Kitchenware and Houseware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438094 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Kitchenware and Houseware Market Size

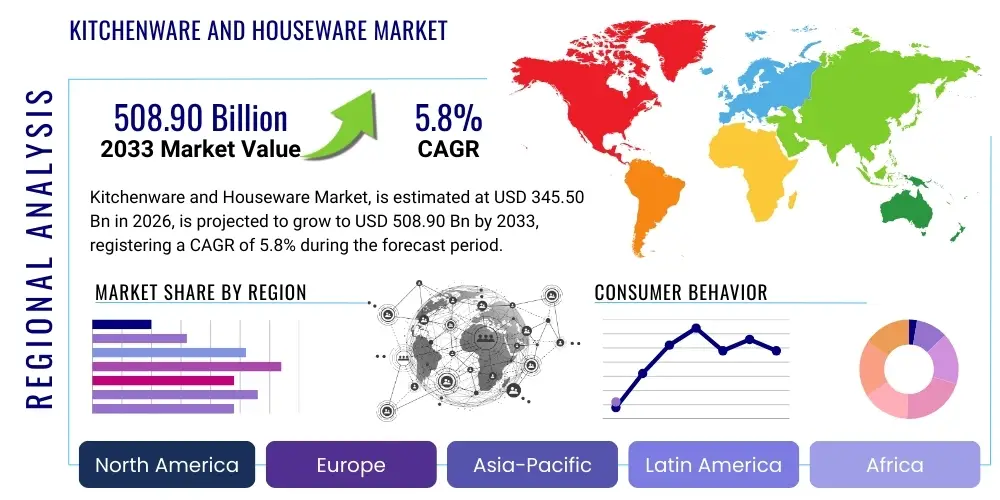

The Kitchenware and Houseware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at 345.50 Billion USD in 2026 and is projected to reach 508.90 Billion USD by the end of the forecast period in 2033. This robust expansion is fueled by increasing disposable incomes globally, rapid urbanization leading to smaller yet technologically equipped residences, and a significant shift in consumer preference towards premium, aesthetically pleasing, and multifunctional kitchen gadgets and home essentials. The post-pandemic emphasis on home cooking and home improvement has further accelerated demand across core segments, including cooking utensils, storage solutions, and small electrical appliances, cementing the market's trajectory towards substantial valuation growth.

Kitchenware and Houseware Market introduction

The Kitchenware and Houseware Market encompasses a vast array of products designed for domestic utility, culinary preparation, serving, and home maintenance. This sector includes everything from basic non-stick cookware and ceramic dinnerware to advanced smart kitchen appliances, cleaning tools, storage containers, and decorative home items. Products within this market are categorized based on function, material (e.g., stainless steel, silicone, glass, plastic), and end-use application, catering primarily to residential consumers, although hospitality and commercial sectors also represent significant application areas. The core benefit derived from these products is enhanced efficiency, convenience, and aesthetic appeal in daily household operations, directly improving the quality of domestic life.

Major applications of modern kitchenware extend beyond simple cooking to include complex food preservation techniques, automated beverage preparation, and sophisticated organizational systems that maximize space utility in compact urban dwellings. The market’s driving factors are intrinsically linked to macroeconomic stability, evolving global lifestyle trends, and intense product innovation. Key drivers include the rising popularity of home automation and IoT integration in kitchen appliances, a growing consumer focus on health and wellness demanding specialized cooking equipment (e.g., air fryers, slow juicers), and the powerful influence of social media and home décor trends that necessitate frequent updates of houseware items to match contemporary styles. Furthermore, durability and sustainability have become paramount product attributes, influencing purchasing decisions significantly.

The convergence of advanced manufacturing techniques and consumer demand for personalized and durable goods is reshaping the competitive landscape. Manufacturers are increasingly adopting circular economy models, utilizing recycled or bio-based materials, and designing products for longevity and repairability, thereby catering to the environmentally conscious millennial and Gen Z populations. The rapid expansion of e-commerce platforms has democratized access to niche and international brands, challenging established incumbents and ensuring a highly dynamic market characterized by continuous technological and design evolution. This sustained focus on utility combined with aesthetic value ensures continuous market buoyancy, irrespective of minor economic fluctuations.

Kitchenware and Houseware Market Executive Summary

The Kitchenware and Houseware Market Executive Summary reveals a dynamic environment marked by robust e-commerce penetration, accelerating adoption of smart technology, and a pronounced shift toward sustainable product offerings. Business trends highlight strategic alliances between traditional manufacturers and technology firms to integrate Artificial Intelligence (AI) and Internet of Things (IoT) capabilities into appliances, focusing on operational efficiency and energy savings. Furthermore, there is a global trend towards premiumization, where consumers are willing to invest more in high-quality, durable, and aesthetically superior products, driven by the enduring interest in home aesthetics and functionality popularized during the recent increase in remote work arrangements. This is simultaneously leading to significant innovation in material sciences, particularly in non-toxic, PFOA-free coatings for cookware and durable, lightweight plastics for storage solutions, mitigating health concerns associated with traditional materials.

Regional trends indicate that Asia Pacific (APAC) remains the fastest-growing market, largely due to rapid urbanization, expanding middle-class populations with increased purchasing power, and high rates of new housing construction, particularly in China and India. North America and Europe, while mature, exhibit strong growth in the specialized and premium segments, driven by sophisticated consumer demands for personalized and sustainable home solutions. These regions are also leading the adoption curve for sophisticated houseware categories like robotic vacuums and advanced water purification systems. Regulatory frameworks in developed economies are increasingly emphasizing product safety, energy efficiency, and waste reduction, further influencing product design and manufacturing processes across all regional markets.

Segment trends underscore the dominance of the Cookware and Bakeware segment, which is experiencing significant technological upgrades, including temperature-regulating handles and integrated sensors for precise cooking. The Small Electrical Appliances segment, encompassing air fryers, coffee makers, and food processors, is witnessing the highest growth rate due to convenience and time-saving benefits. Within housewares, storage and organization solutions are crucial, reflecting the consumer need to maximize utility in confined living spaces. Moreover, the distribution channel is rapidly transitioning, with specialized online retailers and Direct-to-Consumer (D2C) brands gaining substantial market share, utilizing targeted digital marketing campaigns and personalized shopping experiences to bypass traditional brick-and-mortar retail constraints and directly engage with consumers.

AI Impact Analysis on Kitchenware and Houseware Market

User queries regarding the impact of AI on the Kitchenware and Houseware Market frequently center on the practicality of smart integration, data privacy concerns associated with connected devices, and the perceived value addition versus the increased cost. Users are keenly interested in how AI can automate complex cooking tasks, optimize inventory management within the pantry (smart refrigerators), and personalize routines (e.g., coffee preferences, cleaning schedules). Key themes emerging from these queries involve the reliability of AI-driven maintenance diagnostics, the long-term upgradability of smart appliances, and whether AI integration truly simplifies domestic chores or merely introduces unnecessary technological complexity. This collective focus demonstrates a cautious optimism, where consumers expect AI to deliver tangible benefits like reduced food waste, energy savings, and superior culinary results, justifying the higher investment required for these next-generation products.

- AI integration facilitates predictive maintenance and diagnostics for complex electrical appliances, extending product lifespan.

- Smart kitchen appliances (e.g., ovens, cooktops) use AI to automate cooking processes, adjusting temperature and time based on food type and desired outcome.

- AI-driven personalized recommendation engines guide consumers on recipe selection based on available ingredients and dietary restrictions.

- Inventory management via smart refrigerators and pantries reduces food wastage by tracking expiration dates and suggesting timely use.

- Generative AI models are used in product design, accelerating the development of ergonomic and highly functional houseware forms based on analysis of user interaction data.

- Enhanced supply chain efficiency through AI-optimized forecasting and inventory tracking, improving product availability for manufacturers and retailers.

- Smart home ecosystems utilize AI to synchronize kitchen and houseware operation with broader home management systems (e.g., linking lighting and climate control to dining schedules).

DRO & Impact Forces Of Kitchenware and Houseware Market

The Kitchenware and Houseware Market is primarily driven by escalating consumer expenditure on home improvement, robust growth in the residential real estate sector globally, and continuous innovation focused on safety and convenience. Key drivers include the surging demand for energy-efficient appliances, the proliferation of specialized, single-function gadgets catering to niche culinary interests, and the strong consumer preference for sustainable and ethically sourced materials. Restraints, however, include the volatility of raw material prices (metals, plastics), the relatively long replacement cycle for high-value items like major appliances, and intense price competition, particularly in the basic and standardized product categories from low-cost manufacturers. Counteracting these restraints, the opportunities lie in expanding into emerging markets, developing modular and customizable product lines, and capitalizing on the burgeoning market for replacement parts and circular economy services. The overall impact forces suggest a market poised for sustained growth, provided manufacturers successfully navigate supply chain disruptions and maintain competitive pricing strategies without compromising product quality or innovative features.

The most significant impact force shaping the market is the consumer demand for health and safety features, compelling a rapid transition away from traditional non-stick coatings and potentially harmful plastics toward ceramics, stainless steel, and specialized polymers. This shift creates both an opportunity for material science innovators and a restraint for legacy manufacturers tied to older production methods. Furthermore, digital transformation acts as a powerful driver, enabling D2C models that increase profit margins and allowing for hyper-personalized marketing based on detailed consumer purchasing data. However, this reliance on digital channels simultaneously introduces the restraint of cybersecurity risks for connected devices and the need for continuous technological updates, potentially leading to planned obsolescence concerns if not managed transparently.

The influence of lifestyle trends, particularly the popularity of minimalist living and multifunctional designs, heavily impacts the product portfolio. While drivers emphasize convenience and high technology, restraints often emerge from consumer resistance to complex interfaces or skepticism about the longevity of overly integrated smart products. Manufacturers who successfully balance cutting-edge technology (Driver) with intuitive, reliable, and durable design (Opportunity) will gain significant competitive advantage. The market remains sensitive to global economic health; while premium segments show resilience, the mass market segments are highly susceptible to inflationary pressures and consumer belt-tightening, emphasizing the perpetual force of cost-effectiveness in purchasing decisions across all product categories.

Segmentation Analysis

The Kitchenware and Houseware Market is extensively segmented based on product type, material, distribution channel, and application, allowing for precise market targeting and strategic development. Analyzing these segments is critical as consumer preferences vary dramatically based on region, income level, and lifestyle. The major product categories, such as cooking utensils, cutlery, storage solutions, and small electrical appliances, each exhibit unique growth trajectories influenced by technological maturity and cultural cooking habits. Material segmentation reflects the growing importance of sustainability and health concerns, with segments like eco-friendly materials and specialized metals experiencing accelerated demand compared to conventional plastics and generic alloys. Distribution channels are undergoing transformation, with the E-commerce segment emerging as the definitive growth engine, challenging the traditional dominance of hypermarkets and specialized retail stores through convenience and greater product variety.

- By Product Type:

- Cookware and Bakeware (Pots, Pans, Baking Trays)

- Cutlery and Dinnerware (Knives, Forks, Plates, Bowls)

- Small Electrical Appliances (Coffee Makers, Toasters, Air Fryers, Blenders)

- Storage and Organization (Containers, Shelving, Food Preservation Systems)

- Tools and Gadgets (Peelers, Openers, Measuring Cups)

- Tableware and Serving Accessories

- Cleaning and Maintenance Houseware (Brooms, Mops, Laundry Baskets, Vacuum Cleaners)

- By Material:

- Metal (Stainless Steel, Cast Iron, Aluminum)

- Ceramic and Glass

- Plastic and Polymer (BPA-free)

- Silicone

- Wood and Bamboo (Sustainable Materials)

- By Distribution Channel:

- Offline Retail (Hypermarkets/Supermarkets, Specialty Stores, Department Stores)

- Online Retail (E-commerce Platforms, Company-owned Websites)

- By Application:

- Residential

- Commercial (Hospitality, Catering Services)

Value Chain Analysis For Kitchenware and Houseware Market

The value chain for the Kitchenware and Houseware Market begins with upstream activities focused on raw material sourcing, which is highly sensitive to global commodity markets, particularly for steel, aluminum, glass, and specialized polymers. Manufacturers engage in complex design and tooling processes, where innovation in material science (e.g., developing durable non-toxic coatings or recycled plastics) adds significant value. High barriers to entry exist in the manufacturing stage for complex electrical appliances requiring advanced technology and compliance with energy efficiency standards. Efficiency in upstream logistics, particularly managing global sourcing networks and minimizing manufacturing waste, is critical for competitive pricing and maintaining robust margins.

The core value is generated in the midstream, encompassing manufacturing, branding, and intellectual property development. Effective branding and design differentiation are essential, as many basic products are easily commoditized. Distribution channels form the critical link between production and the consumer (downstream analysis). The distribution landscape is bifurcated into direct and indirect channels. Indirect distribution, historically dominated by large hypermarkets and specialty houseware stores, relies on volume sales and established retail partnerships. Direct distribution, primarily through D2C e-commerce platforms and company-owned stores, offers higher control over branding and customer experience, yielding superior data insights and often better profit margins per unit, though requiring substantial investment in logistics and digital infrastructure.

Downstream activities center on retail, consumer engagement, and post-sale services. Successful retail involves strategic merchandising, leveraging sensory experiences in physical stores, and optimizing online platforms with high-quality visual content and customer reviews. After-sales service, including warranties and the availability of replacement parts, significantly enhances long-term brand loyalty and market reputation, particularly for high-value appliances. The increasing focus on sustainability necessitates efficient reverse logistics for recycling and repair, adding another crucial layer to the downstream value proposition. Companies that integrate supply chain sustainability, from sourcing recycled steel (upstream) to offering repair services (downstream), are best positioned for long-term market leadership.

Kitchenware and Houseware Market Potential Customers

Potential customers in the Kitchenware and Houseware Market are primarily segmented into four major groups: Residential End-Users (Homeowners and Renters), Commercial Entities (Hotels, Restaurants, Cafés, Institutions), Gift Buyers, and Interior Decorators/Designers. The largest segment, Residential End-Users, is further differentiated by demographic factors such as income, age, and family structure. Affluent millennials and Gen Z consumers, particularly those prioritizing health, sustainable living, and home aesthetics, are primary targets for premium, smart, and eco-friendly products. These buyers are generally early adopters of technologically advanced gadgets and are heavily influenced by digital content and design trends. Conversely, budget-conscious families seek durable, functional, and cost-effective solutions, primarily purchasing through mass retail channels and focusing on essential replacement cycles.

A second crucial segment includes Commercial Entities, where purchasing decisions are driven by durability, industrial compliance, volume requirements, and specialized performance (e.g., high-speed commercial blenders, heavy-duty induction cooktops). These customers require B2B solutions, bulk discounts, and long-term service contracts, often necessitating robust supplier relationships. This segment is less sensitive to aesthetic trends than residential buyers but highly sensitive to operational downtime and failure rates, making product reliability paramount. The growing hospitality sector, particularly the boutique hotel and high-end restaurant market, is increasingly demanding customized, branded houseware and premium tableware to enhance the customer experience.

The market also heavily relies on secondary buyers, specifically individuals purchasing items as gifts for weddings, housewarmings, and holidays, which drives demand for luxury and novelty items. Interior designers and home staging professionals represent a specialized, influential segment that dictates demand for high-end, designer houseware, often procuring through specialized trade channels. Effectively targeting these diverse customer groups requires highly differentiated marketing strategies, emphasizing digital channels for residential buyers seeking style and technological updates, and relationship-based selling focused on reliability and volume for commercial clients seeking operational excellence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 345.50 Billion USD |

| Market Forecast in 2033 | 508.90 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meyer Corporation, World Kitchen LLC, Newell Brands, Conair Corporation, Groupe SEB, Samsung Electronics Co. Ltd., LG Electronics, Haier Smart Home, Lifetime Brands Inc., Tupperware Brands Corporation, Zepter International, Hamilton Beach Brands Holding Company, Xiaomi Corporation, Panasonic Corporation, Shun Cutlery, Fiskars Group, Cuisinart (Subsidiary of Conair), WMF Group, OXO International (A Helen of Troy Company), IKEA Systems B.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kitchenware and Houseware Market Key Technology Landscape

The technological landscape of the Kitchenware and Houseware Market is defined by the pervasive integration of connectivity, material science advancements, and energy efficiency protocols. The primary technological thrust involves the Internet of Things (IoT), enabling smart connectivity between appliances (e.g., ovens communicating with recipe apps or refrigerators monitoring food stock). This connectivity facilitates remote operation, personalized usage profiles, and real-time diagnostic reporting, moving the kitchen from a functional space to an integrated technological hub. Manufacturers are heavily investing in induction heating technology, which offers superior energy efficiency and speed compared to traditional heating methods, and advanced sensor technologies embedded in cookware for precision temperature control, minimizing cooking errors and enhancing food quality.

Material innovation is a parallel, critical technological area. The shift from traditional non-stick coatings containing perfluorooctanoic acid (PFOA) to safer, more durable ceramic and specialized silicone coatings is a major trend driven by consumer health concerns. Similarly, advancements in lightweight, durable, and antimicrobial plastics are improving the utility and safety of storage and cleaning housewares. In the houseware sector, robotic technology is transforming cleaning, with sophisticated robotic vacuum cleaners and mops utilizing lidar and AI navigation systems to optimize cleaning patterns and avoid obstacles. These technologies reduce manual effort and contribute significantly to the overall smart home ecosystem, emphasizing automation as a core value proposition.

Furthermore, technology is redefining manufacturing processes itself. Additive manufacturing (3D printing) is increasingly used for prototyping complex parts and for producing highly customized components on demand, particularly in premium, specialized houseware segments. The industry is also adopting advanced computer-aided design (CAD) and simulation software to optimize product ergonomics and material usage, ensuring both aesthetic appeal and environmental sustainability. This holistic technological approach—encompassing smart functionality, material safety, and efficient production—is crucial for maintaining competitiveness and meeting the evolving regulatory requirements for energy consumption and waste reduction across all product segments.

Regional Highlights

Regional dynamics are critical to understanding the global Kitchenware and Houseware Market structure, as purchasing patterns, design preferences, and technological adoption rates vary significantly across geographies. Each region presents unique growth opportunities driven by varying economic indicators, cultural cooking habits, and regulatory environments.

- Asia Pacific (APAC): APAC is the epicenter of market growth, driven by rapid urbanization, substantial increases in disposable income, and the emergence of a massive middle-class population eager for modern, Western-style kitchen fittings and appliances. Countries like China and India are characterized by high volumes of new residential construction and a strong consumer willingness to adopt smart home technologies, making them prime targets for small electrical appliances and integrated kitchen systems. The demand in APAC is often balanced between high-end luxury goods and functional, value-for-money products due to vast economic disparities.

- North America: This region is characterized by high consumer spending and a mature market favoring premiumization, durability, and brand reputation. Growth is propelled by strong demand for sophisticated smart kitchen devices, specialized cooking equipment (e.g., sous vide machines, high-powered blenders), and a powerful trend towards home renovation and interior design updates. Sustainability is a critical purchase driver, leading to high adoption rates for products made from recycled, non-toxic, and ethically sourced materials. The US market dictates many global design trends due to its large size and influential retail landscape.

- Europe: European markets are highly regulated, prioritizing energy efficiency, safety, and circular economy principles. Germany, the UK, and France are key contributors, demonstrating robust demand for high-quality, long-lasting products, often favoring European brands known for precision engineering and timeless design. The market growth here is steady, driven by replacement cycles and a sustained interest in sustainable houseware, including reusable food storage and minimalist kitchen tools. Regulatory compliance (e.g., RoHS, REACH standards) heavily influences product development and import strategies.

- Latin America (LATAM): Growth in LATAM is promising but often volatile, influenced by macroeconomic stability in major economies like Brazil and Mexico. The market is primarily volume-driven, with increasing penetration of modern retail formats (supermarkets and e-commerce). There is rising demand for basic and mid-range kitchen appliances, though luxury segments are expanding in metropolitan centers. Product choices are often influenced by local culinary traditions, requiring regional customization in terms of appliance capacity and functionality.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market characteristics. The GCC countries (e.g., UAE, Saudi Arabia) show significant demand for high-end, luxury kitchenware and integrated smart kitchens, driven by high per capita incomes and robust tourism/hospitality sectors. Conversely, parts of Africa focus on functional, durable, and affordable products. The market here is highly reliant on import channels, making it sensitive to global shipping costs and geopolitical stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kitchenware and Houseware Market.- Meyer Corporation

- World Kitchen LLC

- Newell Brands

- Conair Corporation

- Groupe SEB

- Samsung Electronics Co. Ltd.

- LG Electronics

- Haier Smart Home

- Lifetime Brands Inc.

- Tupperware Brands Corporation

- Zepter International

- Hamilton Beach Brands Holding Company

- Xiaomi Corporation

- Panasonic Corporation

- Shun Cutlery

- Fiskars Group

- Cuisinart (Subsidiary of Conair)

- WMF Group

- OXO International (A Helen of Troy Company)

- IKEA Systems B.V.

- Tramontina

- Tefal (Groupe SEB)

- Electrolux AB

- Whirlpool Corporation (Small Appliances Division)

- Zwilling J.A. Henckels AG

- Villeroy & Boch

- Miele & Cie. KG

- Instant Brands (Pyrex, Instant Pot)

- Lenox Corporation

Frequently Asked Questions

Analyze common user questions about the Kitchenware and Houseware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Kitchenware and Houseware Market?

The primary driver is the accelerating consumer adoption of smart home technology and the increasing focus on health and wellness. This drives demand for integrated IoT kitchen appliances (smart ovens, refrigerators) and specialized health-focused gadgets like air fryers and sophisticated juicers, coupled with a preference for non-toxic, sustainable cooking materials.

How is sustainability impacting product development in the Kitchenware sector?

Sustainability is a core trend, leading manufacturers to prioritize recycled, bio-based, or non-toxic materials (e.g., bamboo, recycled plastics, ceramic coatings). Product lifecycles are being extended through modular design for easy repair, and companies are implementing extensive recycling programs to reduce their environmental footprint, meeting demand from environmentally conscious consumers.

Which distribution channel is expected to dominate the Kitchenware and Houseware Market by 2033?

The Online Retail (E-commerce) channel is projected to dominate due to its unparalleled convenience, expansive product selection, and the effectiveness of Direct-to-Consumer (D2C) brand strategies. While physical retail remains important for high-touch appliance purchases, online platforms offer superior reach and data analytics for personalized marketing, accelerating segment growth.

What role does Artificial Intelligence (AI) play in modern kitchen appliances?

AI primarily enhances user experience and efficiency by enabling automation, personalization, and predictive capabilities. This includes AI-driven cooking algorithms that adjust settings automatically, smart inventory management in refrigerators to reduce food waste, and integration with digital assistants for hands-free operation and recipe guidance, turning the kitchen into an intelligent, efficient workspace.

Which regional market offers the highest potential growth rate for houseware manufacturers?

Asia Pacific (APAC), specifically the markets in China and India, offers the highest potential growth rate. This is attributed to rapid economic development, significant infrastructure and housing expansion, and the swift integration of modern, convenience-focused consumer products among the expanding middle-class population across the subregion.

Detailed Market Dynamics and Consumer Behavior Analysis

The Kitchenware and Houseware market's long-term viability is deeply rooted in consumer psychology, particularly the perceived value of home aesthetics and functionality. Post-recessionary and pandemic-induced trends have solidified the home as a central hub for work, leisure, and dining, accelerating investment in quality kitchen and houseware items. The shift is evident in the consumer willingness to pay a premium for branded products that offer enhanced durability, multi-functionality, and sophisticated design elements that align with modern interior trends. Consumers are increasingly viewing kitchenware not merely as utilitarian tools but as extensions of personal style and indicators of lifestyle quality. This emotional connection drives higher replacement rates for aesthetic reasons, even if the current product is functional, creating robust demand in the mid-to-high price segments.

Furthermore, the competitive dynamic is being shaped by fast-moving consumer goods (FMCG) strategies adapted by durable goods manufacturers. This involves shorter product cycles for certain segments (like gadgets and seasonal decorative houseware) and aggressive digital marketing, leveraging social media influencers and user-generated content to establish product relevance and trigger impulse purchasing. The ability to offer a seamlessly integrated purchasing experience—from online research and review verification to efficient delivery and easy returns—is now a non-negotiable prerequisite for market success. Brands must actively engage with consumer feedback regarding product deficiencies, particularly concerns around long-term material performance and software reliability in smart devices, to maintain trust and brand loyalty in a highly transparent digital environment.

Technological advancement, while being a key driver, introduces specific challenges related to consumer education and interoperability. As more appliances become "smart," consumers require clear, user-friendly interfaces and robust assurance that devices from different brands will function harmoniously within their home ecosystem. The market must address the digital divide, ensuring that smart technology remains accessible and relevant without alienating demographics less comfortable with complex interfaces. Manufacturers are increasingly prioritizing intuitive design and rigorous compatibility testing to ensure a smooth transition toward fully automated home environments. Innovation in packaging and sustainable logistics is also becoming a subtle yet powerful differentiator, aligning corporate practices with consumer environmental values.

Competitive Landscape Analysis

The competitive landscape of the Kitchenware and Houseware Market is highly fragmented yet dominated by a few global conglomerates that hold significant market share in core appliance segments. These large players (such as Groupe SEB, Newell Brands, and LG Electronics) leverage extensive distribution networks, economies of scale in manufacturing, and substantial R&D budgets to sustain their market positions. Their strategy often involves a broad portfolio catering to various price points, from entry-level essentials to premium smart appliances. These incumbents face intense competition from specialized D2C brands that utilize hyper-focused product offerings (e.g., highly specialized coffee equipment or unique storage solutions) and direct consumer engagement to carve out niche markets and build powerful digital communities around specific product categories.

A key area of strategic competition is patent development and intellectual property protection, particularly regarding material innovations (e.g., non-stick coatings, specialized steel alloys) and proprietary software for smart appliances. Companies are consistently filing patents to secure advantages in performance, safety, and energy efficiency, creating a technology arms race within the premium segment. Mergers and acquisitions (M&A) remain a prevalent competitive strategy, allowing large firms to quickly acquire specialized technology, expand their presence in niche high-growth markets (like robotic cleaning), or gain immediate access to established regional distribution networks, particularly in APAC and Latin America.

Beyond product innovation and market consolidation, competition is increasingly focused on supply chain resilience and ethical sourcing. Modern consumers and institutional buyers demand transparency regarding labor practices and environmental impact, pushing brands to compete not only on price and quality but also on corporate social responsibility (CSR) performance. Brands that effectively communicate their commitment to fair trade, sustainable material sourcing, and end-of-life product management gain a distinct competitive edge, particularly in highly conscious markets like Western Europe and North America. This shifts the basis of competition from pure product features to holistic brand trustworthiness and operational integrity, requiring continuous investment in complex global supply chain auditing and ethical compliance programs.

Future Market Outlook and Strategic Recommendations

The future outlook for the Kitchenware and Houseware Market is exceptionally positive, projected to sustain strong growth fueled by the convergence of technology and domestic lifestyle prioritization. The market is expected to witness further consolidation in the small electrical appliance segment as major electronics companies integrate kitchen gadgets into their broader smart home ecosystems. Key growth areas will include multifunctional, space-saving designs tailored for smaller urban residences, premiumization across all core categories, and the widespread adoption of customized, subscription-based services for consumables (e.g., replacement filters, specialized cleaning agents) linked to smart appliances, ensuring recurring revenue streams for manufacturers.

Strategic recommendations for market participants center on three key pillars: technological integration, supply chain de-risking, and targeted sustainability investment. Manufacturers must accelerate the deployment of user-friendly IoT and AI capabilities, ensuring robust data security and interoperability to justify the premium price tag of smart products. Simultaneously, diversifying the sourcing of key raw materials (metals and advanced polymers) and establishing regional manufacturing hubs will mitigate the risks associated with global geopolitical tensions and logistics volatility. Companies must also strategically invest in R&D focused on achieving zero-waste manufacturing processes and developing readily recyclable product components to secure a long-term competitive advantage aligned with future environmental regulations.

Furthermore, companies are advised to leverage digital platforms not just for sales but as primary channels for consumer education, interactive product demonstrations, and post-purchase support. Developing rich, localized digital content that addresses regional culinary preferences and cleaning challenges will significantly enhance consumer engagement and conversion rates. Focused efforts on emerging markets, particularly capitalizing on the accelerating e-commerce penetration in Southeast Asia and parts of Africa, through localized product lines and culturally relevant marketing campaigns, will be crucial for maximizing global market share by the end of the forecast period in 2033. Maintaining a robust balance between cutting-edge technology and foundational product durability will define market leadership in the coming decade.

Sustainability and Circular Economy Initiatives

The sustainability mandate is rapidly evolving from a niche consumer preference to a core industry standard within the Kitchenware and Houseware Market. This transformation is driven by stricter governmental regulations concerning material use and waste, coupled with pronounced consumer activism focusing on environmental protection. Manufacturers are now systematically redesigning products under the principles of the circular economy, emphasizing repairability, modularity, and the use of Monomaterials (materials that are easier to recycle when separated). This involves careful material selection, such as prioritizing recycled aluminum or bio-plastics, and avoiding complex, inseparable assemblies that hinder efficient end-of-life processing. The development of durable, long-lasting products is also a crucial sustainability strategy, countering the trend of planned obsolescence, which historically affected the appliance sector.

Leading companies are establishing transparent take-back and recycling programs, sometimes partnering with specialized waste management firms or offering financial incentives for consumers to return old appliances or cookware. This not only reduces landfill waste but also secures a supply of valuable secondary raw materials, contributing to resource independence. The shift towards sustainable business practices extends into packaging, where companies are eliminating single-use plastic and favoring biodegradable or compostable materials. Effective communication of these efforts, including clear labeling regarding material composition and repair options, is vital for building trust with the modern ethical consumer, who actively seeks out brands demonstrating verifiable environmental responsibility.

The financial viability of these sustainable initiatives is increasingly evident. While initial R&D costs for new materials may be high, the long-term benefits include reduced exposure to volatile primary commodity markets, enhanced brand reputation, and compliance with impending extended producer responsibility (EPR) legislation across major markets. Furthermore, the development of energy-efficient products (e.g., high-efficiency induction cooktops, low-power smart cleaning devices) addresses the growing consumer demand to minimize utility costs. Therefore, sustainability is not merely a cost center but a fundamental engine for innovation and a crucial element of competitive differentiation in the current market environment.

Regulatory and Compliance Overview

The Kitchenware and Houseware Market operates under a complex framework of national and international regulations governing product safety, energy consumption, and material toxicity. In Europe, the RoHS (Restriction of Hazardous Substances) Directive and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations strictly control the use of dangerous substances, significantly influencing the material composition of electrical appliances and cookware coatings. The U.S. consumer market is governed by the Consumer Product Safety Commission (CPSC) and state-level regulations, particularly Proposition 65 in California, which mandates warnings regarding exposure to certain chemicals, forcing global manufacturers to comply with the highest standards if they wish to access these lucrative markets.

For small electrical appliances, energy efficiency standards are rigorously enforced, such as the Energy Star program in North America and Ecodesign directives in the EU, which require continuous optimization of appliance performance relative to power consumption. Failure to meet these mandatory efficiency benchmarks can result in product recalls or hefty fines, thereby significantly influencing product design and manufacturing costs. Regulatory scrutiny is also intensifying in the food contact materials segment, ensuring that plastics, ceramics, and metal alloys used in cookware and storage containers do not leach harmful substances, driving the adoption of BPA-free plastics and certified non-stick alternatives.

Compliance complexity is further heightened by the rise of smart, connected devices, introducing regulations related to data privacy and cybersecurity. Manufacturers of IoT-enabled kitchenware must adhere to global data protection laws (like GDPR in Europe) regarding the collection and storage of user data, such as personalized cooking preferences or usage patterns. Navigating this multi-faceted regulatory environment demands continuous investment in internal testing laboratories, sophisticated traceability systems, and expert compliance teams to ensure that product innovations are market-ready, safe, and legally compliant across all target geographies, minimizing legal and reputational risks.

Innovations in Materials and Manufacturing

Material science is arguably the most dynamic area of innovation in the Kitchenware Market, driven by the dual pressures of enhanced performance and consumer safety. The segment is experiencing a rapid evolution beyond traditional stainless steel and aluminum towards specialized alloys and advanced composite materials that offer superior heat distribution, lighter weight, and improved non-corrosive properties. A significant trend is the refinement of carbon steel and specialized cast iron cookware, which are gaining popularity due to their natural non-stick properties and perceived health benefits, alongside the development of PFOA-free, multilayer ceramic-based non-stick surfaces that offer durability without toxicity concerns.

In the Houseware segment, the focus is on polymer science, particularly the creation of robust, transparent, and aesthetically appealing plastics that are free from harmful chemicals like BPA (Bisphenol A). Innovations include specialized silicone compounds used in baking molds and utensils for heat resistance and flexibility, and antimicrobial polymers integrated into cleaning tools and storage containers to enhance hygiene. The pursuit of sustainable material alternatives, such as composite materials incorporating natural fibers (e.g., bamboo, rice husk) or bio-derived polymers, is reshaping the supply chain for basic houseware items, making them both functional and environmentally responsible.

Manufacturing innovation complements material science through the application of advanced techniques like hydroforming for producing seamless, complex metal shapes (e.g., pots and pans), which improves heat transfer efficiency and durability while reducing material waste. Automation and precision robotics are streamlining assembly lines, particularly for complex small electrical appliances, ensuring consistent quality and enabling quicker mass production of customized designs. This integration of high-precision manufacturing with cutting-edge material development allows manufacturers to achieve the superior quality, durability, and safety required by the increasingly demanding global consumer base, while simultaneously addressing regulatory and sustainability requirements.

Deep Dive into Residential Consumer Segments

The residential consumer base for kitchenware and houseware is highly stratified, requiring tailored marketing and product development strategies. The "Culinary Enthusiasts" segment comprises individuals who view cooking as a hobby and prioritize high-end, professional-grade equipment, focusing heavily on precision, design pedigree, and specialized tools like high-carbon cutlery or complex stand mixers. This segment is characterized by high spending power and low price elasticity, seeking quality and brand heritage, and they frequently rely on specialized retail and expert reviews for purchasing decisions.

The "Convenience Seekers" represent the largest volume segment, primarily driven by busy professionals and families prioritizing time-saving devices and organizational efficiency. This group eagerly adopts smart appliances, air fryers, multi-cookers, and modular storage solutions. Their purchasing decisions are heavily influenced by ease of use, positive online reviews, and value-added features like automation and energy efficiency. They are the core target for mass-market e-commerce strategies and appreciate mid-range products that offer a strong balance between functionality and affordability.

Finally, the "Value and Sustainability Conscious" segment, largely comprised of younger demographics and environmentally focused consumers, dictates the shift towards ethically produced goods. They prioritize products made from recycled or natural materials, seek durable items that minimize waste, and are often willing to pay a slight premium if the sustainability claims are verifiable and transparent. For this segment, the brand narrative around corporate social responsibility (CSR) and product longevity is often more influential than the immediate technological capability, requiring brands to demonstrate commitment beyond mere compliance to truly capture this growing demographic's purchasing loyalty and influence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager