Label Printer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434357 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Label Printer Market Size

The Label Printer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global shift towards automated supply chain management, the pervasive growth of e-commerce necessitating efficient inventory tracking, and increasing regulatory demands across pharmaceutical and food industries for detailed product labeling and traceability.

Label Printer Market introduction

The Label Printer Market encompasses devices designed for creating and printing adhesive-backed labels, tags, and wristbands used primarily for identification, tracking, compliance, and product information dissemination across various industrial and commercial settings. These devices utilize diverse printing technologies, predominantly thermal transfer and direct thermal, catering to specific durability and operational speed requirements. Modern label printers are critical infrastructure components, integrating seamlessly with Enterprise Resource Planning (ERP) systems, Warehouse Management Systems (WMS), and Point-of-Sale (POS) systems to ensure real-time data accuracy and operational efficiency throughout the global supply chain, from raw material procurement to final consumer delivery.

Major applications of label printers span logistics and warehousing, where they are essential for shipping labels, pallet tracking, and asset management; retail, utilized for price marking, shelf labeling, and security tags; and healthcare, indispensable for patient identification, specimen tracking, and pharmacy labeling compliance. The proliferation of stock-keeping units (SKUs) resulting from mass customization and the continuous evolution of global commerce models necessitate highly flexible, reliable, and high-speed labeling solutions. Benefits derived from deploying advanced label printing systems include minimized human error, improved inventory visibility, enhanced regulatory adherence, and accelerated processing times, ultimately contributing to reduced operational expenditure and superior customer satisfaction.

Key driving factors supporting the sustained growth of this market include the digital transformation initiatives across manufacturing sectors emphasizing Industry 4.0 principles, the exponential rise in parcel volume generated by online retail giants, and stringent governmental regulations—particularly in food and pharmaceutical sectors—mandating precise, tamper-proof labeling for consumer safety. Furthermore, the increasing adoption of mobile label printers offers significant advantages in flexibility and efficiency within dynamic warehouse environments, providing workers with the capability to print labels exactly where they are needed, eliminating unnecessary travel time and bottlenecks in workflow processes.

Label Printer Market Executive Summary

The Label Printer Market is currently experiencing robust momentum, characterized by several intersecting business and technological trends focusing on connectivity, efficiency, and sustainability. Key business trends indicate a definitive shift towards industrial and mobile printer adoption, driven by the demand for higher throughput and operational flexibility in large-scale logistics and manufacturing hubs. Companies are increasingly investing in printers capable of supporting advanced data capture technologies, such as RFID encoding and 2D barcode printing, transitioning from traditional linear barcodes to data matrix formats to accommodate greater information density, especially pertinent for product serialization in pharmaceuticals and electronics.

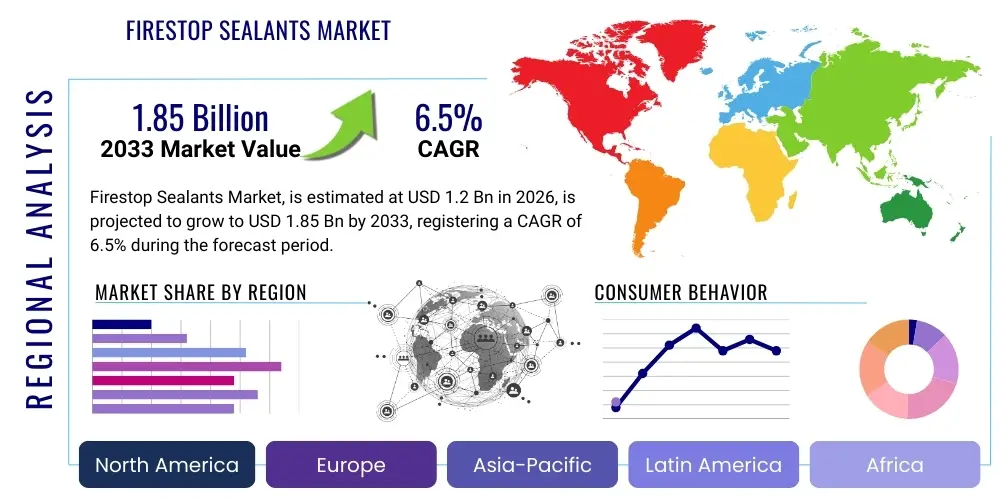

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, propelled by rapid industrialization, massive investments in infrastructure development, and the burgeoning e-commerce ecosystem in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, maintain dominance in terms of technological adoption and value, driven by high labor costs necessitating automation and stringent regulatory environments demanding advanced tracking solutions. These regions are focused on upgrading existing equipment to smart, IoT-enabled devices that facilitate predictive maintenance and remote management, improving overall equipment effectiveness (OEE) metrics.

Segmentation trends reveal that the thermal transfer segment holds a substantial market share due to the superior durability and longevity of the printed labels, favored in permanent asset tagging and extreme environmental conditions within manufacturing and chemical industries. Concurrently, the mobile label printer segment is exhibiting the highest growth rate, reflecting the increased emphasis on field services, on-demand printing in warehousing, and last-mile delivery optimization. The logistics and transportation sector remains the largest application segment, underscoring the critical role label printers play in facilitating complex, multi-modal distribution networks globally, ensuring accuracy and speed essential for modern consumer expectations.

AI Impact Analysis on Label Printer Market

Common user questions regarding AI's impact on the Label Printer Market often revolve around how artificial intelligence can optimize printing workflows, reduce consumables waste, and enhance data integrity across complex supply chains. Users inquire about AI's potential in predictive maintenance (forecasting printer failures before they occur), automating label layout and design based on real-time data inputs (e.g., dynamically changing compliance information or destination details), and optimizing the material consumption process. The primary theme identified is the expectation that AI integration will transform label printing from a static, reactive process into a dynamic, intelligent system capable of autonomous decision-making and continuous self-optimization, thereby maximizing uptime and minimizing total cost of ownership (TCO).

The influence of AI is most pronounced in refining operational efficiencies and supporting advanced traceability requirements. AI algorithms are being deployed in enterprise printing solutions to analyze historical usage patterns, environmental factors, and print job characteristics. This analysis allows the system to proactively flag potential component wear, automatically order replacement parts or ink/ribbon supplies just-in-time, and dynamically adjust print settings (such as heat and speed) to maximize print quality while minimizing energy consumption. Such predictive capabilities significantly reduce unplanned downtime, a critical metric in high-volume, time-sensitive logistics and manufacturing operations where a stoppage in labeling can halt the entire production line.

Furthermore, AI plays a crucial role in enhancing data integrity and compliance in highly regulated environments, particularly pharmaceuticals and food safety. AI-powered vision systems integrated with high-speed label applicators use machine learning to inspect printed labels immediately after printing, verifying readability, barcode quality, and placement accuracy against defined standards, mitigating the risk of non-compliance and costly recalls. This shift towards smart quality control, driven by AI, elevates the reliability of the label printing process, ensuring that the critical data embedded in the label is accurate and scannable throughout its lifecycle, supporting global serialization and traceability mandates effectively.

- AI-driven predictive maintenance forecasts printer failures, minimizing operational downtime and maximizing printer lifespan.

- Intelligent label design automation ensures dynamic content adaptation based on changing regulatory or supply chain data.

- Optimization of print settings (heat, speed, ribbon usage) through machine learning reduces consumable waste and operational costs.

- AI-powered vision systems perform real-time quality control and verification of printed labels and barcodes for regulatory compliance.

- Integration with IoT sensors facilitates autonomous fleet management and resource allocation across large-scale printing infrastructures.

DRO & Impact Forces Of Label Printer Market

The dynamics of the Label Printer Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market direction and investment priorities. A primary driver is the pervasive expansion of the global e-commerce sector, which necessitates billions of shipping labels annually, driving demand for high-speed, reliable industrial and desktop printers. Coupled with this is the escalating need for regulatory compliance across pharmaceuticals (e.g., UDI, serialization) and food safety (e.g., allergen labeling, country of origin), mandating highly accurate and consistent printing capabilities. These foundational drivers are strongly impacted by the accelerating trend of manufacturing automation and the adoption of digital transformation frameworks like Industry 4.0, integrating printing devices into cohesive, intelligent production ecosystems.

However, market growth faces notable restraints, primarily the significant initial capital expenditure associated with high-end industrial label printers and specialized RFID encoding equipment, which can present barriers to entry for Small and Medium-sized Enterprises (SMEs). Furthermore, the market is continually challenged by the requirement for standardization and interoperability; integrating diverse label printing hardware and proprietary software into disparate legacy IT systems across global operations often presents technical complexity and cost overhead. Price sensitivity in competitive sectors like fast-moving consumer goods (FMCG) also pressures manufacturers to lower the cost of consumables (ribbons, labels, thermal paper), which impacts the overall profitability and innovation investment cycles of hardware providers.

Opportunities for future expansion are predominantly centered around the convergence of label printing with cutting-edge technologies. The rise of Smart Labels, incorporating NFC, RFID, and flexible electronics, creates demand for specialized, advanced printers capable of encoding and printing on novel materials, opening new revenue streams in asset tracking and anti-counterfeiting applications. Sustainability also represents a major opportunity; developing eco-friendly printing solutions, such as linerless labels, recyclable media, and energy-efficient thermal technology, aligns with global corporate social responsibility goals and appeals to environmentally conscious businesses. Moreover, the growing focus on decentralized, edge computing models provides an avenue for advanced mobile printing solutions with enhanced processing power and security features.

Segmentation Analysis

The Label Printer Market is extensively segmented based on technology type, material capability, deployment method (mobile, desktop, industrial), and diverse application sectors. Analyzing these segments provides a granular view of market dynamics, revealing specific areas of high growth and technological maturity. The predominant segmentation criteria revolve around the printing method—primarily thermal—and the intended use environment, which dictates factors such as print speed, durability, duty cycle, and connectivity options. Strategic market players tailor their product lines, ranging from compact desktop printers for retail environments to rugged industrial units designed for 24/7 manufacturing operations, to address these specific sectoral needs and leverage specialized material compatibility, such as printing on highly resistant polyester or specific compliance-mandated direct food contact materials.

- By Type: Direct Thermal, Thermal Transfer, Inkjet, Laser, Dot Matrix

- By Technology/Mechanism: Desktop Printers, Industrial Printers, Mobile Printers

- By Printing Resolution: 203 DPI, 300 DPI, 600 DPI and above

- By Connectivity: Wired (USB, Ethernet), Wireless (Wi-Fi, Bluetooth, NFC)

- By Application: Logistics and Shipping, Manufacturing, Retail and e-commerce, Healthcare (Patient Identification, Pharmacy), Government, Food and Beverage

- By Consumables: Labels (Paper, Synthetic), Ribbons, Thermal Transfer Paper, Specialist Media (RFID/NFC Tags)

- By Region: North America, Europe, Asia Pacific (APAC), Latin America (LATAM), Middle East and Africa (MEA)

Value Chain Analysis For Label Printer Market

The value chain of the Label Printer Market is intricate, spanning from the highly technical upstream sourcing of specialized components to the complex downstream processes of distribution, integration, and aftermarket support. The upstream analysis focuses heavily on the procurement and development of critical hardware components, including thermal print heads (often supplied by specialized manufacturers like Kyocera or ROHM), integrated circuits, specialized sensors, and the internal mechanisms responsible for media handling. Additionally, the development of proprietary firmware and driver software that ensures seamless integration with enterprise systems is a crucial, high-value component of the upstream supply chain. Companies that control key component manufacturing or intellectual property related to print head technology maintain a significant competitive advantage due to the high replacement cost and technical difficulty of these parts.

Midstream activities involve the core manufacturing, assembly, and testing of the label printer units. This stage includes complex system integration, quality control, and the implementation of customized regional configurations (power supplies, language settings, regulatory compliance certifications). High-volume industrial printers often undergo specialized manufacturing processes to ensure ruggedness and compliance with stringent environmental standards. Simultaneously, the manufacturing of label consumables (adhesive materials, coatings, thermal papers, and transfer ribbons) operates in parallel, heavily influencing the performance and total cost of ownership of the final product. Strong vertical integration between hardware manufacturers and consumable suppliers often leads to optimized performance and locked-in customer relationships.

The downstream segment primarily involves distribution channels and end-user engagement. Distribution is handled through a mix of direct sales channels, particularly for large industrial accounts requiring customization and integration services, and indirect channels relying on value-added resellers (VARs), system integrators, and e-commerce platforms for wider market reach, especially for desktop and mobile units. Post-sale activities, including maintenance contracts, provision of proprietary consumables, technical support, and the provision of professional services for integration with complex WMS and ERP systems, represent significant recurring revenue streams. The efficiency of the distribution network and the technical expertise of the channel partners are critical determinants of customer satisfaction and market penetration.

Label Printer Market Potential Customers

Potential customers for label printers are highly diverse, spanning virtually every sector involved in the movement, inventory, or regulatory handling of physical goods and sensitive information. The largest segment of end-users is situated within the logistics, warehousing, and transportation sector. These companies rely heavily on high-speed industrial printers for printing shipping manifests, compliance labels, pallet identifiers, and carton labels, necessitating robust, high-duty cycle equipment capable of operating in harsh environments. The increasing demand for same-day and next-day delivery models further solidifies this segment as a primary growth driver, demanding highly mobile and reliable label printing solutions for optimized last-mile execution.

The retail and e-commerce sector represents another critical customer base, utilizing desktop and mobile printers for applications such as shelf labeling, markdown and promotion tags, price integrity checks, asset management, and point-of-sale receipt printing integrated with inventory databases. The rapid expansion of omnichannel retail requires flexible labeling solutions that can handle both traditional retail needs and high-volume e-commerce fulfillment labeling from centralized distribution centers. These customers prioritize ease of use, connectivity options, and aesthetics, particularly for devices visible to store staff and customers.

Furthermore, the healthcare and pharmaceutical industries constitute a high-value customer segment due to stringent regulatory requirements and the need for absolute accuracy in patient safety applications. Hospitals, clinics, laboratories, and pharmaceutical manufacturers utilize label printers for patient wristband identification, specimen labeling, pharmacy prescription fulfillment, and serializing drug packaging to meet global traceability mandates (e.g., DSCSA in the US). These applications demand specialized printers that can handle specific media (e.g., antimicrobial plastics) and offer high resolution to ensure minute barcode readability, where failure to print accurately can have severe safety and legal implications. Other significant customer segments include manufacturing (work-in-progress tracking, asset tagging) and government/defense (secure document and asset tracking).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, SATO Holdings, Honeywell International, Brother Industries, Toshiba TEC, Epson Corporation, Avery Dennison, Seiko Epson, Primera Technology, TSC Auto ID Technology, cab Produkttechnik, Dascom, Printronix, Linx Printing Technologies, Wasp Barcode Technologies, Datamax-O'Neil (part of Honeywell), GoDEX International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Label Printer Market Key Technology Landscape

The technological landscape of the Label Printer Market is rapidly evolving beyond basic thermal printing capabilities, driven primarily by the need for enhanced data capture, connectivity, and enterprise integration. The most significant shift involves the sophisticated convergence of traditional thermal printing with radio frequency identification (RFID) encoding capabilities. Advanced label printers are now expected to not only print human-readable information and barcodes but also simultaneously encode RFID inlays embedded within the label material. This integrated process ensures that labels serve both immediate visual/scanner identification and long-range, automated inventory tracking, which is essential for high-value asset management and precise supply chain synchronization. The adoption of specialized UHF and HF RFID encoding modules represents a substantial value addition for industrial customers.

Connectivity and the Internet of Things (IoT) are fundamentally transforming label printer deployment and management. Modern label printers feature advanced networking capabilities, including secure Wi-Fi 6, robust Bluetooth connectivity, and full integration with cloud-based device management platforms. This IoT integration allows large organizations to monitor the performance, consumables status, and maintenance needs of entire fleets of printers remotely and in real-time, regardless of geographical location. This move towards 'Printer as a Service' or managed print services improves fleet uptime, optimizes inventory management for consumables, and enables predictive servicing schedules, significantly reducing the Total Cost of Ownership (TCO) for enterprises with distributed operations.

Furthermore, innovations in print media and ink technology are shaping the market. There is increasing commercial viability for linerless labels—labels without the traditional silicone backing liner—which significantly reduces waste, increases the number of labels per roll, and improves efficiency in high-throughput retail and logistics environments. In specialized applications, particularly those requiring color coding or highly durable imagery, advanced inkjet technology, capable of high-resolution, full-color label printing on demand, is gaining traction over older, pre-printed label stocks. Security features, such as micro-printing, tamper-evident materials, and cryptographic elements, are also being integrated directly into the printing process, essential for combating counterfeiting in pharmaceuticals and luxury goods sectors, further highlighting the technological maturity of the market.

Regional Highlights

Regional dynamics in the Label Printer Market are highly divergent, influenced by factors such as the maturity of e-commerce penetration, regulatory mandates, and levels of industrial automation adoption.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive manufacturing bases (China, India), rapid infrastructure investment in logistics networks, and the dominant growth of digital retail markets. The region's increasing adoption of automated warehousing solutions and the need to comply with international traceability standards drive high demand for industrial and high-volume desktop thermal printers.

- North America: North America holds a leading position in market value, characterized by early adoption of advanced technologies like RFID and mobile printing. The demand here is driven by the robust presence of large e-commerce entities, stringent healthcare regulations (requiring precise patient and specimen labeling), and a strong focus on automation to offset high labor costs, leading to high investment in integrated, IoT-enabled printing systems.

- Europe: Europe represents a mature market with steady growth, primarily driven by the implementation of EU regulations concerning food labeling (e.g., origin tracing) and pharmaceutical serialization (e.g., Falsified Medicines Directive). The emphasis in this region is placed on sustainability, driving demand for linerless, environmentally friendly label media and energy-efficient printing equipment. Germany, the UK, and France are key contributors to market size due to strong manufacturing and logistics sectors.

- Latin America (LATAM): The LATAM market is experiencing significant growth from an emerging base, driven by improving trade infrastructure and the professionalization of logistics operations. Investment in basic and mid-range thermal printers is high, focusing on standardizing identification processes across various manufacturing and retail operations.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC nations, driven by large-scale infrastructure projects, expansion of logistics hubs (like Dubai), and growing investment in the pharmaceutical sector. Demand is primarily focused on durable, reliable printing solutions suitable for high-temperature and sometimes harsh operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Label Printer Market.- Zebra Technologies

- SATO Holdings

- Honeywell International

- Brother Industries

- Toshiba TEC

- Epson Corporation

- Avery Dennison

- Seiko Epson

- Primera Technology

- TSC Auto ID Technology

- cab Produkttechnik

- Dascom

- Printronix

- Linx Printing Technologies

- Wasp Barcode Technologies

- GoDEX International

- DataMax-O'Neil (now part of Honeywell)

- CITIZEN SYSTEMS EUROPE

Frequently Asked Questions

Analyze common user questions about the Label Printer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Label Printer Market?

The primary driver is the exponential growth of the global e-commerce industry, which necessitates precise, high-speed, and high-volume labeling for parcel tracking, fulfillment logistics, and returns management worldwide, coupled with increasingly strict regulatory requirements for product traceability.

Which label printer technology dominates the market and why?

Thermal printing technology, specifically thermal transfer, dominates the industrial segment due to its reliability, speed, and the durability of the resulting labels, making it ideal for long-term identification, harsh environment applications, and stringent regulatory compliance in manufacturing and logistics.

How is the integration of RFID impacting future label printer designs?

The integration of RFID requires label printers to function as encoders, simultaneously printing visual data and embedding digital data onto RFID inlays. Future designs are focused on optimizing high-speed encoding capabilities, ensuring accuracy, and supporting diverse tag types for advanced asset tracking applications.

What role do mobile label printers play in modern supply chain management?

Mobile label printers significantly enhance operational efficiency by allowing workers to print labels on demand at the point of application, such as in shipping docks or remote inventory locations. This capability reduces walking time, minimizes errors, and supports real-time inventory adjustments and last-mile delivery processes effectively.

Are sustainable printing solutions, such as linerless labels, a major market trend?

Yes, sustainability is a critical market trend. Linerless labels are increasingly adopted, particularly in high-volume sectors like retail and quick-service restaurants, as they eliminate liner waste, reduce storage space, and improve the number of labels per roll, aligning with corporate environmental mandates and waste reduction goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Barcode Label Printer Market Size Report By Type (Desktop Type, Industrial Type, Mobile Type), By Application (Transportation & Logistics, Manufacturing, Retail, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Label Printer Applicator Machines Market Statistics 2025 Analysis By Application (Food and Beverage, Pharmaceutical and Healthcare, Electronics, Others), By Type (Integrated Automated Label Applicators, Stand-alone Labelers, Semi-automated Applicators), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Color Label Printer Market Statistics 2025 Analysis By Application (Home & Home Office, Small & Medium Business, Large Business & Workgroups, School, Government), By Type (Inkjet, Laser, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Handheld Label Printer Market Statistics 2025 Analysis By Application (Manufacturing, Retail & Logistics, Home & Office & Education), By Type (With Wifi, Non-Wifi), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager