Lab Supplies and Laboratory Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434456 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Lab Supplies and Laboratory Products Market Size

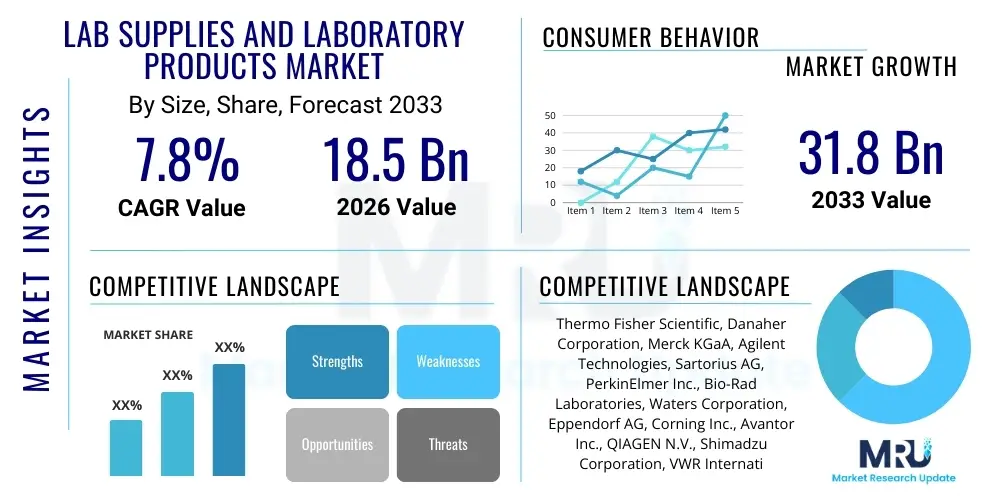

The Lab Supplies and Laboratory Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2033. This consistent expansion is predominantly fueled by the increasing investment in pharmaceutical and biotechnology research and development (R&D) activities globally, coupled with the rapid adoption of advanced analytical instruments and specialized consumables essential for high-throughput screening and complex diagnostics.

The core drivers of this valuation trajectory include the persistent demand for specialized disposables, such as advanced plasticware, chromatography columns, and reagents, which are critical for maintaining sterility and accuracy in experimental procedures. Furthermore, the push towards personalized medicine and genomics research necessitates highly precise and reliable laboratory tools, thereby bolstering the sales volume of sophisticated equipment like mass spectrometers, sequencers, and automated liquid handling systems across academic, industrial, and clinical settings.

Lab Supplies and Laboratory Products Market introduction

The Lab Supplies and Laboratory Products Market encompasses a wide array of tools, equipment, consumables, reagents, and services essential for conducting scientific research, clinical diagnostics, and quality control across various industries including biotechnology, pharmaceuticals, clinical chemistry, and academia. These products range from basic glassware and plasticware to highly sophisticated analytical instrumentation such as polymerase chain reaction (PCR) machines, centrifuges, microscopes, and advanced chromatography systems. The primary product description centers on their functionality: enabling accurate measurement, precise material handling, contamination control, sample preparation, and data generation necessary for scientific discovery and validation.

Major applications of lab supplies span drug discovery and development, where they support target identification and compound screening; clinical diagnostics, facilitating disease detection and monitoring; and fundamental life sciences research, aiding in cellular and molecular biology studies. The fundamental benefit provided by these products is the standardization and reproducibility of experimental results, which is paramount for regulatory compliance and scientific integrity. Driving factors include sustained government funding for life sciences research, the global imperative to develop novel therapies for chronic and infectious diseases, and the continuous trend toward laboratory automation to enhance operational efficiency and throughput.

Lab Supplies and Laboratory Products Market Executive Summary

The Lab Supplies and Laboratory Products Market is characterized by robust growth, driven primarily by favorable business trends surrounding increased private and public investment in biopharmaceutical R&D, particularly in novel modalities like cell and gene therapies. Segment trends indicate a strong shift towards advanced consumables and digitalized instrumentation, with automation tools witnessing the highest adoption rates due to labor scarcity and the need for precision at scale. Geographically, while North America and Europe remain the largest established markets due to their mature R&D infrastructures, the Asia Pacific region, led by China and India, exhibits the highest growth potential, fueled by expanding healthcare infrastructure, localized pharmaceutical manufacturing, and substantial governmental initiatives supporting academic research. Strategic mergers and acquisitions among key market players are consolidating the supply chain, enhancing specialized product portfolios, and accelerating the integration of software and data analysis capabilities into traditional laboratory workflows.

AI Impact Analysis on Lab Supplies and Laboratory Products Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Lab Supplies and Laboratory Products Market frequently center on the transformation of traditional laboratory workflows into highly optimized, autonomous environments. Key themes explored include how AI facilitates predictive maintenance for sensitive equipment, optimizing operational uptime and resource allocation; how machine learning enhances the efficacy of high-throughput screening (HTS) by rapidly analyzing complex data sets generated by sequencers and advanced microscopes; and the integration of AI-powered software into laboratory information management systems (LIMS) to improve data integrity and experimental design. Users are concerned with the necessary standardization of lab supplies (e.g., smart reagents or labeled plasticware) required to be compatible with fully automated, AI-driven robotic systems, expecting AI to dramatically shorten drug discovery timelines and minimize human error in routine tasks.

The transformative effect of AI extends deeply into the optimization of chemical inventories and supply chain management. By employing sophisticated algorithms, AI can predict future consumption rates of high-value reagents and specialized consumables based on research pipeline activity and ongoing experimental schedules. This predictive capability significantly reduces waste, prevents stockouts of critical supplies, and optimizes procurement processes, creating a leaner, more efficient laboratory ecosystem. Furthermore, AI tools are increasingly being embedded within analytical instruments themselves, enabling real-time data quality checks and automated calibration adjustments, ultimately improving the reliability and reproducibility of results derived using standard lab products.

This integration of smart technology necessitates an evolution in the manufacturing specifications for traditional lab supplies, demanding higher precision, embedded sensor capabilities, and seamless compatibility with robotic arm manipulation. The focus shifts from merely providing a container or tool to offering a data-generating component within an integrated system. For instance, AI requires standardized, machine-readable labeling on consumables to ensure automated tracking and provenance, driving manufacturers to invest heavily in smart labeling and tracking technologies, thereby adding a layer of digital value to basic physical products.

- AI-driven automation accelerates sample preparation and analysis throughput.

- Predictive maintenance algorithms reduce equipment downtime and maintenance costs.

- Machine learning improves data interpretation quality from high-volume analytical instruments.

- AI optimizes supply chain logistics, predicting reagent consumption and minimizing inventory costs.

- Integration of smart sensors into consumables enables automated tracking and real-time process monitoring.

DRO & Impact Forces Of Lab Supplies and Laboratory Products Market

The dynamics of the Lab Supplies and Laboratory Products Market are profoundly shaped by a combination of accelerating Drivers, persistent Restraints, and transformative Opportunities, collectively known as DRO & Impact Forces. The primary drivers stem from the globalization of pharmaceutical research, characterized by exponential increases in R&D spending, coupled with the rising incidence of chronic diseases demanding extensive diagnostic and therapeutic research. Technological advancements, particularly in genomics, proteomics, and personalized medicine, necessitate continuous upgrades and higher-specification supplies, sustaining demand. However, the market is constrained by factors such as the high capital expenditure required for sophisticated instruments, stringent regulatory hurdles (especially in clinical diagnostics), and the challenge of managing complex supply chains for sensitive biological reagents and materials across diverse global locations, which can be susceptible to geopolitical disruptions and logistical bottlenecks.

Opportunities for expansion are abundant, particularly in emerging economies like those across the Asia Pacific and Latin America, where rapid governmental investment in establishing advanced clinical and research infrastructure is occurring. Furthermore, the ongoing shift toward sustainable and eco-friendly laboratory practices presents a significant opportunity for manufacturers to innovate and introduce recyclable, biodegradable, or reduced-waste consumables. The integration of laboratory automation and informatics also provides a clear path for market players to offer value-added services, moving beyond mere product provision to providing holistic laboratory solutions that improve data management and experimental efficiency. These forces exert substantial pressure on market players to prioritize innovation, streamline production, and enhance their logistical resilience to maintain competitive relevance.

The impact forces influencing this market include rapid product obsolescence, especially in the instrumentation segment, where new technologies often render older models inefficient quickly, compelling users to frequently update their equipment portfolios. Furthermore, intense price competition, particularly in the basic consumable segment, mandates continuous optimization of manufacturing costs. The requirement for specialized expertise to operate and maintain high-end equipment acts as a barrier to entry for smaller research institutions but simultaneously drives the market for specialized training and servicing contracts provided by the major vendors. Overall, the market remains highly sensitive to public health crises (like pandemics), which immediately surge demand for specific diagnostic and testing supplies, demonstrating a significant correlation between global health priorities and market velocity.

Segmentation Analysis

The Lab Supplies and Laboratory Products Market is comprehensively segmented based on product type, end-user, technology, and application, allowing for a detailed analysis of market dynamics across specific functional areas. By product type, the market is primarily divided into Equipment (instruments like centrifuges, microscopes, PCR systems) and Consumables (reagents, plasticware, glassware, chemicals, and media), with the Consumables segment typically holding the larger market share due to their recurrent purchase cycles. Within equipment, analytical instrumentation, which includes high-performance liquid chromatography (HPLC) systems and mass spectrometers, commands the highest value due to the precision required in modern R&D.

The end-user segmentation is critical for understanding demand drivers, encompassing Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Hospitals and Diagnostic Centers, and Contract Research Organizations (CROs). Pharmaceutical and Biotech companies represent the dominant revenue generator, driven by extensive drug discovery pipelines and large-scale manufacturing needs. Academic institutions, while having lower per-unit spending, contribute significantly to volume demand, particularly for general-purpose equipment and routine consumables used in foundational scientific exploration and training. The rapid growth of CROs globally, acting as outsourcing partners for major pharma, is creating a concentrated and high-volume demand hub.

Further segmentation by technology, such as spectroscopy, chromatography, and flow cytometry, highlights areas of intense innovation and investment. The increasing adoption of high-throughput technologies across all end-user groups emphasizes the market’s pivot towards automation and miniaturization. Analyzing these segments provides strategic insights into investment opportunities, revealing that high-value, specialized reagents and advanced sample preparation kits designed for complex genomic assays are currently outpacing the growth of basic laboratory staples, indicating a maturation in research complexity.

- By Product Type:

- Equipment (Analytical Instruments, General Equipment, Automation Systems)

- Consumables (Reagents and Kits, Plasticware, Glassware, Media and Sera, Chemicals)

- By Technology:

- Spectroscopy (Mass, UV-Vis, Atomic)

- Chromatography (HPLC, GC, TLC)

- Cell Culture and Analysis

- Molecular Biology and Genomics

- By End User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Food and Beverage Testing Laboratories

Value Chain Analysis For Lab Supplies and Laboratory Products Market

The value chain for the Lab Supplies and Laboratory Products Market begins with Upstream Analysis focusing on the sourcing and refinement of specialized raw materials, including high-purity chemicals, specialized plastics, and complex electronic components necessary for instruments. Raw material suppliers must adhere to extremely stringent quality standards (e.g., medical grade, USP standards) due to the highly sensitive nature of laboratory experiments. This stage is dominated by specialized chemical producers and component manufacturers. Following material procurement, complex manufacturing processes convert these inputs into finished products, requiring specialized fabrication facilities for both high-precision instruments (e.g., laser alignment, microfluidic etching) and certified sterile consumables (e.g., cleanroom production of pipette tips and tissue culture plates).

The midstream segment involves the Distribution Channel, which is critical due to the wide variety of products and the global dispersion of customers. Distribution is handled through a mix of Direct and Indirect channels. Direct sales channels, utilized by major manufacturers for high-capital equipment and specialized services, offer technical support and customization directly to large pharmaceutical clients. Indirect channels rely heavily on third-party specialized distributors (e.g., VWR, Fisher Scientific equivalents) who manage large catalogs, inventory, logistics (often refrigerated or hazardous material handling), and localized customer support, serving the vast majority of academic and small-to-midsize clinical labs efficiently. These distributors aggregate products from numerous manufacturers, simplifying the procurement process for end-users.

The Downstream Analysis involves the integration and usage of these products by the End-Users. Effective downstream operations require manufacturers to provide extensive after-sales support, including installation, calibration, preventative maintenance, and application training, especially for complex analytical instruments. The efficiency of the entire value chain is dictated by logistical precision, as many reagents and biological supplies are temperature-sensitive and have short shelf lives. Digitalization, through e-commerce platforms and LIMS integration, is increasingly optimizing the transaction and inventory management aspects between distributors and end-users, ensuring timely delivery and minimizing disruptions to critical research timelines.

Lab Supplies and Laboratory Products Market Potential Customers

The potential customer base for the Lab Supplies and Laboratory Products Market is diverse yet concentrated around institutions engaged in scientific inquiry, healthcare, and industrial quality assurance. The primary End-User/Buyers of these products are multinational Pharmaceutical and Biotechnology Companies, which utilize supplies extensively across their discovery, preclinical testing, clinical trials, and manufacturing quality control laboratories. These customers demand high-volume, regulatory-compliant, and often custom-designed consumables and state-of-the-art analytical equipment to maintain rapid pipeline progression and strict regulatory standards required for drug approval.

Another major segment comprises Academic and Government Research Institutes, which rely heavily on lab supplies to execute foundational scientific grants and educational programs. While price sensitivity can be higher in this segment, the demand volume for general-purpose equipment, educational materials, and basic reagents is substantial and stable, often tied directly to governmental and philanthropic funding cycles. Clinical Diagnostic Laboratories and Hospitals form a critical third segment, purchasing high volumes of standardized kits, blood collection supplies, and specialized reagents required for routine patient testing, infectious disease screening, and histology services, prioritizing reliability and certification.

Furthermore, specialized industrial sectors such as Contract Research Organizations (CROs), which offer outsourced R&D services, and the Food and Beverage, Environmental Testing, and Forensics sectors represent significant buyers. CROs, in particular, serve as high-growth, concentrated customers due to their mandate to execute projects for multiple clients, requiring immediate access to a broad and advanced suite of equipment and supplies. The consistent demand across these varied yet interrelated sectors ensures the structural stability and continued growth of the lab supplies market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, Agilent Technologies, Sartorius AG, PerkinElmer Inc., Bio-Rad Laboratories, Waters Corporation, Eppendorf AG, Corning Inc., Avantor Inc., QIAGEN N.V., Shimadzu Corporation, VWR International (Avantor), Mettler-Toledo International, Inc., Promega Corporation, Tecan Group, Greiner Bio-One, Hitachi High-Tech Corporation, Becton Dickinson and Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lab Supplies and Laboratory Products Market Key Technology Landscape

The Lab Supplies and Laboratory Products Market is characterized by a rapidly evolving technological landscape, focusing heavily on enhancing precision, miniaturization, and throughput. A critical technology driving demand is the integration of advanced analytical chemistry platforms, specifically High-Performance Liquid Chromatography (HPLC) coupled with high-resolution Mass Spectrometry (HRMS). These systems require highly specialized columns, mobile phases, and certified reference standards, significantly boosting the demand for high-purity consumables. Furthermore, the exponential growth of genomics necessitates continuous innovation in sequencing technologies and Polymerase Chain Reaction (PCR) systems, leading to the development of microfluidic-based PCR devices and single-cell sequencing platforms that demand highly sensitive, low-volume plasticware and bespoke reagent kits tailored for minimal sample loss and high specificity.

Automation and digitalization represent the second major pillar of the technology landscape. Laboratory Information Management Systems (LIMS) are foundational, integrating instrument data, managing sample tracking, and ensuring regulatory compliance. Complementing LIMS are automated liquid handling robots and robotic plate readers, which minimize human intervention and error, thereby requiring specialized consumables designed for robotic compatibility, such as standardized microplates and reservoirs with optimized flatness and volume consistency. The application of sensor technology is also rising, with smart lab products featuring embedded connectivity (IoT) that tracks usage, temperature, and inventory levels automatically, enabling proactive resupply management and real-time environmental monitoring within controlled laboratory settings.

Finally, the growing focus on cell and gene therapy manufacturing has propelled the need for specialized cell culture technologies. This includes the development of advanced bioreactors, highly regulated cell culture media (often serum-free or chemically defined), and specialized materials for sterile processing and cryopreservation. Technologies such as flow cytometry and high-content imaging systems are crucial for cell characterization and quality control, requiring specialized reagents and precise optical plasticware. Overall, the technology landscape is migrating towards fully integrated, software-driven solutions that connect instruments and consumables seamlessly, optimizing the entire laboratory workflow from sample input to data output.

Regional Highlights

The global Lab Supplies and Laboratory Products Market exhibits significant regional variations in terms of maturity, growth trajectory, and technological adoption, largely reflecting localized R&D expenditure and healthcare infrastructure development. North America, encompassing the United States and Canada, currently holds the largest market share, driven by massive federal and private investment in biomedical research, a strong presence of major pharmaceutical and biotechnology headquarters, and the early adoption of advanced laboratory automation and AI-integrated systems. The dense network of leading academic research institutions and well-established clinical diagnostic centers ensures continuous, high-value demand for both high-end instrumentation and specialized, quality-certified consumables. Regulatory frameworks, while stringent, are conducive to innovation, fostering a market environment ripe for the introduction of cutting-edge research tools.

Europe represents the second-largest market, characterized by significant governmental support for life sciences, particularly in Germany, the UK, and France. The market here is sustained by a robust pharmaceutical manufacturing base and high standards for environmental and regulatory testing. European markets place a premium on reliability and longevity of equipment, often coupled with a growing focus on sustainable laboratory practices, driving demand for energy-efficient instruments and eco-friendly consumables. However, market growth in Europe can be slightly tempered by bureaucratic procurement processes within public health systems and academic sectors.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fundamentally fueled by increased government expenditure in healthcare infrastructure development, the establishment of numerous research hubs, and the migration of pharmaceutical manufacturing and R&D activities to countries like China, India, and South Korea. These nations are aggressively investing in domestic biotechnology capabilities, creating immense, untapped demand for modern analytical equipment and bulk consumables. The market in APAC is also characterized by a growing price sensitivity, favoring locally produced or value-optimized products, although demand for high-quality imported instruments remains strong within premier research facilities.

Latin America and the Middle East & Africa (MEA) currently represent smaller, yet strategically important, emerging markets. Growth in Latin America is tied to improving healthcare access and increased funding for academic research, particularly in Brazil and Mexico. The MEA region’s market expansion is being driven by significant investment in developing world-class medical cities and diversifying economies away from oil dependency, leading to the creation of advanced diagnostic and biomedical research centers that require full complements of laboratory supplies and products.

- North America: Dominant market share; driven by high R&D spending, biopharma presence, and early adoption of automation and AI.

- Europe: Mature market; sustained by strong regulatory framework, established pharmaceutical industry, and increasing focus on lab sustainability.

- Asia Pacific (APAC): Highest projected growth rate; fueled by government investment, infrastructure expansion, and localized manufacturing shift (China, India).

- Latin America & MEA: Emerging high-potential markets; growth linked to improving clinical diagnostics infrastructure and economic diversification investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lab Supplies and Laboratory Products Market.- Thermo Fisher Scientific

- Danaher Corporation

- Merck KGaA

- Agilent Technologies

- Sartorius AG

- PerkinElmer Inc.

- Bio-Rad Laboratories

- Waters Corporation

- Eppendorf AG

- Corning Inc.

- Avantor Inc.

- QIAGEN N.V.

- Shimadzu Corporation

- VWR International (Avantor)

- Mettler-Toledo International, Inc.

- Promega Corporation

- Tecan Group

- Greiner Bio-One

- Hitachi High-Tech Corporation

- Becton Dickinson and Company

Frequently Asked Questions

Analyze common user questions about the Lab Supplies and Laboratory Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the substantial growth in the Lab Supplies and Laboratory Products Market?

The market growth is primarily driven by surging global R&D expenditure within the pharmaceutical and biotechnology sectors, the increasing prevalence of chronic and infectious diseases necessitating advanced diagnostics, and widespread adoption of laboratory automation technologies to enhance precision and throughput.

Which product segment holds the highest market share and why?

The consumables segment, including reagents, kits, and specialized plasticware, typically holds the highest market share. This is due to the necessity of continuous, recurring purchases required to execute experiments, unlike instruments which represent high initial capital expenditure.

How is digitalization impacting the procurement of lab supplies?

Digitalization is streamlining procurement through advanced Laboratory Information Management Systems (LIMS), e-commerce platforms, and smart inventory management tools, which utilize sensors and AI to predict consumption, automate reordering, and ensure end-to-end sample tracking and data integrity.

What are the primary restraints challenging market expansion?

Key restraints include the high initial investment cost associated with purchasing sophisticated analytical instruments, the complexity and expense of maintaining compliant cold chain logistics for sensitive reagents, and strict global regulatory requirements for clinical-grade products.

Which regional market offers the most significant growth opportunity?

The Asia Pacific (APAC) region, specifically countries like China and India, offers the most significant growth opportunity due to robust governmental initiatives supporting scientific research, rapidly expanding domestic biopharma manufacturing capabilities, and substantial investment in new laboratory infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager