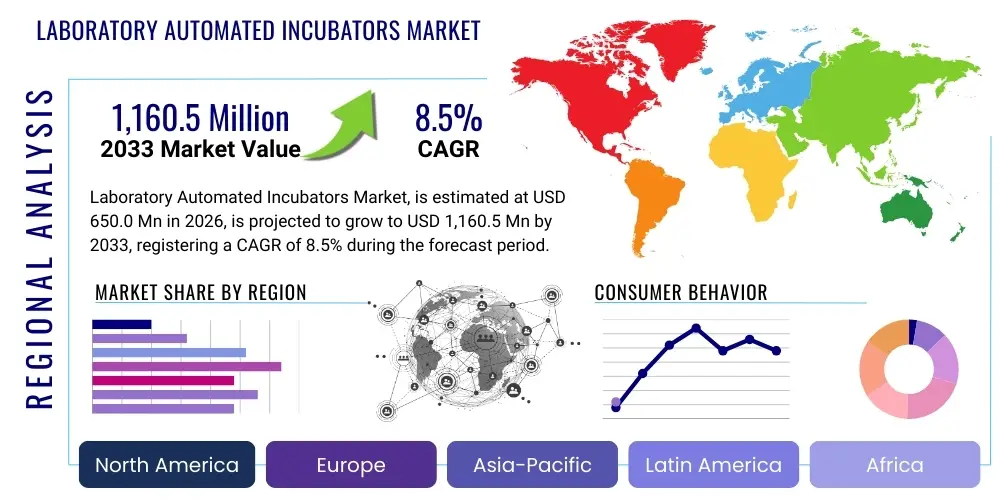

Laboratory Automated Incubators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439179 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Laboratory Automated Incubators Market Size

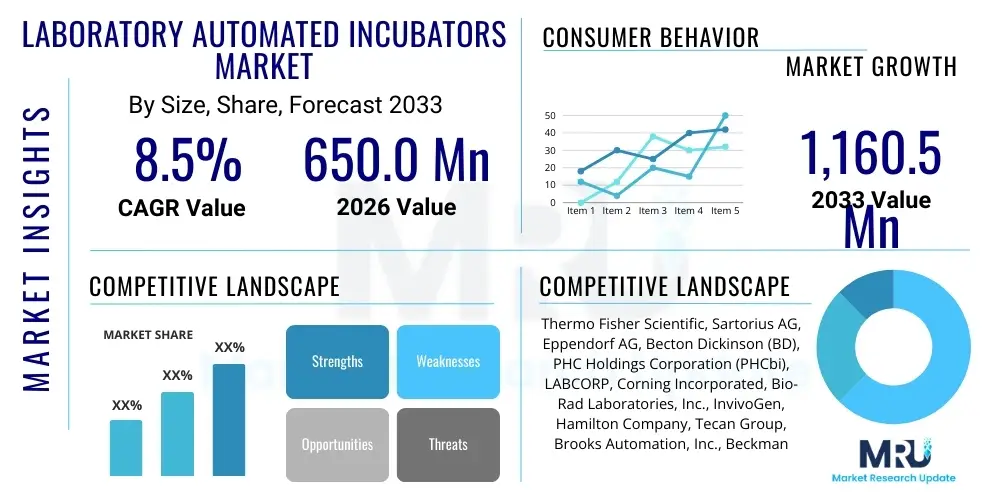

The Laboratory Automated Incubators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 650.0 million in 2026 and is projected to reach USD 1,160.5 million by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing demand for high-throughput screening (HTS) in drug discovery, coupled with the necessity for stringent environmental control and standardization in cellular research and biological manufacturing processes. The shift toward fully automated laboratory environments, particularly in pharmaceutical and biotechnology sectors, underscores the significant investment in advanced incubation systems capable of continuous, walk-away operation and precise monitoring, guaranteeing reproducibility and minimizing human error in sensitive biological assays.

Laboratory Automated Incubators Market introduction

The Laboratory Automated Incubators Market encompasses highly sophisticated equipment designed to provide optimal, controlled environmental conditions (temperature, humidity, CO2/O2 levels) for the growth and maintenance of cellular, microbial, or tissue cultures, while integrating seamlessly with robotic handling systems. These systems are crucial components in modern high-throughput laboratories, replacing traditional manual incubators to enhance efficiency, scale, and data integrity. Automated incubators are characterized by features such as integrated plate handlers, automated lid removal, stacker modules, and sophisticated climate control algorithms, which facilitate continuous, unattended operation essential for large-scale experiments and clinical testing.

Major applications of these automated systems span across critical scientific disciplines, including drug discovery and development, cancer research, regenerative medicine, and large-scale diagnostic testing. Pharmaceutical and biotechnology companies leverage automated incubation to accelerate the screening of novel compounds and manage extensive cell line repositories. Furthermore, academic research institutions and contract research organizations (CROs) utilize these devices to standardize complex cell-based assays, ensuring reliable and comparable results across multiple experimental runs. The fundamental benefit provided by automated incubators is the reduction in variability inherent in manual procedures, leading to more robust and statistically significant biological data.

The market is currently experiencing significant acceleration driven by several interconnected factors. First, the global surge in biological research and the escalating complexity of cell culture protocols mandate systems that offer unparalleled environmental stability and minimal disruption. Second, the cost pressures associated with extensive manual labor are pushing laboratories toward automation solutions that enhance productivity and throughput capacity without increasing operational headcount. Finally, advancements in integrated robotics and software interfaces are making these automated systems more accessible and easier to integrate into existing laboratory information management systems (LIMS), solidifying their role as indispensable tools in the future of biological experimentation.

Laboratory Automated Incubators Market Executive Summary

The global Laboratory Automated Incubators Market is experiencing transformative growth, underpinned by accelerating trends in biological manufacturing and personalized medicine. Business trends highlight a strong focus on strategic partnerships between incubator manufacturers and robotics suppliers to offer holistic automation platforms, moving beyond standalone hardware sales. Key players are heavily investing in software integration capabilities, particularly predictive maintenance features and connectivity protocols compatible with broader lab automation ecosystems, ensuring competitive differentiation based on operational intelligence rather than solely hardware specifications. The market is consolidating around providers offering modular and scalable systems that can adapt to varying throughput requirements, from small academic labs to large industrial facilities.

Regionally, North America maintains market dominance due to early adoption of high-cost automation technologies, significant government funding for biological research, and the concentrated presence of major pharmaceutical and biotech firms. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by expanding clinical trial activities, increasing investment in establishing advanced research infrastructure in countries like China and India, and the rising prevalence of chronic diseases necessitating rapid diagnostic development. Europe follows, driven by strict quality control standards in therapeutic manufacturing and the expansion of advanced research initiatives focused on areas such as synthetic biology and cell therapy production.

Segment trends reveal a pronounced shift toward high-capacity, multigas automated incubators, primarily due to the rising complexity of sensitive cell lines (e.g., stem cells, primary cells) that require precise oxygen and carbon dioxide control beyond standard atmospheric conditions. The pharmaceutical and biotechnology segment remains the largest end-user, prioritizing integration speed and reliability for compound screening. Furthermore, there is growing interest in benchtop or compact automated systems designed for smaller laboratories seeking to initiate automation without the capital expenditure required for full-scale centralized automation solutions, demonstrating market maturity in addressing diverse customer needs.

AI Impact Analysis on Laboratory Automated Incubators Market

Common user questions regarding AI's impact on automated incubators revolve primarily around how AI can enhance reliability, predict equipment failure, and optimize experimental conditions without human intervention. Users frequently ask about the capability of AI to analyze real-time data from hundreds of incubation chambers simultaneously to detect subtle anomalies that might compromise cell viability, such as minor temperature fluctuations or deviations in gas flow rates. There is significant interest in algorithms that can learn from historical culture performance data, adjusting environmental parameters dynamically to achieve optimal cell growth kinetics and ensuring consistency across batches. Concerns often center on data security, the complexity of integrating sophisticated AI models with existing legacy laboratory infrastructure, and the validation required for using AI-optimized protocols in regulated environments like Good Manufacturing Practice (GMP) facilities.

AI integration is fundamentally transforming automated incubators from mere environmental control units into intelligent biological monitoring and decision-making systems. Machine learning algorithms are being employed to process vast datasets generated by embedded sensors (e.g., pH, dissolved oxygen, cell confluence imaging), providing predictive diagnostics for both the equipment and the biological process itself. This shift allows laboratories to minimize costly experimental failures caused by unforeseen hardware malfunctions or suboptimal culture conditions. By applying advanced statistical analysis, AI can identify correlations between environmental inputs and cellular outputs, leading to unprecedented levels of process optimization and standardization, which is critical for scaling up complex biomanufacturing workflows, such as those utilized in CAR T-cell therapy production.

The implementation of AI also drives substantial improvements in preventative maintenance and operational efficiency (OEE). Instead of scheduled maintenance, AI models analyze vibration patterns, power consumption, and control loop performance to predict exactly when components, such as humidifiers or gas sensors, are likely to fail, allowing for just-in-time servicing. This reduces downtime significantly. Furthermore, in high-throughput screening, AI assists in image analysis of cell confluence and morphology captured within the incubator, providing instantaneous feedback on culture health and automatically flagging wells or plates exhibiting abnormal growth. This level of autonomous monitoring ensures maximal uptime and enhances the overall reliability and rigor of high-stakes biological experimentation.

- AI enables predictive maintenance, forecasting hardware failure based on sensor data patterns.

- Machine learning optimizes environmental set points dynamically for specific cell lines and assay types.

- Advanced image analysis algorithms automatically assess cell confluence and morphology in real-time.

- AI improves data integrity by identifying and reporting subtle environmental anomalies instantly.

- Enhanced regulatory compliance through automated logging and deviation detection based on learned norms.

DRO & Impact Forces Of Laboratory Automated Incubators Market

The market trajectory is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces. The primary driver is the global emphasis on accelerating drug discovery pipelines, which mandates the use of high-throughput, reproducible cell culture environments to screen millions of compounds efficiently. Simultaneously, the restraints, largely centered on the substantial initial capital investment required for these sophisticated robotic systems and the specialized training needed for technical staff, moderate the adoption rate, particularly among smaller academic or governmental research facilities with limited budgets. Opportunities arise primarily from the technological evolution toward IoT-enabled, cloud-connected incubators and the expansion of cell and gene therapy manufacturing, which requires tightly controlled, GMP-compliant automated cell culture systems, positioning automated incubators as foundational infrastructure for next-generation medicine.

Drivers: The escalating prevalence of chronic diseases, such as cancer and diabetes, necessitates continuous innovation in therapeutic development, driving demand for high-capacity screening methods. Automated incubators provide the indispensable environmental control and scalability required for handling large batches of cell-based assays, ensuring minimal manual handling and subsequent contamination risk. Furthermore, regulatory bodies increasingly emphasize data quality and reproducibility in preclinical and clinical studies, prompting laboratories to invest in automated systems that provide comprehensive audit trails and standardized operating procedures inherently. The continuous integration of incubators with robotic work cells and Laboratory Information Management Systems (LIMS) further catalyzes adoption by making automation more fluid and data-centric.

Restraints: The market faces significant hurdles related to the high implementation cost of integrated automation platforms, which often include not just the incubator but also robotic arms, track systems, and sophisticated climate control infrastructure. This high barrier to entry limits uptake in emerging markets and smaller research entities. Additionally, the complexity associated with integrating different vendor systems (incubators, liquid handlers, readers) sometimes leads to interoperability issues, creating technological friction. The necessity for highly skilled personnel capable of programming, maintaining, and troubleshooting these complex electro-mechanical systems also poses a staffing challenge, especially in regions lacking specialized automation expertise.

Opportunities: Major growth avenues exist in the burgeoning field of biomanufacturing, specifically cell and gene therapy (CGT). CGT processes require closed, sterile, and highly repeatable incubation environments, areas where automated systems excel and are often mandated for GMP compliance. Miniaturization and the development of compact, modular automated incubators offer an opportunity to penetrate mid-sized laboratories and specialized diagnostic centers. Furthermore, the push towards establishing standardized global protocols for clinical diagnostics and drug safety testing presents a substantial opportunity for manufacturers offering validated, globally supported automated incubation solutions, moving the industry toward decentralized, yet standardized, testing capabilities.

- Drivers:

- Increased R&D spending in the pharmaceutical and biotechnology sectors.

- Growing demand for high-throughput screening (HTS) in drug discovery.

- Necessity for stringent environmental control and standardization in complex cell cultures (e.g., stem cells).

- Focus on minimizing human intervention and reducing contamination risk in sterile workflows.

- Restraints:

- High initial capital expenditure required for complete automation setups.

- Technical complexity and challenges associated with system integration and maintenance.

- Need for specialized training and limited availability of skilled automation technicians.

- Opportunity:

- Expansion of cell and gene therapy (CGT) manufacturing, requiring GMP-compliant automated incubation.

- Development of compact, modular, and benchtop automated systems for smaller laboratories.

- Integration with advanced data analytics and cloud computing for remote monitoring and optimization.

Segmentation Analysis

The Laboratory Automated Incubators Market is comprehensively segmented based on technology type, application, and end-user, reflecting the diverse requirements across the scientific community. Technology-wise, the core distinction lies between robotic plate stackers integrated with standard incubators and fully integrated, centralized robotic incubation units, with the latter offering superior throughput and environmental isolation. Application segmentation highlights the dominance of drug discovery and toxicology testing, where large volumes of assays necessitate automated handling and precise temporal control. The trend toward personalized medicine is increasingly emphasizing segment specific solutions tailored for rare or primary cell culture protocols. Understanding these segmentations is critical for manufacturers aiming to align their product development with specific workflow needs and regulatory compliance requirements.

Within the technology segment, the transition towards multigas control capabilities (beyond standard CO2) is highly significant. Advanced automated incubators now offer precise O2 regulation, vital for simulating in vivo hypoxic environments crucial for cancer research and stem cell maintenance. Furthermore, the segmentation by throughput capacity—ranging from benchtop automated units handling tens of plates to floor-standing units managing hundreds or thousands—determines the primary target market, with large contract research organizations (CROs) and pharmaceutical companies driving the demand for ultra-high-throughput systems. The increasing sophistication in temperature mapping and consistency monitoring across the entire stack also differentiates premium automated solutions from basic models, reflecting the market’s focus on verifiable performance.

End-user segmentation clearly establishes pharmaceutical and biotechnology companies as the primary revenue generators due to their extensive R&D budgets and requirement for validated, industrial-scale automation. Academic and research institutes constitute the second largest segment, driven by grants focused on fundamental biological discoveries, though their budget constraints often lead them toward modular or smaller-scale automation solutions. Clinical laboratories, particularly those specializing in high-volume microbiology or advanced genetic testing, form a rapidly expanding segment, adopting automated incubators to ensure rapid turnaround times and regulatory adherence. The diverse requirements across these end-user groups necessitate highly customizable and flexible automation configurations, encouraging manufacturers to offer versatile software integration and hardware configurations.

- By Type:

- High-Capacity Automated Incubators (Floor-standing, integrated robotic systems)

- Benchtop Automated Incubators (Compact, modular units)

- Multigas Automated Incubators (O2 and CO2 control)

- Standard CO2 Automated Incubators

- By Application:

- Drug Discovery and Compound Screening

- Cell and Gene Therapy Manufacturing (CGT)

- Stem Cell Research and Regenerative Medicine

- Toxicology Testing and Safety Assessment

- Clinical Diagnostics (Microbiology and Viability Testing)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs)

- Clinical Laboratories and Hospitals

Value Chain Analysis For Laboratory Automated Incubators Market

The value chain for the Laboratory Automated Incubators Market begins with upstream suppliers providing critical, high-precision components, including advanced sensor technologies (temperature, gas, humidity), specialized materials for constructing environmentally inert chambers (e.g., stainless steel), and complex motion control components (motors, robotic arms, linear actuators). The quality and reliability of these upstream components directly impact the overall performance and lifespan of the automated incubator. Key innovation in the upstream segment focuses on developing miniaturized, highly accurate sensors and frictionless robotic mechanisms capable of continuous, long-term operation under humid conditions. Strategic sourcing of reliable and certified components is paramount for manufacturers to ensure compliance with stringent quality and regulatory standards, such as ISO and GMP guidelines, required by end-users in the biopharmaceutical sector.

The core manufacturing stage involves the sophisticated assembly and integration of these components, coupled with the development of proprietary control software and robotics management systems. Manufacturers invest heavily in software development to ensure seamless integration with broader laboratory automation platforms, standardized data output (e.g., HL7, proprietary APIs), and user-friendly interfaces. Distribution channels are generally bifurcated into direct sales models, particularly for large, complex, and customized integrated systems sold directly to major pharmaceutical firms and CROs, and indirect sales through specialized global or regional distributors. Indirect channels are often preferred for standard benchtop models sold to academic or smaller clinical labs, offering localized support and faster fulfillment.

Downstream activities center on installation, validation (IQ/OQ/PQ), training, and extensive after-sales service and maintenance. Given the high criticality of these systems in drug production and research, reliable servicing and rapid response times are crucial competitive differentiators. End-users rely heavily on robust service contracts, including remote diagnostic capabilities—often enabled by IoT connectivity—to minimize downtime. The shift toward fully automated laboratories drives demand for comprehensive system integration support, where the incubator provider works collaboratively with robotic manufacturers and LIMS providers to ensure end-to-end functionality. This complex downstream support structure underscores the consultative nature of sales in this high-value market segment.

Laboratory Automated Incubators Market Potential Customers

The primary end-users and potential buyers for Laboratory Automated Incubators are large organizations engaged in high-volume, regulated biological testing and manufacturing, where reproducibility and throughput are non-negotiable requirements. This includes major global pharmaceutical companies and their specialized research divisions, which utilize these incubators extensively for primary and secondary compound screening, cell line development, and stability testing of biological products. Biotechnology firms, particularly those focused on developing advanced therapies such as monoclonal antibodies, gene editing tools, and novel vaccines, represent another critical customer base, requiring GMP-compliant automated systems to maintain the integrity of their proprietary cell cultures during scale-up and production phases.

Contract Research Organizations (CROs) constitute a highly dynamic customer segment. CROs operate on stringent timelines and often manage multiple client projects simultaneously, necessitating versatile, reliable, and high-throughput automation platforms to maximize efficiency and maintain service levels. Their demand often focuses on large, modular systems capable of rapidly changing protocols and integrating with diverse laboratory equipment owned by their clients. Furthermore, increasingly complex academic research centers and large government-funded laboratories that operate core facilities or specialize in areas like high-throughput genomics, proteomics, or specialized disease modeling are also significant purchasers, often driven by the need to standardize results across multi-investigator projects.

Finally, the rapidly expanding sector of Cell and Gene Therapy (CGT) manufacturing facilities represents the fastest growing segment of potential customers. These facilities require automated, closed-system incubators as non-negotiable elements in their sterile production environments, ensuring patient safety and regulatory adherence. Clinical laboratories, particularly those specializing in high-volume microbial identification or advanced clinical diagnostics that rely on cell culture, are also increasing their adoption rates, seeking automation to handle the rising demand for sophisticated diagnostic tests quickly and reliably. These varied customers share the common need for validated performance, scalability, and seamless integration into automated workflows.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 million |

| Market Forecast in 2033 | USD 1,160.5 million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Sartorius AG, Eppendorf AG, Becton Dickinson (BD), PHC Holdings Corporation (PHCbi), LABCORP, Corning Incorporated, Bio-Rad Laboratories, Inc., InvivoGen, Hamilton Company, Tecan Group, Brooks Automation, Inc., Beckman Coulter (Danaher), Hitachi High-Tech Corporation, VWR International (Avantor), Liconic Instruments, Agilent Technologies, Inc., Wako Automation, Kuhner AG, Baker Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Automated Incubators Market Key Technology Landscape

The technology landscape of the Laboratory Automated Incubators Market is rapidly evolving, moving toward fully integrated, "smart" incubation environments. A core technological advancement is the integration of sophisticated environmental control systems that maintain ultra-stable conditions, utilizing PID (Proportional-Integral-Derivative) controllers for precise temperature management and infrared (IR) sensors for accurate CO2 level monitoring, overcoming the stability issues associated with older thermal conductivity (TC) sensors. Furthermore, the inclusion of proprietary contamination mitigation techniques, such as high-temperature sterilization cycles (e.g., 180°C dry heat) or continuous ultraviolet (UV) sterilization systems integrated into the air handling, is a critical differentiating technology ensuring sterile operation essential for GMP compliance and long-term culture health.

Another pivotal technological advancement is the development of advanced robotic handling mechanisms specifically designed for the delicate environment of cell culture. This includes frictionless motion systems and specialized gripper technologies that minimize plate vibration and thermal shock when transferring microplates, maintaining culture integrity during automation. Crucially, modern systems are equipped with embedded monitoring technologies, such as non-invasive sensors for continuous pH monitoring and internal micro-imaging systems, allowing researchers to track cell confluence and morphology without removing plates from the stable incubation environment. This real-time, non-disruptive monitoring provides superior data granularity and control over the biological process, moving beyond simple environmental logging to biological feedback loops.

Connectivity and data management are central to the current technology paradigm. Automated incubators are now universally equipped with Industrial Internet of Things (IIoT) capabilities, allowing for cloud connectivity, remote monitoring, and integration with LIMS and Electronic Lab Notebooks (ELN). This seamless data flow supports high-level AI/ML driven analytics for process optimization and historical data review. Moreover, the push towards modular, flexible automation architectures employing standardized communication protocols (like OPC UA) ensures that incubators from different vendors can interact smoothly within a customized robotic cell, addressing the previously restrictive challenge of vendor lock-in and allowing laboratories to tailor their automation platforms precisely to their specific research or manufacturing needs.

Regional Highlights

The Laboratory Automated Incubators Market demonstrates varied growth dynamics across major global regions, influenced by differences in research funding, regulatory landscapes, and the concentration of biopharmaceutical activity. North America, encompassing the United States and Canada, currently holds the dominant market share. This leadership is attributed to the substantial presence of global pharmaceutical headquarters, vast government and private investment in life sciences R&D (particularly in cancer research and complex cell therapies), and the early and pervasive adoption of high-end, fully integrated laboratory automation technologies. The stringent quality standards in the U.S. pharmaceutical sector mandate high-throughput, validated equipment, driving continuous demand for the most sophisticated and reliable automated incubation systems, often integrated into multi-million dollar robotic work cells.

Europe represents the second largest market, characterized by strong governmental support for academic research and a powerful biomanufacturing sector, particularly in countries like Germany, the UK, and Switzerland. Adoption rates are high, driven by the need to streamline vaccine production, biological drug development, and specialized diagnostics under strict European Medicines Agency (EMA) guidelines. The European market exhibits a strong preference for high-quality, energy-efficient systems with robust technical support, reflecting a focus on sustainable laboratory operations alongside scientific rigor. Funding initiatives, such as Horizon Europe, continue to push investment into advanced biotechnology infrastructure, sustaining consistent demand for sophisticated automated incubators across the continent.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, primarily spurred by massive investments in research infrastructure development across China, Japan, South Korea, and India. China, in particular, is rapidly establishing itself as a global leader in biosimilars production and clinical trials, leading to an exponential increase in the establishment of high-throughput laboratories and GMP facilities requiring automated incubation. Expanding healthcare access, increasing prevalence of western diseases, and supportive government policies aimed at localizing drug development and manufacturing contribute significantly to this regional acceleration. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but show promising growth potential, particularly in key economic hubs such as Brazil, Saudi Arabia, and South Africa, as these regions invest in modernizing their diagnostic and pharmaceutical research capabilities.

- North America: Market dominance, driven by extensive R&D spending, concentration of major biopharma companies, and rapid adoption of full laboratory automation.

- Europe: Strong growth underpinned by government funding in academic research, high regulatory standards (EMA), and robust biomanufacturing activities, focusing on sustainable technology.

- Asia Pacific (APAC): Highest CAGR, fueled by massive infrastructure investment, growth in local drug discovery and biosimilars manufacturing, and expanding clinical trial volumes, particularly in China and India.

- Latin America (LATAM): Emerging market growth driven by clinical research expansion and modernization of hospital laboratories in countries like Brazil and Mexico.

- Middle East & Africa (MEA): Growth centered on strategic investments in healthcare and biotechnology hubs (e.g., UAE, Saudi Arabia) aiming to reduce reliance on imported pharmaceuticals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Automated Incubators Market.- Thermo Fisher Scientific

- Sartorius AG

- Eppendorf AG

- Becton Dickinson (BD)

- PHC Holdings Corporation (PHCbi)

- Liconic Instruments

- Brooks Automation, Inc.

- Hamilton Company

- Tecan Group

- Agilent Technologies, Inc.

- Beckman Coulter (Danaher Corporation)

- Hitachi High-Tech Corporation

- Corning Incorporated

- Bio-Rad Laboratories, Inc.

- InvivoGen

- Kuhner AG

- Wako Automation

- LiCONiC Systems GmbH

- Baker Company

- VWR International (Avantor)

Frequently Asked Questions

Analyze common user questions about the Laboratory Automated Incubators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of automated incubators over traditional manual incubators?

Automated incubators significantly enhance throughput, minimize contamination risk via robotic handling, ensure unparalleled environmental stability, and provide comprehensive data logging and traceability for regulatory compliance, offering superior reproducibility crucial for high-stakes biological assays and manufacturing.

How does AI impact the operational efficiency and reliability of these laboratory systems?

AI integrates predictive maintenance algorithms to anticipate component failure, optimizes gas and temperature set points based on real-time cell health data, and automates image analysis for confluence monitoring, drastically reducing downtime and improving overall experimental success rates through intelligent control.

Which end-user segment drives the highest demand in the Automated Incubators Market?

Pharmaceutical and biotechnology companies represent the largest revenue-generating segment. Their demand is driven by the necessity for high-throughput screening, compound testing, and adherence to strict GMP standards for developing biologics, cell therapies, and novel small-molecule drugs at industrial scale.

What major technological trends are currently shaping the development of new automated incubators?

Key technological trends include IoT integration for remote monitoring and cloud data management, the incorporation of multigas control (O2 regulation) for advanced cell culture, and the development of modular, scalable robotic interfaces to maximize integration flexibility within existing laboratory automation ecosystems.

What is the main restraint preventing wider adoption of automated incubation systems?

The significant high initial capital investment required for purchasing the integrated automation platforms, including the incubator, robotics, and complex software integration, poses the primary restraint, especially for smaller academic institutions and laboratories operating under restricted budgetary constraints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager