Kids Wear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437488 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Kids Wear Market Size

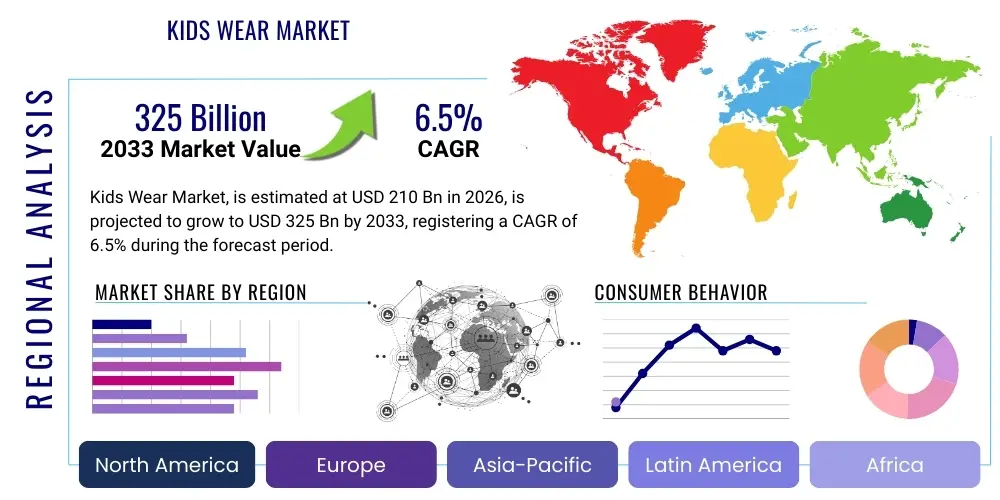

The Kids Wear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 210 Billion in 2026 and is projected to reach USD 325 Billion by the end of the forecast period in 2033.

Kids Wear Market introduction

The Kids Wear Market encompasses apparel and footwear designed for infants, toddlers, children, and pre-teens (typically newborn up to 14 years old). This segment is characterized by high replacement rates driven by rapid child growth, seasonal changes, and fashion trends heavily influenced by social media and parental preferences for quality, comfort, and sustainability. Key products include casual wear, formal wear, sleepwear, swimwear, and specialized athletic attire. The primary applications span daily use, school uniforms, and recreational activities, catering to diverse requirements based on age group and lifestyle.

The market benefits significantly from rising global disposable incomes, particularly in developing economies, which allows parents to prioritize branded and higher-quality clothing. Furthermore, the growing influence of "mini-me" fashion—where children's clothing mirrors adult styles—and the integration of technology, such as smart fabrics for safety or health monitoring, are enhancing product value propositions. Safety standards and regulatory compliance regarding materials and dyes remain crucial differentiators for brands aiming to build parental trust and secure market share.

Driving factors propelling this market include the global population growth, urbanization leading to increased exposure to retail trends, and the premiumization of the infant clothing segment driven by first-time parents seeking the best for their newborns. E-commerce penetration is a critical accelerator, offering convenience and access to international brands, significantly reducing geographical barriers to purchase. Conversely, challenges such as fast-fashion waste concerns and fluctuating raw material costs necessitate constant innovation in supply chain management and sustainable sourcing practices.

Kids Wear Market Executive Summary

The Kids Wear Market is experiencing robust expansion, fueled primarily by accelerated digitalization and the consumer shift toward sustainable and organic clothing options. Business trends indicate a strong focus on direct-to-consumer (DTC) models and subscription services, allowing brands to forge deeper connections with parents and gather valuable purchasing data. Strategic mergers, acquisitions, and collaborations between traditional apparel manufacturers and specialized children's accessory companies are common, aimed at creating comprehensive lifestyle offerings. Retail strategies are increasingly omnichannel, leveraging physical stores for experiential shopping while relying on sophisticated e-commerce platforms for transaction efficiency and global reach.

Regionally, Asia Pacific (APAC) stands out as the highest-growth market, driven by large populations, rising middle-class disposable incomes, and the strong cultural emphasis on children's presentation. North America and Europe, while mature, maintain dominant positions due to high consumer spending power and early adoption of premium and ethical brands. Trends within these regions emphasize technical wear, functional features (e.g., adjustable sizing, thermal regulation), and transparent supply chains, prioritizing ethical sourcing and reduced carbon footprints. Latin America and the Middle East & Africa (MEA) represent emerging opportunities, spurred by rapid urbanization and increasing brand awareness imported via digital channels.

Segmentation trends highlight the dominance of the casual wear segment due to everyday utility, though the market for specialized sports and performance wear is growing rapidly as participation in organized youth athletics increases globally. Based on distribution, online retail continues to capture significant share from traditional departmental stores, offering unparalleled convenience for busy parents. Furthermore, the market is segmenting sharply by material, with organic cotton and recycled synthetic fibers gaining traction as parents prioritize non-toxic and eco-friendly choices over conventional, mass-produced textiles, signaling a clear shift towards value over sheer volume.

AI Impact Analysis on Kids Wear Market

User inquiries concerning the integration of Artificial Intelligence (AI) in the Kids Wear Market generally revolve around personalization, inventory management, and enhancing the customer journey. Key themes identified include how AI can accurately predict fluctuating demand related to seasonal changes and growth spurts, minimizing overstocking and waste, which is a major concern in children's apparel. Users are also highly interested in AI-driven recommendations systems that suggest appropriate sizing and styles based on past purchases and demographic data, addressing the common challenge of sizing inconsistency across brands. Furthermore, concerns are raised regarding the ethical use of child-related data collected through smart clothing or personalized shopping experiences, requiring brands to implement robust privacy safeguards and transparent data usage policies. The expectation is that AI will ultimately lead to a highly customized, efficient, and sustainable retail ecosystem for kids' apparel.

The application of predictive analytics, powered by AI, is fundamentally transforming inventory planning for kids' wear. Unlike adult clothing, children's sizes change frequently, making inventory forecasting complex. AI models ingest data on birth rates, regional growth charts, weather patterns, and specific school uniform requirements to generate highly accurate demand forecasts, thereby reducing markdowns and optimizing working capital. This level of precision is crucial for managing the delicate balance between having sufficient stock for rapidly growing children and avoiding dead stock that occurs as seasons change.

In the direct consumer sphere, AI is being deployed through advanced conversational interfaces and virtual try-on technologies. Chatbots and virtual assistants aid parents in navigating complicated sizing charts and filtering options based on specific needs (e.g., sensory-friendly fabrics, specific safety ratings). Moreover, image recognition AI assists in trend spotting by analyzing global fashion blogs and social media platforms to quickly identify emerging children’s styles, allowing design teams to accelerate product development cycles and remain highly reactive to fast-moving youth consumer preferences, streamlining the path from trend identification to retail placement.

- AI-driven Predictive Analytics: Optimizing inventory management by forecasting demand based on age, size changes, and seasonality, significantly reducing waste.

- Personalized Sizing Recommendations: Utilizing machine learning algorithms to reduce return rates by suggesting the most accurate fit based on previous purchases and standard growth metrics.

- Enhanced Customer Service: Implementing AI chatbots to handle sizing inquiries, product care instructions, and order tracking, improving parental convenience.

- Trend Forecasting: Analyzing social media and global sales data to identify and rapidly implement emerging colors, materials, and styles popular in the youth segment.

- Supply Chain Optimization: Using AI to monitor logistics risks, track ethical sourcing compliance, and ensure timely delivery of essential seasonal inventory.

DRO & Impact Forces Of Kids Wear Market

The Kids Wear Market is influenced by a dynamic interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape its trajectory. A primary driver is the rising parental expenditure on children's well-being and appearance, often termed "pester power," where children actively influence purchase decisions. This is augmented by significant opportunities arising from the shift towards ethical manufacturing and biodegradable materials, appealing strongly to millennial and Gen Z parents who prioritize environmental and social governance (ESG) criteria in their purchasing decisions. Conversely, major restraints include intense price competition, particularly from unorganized and regional players, and the constant fluctuation in raw material prices, which pressures profit margins for established brands. The overall impact forces center around digitalization, pushing all retailers toward omnichannel excellence, and the regulatory environment focusing intensely on product safety and material composition.

Key drivers extend beyond basic necessity and now include the social phenomenon of children being viewed as style icons, driving demand for premium, branded, and miniaturized versions of adult fashion (the "mini-me" effect). The normalization of gender-neutral clothing and a greater focus on adaptive clothing for children with disabilities also expand the market scope and require specialized product lines. Furthermore, the burgeoning e-commerce ecosystem, particularly in emerging economies, provides unprecedented market penetration, making international brands accessible to a wider demographic, thereby boosting competition and accelerating consumer demand simultaneously.

Restraints are often operational and logistical in nature. The complexity of sizing and the short shelf life of styles due to rapid child growth necessitate complex logistics management to minimize stock obsolescence. Furthermore, market entry barriers are relatively low for basic apparel, leading to fragmentation and aggressive pricing strategies, which can dilute brand value unless differentiation is achieved through superior quality or specialized features. Opportunities reside in leveraging technology for customized clothing services, such as on-demand printing or personalized embroidery, and expanding into niche categories like performance sports gear for increasingly serious young athletes. Developing closed-loop recycling programs for worn-out children's clothing offers a significant environmental opportunity and enhances brand loyalty among conscious consumers.

Segmentation Analysis

The Kids Wear Market is systematically segmented based on product type, user age group, distribution channel, and material type, providing a detailed view of consumer behavior and growth pockets. Product Type remains the largest differentiator, with segments ranging from functional everyday apparel to highly specialized formal wear. Age group segmentation—infant, toddler, and pre-teen—is vital as it dictates design complexity, safety features, and material durability requirements. The proliferation of online platforms has made Distribution Channel a critical metric, differentiating between purely digital retail and traditional brick-and-mortar sales, while the growing consumer awareness mandates Material Type segmentation, focusing heavily on natural versus synthetic and organic versus conventional fabrics.

Detailed analysis of the market segments reveals that the 8 to 14 years segment (pre-teen) exhibits the highest growth potential in terms of value, as this age group starts exhibiting independent purchasing influence and greater interest in brand identity and fashion trends, driving demand for higher average selling prices. The infant wear category (0-3 years), while smaller in volume, maintains high profitability due to the premiumization driven by safety concerns and parental willingness to spend on high-quality, organic, and certified materials. Geographically, segmentation highlights the shift of manufacturing capabilities and consumption volume towards Asian countries, altering global supply chain dynamics and brand focus.

Material-based segmentation is increasingly critical, defining the future direction of product development. The demand for organic cotton is soaring due to its hypoallergenic and sustainable properties, contrasting sharply with conventional synthetic fibers, which face scrutiny over microplastic shedding. Retailers are responding by creating sustainable collections that command higher price points. The success of any brand is now intrinsically linked to its ability to communicate sustainability metrics effectively across all distribution channels, thereby influencing purchasing decisions at the segmented end-user level.

- Product Type:

- Outerwear

- Innerwear & Sleepwear

- Casual Wear (T-shirts, Jeans, Dresses)

- Formal Wear

- Footwear

- Accessories

- User Age Group:

- Infants (0-3 years)

- Toddlers (3-7 years)

- Pre-Teens (8-14 years)

- Distribution Channel:

- Online Retail (E-commerce platforms, Brand Websites)

- Offline Retail (Specialty Stores, Departmental Stores, Supermarkets/Hypermarkets)

- Material Type:

- Natural (Cotton, Wool, Silk)

- Synthetic (Polyester, Nylon, Rayon)

- Blended

Value Chain Analysis For Kids Wear Market

The Kids Wear market value chain is extensive, beginning with upstream activities involving raw material procurement, primarily focused on textile fibers such as cotton, polyester, and specialty materials like organic wool. Upstream analysis highlights the necessity for secure sourcing partnerships and certification processes (e.g., GOTS for organic cotton) to meet stringent consumer demands for sustainability and safety. Cost management at this stage is crucial, as volatile commodity prices directly impact final product profitability. Manufacturing, including spinning, weaving, and processing, often occurs in specialized hubs in Asia, demanding rigorous quality control to ensure compliance with international child safety standards regarding choking hazards, flammability, and chemical residue.

The downstream segment involves crucial marketing, branding, and distribution logistics. Effective branding in kids' wear requires emotional appeal to parents (trust, safety, quality) and visual appeal to children (design, character licensing). Distribution channels are highly diversified, encompassing direct sales through brand-owned stores (vertical integration), indirect sales via specialty multi-brand boutiques, and the rapidly growing e-commerce platforms. The complexity of inventory management—due to the large number of SKUs required to cover different ages, genders, seasons, and sizes—adds significant cost and operational challenge at the downstream level.

Distribution channels are undergoing rapid transformation. Direct distribution via dedicated brand e-commerce sites allows for maximum control over pricing and customer data, fostering personalized marketing strategies. Indirect channels, particularly marketplaces like Amazon or Zalando, offer massive reach and logistical support but require brands to navigate competition and manage margin dilution. For kids' wear, the physical store presence remains important for experiential shopping and size confirmation, especially for infants and first-time parents. Therefore, successful market players utilize an integrated omnichannel approach where direct and indirect channels complement each other, ensuring seamless product availability and consistent brand messaging across all touchpoints.

Kids Wear Market Potential Customers

The potential customers for the Kids Wear Market are primarily parents (both biological and adoptive) and guardians who make the purchasing decisions, often influenced by the children themselves, especially in the pre-teen segment. This customer base is highly segmented not only by disposable income but also by priorities such as sustainability, brand loyalty, and technological adoption. High-income families often seek premium, designer, or performance-oriented apparel, focusing on durable materials and exclusive collections. Conversely, middle-income segments prioritize value, durability, and practical features suitable for everyday wear, often shopping at hypermarkets or mass-market online retailers.

A rapidly growing segment of potential customers includes grandparents and gift-givers, particularly for infant wear, driving demand for gift sets, seasonal apparel, and licensed character merchandise. This group often prioritizes perceived quality and brand reputation. Furthermore, educational institutions and organizational buyers represent a significant segment for school uniforms and specialized team apparel. These institutional customers focus heavily on bulk pricing, adherence to specific uniform codes, and guaranteed durability to withstand frequent washing and rough use.

Crucially, potential customers are increasingly digital natives who rely heavily on online reviews, social media recommendations, and influencer endorsements before making a purchase. This group demands transparency regarding material sourcing, manufacturing processes, and sizing accuracy. Brands targeting this modern consumer must therefore invest in high-quality digital content, clear return policies, and personalized communication strategies to secure market share and cultivate long-term loyalty in a highly competitive, emotionally driven purchase category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 210 Billion |

| Market Forecast in 2033 | USD 325 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carter’s, Inditex (Zara Kids), H&M, Gap Kids, The Children's Place, Nike, Adidas, Benetton Group, Mothercare, Levi Strauss & Co., Disney Consumer Products, Ralph Lauren, PUMA, M&S, OshKosh B’gosh, Next Plc, V.F. Corporation, Primary, Patagonia. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kids Wear Market Key Technology Landscape

The Kids Wear Market is rapidly adopting advanced manufacturing and retail technologies to address unique challenges related to rapid growth, safety, and supply chain efficiency. Key technologies include the use of 3D printing for specialized footwear and accessories, offering customized fits and reducing waste in the production process. Material science innovations are paramount, focusing on developing fabrics with enhanced functional properties such as UV protection, antimicrobial treatment, and self-cleaning capabilities, directly appealing to safety-conscious parents. Furthermore, sophisticated Product Lifecycle Management (PLM) software is used to manage the vast range of size variations, material certifications, and regulatory compliance required for children’s products across different international markets, ensuring traceability from raw fiber to final sale.

Digitalization in the consumer experience is driving the adoption of Augmented Reality (AR) and Virtual Reality (VR) tools. AR fitting rooms allow parents to visualize how clothes look on their children without physical contact, a feature highly valued post-pandemic. Retailers are also leveraging Radio Frequency Identification (RFID) tags at the item level to improve inventory accuracy, prevent theft, and facilitate rapid returns processing, which is critical given the high return rate associated with size uncertainty in children’s apparel. The integration of IoT (Internet of Things) into specific high-value apparel items, known as 'smart clothing,' enables monitoring of vital signs or tracking location, creating new premium segments focused on child safety and health.

On the back-end, advanced Enterprise Resource Planning (ERP) systems are crucial for managing the complex, often global, supply chains typical of large kids' wear brands. These systems integrate merchandising, design, procurement, and logistics, enabling just-in-time inventory strategies tailored to seasonal and rapid growth shifts. Robotics and automation are also increasingly used in high-volume production facilities to handle textile cutting and assembly, improving precision and reducing labor costs, ensuring that sustainable and specialized product lines can be manufactured economically while maintaining required safety and quality standards.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the market in terms of volume and is poised for the fastest growth. This is driven by large population bases in China and India, coupled with rapid urbanization and a significant increase in disposable income among the middle class. The region's manufacturing prowess also makes it a key sourcing hub globally, though rising domestic consumption is shifting focus towards local brand development and sophisticated e-commerce infrastructure adoption.

- North America: This region is characterized by high spending on premium and branded apparel, particularly in the performance wear and designer categories. Consumer demand focuses heavily on sustainability, ethical sourcing, and technological integration (e.g., smart fabrics). E-commerce penetration is exceptionally high, and marketing relies heavily on digital influencers and direct-to-consumer models.

- Europe: Europe maintains a substantial market share, driven by stringent safety and environmental regulations (like REACH), compelling brands to innovate in sustainable materials and circular fashion initiatives. Western European countries exhibit high demand for organic and non-toxic clothing, positioning eco-friendly brands favorably. The region's fashion centers heavily influence global kids' wear trends.

- Latin America (LATAM): LATAM is an emerging market characterized by economic volatility but significant potential, particularly in urban centers like Brazil and Mexico. The market is increasingly adopting global fashion trends, driven by digital media consumption. Domestic players often compete fiercely with international brands based on pricing and local relevance, with traditional retail channels remaining strong.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, fueled by high discretionary income, strong preference for luxury international brands, and rapid retail infrastructure development (malls and specialized boutiques). Demand often peaks around religious holidays and social events, requiring brands to manage seasonal inventory spikes effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kids Wear Market.- Carter’s

- Inditex (Zara Kids)

- H&M

- Gap Kids

- The Children's Place

- Nike

- Adidas

- Benetton Group

- Mothercare

- Levi Strauss & Co.

- Disney Consumer Products

- Ralph Lauren

- PUMA

- M&S

- OshKosh B’gosh

- Next Plc

- V.F. Corporation

- Primary

- Patagonia

Frequently Asked Questions

Analyze common user questions about the Kids Wear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the sustainable Kids Wear Market?

The sustainable Kids Wear Market growth is primarily driven by heightened parental awareness concerning chemical exposure (non-toxic materials) and environmental impact. Millennial and Gen Z parents actively seek certifications (like GOTS) and transparent sourcing to ensure products are ethically made and minimize ecological footprint, favoring organic cotton and recycled fabrics.

How does e-commerce influence kids' apparel purchasing behavior?

E-commerce profoundly influences purchasing behavior by providing vast selection, price comparison tools, and critical user reviews, addressing convenience needs for busy parents. Digital channels are crucial for brand discovery and are rapidly adopting AI-driven sizing tools to mitigate the high return rates historically associated with online clothing purchases for children.

What is the significance of the "mini-me" trend in the market?

The "mini-me" trend, where children's styles mimic adult high fashion, is significant because it encourages premiumization and accelerated trend adoption. This pushes brands to create higher-value products with greater design complexity, increasing average transaction value and linking kids' wear cycles more closely to fast-moving adult fashion cycles.

Which age segment holds the highest profit potential in kids' wear?

While the infant wear segment (0-3 years) often commands premium prices due to safety focus, the Pre-Teens segment (8-14 years) holds the highest profit potential by value. This is due to increased product differentiation (performance wear, branded footwear), independent influence on purchasing, and higher expenditure on fashion-driven items.

What are the primary operational challenges faced by Kids Wear manufacturers?

Primary operational challenges include managing complex inventory due to rapid and frequent size changes, mitigating volatile raw material costs, and navigating stringent international regulatory requirements regarding child safety, flammability standards, and toxic substance restrictions in materials and dyes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager