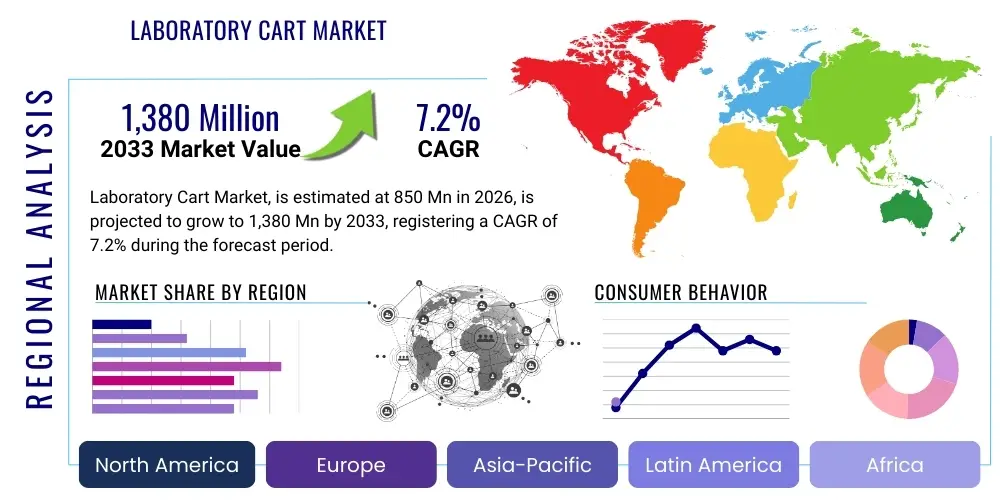

Laboratory Cart Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439608 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Laboratory Cart Market Size

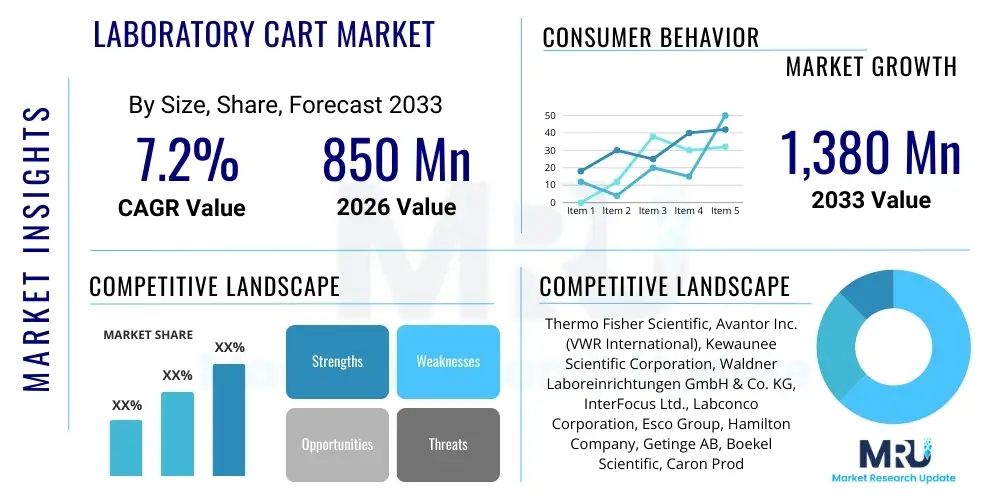

The Laboratory Cart Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,380 million by the end of the forecast period in 2033.

Laboratory Cart Market introduction

The laboratory cart market encompasses a wide range of mobile and versatile storage and transport solutions designed to enhance efficiency, organization, and safety within various scientific and medical environments. These essential tools are instrumental in facilitating the smooth operation of laboratories by providing a portable means to move equipment, samples, reagents, and other critical supplies. Their design often incorporates features such as durable materials, specialized compartments, and easy maneuverability, catering to the unique demands of research, clinical diagnostics, pharmaceutical development, and educational settings. As the backbone of many laboratory workflows, these carts contribute significantly to operational fluidity and personnel productivity, minimizing downtime and maximizing the utilization of valuable resources.

Major applications for laboratory carts span across hospitals, diagnostic centers, pharmaceutical and biotechnology companies, academic and research institutions, and industrial quality control labs. In these diverse settings, carts are utilized for tasks ranging from transporting phlebotomy supplies for patient blood draws to securely moving delicate analytical instruments or hazardous materials within a research facility. The benefits of using laboratory carts are manifold, including improved workflow organization, enhanced ergonomic conditions for laboratory personnel, reduced risk of cross-contamination through dedicated storage, and overall optimization of space. They allow for dynamic lab configurations, enabling laboratories to adapt quickly to changing experimental needs or patient care demands without significant structural alterations.

The market's growth is primarily driven by several key factors. A continuous surge in global research and development (R&D) activities, particularly in life sciences and biotechnology, fuels the demand for advanced laboratory infrastructure, including specialized carts. The increasing number of diagnostic tests performed in clinical laboratories worldwide, coupled with the expansion and modernization of healthcare facilities, further propels market expansion. Moreover, a growing emphasis on laboratory safety standards, the need for efficient sample management, and the desire for ergonomic solutions to mitigate physical strain on laboratory technicians are all significant contributors to the sustained demand for diverse types of laboratory carts. The ongoing trend towards laboratory automation and the integration of sophisticated equipment also necessitate robust and adaptable mobile platforms.

Laboratory Cart Market Executive Summary

The global laboratory cart market is experiencing dynamic shifts, characterized by evolving business trends, significant regional disparities in growth, and increasing diversification across product segments. Key business trends indicate a growing preference for customized, modular, and smart laboratory carts that can integrate seamlessly with existing lab information management systems (LIMS) and automate routine tasks. Manufacturers are increasingly focusing on incorporating durable, easy-to-clean, and chemically resistant materials to meet stringent regulatory standards, especially in pharmaceutical and clinical settings. Furthermore, there is a pronounced move towards sustainable manufacturing practices and the use of eco-friendly materials, driven by corporate social responsibility initiatives and increasing end-user demand for environmentally conscious products. This emphasis on innovation and adaptability is reshaping the competitive landscape, pushing companies to invest heavily in R&D to deliver more versatile and technologically advanced solutions.

Regional trends reveal a robust growth trajectory in the Asia Pacific (APAC) market, propelled by escalating healthcare expenditure, burgeoning biotechnology research, and rapid expansion of pharmaceutical manufacturing capabilities in countries like China and India. North America and Europe, while mature markets, continue to demonstrate steady demand, largely due to high R&D investments, an aging population requiring more sophisticated diagnostic and healthcare services, and a strong regulatory framework enforcing quality and safety in laboratories. Latin America, the Middle East, and Africa are emerging as promising markets, driven by improving healthcare infrastructure, government initiatives to boost scientific research, and increasing foreign investments in the healthcare and life sciences sectors. These regions represent significant untapped potential, though they often contend with unique challenges such as economic instability and varying regulatory landscapes.

Segment trends underscore the market's response to specialized needs within laboratories. Utility carts, owing to their versatility, maintain a significant market share, but specialized carts such as anesthesia carts, crash carts, and phlebotomy carts are witnessing accelerated adoption due to their critical role in specific medical procedures and emergency responses. The demand for workstation carts, which provide mobile and ergonomic platforms for instruments and laptops, is also on the rise, supporting flexible laboratory configurations and decentralized testing models. Material-wise, stainless steel carts remain popular for their durability and ease of sterilization, yet advanced polymers and aluminum are gaining traction due to their lightweight properties and resistance to specific chemicals. The emphasis on tailored solutions for different end-user applications, from academic research to high-throughput clinical diagnostics, is driving diversification and innovation across all segments, ensuring that the market continues to meet the complex and evolving requirements of modern laboratories.

AI Impact Analysis on Laboratory Cart Market

The integration of Artificial Intelligence (AI) into laboratory cart technology represents a transformative shift, addressing core user questions around automation, efficiency, and data management in dynamic laboratory environments. Users are primarily concerned with how AI can enhance the functionality and utility of carts beyond simple transport, seeking solutions that can independently navigate, optimize routes, manage inventory, and provide real-time operational insights. Key expectations revolve around AI's ability to minimize human error, reduce manual labor, and accelerate workflows, thereby freeing up skilled personnel for more complex tasks. There is significant interest in predictive maintenance capabilities for cart components and integrated instruments, as well as the potential for AI-driven analytics to improve resource allocation and operational planning. Concerns, however, include the initial cost of AI-enabled systems, data security and privacy implications, the complexity of integration with existing lab infrastructure, and the ethical considerations surrounding increased automation in sensitive laboratory operations.

- Autonomous navigation and intelligent pathfinding within complex laboratory layouts, optimizing transport routes and avoiding obstacles.

- Real-time inventory management through integrated RFID or vision systems, tracking consumables and samples directly on the cart and alerting staff to low stock levels or misplaced items.

- Predictive maintenance for cart components and integrated equipment, using AI to monitor performance and anticipate potential failures, reducing downtime.

- Environmental monitoring capabilities (temperature, humidity) for sensitive samples or reagents carried on the cart, with AI-driven alerts for deviations.

- Integration with Laboratory Information Management Systems (LIMS) and Electronic Health Records (EHR) for automated data logging, task assignment, and compliance tracking.

- Enhanced security features, including biometric access control and AI-powered surveillance to protect valuable contents or sensitive data.

- Adaptive workflow optimization, where AI learns from usage patterns to suggest more efficient processes or cart configurations.

DRO & Impact Forces Of Laboratory Cart Market

The laboratory cart market is significantly shaped by a confluence of driving forces, restraining factors, and emerging opportunities, all interacting to create a dynamic impact landscape. Key drivers include the global surge in research and development expenditures across life sciences, pharmaceuticals, and biotechnology, which directly correlates with the demand for advanced and efficient laboratory infrastructure. The continuous expansion and modernization of healthcare facilities worldwide, coupled with an aging global population requiring more diagnostic and medical services, also fuel the need for versatile and reliable mobile storage and transport solutions. Furthermore, increasingly stringent regulatory standards for laboratory safety, ergonomics, and sample integrity compel institutions to invest in high-quality, specialized carts that meet these compliance requirements. The growing trend towards laboratory automation and the adoption of Lean principles in lab management also necessitate the use of well-designed carts that optimize workflow and minimize manual effort, contributing to their pervasive adoption across diverse scientific environments.

Despite these robust drivers, the market faces several notable restraints. The initial high capital investment required for acquiring specialized or technologically advanced laboratory carts can be a significant barrier, particularly for smaller research institutions or budget-constrained clinical laboratories. The lack of universal standardization across cart designs and features can also present challenges, leading to compatibility issues with various lab equipment or workflow protocols. Moreover, the maintenance and repair costs associated with complex, integrated carts, especially those with electronic components or automated features, can add to the total cost of ownership. In some regions, a lack of awareness regarding the long-term benefits of investing in ergonomic and efficient cart solutions, coupled with a preference for traditional, less advanced options, can impede market penetration. These restraints collectively necessitate careful consideration by manufacturers to develop cost-effective and user-friendly solutions that address diverse budgetary and operational constraints.

Opportunities within the laboratory cart market are plentiful and revolve around technological innovation, market expansion, and strategic partnerships. The development of 'smart' carts with integrated sensors, RFID technology, and AI capabilities for inventory tracking, environmental monitoring, and autonomous navigation presents a significant growth avenue. Customization and modular design offer opportunities to cater to highly specialized laboratory requirements, allowing for flexible configurations that can adapt to changing research or clinical needs. Emerging markets in Asia Pacific, Latin America, and the Middle East and Africa represent substantial untapped potential, driven by improving healthcare infrastructure and increasing scientific investments. Strategic collaborations between cart manufacturers, laboratory equipment providers, and software developers can lead to integrated solutions that offer enhanced connectivity and data management, further optimizing laboratory operations. These opportunities, coupled with ongoing advancements in materials science for improved durability and chemical resistance, are poised to reshape the market landscape and drive future growth.

Segmentation Analysis

The laboratory cart market is meticulously segmented to provide a comprehensive understanding of its diverse landscape, reflecting variations in product types, materials used, applications, and end-user demands. This segmentation allows manufacturers and stakeholders to identify niche markets, tailor product development, and refine marketing strategies to address specific operational needs within the scientific and medical community. By dissecting the market into distinct categories, it becomes possible to analyze growth drivers and restraints unique to each segment, offering a granular view of the market's overall trajectory. The differentiation across these segments underscores the varied requirements of different laboratory environments, from sterile hospital settings to rugged industrial research facilities, ensuring that solutions are purpose-built for optimal performance and compliance.

- By Product Type:

- Utility Carts

- Phlebotomy Carts

- Anesthesia Carts

- Crash Carts (Emergency Carts)

- Supply Carts

- Workstation Carts (Mobile Workstations)

- Disaster Carts

- Customized Carts

- By Material:

- Stainless Steel Carts

- Aluminum Carts

- Plastic/Polymer Carts

- Hybrid Material Carts

- By Application:

- Research & Development Laboratories

- Clinical Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Academic & Educational Institutions

- Hospitals & Healthcare Facilities

- Industrial Quality Control Labs

- Forensic Laboratories

- By End-User:

- Hospitals

- Diagnostic Centers

- Pharmaceutical & Biotech Companies

- Research Institutes

- Academic Institutions

- By Mobility:

- Mobile Carts (with casters)

- Stationary Carts (with lockable wheels or fixed base)

- By Capacity:

- Small Capacity Carts

- Medium Capacity Carts

- Large Capacity Carts

Value Chain Analysis For Laboratory Cart Market

The value chain for the laboratory cart market initiates with the upstream activities involving the sourcing and processing of raw materials, which are fundamental to the product's quality and functionality. This stage includes suppliers of various metals such as stainless steel and aluminum, crucial for durability, hygiene, and chemical resistance, along with manufacturers of high-grade plastics and polymers for lightweight and cost-effective designs. Components like casters, locking mechanisms, ergonomic handles, specialized drawers, and electronic accessories (e.g., power outlets, data ports, sensors for smart carts) are also sourced from a diverse network of specialized component manufacturers. The efficiency and reliability of this upstream supply chain directly impact the final product's cost, quality, and time-to-market, making strong supplier relationships and quality control paramount.

Following the procurement of raw materials and components, the manufacturing phase involves design, fabrication, assembly, and quality assurance. This stage transforms raw inputs into finished laboratory carts, requiring precision engineering to ensure structural integrity, ergonomic design, and adherence to specific industry standards (e.g., for sterile environments or chemical resistance). Manufacturers often invest in advanced machinery for cutting, welding, molding, and finishing, along with rigorous testing protocols to verify load capacity, maneuverability, and durability. Customization is a key aspect here, as many laboratories require carts tailored to specific instruments, workflows, or space constraints. Innovations in manufacturing processes, such as modular design or advanced robotic assembly, contribute to efficiency and consistency, further enhancing the value proposition of the end product.

The downstream segment of the value chain focuses on distribution and sales, connecting finished laboratory carts with end-users through various channels. This typically includes a mix of direct sales, where manufacturers sell directly to large institutions or for highly customized orders, and indirect channels involving a network of distributors, wholesalers, and medical/laboratory equipment suppliers. These intermediaries often provide value-added services such as local warehousing, installation, maintenance, and technical support, playing a critical role in market reach and customer service. Online sales platforms and e-commerce portals are also growing in importance, offering wider access and competitive pricing, especially for standard utility carts. The effectiveness of these distribution channels is vital for timely delivery, efficient inventory management, and ensuring customer satisfaction, ultimately influencing market penetration and brand loyalty. Understanding and optimizing this complex network is crucial for sustained market success.

Laboratory Cart Market Potential Customers

The primary consumers and end-users of laboratory carts span a broad spectrum of scientific, medical, and industrial sectors, each with distinct needs and operational environments. Hospitals and healthcare facilities represent a significant segment, utilizing carts for a myriad of purposes including patient care, surgical instrument transport, medication delivery, phlebotomy, and emergency response (e.g., crash carts). In these settings, factors such as ease of sterilization, antimicrobial properties, secure storage, and robust mobility are paramount to ensure patient safety and efficient clinical workflows. The diverse departmental needs within a hospital, from operating rooms to intensive care units and outpatient clinics, necessitate a wide range of specialized cart types, driving consistent demand for versatile and high-quality solutions tailored to critical care and routine medical procedures.

Clinical diagnostic laboratories form another crucial customer segment, relying on laboratory carts for transporting samples, reagents, and diagnostic equipment between different testing stations or processing areas. The need for efficient sample management, protection against contamination, and ergonomic design for technicians performing repetitive tasks makes these carts indispensable. Similarly, pharmaceutical and biotechnology companies are major buyers, using carts extensively in research and development, quality control, and manufacturing processes. These environments often require carts that can withstand exposure to various chemicals, maintain sterile conditions, and securely transport expensive and sensitive materials, making specialized and durable designs a priority. The rapid pace of drug discovery and development, coupled with increasing investments in biotech research, ensures a steady demand from this sector, often for highly customized and technologically integrated solutions.

Academic and research institutions, including universities and government-funded laboratories, constitute a substantial customer base. Here, laboratory carts facilitate the movement of experimental setups, glassware, chemicals, and educational materials across different labs or classrooms. Versatility, durability, and cost-effectiveness are often key considerations, as these institutions manage diverse research projects and educational programs. Industrial quality control laboratories across various sectors, such as food and beverage, environmental testing, and manufacturing, also heavily utilize laboratory carts for transporting samples for analysis, calibration equipment, and general supplies. The demand from these varied end-user segments highlights the universal utility of laboratory carts in enhancing operational efficiency, safety, and organization across the entire scientific and medical ecosystem, driving continuous innovation and market growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,380 Million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Avantor Inc. (VWR International), Kewaunee Scientific Corporation, Waldner Laboreinrichtungen GmbH & Co. KG, InterFocus Ltd., Labconco Corporation, Esco Group, Hamilton Company, Getinge AB, Boekel Scientific, Caron Products & Services, Inc., Sheldon Manufacturing Inc., Steris Corporation, Medical Logistics, Inc., Lakeside Manufacturing, Inc., Metro (Ali Group), Waterloo Healthcare, Harloff Company, Capsa Healthcare, Sanyo Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Cart Market Key Technology Landscape

The technological landscape of the laboratory cart market is continuously evolving, driven by the demand for enhanced functionality, improved ergonomics, and seamless integration within modern lab environments. One critical area of development is the use of advanced materials. While stainless steel remains a staple due to its durability and ease of sterilization, manufacturers are increasingly incorporating high-grade polymers and specialized aluminum alloys. These materials offer benefits such as lighter weight for easier maneuverability, enhanced chemical resistance against aggressive reagents, and in some cases, antimicrobial properties to reduce contamination risks. The selection of materials is crucial for ensuring the longevity and safety of carts, especially in environments exposed to corrosive substances or requiring aseptic conditions, thus driving innovation in material science applications for laboratory equipment.

Another significant aspect of the technology landscape is the integration of smart features and connectivity. Modern laboratory carts are moving beyond simple storage solutions to become integral components of intelligent laboratory ecosystems. This includes the incorporation of RFID (Radio Frequency Identification) tags or barcode scanners for automated inventory tracking, enabling real-time management of samples, reagents, and equipment directly on the cart. Furthermore, some advanced carts feature integrated sensors for monitoring environmental conditions such as temperature and humidity, crucial for maintaining the integrity of sensitive materials during transport. The ability of these carts to connect wirelessly to Laboratory Information Management Systems (LIMS) or hospital networks facilitates automated data logging, task assignment, and compliance reporting, streamlining workflows and reducing manual errors, which is a major technological leap for operational efficiency.

Ergonomic design and power management solutions also represent key technological advancements. Carts are now engineered with adjustable heights, comfortable handles, and advanced caster systems that ensure smooth, quiet movement and easy navigation even over uneven surfaces, significantly reducing physical strain on laboratory personnel. The integration of robust power supplies, including rechargeable battery packs, allows for on-board powering of laptops, diagnostic instruments, and other electronic devices, transforming carts into mobile workstations that support decentralized testing and data analysis. This shift towards self-sufficient, mobile platforms enhances flexibility and productivity in busy lab settings. The combination of durable materials, smart technology, and thoughtful ergonomic design collectively defines the cutting-edge of the laboratory cart market, catering to the sophisticated demands of contemporary scientific research and healthcare delivery.

Regional Highlights

- North America: A mature market characterized by high R&D expenditure in life sciences, a robust healthcare infrastructure, and stringent regulatory standards. The region leads in adopting technologically advanced and specialized laboratory carts, driven by significant investments from pharmaceutical companies, biotechnology firms, and academic research institutions.

- Europe: Exhibits steady growth, influenced by an aging population necessitating increased healthcare services, strong government funding for scientific research, and a focus on laboratory automation and quality control. Countries like Germany, the UK, and France are key contributors, emphasizing ergonomic design and compliance with high safety and environmental standards.

- Asia Pacific (APAC): The fastest-growing region, propelled by expanding healthcare infrastructure, rising disposable incomes, increasing investments in pharmaceutical and biotechnology R&D, and the establishment of new diagnostic and research laboratories. Countries such as China, India, and Japan are significant players, with a burgeoning demand for both standard and advanced laboratory cart solutions.

- Latin America: An emerging market with growing investments in healthcare and life sciences, driven by improving economic conditions and government initiatives to modernize research facilities. Demand is increasing for basic utility carts and specialized solutions as regional infrastructure develops, offering considerable untapped potential.

- Middle East and Africa (MEA): Shows promising growth, particularly in the Gulf Cooperation Council (GCC) countries, due to substantial government spending on healthcare infrastructure development, medical tourism, and efforts to diversify economies through scientific research. The region is gradually adopting more sophisticated laboratory equipment, including specialized carts, as its research capabilities expand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Cart Market.- Thermo Fisher Scientific

- Avantor Inc. (VWR International)

- Kewaunee Scientific Corporation

- Waldner Laboreinrichtungen GmbH & Co. KG

- InterFocus Ltd.

- Labconco Corporation

- Esco Group

- Hamilton Company

- Getinge AB

- Boekel Scientific

- Caron Products & Services, Inc.

- Sheldon Manufacturing Inc.

- Steris Corporation

- Medical Logistics, Inc.

- Lakeside Manufacturing, Inc.

- Metro (Ali Group)

- Waterloo Healthcare

- Harloff Company

- Capsa Healthcare

- Sanyo Medical

Frequently Asked Questions

Analyze common user questions about the Laboratory Cart market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a laboratory cart primarily used for?

A laboratory cart is primarily used for the mobile storage and transport of laboratory equipment, samples, reagents, and supplies, enhancing efficiency, organization, and safety across various scientific and medical environments. They facilitate smooth workflows, reduce manual handling, and optimize space utilization in labs, hospitals, and research facilities.

What are the key types of laboratory carts available in the market?

Key types include utility carts for general transport, phlebotomy carts for blood draws, anesthesia carts for operating rooms, crash carts for emergencies, supply carts for consumables, and workstation carts that provide mobile platforms for instruments and computers. Specialized carts also exist for specific applications or materials.

What materials are commonly used in the construction of laboratory carts?

Laboratory carts are commonly constructed from durable and easy-to-clean materials such as stainless steel, known for its hygiene and corrosion resistance, and aluminum for its lightweight properties. High-grade plastics and polymers are also frequently used, often offering chemical resistance and cost-effectiveness, sometimes in hybrid designs.

How does technological advancement impact laboratory cart design and functionality?

Technological advancements are transforming laboratory carts by integrating smart features like RFID for inventory tracking, sensors for environmental monitoring, and connectivity to LIMS. AI-driven autonomous navigation and predictive maintenance are also emerging. These innovations enhance automation, data management, and operational efficiency, making carts more intelligent and versatile.

Which industries are the primary consumers of laboratory carts?

The primary consumers of laboratory carts include hospitals and healthcare facilities, clinical diagnostic laboratories, pharmaceutical and biotechnology companies, academic and research institutions, and industrial quality control labs. These diverse sectors rely on carts for their specific operational needs, from patient care to advanced scientific research.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager