KM and KVM Switches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434574 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

KM and KVM Switches Market Size

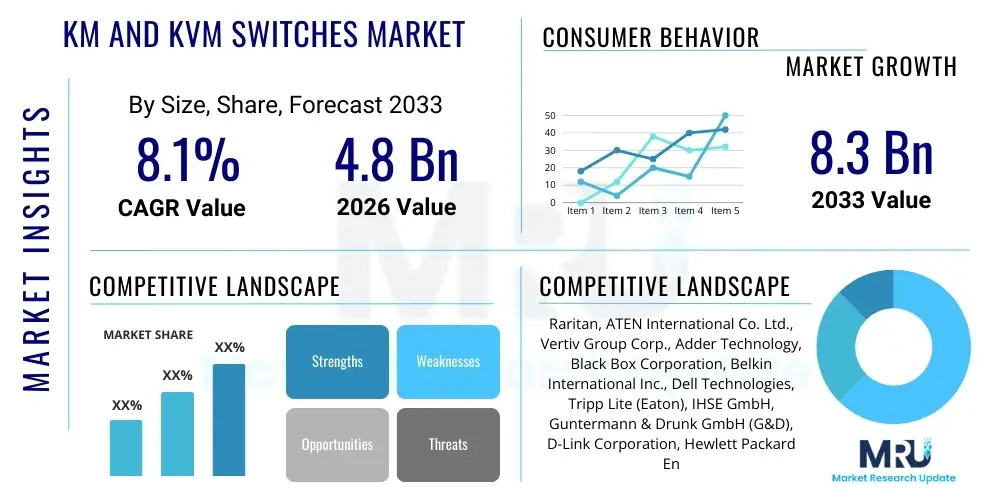

The KM and KVM Switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

KM and KVM Switches Market introduction

The KM (Keyboard and Mouse) and KVM (Keyboard, Video, and Mouse) Switches Market encompasses devices crucial for managing multiple computing devices or servers from a single set of peripherals. These switches provide centralized control, simplifying operations in data centers, server rooms, broadcasting studios, and command centers. KVM switches traditionally allow switching between video feeds and peripheral inputs, while KM switches focus purely on peripheral control, often used in multi-monitor setups across different computers. The necessity for high-density computing environments, coupled with the increasing adoption of virtualization and remote management capabilities, positions these switches as fundamental components of modern IT infrastructure. The evolution of KVM technology from analog switching to sophisticated digital, IP-based KVM over network solutions, capable of handling ultra-high-definition video and secure access, is a key market driver.

The primary applications of KM and KVM switches span across enterprise data centers, where they are utilized for maintenance, troubleshooting, and direct server access; industrial control rooms, requiring simultaneous monitoring and control of various systems; and government/military sectors, demanding secure and resilient management of critical infrastructure. Benefits derived from utilizing these systems include significant reduction in hardware clutter, optimizing space utilization, lowering energy consumption by consolidating multiple workstations, and dramatically enhancing operational efficiency through centralized administration. Furthermore, modern KVM solutions integrate advanced security features, essential for regulated industries handling sensitive data, thereby bolstering their strategic importance in enterprise governance.

Major driving factors influencing the market expansion include the exponential growth in global data center construction and modernization projects, the persistent demand for seamless remote server management capabilities across distributed networks, and the rapid deployment of high-resolution video standards (4K and 8K) requiring specialized KVM bandwidth capabilities. Additionally, the proliferation of hybrid work models necessitates secure, high-performance remote access tools that KVM over IP solutions effectively provide. The increasing complexity of IT environments, demanding rapid deployment and high uptime, ensures that sophisticated, feature-rich KM and KVM switch solutions remain indispensable tools for system administrators globally.

KM and KVM Switches Market Executive Summary

The KM and KVM Switches Market is characterized by a definitive shift toward digital and IP-based solutions, driven by the global imperative for remote server management and centralized IT administration in increasingly complex data center environments. Business trends indicate strong investment in KVM technologies that support high-performance video transmission, such as 4K and 8K resolutions, particularly benefiting sectors like media, broadcasting, and sophisticated design firms. Consolidation among smaller market players and strategic partnerships focused on cybersecurity integration are defining competitive dynamics. Furthermore, the rising adoption of hybrid infrastructure—combining on-premise servers with cloud resources—demands KVM solutions capable of providing secure, unified access management across these heterogeneous environments, making software-defined KVM (SD-KVM) a burgeoning area of interest for enterprise customers seeking scalable and flexible solutions.

Regional trends highlight North America and Europe as established leaders, primarily due to the high concentration of hyperscale data centers, robust enterprise IT spending, and stringent regulatory requirements that mandate secure physical and digital access controls. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, fueled by rapid industrialization, massive investments in digital infrastructure development (especially in countries like China and India), and the escalating demand for server management tools within burgeoning financial services and telecom sectors. The regional differentiation lies not just in volume but in technological maturity; while Western markets prioritize advanced features like redundancy and failover, APAC markets focus heavily on initial deployment cost-efficiency alongside necessary feature sets like IP remote access.

Segment trends reveal that the KVM over IP segment holds substantial market dominance and is the primary growth engine, overshadowing traditional analog or even digital non-networked KVM. By technology, the 16-port and 32-port rack-mounted switches are standard in enterprise settings, while high-density modular matrices are gaining traction in large command and control centers. Vertical analysis underscores the strong reliance of the IT and Telecommunications sector on these switches for managing vast server farms, followed closely by the Media and Entertainment industry, which requires lossless, low-latency video switching for live production and post-production workflows. Peripheral compatibility, especially supporting advanced USB standards and integrated audio, remains a key differentiating feature influencing purchasing decisions across all major market segments.

AI Impact Analysis on KM and KVM Switches Market

User questions regarding the impact of Artificial Intelligence (AI) on the KM and KVM Switches Market primarily revolve around whether AI will automate the need for physical KVM access, how AI integrates into monitoring and predictive maintenance of server rooms accessed via KVM, and if AI-driven resource orchestration systems will ultimately replace manual switching needs. The key themes summarized from user inquiries indicate a mixture of concern regarding obsolescence and expectation for enhancement. Users anticipate that AI will not eliminate KVM but rather augment its functionality, focusing on predictive failure analysis of connected infrastructure, optimizing resource allocation managed through KVM interfaces, and enhancing the security layers protecting remote KVM sessions against unauthorized access attempts. The prevailing expectation is for KVM systems to evolve into 'smart access portals' that integrate AI-powered insights for operational decision-making.

The incorporation of AI and Machine Learning (ML) primarily influences the operational layer of data center management, which is closely linked to KVM usage. AI algorithms are increasingly being used within Data Center Infrastructure Management (DCIM) solutions to analyze operational data collected from servers, storage, and networking equipment. This analysis aids administrators, who use KVM switches to interface with these systems, by providing proactive alerts regarding impending hardware failures or cooling inefficiencies. While the core function of the KVM switch—providing physical control—remains, the intelligence guiding when and how administrators intervene is significantly enhanced by AI-driven predictive insights, streamlining maintenance workflows accessed directly through the KVM console.

Furthermore, AI is crucial in enhancing the security and efficiency of KVM over IP sessions. ML models can analyze user behavior patterns during remote access, identifying anomalous activities that might indicate a security breach or misuse of privileged access rights. This capability elevates the security posture of KVM systems, which are often the last line of physical access control. For optimization, AI can also manage the load balancing and connectivity resources of high-density KVM matrices, ensuring optimal video stream quality and low latency for mission-critical applications without manual intervention. This technological convergence ensures KVM switches remain relevant by becoming smarter, more secure, and integral components of automated IT environments.

- AI-powered predictive maintenance reduces manual intervention frequency managed via KVM.

- Machine learning algorithms enhance KVM over IP session security through behavioral anomaly detection.

- AI integration in DCIM tools optimizes server room resource management accessed through KVM consoles.

- Automated troubleshooting guided by AI simplifies complex configuration changes executed via KVM.

- Increased adoption of AI/ML servers drives demand for high-bandwidth, low-latency KVM systems.

DRO & Impact Forces Of KM and KVM Switches Market

The KM and KVM Switches Market is significantly impacted by the interplay of robust growth drivers and persistent challenges. Key drivers include the exponential proliferation of data centers globally, the non-negotiable requirement for secure, centralized remote management in complex IT ecosystems, and the continuous upgrade cycle necessitated by higher video resolutions (4K/8K) and faster data transfer standards (USB 3.0/3.1). These factors create a mandatory demand base, particularly within regulated industries like finance, government, and defense, which require reliable out-of-band management. Conversely, the market faces restraints such as the increasing sophistication of software-defined infrastructure (SDI) and virtualization technologies that reduce the immediate need for direct hardware access, alongside the rising capital expenditure associated with implementing complex, high-density KVM matrix solutions. Opportunities lie in developing ultra-secure KVM solutions for industrial IoT and operational technology (OT) environments and pioneering KVM solutions specifically tailored for edge computing deployments, where centralized management is challenging but critical.

Impact forces currently shaping the competitive landscape are predominantly technological. The shift from CATx cabling to fiber optic extension and IP networking drastically increases the distance and fidelity of KVM connections, impacting product design cycles. The threat of substitutes, particularly sophisticated remote desktop protocols (RDP) and integrated server management interfaces (like iDRAC or HPE iLO), compels KVM manufacturers to focus on features that these protocols cannot match, such as true BIOS-level access, zero-latency performance for mission-critical applications (e.g., broadcasting), and robust physical isolation. Supplier power is moderate, driven by the specialized componentry required for high-bandwidth video processing, while buyer power remains high due to fierce competition and the modular nature of many KVM solutions, allowing easy substitution or vendor lock-in avoidance.

Market sustainability and growth are directly tied to the ability of manufacturers to address the emerging demand for integrated control environments. This involves not only managing servers but also industrial control systems, virtual machines, and cloud environments through a unified, secure KVM gateway. The market dynamics favor vendors who can seamlessly integrate their KVM solutions with existing enterprise security frameworks (like LDAP/Active Directory) and offer scalable, future-proof systems capable of handling the bandwidth demands of next-generation computing hardware, thus mitigating the threat posed by virtualization and maintaining the indispensable nature of physical control access.

Segmentation Analysis

The KM and KVM Switches Market is segmented extensively based on technology, product type, application size, and end-user industry. The fundamental technological bifurcation exists between traditional Analog KVM and modern Digital/IP KVM switches, with the latter rapidly dominating due to superior remote access and scalability features essential for contemporary data centers. Product type segmentation distinguishes between centralized switches (rack-mounted units) and extenders (solutions that transmit KVM signals over long distances, often via CATx or fiber optic cabling), reflecting the architectural needs of different deployment sizes, from small office setups to hyperscale facilities. Application size typically categorizes products into small, medium, and large-scale enterprise solutions, directly correlating with the required port density and matrix complexity. The most critical segment, based on growth and value, remains the KVM over IP segment due to its alignment with global remote workforce trends and distributed IT infrastructure management needs.

- By Technology:

- Analog KVM Switches

- Digital KVM Switches

- KVM over IP Switches

- By Product Type:

- Rack-Mounted KVM Switches (8-port, 16-port, 32-port)

- Desktop KVM Switches (2-port, 4-port)

- KVM Extenders (CATx, Fiber Optic)

- KVM Matrix Switches/High-Performance KVM

- By Application Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises and Data Centers

- By End-User Industry:

- IT and Telecommunication

- Media and Entertainment (Broadcasting)

- Government and Defense

- Healthcare

- Education

- Manufacturing and Industrial Control

Value Chain Analysis For KM and KVM Switches Market

The value chain for KM and KVM Switches begins with upstream activities centered on raw material procurement, specialized component manufacturing, and research and development (R&D). Upstream analysis reveals a high reliance on suppliers for specific electronic components, including high-speed video processing chips (e.g., ASICs or FPGAs required for 4K/8K transmission), specialized networking components, and integrated circuits crucial for secure IP communication and signal conversion. R&D investments at this stage are vital, focusing on reducing signal latency, improving security protocols, and achieving higher data throughput capabilities, which often involves partnerships between KVM vendors and chip manufacturers to customize silicon for optimal performance in demanding applications like broadcasting and advanced simulation.

The midstream involves the core manufacturing, assembly, and quality assurance processes. KVM manufacturers assemble components into final products, focusing heavily on robust casing, efficient cooling for rack-mounted units, and rigorous testing to ensure compatibility across diverse operating systems and peripheral types. This stage often involves significant intellectual property related to proprietary switching mechanisms and software interfaces. Key strategic decisions here revolve around manufacturing location (often Asia Pacific for cost efficiency) versus proximity to primary end markets (North America/Europe for rapid customization and logistics). Effective inventory management is crucial to handle the wide variety of port configurations (2-port to 256-port matrices) and technology types (Analog vs. IP).

Downstream analysis covers distribution channels, sales, and post-sales support. Distribution channels are varied, including direct sales for large, customized enterprise and government projects, and indirect channels through authorized distributors, system integrators, and value-added resellers (VARs) who provide installation and integration services. The distribution of KVM over IP solutions relies heavily on IT system integrators who bundle KVM solutions with servers, networking gear, and DCIM platforms. Direct and indirect sales efforts both require highly technical expertise; direct sales teams focus on complex matrix solutions for hyperscale clients, while indirect partners serve the broader SME and general enterprise market, providing localized support and maintenance contracts essential for high-availability IT environments.

Post-sales support is a critical value differentiator, particularly for complex KVM solutions deployed in mission-critical environments. This includes firmware updates, technical troubleshooting, and warranty services. Vendors who excel in providing proactive support and easy integration APIs (Application Programming Interfaces) for DCIM tools tend to achieve higher customer retention and market share. The effective management of this final stage ensures the total cost of ownership (TCO) is acceptable to the end-user, thereby reinforcing the value proposition of the hardware investment against cheaper, less secure software alternatives.

KM and KVM Switches Market Potential Customers

The primary customers for KM and KVM Switches are organizations requiring centralized, secure, and highly efficient control over numerous servers and computing systems. This audience spans all segments of data center operators, ranging from small server rooms in educational institutions to massive, global hyperscale cloud providers. A core customer segment includes IT administrators and data center technicians who rely on KVM switches for critical tasks such as operating system installation, BIOS configuration, troubleshooting hardware failures, and routine maintenance that cannot be performed through software-based remote management tools. For these technical users, the zero-latency, true hardware access provided by KVM is indispensable for ensuring maximum uptime and rapid recovery from system outages.

Beyond traditional IT environments, a significant and high-value customer base resides within specialized sectors like Media and Entertainment (M&E) and Industrial Control. M&E customers, especially broadcasters and post-production studios, demand KVM switches that guarantee uncompressed, visually lossless video signal transmission with near-zero latency, which is essential for live production feeds and color-critical workflows. In Industrial Control and Manufacturing, KVM solutions are used to extend control interfaces from rugged industrial PCs located in harsh environments (factory floors) to protected control rooms, offering both centralized monitoring and enhanced physical security against unauthorized access to critical operational technology (OT) systems.

The government and defense sectors represent another crucial segment, prioritizing secure KVM solutions that comply with strict security standards, often requiring features like Common Criteria certification and physical air gaps or port protection to prevent data leakage and cross-system interference. These customers typically invest in high-security, often fiber-based, KVM matrix systems for command centers, war rooms, and secure network operation centers (NOCs). The trend towards edge computing also creates new potential customers in retail, telecommunications, and logistics, where small, dispersed server clusters require efficient, IP-based remote management to reduce travel and maintenance costs associated with managing hundreds or thousands of localized computing points.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Raritan, ATEN International Co. Ltd., Vertiv Group Corp., Adder Technology, Black Box Corporation, Belkin International Inc., Dell Technologies, Tripp Lite (Eaton), IHSE GmbH, Guntermann & Drunk GmbH (G&D), D-Link Corporation, Hewlett Packard Enterprise (HPE), Schneider Electric SE, Avocent (Emerson), Apantac LLC, Icron Technologies (Maxim Integrated), Amulet Hotkey, Minicom Advanced Systems, StarTech.com, TRENDnet Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

KM and KVM Switches Market Key Technology Landscape

The KM and KVM Switches market is undergoing a profound technological transformation, moving from proprietary analog signaling toward open, standards-based digital networking. The most critical technological shift is the widespread adoption of KVM over IP solutions, which leverage standard Ethernet infrastructure to transmit video, audio, and peripheral signals. This shift provides unparalleled scalability, remote access capabilities across global networks, and integration with established cybersecurity protocols like encryption (AES) and authentication services (LDAP/Active Directory). Modern KVM over IP systems utilize highly efficient compression algorithms, such as H.264, H.265, or specialized visually lossless codecs, to transmit high-resolution video streams (up to 4K and 8K) with minimal latency, addressing the critical needs of bandwidth-intensive applications in broadcasting and graphic design.

Beyond network transmission, advancements in peripheral emulation and signal management are crucial. Modern KVM switches must flawlessly emulate the connected keyboard and mouse to the operating system, ensuring seamless plug-and-play functionality regardless of the distance or network path. The integration of USB 3.0 and newer standards demands higher bandwidth processing within the switch hardware to support fast peripherals like external storage or advanced input devices. Furthermore, modular matrix switch technology is replacing fixed-port chassis in large installations. These modular systems allow administrators to hot-swap input/output cards (e.g., swapping a DVI card for a DisplayPort 1.4 card) to adapt to evolving server and display technologies without replacing the entire infrastructure, significantly improving long-term cost efficiency and future-proofing the investment.

Security technologies are rapidly becoming a foundational component of the KVM landscape, particularly in defense and financial sectors. Secure KVM switches are incorporating specialized features such as hardware-level protection against unauthorized data transfer (often achieved through air-gapped data paths), tamper-evident seals, and firmware protection to guard against physical and digital compromises. The development of centralized management software platforms is also a key technological trend. These platforms allow administrators to manage thousands of distributed KVM endpoints, providing unified access control, monitoring session logs, and streamlining system updates across the entire KVM infrastructure from a single pane of glass, which is vital for maintaining compliance and operational oversight in globally distributed enterprises.

Regional Highlights

- North America: North America maintains market leadership, driven by the world’s highest concentration of hyperscale and colocation data centers, along with a strong early adoption of cutting-edge KVM over IP and high-performance KVM matrix solutions. The region benefits from substantial investment in defense, government infrastructure, and a robust media and entertainment industry that demands premium, low-latency video switching technology. Stringent regulatory environments in sectors like finance and healthcare necessitate secure, traceable hardware access, favoring vendors who offer advanced cybersecurity features and compliance documentation. The maturity of the IT market ensures a persistent replacement and upgrade cycle for advanced KVM equipment.

- Europe: Europe represents a mature and technologically sophisticated market, characterized by strong demand from centralized industrial control systems, automotive R&D, and financial services based in key hubs like London and Frankfurt. The implementation of ambitious digital transformation initiatives and the proliferation of edge computing sites across the continent necessitate scalable and reliable remote KVM management solutions. Western European countries exhibit a high affinity for premium KVM solutions that offer energy efficiency and high interoperability with virtualization platforms, driving growth in fiber-based and modular KVM architectures.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by explosive growth in data center construction, particularly in emerging economies such as China, India, and Southeast Asian nations. Market expansion is fueled by government-led initiatives supporting digitalization, massive infrastructure investments in telecom and IT services, and the rapid expansion of local e-commerce and cloud service providers. While price sensitivity remains a factor, the increasing complexity of IT systems is driving demand for both cost-effective KVM over IP solutions for remote sites and high-density KVM for large corporate data centers and NOCs.

- Latin America (LATAM): The LATAM market exhibits steady growth, primarily focused on modernizing existing IT infrastructure within government, telecom, and oil and gas sectors. Demand is concentrated on reliable, cost-effective KVM solutions that facilitate centralized management across geographically dispersed sites. Growth is constrained by fluctuating economic conditions but is increasingly driven by foreign direct investment in data center facilities in countries like Brazil and Mexico, leading to heightened interest in scalable IP-based KVM systems.

- Middle East and Africa (MEA): Growth in the MEA region is sector-specific, dominated by large-scale projects in the government, defense, and energy sectors, especially in the GCC countries. Significant investment in building Smart Cities and high-tech government command centers drives the adoption of advanced, high-security KVM matrices. The requirement for resilient and secure communication infrastructure, often in remote or sensitive locations, emphasizes the need for fiber optic and robust IP KVM extenders capable of operating reliably under challenging environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the KM and KVM Switches Market.- Raritan (Legrand)

- ATEN International Co. Ltd.

- Vertiv Group Corp.

- Adder Technology

- Black Box Corporation

- Belkin International Inc.

- Dell Technologies

- Tripp Lite (Eaton)

- IHSE GmbH

- Guntermann & Drunk GmbH (G&D)

- D-Link Corporation

- Hewlett Packard Enterprise (HPE)

- Schneider Electric SE

- Avocent (Emerson Electric Co.)

- Apantac LLC

- Icron Technologies (Maxim Integrated)

- Amulet Hotkey

- Minicom Advanced Systems

- StarTech.com

- TRENDnet Inc.

Frequently Asked Questions

Analyze common user questions about the KM and KVM Switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional KVM and KVM over IP solutions?

Traditional KVM switches connect peripherals directly to servers using physical cabling (VGA, DVI, HDMI, USB), limiting distance and requiring proprietary infrastructure. KVM over IP digitizes the signals and transmits them over a standard Ethernet network, offering unlimited distance, global remote access, and enhanced security integration using network protocols.

How does the shift to 4K and 8K video resolutions impact KVM technology demand?

Higher resolutions require significantly increased bandwidth and reduced compression artifacts. This drives demand for high-performance digital KVM and specialized KVM over IP systems featuring advanced video processing capabilities, such as DisplayPort 1.4 support and proprietary visually lossless codecs, ensuring zero latency and high fidelity, especially crucial in broadcasting and medical imaging.

Are KVM switches being replaced by modern virtualization and remote desktop software?

While virtualization reduces the reliance on physical hardware access for routine tasks, KVM switches remain indispensable for true out-of-band management. They provide necessary access for BIOS configuration, OS installation, and troubleshooting system freezes or network failures, tasks that software-based tools cannot reliably perform. KVM serves as the secure, last line of physical console control.

Which industry vertical is showing the fastest adoption rate for high-security KVM switches?

The Government and Defense sectors are demonstrating the fastest adoption of high-security KVM switches, particularly those meeting Common Criteria or TEMPEST standards. This growth is mandated by the need to maintain strict data separation between different security networks (air-gapping) and to prevent unauthorized access or data leakage in sensitive command and control environments.

What are the main security concerns associated with KVM over IP and how are vendors addressing them?

Key concerns include unauthorized remote access and network vulnerability. Vendors address this by implementing robust security features such as high-level encryption (AES 256), mandatory multi-factor authentication, support for enterprise security protocols (LDAP/AD), and auditing tools that log all remote session activity, ensuring compliance and data protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager