Kiteboarding Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437523 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Kiteboarding Equipment Market Size

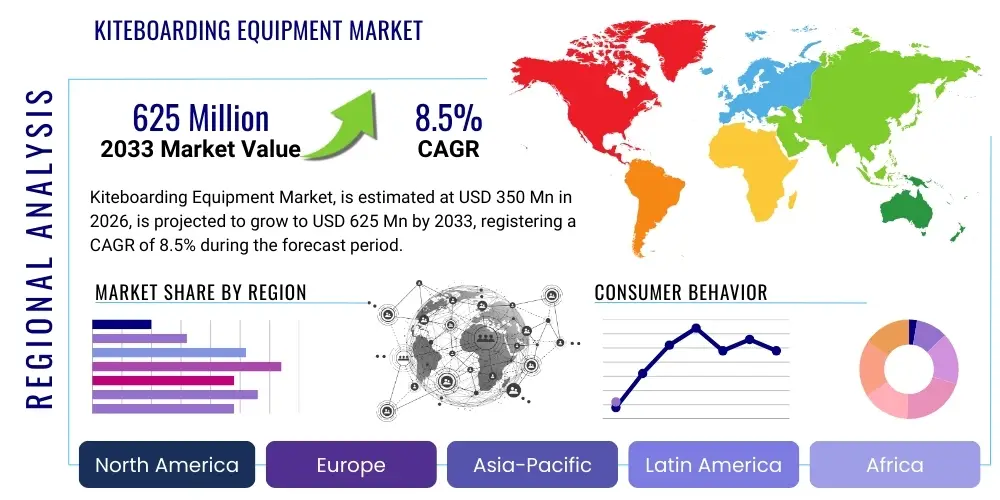

The Kiteboarding Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $350 Million USD in 2026 and is projected to reach $625 Million USD by the end of the forecast period in 2033.

Kiteboarding Equipment Market introduction

The Kiteboarding Equipment Market encompasses the manufacturing, distribution, and sale of specialized gear required for the extreme water sport of kiteboarding, sometimes referred to as kitesurfing. This equipment primarily includes kites (foils or inflatable), control bars and lines, harnesses, kiteboards (twin tip, directional, or foil boards), and essential safety accessories such as helmets and impact vests. Modern equipment is characterized by continuous innovation in material science, focusing on reducing weight, enhancing durability, and improving performance efficiency across various wind and wave conditions. The drive for safer and more user-friendly gear has significantly expanded the sport's appeal beyond expert riders to include novice and intermediate enthusiasts, thereby accelerating market penetration globally. The growing adoption of hydrofoiling technology within kiteboarding represents a critical evolution, demanding specialized board designs and generating higher average selling prices for premium equipment.

Kiteboarding equipment finds its major applications across recreational sports, professional competitions (like the Kiteboarding World Cup), and specialized training schools. Recreational usage constitutes the largest application segment, driven by the global expansion of coastal tourism and the increasing popularity of adventure sports vacations. The inherent thrill and freedom offered by kiteboarding, coupled with advancements in gear making the sport more accessible, drive consumer spending. Furthermore, specialized applications involve hydrofoiling equipment designed for light wind conditions and racing, requiring precision-engineered carbon fiber boards and high-aspect ratio kites. Safety and performance are paramount across all applications, necessitating rigorous testing and certification processes for major manufacturers to comply with international standards.

Market growth is substantially driven by the rising disposable incomes in developed economies, coupled with increased participation in outdoor and water-based leisure activities. Technological enhancements, particularly in canopy materials (like advanced ripstop nylon and composite fabrics) and lightweight board construction (using epoxy, foam cores, and carbon reinforcements), continually prompt replacement cycles among dedicated users seeking performance gains. The benefits of modern equipment include greater depower capabilities for enhanced safety, improved upwind performance, and increased portability. These factors collectively contribute to a favorable market environment, encouraging new participants and retaining the existing user base through premium product offerings and continuous innovation in ease of use.

Kiteboarding Equipment Market Executive Summary

The Kiteboarding Equipment Market is undergoing robust expansion characterized by strong investment in hydrofoil technology and digital engagement strategies aimed at specific demographic cohorts. Current business trends indicate a critical shift towards sustainability, with consumers demanding eco-friendly materials and ethical manufacturing processes, influencing supply chain decisions and product branding. Major manufacturers are focusing on mergers and acquisitions to consolidate market share and leverage specialized expertise in emerging segments like wing foiling, which, while distinct, utilizes synergistic manufacturing techniques and distribution channels. The proliferation of specialized online retailers and direct-to-consumer models is reshaping the distribution landscape, offering personalized purchasing experiences and competitive pricing, forcing traditional brick-and-mortar stores to pivot towards experiential retail models focused on demos and lessons. Furthermore, the integration of smart technology components, such as GPS trackers and performance monitoring sensors within control systems, is becoming an emerging competitive differentiator.

Regionally, Europe and North America remain the dominant markets, leveraging extensive coastlines, established water sports cultures, and high levels of consumer spending on recreational activities. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by the development of coastal infrastructure, increasing middle-class populations in countries like Vietnam, Thailand, and the Philippines, and dedicated governmental efforts to promote water sports tourism. Regulatory environments, particularly regarding beach access and safety standards, vary significantly by region, impacting the operational strategies of equipment rental businesses and training centers. The Middle East and Africa (MEA) represent nascent markets with significant untapped potential, driven primarily by luxury tourism development in coastal areas, necessitating high-end, durable equipment tailored to arid climates and varied wind patterns.

Segmentation trends highlight the increasing dominance of the Hydrofoil segment, driven by its versatility across various wind speeds and the enhanced perceived value for advanced riders. By product type, Kites maintain the largest revenue share due to their necessary replacement frequency and higher unit costs associated with specialized materials and complex rigging systems. The Aftermarket segment, encompassing repairs, spare parts, and upgraded components, is also growing rapidly, reflecting the high value consumers place on extending the lifespan of premium gear. In terms of distribution, while specialty sports stores still cater to the core user base, e-commerce platforms are increasingly gaining traction, offering unparalleled product comparison tools, user reviews, and global logistics efficiency, thus redefining consumer purchasing habits across all equipment categories.

AI Impact Analysis on Kiteboarding Equipment Market

User queries regarding AI's influence in the Kiteboarding Equipment Market primarily revolve around personalized gear selection, safety enhancements through predictive analytics, and optimizing manufacturing efficiency. Common concerns include how AI algorithms can accurately recommend kite sizes and board types based on individual rider profiles (weight, skill level, local conditions), and the potential for smart kites integrating sensors for real-time performance feedback and autonomous safety adjustments. Users also inquire about AI-driven design processes, specifically the use of computational fluid dynamics (CFD) and machine learning to rapidly iterate and optimize kite canopy shapes and board rocker lines for peak aerodynamic and hydrodynamic efficiency. The overarching expectation is that AI will democratize high-performance gear design, improve rider safety through predictive failure alerts, and streamline complex inventory management for specialized retail operations.

- AI-Driven Design Optimization: Utilizing machine learning models to analyze vast datasets of performance metrics and rider feedback to rapidly refine kite shapes, leading to optimized lift and drag ratios and improved stability.

- Personalized Equipment Recommendation: Developing algorithms that cross-reference rider biometrics, local weather patterns, and skill level to suggest the ideal kite size, board type, and harness configuration, enhancing customer satisfaction and reducing return rates.

- Predictive Maintenance and Safety: Integration of IoT sensors and AI analytics within control bars and harnesses to monitor stress points on lines and fabrics, predicting equipment failure before it occurs and dramatically improving safety standards.

- Supply Chain and Inventory Forecasting: Applying AI to predict regional demand shifts influenced by seasonal weather forecasts and major events, optimizing raw material procurement (e.g., Dacron, specific nylons) and production schedules.

- Virtual Training and Simulation: Creating immersive digital twins and simulators utilizing AI to analyze rider movements, offering personalized coaching feedback without the need for physical on-water instruction, accelerating skill acquisition.

DRO & Impact Forces Of Kiteboarding Equipment Market

The market dynamics are governed by several critical forces encompassing high participation rates, technological advancements, substantial initial investment barriers, and environmental variables. Drivers primarily include the expanding global adventure tourism industry and continuous material science innovation leading to lighter and safer gear. Restraints center around the high cost of premium equipment, which creates a significant barrier to entry for casual users, and the inherent dependence on highly specific and consistent weather conditions (wind) for the sport to be viable. Opportunities lie in the increasing acceptance of hydrofoil equipment, which mitigates the low-wind limitation, and expansion into developing coastal markets, particularly in Asia-Pacific. These four elements (Drivers, Restraints, Opportunities) collectively shape the competitive landscape and strategic direction for manufacturers, dictating investment in R&D and market segmentation strategies. The underlying impact forces, derived from Porter's five forces analysis, further clarify the market's intensity.

The primary driving force is the aggressive pace of product innovation focused on maximizing safety and enhancing user experience, particularly through the development of intuitive depower systems and rugged, yet lightweight, materials like specialized high-tenacity polyester fabrics. This constant technological push motivates experienced kiters to upgrade frequently. However, the market faces strong headwinds from restraints, specifically the relatively steep learning curve associated with mastering kite control, which necessitates costly training programs or dedicated self-learning time. Furthermore, insurance costs and regulatory restrictions in environmentally sensitive coastal zones can sometimes impede participation rates and rental business growth. Manufacturers must therefore strategically balance innovation costs with pricing to maintain competitiveness against lower-cost entrants.

Opportunities for sustained growth are substantial, particularly through the introduction of specialized gear tailored for youth markets and rental operators, focusing on extreme durability and ease of repair. The shift toward incorporating eco-friendly components, such as recycled plastics in board cores or bio-based resins, presents a key differentiator aligned with modern consumer values. Conversely, impact forces, such as the moderate threat of new entrants (due to the capital intensity required for kite design and testing), and the high bargaining power of large, established distributors in regional markets, necessitate sophisticated supply chain management and strong brand loyalty building. The threat of substitutes, while low (as no other sport offers the precise experience of kiteboarding), does require the industry to remain competitive against alternative high-value water sports like stand-up paddleboarding (SUP) or windsurfing.

Segmentation Analysis

The Kiteboarding Equipment Market is meticulously segmented based on product type, application, distribution channel, and specific rider level, allowing for targeted product development and marketing strategies. Product segmentation is crucial, differentiating high-cost, high-performance items like Kites and Boards from essential accessories and safety gear. The market's structure reflects a significant differentiation in material use and design complexity, which directly correlates to pricing tiers and target demographics. Furthermore, the segmentation by application—recreational vs. professional/training—helps manufacturers allocate resources effectively between mass-market durability and niche, high-performance specifications required by competitive athletes. Understanding these segments is vital for predicting sales velocity and inventory requirements across different geographical regions, especially considering the seasonal nature of the sport.

- By Product Type:

- Kites (Inflatable Kites/LEI, Foil Kites)

- Kiteboards (Twin Tip Boards, Directional Boards, Hydrofoil Boards)

- Control Bars and Lines

- Harnesses (Seat Harnesses, Waist Harnesses)

- Safety Equipment and Accessories (Impact Vests, Helmets, Leashes)

- By Application:

- Recreational

- Professional and Training Schools

- By Distribution Channel:

- Specialty Sports Stores

- Online Retail

- Direct to Consumer (D2C)

- By End User:

- Beginners

- Intermediate

- Advanced/Professional

Value Chain Analysis For Kiteboarding Equipment Market

The value chain for kiteboarding equipment begins with upstream activities focused heavily on raw material sourcing and precision textile manufacturing. This stage involves securing specialized high-grade materials such as ripstop nylon for kite canopies, high-density polyethylene and carbon fiber for board construction, and aviation-grade aluminum or carbon composites for control bars and foils. Key considerations upstream include negotiating competitive pricing for proprietary textile coatings and ensuring the ethical sourcing of composite resins. Manufacturers often invest heavily in R&D at this stage to develop proprietary material blends that offer superior strength-to-weight ratios, enhancing both safety and performance characteristics of the final product. Specialized vendors, primarily based in Asia, dominate the fabrication of customized textiles and high-pressure bladders, requiring robust quality control mechanisms from equipment brands.

The midstream phase involves manufacturing, assembly, and rigorous testing. Given the high-risk nature of the sport, quality assurance is paramount; every component, from line strength to harness stitching, must meet stringent international safety standards (e.g., ISO certifications). Distribution channels form the critical link to the downstream market. This includes both direct and indirect routes. Direct sales leverage the manufacturer's own websites and flagship stores, offering higher margins and immediate customer feedback. Indirect channels primarily involve specialty water sports retail outlets that offer personalized fitting and expert advice, and large e-commerce marketplaces that provide broad geographic reach and logistical efficiency. Rental fleets and training centers also act as crucial indirect channels, driving volume sales for durable, entry-level equipment.

Downstream activities focus on sales, marketing, and after-sales service. Effective marketing strategies often rely on high-quality action sports media, professional endorsements, and organizing events or demos at prime kite spots to generate consumer interest and brand loyalty. After-sales service, including warranty support, repair availability, and the supply of spare parts (e.g., replacement bladders, lines, fins), is vital for customer retention, reflecting the high value and investment associated with kiteboarding gear. Potential customers, or end-users, vary widely, ranging from affluent seasonal vacationers seeking recreational novelty to highly dedicated professional athletes requiring bespoke, custom-tuned equipment for competition. Efficient management of the entire value chain, particularly optimizing logistics for seasonal demand peaks, is essential for maintaining profitability in this specialized niche.

Kiteboarding Equipment Market Potential Customers

Potential customers for kiteboarding equipment span a diverse socio-economic and demographic spectrum but are generally categorized into distinct groups based on commitment level, disposable income, and riding frequency. The primary customer base consists of Affluent Recreational Enthusiasts, typically high-income individuals (aged 25-55) residing near coastal areas or frequently traveling to dedicated kite destinations, who prioritize high-end, brand-name gear offering the latest technological advancements in safety and performance. This segment drives the demand for premium carbon fiber boards and advanced foil systems. The second significant segment is the Beginner/Intermediate Rider, who often procures equipment through training centers or utilizes rental fleets initially. These customers prioritize durability, ease of use, and competitive pricing, often opting for packaged starter kits that include entry-level twin tips and forgiving, high-depower kites.

A rapidly growing segment comprises the Hydrofoil Adapters and Low-Wind Riders, who represent experienced users seeking specialized equipment to maximize water time regardless of wind strength. This group demands high-precision, low-volume hydrofoil boards and specialized lightweight kites designed for minimal wind conditions. Furthermore, kiteboarding schools and rental businesses constitute a major B2B customer segment. These entities require robust, highly durable, and easily repairable equipment (often favoring specific brands known for their after-sales support) to withstand constant commercial use and the learning process of multiple students. Their purchasing decisions are driven by total cost of ownership, including maintenance and replacement cycles.

Geographically, potential customers are concentrated in areas with reliable wind and water access, such as the Mediterranean coastlines, the Caribbean, Western Europe (e.g., Portugal, Spain, Netherlands), and the U.S. West and East Coasts. Market expansion is increasingly targeting emerging coastal tourism destinations in Southeast Asia and parts of Latin America, where the rising middle class seeks high-value leisure activities. Effective engagement with these potential customers requires targeted digital marketing, strong social proof through rider communities and professional endorsements, and providing exceptional technical support and fitting advice, especially when dealing with the high complexity of modern kite rigs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million USD |

| Market Forecast in 2033 | $625 Million USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | North Kiteboarding, Duotone Kiteboarding, F-One International, Slingshot Sports, Cabrinha Kites, Liquid Force, Ozone Kites, Airush Kiteboarding, Eleveight Kites, Naish International, RRD Roberto Ricci Designs, Flysurfer Kiteboarding, Core Kiteboarding, Best Kiteboarding, Starkites, Peter Lynn Kiteboarding, Shinnworld, Axis Kiteboarding, Xenon Boards, Nobile Kiteboarding |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kiteboarding Equipment Market Key Technology Landscape

The technology landscape in the kiteboarding equipment market is highly dynamic, driven by the imperative to maximize performance, safety, and durability while minimizing weight. A primary technological focus is on advanced materials science. Kites are increasingly utilizing high-tenacity, low-stretch fabrics, such as Teijin Technoforce T9600, paired with lightweight but rigid Dacron or specialized composite materials for the leading edge and struts. This innovation ensures better shape retention in turbulent air, leading to improved flight stability and faster response times. Furthermore, sophisticated CAD/CAM software is essential for precision cutting and assembly of complex 3D kite shapes, guaranteeing consistency in manufacturing. Board technology leverages high-grade materials like carbon fiber laminates and advanced foam cores (e.g., Paulownia wood or high-density PVC foam) encapsulated in epoxy resins, resulting in lighter boards with superior flex patterns and resilience against impact.

Another crucial technological area involves the control systems and safety mechanisms. Modern control bars feature quick-release safety systems that comply with stringent international standards (e.g., the International Kiteboarding Organization - IKO safety requirements), allowing riders to instantly depower the kite fully in emergency situations. The evolution of line technology, moving towards specialized high-modulus polyethylene (HPME, like Dyneema or Spectra), ensures minimal line stretch, maximum strength, and reduced diameter, crucial for direct feedback and optimized aerodynamics. Furthermore, the advent of specialized hydrofoil equipment has necessitated complex engineering of mast and fuselage connections, often involving precision CNC-machined aluminum or high-pressure carbon molding to handle extreme torsional forces and reduce hydrodynamic drag efficiently.

Digital integration is an emerging technological trend. While not yet pervasive, key players are exploring IoT integration through embedded sensors in harnesses or boards to monitor real-time performance metrics such as speed, jump height, and G-forces. This data collection capability feeds into rider training and product development cycles. Furthermore, environmental durability technologies, including UV-resistant coatings and specialized anticorrosive treatments for saltwater use on metallic components (like stainless steel hardware in harnesses and control bars), are fundamental requirements. These continuous technological enhancements ensure the equipment remains reliable under harsh marine conditions and meets the performance demands of advanced riders, solidifying the market's premium pricing structure.

The convergence of material science and design methodologies is exemplified by the evolution of foil kites and their increased prominence in racing and low-wind conditions. Unlike traditional inflatable leading-edge (LEI) kites, foil kites employ internal chambers that self-inflate upon launch, mimicking the aerodynamic efficiency of paragliding wings. The development of advanced cell structure geometry and material permeability control is critical here, requiring specialized computational fluid dynamics (CFD) modeling software to optimize internal air pressure distribution and minimize parasitic drag. This highly technical approach differentiates leading manufacturers, driving competitive advantage through superior upwind performance and reduced pack size, appealing directly to the professional and travel-focused recreational segments. The innovation extends to the rapid development cycle of specialized hydrofoil wings, utilizing complex hydrodynamics analysis to achieve early planing and stability at high speeds, significantly lowering the minimum wind speed required for efficient kiteboarding. Specialized manufacturers are utilizing finite element analysis (FEA) to test the structural integrity of carbon masts and fuselages, ensuring reliability under extreme loads imposed by aggressive maneuvers or high-speed runs.

Safety technology continues to undergo rigorous refinement, moving beyond basic depower functionality to incorporate redundant safety systems and ergonomic improvements. Modern harnesses feature refined load distribution systems, often utilizing internal support structures and specialized padding materials that adapt to the rider's body shape, minimizing back strain during extended sessions. The development of quick-release mechanisms involves sophisticated mechanical engineering to ensure activation under load, a critical requirement for safety assurance in turbulent conditions. Furthermore, the standardization of equipment interface protocols (e.g., universal pigtails and line connections) across different brands is a subtle but important technological advancement that simplifies rigging and enhances user convenience. This standardization is often driven by collaboration within industry associations to improve overall sport safety and accessibility. The materials used in lines, specifically the application of specialized coatings, also represents a technological focus, aimed at reducing friction, minimizing water absorption, and enhancing resistance to UV degradation, all essential for maintaining line integrity and rider safety over time.

In the realm of manufacturing processes, automation and precision machinery play an increasingly vital role. Laser cutting technology is employed extensively in cutting kite canopy panels, ensuring perfect alignment and minimal material waste, which is crucial for achieving the kite's designed aerodynamic profile. Ultrasonic welding and specialized sewing machines are utilized for assembling high-stress areas of the kite (e.g., the attachment points of lines and struts), providing durability far superior to standard industrial stitching. For boards, advanced molding techniques, including vacuum bagging and high-pressure resin infusion, are standard practice for creating composite structures that offer maximum stiffness and minimal voids, essential for high-performance characteristics. These technological investments in manufacturing infrastructure allow top-tier brands to maintain tight tolerances, consistency, and superior quality control, which directly translates into premium product offerings and justifies the higher price point compared to generic equipment. The sophisticated tooling and processes required for hydrofoil construction, particularly the precision machining of the aluminum or carbon components, further elevate the technological barrier to entry for new manufacturers.

Regional Highlights

- Europe: Europe is the largest and most mature market for kiteboarding equipment, characterized by a highly engaged consumer base, a dense network of specialized retailers, and favorable coastal geographies (e.g., the Mediterranean, the Atlantic coast of Portugal and France). The region benefits from strong brand heritage, hosting major international kite events, and stringent safety regulations that drive demand for high-quality, certified gear. Western Europe, specifically Germany, Spain, and the UK, contributes significantly to revenue, focusing on both recreational and competition-grade equipment. The trend toward environmental sustainability is most pronounced here, pushing manufacturers to innovate with recycled and eco-friendly materials.

- North America (NA): North America, led by the U.S., represents a highly dynamic market driven by strong consumer purchasing power and a large disposable income directed towards leisure and adventure sports. Key markets include Florida, California, and the Outer Banks. This region exhibits high demand for advanced technological equipment, particularly hydrofoils, due to the varying wind conditions and the large number of experienced riders seeking performance optimization. The market structure is dominated by online sales and large specialty retailers, with a strong emphasis on direct engagement through local kite communities and large-scale demos.

- Asia Pacific (APAC): APAC is poised for the fastest growth, driven by the expansion of coastal tourism infrastructure, rising living standards in key economies (China, Thailand, Vietnam), and the emerging popularity of water sports among the youth population. While currently focused on beginner and intermediate equipment procured through rapidly expanding kite schools, the region offers immense future potential for high-end gear. Investment in logistics and local distribution networks is critical for market penetration, addressing challenges related to import duties and localized consumer preferences for durability over specialized lightness.

- Latin America (LATAM): LATAM is a significant market for kite tourism, particularly in Brazil and parts of the Caribbean, which are globally renowned kite spots. The demand is heavily influenced by international tourism and expatriate communities, driving sales of both high-end imported gear and local durable equipment designed for heavy use. Pricing sensitivity and currency fluctuations present significant market challenges, often leading to a stronger aftermarket for repairs and used equipment compared to other regions.

- Middle East and Africa (MEA): MEA is an emerging market primarily linked to luxury coastal resort development and specialized sports tourism in regions like the UAE and Egypt. Demand focuses on premium, durable equipment tailored to arid environments and intense UV exposure. Growth in Africa is more localized, driven by specific kite hubs like Cape Town, requiring resilient gear suitable for powerful conditions. The market size remains smaller but is characterized by high average transaction values.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kiteboarding Equipment Market.- North Kiteboarding

- Duotone Kiteboarding

- F-One International

- Slingshot Sports

- Cabrinha Kites

- Liquid Force

- Ozone Kites

- Airush Kiteboarding

- Eleveight Kites

- Naish International

- RRD Roberto Ricci Designs

- Flysurfer Kiteboarding

- Core Kiteboarding

- Best Kiteboarding

- Starkites

- Peter Lynn Kiteboarding

- Shinnworld

- Axis Kiteboarding

- Xenon Boards

- Nobile Kiteboarding

- Spleene Kiteboarding

- CrazyFly Kiteboarding

- Underground Kiteboards

- Genetrix Kiteboarding

- Takoon Kiteboarding

- Mako Boardsports

- Tona Kiteboards

- Wainman Hawaii

- Riderzone

- Switch Kites

- Blade Kites

- Aeros Kites

- Ocean Rodeo

- LTD Kiteboarding

- Line Up Kiteboarding

Frequently Asked Questions

Analyze common user questions about the Kiteboarding Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Kiteboarding Equipment Market?

The Kiteboarding Equipment Market is projected to grow at a robust CAGR of 8.5% during the forecast period from 2026 to 2033, driven primarily by technological advancements and increasing participation in adventure tourism globally.

Which product segment dominates the Kiteboarding Equipment Market in terms of revenue?

The Kites segment, encompassing both Inflatable Kites (LEI) and Foil Kites, holds the largest revenue share due to the high material costs, complex manufacturing processes, and the necessity for frequent replacement or upgrading driven by technological innovation.

How is AI technology influencing the future design and safety of kiteboarding equipment?

AI is significantly impacting the market by enabling advanced design optimization using computational models, facilitating personalized equipment recommendations based on rider data, and improving safety through predictive maintenance analytics integrated into control systems and harnesses.

Which geographical region is expected to exhibit the fastest growth in the market?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market for kiteboarding equipment, fueled by increasing coastal tourism infrastructure, rising disposable incomes, and the expanding popularity of water sports activities across key coastal nations.

What are the primary factors restraining the growth of the Kiteboarding Equipment Market?

Market growth is primarily restrained by the high initial investment cost required for specialized, premium gear, which acts as a significant barrier to entry for new users, alongside the inherent dependence on specific and consistent wind and weather conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager