Knee Cartilage Repair Devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439588 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Knee Cartilage Repair Devices Market Size

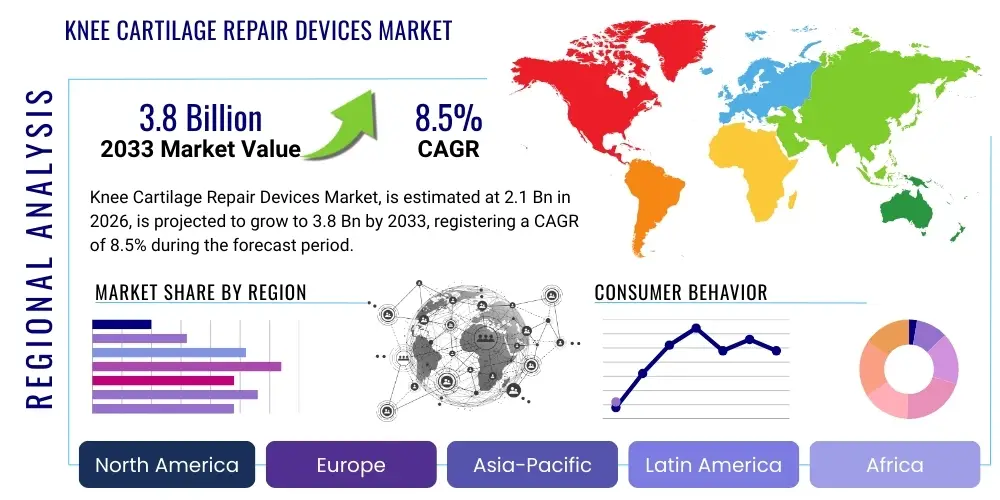

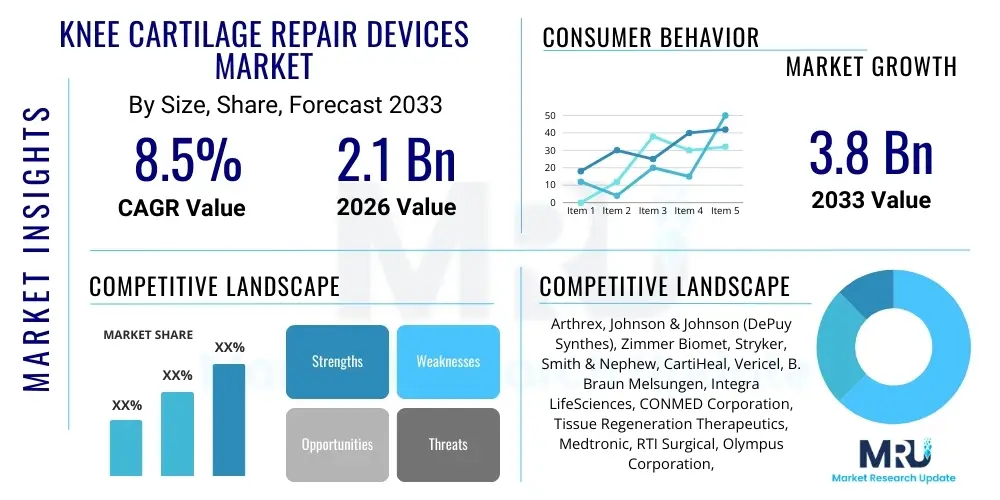

The Knee Cartilage Repair Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Knee Cartilage Repair Devices Market introduction

The Knee Cartilage Repair Devices Market encompasses a range of specialized medical instruments, implants, and biological scaffolds designed to treat localized defects in the articular cartilage of the knee joint. Articular cartilage damage, often resulting from acute trauma, degenerative conditions, or sports injuries, frequently leads to chronic pain and significant mobility impairment, necessitating sophisticated restorative procedures. Key product categories include microfracture instruments, autologous chondrocyte implantation (ACI) kits, matrix-induced autologous chondrocyte implantation (MACI) products, osteochondral allografts and autografts, and synthetic or biodegradable scaffolds. The primary objective of these devices is to regenerate or replace damaged hyaline cartilage, offering patients improved function and delaying or avoiding total knee arthroplasty, especially in younger, active populations.

The market's expansion is fundamentally driven by the escalating global incidence of knee osteoarthritis and sports-related injuries, coupled with increasing patient awareness regarding advanced non-arthroplasty treatment options. Technological advancements, particularly in tissue engineering and biomaterials science, are continuously introducing more effective and durable repair solutions. Furthermore, the rising adoption of minimally invasive surgical techniques, such as arthroscopy, for cartilage repair procedures reduces recovery times and surgical morbidity, thereby broadening the eligible patient pool and encouraging procedure acceptance among both surgeons and patients. The sophisticated nature of cartilage biology dictates high research and development investment to overcome the tissue's inherent inability to self-repair effectively.

Major applications of these devices span focal chondral defects, osteochondritis dissecans (OCD), and small to moderate post-traumatic lesions. Key benefits include pain reduction, restoration of joint kinematics, and prolonged joint longevity. Driving factors for market buoyancy include the demographic shift toward an aging population more susceptible to joint degeneration, rising participation in high-impact recreational activities, and substantial reimbursement coverage for innovative regenerative treatments in developed economies. However, challenges related to the high cost of advanced biological therapies and the long-term clinical durability of synthetic scaffolds occasionally temper the market growth rate.

Knee Cartilage Repair Devices Market Executive Summary

The Knee Cartilage Repair Devices Market is poised for robust growth driven by significant technological innovations across biological and synthetic repair methods. Business trends highlight a strong industry focus on developing third-generation ACI and MACI techniques that utilize advanced bio-scaffolds to enhance cell viability and integration, minimizing the need for periosteal patches. Additionally, the increasing convergence of orthopedic devices with digital health platforms for patient monitoring and rehabilitation optimization represents a key strategic imperative for market leaders. Competitive intensity remains high, marked by strategic mergers, acquisitions, and exclusive distribution agreements aimed at expanding geographic reach and consolidating product portfolios, particularly within the lucrative North American and European markets. Companies are also heavily investing in long-term clinical trials to secure robust evidence supporting the superiority of biological techniques over traditional methods like microfracture.

Regional trends indicate North America maintaining its dominance due to high healthcare expenditure, sophisticated surgical infrastructure, and favorable reimbursement landscapes for advanced cellular therapies. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by improving healthcare access, a burgeoning medical tourism sector focused on orthopedic care, and rapidly increasing adoption of Western treatment protocols in populous countries like China and India. European growth remains stable, characterized by early adoption of centralized regulatory approvals for novel tissue-engineered products. Segment trends emphasize the shifting preference toward cell-based therapies (ACI/MACI) and tissue scaffolds over simple debridement techniques, given the superior long-term outcomes associated with true hyaline cartilage regeneration. The osteochondral allografts segment, though limited by donor availability, remains critical for large, deep defects.

The overall market trajectory is defined by a delicate balance between cost-effectiveness and clinical efficacy. While biological treatments offer the best chance for true repair, their high cost necessitates rigorous evaluation of patient suitability and comprehensive insurance coverage. The market is witnessing a move away from first-generation devices toward integrated systems that combine surgical tools, delivery mechanisms, and regenerative materials into standardized, user-friendly kits. Furthermore, regulatory scrutiny, particularly from bodies like the FDA and EMA, regarding the long-term safety and immunological response to implanted scaffolds and engineered tissues, influences the speed of product commercialization and market penetration, requiring companies to establish robust post-market surveillance programs.

AI Impact Analysis on Knee Cartilage Repair Devices Market

User inquiries regarding AI's influence in the Knee Cartilage Repair Devices Market frequently center on its potential to revolutionize diagnosis, personalize treatment protocols, and optimize surgical outcomes. Key themes identified include the use of AI in image segmentation (MRI/CT) for precise defect size measurement, predictive modeling for treatment success based on patient specific biomechanical data, and enhancing the precision of robotic-assisted delivery systems for cell implantation. Concerns often revolve around the regulatory pathways for AI-driven diagnostic tools, data privacy associated with large patient datasets, and ensuring the algorithms accurately account for the complex mechanical environment of the knee joint. Users expect AI to reduce procedural variability, leading to more consistent and durable cartilage repair results while making complex biological therapies more accessible and cost-effective through enhanced planning and material utilization efficiency.

- AI-enhanced diagnostic imaging processing for sub-millimeter accurate cartilage defect mapping and severity assessment.

- Predictive analytics leveraging patient demographics, injury history, and genetic markers to forecast the long-term success rate of specific repair modalities (e.g., ACI vs. allograft).

- Optimization of surgical robot navigation systems, guiding surgeons in real-time for precise scaffold placement and graft orientation, particularly in complex or deep lesions.

- Development of machine learning models to analyze biomechanical load distribution post-surgery, informing personalized rehabilitation schedules and reducing failure risks.

- Automated quality control systems in tissue engineering labs to assess the viability and purity of cultured chondrocytes used in ACI/MACI procedures.

DRO & Impact Forces Of Knee Cartilage Repair Devices Market

The Knee Cartilage Repair Devices Market is dynamically influenced by a synergistic interplay of market drivers and inherent restraints, punctuated by substantial technological opportunities, all mediated by critical impact forces such as regulatory stringency and reimbursement policies. The primary drivers include the burgeoning prevalence of degenerative joint diseases and sports injuries, the strong push toward biological joint preservation techniques over replacement, and continuous innovations in biomaterials that yield more durable and biologically active scaffolds. Conversely, major restraints encompass the high procedural costs associated with cell-based therapies, the inherent technical challenge of replicating durable hyaline cartilage, and the limited availability of high-quality donor tissue for allografts. Opportunities reside in leveraging 3D bioprinting for customized scaffolds, exploring novel gene therapy approaches to enhance cartilage regeneration, and penetrating emerging markets where the demand for advanced orthopedic care is rapidly accelerating. These market dynamics are subjected to impact forces from increasing regulatory demands for long-term efficacy data and fluctuations in healthcare policy impacting coverage for experimental or expensive regenerative treatments.

Specifically, the rise in obesity rates globally contributes significantly to joint loading, increasing the incidence of cartilage degradation, which serves as a powerful market driver. Simultaneously, the limited shelf life and logistics surrounding viable cellular products (like autologous chondrocytes) act as a structural restraint, complicating widespread global distribution and timely clinical application. The development of off-the-shelf, acellular scaffolds that bypass these logistical challenges presents a massive opportunity. Furthermore, the strong influence of orthopedic key opinion leaders (KOLs) and professional society guidelines (e.g., ISAKOS) dictates adoption patterns; thus, robust, multi-year clinical data becomes a critical impact force determining the commercial success of any new device or technique.

In summary, the market exhibits a positive growth trajectory, predominantly because the clinical demand for effective joint preservation vastly outweighs the limitations posed by current cost structures. The continuous refinement of surgical techniques, particularly arthroscopic delivery methods, enhances the practicality of these devices. The most significant sustained impact force remains governmental and private payer reimbursement decisions; broad coverage incentivizes patient and provider adoption, while restrictive policies suppress growth despite technological superiority. This economic reality drives fierce competition among manufacturers to demonstrate compelling long-term cost-effectiveness data.

Segmentation Analysis

The Knee Cartilage Repair Devices Market is systematically segmented based on the type of procedure, the nature of the repair material utilized, the specific injury location, and the end-user setting, providing a granular view of market dynamics and adoption trends. Procedure types range from simple palliative techniques (microfracture) to complex restorative procedures (ACI, MACI, OATS). The repair material segmentation differentiates between cellular scaffolds (autologous and allogeneic chondrocytes), acellular scaffolds (synthetic and natural polymers), and osteochondral grafts. This structural segmentation is crucial for understanding technological maturation and the commercialization pathway for new product introductions. Analysis reveals a strategic shift towards biological and combined therapies, reflecting improved clinical outcomes and growing physician confidence in regenerative medicine.

The detailed segmentation also allows stakeholders to identify high-growth niches. For example, the segment focusing on scaffolds (both biological and synthetic) is experiencing rapid innovation as manufacturers strive to develop materials that closely mimic the native biomechanical and biochemical properties of hyaline cartilage, enhancing integration and functional durability. End-user segmentation typically divides the market between hospitals (which handle most complex surgeries) and ambulatory surgical centers (ASCs), which are increasingly preferred for less invasive, routine procedures due to lower overheads and streamlined patient flows. Geographical segmentation, differentiating between established, high-revenue regions like North America and rapidly expanding markets like APAC, guides strategic investment and resource allocation decisions for major players.

- By Procedure Type:

- Chondroplasty (Debridement and Lavage)

- Microfracture

- Autologous Chondrocyte Implantation (ACI)

- Matrix-Induced Autologous Chondrocyte Implantation (MACI)

- Osteochondral Autograft Transfer System (OATS)

- Osteochondral Allograft Transplantation

- Scaffold Implantation (Synthetic and Biological)

- By Material Type:

- Cell-Based (Chondrocytes, Stem Cells)

- Acellular Scaffolds (Collagen, Hyaluronic Acid, Biodegradable Polymers)

- Grafts (Autografts, Allografts)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Orthopedic Clinics

Value Chain Analysis For Knee Cartilage Repair Devices Market

The value chain for the Knee Cartilage Repair Devices Market is complex, stretching from the sourcing and processing of raw materials (biomaterials like collagen or synthetic polymers, and biological resources like tissue banks) to the final surgical delivery and post-operative monitoring. Upstream activities involve intensive Research and Development (R&D) focused on material science, cell culture techniques, and clinical validation. Key upstream players include specialized biotech firms and tissue engineering laboratories responsible for developing and manufacturing scaffolds or processing autologous/allogeneic cellular products. Quality control at this stage is paramount, especially for temperature-sensitive biological components, requiring stringent manufacturing practices (GMP).

Midstream processes center on device manufacturing, sterilization, packaging, and regulatory approval. This phase involves assembling instruments (e.g., microfracture kits, OATS delivery systems) and integrating them with the core repair material. Distribution channels play a critical role; direct distribution is often employed for high-value, specialized biological products requiring dedicated logistics (cold chain management), ensuring product viability up to the point of use. Indirect distribution utilizes specialized orthopedic distributors and wholesalers to handle high-volume commodity devices, such as general arthroscopic tools and standard synthetic scaffolds, maximizing market reach efficiently while minimizing the manufacturer's operational burden.

Downstream activities involve marketing, sales, surgical training, and product implementation by end-users (hospitals and ASCs). The relationship between manufacturers and orthopedic surgeons is crucial; intensive training is often required for new, technically demanding procedures like MACI. The final stage involves patient recovery and long-term follow-up, increasingly incorporating digital tools for post-surgical compliance and outcome tracking. The efficiency of the value chain is highly contingent upon regulatory compliance and the ability to maintain the integrity of sophisticated biological products throughout the supply chain.

Knee Cartilage Repair Devices Market Potential Customers

The primary end-users and buyers in the Knee Cartilage Repair Devices Market are healthcare institutions, encompassing a wide range of facilities specializing in orthopedic trauma and degenerative joint care. These entities procure devices and implants through established procurement cycles, typically involving purchasing managers, hospital administrators, and influential orthopedic surgical staff who specify product needs based on clinical efficacy and economic factors. Major buyers include large academic medical centers and specialized trauma hospitals, which require the full spectrum of devices, particularly high-cost biological options like ACI/MACI, due to their involvement in complex cases and clinical research. These institutions often purchase in bulk or enter into long-term supply contracts with device manufacturers.

Ambulatory Surgical Centers (ASCs) represent a rapidly expanding customer segment, driven by the shift toward outpatient orthopedic procedures. ASCs prioritize devices that are efficient, require minimal operating room time, and are cost-effective, favoring advanced microfracture tools and standardized acellular scaffolds over highly customized cellular products that require specialized lab services. Private and government insurance providers, while not direct customers of the devices, heavily influence purchasing decisions by dictating reimbursement policies, acting as financial gatekeepers that determine which treatments are accessible to patients, thereby shaping the demand for specific device types.

Finally, the orthopedic surgeon, acting as the procedural decision-maker, is the ultimate influencer. Surgeons evaluate devices based on ease of use, documented clinical success, and ability to address specific defect morphologies. The potential patient pool includes young to middle-aged adults (15-55 years old) suffering from focal, symptomatic cartilage lesions, typically resulting from sports injuries or acute trauma, who are seeking joint preservation before severe osteoarthritis mandates total knee replacement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arthrex, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, Stryker, Smith & Nephew, CartiHeal, Vericel, B. Braun Melsungen, Integra LifeSciences, CONMED Corporation, Tissue Regeneration Therapeutics, Medtronic, RTI Surgical, Olympus Corporation, CryoLife, Bioventus, CellGenix, BioTissue, Ossur. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Knee Cartilage Repair Devices Market Key Technology Landscape

The technological landscape of the Knee Cartilage Repair Devices Market is characterized by a rapid evolution toward regenerative and tissue-engineering approaches designed to induce the formation of hyaline-like cartilage rather than mechanically inferior fibrocartilage. A cornerstone technology is Matrix-Induced Autologous Chondrocyte Implantation (MACI), representing the third generation of ACI. MACI utilizes biodegradable synthetic or natural matrices (e.g., collagen or hyaluronic acid scaffolds) seeded with the patient's own harvested chondrocytes. This technique offers significant advantages over traditional ACI by simplifying the surgical procedure, requiring fewer stitches, and allowing for a more precise, three-dimensional cell delivery, thereby promoting better cell retention and integration into the defect site. Continuous innovation in scaffold design is focusing on developing porosity, mechanical stiffness, and degradation rates that optimally match the biomechanical demands of the knee joint during the healing process.

Another dominant technological trend involves the advancement of Osteochondral Allograft Transplantation and related delivery systems. While limited by donor availability and potential immune rejection, allografts remain the gold standard for large, deep, or multi-compartmental osteochondral defects. Technological progress here focuses on improving tissue banking processes, enhancing graft preservation techniques (e.g., cryopreservation and specialized culture media) to maintain chondrocyte viability for extended periods, and developing precise, instrumented systems (OATS kits) that allow surgeons to harvest and implant grafts with minimal trauma and maximum geometric accuracy. Furthermore, research into mesenchymal stem cells (MSCs) and their potential to differentiate into chondrocytes within an acellular scaffold is accelerating, promising "off-the-shelf" solutions that negate the need for two-stage procedures or autologous cell expansion, fundamentally streamlining the treatment process.

Emerging technologies, poised to reshape the market, include 3D bioprinting for personalized cartilage scaffolds and the integration of minimally invasive robotic surgery. 3D bioprinting allows for the creation of patient-specific scaffolds perfectly matching the defect geometry, potentially enhancing integration and long-term functionality. Robotics and navigation systems are being adapted to assist in precise drilling for microfracture or subchondral bone preparation for scaffold implantation, improving consistency and reducing operative variability. These technological advancements, combined with improved understanding of subchondral bone remodeling, are steering the market away from simple defect filling toward complex, functional tissue regeneration.

Regional Highlights

The global Knee Cartilage Repair Devices Market demonstrates significant regional variation in terms of market maturity, regulatory environments, technological adoption rates, and reimbursement scenarios.

- North America (U.S. and Canada): Dominates the global market share primarily due to high awareness regarding advanced joint preservation therapies, extensive healthcare infrastructure, and favorable reimbursement policies for sophisticated procedures like MACI and osteochondral allograft transplantation. The presence of major device manufacturers and a high prevalence of sports-related knee injuries further solidify its leading position. The U.S. remains the epicenter for R&D and commercialization of next-generation cellular and scaffold technologies.

- Europe (Germany, U.K., France, Italy, Spain): Represents the second-largest market, characterized by centralized regulatory frameworks (EMA) that often facilitate earlier adoption of advanced techniques than in other regions. Germany, in particular, showcases high procedure volumes driven by its comprehensive healthcare system and strong focus on orthopedic specialty care. However, pricing pressures and varying national reimbursement schemes across member states influence market penetration unevenly.

- Asia Pacific (APAC) (China, Japan, India, South Korea): Poised for the fastest growth due to rapidly improving healthcare expenditure, increasing patient population access to advanced treatment modalities, and a growing medical tourism industry focused on high-end orthopedic surgery. While Japan and South Korea are early adopters of biological scaffolds, the massive patient bases in China and India offer substantial long-term growth opportunities once device affordability and physician training improve.

- Latin America (LATAM): Exhibits nascent growth, constrained mainly by infrastructural deficits, lower public healthcare spending, and inconsistent reimbursement coverage for specialized orthopedic implants. However, private healthcare sectors in major economies like Brazil and Mexico are showing increasing adoption of established, cost-effective techniques like OATS and traditional microfracture.

- Middle East and Africa (MEA): Growth is localized, heavily concentrated in Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) where high disposable income supports the import and use of premium orthopedic devices. The region relies heavily on international partnerships and imported expertise for advanced cartilage repair procedures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Knee Cartilage Repair Devices Market.- Arthrex

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet

- Stryker Corporation

- Smith & Nephew plc

- CartiHeal

- Vericel Corporation

- B. Braun Melsungen AG

- Integra LifeSciences Holdings Corporation

- CONMED Corporation

- Medtronic plc

- RTI Surgical

- Olympus Corporation

- CryoLife, Inc.

- Bioventus LLC

- Osiris Therapeutics (now part of Smith & Nephew)

- Tornier N.V. (now part of Wright Medical/Stryker)

- BioTissue SA

- Ossur hf

- CellGenix GmbH

Frequently Asked Questions

Analyze common user questions about the Knee Cartilage Repair Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ACI and MACI cartilage repair techniques?

Autologous Chondrocyte Implantation (ACI) is a two-stage procedure where cells are harvested, cultured, and then implanted under a sutured periosteal flap. Matrix-Induced Autologous Chondrocyte Implantation (MACI), the advanced generation, uses a 3D biodegradable scaffold seeded with cells, simplifying the surgical procedure (often requiring fewer sutures) and improving cell retention and functional integration into the knee defect.

Which geographical region leads the global market for knee cartilage repair devices?

North America, particularly the United States, leads the market due to robust healthcare spending, high incidence of sports injuries necessitating joint preservation, quick adoption of cutting-edge regenerative technologies, and well-established reimbursement structures for complex orthopedic procedures.

What are the key market drivers influencing the growth of cartilage repair devices?

The primary drivers include the rising global prevalence of chronic knee osteoarthritis, increasing awareness and patient demand for joint preservation alternatives to total knee replacement, and continuous advancements in biomaterials and tissue engineering yielding more durable and biologically efficacious scaffolds.

Are synthetic scaffolds or biological cell-based therapies more commonly used today?

While traditional techniques like microfracture (which often results in inferior fibrocartilage) are common, the trend is rapidly shifting toward biological cell-based therapies (MACI/ACI) and advanced biological scaffolds, as they offer superior clinical outcomes by promoting the regeneration of hyaline-like cartilage and providing better long-term joint function.

How does the cost of cartilage repair devices impact market accessibility?

High procedural costs, especially for customized cell-based therapies (e.g., ACI which involves specialized laboratory culturing), act as a restraint, limiting access in regions with underdeveloped insurance coverage or low healthcare spending. This financial barrier often necessitates manufacturers to focus on demonstrating long-term cost-effectiveness compared to alternative surgical options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager