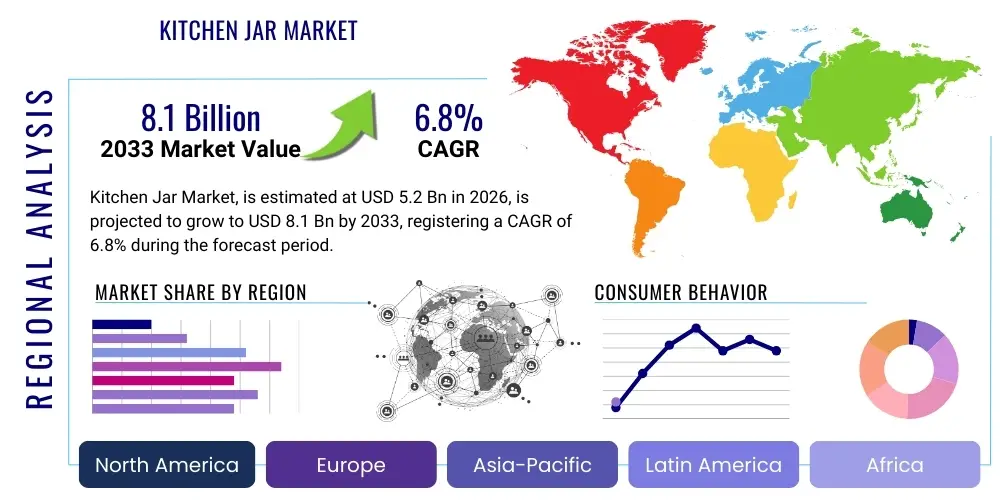

Kitchen Jar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436120 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Kitchen Jar Market Size

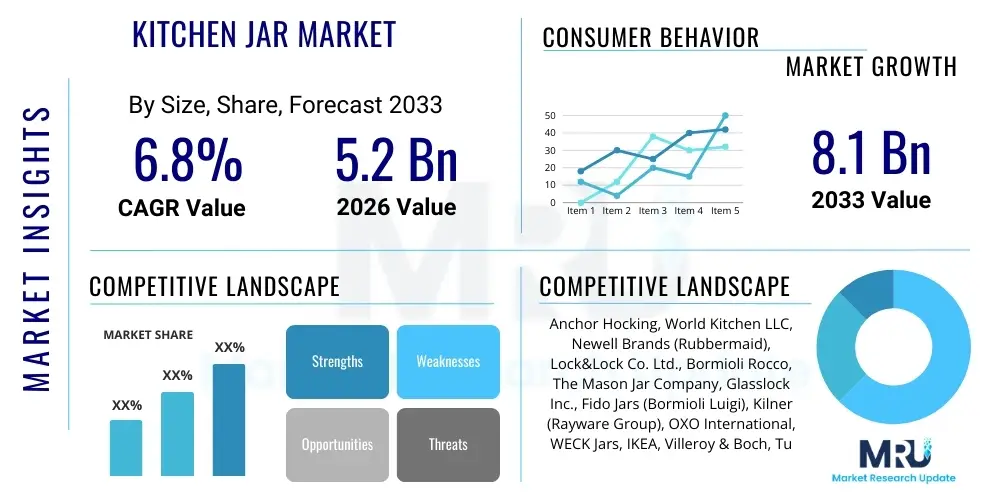

The Kitchen Jar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.1 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fueled by increasing consumer preference for organized kitchen spaces, the growing trend of home cooking and bulk food storage, and continuous innovation in jar materials and sealing technologies aimed at enhancing food freshness and shelf life. The market scope includes storage solutions made from various materials such as glass, plastic, ceramic, and stainless steel, catering to diverse aesthetic and functional requirements across residential and commercial sectors.

Kitchen Jar Market introduction

The Kitchen Jar Market encompasses the manufacturing, distribution, and sale of containers primarily designed for storing food items, ingredients, and preserved goods within a kitchen environment. These products serve crucial functions, ranging from basic preservation and organization to aesthetic enhancement of culinary spaces. Historically, kitchen jars have evolved from simple utility items to highly functional and design-oriented household staples. The products are categorized broadly by material (glass, plastic, metal), closure type (airtight seals, screw tops, clip tops), and capacity, addressing the varied needs of modern consumers, including health-conscious individuals prioritizing non-toxic materials and bulk buyers seeking efficient storage solutions.

Major applications of kitchen jars span dry food storage (grains, flour, pasta, spices), liquid preservation (pickles, jams, sauces), and general organization, increasingly driven by trends in pantry optimization and minimalist design. Key benefits include improved food hygiene, extended shelf life of perishable items due to superior sealing mechanisms, and clutter reduction. Furthermore, the rising demand for sustainable and reusable packaging alternatives heavily influences market dynamics, positioning glass jars, in particular, as a preferred choice for eco-conscious consumers globally. The market's robust structure supports both high-volume standardized products and artisanal, specialized storage solutions.

Driving factors propelling market growth include rapid urbanization leading to smaller, highly organized living spaces; the global surge in interest in baking, cooking, and home preservation (e.g., canning); and technological advancements in manufacturing processes that reduce production costs while enhancing product durability and safety. The shift towards transparent and aesthetically pleasing storage solutions, often showcased in open shelving concepts, also acts as a significant market catalyst. Furthermore, stringent regulations regarding food safety and material toxicity (e.g., BPA-free standards for plastic) consistently push manufacturers towards premium, certified products, thereby bolstering the overall market value.

Kitchen Jar Market Executive Summary

The Kitchen Jar Market is experiencing robust expansion, characterized by a fundamental shift towards premiumization and sustainability across product lines. Current business trends indicate a strong focus on smart storage integration, including modular and stackable designs that maximize efficiency, particularly in urban kitchens. Manufacturers are investing heavily in advanced sealing technologies (vacuum sealing, silicone gaskets) to meet consumer demands for superior food preservation capabilities. The competitive landscape is fragmented, with large conglomerates focusing on mass production and specialized niche players capitalizing on custom design, personalization, and high-end materials like hand-blown glass and exotic ceramics.

Regionally, Asia Pacific (APAC) dominates the market due to its large population base, high prevalence of traditional home cooking, and growing disposable incomes driving kitchen upgrades. However, North America and Europe demonstrate the highest adoption rates for technologically advanced and design-centric storage solutions, driven by strong e-commerce penetration and the influence of home organization media. Latin America and MEA are emerging as high-growth markets, fueled by increasing retail modernization and urbanization, leading to higher demand for organized pantry systems.

Segment trends highlight the Glass segment's dominant position, primarily due to its non-reactive nature, visual appeal, and infinite recyclability, aligning perfectly with global sustainability mandates. The closure type segment shows rapid growth in airtight and vacuum-seal closures, reflecting consumer prioritization of freshness. Distribution channels are shifting, with online retail platforms demonstrating faster growth than traditional brick-and-mortar stores, offering consumers greater variety and convenience in specialized jar selection. Commercial end-users, such as restaurants and cafes, also represent a stable, growing segment requiring specialized, heavy-duty storage solutions.

AI Impact Analysis on Kitchen Jar Market

User queries regarding the impact of Artificial Intelligence (AI) on the Kitchen Jar Market typically revolve around supply chain optimization, smart inventory management, personalized product recommendations, and the potential integration of AI into smart kitchen appliances. Consumers and industry stakeholders are keen to understand how AI can solve pain points such as estimating optimal jar sizes based on consumption habits, forecasting seasonal ingredient storage needs, and automating inventory tracking within large pantry setups. Key themes include the efficiency gains in manufacturing quality control (detecting minor defects in glass or seals), optimizing logistics routes for fragile goods, and developing predictive maintenance schedules for production machinery. The main concern centers on the practical application of AI in a low-tech product category and the value proposition of 'smart jars' versus traditional, cost-effective alternatives.

AI is beginning to influence the Kitchen Jar Market primarily through back-end operations and consumer personalization. In manufacturing, AI-driven computer vision systems are drastically improving quality control, identifying micro-fissures or seal inconsistencies faster and more reliably than human inspection, thereby reducing waste and enhancing product safety. In the retail sector, AI algorithms analyze purchasing patterns, local culinary trends, and shelf-life requirements to recommend optimal storage container sets (e.g., specific spice jar sizes, flour canisters, or fermentation vessels) to individual consumers, dramatically boosting conversion rates and customer satisfaction. Furthermore, generative AI tools are used in product design, simulating how different jar shapes and materials perform under various environmental conditions (humidity, temperature changes) to optimize functional design long before physical prototyping begins.

The future application of AI lies in its potential integration with smart kitchen ecosystems. While fully 'smart' jars remain niche, AI can facilitate connection points. For instance, sensors in pantry systems, managed by an AI hub, could track contents and send alerts when specific jars are running low, automatically triggering grocery list updates. This transforms the kitchen jar from a static container into a dynamic component of an integrated home management system. This shift requires standardization of digital identifiers (like QR codes or RFID tags) on jars to enable seamless tracking and data collection, fundamentally altering the perceived value of storage solutions from mere containers to data points within a smart home network. This technological overlay addresses the modern consumer's demand for seamless convenience and automated inventory management, especially for bulk and frequently used items.

- Enhanced Quality Control (Manufacturing): AI-powered visual inspection detects minor defects in seals, glass, and plastic structure, minimizing recall risk.

- Optimized Supply Chain Logistics: AI algorithms predict demand fluctuations and optimize delivery routes for fragile goods, reducing transit damage and costs.

- Personalized Product Recommendations: Machine learning models analyze user culinary habits to suggest optimized jar sets (material, size, closure type).

- Inventory Management Systems: AI integration with smart pantry sensors enables automated tracking of jar contents and low-stock alerts.

- Predictive Maintenance: AI monitors jar production machinery to anticipate failures, ensuring continuous, high-volume manufacturing output.

- Generative Design: AI tools accelerate the development of ergonomically superior and thermally resilient jar designs.

DRO & Impact Forces Of Kitchen Jar Market

The Kitchen Jar Market is primarily driven by consumer trends emphasizing organization, health, and sustainability, leading to increased demand for high-quality, non-toxic storage solutions, particularly glass and premium plastics. However, this growth is often restrained by the volatility in raw material costs (silica sand for glass, petroleum for plastic), and the significant logistical challenges associated with safely transporting fragile products like glass jars over long distances. Opportunities abound in product diversification, specifically targeting niche markets such as fermentation kits, specialized coffee storage, and aesthetically customizable jar lines that appeal to the design-conscious demographic. These factors collectively exert a powerful impact force on pricing strategies, material substitution, and innovation timelines within the highly competitive storage market ecosystem.

Drivers include the widespread adoption of modern interior design trends that favor open shelving and organized, transparent storage; the growing awareness of food waste reduction, encouraging consumers to store leftovers and bulk purchases effectively; and the expansion of the e-commerce sector, which makes a wider variety of specialized jar products accessible globally. Furthermore, the cultural shift towards healthier eating and home cooking, accelerated by global events, has cemented kitchen storage as an essential household investment. These drivers ensure sustained volume demand and pressure manufacturers to innovate rapidly, focusing on superior sealing performance and non-leaching material safety.

Restraints largely center around cost and competitive substitution. Cheap, low-quality plastic alternatives often flood the market, suppressing the average selling price and posing a challenge for premium manufacturers. Furthermore, regulatory complexity regarding food contact materials across different regions requires costly compliance checks. Logistical costs, particularly for heavy glass products, represent a continuous operational restraint, often requiring sophisticated, high-cost packaging solutions to prevent damage during transit. Opportunities for market expansion are significant, focusing on developing lightweight, high-strength composite materials that offer the aesthetic appeal of glass with the durability of plastic, and penetrating commercial sectors such as specialized food processing and small-batch artisan production where high-quality, certified storage is mandatory.

Impact forces are determined by material innovation, consumer spending patterns, and globalization. The intensity of rivalry among existing competitors is high, driven by differentiation in design patents and pricing wars, particularly in standard capacity segments. The threat of substitutes is moderate to high, as consumers can often opt for alternative containers (e.g., zip-lock bags, disposable plastic containers) for short-term storage, although kitchen jars maintain a distinct advantage for long-term preservation. Supplier bargaining power is notable, especially for high-grade glass manufacturers, while buyer bargaining power remains strong, fueled by extensive product transparency and comparison capabilities offered by online retail platforms. Overall, the market remains dynamic, requiring strategic agility to leverage sustainability trends while managing operational constraints.

Segmentation Analysis

The Kitchen Jar Market is strategically segmented based on key differentiating characteristics including material type, closure mechanism, capacity, end-user application, and distribution channel. This granular segmentation allows market participants to tailor product offerings and marketing strategies to specific consumer needs, such as health-conscious users preferring glass or commercial entities requiring durable, high-capacity plastic containers. Understanding these segments is crucial for accurate market forecasting and identifying high-growth opportunities, particularly within niche applications like specialized food preservation (e.g., anaerobic fermentation) or modular, space-saving designs sought after in urban environments.

Material type remains the most critical segmentation axis, influencing pricing, durability, and consumer safety perceptions. Glass dominates due to its inert nature and recyclability, followed closely by plastics (PP, PET, Tritan), which offer lightweight convenience and shatter resistance. The closure type segment dictates the functional effectiveness of the jar, with airtight seals and vacuum closures commanding higher prices due to their ability to extend food freshness significantly. Capacity segmentation helps manufacturers target specific purchasing habits, ranging from small spice jars (under 250ml) to large bulk storage containers (over 2 liters) designed for flour or rice.

End-user segmentation clearly distinguishes between the robust residential market, driven by aesthetics and individual organizational needs, and the commercial sector (restaurants, catering services), which prioritizes volume, durability, and industrial washing compatibility. The distribution channel analysis confirms the growing importance of e-commerce, which provides specialized and imported storage options, contrasting with the high-volume sales generated through traditional hypermarkets and specialty home goods stores. Strategic positioning across these segments ensures market resilience and maximizes the addressable consumer base by matching specific product attributes to defined user requirements.

- By Material Type:

- Glass Jars (Dominant Segment)

- Plastic Jars (PET, PP, Tritan, Acrylic)

- Ceramic Jars

- Stainless Steel Jars

- By Closure Type:

- Screw Tops

- Airtight/Clip Tops (Wire Bails)

- Vacuum Seals

- Push-On Lids

- By Capacity:

- Small (Under 250 ml)

- Medium (250 ml – 1000 ml)

- Large (1000 ml – 2500 ml)

- Bulk (Above 2500 ml)

- By End-User:

- Residential

- Commercial (HORECA, Food Processing Units)

- By Distribution Channel:

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Retail (E-commerce)

- Direct Sales

Value Chain Analysis For Kitchen Jar Market

The value chain of the Kitchen Jar Market begins with upstream activities involving the sourcing of primary raw materials—silica sand and soda ash for glass manufacturing, and crude oil derivatives for plastic resins. Suppliers of specialized components, such as silicone gaskets for airtight seals, metal clips for wire bails, and high-grade stainless steel, exert moderate influence on input costs. Efficiency at this stage is crucial, as the cost structure of raw materials heavily dictates the final manufacturing price. Upstream analysis focuses on securing stable supply contracts, implementing advanced inventory management to mitigate price volatility, and investing in sustainable sourcing practices, particularly for glass, which is material-intensive.

Midstream activities involve core manufacturing, including blowing, molding, and injection processes, followed by finishing, labeling, and quality assurance. This phase is capital-intensive, requiring specialized machinery for precise forming, annealing (for glass), and intricate seal assembly. Manufacturers differentiate themselves through product innovation, focusing on patented closure designs, stackability features, and aesthetic appeal. The integration of automation and AI-driven quality checks during manufacturing is becoming standard practice to reduce operational defects and improve yield rates. Efficient production management and minimized energy consumption are critical factors for maintaining competitiveness in the midstream segment.

The downstream segment encompasses distribution channels, marketing, and sales. The market uses both direct and indirect distribution. Direct channels involve large manufacturers supplying directly to major commercial end-users (e.g., bulk food manufacturers) or establishing their own dedicated e-commerce portals. Indirect channels, which dominate residential sales, rely on wholesalers, distributors, hypermarkets, and increasingly, powerful online retailers like Amazon and specialized home goods websites. The role of distributors is crucial for handling the logistics of fragile products, requiring specialized packaging and warehousing. The robust growth of e-commerce has significantly compressed the downstream segment, requiring traditional distributors to invest heavily in robust fulfillment capabilities and sophisticated last-mile delivery solutions to cater to individual consumer orders efficiently.

Kitchen Jar Market Potential Customers

The potential customer base for the Kitchen Jar Market is broad and segmented into two major categories: Residential Consumers and Commercial/Institutional End-Users. Residential consumers constitute the largest market share, driven by demographic factors such as household formation, interest in culinary trends, and the increasing focus on sustainable living. Within this segment, young professionals, families, and retirees all represent key buyer groups, each seeking different attributes—younger buyers prioritize aesthetics and modularity, while established households focus on durability and long-term storage capacity. High-income demographics are particularly susceptible to premium, design-oriented, and branded storage solutions.

A significant subset of the residential market comprises individuals highly engaged in food preparation activities, including home bakers, preservers (canners), and those utilizing specialized health diets requiring meticulous ingredient separation and storage. These customers often demand specialized jars, such as those resistant to thermal shock for canning or UV protection for delicate spices. Marketing efforts targeting this group emphasize functional specifications, material quality, and certification (e.g., temperature rating, airtightness guarantee). The rise of social media influencers promoting 'pantry goals' also catalyzes demand, positioning jars not just as utility items but as key components of home décor.

Commercial end-users represent a high-volume, B2B segment requiring industrial-grade products. This includes the Hospitality sector (Hotels, Restaurants, Cafes - HORECA), catering services, small and large-scale food processing units, and specialized retailers (e.g., gourmet food stores that sell in bulk). These customers prioritize large capacities, ease of cleaning (dishwasher compatibility), stacking stability, regulatory compliance regarding food safety, and cost-effectiveness over aesthetic appeal. Their purchasing decisions are often based on large contracts, consistent supply, and certifications that meet local health department standards. As the food service industry globalizes, the demand for standardized, reliable, and easily traceable storage solutions for ingredients and prepared foods is consistently growing across this commercial segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Anchor Hocking, World Kitchen LLC, Newell Brands (Rubbermaid), Lock&Lock Co. Ltd., Bormioli Rocco, The Mason Jar Company, Glasslock Inc., Fido Jars (Bormioli Luigi), Kilner (Rayware Group), OXO International, WECK Jars, IKEA, Villeroy & Boch, Tupperware Brands Corporation, WMF Group, ZWILLING J.A. Henckels, Le Parfait, Sistema Plastics, Berry Global Inc., Silgan Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kitchen Jar Market Key Technology Landscape

The technological landscape of the Kitchen Jar Market focuses less on radical electronic invention and more on sophisticated material science, advanced manufacturing processes, and sealing mechanisms that enhance product functionality and longevity. A primary area of innovation lies in Glass Manufacturing Technology, specifically utilizing advanced annealing techniques to increase the thermal and impact resistance of borosilicate and soda-lime glass, making jars safer and more durable for demanding kitchen use, such as sudden temperature changes (from refrigerator to boiling water). Furthermore, the implementation of automated, multi-stage molding processes ensures uniform wall thickness and precise threading for superior lid fitment, crucial for maintaining vacuum or airtight conditions.

Sealing technology represents the most competitive technological area. Modern jars increasingly incorporate advanced materials like food-grade silicone, thermoplastic elastomers (TPE), and highly specialized rubber compounds in gaskets and seals. These materials offer superior resistance to grease, acid, and temperature fluctuations compared to traditional rubber or plastic seals, significantly improving the shelf life of stored contents. Vacuum sealing technology, previously reserved for industrial applications, is now becoming mainstream in premium residential jar systems, often integrating manual or electronic pump mechanisms directly into the lid design to actively remove air and halt oxidation, thereby meeting the high consumer demand for superior food preservation.

In terms of materials, the drive for sustainability pushes the development of recyclable and bio-based plastics. Manufacturers are investing in technologies to produce high-clarity, food-safe plastics (like Tritan or specialized PET) that are certified BPA-free and mimic the visual clarity of glass while offering lightweight portability and shatter resistance. Additionally, technologies related to surface treatment, such as anti-microbial coatings for plastic interiors or specialized texturing to prevent slippage, are being adopted to improve hygiene and usability. The integration of QR codes, RFID tags, or NFC chips on jars for inventory tracking, while still nascent, represents the cutting edge of digital integration, connecting physical storage solutions to cloud-based inventory management systems, fundamentally redefining the functionality of kitchen jars in the smart home ecosystem.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market share holder, driven by high population density, a strong cultural emphasis on home cooking and preserving, and the rapid growth of the middle class in countries like China and India. The demand is segmented, with high-volume, cost-effective plastic jars dominating general storage, while premium glass and ceramic jars see strong uptake in urban centers, fueled by increasing disposable income and exposure to global organization trends. Manufacturing capacity is highest in this region, making it a critical hub for global supply.

- North America: North America represents a mature, high-value market characterized by strong consumer preference for branded, highly specialized, and technologically advanced storage solutions (e.g., modular, stackable, vacuum-seal systems). E-commerce penetration is exceptionally high, allowing niche players specializing in designer or eco-friendly jars to thrive. The market here is driven by convenience, aesthetics, and robust health and safety standards (BPA-free mandates).

- Europe: Europe is a key market, distinguished by its high demand for sustainable and recyclable products. Glass jars, particularly those manufactured by established European brands known for heritage and quality (e.g., Kilner, Le Parfait), hold a strong market position due to stringent environmental regulations and consumer consciousness regarding plastic waste. Western European countries exhibit high expenditure on premium, reusable kitchen items, focusing heavily on aesthetics and certified food safety.

- Latin America (LATAM): LATAM is experiencing significant growth, supported by urbanization and modernization of retail infrastructure. Demand is increasing for basic, affordable storage solutions, moving away from informal packaging. As income levels rise, there is a gradual shift towards mid-range plastic and glass jars offering better sealing capabilities and durability. Market expansion is currently focused on improving regional distribution networks.

- Middle East and Africa (MEA): The MEA market is developing, with growth concentrated in urban hubs and wealthier Gulf Cooperation Council (GCC) nations. Demand is tied closely to expatriate consumer habits and the burgeoning hospitality sector, requiring commercial-grade storage. Key drivers include increasing food import reliance and the need for climate-appropriate, highly durable storage to withstand extreme temperatures and humidity, favoring stainless steel or thick glass solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kitchen Jar Market.- Anchor Hocking

- World Kitchen LLC

- Newell Brands (Rubbermaid)

- Lock&Lock Co. Ltd.

- Bormioli Rocco

- The Mason Jar Company

- Glasslock Inc.

- Fido Jars (Bormioli Luigi)

- Kilner (Rayware Group)

- OXO International

- WECK Jars

- IKEA

- Villeroy & Boch

- Tupperware Brands Corporation

- WMF Group

- ZWILLING J.A. Henckels

- Le Parfait

- Sistema Plastics

- Berry Global Inc.

- Silgan Holdings Inc.

Frequently Asked Questions

Analyze common user questions about the Kitchen Jar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material driving growth in the Kitchen Jar Market?

Glass is the primary material driving high-value growth due to its sustainability credentials (infinite recyclability), non-reactive nature, and alignment with modern aesthetic demands for transparent kitchen organization. Premium plastics, particularly BPA-free Tritan, also contribute significantly due to their lightweight and durable characteristics.

How do air-tight seals affect the value chain of kitchen jars?

Airtight and vacuum seals introduce higher value into the manufacturing process by requiring specialized, high-performance materials like silicone and precision molding. This technology increases the perceived utility of the jar, allowing manufacturers to command a premium price point based on extended food freshness and superior preservation capabilities.

Which distribution channel is experiencing the fastest growth for kitchen jar sales?

Online retail (E-commerce) is experiencing the fastest growth. This channel offers consumers unparalleled access to a diverse range of specialized products, including niche foreign brands, bulk purchasing options, and designer modular systems, which are often unavailable in traditional brick-and-mortar stores.

What are the key differences between residential and commercial kitchen jar demands?

Residential demand prioritizes aesthetics, material safety, and convenient size variability. Commercial demand (HORECA) focuses on large-scale capacity, extreme durability, resistance to industrial cleaning, stacking efficiency, and stringent compliance with food safety regulations, often favoring standardized, heavy-duty plastic or stainless steel solutions.

How is AI impacting the manufacturing of glass kitchen jars?

AI primarily impacts glass jar manufacturing through enhanced quality control using computer vision systems. These systems rapidly identify minute structural defects, such as imperfections in the glass or sealing area, ensuring that only flawlessly manufactured, safe, and air-tight products reach the market, thereby reducing waste and recall risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager