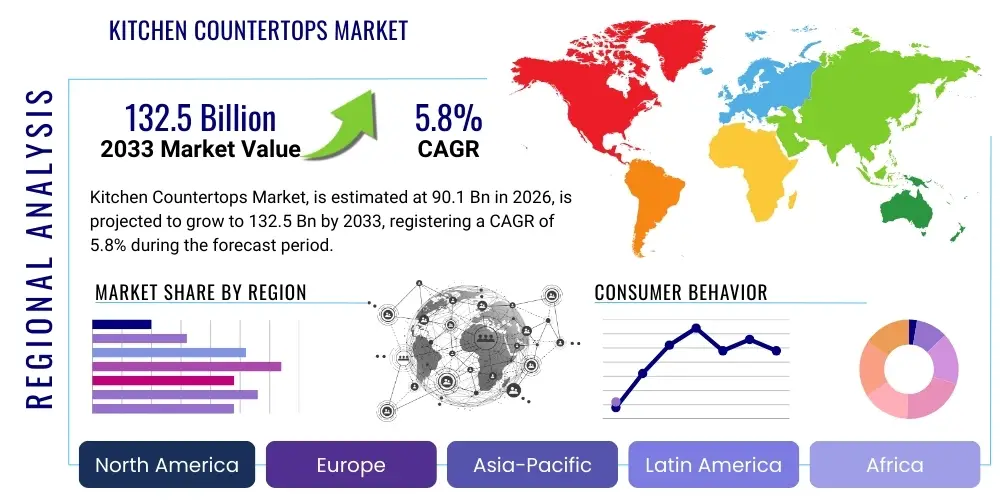

Kitchen Countertops Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440521 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Kitchen Countertops Market Size

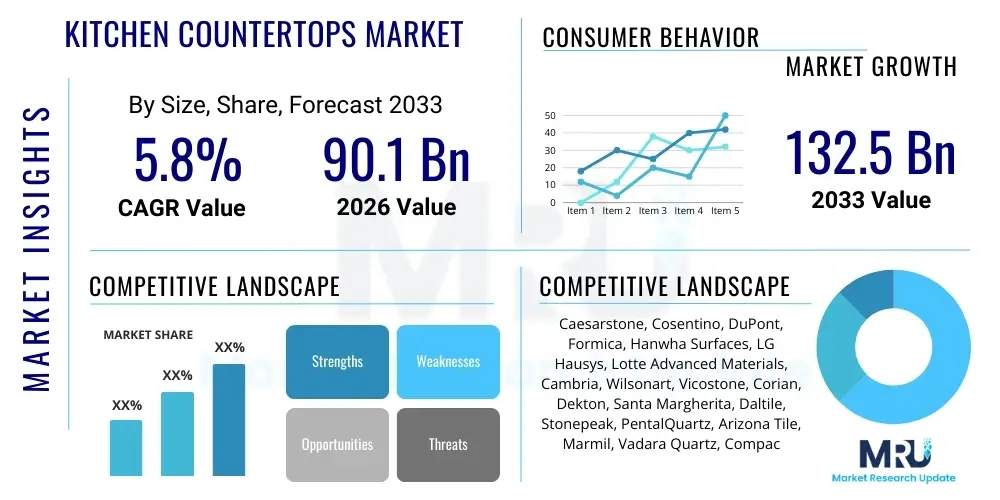

The Kitchen Countertops Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 90.1 billion in 2026 and is projected to reach USD 132.5 billion by the end of the forecast period in 2033.

Kitchen Countertops Market introduction

The Kitchen Countertops Market encompasses the global industry involved in the manufacturing, distribution, and installation of surfaces used in kitchen environments. These essential surfaces serve functional purposes, providing durable and hygienic workspaces for food preparation, cooking, and dining, while also playing a critical aesthetic role in defining the overall style and appeal of a kitchen space. The market offers a diverse range of materials, each possessing unique characteristics in terms of durability, appearance, maintenance requirements, and cost, catering to a broad spectrum of consumer preferences and budget constraints.

Major applications for kitchen countertops are predominantly found in residential settings, including new home construction, extensive home renovations, and minor kitchen upgrades, alongside significant demand from the commercial sector such as restaurants, hotels, institutional kitchens, and office breakrooms. The core benefits derived from high-quality kitchen countertops include enhanced hygiene and ease of cleaning, exceptional durability against heat, scratches, and impacts, and a significant contribution to interior design, boosting property value and user satisfaction. The material choice often reflects a balance between desired aesthetics and practical performance, with consumers increasingly seeking solutions that offer both longevity and visual appeal.

Several driving factors are propelling the growth of this market. A robust global real estate and construction industry, particularly in emerging economies, is a primary driver. Additionally, increasing disposable incomes, urbanization trends, and a growing consumer focus on home aesthetics and functionality are fueling demand for premium and customized kitchen solutions. The rising popularity of open-plan living and modular kitchens, coupled with a surge in kitchen remodeling projects, further contributes to market expansion. Technological advancements in manufacturing processes, leading to more resilient and visually appealing materials, along with growing environmental awareness driving demand for sustainable options, are also significant growth catalysts.

Kitchen Countertops Market Executive Summary

The Kitchen Countertops Market is currently experiencing dynamic shifts driven by evolving consumer preferences, technological advancements, and a vibrant global construction landscape. Business trends indicate a strong move towards customization and personalization, with manufacturers offering an expansive palette of materials, finishes, and edge profiles to meet diverse design requirements. There is also a notable increase in demand for premium and engineered surfaces, such as quartz and solid surface materials, which offer superior durability, aesthetic versatility, and low maintenance compared to traditional natural stone options. Supply chain optimization and efficient logistics are becoming increasingly crucial for manufacturers to maintain competitive pricing and timely delivery, especially in a market characterized by diverse material sourcing and regional manufacturing hubs.

Regional trends reveal varied growth trajectories and material preferences across different geographies. North America and Europe, as mature markets, exhibit steady growth driven by renovation activities and a strong inclination towards high-end, aesthetically pleasing, and sustainable countertop solutions. The Asia Pacific region is poised for significant expansion, fueled by rapid urbanization, increasing middle-class disposable incomes, and a booming residential and commercial construction sector, particularly in countries like China and India. Latin America and the Middle East & Africa also present considerable growth opportunities, as infrastructure development and a rising focus on modern living standards contribute to increased demand for sophisticated kitchen interiors. Material preferences often differ regionally, with natural stone remaining popular in some areas due to cultural preferences, while engineered materials gain traction globally due to their consistent quality and design flexibility.

Segmentation trends highlight the dominance of engineered stone, particularly quartz, due to its exceptional performance characteristics and design flexibility, making it a preferred choice for both residential and commercial applications. While natural stones like granite and marble maintain a significant market share, their growth is somewhat constrained by cost, maintenance requirements, and environmental considerations. Laminates continue to hold a strong position in the budget-friendly segment, benefiting from continuous innovations in aesthetics and durability. Application-wise, the residential sector remains the largest segment, driven by both new construction and a robust remodeling market, while the commercial sector demonstrates steady growth with increasing demand from hospitality, healthcare, and corporate facilities. The distribution landscape is also evolving, with a growing presence of online channels complementing traditional retail and specialty stores, providing consumers with greater accessibility and choice.

AI Impact Analysis on Kitchen Countertops Market

Common user questions regarding AI's impact on the Kitchen Countertops Market frequently revolve around how artificial intelligence can enhance design processes, optimize material selection, streamline manufacturing, and personalize consumer experiences. Users are keen to understand if AI can lead to more efficient material cutting, reduce waste, predict design trends, and ultimately make countertop purchasing decisions easier and more informed. There is also interest in AI's potential to improve supply chain transparency, automate quality control, and even facilitate virtual try-ons or augmented reality applications for visualizing countertops in a kitchen space. The underlying themes are centered on efficiency, customization, sustainability, and improved user engagement through intelligent solutions across the value chain.

- AI-powered design tools assist consumers and designers in visualizing various countertop materials, colors, and patterns within their specific kitchen layouts, significantly accelerating the design process and enhancing personalization.

- Predictive analytics driven by AI helps manufacturers anticipate material demand, optimize inventory management, and forecast market trends, leading to more efficient production schedules and reduced waste.

- AI-enabled machinery in manufacturing facilities can precisely cut and shape complex countertop designs, minimizing material wastage and improving production accuracy and speed.

- Automated quality control systems utilizing AI and computer vision detect flaws and inconsistencies in countertop slabs with greater precision than manual inspection, ensuring higher product quality.

- AI algorithms can analyze vast datasets of consumer preferences and purchase history to recommend suitable countertop materials and styles, leading to more targeted marketing and sales strategies.

- Supply chain optimization through AI improves logistics, tracks raw material sourcing, and identifies potential disruptions, enhancing overall operational efficiency and reducing lead times.

DRO & Impact Forces Of Kitchen Countertops Market

The Kitchen Countertops Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively exert significant Impact Forces on its growth trajectory. Key drivers include robust global construction and real estate development, particularly in residential sectors, along with an increasing consumer focus on home renovation and aesthetic upgrades. Rising disposable incomes and urbanization in developing regions further fuel demand for modern kitchen solutions. The desire for durable, low-maintenance, and visually appealing surfaces is a constant driving force, prompting innovation in material science and design. Furthermore, technological advancements in manufacturing processes enable the production of a wider variety of materials and finishes at competitive price points, expanding consumer choice and market accessibility.

However, the market also faces notable restraints. Fluctuations in raw material prices, particularly for natural stone and petroleum-derived resins used in engineered surfaces, can impact manufacturing costs and consumer prices. Environmental concerns related to quarrying, energy consumption in production, and waste disposal pose challenges, especially as consumers increasingly seek sustainable options. Intense competition from both established players and new entrants, coupled with the availability of numerous substitute materials, can lead to pricing pressures and margin erosion. The relatively long product lifespan of countertops means replacement cycles are extended, which can temper consistent demand from the existing market base. Economic downturns and global crises also tend to reduce discretionary spending on home improvements, acting as significant dampeners.

Opportunities within the market are abundant and diverse. The growing trend towards smart homes and integrated kitchen technology presents avenues for innovative countertop solutions incorporating charging pads, hidden controls, or interactive displays. The increasing demand for sustainable and eco-friendly materials, such as recycled glass, reclaimed wood, or bio-based composites, offers a lucrative niche for manufacturers willing to invest in green technologies and certifications. Emerging markets, with their rapid infrastructure development and expanding middle classes, represent untapped potential for market penetration. Furthermore, the rising popularity of outdoor kitchens and multi-functional spaces creates new application areas for durable and weather-resistant countertop materials. Customization and personalization trends continue to open doors for niche products and services, allowing manufacturers to cater to specific design preferences and premium segments. The continuous evolution of digital visualization tools and e-commerce platforms also provides new channels for market outreach and sales.

Segmentation Analysis

The Kitchen Countertops Market is broadly segmented based on material type, application, end-use, and distribution channel, providing a comprehensive view of market dynamics and consumer preferences across different categories. Each segment exhibits distinct growth patterns and competitive landscapes, reflecting varying demands for aesthetics, functionality, durability, and cost. Understanding these segmentations is crucial for stakeholders to identify lucrative opportunities, tailor product offerings, and develop targeted marketing strategies that resonate with specific consumer needs. The market's diversity allows for a wide range of products catering to both budget-conscious consumers and those seeking premium, high-performance solutions.

- By Material:

- Natural Stone (Granite, Marble, Quartzite, Soapstone)

- Engineered Stone (Quartz, Solid Surface, Sintered Stone)

- Laminates

- Wood/Butcher Block

- Stainless Steel

- Concrete

- Tile

- Recycled Materials

- By Application:

- Residential

- Commercial (Hospitality, Restaurants, Offices, Healthcare, Education)

- By End-Use:

- New Construction

- Renovation/Remodeling

- By Distribution Channel:

- Retail Stores (Home Improvement Stores, Specialty Stores)

- Online Stores

- Direct Sales (Fabricators, Contractors)

Value Chain Analysis For Kitchen Countertops Market

The value chain for the Kitchen Countertops Market is a complex and multi-layered process, beginning with the extraction and processing of raw materials and culminating in the final installation in residential or commercial spaces. Upstream analysis involves the sourcing of primary materials, such as quartz aggregates, natural stone blocks, resins, laminates, wood, and metals. This stage is crucial for ensuring quality, sustainability, and cost-effectiveness. Key players in the upstream segment include mining companies for natural stone, chemical companies for resins and polymers, and various suppliers of wood and metal. Relationships at this stage are often characterized by long-term contracts and supply agreements, with a growing emphasis on ethical sourcing and environmental compliance to meet regulatory standards and consumer expectations.

Midstream activities involve the manufacturing and fabrication of countertop slabs and custom pieces. This includes processes like cutting, polishing, bonding, and finishing of raw materials into ready-to-install countertops. Manufacturers transform raw materials into finished or semi-finished products, such as quartz slabs, solid surface sheets, or laminated panels. Fabricators then cut these slabs according to specific kitchen designs, create edge profiles, and prepare them for installation. This stage requires significant capital investment in machinery, skilled labor, and advanced technology to ensure precision and quality. Innovation in manufacturing techniques, such as advanced CNC machining and waterjet cutting, plays a vital role in enhancing product customization and reducing waste.

Downstream analysis covers the distribution, sales, and installation of kitchen countertops. The distribution channel is diverse, involving direct sales from manufacturers to large commercial projects, wholesale distributors supplying smaller fabricators and retailers, and a robust network of retail stores (including home improvement centers and specialty kitchen and bath showrooms). Online channels are also gaining traction, allowing consumers to browse and select options more conveniently. Direct and indirect distribution channels coexist, with direct sales often preferred for customized or high-volume projects, while indirect channels provide broader market reach. Installation services, typically performed by skilled fabricators or contractors, represent the final critical step, ensuring proper fit, finish, and customer satisfaction. Effective coordination across these stages is essential for market efficiency, timely project completion, and maintaining competitive pricing and service quality.

Kitchen Countertops Market Potential Customers

Potential customers for the Kitchen Countertops Market are highly diverse, spanning both the residential and commercial sectors, each with distinct needs, preferences, and purchasing behaviors. In the residential segment, the primary end-users include homeowners undertaking new construction projects, individuals engaged in extensive kitchen remodels, and those performing minor upgrades or repairs. These consumers often seek countertops that not only align with their aesthetic preferences and lifestyle but also offer durability, ease of maintenance, and an appropriate balance of cost and value. Demographic factors such as age, income level, family size, and regional design trends significantly influence their material choices, from budget-friendly laminates to premium natural stone or engineered quartz. The increasing focus on home aesthetics, property value enhancement, and personalized living spaces drives significant demand from this segment.

Within the residential market, there are also specific buyer groups such as first-time homebuyers who may prioritize affordability and practicality, compared to luxury homeowners who may opt for bespoke designs and high-end materials. Renovation projects often see homeowners investing in higher quality materials as a long-term upgrade, while new construction projects might be influenced by builder-grade selections or developer packages. Architectural firms, interior designers, and independent contractors also serve as indirect customers, specifying countertop materials for their clients' projects, thereby acting as influential decision-makers in the purchasing process. Their recommendations are often based on performance specifications, design compatibility, and supplier reliability, highlighting the importance of building strong professional relationships.

The commercial sector represents another substantial customer base, including hotels, restaurants, cafes, corporate offices, educational institutions, healthcare facilities, and retail establishments. These customers typically require countertops that can withstand heavy usage, adhere to strict hygiene standards, and meet specific aesthetic requirements that align with their brand image or functional needs. For instance, restaurants prioritize durability and ease of sanitation, while corporate offices may focus on sophisticated aesthetics and collaborative workspace integration. Commercial buyers often purchase in bulk, prioritizing supplier reliability, volume discounts, and adherence to project timelines and specifications. Building contractors, commercial developers, and facility managers are key decision-makers in this segment, requiring robust and long-lasting solutions that offer a strong return on investment. The continuous development of new commercial spaces and the periodic renovation of existing ones ensure a steady demand stream from this segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 90.1 Billion |

| Market Forecast in 2033 | USD 132.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caesarstone, Cosentino, DuPont, Formica, Hanwha Surfaces, LG Hausys, Lotte Advanced Materials, Cambria, Wilsonart, Vicostone, Corian, Dekton, Santa Margherita, Daltile, Stonepeak, PentalQuartz, Arizona Tile, Marmil, Vadara Quartz, Compac |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kitchen Countertops Market Key Technology Landscape

The Kitchen Countertops Market is increasingly shaped by a dynamic technological landscape that influences everything from material development to manufacturing processes and design integration. Advanced manufacturing techniques, such as Computer Numerical Control (CNC) machining and waterjet cutting, are pivotal in enabling precise and intricate countertop fabrication, significantly reducing material waste and expanding design possibilities. These technologies allow for complex edge profiles, seamless sink cutouts, and custom inlay designs with unparalleled accuracy, catering to the growing demand for highly personalized kitchen aesthetics. Furthermore, automated polishing and finishing lines ensure consistent quality and accelerate production cycles, crucial for meeting market demand efficiently. Innovations in these areas contribute directly to both the cost-effectiveness and the aesthetic appeal of a wide range of countertop materials.

Material science and engineering play a crucial role in the evolution of kitchen countertops. Significant advancements have been made in developing engineered stones, particularly quartz, to enhance their durability, stain resistance, and visual versatility. This includes the development of proprietary resin formulations that bind quartz aggregates, as well as sophisticated pigment technologies that create a vast array of colors, patterns, and realistic natural stone aesthetics. The rise of sintered stone technologies, such as Dekton and Lapitec, represents another significant leap, offering ultra-compact surfaces with exceptional resistance to heat, scratches, UV radiation, and chemicals. These materials are manufactured using high-pressure and high-temperature processes that mimic the formation of natural stone, resulting in surfaces that are extremely resilient and suitable for both indoor and outdoor applications. Continuous research in these areas aims to further improve performance characteristics while also exploring more sustainable and eco-friendly compositions.

Digital technologies are also transforming the customer experience and design process within the market. Augmented Reality (AR) and Virtual Reality (VR) applications allow consumers to visualize different countertop materials and designs within their own kitchen spaces before making a purchase, significantly enhancing decision-making confidence and reducing buyer's remorse. 3D rendering software and advanced CAD programs empower designers and fabricators to create precise models and ensure flawless integration with other kitchen elements. E-commerce platforms are leveraging these digital tools to offer more immersive shopping experiences. Furthermore, smart kitchen integration technologies, though nascent, are beginning to influence countertop design, with embedded wireless charging pads, touch-sensitive controls, and integrated sensors becoming potential future features. These technological advancements collectively drive innovation, improve product quality, and enhance the overall customer journey in the Kitchen Countertops Market.

Regional Highlights

- North America: A mature market characterized by high consumer spending power and a strong focus on home renovations and new luxury residential construction. Engineered stone, especially quartz, dominates, alongside a consistent demand for natural granite and solid surfaces. Customization and integration of smart home features are key trends.

- Europe: Exhibits steady growth, with Germany, France, and the UK leading. There's a strong preference for durable, aesthetically pleasing, and increasingly sustainable materials. Natural stone and engineered quartz remain popular, while laminates cater to budget-conscious segments. Emphasis on quality and design innovation.

- Asia Pacific (APAC): The fastest-growing region, driven by rapid urbanization, burgeoning middle-class populations, and significant infrastructure development in countries like China, India, and Southeast Asia. Demand spans all material types, with a growing shift towards engineered surfaces for their consistency and performance.

- Latin America: Experiencing growth fueled by economic development and an expanding construction sector. Natural stone, particularly granite, holds a strong cultural preference, but engineered quartz is gaining traction due to its modern appeal and low maintenance. Brazil and Mexico are key markets.

- Middle East and Africa (MEA): Marked by substantial investments in residential and commercial infrastructure, particularly in the GCC countries. Luxury and high-end materials are preferred in many urban centers, with natural stone and engineered surfaces seeing high demand for upscale projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kitchen Countertops Market.- Caesarstone

- Cosentino

- DuPont

- Formica

- Hanwha Surfaces

- LG Hausys

- Lotte Advanced Materials

- Cambria

- Wilsonart

- Vicostone

- Corian

- Dekton

- Santa Margherita

- Daltile

- Stonepeak

- PentalQuartz

- Arizona Tile

- Marmil

- Vadara Quartz

- Compac

Frequently Asked Questions

What are the most popular materials for kitchen countertops currently?

Currently, engineered quartz stands out as the most popular material due to its exceptional durability, non-porous nature, wide range of aesthetic options, and low maintenance requirements. Natural granite remains highly sought after for its unique patterns and heat resistance. Solid surface materials like Corian are also favored for their seamless appearance and repairability, while laminates continue to be popular for their affordability and improved design versatility. The choice often balances budget, desired aesthetic, and practical performance needs.

How do I choose the right kitchen countertop material for my home?

Choosing the right kitchen countertop material involves evaluating several factors: your budget, desired aesthetic, durability needs (resistance to scratches, heat, stains), maintenance requirements, and lifestyle. For high-traffic kitchens, durable options like quartz or granite are excellent. If you prioritize a seamless look and repairability, solid surface is ideal. For budget-conscious renovations, high-quality laminates offer great value. Consider samples in your kitchen's lighting, and discuss pros and cons with a design professional to align with your specific needs and long-term expectations.

What are the emerging trends in kitchen countertop design and technology?

Emerging trends include a strong preference for ultra-compact surfaces (sintered stone) known for extreme durability and outdoor use, and an increasing demand for sustainable and recycled materials. Design-wise, matte finishes, earthy tones, and patterns mimicking natural veining are highly popular. Integrated technology, such as wireless charging pads and hidden smart controls, is also an evolving trend. There's a growing movement towards larger islands with waterfall edges and mixed material applications, creating visually dynamic and highly functional kitchen spaces that also cater to open-plan living.

How does the cost of kitchen countertops vary by material and installation?

The cost of kitchen countertops varies significantly based on material, complexity of fabrication, and installation. Laminates are generally the most affordable, followed by some tiles. Mid-range options include solid surface materials and some engineered quartz. High-end materials like natural marble, premium granite, and certain quartz brands, as well as ultra-compact sintered stones, represent the highest price points. Installation costs are influenced by the material's weight, the complexity of cuts (e.g., sink cutouts, curved edges), and labor rates in your region. Customization and intricate designs will also increase overall project expenses.

What are the key maintenance considerations for different countertop materials?

Maintenance varies greatly by material. Natural stones like granite and marble require periodic sealing to prevent staining and protect against moisture absorption; they should also be cleaned with pH-neutral cleaners. Engineered quartz is low maintenance, only needing routine cleaning with mild soap and water, as it is non-porous and highly stain-resistant. Solid surface materials are also non-porous and can often be repaired if scratched. Laminates are easy to clean but are susceptible to heat damage and scratches. Stainless steel requires specific cleaners to avoid streaks and fingerprints. Always consult manufacturer guidelines for the best long-term care practices to preserve the beauty and longevity of your countertops.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager