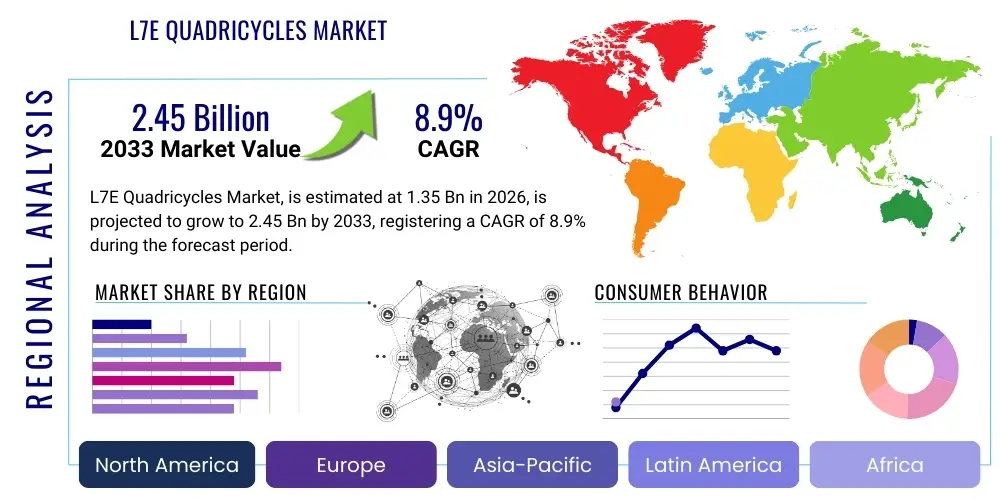

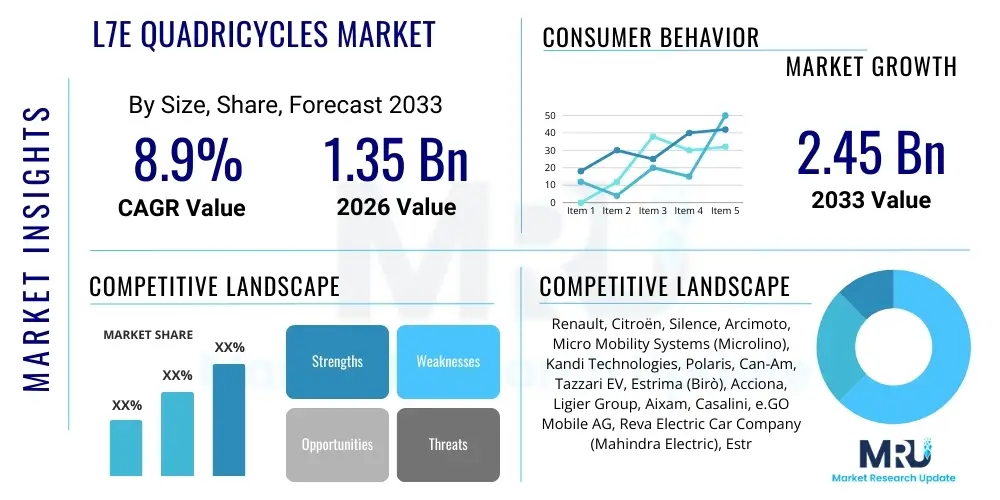

L7E Quadricycles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439491 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

L7E Quadricycles Market Size

The L7E Quadricycles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033.

L7E Quadricycles Market introduction

The L7E quadricycles market encompasses a category of four-wheeled motor vehicles, typically characterized by their lightweight construction and classification under European Union vehicle category L7E, which defines heavy quadricycles. These vehicles often bridge the gap between motorcycles and conventional passenger cars, offering enhanced stability and protection compared to two-wheelers, while maintaining a compact footprint ideal for urban environments. Primarily designed for urban and suburban mobility, L7E quadricycles are increasingly becoming a popular choice due to their operational efficiency, ease of parking, and reduced environmental impact, especially with the growing prevalence of electric powertrains. Their versatility makes them suitable for a wide array of applications, from personal commuting to specialized commercial uses, addressing modern transportation challenges.

Product descriptions for L7E quadricycles highlight features such as a maximum unladen mass of 450 kg for passenger vehicles (or 600 kg for goods transport), excluding battery weight for electric models, and a maximum net power of 15 kW. Many models are electric, offering zero-emission travel, low running costs, and silent operation. Major applications include daily urban commuting, last-mile delivery services for businesses, local tourism exploration, and integration into shared mobility fleets, addressing the evolving preferences of consumers and enterprises alike. These vehicles provide a practical solution for navigating congested city streets, offering a balance of convenience, affordability, and environmental responsibility, making them an attractive alternative to larger, heavier vehicles.

The benefits driving the adoption of L7E quadricycles are multifaceted. Environmentally, the shift towards electric L7E models significantly reduces carbon emissions and urban noise pollution, aligning with global sustainability goals and stringent environmental regulations. Economically, these vehicles offer lower purchase costs compared to traditional cars, coupled with substantially reduced operating expenses due to electricity pricing and minimal maintenance. Their compact size ensures superior maneuverability and ease of parking in dense urban areas, a critical advantage for city dwellers. Furthermore, government incentives, increasing fuel prices, and continuous technological advancements in battery efficiency and vehicle design are significant driving factors fueling market expansion, positioning L7E quadricycles as a viable and sustainable urban transport solution for the future.

L7E Quadricycles Market Executive Summary

The L7E Quadricycles Market is experiencing dynamic growth, propelled by a confluence of business trends, regional shifts, and evolving segment demands. A prominent business trend is the aggressive pursuit of electrification by manufacturers, leading to a proliferation of advanced electric L7E models that offer extended range, faster charging, and enhanced connectivity. This focus on sustainable mobility is also driving innovation in vehicle-sharing platforms, where quadricycles are proving to be a highly efficient and cost-effective option for urban fleets. Companies are also exploring integration with smart city infrastructure and developing specialized variants for specific commercial applications, such as compact utility vehicles for urban logistics and municipal services, indicating a diversification of business models beyond personal ownership.

Regionally, Europe stands as the mature and leading market for L7E quadricycles, benefiting from established regulatory frameworks, strong consumer awareness, and significant government incentives for electric vehicle adoption, particularly in countries like France, Italy, and Germany. However, Asia-Pacific is rapidly emerging as a high-growth region, driven by escalating urbanization, rising disposable incomes, and increasing environmental consciousness in populous nations such as China and India. These markets present substantial opportunities for manufacturers to introduce affordable and practical electric quadricycles that cater to the dense urban landscapes and developing infrastructure. North America, while currently a niche market, shows potential for specialized applications like campus mobility and urban tourism, with growing interest in eco-friendly and compact transport solutions.

Segmentation trends within the L7E quadricycles market underscore a clear shift towards electric powertrains, which now dominate new product launches and consumer interest due to their environmental benefits and lower running costs. The commercial segment is witnessing robust expansion, with last-mile delivery services, rental companies, and public utilities increasingly incorporating quadricycles into their fleets for efficient and sustainable operations. Concurrently, the personal use segment continues to thrive, particularly among urban commuters, younger generations, and individuals seeking secondary vehicles for local errands and leisure. This diversification across applications and the strong preference for electric variants are foundational elements shaping the market's trajectory, emphasizing a move towards more sustainable, efficient, and versatile urban transport solutions.

AI Impact Analysis on L7E Quadricycles Market

User questions regarding AI's impact on the L7E Quadricycles Market frequently revolve around potential enhancements in safety, efficiency, and user experience. Common queries include how AI can improve autonomous driving capabilities in these compact vehicles, optimize battery performance and charging routes, and contribute to predictive maintenance for fleet management. Users are also keen to understand AI's role in personalized user interfaces, advanced navigation systems, and potentially reducing accident rates through sophisticated sensor fusion and decision-making algorithms. The overarching theme is an expectation that AI will transform L7E quadricycles from basic urban transporters into intelligent, connected, and highly efficient mobility solutions, addressing both consumer convenience and operational challenges for businesses. Concerns also touch upon data privacy, the cost implications of integrating AI, and the regulatory landscape for autonomous features in this specific vehicle category.

- Autonomous Driving Features: AI enables advanced driver-assistance systems (ADAS) and progressively higher levels of autonomous driving capabilities, improving safety and reducing driver fatigue, particularly in controlled urban environments.

- Predictive Maintenance: AI algorithms analyze vehicle performance data to anticipate maintenance needs, optimize service schedules, and prevent breakdowns, significantly reducing operational costs and downtime for both individual owners and fleet operators.

- Optimized Route Planning and Navigation: AI-powered navigation systems offer real-time traffic analysis, dynamic route optimization, and personalized travel recommendations, enhancing efficiency for commuters and delivery services.

- Battery Management Systems (BMS): AI optimizes battery charging and discharging cycles, monitors battery health, and extends overall battery life, crucial for the performance and longevity of electric L7E quadricycles.

- Personalized User Experience: AI can adapt vehicle settings, infotainment options, and driver preferences, creating a more intuitive and enjoyable driving experience tailored to individual users.

- Enhanced Safety Systems: Through advanced sensor data analysis (cameras, radar, lidar), AI improves collision avoidance, pedestrian detection, and emergency braking systems, increasing overall vehicle safety.

- Manufacturing and Design Optimization: AI-driven simulations and generative design tools can accelerate the development process, optimize vehicle structures for weight and safety, and improve manufacturing efficiency.

- Shared Mobility Management: AI algorithms can optimize vehicle distribution, predict demand, and manage charging schedules for shared L7E quadricycle fleets, maximizing utilization and profitability.

DRO & Impact Forces Of L7E Quadricycles Market

The L7E Quadricycles Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. Key drivers include accelerating urbanization globally, which increases demand for compact and agile transportation solutions capable of navigating congested city centers efficiently. Growing environmental consciousness and stringent emission regulations, particularly in Europe, strongly push consumers and fleet operators towards zero-emission electric quadricycles. Furthermore, the rising costs of fuel for conventional vehicles make electric L7E alternatives more economically attractive over their lifecycle. Technological advancements in battery capacity, motor efficiency, and lightweight materials are continuously enhancing the performance and appeal of these vehicles, making them more viable for longer ranges and varied applications. Lastly, supportive government incentives, such as purchase subsidies and tax benefits for electric vehicles, play a crucial role in lowering the barrier to entry for potential buyers and fostering market adoption.

Despite these significant tailwinds, the market faces several notable restraints. The perception of L7E quadricycles as less safe than conventional cars, due to their smaller size and lighter construction, can deter some consumers, even with improved safety features. Limited top speeds and ranges of certain models can restrict their applicability to strictly urban or short-distance travel, impacting versatility. The initial purchase cost of electric L7E quadricycles, while lower than many full-sized electric cars, can still be a barrier for budget-conscious buyers in some regions. Moreover, regulatory complexities and varying classification standards across different regions can create market fragmentation and hinder widespread adoption. The nascent charging infrastructure in some developing markets also poses a challenge, limiting the convenience and practicality of electric models, which collectively slow down the market's full potential.

Opportunities for growth are abundant within the L7E quadricycles market, particularly in the expansion of shared mobility services where these vehicles offer a cost-effective and flexible option for short-term rentals and ride-sharing in urban cores. The burgeoning last-mile delivery sector presents a substantial commercial opportunity, as businesses seek efficient, sustainable, and compact vehicles to navigate urban logistics. Advancements in battery technology promise to overcome range anxiety, offering lighter, more powerful, and faster-charging solutions that enhance usability. Furthermore, the development of specialized L7E quadricycle variants for niche markets, such as university campuses, industrial parks, and tourist resorts, opens new revenue streams. External impact forces like global economic shifts, evolving consumer preferences towards sustainable living, and the increasing investment in smart city infrastructure will continue to shape the market dynamics, influencing demand and innovation in the years to come, emphasizing resilience and adaptability for market players.

Segmentation Analysis

The L7E Quadricycles Market is rigorously segmented to provide a granular understanding of its diverse landscape, enabling businesses to identify specific niches, tailor product development, and optimize market entry strategies. These segmentations typically consider power source, application, end-user, and specific vehicle characteristics, reflecting the varied demands and operational contexts within which L7E quadricycles operate. Analyzing these segments helps in comprehending consumer preferences, technological trends, and competitive dynamics, leading to more informed strategic decisions and targeted marketing efforts across different geographical regions and demographic groups, further refining market intelligence.

- By Power Source:

- Electric Quadricycles: Dominant and growing segment, driven by environmental regulations, government incentives, and advancements in battery technology. Offers zero emissions and lower running costs.

- Internal Combustion Engine (ICE) Quadricycles: Traditional segment, gradually declining in market share due to emission norms and the shift towards electrification, though still present in some regions due to lower initial cost.

- By Application:

- Personal Use: Vehicles used for daily commuting, local errands, leisure, and as secondary family vehicles, popular among urban dwellers seeking compact and efficient transport.

- Commercial Use: Encompasses diverse applications such as last-mile delivery services for logistics and e-commerce, urban tourism (rental fleets), municipal services (e.g., park maintenance, waste collection), and corporate fleets for intra-campus mobility.

- Shared Mobility: Integration into car-sharing, ride-sharing, and scooter-sharing platforms, offering flexible, on-demand urban transportation solutions.

- By End-User:

- Individual Consumers: Urban commuters, elderly population, young drivers (where legally permitted), and environmentally conscious individuals.

- Businesses & Fleet Operators: Logistics companies, rental agencies, hospitality sector, government agencies, and educational institutions.

- By Range (for Electric Quadricycles):

- Short Range (typically up to 100 km): Suited for intra-city commuting and localized deliveries.

- Medium Range (100-200 km): Offers more versatility for extended urban travel and suburban connections.

Value Chain Analysis For L7E Quadricycles Market

The value chain for the L7E Quadricycles Market encompasses a series of interconnected stages, beginning with the sourcing of raw materials and extending all the way to end-user consumption and aftermarket services. Upstream analysis reveals a critical dependency on suppliers of advanced materials, particularly lightweight composites and specialized steels for chassis and bodywork, which contribute to vehicle efficiency and safety. Battery manufacturers, motor suppliers, and electronic component producers form another crucial upstream segment, with innovation in these areas directly impacting vehicle performance, range, and cost. Furthermore, specialized suppliers of braking systems, suspension components, and interior fit-outs are integral, highlighting the diverse industrial ecosystem required to assemble these compact vehicles. The quality and cost-effectiveness of these upstream components directly influence the final product's competitiveness and market appeal, demanding robust supplier relationships and supply chain management.

Midstream activities primarily involve the design, engineering, and manufacturing processes, where raw materials and components are integrated into finished L7E quadricycles. This stage often includes vehicle assembly plants, quality control, and testing facilities. Innovation in manufacturing techniques, such as modular design and robotic assembly, is becoming increasingly important for efficiency and scalability. Downstream analysis focuses on the distribution, sales, and aftermarket services. Distribution channels are varied, including traditional automotive dealerships, specialized electric vehicle showrooms, online direct-to-consumer sales platforms, and partnerships with shared mobility operators. Direct sales allow manufacturers greater control over branding and customer relationships, while indirect channels leverage established networks to reach wider audiences, necessitating careful channel strategy based on regional market characteristics and brand positioning. The increasing trend towards digital showrooms and direct online ordering is reshaping traditional distribution models, emphasizing convenience and accessibility for consumers.

Post-sales, the aftermarket segment is crucial for sustained customer satisfaction and brand loyalty. This includes maintenance and repair services, spare parts supply, and increasingly, specialized charging solutions and software updates for electric models. The establishment of efficient service networks, availability of skilled technicians, and access to genuine parts are paramount for ensuring vehicle longevity and reliability. Both direct (manufacturer-owned service centers) and indirect (authorized third-party service providers) models are prevalent. The entire value chain is characterized by a strong drive towards sustainability, with manufacturers and suppliers increasingly focusing on circular economy principles, such as battery recycling and responsible sourcing, to enhance the overall environmental footprint of L7E quadricycles. This integrated approach across the value chain, from raw material to end-of-life, is essential for long-term success in this evolving market.

L7E Quadricycles Market Potential Customers

The L7E Quadricycles Market caters to a diverse range of potential customers, spanning individual consumers, businesses, and public sector entities, each driven by unique needs and preferences. For individual consumers, urban dwellers represent a significant demographic, particularly those seeking compact, efficient, and environmentally friendly alternatives to conventional cars for daily commuting, local errands, and short-distance travel within congested city environments. This includes young drivers (where regulations permit, often as a first vehicle), older adults looking for easy-to-manage vehicles, and environmentally conscious individuals keen on reducing their carbon footprint. The growing appeal of electric mobility, coupled with the practical advantages of easy parking and lower running costs, makes L7E quadricycles an attractive proposition for those prioritizing convenience and sustainability in their personal transport choices.

Businesses and fleet operators constitute another rapidly expanding segment of potential customers. This category includes last-mile delivery companies, courier services, and e-commerce logistics providers who benefit immensely from the agility and cost-efficiency of L7E quadricycles in urban settings. These vehicles offer a practical solution for navigating narrow streets and frequent stops, optimizing delivery times and reducing operational expenses. Furthermore, rental agencies and tourism operators in urban and resort areas are increasingly adopting quadricycles to offer unique and eco-friendly transportation experiences to tourists. Shared mobility platforms are also key customers, leveraging these vehicles for short-term rentals, providing flexible and accessible transportation options within cities. The robust potential for commercial applications underscores the versatility and economic viability of L7E quadricycles beyond personal use.

Beyond traditional consumer and commercial segments, L7E quadricycles also find potential buyers in niche markets and public sector organizations. Municipalities and public utility companies can utilize these vehicles for various tasks such as park maintenance, meter reading, or small-scale waste collection, benefiting from their compact size and low operating costs. Educational institutions, particularly large university campuses, can integrate quadricycles into their internal transport systems for staff and student mobility. Companies with large industrial complexes also represent a potential market for intra-facility transportation. The adaptability of L7E quadricycles to various configurations, from basic passenger models to utilitarian cargo variants, allows manufacturers to target a broad spectrum of end-users by customizing offerings to meet specific functional requirements and operational demands, thereby broadening their market penetration and appeal across diverse sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Renault, Citroën, Silence, Arcimoto, Micro Mobility Systems (Microlino), Kandi Technologies, Polaris, Can-Am, Tazzari EV, Estrima (Birò), Acciona, Ligier Group, Aixam, Casalini, e.GO Mobile AG, Reva Electric Car Company (Mahindra Electric), Estrima (Birò), Goupil (Polaris), E-car, S.A. (Invicta Electric), ZD Motor Co., Ltd. (Zhidou) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

L7E Quadricycles Market Key Technology Landscape

The L7E Quadricycles Market is undergoing a significant technological transformation, largely driven by the imperative for sustainable and efficient urban mobility. Central to this evolution is advancements in battery technology, with lithium-ion batteries being the predominant choice due to their high energy density, longer lifespan, and faster charging capabilities. Research and development efforts are continuously focused on improving battery chemistry to increase range, reduce weight, and lower costs, including exploring solid-state batteries and innovative thermal management systems to enhance performance and safety under various conditions. Concurrently, the efficiency and power output of electric motors are crucial, with permanent magnet synchronous motors (PMSM) and AC induction motors being optimized for compactness, high torque at low speeds, and improved energy conversion rates, ensuring dynamic performance suitable for urban driving while minimizing energy consumption. These powertrain innovations are fundamental to making electric L7E quadricycles more competitive and appealing to a broader consumer base.

Beyond the core powertrain, the integration of lightweight materials technology is pivotal for L7E quadricycles to meet their weight classification limits while maintaining structural integrity and safety. Materials such as high-strength steel, aluminum alloys, and advanced composites (e.g., carbon fiber reinforced plastics) are increasingly being utilized in chassis and body construction, reducing overall vehicle mass and thereby enhancing energy efficiency and maneuverability. This reduction in weight also positively impacts battery size requirements, creating a virtuous cycle of efficiency. Furthermore, the burgeoning field of connectivity and smart vehicle features is making its way into L7E quadricycles. Telematics systems, GPS navigation, and smartphone integration are becoming standard, offering features like remote diagnostics, geofencing for fleet management, and real-time traffic updates. Vehicle-to-everything (V2X) communication technologies are also in early stages of integration, promising enhanced safety through communication with infrastructure and other vehicles.

The future technology landscape for L7E quadricycles also heavily involves the development of Advanced Driver-Assistance Systems (ADAS) and foundational elements for autonomous driving capabilities. While full autonomy might be some time away for this category, features like parking assist, collision avoidance systems, blind-spot detection, and adaptive cruise control are being increasingly incorporated to improve safety and driver convenience. Sensor technology, including cameras, radar, and ultrasonic sensors, underpins these ADAS features, enabling better environmental perception. Software and artificial intelligence algorithms are critical for processing this sensor data and making intelligent driving decisions. Additionally, advancements in charging infrastructure, including fast-charging capabilities and the potential for wireless charging, are vital for overcoming range anxiety and improving the overall practicality of electric L7E quadricycles. The convergence of these technologies promises to transform L7E quadricycles into highly intelligent, safe, and efficient urban mobility solutions, reshaping the future of personal and commercial transportation in urban settings.

Regional Highlights

- Europe: Dominant market, driven by favorable regulatory frameworks, high urban density, strong environmental policies, and significant consumer adoption of electric vehicles. Countries like France, Italy, Germany, and Spain are leading in sales and manufacturing, with a mature ecosystem for L7E quadricycles.

- Asia Pacific (APAC): Emerging as a high-growth region due to rapid urbanization, increasing disposable incomes, and growing concerns over air pollution. China and India present vast opportunities, with local manufacturers and policy support driving the adoption of compact electric mobility solutions, particularly for personal use and last-mile delivery.

- North America: A niche market with slower adoption compared to Europe, primarily due to different regulatory classifications and a preference for larger vehicles. However, interest is growing in specific urban corridors, university campuses, and for specialized applications like tourism or utility vehicles, especially with the push for electrification.

- Latin America: Nascent market with potential for growth in dense urban centers like São Paulo, Mexico City, and Bogotá, where traffic congestion and environmental concerns are significant. Economic factors and developing infrastructure play a critical role in market penetration, with initial adoption focused on commercial fleets and specific urban projects.

- Middle East and Africa (MEA): Currently a very nascent market with limited penetration. Growth potential is tied to ongoing smart city developments, increasing investments in sustainable transportation infrastructure, and evolving regulatory support for electric and compact vehicles, particularly in urban hubs like Dubai and Riyadh.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the L7E Quadricycles Market.- Renault

- Citroën

- Silence

- Arcimoto

- Micro Mobility Systems (Microlino)

- Kandi Technologies

- Polaris

- Can-Am (BRP)

- Tazzari EV

- Estrima (Birò)

- Acciona

- Ligier Group

- Aixam

- Casalini

- e.GO Mobile AG

- Reva Electric Car Company (Mahindra Electric)

- Goupil (Polaris)

- E-car, S.A. (Invicta Electric)

- ZD Motor Co., Ltd. (Zhidou)

- XEV (Yoyo)

Frequently Asked Questions

What are L7E Quadricycles?

L7E quadricycles are a category of heavy four-wheeled motor vehicles, typically designed for urban mobility. They bridge the gap between motorcycles and cars, offering enhanced stability, compact size, and often feature electric powertrains for efficient, emission-free travel in city environments.

What are the primary drivers for the L7E Quadricycles market growth?

Key drivers include rapid urbanization, stringent environmental regulations pushing for zero-emission vehicles, rising fuel costs, government incentives for electric vehicle adoption, and continuous technological advancements in battery efficiency and vehicle design.

What are the main challenges hindering the growth of the L7E Quadricycles market?

Major challenges include public perception regarding safety compared to conventional cars, limitations in range and speed for some models, high initial purchase costs (for certain electric variants), and complexities arising from varied regulatory frameworks across different regions.

How is Artificial Intelligence impacting the L7E Quadricycles sector?

AI is transforming L7E quadricycles through features like advanced driver-assistance systems (ADAS), optimized route planning, predictive maintenance for fleets, intelligent battery management systems, and personalized user experiences, enhancing safety and efficiency.

Which regions are leading or showing significant potential in the L7E Quadricycles market?

Europe is the leading market due to favorable regulations and high adoption. Asia Pacific, particularly China and India, is an emerging high-growth region driven by urbanization. North America remains a niche market but shows potential in specific urban and campus applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager