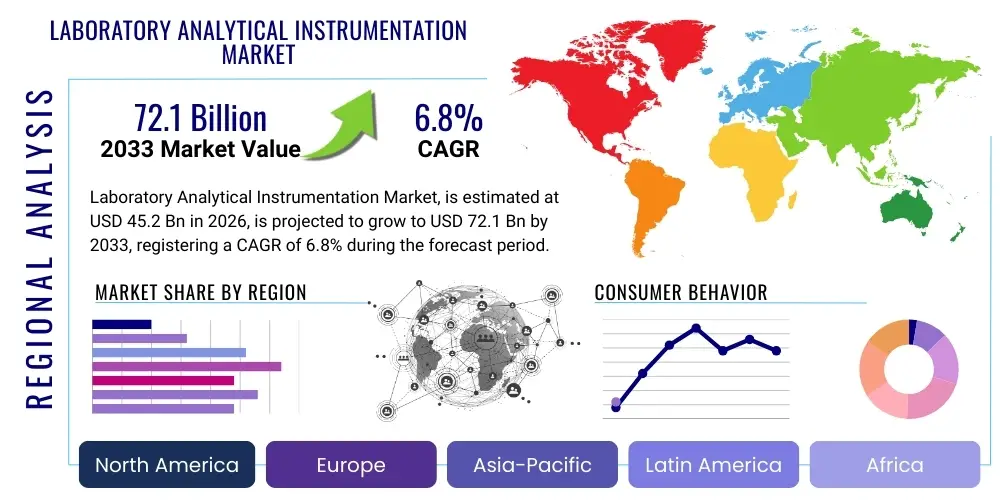

Laboratory Analytical Instrumentation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437069 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Laboratory Analytical Instrumentation Market Size

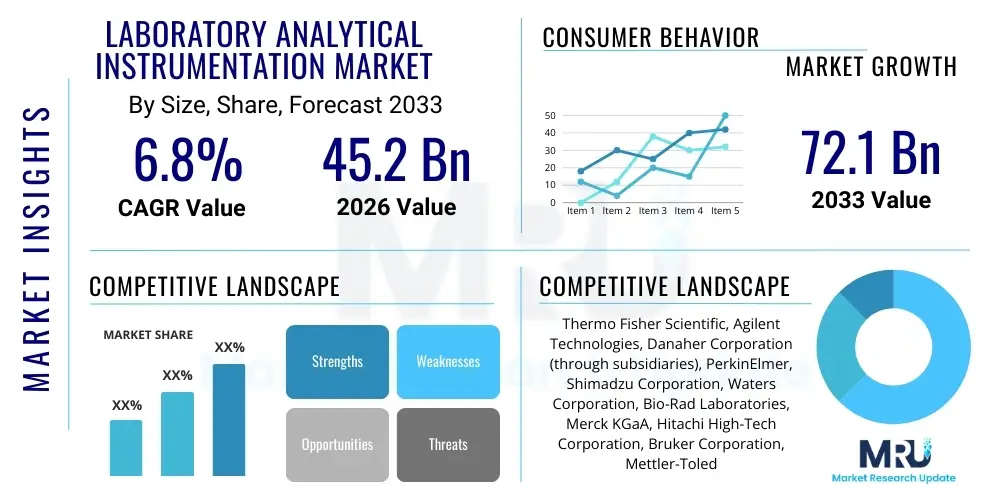

The Laboratory Analytical Instrumentation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 72.1 Billion by the end of the forecast period in 2033.

Laboratory Analytical Instrumentation Market introduction

The Laboratory Analytical Instrumentation Market encompasses a sophisticated range of devices and systems utilized for the qualitative and quantitative analysis of chemical and biological samples in diverse research, clinical, and industrial settings. These instruments are essential tools for measuring physical, chemical, and biological characteristics, facilitating crucial tasks such as drug discovery, disease diagnostics, quality control, environmental monitoring, and forensic science. The core product categories within this market include spectroscopy, chromatography, mass spectrometry, sequencing, and polymerase chain reaction (PCR) systems, each serving specialized analytical needs with increasing levels of sensitivity and throughput. The advancement of these instruments, driven by miniaturization and enhanced data processing capabilities, directly supports global scientific innovation.

Major applications for laboratory analytical instrumentation span pharmaceuticals and biotechnology, where instruments are indispensable for R&D, clinical trials, and manufacturing quality assurance. In the clinical diagnostics field, high-throughput analyzers are vital for rapid and accurate patient testing. Furthermore, environmental testing laboratories rely heavily on separation and detection technologies, such as gas chromatography-mass spectrometry (GC-MS) and high-performance liquid chromatography (HPLC), to monitor pollutants and ensure regulatory compliance. The instruments offer substantial benefits, including high precision, automation, reduced manual error, and the capacity to analyze complex matrices, accelerating the pace of scientific discovery and industrial process optimization.

Key driving factors accelerating the market growth include the escalating global investment in pharmaceutical R&D, particularly in personalized medicine and biologics, which necessitates advanced separation and identification tools. Simultaneously, the stringent regulatory environment worldwide, especially concerning food safety and environmental protection, mandates the adoption of highly accurate and reliable analytical techniques. Technological convergence, such as the integration of artificial intelligence (AI) for data interpretation and instrument self-calibration, further enhances operational efficiency and drives the replacement cycle for older instrument platforms, thereby sustaining robust market expansion throughout the forecast period.

Laboratory Analytical Instrumentation Market Executive Summary

The Laboratory Analytical Instrumentation Market is characterized by intense technological evolution, shifting towards integrated, automated, and portable systems designed for high-throughput screening. Key business trends indicate a strong focus on strategic acquisitions and partnerships among major players to consolidate market share and integrate complementary technologies, particularly in the fields of next-generation sequencing (NGS) and advanced mass spectrometry. The shift toward personalized medicine and the rapid development of biosimilars are fueling demand for sophisticated instruments capable of complex biomolecular characterization, compelling vendors to continually upgrade their product lines with enhanced sensitivity and specificity features, thus driving premium pricing and strong R&D investment cycles.

Regionally, North America maintains its dominance due to substantial R&D budgets, the presence of major biopharmaceutical companies, and advanced healthcare infrastructure, setting the pace for technological adoption. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, primarily driven by expanding government initiatives in healthcare modernization, rising academic research funding, and the relocation of manufacturing and research facilities to countries like China and India. European markets remain robust, supported by strong regulatory frameworks and persistent demand from academic institutions and clinical laboratories, focusing heavily on environmental and food safety monitoring.

Segment trends highlight the leading position of chromatography and mass spectrometry instruments, crucial for quality control and complex mixture separation in both life sciences and chemical analysis. The spectroscopy segment, including Nuclear Magnetic Resonance (NMR) and Atomic Absorption Spectroscopy (AAS), is experiencing steady growth, propelled by industrial quality assurance needs. Furthermore, the consumables and services segment is consistently outpacing instrument sales growth, emphasizing the long-term revenue stream stability derived from recurring purchases of reagents, columns, kits, and maintenance contracts, reflecting the entrenched nature of these instruments in routine laboratory operations.

AI Impact Analysis on Laboratory Analytical Instrumentation Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Laboratory Analytical Instrumentation Market frequently center on automation enhancement, data processing efficiency, and predictive maintenance capabilities. Common questions revolve around how AI can minimize human error during sample preparation, accelerate the interpretation of complex spectral or chromatogram data, and facilitate the development of novel biomarkers. Users express high expectations for AI to transform analytical workflows by moving beyond simple data logging to generating actionable insights, particularly in high-volume areas such as drug screening and clinical diagnostics. Furthermore, there is significant interest in AI's role in instrument self-optimization and diagnosing potential mechanical faults before they cause downtime, thereby maximizing laboratory productivity and extending instrument lifespan.

The influence of AI is revolutionizing instrument design and operation, moving analytical systems toward autonomous functionality. AI algorithms are increasingly being embedded within analytical software to handle vast datasets generated by high-throughput instruments, such as mass spectrometers and sequencers, allowing for faster and more accurate peak identification, deconvolution, and compound quantification. This computational power significantly shortens the time required for data analysis, which was historically a major bottleneck in research and clinical workflows. For example, in drug discovery, AI models can predict compound toxicity or efficacy based on preliminary analytical results, streamlining the candidate selection process.

Moreover, AI is pivotal in democratizing advanced analytical techniques. By providing sophisticated, user-friendly interfaces and automated troubleshooting guides, AI reduces the reliance on highly specialized operators, making complex instrumentation accessible to a broader range of laboratory personnel. The ongoing development of machine learning models focused on optimizing method parameters—such as flow rates in chromatography or voltage settings in mass spectrometry—ensures consistent performance and reduces the need for frequent manual recalibration, significantly improving laboratory efficiency and standardizing analytical results across different geographical locations and operators.

- AI enables automated optimization of analytical method parameters, reducing development time and enhancing reproducibility.

- Machine learning algorithms significantly accelerate the processing and interpretation of complex analytical data, such as spectral and genomic sequences.

- Predictive maintenance using AI minimizes instrument downtime by anticipating component failures based on operational metrics.

- AI integration facilitates advanced diagnostics and biomarker discovery through pattern recognition in large-scale omics data (proteomics, metabolomics).

- Robotics and AI-driven workflow management systems increase throughput and reduce manual handling errors in high-volume laboratories.

- Enhanced data integrity and security management through AI-powered auditing and compliance checks are becoming standard.

DRO & Impact Forces Of Laboratory Analytical Instrumentation Market

The trajectory of the Laboratory Analytical Instrumentation Market is primarily dictated by the confluence of robust drivers stemming from technological innovation and expanding application scope, countered by significant restraining factors such as high costs and regulatory hurdles, alongside compelling opportunities arising from emerging market penetration and technological convergence. Driving forces include accelerating investments in biopharma R&D, stringent regulatory mandates for product quality and environmental monitoring, and continuous advancements in miniaturization and automation. Conversely, market growth is often constrained by the substantial initial capital investment required for high-end instruments, the complexity associated with their operation and maintenance, and the shortage of highly skilled analytical personnel capable of maximizing instrument utility. The key impact forces currently shaping the market dynamics include the rapid adoption of hyphenated techniques (e.g., LC-MS/MS), the increasing preference for contract research organizations (CROs), and the imperative for instruments compliant with global pharmacopeia standards, all contributing to a highly competitive and innovation-centric landscape.

The primary drivers fuel market expansion across diverse sectors. The expansion of the global biopharmaceutical pipeline, particularly in cell and gene therapies and monoclonal antibodies, necessitates advanced instruments for detailed structural and functional characterization, providing sustained demand for high-resolution mass spectrometry and advanced chromatography systems. Regulatory bodies worldwide are continuously increasing scrutiny over food safety, environmental pollution, and pharmaceutical quality, compelling laboratories to invest in state-of-the-art analytical tools to meet lowered detection limits and enhanced quantification requirements. Furthermore, continuous technological breakthroughs, such as the introduction of smaller, faster, and more sensitive instruments, coupled with sophisticated data analysis software, encourage existing laboratories to upgrade their older equipment, thus sustaining replacement demand.

Restraints, however, pose challenges, particularly in budget-constrained markets. High-end analytical instruments often carry multi-million dollar price tags, making procurement difficult for smaller academic institutions or clinical laboratories in developing regions. Beyond the initial purchase, the recurring costs associated with specialized consumables, certified reagents, and mandatory service contracts contribute significantly to the total cost of ownership (TCO). Moreover, the complexity of modern analytical protocols, especially for advanced techniques like proteomics or metabolomics, necessitates highly specialized training. The scarcity of personnel with expertise in both analytical chemistry and advanced data analytics acts as a operational bottleneck, delaying the deployment and maximization of instrument capabilities across various end-user segments.

Opportunities for growth are abundant, particularly through geographical expansion and strategic product development. The untapped potential in emerging economies, driven by government initiatives to improve healthcare infrastructure and establish local pharmaceutical manufacturing hubs, presents substantial avenues for market penetration. Furthermore, the rising demand for point-of-care (POC) testing and portable analytical instruments for fieldwork, remote diagnostics, and rapid quality checks offers a distinct opportunity for miniaturization and low-cost manufacturing innovations. The integration of advanced diagnostics into clinical settings, alongside the ongoing revolution in personalized medicine, ensures a continuous stream of highly specialized applications requiring bespoke analytical solutions, thereby maintaining strong investment in R&D and specialized instrument niches.

- Drivers:

- Increasing global R&D spending in pharmaceutical and biotech sectors.

- Growing need for stringent quality control and regulatory compliance in food and environmental testing.

- Technological advancements leading to greater sensitivity, accuracy, and automation (e.g., hyphenated techniques).

- Expansion of clinical diagnostics and personalized medicine requiring advanced molecular analysis.

- Restraints:

- High initial procurement cost and substantial total cost of ownership (TCO) of complex instrumentation.

- Requirement for highly skilled technical personnel for instrument operation and sophisticated data interpretation.

- Challenges in standardization and inter-laboratory compatibility of analytical results.

- Opportunities:

- Significant market potential in emerging economies (APAC, LATAM) due to infrastructure development.

- Development and commercialization of portable, miniaturized, and cost-effective analytical instruments (POC testing).

- Growing utilization of analytical services provided by CROs and central laboratories.

- Impact Forces:

- Intense competition driving continuous innovation in resolution and throughput capabilities.

- Consolidation among major vendors through M&A to acquire specialized technology portfolios.

- Regulatory environment mandating compliance with GxP and data integrity standards (e.g., CFR Part 11).

- Integration of Artificial Intelligence (AI) and Machine Learning (ML) for enhanced data processing and method development.

Segmentation Analysis

The Laboratory Analytical Instrumentation Market is systematically segmented across instrument types, application areas, and end-users, reflecting the diverse technological landscape and specialized requirements of the analytical community. Instrumentation segmentation differentiates between core separation science tools (Chromatography, Mass Spectrometry) and detection/identification tools (Spectroscopy, DNA Sequencing), each designed for specific analytical challenges. Application segmentation highlights the dominance of pharmaceutical R&D, followed closely by clinical diagnostics and environmental monitoring, areas characterized by high regulatory stringency and the need for precision. The end-user analysis reveals academic and research institutions, coupled with pharmaceutical and biotechnology companies, as the primary consumers, influencing product development towards high-sensitivity and high-throughput systems, while the consumables and services segment continues to provide the most stable recurring revenue stream, driven by the operational lifecycle of the installed instrument base.

- By Type:

- Spectroscopy (Molecular Spectroscopy, Atomic Spectroscopy)

- Chromatography (HPLC, GC, TLC)

- Mass Spectrometry (GC-MS, LC-MS, ICP-MS)

- Flow Cytometry

- PCR & qPCR Systems

- Next-Generation Sequencing (NGS)

- By Application:

- Pharmaceutical & Biotechnology R&D

- Clinical Diagnostics & Healthcare

- Environmental Testing

- Food & Beverage Testing

- Forensics & Toxicology

- Academic Research

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Clinical Laboratories

- Academic & Government Research Institutions

- Food & Environmental Testing Laboratories

- By Component:

- Instruments

- Consumables (Columns, Reagents, Standards)

- Software & Services (Maintenance, Training, Informatics)

Value Chain Analysis For Laboratory Analytical Instrumentation Market

The value chain for the Laboratory Analytical Instrumentation Market begins with highly specialized upstream activities involving the sourcing of precision components, advanced optics, specialized electronics, and high-purity raw materials required for manufacturing analytical systems. This upstream segment is capital-intensive and relies heavily on niche suppliers capable of meeting stringent quality and tolerance specifications. Research and development form a critical part of the initial value creation, focusing on developing proprietary technologies for enhanced detection, separation efficiency, and data handling capabilities, ensuring instruments remain competitive through superior performance metrics.

Midstream activities encompass the actual manufacturing, assembly, software integration, and rigorous quality assurance processes. Leading market players often maintain specialized manufacturing sites globally, focusing on lean production techniques while adhering to global regulatory standards (e.g., ISO, CE marking). A key differentiator at this stage is the integration of sophisticated informatics platforms and validated software, which transforms raw data into meaningful analytical results, thereby adding substantial intellectual value to the final product. Product commercialization and marketing involve targeted sales efforts directed at research heads, laboratory managers, and procurement specialists within key end-user segments.

Downstream activities focus heavily on distribution, installation, application support, and after-sales service, which is crucial for maximizing customer lifetime value. Direct distribution channels are typically used for high-end, complex instruments like NGS or high-resolution Mass Spectrometers, allowing vendors to maintain control over specialized installation and training. Indirect channels, utilizing specialized distributors and regional sales representatives, are often employed for consumables, standardized reagents, and instruments destined for broader geographical coverage or non-critical applications. The long-term recurring revenue generated through maintenance contracts, software updates, and consumable sales underscores the vital role of the downstream service network in sustaining market profitability and customer satisfaction throughout the entire lifespan of the analytical instrument.

Laboratory Analytical Instrumentation Market Potential Customers

The primary customer base for the Laboratory Analytical Instrumentation Market is highly diversified yet centrally concentrated among entities engaged in scientific research, quality assurance, and clinical service delivery. Pharmaceutical and biotechnology companies represent the largest and most valuable end-user segment, driving demand for instrumentation utilized in drug discovery, process development (e.g., fermentation monitoring), and stringent quality control testing of novel therapeutics and biosimilars. Their requirement for high-throughput, regulatory-compliant, and highly accurate instruments (such as LC-MS/MS and advanced sequencers) ensures sustained investment in the latest technologies to maintain competitive advantage and meet regulatory scrutiny.

Academic and government research institutions constitute another core customer group, utilizing a wide array of analytical instruments for fundamental scientific exploration, basic research grants, and training future scientists. Although often constrained by public funding cycles, these institutions drive the demand for cutting-edge, highly specialized instruments that push the boundaries of detection limits and structural analysis, such as advanced NMR and electron microscopy systems. Their purchasing decisions are often influenced by grant availability and the need for versatility across multiple research domains, demanding flexible instrument platforms that can adapt to evolving scientific methodologies.

Furthermore, clinical laboratories and hospital systems are rapidly growing potential customers, particularly with the global shift towards molecular diagnostics and personalized healthcare. These laboratories require automated, robust, and highly reliable analyzers—including clinical chemistry analyzers, flow cytometers, and qPCR systems—capable of processing large volumes of patient samples rapidly and accurately under strict regulatory guidelines (e.g., CLIA, CAP). The expanding network of contract research organizations (CROs) and contract manufacturing organizations (CMOs) also represents a significant growth segment, as these organizations frequently outsource analytical testing services and require substantial fleets of diversified, state-of-the-art instrumentation to serve their global clientele effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 72.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Agilent Technologies, Danaher Corporation (through subsidiaries), PerkinElmer, Shimadzu Corporation, Waters Corporation, Bio-Rad Laboratories, Merck KGaA, Hitachi High-Tech Corporation, Bruker Corporation, Mettler-Toledo International Inc., Eppendorf SE, F. Hoffmann-La Roche Ltd., GE Healthcare, QIAGEN N.V., Analytik Jena AG, JASCO Corporation, LECO Corporation, Malvern Panalytical, Sartorius AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Analytical Instrumentation Market Key Technology Landscape

The technological landscape of the Laboratory Analytical Instrumentation Market is defined by continuous innovation across three primary axes: sensitivity and resolution, automation and throughput, and data informatics integration. In separation science, Ultra High-Performance Liquid Chromatography (UHPLC) systems are replacing traditional HPLC, offering significantly faster run times and improved resolution, especially crucial for complex mixture analysis in proteomics and metabolomics. This is often coupled with High-Resolution Mass Spectrometry (HRMS), such as Orbitrap and Q-ToF technologies, which provide unprecedented mass accuracy and isotopic fidelity, allowing for definitive compound identification and structural elucidation that was previously unattainable with conventional detection methods.

Automation and high-throughput capabilities are critical, particularly in industrial and clinical settings. Robotics integration, sample preparation platforms, and microfluidics are converging to create fully automated workflows, minimizing manual intervention and the associated risk of sample variability and contamination. Instruments utilizing microfluidic chips are enabling 'lab-on-a-chip' functionality, facilitating rapid, low-volume analysis, which is highly valuable for point-of-care diagnostics and single-cell analysis. Furthermore, the advancements in Next-Generation Sequencing (NGS) technologies, including third-generation sequencing platforms, are drastically reducing sequencing costs and increasing speed, making large-scale genomics and personalized medicine economically viable.

The third critical technological pillar is the evolution of laboratory informatics and software solutions. Modern analytical instruments generate terabytes of data, necessitating robust Laboratory Information Management Systems (LIMS) and advanced data analytics software incorporating AI and machine learning. These informatics tools handle data storage, integrity, retrieval, and automated interpretation, ensuring compliance with global regulatory standards like 21 CFR Part 11. The connectivity between instruments via the Internet of Things (IoT) infrastructure allows for real-time monitoring, remote diagnostics, and standardized data exchange, transforming individual instruments into integrated components of a seamless, smart laboratory ecosystem focused on efficiency and reproducibility.

Regional Highlights

The global market for laboratory analytical instrumentation exhibits significant regional disparities influenced by R&D expenditure, regulatory maturity, and healthcare infrastructure quality. North America consistently dominates the market, primarily due to the established presence of the world's largest pharmaceutical and biotechnology companies, coupled with extensive government and private funding directed towards life sciences research. The region, particularly the United States, is an early adopter of cutting-edge technologies like advanced mass spectrometry and NGS, driven by the intense competitive environment in drug discovery and personalized diagnostics. High capital spending capabilities and robust regulatory oversight (FDA, EPA) demanding sophisticated analytical compliance further solidify North America's leading position, particularly in high-value instrument segments.

Europe represents the second-largest market, characterized by strong academic research traditions, advanced healthcare systems, and stringent environmental and food safety regulations enforced by bodies like the European Medicines Agency (EMA). Growth in Europe is sustained by significant EU funding for collaborative research projects and a high demand for environmental monitoring instruments across key economies such as Germany, the UK, and France. The region is seeing increased adoption of automated systems to optimize operational efficiency within highly regulated centralized testing facilities, focusing on precision medicine initiatives and sustainable industrial practices that rely heavily on analytical validation.

The Asia Pacific (APAC) region is poised for the highest growth rate during the forecast period. This rapid expansion is fueled by increasing foreign direct investment in biopharmaceutical manufacturing, government initiatives aimed at modernizing clinical laboratory infrastructure, and the growing focus on domestic R&D, particularly in China, India, Japan, and South Korea. Rising incomes, expanding healthcare access, and the urgent need for environmental quality control in densely populated industrial areas are creating enormous opportunities for both instrument sales and related consumables, making APAC a critical strategic focus area for global market vendors seeking expansion beyond traditional Western markets.

- North America: Dominant market share driven by robust pharmaceutical R&D, advanced clinical diagnostics infrastructure, and high expenditure on life sciences research. Key demand for Mass Spectrometry and Next-Generation Sequencing.

- Europe: Strong second position, supported by stringent regulatory standards (EMA), significant academic funding, and high consumption of instruments for food safety and environmental applications.

- Asia Pacific (APAC): Fastest-growing region due to increasing government investment in healthcare, expansion of the biotechnology sector, and growing demand from localized pharmaceutical manufacturing and quality control labs.

- Latin America (LATAM): Emerging market characterized by improving healthcare access and increasing investment in local research, primarily focused on establishing basic and mid-range analytical capabilities, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Limited but growing market, driven primarily by investments in oil and gas analysis, quality control infrastructure development, and specialized clinical laboratory modernization projects in high-income nations like the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Analytical Instrumentation Market.- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Danaher Corporation

- PerkinElmer, Inc.

- Shimadzu Corporation

- Waters Corporation

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Hitachi High-Tech Corporation

- Bruker Corporation

- Mettler-Toledo International Inc.

- Eppendorf SE

- F. Hoffmann-La Roche Ltd.

- GE Healthcare

- QIAGEN N.V.

- Analytik Jena AG

- JASCO Corporation

- LECO Corporation

- Malvern Panalytical

- Sartorius AG.

Frequently Asked Questions

Analyze common user questions about the Laboratory Analytical Instrumentation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Laboratory Analytical Instrumentation Market?

The Laboratory Analytical Instrumentation Market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by increased investment in pharmaceutical research and regulatory compliance needs.

Which segment holds the largest share in the Laboratory Analytical Instrumentation Market?

The Chromatography and Mass Spectrometry segments collectively hold the largest market share due to their indispensable role in pharmaceutical quality control, complex mixture analysis, and increasingly sophisticated clinical diagnostics and proteomics workflows.

What are the key technological trends influencing modern laboratory instrumentation?

Key technological trends include the integration of artificial intelligence (AI) for enhanced data processing, the continuous advancement towards high-resolution and high-throughput systems (UHPLC, HRMS), and the expansion of miniaturized and portable instruments for decentralized analysis.

Which region is expected to demonstrate the fastest growth in this market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, stimulated by governmental initiatives to upgrade healthcare infrastructure, growing domestic biopharmaceutical manufacturing capabilities, and rising academic research funding.

What challenges restrain the expansion of the Analytical Instrumentation Market?

Primary restraints include the high initial procurement costs of advanced analytical systems, the substantial total cost of ownership (TCO) associated with consumables and service, and the shortage of highly specialized technical personnel required for operation and method development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager