements to highly integrated, narrative-driven campaigns, particularly on platforms like YouTube and TikTok, which directly drive consumer awareness and immediate sales conversion, reinforcing the fast-fashion nature of certain toy categories and requiring manufacturers to shorten their product iteration cycles significantly to remain relevant in a dynamic, social-media-driven marketplace. This need for agility in both design and distribution is a defining characteristic of the modern toy industry.

The value chain is being rigorously scrutinized for ethical compliance, extending beyond immediate manufacturing sites to encompass the sourcing of critical materials. Consumers, particularly in Western markets, demand supply chain transparency, pushing major players to implement sophisticated tracking technologies, such as blockchain, to verify the origin and sustainable handling of materials like wood or natural rubber. This enhanced traceability is quickly transitioning from a brand differentiator to a baseline consumer expectation. Moreover, the integration of educational curricula into toy design is becoming highly specialized, involving collaborations with child psychologists and certified educators to ensure products meet measurable learning outcomes. This clinical approach to product development strengthens the marketing narrative, justifying premium pricing by emphasizing documented developmental benefits and educational validity over mere entertainment value, fundamentally altering how toys are perceived by discerning buyers.

Economic headwinds, including global inflation and recessionary fears, could temper consumer discretionary spending, yet the Kids Toys Market historically demonstrates resilience, as parents often prioritize child-related expenditures. Manufacturers are responding by offering tiered product lines, ensuring accessible entry points at lower price ranges while maintaining high-end offerings for the premium segment, effectively mitigating broad economic risk exposure. Technological advancements are also supporting operational resilience; for example, leveraging AI-driven predictive analytics for inventory management reduces waste and carrying costs, ensuring that stock levels accurately reflect anticipated seasonal demand peaks. This technological sophistication in back-end operations is becoming as crucial as front-end product innovation for maintaining competitive advantage and margin stability in a global market characterized by high logistics costs and rapid consumer shifts.

The regulatory framework is tightening globally, particularly concerning data privacy (GDPR-K, COPPA) for connected toys, compelling companies to embed privacy-by-design principles into product development from the outset, increasing initial R&D costs but safeguarding against massive regulatory penalties and reputational damage. Furthermore, the market is seeing a renewed focus on sensory development toys, moving away from purely screen-based interaction toward products that encourage tactile exploration and gross motor skill development, reflecting a parental backlash against overly digitized childhoods. This emphasis on ‘unplugged’ play creates substantial opportunities for traditional toy segments, especially wooden and construction toys, provided they are innovated with modern aesthetics and developmental relevance. The future successful toy portfolio will be balanced, offering both high-tech connectivity and foundational, tangible play options.

In summary, the Kids Toys Market is undergoing a deep transformation characterized by sustainable practices, digital integration, and heightened regulatory scrutiny. The expansion is robustly driven by demographic factors and educational prioritization, particularly in developing economies. Strategic competitive success hinges on seamless integration of safety, educational value, and technological novelty, backed by transparent and resilient global supply chains. The market promises strong returns for companies capable of maintaining ethical standards while effectively navigating the complex intersection of entertainment, education, and emerging technology across diverse regional consumer landscapes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager