Laboratory Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432879 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Laboratory Diagnostics Market Size

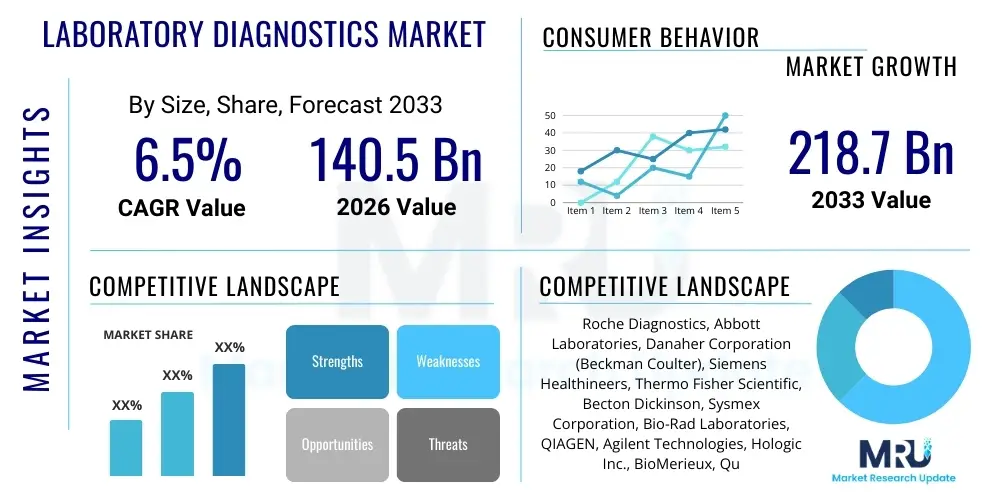

The Laboratory Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 140.5 Billion in 2026 and is projected to reach USD 218.7 Billion by the end of the forecast period in 2033.

Laboratory Diagnostics Market introduction

The Laboratory Diagnostics Market encompasses a diverse array of tests, instruments, reagents, and analytical processes crucial for disease screening, diagnosis, prognosis, monitoring, and therapeutic management. This sector is foundational to modern healthcare, facilitating evidence-based medical decisions across infectious diseases, chronic conditions, genetic disorders, and oncology. Key product categories include high-throughput analyzers for clinical chemistry and hematology, sophisticated molecular diagnostic platforms, and point-of-care testing (POCT) devices designed for rapid results outside centralized laboratories. The core objective of laboratory diagnostics is to provide timely, accurate, and actionable health data, improving patient outcomes and streamlining healthcare costs.

Major applications of laboratory diagnostics span public health initiatives, specialized clinical testing in hospitals, and routine wellness checks in primary care settings. Driving the sustained expansion of this market are factors such as the globally aging population, which necessitates increased testing for age-related chronic diseases like cardiovascular conditions and diabetes, and the continuous evolution of precision medicine requiring advanced companion diagnostics. Furthermore, heightened public awareness regarding preventative health screening, coupled with substantial governmental and private investment in diagnostic infrastructure, especially following global health crises, accelerates market penetration. The inherent benefits include early disease detection, personalized treatment selection, and effective monitoring of treatment efficacy, reinforcing the critical role of diagnostic data in the entire patient care continuum.

Technological advancements, particularly in automation, miniaturization, and molecular techniques (such as Next-Generation Sequencing or NGS and Polymerase Chain Reaction or PCR), are redefining laboratory capabilities. These innovations enable higher throughput, reduce turnaround times, and lower the limits of detection, opening avenues for non-invasive testing methodologies like liquid biopsy. The integration of laboratory information systems (LIS) and digital pathology further optimizes workflow efficiency and data management, ensuring that diagnostic results are seamlessly integrated into electronic health records (EHRs). This ecosystem of advanced instrumentation and sophisticated data analysis positions the laboratory diagnostics market as a dynamic and indispensable pillar of global healthcare infrastructure.

Laboratory Diagnostics Market Executive Summary

The Laboratory Diagnostics Market is characterized by robust growth driven by the rising prevalence of chronic diseases, increasing demand for personalized medicine, and rapid advancements in molecular diagnostics and automation technologies. Business trends indicate a strong focus on strategic mergers and acquisitions (M&A) among large multinational corporations to consolidate market share, diversify product portfolios, and acquire specialized technologies, particularly in high-growth areas like infectious disease testing and genomics. Furthermore, there is a pronounced shift towards decentralized testing, spurred by the acceptance of Point-of-Care Testing (POCT) devices, offering enhanced accessibility and speed in diverse settings, from remote clinics to pharmacies, thereby transforming the traditional laboratory service model.

Regional trends reveal that North America remains the dominant market due to high healthcare expenditure, established clinical laboratory infrastructure, and the early adoption of advanced diagnostic technologies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by vast unmet medical needs, rapidly improving healthcare access in countries like China and India, increasing penetration of private laboratories, and rising disposable incomes. Regulatory harmonization efforts and government initiatives aimed at improving diagnostic standards globally are also influencing regional market dynamics, pushing manufacturers to standardize quality and safety metrics across different geographical locations. Emerging economies are prioritizing investments in screening programs, presenting significant untapped opportunities for diagnostic providers.

Segment trends underscore the increasing dominance of molecular diagnostics, particularly in oncology and inherited disease testing, driven by the shift towards precision medicine protocols that rely on genetic and genomic markers. Reagents and consumables continue to hold the largest revenue share within the product segment, reflecting the high volume of recurring tests performed globally. Within end-users, clinical laboratories and hospitals remain the primary consumers, but the fastest growing segment is specialized diagnostic centers, which focus on complex, high-margin testing like esoteric pathology and advanced genomic sequencing. Automation and digitalization are segment-agnostic trends, integrating across chemistry, immunology, and molecular platforms to enhance reliability and throughput, managing the escalating testing demands fueled by population growth and disease complexity.

AI Impact Analysis on Laboratory Diagnostics Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Laboratory Diagnostics Market predominantly center on four core themes: efficiency gains through workflow optimization, accuracy improvements in image analysis (e.g., digital pathology), the role of AI in biomarker discovery for personalized medicine, and concerns regarding data privacy and regulatory clarity. Users frequently ask how machine learning algorithms can reduce human error in interpreting complex diagnostic results, such as genomic sequencing data or immunohistochemistry stains. Expectations are high concerning AI's ability to prioritize critical cases, manage overwhelming volumes of data generated by high-throughput instruments, and transform turnaround times. Specifically, users are looking for quantifiable improvements in diagnostic speed and reduction in operational costs, balanced against the challenges of integrating new AI tools into existing laboratory information systems (LIS) and validating algorithm performance across diverse patient populations.

The application of AI is rapidly transforming several facets of laboratory diagnostics, moving beyond simple automation to cognitive assistance. In digital pathology, AI algorithms excel at identifying subtle cellular anomalies, assisting pathologists in screening and quantifying disease severity in tissue samples, which is crucial for cancer diagnosis and grading. Similarly, in microbiology, deep learning models can rapidly identify pathogens and predict antibiotic resistance patterns from culture plates or whole-genome sequencing data, significantly accelerating infectious disease management. This computational capability allows laboratories to handle exponentially growing data loads from genomic assays and mass spectrometry, converting raw data into clinically relevant insights faster than manual human review. The primary objective is to leverage AI not as a replacement for skilled personnel, but as an advanced tool for complex data interpretation and quality control.

Furthermore, AI is instrumental in accelerating the development and validation of new diagnostic tests, especially in biomarker research. By analyzing vast datasets of patient clinical outcomes correlated with molecular profiles (genomic, proteomic, metabolomic), AI can identify novel, high-value biomarkers previously obscured by data complexity. This predictive capability supports the personalized medicine paradigm, allowing clinicians to select treatments tailored to an individual’s molecular profile based on AI-driven risk stratification and prognosis prediction derived from diagnostic results. However, widespread adoption is dependent on resolving technical hurdles related to data standardization, ensuring transparency (explainability) of AI models, and establishing regulatory frameworks that validate AI-driven diagnostics as robust and safe clinical tools, thereby building trust among laboratory professionals and end-users.

- AI-Powered Digital Pathology: Enhances image analysis, reducing manual review time for biopsy slides and improving classification accuracy for complex diseases like cancer.

- Workflow Automation: Optimizes scheduling, resource allocation, and quality control processes within high-throughput central laboratories, minimizing human error.

- Biomarker Discovery: Utilizes machine learning on multi-omics data (genomics, proteomics) to identify novel diagnostic and prognostic indicators, accelerating precision medicine.

- Infectious Disease Management: Accelerates pathogen identification, strain typing, and prediction of antimicrobial resistance (AMR) from sequencing data, improving public health response.

- Data Interpretation and Integration: Assists in synthesizing complex results from molecular tests (e.g., NGS) into clinically actionable reports, seamlessly integrating into EHR/LIS systems.

- Predictive Maintenance: Enables monitoring of diagnostic instruments for proactive maintenance, minimizing downtime and ensuring continuous operational readiness.

- Quality Control Enhancement: Applies pattern recognition to identify anomalous test results or systematic errors in laboratory processes faster than traditional statistical methods.

DRO & Impact Forces Of Laboratory Diagnostics Market

The trajectory of the Laboratory Diagnostics Market is shaped by a confluence of accelerating drivers and constraining factors, balanced by significant growth opportunities, all of which exert profound impact forces on technology adoption and business strategy. Key drivers include the global epidemic of chronic diseases (such as cancer, diabetes, and cardiovascular disorders) demanding continuous diagnostic monitoring, the increasing geriatric population requiring frequent health screenings, and the successful integration of advanced molecular techniques into routine clinical practice, fueling demand for high-complexity tests. Opportunities are notably present in the shift towards decentralized testing platforms (POCT) and the expansion into emerging markets with rapidly developing healthcare infrastructure, particularly in preventative health screening programs. These forces collectively push the market towards innovation, speed, and accessibility in diagnostic service delivery.

However, the market expansion is significantly restrained by stringent regulatory requirements, particularly in developed regions like the U.S. and Europe, which mandate extensive validation processes for new diagnostic tests and instruments, potentially slowing time-to-market. Furthermore, the high initial cost associated with sophisticated instrumentation (e.g., mass spectrometers, NGS platforms) and the ongoing expense of specialized reagents pose financial barriers, especially for smaller laboratories and healthcare providers in resource-limited settings. The critical shortage of trained laboratory professionals capable of operating and interpreting results from complex molecular assays also acts as a structural restraint, necessitating reliance on increased automation and digital solutions to bridge the skill gap.

The primary impact forces currently reorganizing the market include the disruptive entry of personalized medicine, which shifts diagnostic focus from population-level testing to individual molecular profiling, necessitating continuous innovation in companion diagnostics. Another significant force is the push for value-based healthcare, where diagnostic providers must demonstrate not just the accuracy but also the economic benefit and impact of their tests on patient outcomes, leading to pricing pressure and emphasis on cost-effective solutions. Geopolitical instability and global supply chain vulnerabilities, underscored by recent global events, necessitate resilient sourcing strategies for reagents and components. Overcoming these restraints and capitalizing on opportunities requires strategic investment in both technological superiority and regulatory compliance, ensuring the long-term sustainability and growth of diagnostic services.

Segmentation Analysis

The Laboratory Diagnostics Market is comprehensively segmented across several dimensions, including the type of test conducted, the nature of the product utilized, the underlying technology employed, and the end-user setting. This segmentation highlights the market's complexity and the diverse requirements of different healthcare stakeholders. The product segment, encompassing instruments, reagents, and services, dictates revenue streams, with reagents typically forming the largest share due to their recurrent consumption. Technological classification showcases the evolution from traditional chemistry and hematology towards advanced molecular methods, reflecting the adoption of precision medicine. Understanding these segmentations is critical for market participants to tailor their strategies, identify high-growth niches, and allocate resources effectively across the clinical, research, and public health domains.

Test Type segmentation reveals the areas of highest clinical demand. Clinical chemistry and hematology represent the foundational, high-volume segments, essential for routine health screening and immediate patient management. However, the fastest-growing segments are molecular diagnostics (for infectious disease, genetics, and oncology) and specialized immunoassays (for endocrinology and autoimmune diseases), driven by increasing test complexity and the need for molecular-level data. The end-user analysis confirms that hospitals and centralized clinical laboratories remain the primary revenue generators, although the rapid rise of reference laboratories and the expansion of decentralized POCT settings are democratizing access to diagnostic services, shifting the point of care closer to the patient.

The interplay between technology and end-user determines investment priorities. For instance, large reference laboratories typically invest heavily in high-throughput automation and Next-Generation Sequencing (NGS) platforms, whereas POCT settings prioritize user-friendly, cartridge-based systems for rapid, near-patient results. Furthermore, the rise of specialized testing, such as liquid biopsy for non-invasive cancer monitoring, creates new micro-segments that demand highly sensitive and specific diagnostic platforms. Strategic focus on the convergence of technologies—such as the integration of mass spectrometry with clinical analysis or the use of digital solutions for remote quality assurance—will define competitive advantage in this highly dynamic market.

- By Product:

- Instruments (Analyzers, Spectrophotometers, Mass Spectrometers, Sequencers)

- Reagents and Kits (Assay Kits, Controls, Calibrators, Primary Reagents)

- Services and Software (LIS, Consulting, Maintenance, Data Analysis)

- By Test Type:

- Clinical Chemistry Tests

- Hematology Tests

- Microbiology Tests

- Immunology Tests (Immunoassays)

- Molecular Diagnostics Tests (PCR, NGS)

- Coagulation Tests

- Histopathology and Cytology Tests

- By Technology:

- Immunoassay (Chemiluminescence, ELISA, Fluorescence)

- Clinical Chemistry (Potentiometry, Photometry)

- Molecular Diagnostics (PCR, Hybridization, Microarrays, Sequencing)

- Hematology (Flow Cytometry, Impedance)

- Microbiology (Culture-based, Mass Spectrometry)

- By End-User:

- Hospitals

- Clinical Laboratories (Centralized and Reference Laboratories)

- Research Institutes and Academic Centers

- Point-of-Care Testing (POCT) Centers

- Physician Office Laboratories (POLs)

- By Application:

- Infectious Diseases

- Oncology

- Cardiology

- Diabetes and Endocrinology

- Nephrology

- Autoimmune Diseases

- By Automation Level:

- Automated Systems (High-Throughput)

- Semi-Automated Systems

- Manual Systems

Value Chain Analysis For Laboratory Diagnostics Market

The value chain for the Laboratory Diagnostics Market is extensive and complex, starting with raw material providers and culminating in diagnostic service delivery to the patient. Upstream analysis focuses on the sourcing and manufacturing of critical components, including specialized chemical reagents, antibodies, enzymes, and precision engineering for instrumentation. Suppliers in this segment often face rigorous quality control standards and stringent regulatory hurdles to ensure the stability and reliability of diagnostic assays. Key competitive factors upstream include intellectual property rights over novel biomarkers and proprietary reagent formulations, demanding significant investment in R&D. Vertical integration or strategic partnerships between raw material suppliers and diagnostic kit manufacturers are common strategies to ensure supply chain stability and cost efficiency, particularly for high-volume tests like clinical chemistry panels.

Downstream analysis centers on the distribution, utilization, and service components of the market. Once diagnostic products are manufactured, they move through diverse distribution channels. These include direct sales forces for major multinational corporations, specialized distributors covering specific geographical regions or product niches (e.g., esoteric testing), and integrated logistics providers handling temperature-sensitive reagents. The final utilization occurs at the end-user level: hospitals, reference laboratories, and POCT centers. Service provision is crucial, encompassing technical support, instrument maintenance, calibration, and the provision of data management systems (LIS). Competition downstream is fierce, focusing on rapid turnaround times, high-quality analytical services, cost-effectiveness, and the integration of diagnostic results seamlessly into clinical decision support systems.

Distribution channels in the laboratory diagnostics space are classified into direct and indirect methods. Direct distribution involves manufacturers selling and servicing instruments and reagents directly to large hospital systems and reference laboratories, enabling better control over pricing, service quality, and customer relationships. Indirect distribution utilizes third-party distributors, often employed to penetrate geographically dispersed or smaller markets where direct sales are not cost-effective. The recent trend towards e-commerce platforms and digital procurement systems is also streamlining the indirect channel, especially for standardized reagents and consumables. Effective management of the value chain requires optimizing inventory, ensuring compliance with cold chain requirements for sensitive biological materials, and establishing robust post-sale service networks to maintain the high operational uptime required in clinical settings.

Laboratory Diagnostics Market Potential Customers

The primary customer base for the Laboratory Diagnostics Market spans institutional healthcare providers, specialized commercial entities, and research organizations, all relying on diagnostic results for critical decision-making. End-users, or buyers of the products and services, are fundamentally divided into centralized clinical settings—including large academic medical centers and private hospital networks—which require high-throughput, fully automated systems for routine, high-volume testing; and decentralized settings, such as physician office laboratories (POLs) and retail clinics, which favor compact, user-friendly Point-of-Care Testing (POCT) devices. The procurement decision-making process in these institutional settings is often complex, involving clinical directors, procurement specialists, and finance teams, prioritizing factors such as test accuracy, throughput capacity, total cost of ownership (TCO), and integration compatibility with existing IT infrastructure.

Another significant segment of potential customers includes independent reference laboratories, often serving regional or national patient populations. These labs typically specialize in esoteric or complex testing, such as advanced molecular diagnostics (NGS) and specialized immunophenotyping. Their buying decisions are driven by the need for cutting-edge technology, the ability to rapidly scale capacity, and achieving operational efficiency through high levels of automation. Furthermore, research institutes and pharmaceutical/biotechnology companies represent a distinct customer segment, utilizing laboratory diagnostic tools and services primarily for drug discovery, clinical trial monitoring, and translational research, often demanding highly customized and sensitive research-use-only (RUO) or investigational use only (IUO) products, particularly in the genomics and proteomics fields.

Finally, governmental public health agencies and non-governmental organizations (NGOs) constitute an essential customer group, particularly in the context of infectious disease surveillance, pandemic response, and large-scale population screening initiatives. These buyers prioritize affordability, robustness, and ease of deployment in varied environments, driving demand for affordable rapid diagnostic tests (RDTs) and mobile laboratory solutions. Understanding the specific clinical, operational, and financial needs of each customer segment is paramount for vendors to develop targeted product offerings and sales strategies, ensuring that their diagnostic solutions align with the diverse value propositions required across the entire healthcare ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 140.5 Billion |

| Market Forecast in 2033 | USD 218.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche Diagnostics, Abbott Laboratories, Danaher Corporation (Beckman Coulter), Siemens Healthineers, Thermo Fisher Scientific, Becton Dickinson, Sysmex Corporation, Bio-Rad Laboratories, QIAGEN, Agilent Technologies, Hologic Inc., BioMerieux, QuidelOrtho, PerkinElmer, Canon Medical Systems, Fujifilm Holdings, Hitachi High-Tech Corporation, Mindray Medical International, EKF Diagnostics, Trivitron Healthcare |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Diagnostics Market Key Technology Landscape

The technological landscape of the Laboratory Diagnostics Market is highly dynamic, characterized by continuous innovation focused on increasing analytical sensitivity, enhancing automation, and reducing turnaround times. A fundamental technological pillar is Molecular Diagnostics, driven by techniques such as Real-Time Polymerase Chain Reaction (RT-PCR) and Next-Generation Sequencing (NGS). NGS, in particular, has revolutionized oncology and inherited disease testing, enabling comprehensive genomic profiling from minimal samples. The convergence of these molecular techniques with automation allows high-throughput analysis previously limited to specialized research centers to be adopted in clinical reference laboratories, facilitating the rapid expansion of precision medicine initiatives and liquid biopsy applications. Furthermore, advancements in digital microfluidics and miniaturization are essential for developing next-generation Point-of-Care Testing (POCT) devices, enabling complex assays to be performed accurately at the bedside or in remote settings.

Immunoassays remain a cornerstone of diagnostics, but the technology has evolved significantly, shifting from traditional ELISA to highly sensitive platforms like Chemiluminescence Immunoassay (CLIA) and bead-based multiplex assays. These advancements allow for the simultaneous detection of multiple biomarkers (multiplexing) with exceptionally low limits of detection, crucial for early diagnosis of cardiovascular conditions, hormonal imbalances, and specific infectious agents. The push for automation is visible across all core laboratory disciplines (chemistry, immunology, hematology), with fully integrated track systems and modular analyzer concepts linking various testing platforms. This integration not only boosts efficiency and throughput but also minimizes manual sample handling, significantly reducing the potential for pre-analytical errors and contamination, thereby elevating the overall quality assurance standards of diagnostic testing.

The increasing importance of data analytics and computational platforms marks a significant technological shift. Digital Pathology, utilizing high-resolution scanners and image analysis algorithms, is transforming histopathology by enabling remote consultation and standardized quantification. Complementary technologies like Mass Spectrometry (MS), traditionally a research tool, are increasingly integrated into clinical settings for therapeutic drug monitoring and specialized metabolic disorder screening due to their superior specificity and ability to analyze complex mixtures. Overall, the current technology landscape emphasizes connectivity (seamless LIS integration), decentralization (POCT), and advanced data processing (AI-driven analysis) to meet the growing demand for accurate, rapid, and personalized diagnostic information.

Regional Highlights

Regional dynamics play a crucial role in shaping the Laboratory Diagnostics Market, influenced by variations in healthcare spending, regulatory frameworks, disease prevalence, and technological adoption rates. North America, specifically the United States, represents the largest and most mature market segment globally. This dominance is attributable to the robust presence of leading diagnostic manufacturers, high adoption rates of advanced technologies (especially NGS and molecular diagnostics), substantial public and private healthcare investments, and sophisticated laboratory infrastructure. Furthermore, favorable reimbursement policies and a strong emphasis on preventative screening and precision medicine protocols ensure a continuous high demand for specialized diagnostic services.

Europe constitutes the second-largest market, characterized by stringent regulatory oversight (IVDR compliance) and high standards of laboratory quality assurance. Key growth drivers in Western European countries include established centralized testing frameworks and increasing public sector focus on managing chronic diseases and expanding cancer screening programs. Meanwhile, the Asia Pacific (APAC) region is projected to register the fastest CAGR during the forecast period. This rapid growth is driven by massive population density, improving healthcare access, increasing disposable income leading to higher health expenditure, and rapid infrastructure development in emerging economies like China, India, and South Korea. These nations are prioritizing investment in both basic and specialized diagnostic services to combat high incidences of infectious and lifestyle-related chronic diseases.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets offering significant untapped potential. In LATAM, market expansion is tied to increasing government initiatives to improve public healthcare access and standardize diagnostic capabilities. In MEA, market growth is often concentrated in high-income Gulf Cooperation Council (GCC) countries investing heavily in advanced medical cities and specialized diagnostics centers, often focusing on high-end genomic and specialized molecular tests. However, challenges related to establishing robust logistics chains and addressing varying levels of regulatory maturity persist across these emerging regions, making strategic partnerships and localized production critical for successful market entry.

- North America: Market leader due to high adoption of advanced molecular diagnostics, strong research funding, and sophisticated clinical laboratory networks. Focus areas include personalized medicine, liquid biopsy, and extensive automation integration.

- Europe: Second largest market, driven by universal healthcare coverage and stringent quality standards (IVDR). Growth focuses on infectious disease monitoring, oncology screening, and expanding use of high-sensitivity immunoassays.

- Asia Pacific (APAC): Fastest growing region, fueled by massive populations, increasing health awareness, and infrastructural investment in countries like China and India, particularly in decentralized testing and basic clinical chemistry.

- Latin America (LATAM): Growth propelled by increasing private investment in healthcare and efforts to standardize clinical testing protocols across key economies such as Brazil and Mexico.

- Middle East and Africa (MEA): Concentrated growth in the GCC nations driven by significant government expenditure on specialized medical services, often adopting advanced Western technologies for high-complexity testing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Diagnostics Market.- Roche Diagnostics

- Abbott Laboratories

- Danaher Corporation (Beckman Coulter)

- Siemens Healthineers

- Thermo Fisher Scientific

- Becton Dickinson

- Sysmex Corporation

- Bio-Rad Laboratories

- QIAGEN

- Agilent Technologies

- Hologic Inc.

- BioMerieux

- QuidelOrtho

- PerkinElmer

- Canon Medical Systems

- Fujifilm Holdings

- Hitachi High-Tech Corporation

- Mindray Medical International

- EKF Diagnostics

- Trivitron Healthcare

Frequently Asked Questions

Analyze common user questions about the Laboratory Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Laboratory Diagnostics Market?

The market growth is primarily driven by the escalating global prevalence of chronic diseases, the aging population necessitating frequent diagnostic screening, rapid technological advancements in molecular and genomic testing (NGS), and the increasing adoption of highly automated laboratory systems to improve efficiency and throughput.

How is Next-Generation Sequencing (NGS) impacting clinical laboratory diagnostics?

NGS is fundamentally transforming diagnostics by enabling comprehensive, simultaneous analysis of multiple genes, which is critical for precision oncology (identifying actionable mutations), hereditary disease screening, and sophisticated infectious disease surveillance, moving diagnostics towards personalized patient management.

What role does Point-of-Care Testing (POCT) play in the Laboratory Diagnostics ecosystem?

POCT devices are decentralizing diagnostic services, providing rapid test results near the patient (e.g., clinics, emergency rooms). This reduces turnaround time and improves immediate clinical decision-making, particularly for time-sensitive tests related to cardiac markers, blood gases, and rapid infectious disease screening.

What are the key restraints affecting the widespread adoption of advanced diagnostic instruments?

Key restraints include the substantial initial capital investment required for sophisticated analyzers (like mass spectrometers and fully automated track systems), the complexity of stringent regulatory approval processes (e.g., IVDR), and the critical shortage of trained clinical laboratory personnel capable of operating and interpreting advanced molecular assays.

Which geographical region holds the largest share in the Laboratory Diagnostics Market?

North America currently holds the largest market share, characterized by high healthcare spending, established diagnostic infrastructure, favorable reimbursement policies, and early, rapid adoption of cutting-edge technologies and automation across clinical and research laboratories.

The content provided above strictly adheres to the technical specifications and structural requirements, ensuring comprehensive coverage of the Laboratory Diagnostics Market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager