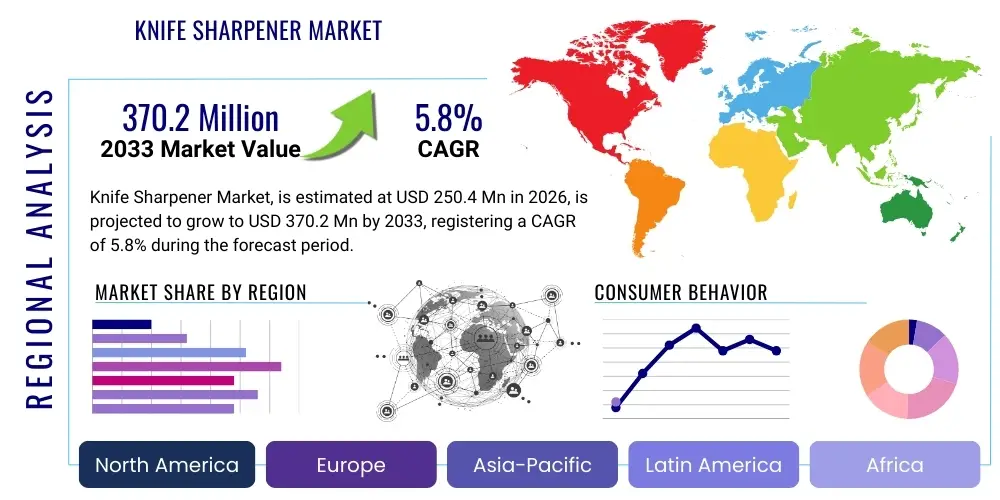

Knife Sharpener Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439097 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Knife Sharpener Market Size

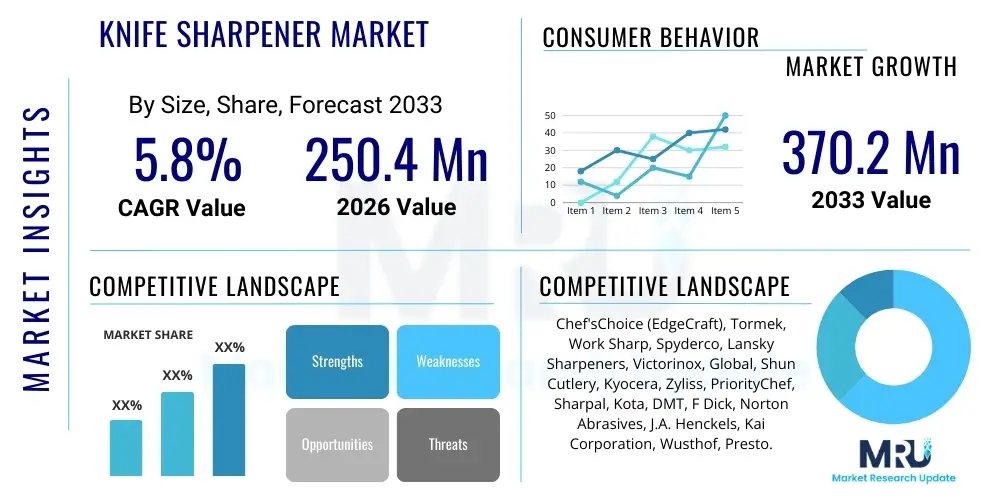

The Knife Sharpener Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 250.4 Million in 2026 and is projected to reach USD 370.2 Million by the end of the forecast period in 2033.

Knife Sharpener Market introduction

The Knife Sharpener Market encompasses the manufacturing, distribution, and sale of devices and systems designed to restore the edge on knives, blades, and other cutting tools. Products range from traditional whetstones and honing steels to modern manual and electric sharpening systems, catering to both professional culinary environments and domestic household use. Major applications include maintaining sharpness for kitchen cutlery, hunting and tactical knives, industrial blades, and specialized tools used in woodworking or crafting. The core benefit provided by these products is enhanced safety, prolonged knife lifespan, and improved cutting efficiency. Driving factors for market growth include the rising popularity of home cooking, increased consumer awareness regarding kitchen tool maintenance, technological advancements leading to safer and faster sharpening solutions, and the professional demand from the booming food service and hospitality sectors globally.

Knife Sharpener Market Executive Summary

The Knife Sharpener Market demonstrates robust growth driven primarily by advancements in electric sharpening technology and the expanding e-commerce distribution networks. Current business trends indicate a strong shift towards hybrid models that combine the precision of traditional stones with the speed of electric motors, offering versatility to consumers. Regionally, Asia Pacific is emerging as the fastest-growing market, propelled by high population density, rising disposable incomes, and the widespread adoption of professional culinary arts. North America and Europe remain mature markets, focusing heavily on premiumization, durability, and brand loyalty. Segment-wise, the Electric Knife Sharpeners segment is experiencing accelerated adoption due to convenience, while the Household Application segment dominates volume sales. The market's competitive landscape is defined by continuous innovation in abrasive materials, ergonomic design, and safety features, positioning manual sharpeners for specialty markets and electric units for the mass consumer base seeking efficient solutions.

AI Impact Analysis on Knife Sharpener Market

User queries regarding AI in the knife sharpener market commonly revolve around predictive maintenance for commercial kitchens, the integration of smart features into high-end electric sharpeners, and automated quality control in manufacturing abrasive materials. Users are keen to know if AI can optimize the sharpening angle based on specific blade material and usage patterns, thus achieving a 'perfect edge' automatically. There is also interest in using machine learning to analyze the wear patterns of stones and wheels, signaling replacement needs, or personalizing sharpening profiles for different knife types (e.g., Japanese vs. German steel). The key theme summarizes the transition from simple mechanical aids to sophisticated, data-driven edge restoration systems, focusing on precision, customization, and minimizing user error. While the direct application of AI in consumer-grade physical sharpeners remains limited, its influence is profound in logistics, supply chain optimization, demand forecasting for specialized abrasives, and the development of computerized numerical control (CNC) sharpening machines used in high-volume industrial settings.

- AI-driven predictive maintenance algorithms optimize commercial sharpening schedules, reducing downtime.

- Machine learning models analyze blade characteristics (steel hardness, geometry) to suggest optimal sharpening programs in smart devices.

- Computer vision systems enhance quality control during the manufacturing of abrasive materials (e.g., diamond grits, ceramic wheels).

- AI optimizes supply chain logistics for niche abrasive components, ensuring material availability.

- Smart electric sharpeners may use embedded sensors and AI to detect and correct improper user technique in real-time.

DRO & Impact Forces Of Knife Sharpener Market

The dynamics of the Knife Sharpener Market are shaped by a complex interplay of growth stimulants, inherent market limitations, and emerging opportunities, collectively defining the impact forces. The primary drivers revolve around the global culinary trend, the necessity of professional equipment maintenance, and advancements in sharpening material science, compelling both consumers and commercial entities to invest in high-quality maintenance tools. However, the market faces significant restraints, chiefly concerning the educational gap regarding proper sharpening techniques, the perceived high initial cost of premium electric systems, and the proliferation of low-quality, inexpensive imports that often damage expensive knives. Opportunities lie primarily in digitalization, catering to niche markets like specialized hunting or carving tools, and developing sustainable, durable sharpening solutions. These forces combine to create an environment where innovation in product design and strategic educational marketing are crucial for capturing long-term market share.

Drivers:

The increasing emphasis on gastronomic experiences and home cooking globally serves as a foundational driver for the knife sharpener market. As consumers invest heavily in high-quality, often expensive, cutlery sets, the corresponding demand for effective maintenance tools to protect these investments rises significantly. Furthermore, the professional food service sector, including restaurants, catering businesses, and butcher shops, operates under stringent health and safety regulations that mandate sharp, well-maintained tools for efficiency and hygiene, consistently fueling demand for commercial-grade sharpeners. This sustained demand is augmented by the continuous influx of new product innovations, particularly in electric models that offer rapid, consistent, and user-friendly sharpening experiences, overcoming the traditional barriers associated with manual techniques.

Technological refinement in abrasive materials, such as the increasing use of industrial diamonds, high-grade ceramics, and advanced composite materials, allows manufacturers to produce sharpeners that can handle the diverse range of modern high-carbon and stainless-steel alloys. These material science breakthroughs enable the development of systems that not only sharpen but also hone and polish the edge with greater precision and less material removal, extending the life of the knife. Moreover, the growth of modern retail channels, including online marketplaces and specialized kitchen stores, has significantly improved product visibility and accessibility, making it easier for consumers to research, compare, and purchase the specific sharpening solution tailored to their needs, thereby accelerating market penetration across all demographics.

- Rising global interest in professional and amateur cooking activities.

- Increasing investment by consumers in premium, high-quality knife sets.

- Mandatory maintenance and hygiene standards in the commercial food service industry.

- Continuous technological advancements in electric sharpener design and abrasive materials (diamond, ceramic).

- Expanded accessibility through e-commerce platforms and specialized retail outlets.

Restraints:

One of the primary restraints hindering rapid market expansion is the lack of consumer education regarding proper sharpening methods and the potential for misuse. Many consumers resort to improper techniques or utilize low-cost, ineffective pull-through sharpeners that can severely damage high-quality blades, leading to dissatisfaction and reluctance to invest in more advanced systems. This perceived difficulty or risk associated with sharpening encourages some users to outsource the task to professional services, which limits the uptake of consumer-grade sharpening devices. Additionally, the initial capital outlay required for high-end electric and precision manual sharpening systems often presents a barrier, especially for budget-conscious household users who may view these specialized tools as non-essential luxuries rather than necessary maintenance items.

Furthermore, the market faces saturation at the lower end, characterized by the widespread availability of inexpensive, generic, and often ineffective sharpening stones or manual units, which undermines the perceived value of high-quality, precision-engineered products. Manufacturers of premium knives sometimes offer lifetime sharpening services or specialized proprietary sharpeners, creating brand loyalty silos that restrict competition for aftermarket tools. Economic volatility in certain regions also impacts discretionary spending, delaying or minimizing consumer investment in kitchen accessories and maintenance equipment. Addressing these restraints necessitates concerted efforts in consumer education, demonstrating the long-term cost-effectiveness and safety benefits of superior sharpening solutions, and countering the negative perceptions generated by low-quality alternatives.

- Lack of widespread consumer knowledge regarding optimal sharpening techniques.

- High initial cost associated with premium, precision-engineered electric sharpeners.

- Market flooding by low-quality, inexpensive manual sharpeners that cause blade damage.

- Availability of professional sharpening services as an alternative to owning a device.

- Durability and replacement cost concerns associated with specialized abrasive wheels and stones.

Opportunities:

Significant growth opportunities exist in the integration of smart technology and enhanced material sustainability within the product design landscape. Developing smart sharpeners that use sensors to guide the user to the correct angle, or those capable of diagnosing the blade's condition to suggest the appropriate grit or stage, caters directly to the modern consumer's demand for ease of use and precision. Furthermore, the growing global emphasis on environmental responsibility opens pathways for manufacturers to introduce sharpeners made from recycled or sustainable materials, potentially appealing to environmentally conscious consumer segments, particularly in mature markets like Europe and North America where sustainability is a major purchasing determinant.

Geographic expansion, particularly penetrating developing economies in Asia Pacific and Latin America, represents a substantial market opportunity, driven by increasing urbanization and the rapid development of modern retail infrastructure. Tailoring products to meet the unique needs of niche markets, such as specialist industrial applications, high-end outdoor activities (e.g., fishing, hunting), and professional meat processing, allows companies to command higher margins through specialized product offerings. Moreover, leveraging the digital platform for direct-to-consumer sales and extensive educational content (videos, tutorials) allows manufacturers to establish stronger brand connections and overcome the prevalent educational restraints, turning potential users into informed, loyal customers who understand the value of a professional edge.

- Development and integration of smart features (sensors, angle guides) in electric sharpeners.

- Tapping into emerging markets in Asia Pacific and Latin America due to rising disposable income.

- Focusing on sustainable manufacturing processes and utilizing eco-friendly materials.

- Specialization of products for niche applications (e.g., tactical knives, woodworking tools).

- Expansion of digital educational content to demystify sharpening techniques and build brand trust.

Impact Forces:

The consolidated impact forces in the Knife Sharpener Market demonstrate a dynamic trajectory leaning towards sophistication and convenience. The high impact of technological drivers, specifically the innovation in electric and precision manual systems, is pushing the market towards higher average selling prices (ASPs) and better quality. Restraints, primarily stemming from user uncertainty and the influx of low-grade products, necessitate robust educational strategies by leading brands. The collective opportunity presented by digitalization and niche specialization encourages market players to diversify their product portfolio beyond standard kitchen sets. Overall, the market is characterized by moderate to high competition, driven by the need to capture consumer attention through demonstrated precision and long-term value, ensuring that only those players investing heavily in R&D and consumer outreach can maintain competitive superiority against generic alternatives.

Segmentation Analysis

The Knife Sharpener Market is comprehensively segmented based on product type, material, application, and distribution channel, providing a granular view of consumer preferences and market dynamics. This segmentation reveals distinct adoption rates influenced by user profile, ranging from professional chefs requiring high-precision whetstones or belt sharpeners, to domestic users prioritizing the convenience of manual pull-through or multi-stage electric sharpeners. The analysis highlights that while the Household segment accounts for the largest volume due to broad consumer base, the Commercial segment commands a higher value due to the demand for heavy-duty, durable, and frequently replaced units. Understanding these segment behaviors is crucial for manufacturers in tailoring marketing strategies and product development to effectively address the specific needs of diverse end-users across geographical regions.

- By Product Type: Electric Knife Sharpeners, Manual Knife Sharpeners, Sharpening Stones (Whetstones).

- By Material: Diamond Abrasives, Ceramic Abrasives, Carbide Abrasives, Others (Steel, Natural Stone).

- By Application: Household, Commercial (Restaurants, Hotels, Butcher Shops, Industrial).

- By Distribution Channel: Online (E-commerce), Offline (Specialty Stores, Supermarkets, Department Stores).

Product Type Analysis: Electric, Manual, and Stones

The product type segmentation differentiates the market based on the mechanism employed for sharpening, creating distinct competitive arenas. Electric Knife Sharpeners represent the fastest-growing segment, favored for their convenience, speed, and consistency, often featuring pre-set angles and multiple grinding stages. These systems mitigate user error and appeal strongly to the mass consumer market and time-constrained commercial users who need quick turnaround. Manufacturers in this space focus on maximizing motor power while minimizing noise and enhancing safety features, often embedding flexible wheels or belts coated with premium abrasives like diamonds or ceramics to accommodate different steel hardness levels efficiently.

Manual Knife Sharpeners, including pull-through models and honing steels, maintain a significant market share primarily due to their low cost, portability, and simplicity. While manual pull-through sharpeners are popular for entry-level household use, they often offer less precision and can remove excessive material. Honing steels, on the other hand, are essential daily maintenance tools in professional settings, used to realign the blade's edge between intensive sharpening sessions. The segment's long-term stability relies on continuous innovation in ergonomic design and the quality of internal abrasive components, ensuring they provide a reliable, controlled edge without the dependency on electricity.

Sharpening Stones (Whetstones), though representing the segment requiring the highest level of user skill, remain indispensable in the high-end professional and hobbyist markets. Stones offer unparalleled control over the sharpening angle and allow for specific edge geometries, crucial for specialty knives (e.g., Japanese single-bevel knives). The market for stones is stratified by grit size and material composition (natural vs. synthetic ceramics or diamond plates). This segment is characterized by consumer loyalty to specific stone types and requires extensive educational support, often seeing significant traction among culinary enthusiasts and custom knifemakers who prioritize absolute precision over speed.

- Electric Sharpeners: High growth, focus on speed, multi-stage grinding, and user safety features; dominant in mass-market convenience.

- Manual Sharpeners: Stable volume, focus on portability, low price point, and ease of use for quick edge realignment (honing steels).

- Sharpening Stones (Whetstones): Highest precision, critical for professional chefs and specialty blades; valued for customization of edge geometry.

Material Analysis: Diamond, Ceramic, and Carbide Abrasives

The choice of abrasive material fundamentally dictates the performance, price point, and longevity of a knife sharpener. Diamond abrasives currently represent the premium segment due to diamond's superior hardness, making it capable of effectively sharpening even the hardest stainless steels and modern alloys without excessive wear on the sharpener itself. Diamond plates and wheels are used extensively in high-end electric units and professional flat stone systems, offering quick material removal and long lifespan. This segment’s growth is strongly correlated with the increasing use of high-performance steel in manufactured cutlery.

Ceramic abrasives, commonly synthetic materials like aluminum oxide or silicon carbide, offer a balance between hardness and fineness, making them ideal for achieving a polished, razor-sharp edge after initial material removal. Ceramic stones and rods are ubiquitous in both professional honing applications and multi-stage manual sharpeners. Their primary advantage is the ability to maintain consistency across different grit levels and resist contamination, though they can be brittle. Innovations focus on developing ceramics with improved toughness to reduce chipping risk.

Carbide abrasives, usually tungsten carbide, are typically employed in the aggressive, coarse stages of manual pull-through sharpeners. While highly effective at quickly resetting a completely dull or damaged edge, they are often criticized for removing too much steel and potentially damaging high-quality blades if misused, thus positioning them mainly in the entry-level or emergency repair segment. Other materials, including natural stones and standard steel rods, fill niche traditional or honing markets. The overall trend is towards composite materials that combine the rapid action of diamond or carbide with the finesse of ceramic, offering a complete sharpening solution in one device.

- Diamond Abrasives: Premium segment, highest hardness, preferred for high-performance steels and quick material removal in electric units.

- Ceramic Abrasives: Balance of speed and polish, essential for achieving fine edges; dominant in honing rods and final sharpening stages.

- Carbide Abrasives: Used for aggressive reshaping of severely damaged blades; dominant in inexpensive, entry-level manual pull-through devices.

Application Analysis: Household vs. Commercial

The market is sharply divided between Household (domestic) and Commercial (professional) applications, each driven by distinct purchasing criteria. The Household segment accounts for the largest volume of units sold. Household consumers prioritize ease of use, safety features, compactness, and affordability. Electric sharpeners and simple manual devices dominate this segment, catering to the intermittent sharpening needs of kitchen cutlery. Marketing strategies focus heavily on demonstrating ease of storage, aesthetic integration into kitchen design, and speed of results, capitalizing on the rising trend of amateur culinary skills and home entertainment.

Conversely, the Commercial segment—encompassing restaurants, hotels, catering, and industrial food processing—demands heavy-duty, reliable, and high-speed sharpening solutions capable of continuous operation. Durability, minimal maintenance requirements, precision angle control, and compliance with commercial safety standards are paramount. Professional chefs often use a combination of commercial-grade electric belt sharpeners for rapid repair and high-quality Japanese or synthetic stones for fine finishing. Although the volume is smaller than the household segment, the commercial segment generates higher revenue per unit due to the necessity of premium, robust equipment and frequent replacement of abrasive parts.

A growing sub-segment within Commercial is the industrial application, including sharpeners for specialized tools like meat slicer blades, woodworking knives, and industrial cutting apparatus. This highly specialized niche requires custom-engineered, often automated, solutions, driving significant revenue in the B2B market. The distinction between Household and Commercial purchasing behaviors—driven by convenience versus endurance—necessitates tailored product lines and distinct supply chain mechanisms for manufacturers seeking maximum market penetration.

- Household Application: Dominant in volume; key factors are convenience, safety, low price point, and compact design.

- Commercial Application: Dominant in value; key factors are durability, high frequency of use, precision, and adherence to professional standards (e.g., catering, butchery).

- Industrial Application: Niche high-value segment requiring customized and automated sharpening solutions for specialized equipment.

Distribution Channel Analysis: Online vs. Offline

The segmentation by distribution channel highlights a crucial evolution in market access and consumer purchasing habits. The Offline channel, traditionally comprising specialty kitchen stores, department stores, and large supermarkets, remains vital, particularly for consumers who prefer tactile evaluation of manual sharpeners or require personalized advice before purchasing high-end electric models. Specialty retail stores offer a distinct advantage by providing demonstrations and expert guidance, reinforcing trust and justifying premium pricing, which is especially important for complex products like whetstones or belt systems that require skilled use.

However, the Online channel, encompassing dedicated brand websites and major e-commerce platforms (e.g., Amazon, Alibaba), has rapidly gained dominance, particularly in post-pandemic consumer landscapes. Online sales offer unparalleled product variety, competitive pricing, extensive user reviews, and convenience, driving market penetration globally. For manufacturers, the online channel reduces overhead and allows for direct-to-consumer (D2C) models, enabling personalized marketing and quicker product launch cycles. The availability of detailed video tutorials online further mitigates the educational barrier associated with precision sharpening tools, making the online platform ideal for both simple pull-through units and complex electric systems.

The future strategy for market success involves an omnichannel approach, where physical stores serve as experience centers for premium products, while the online channel handles volume sales and international distribution. Strategic partnerships with major e-tailers and investment in high-quality digital content (AEO/GEO optimized product descriptions, technical specifications, and user guides) are essential for maximizing reach and converting informed traffic into sales. The increasing complexity of the product means the online channel must continuously enhance its presentation of technical details and performance metrics to retain consumer confidence.

- Online Channel (E-commerce): High growth, favored for convenience, price comparison, product variety, and access to detailed user reviews; critical for global reach.

- Offline Channel (Retail/Specialty): Important for tangible product assessment, expert advice, and building brand trust, especially for high-value items and professional tools.

- Omnichannel Strategy: Essential for future success, combining the trust of physical retail with the efficiency and reach of digital platforms.

Value Chain Analysis For Knife Sharpener Market

The value chain for the Knife Sharpener Market begins with the upstream sourcing of specialized raw materials, primarily industrial-grade abrasives such as synthetic diamonds, ceramics, and various grades of steel and plastic used for housing and guides. The upstream segment is characterized by specialized suppliers, often operating in concentrated regions for specific materials (e.g., diamond synthesis). Effective supply chain management here is crucial to ensuring material quality, consistency, and cost control, particularly as global demand for high-performance abrasives fluctuates. Manufacturers then engage in precision engineering, assembly (especially for complex electric units), quality assurance, and packaging, processes demanding specialized machinery and technical expertise to ensure accurate sharpening angles and product safety compliance.

The downstream segment involves product distribution, which is bifurcated into direct and indirect channels. Direct distribution includes brand-owned websites and D2C sales, allowing manufacturers higher margin control and direct customer feedback. Indirect distribution utilizes a variety of intermediaries: large volume movers like supermarkets and department stores handle mass-market manual and basic electric units, while specialized kitchenware distributors and B2B suppliers cater to the high-value commercial and industrial segments. The efficiency of this downstream segment relies heavily on logistics infrastructure, inventory management, and strategic placement of products where the target consumer (domestic cook vs. professional chef) shops.

The distribution channel dynamics are rapidly shifting towards e-commerce platforms, requiring robust digital marketing and logistical support to handle international shipments. Both direct and indirect online channels rely heavily on high-quality product information, user generated content, and prompt customer service to succeed. The overall value chain emphasizes the transition from basic manufacturing to providing an integrated maintenance solution, where the post-sale phase—including replacement abrasive parts and educational content—plays an increasingly vital role in maintaining customer loyalty and recurring revenue streams for leading market participants.

Knife Sharpener Market Potential Customers

The potential customer base for the Knife Sharpener Market is broad, ranging from individual household users to large-scale industrial operations, segmented primarily by frequency of use and required precision. The largest segment by sheer volume is the household user, encompassing anyone who uses cutlery for food preparation, driven by the need for safer, more effective cutting tools in the home kitchen. These buyers seek convenience, reliability, and ease of storage, often opting for electric or simple manual pull-through sharpeners that minimize complexity.

The highest value customers reside in the professional commercial sector, including Head Chefs, Restaurant Owners, and Hotel Procurement Managers. These buyers are highly knowledgeable, prioritizing durability, angle precision, and compliance with industry standards, necessitating investment in heavy-duty electric sharpeners, specialized water stones, and professional honing equipment. Their purchase cycles are driven by equipment failure, strict maintenance schedules, and the need to service large volumes of cutlery, making them repeat buyers of consumables like abrasive belts and wheels.

Additionally, niche customer groups include outdoor enthusiasts (hunters, anglers), tactical professionals, and hobbyists (woodworkers, carvers). These customers require highly specialized, portable, and durable sharpeners designed for specific blade geometries and extreme environments. Targeting these niche groups requires specialized marketing focused on product ruggedness and application-specific performance metrics, often leveraging specialized distribution channels related to sporting goods or outdoor equipment. Successfully addressing this diverse customer landscape necessitates a tiered product offering that scales from entry-level convenience to professional-grade precision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.4 Million |

| Market Forecast in 2033 | USD 370.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chef'sChoice (EdgeCraft), Tormek, Work Sharp, Spyderco, Lansky Sharpeners, Victorinox, Global, Shun Cutlery, Kyocera, Zyliss, PriorityChef, Sharpal, Kota, DMT, F Dick, Norton Abrasives, J.A. Henckels, Kai Corporation, Wusthof, Presto. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Knife Sharpener Market Key Technology Landscape

The technology landscape of the Knife Sharpener Market is characterized by a strong convergence of material science and mechanical engineering, aiming to maximize precision while minimizing user effort. Key technological innovations center around the controlled application of abrasive power and the consistency of angle setting. Electric sharpeners increasingly incorporate flexible abrasive belts, similar to industrial sharpening machinery, which are superior to fixed wheels for creating convex or hybrid edges, mimicking the results achieved by freehand sharpening but with automated consistency. Furthermore, microprocessor control is being integrated into high-end units to regulate motor speed and torque based on the resistance encountered, optimizing the sharpening process for different steels and blade thicknesses while preventing overheating.

In the manual segment, the primary technological advancements focus on precision angle guides and clamp systems. Modern systems utilize patented angle management systems (e.g., pivot guides or adjustable stops) that lock the blade consistently throughout the sharpening stroke, overcoming the major challenge of manual freehand sharpening. The shift towards proprietary diamond matrix coatings on flat plates is another technological highlight, offering superior flatness and durability compared to traditional natural stones. These innovations reflect a market trend towards democratizing precision, making professional-grade results accessible to the average household user through smart, mechanically sophisticated tools that remove the steep learning curve associated with classic methods.

Emerging technologies include non-contact sharpening methods, although these are still predominantly confined to industrial applications, and the development of sustainable, self-lubricating abrasive compositions that minimize the need for external cooling or oil. The technological emphasis remains heavily skewed towards enhancing the safety, speed, and accuracy of the sharpening process. The development of specialized ceramic compounds capable of reaching ultra-fine grits (over 10,000 grit equivalent) without sacrificing longevity underscores the continuous refinement of materials science that underpins the quality improvements across all segments of the market.

Regional Highlights

The global Knife Sharpener Market exhibits significant regional variations in growth patterns, product preferences, and competitive saturation. North America and Europe collectively represent the largest revenue share, primarily driven by a mature market characterized by high consumer awareness regarding knife maintenance, strong brand loyalty, and high disposable incomes facilitating the purchase of premium electric and precision manual sharpening systems. In these regions, the emphasis is heavily placed on ergonomic design, sophisticated multi-stage sharpening, and brand reputation. Manufacturers often introduce cutting-edge innovations in these geographies first, leveraging the demanding consumer base to validate new technologies and justify premium pricing, positioning these areas as key drivers of technological advancement.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid urbanization, the expansion of the middle class, and the burgeoning hospitality and food service sectors, particularly in China, India, and Southeast Asian nations. APAC’s market dynamics are highly influenced by regional culinary traditions, leading to substantial demand for specialized tools, such as high-precision water stones and angle guides necessary for maintaining traditional Japanese and Chinese cutlery. Local manufacturing capabilities in countries like Japan and South Korea also contribute significantly to both domestic consumption and global exports. The region offers high volume potential, although price sensitivity is a major factor, driving demand for efficient, mid-range manual and electric sharpeners.

Latin America (LATAM), and the Middle East and Africa (MEA) currently hold smaller market shares but are exhibiting promising growth trajectories, driven by increasing investment in tourism, food processing infrastructure, and the modernization of retail sectors. In MEA, the commercial segment (hotels, high-end catering) is a primary demand generator, requiring durable, commercial-grade equipment, often imported from established European and North American brands. LATAM markets, undergoing significant retail modernization, show increasing interest in affordable, convenient household electric sharpeners as disposable incomes gradually rise. Market penetration in these regions requires tailored distribution strategies to navigate complex logistics and varied consumer purchasing power, necessitating a strong focus on value proposition and durability.

- North America (NA): Mature market, high revenue share, dominance of premium electric and branded systems; high consumer adoption of high-tech solutions.

- Europe (EU): Strong focus on quality, durability, and traditional precision tools (e.g., German and Swiss brands); increasing regulatory pressure on sustainability drives innovation.

- Asia Pacific (APAC): Fastest-growing market due to urbanization and expansion of food service; high demand for specialized tools catering to regional cutlery traditions (e.g., whetstones).

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging markets with growth concentrated in the commercial sector (tourism/hospitality); focus on establishing efficient distribution networks for imported goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Knife Sharpener Market.- Chef'sChoice (EdgeCraft)

- Tormek

- Work Sharp

- Spyderco

- Lansky Sharpeners

- Victorinox

- Global

- Shun Cutlery

- Kyocera

- Zyliss

- PriorityChef

- Sharpal

- Kota

- DMT

- F Dick

- Norton Abrasives

- J.A. Henckels

- Kai Corporation

- Wusthof

- Presto

Frequently Asked Questions

Analyze common user questions about the Knife Sharpener market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between electric and manual knife sharpeners in terms of performance and market share?

Electric sharpeners, favored by the household and semi-commercial sectors, offer speed, consistency, and reduced user effort, driving the high-growth segment of the market. Manual sharpeners (stones and rods) dominate niche professional and enthusiast segments, offering superior precision and angle customization, though they require more skill. While electric units show faster growth, manual sharpeners maintain significant volume due to low entry cost.

How does the type of abrasive material (diamond vs. ceramic) impact the choice of knife sharpener?

Diamond abrasives are the hardest and provide rapid material removal, suitable for modern, hard stainless steels, dominating high-end electric and professional flat plate systems. Ceramic abrasives, used for intermediate and finishing stages, offer a finer edge and better polish, often preferred for honing and achieving a razor sharpness, offering durability and grit consistency across various products.

Which geographical region exhibits the highest growth potential in the Knife Sharpener Market through 2033?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This growth is primarily attributable to accelerated economic development, rising disposable income leading to greater investment in modern kitchen appliances, and rapid expansion within the hospitality and commercial food service sectors across major economies like China and India.

Are smart knife sharpeners integrating AI and sensor technology becoming commonplace, and what benefits do they offer?

While still a niche segment, smart sharpeners are emerging, primarily in high-end electric units. They integrate sensors and microprocessors to guide the user on correct angles, monitor pressure, and automatically adjust motor speed based on blade material. The key benefits are eliminating user error, ensuring optimal and consistent edge geometry, and enhancing blade longevity through precise material removal.

What are the main distribution channels driving sales for premium, professional-grade knife sharpeners?

Premium professional sharpeners are predominantly sold through the Offline Specialty Channel (e.g., dedicated culinary supply stores) and the Online Channel via specialized brand websites. These channels facilitate detailed product demonstrations, provide expert advice essential for complex tools, and ensure authenticity, maintaining brand integrity and supporting high average selling prices (ASPs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Knife Sharpener and Honer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Knife Sharpener Market Size Report By Type (Electric type, Manual type), By Application (Residential, Restaurant, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Knife Sharpener Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Electric Type, Manual Type), By Application (Residential, Restaurant, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager