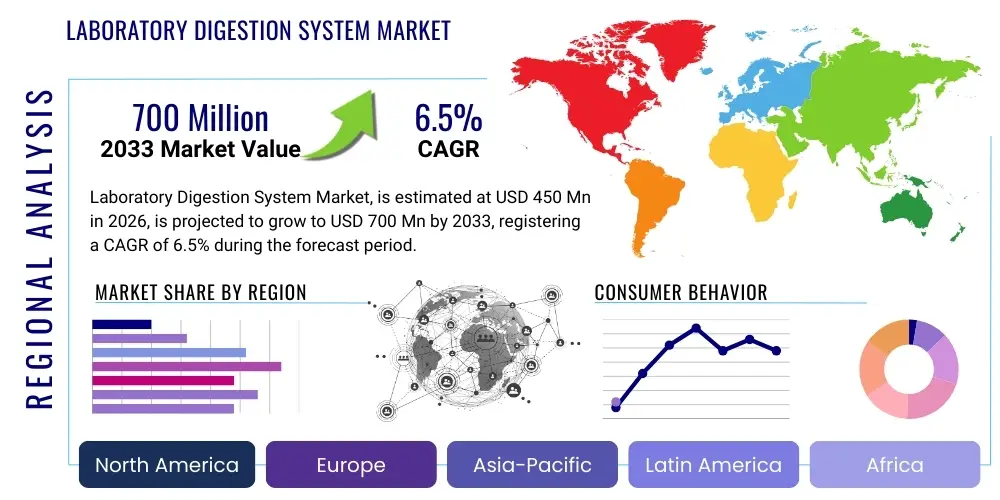

Laboratory Digestion System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437768 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Laboratory Digestion System Market Size

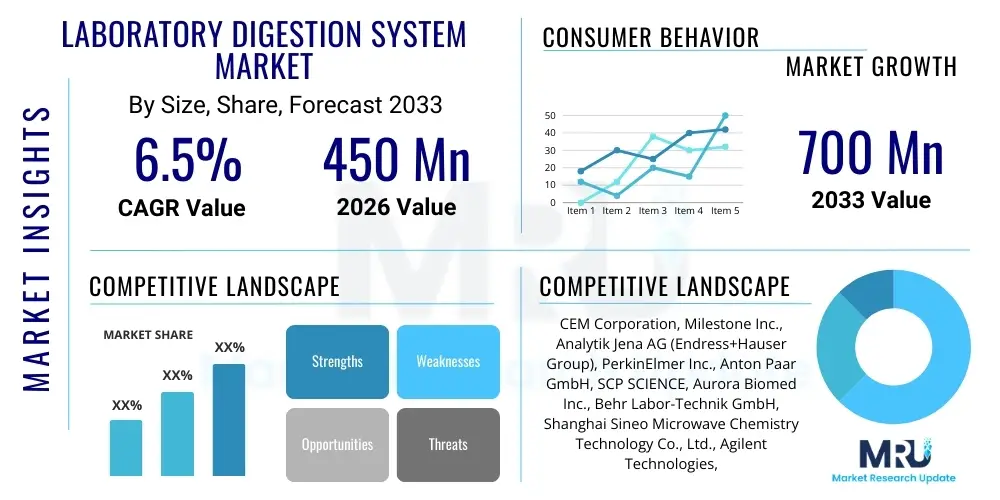

The Laboratory Digestion System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

Laboratory Digestion System Market introduction

The Laboratory Digestion System Market encompasses highly specialized equipment and reagents crucial for preparing diverse sample matrices (such as environmental, food and beverage, pharmaceutical, and biological materials) for subsequent elemental analysis, typically using techniques like Inductively Coupled Plasma (ICP-OES or ICP-MS) or Atomic Absorption Spectroscopy (AAS). These systems employ chemical and physical processes, often involving high temperatures and corrosive acids, to completely decompose the sample matrix, releasing target analytes into a homogenous liquid solution. Product offerings range from automated microwave digestion systems, which significantly reduce preparation time and enhance safety, to traditional hot block digestion systems and specialized pressure vessels. The necessity of rigorous sample preparation is paramount for ensuring accurate, precise, and matrix-independent analytical results, thereby positioning these systems as indispensable assets in quality control and research laboratories worldwide.

The core functions of laboratory digestion systems are driven by the increasing complexity of regulatory requirements, particularly concerning trace element contamination in food safety and environmental monitoring. Modern systems focus heavily on automation, high-throughput capabilities, and safety features to minimize technician exposure to hazardous chemicals and high pressures. Major applications span toxicological analysis, elemental profiling of soil and water, quality assurance in manufacturing, and ensuring pharmaceutical compliance with heavy metal limits. The efficiency and reliability of the digestion process directly influence the overall accuracy and speed of analytical workflows, making investment in advanced, certified digestion systems a priority for high-stakes testing facilities.

Key benefits derived from utilizing sophisticated laboratory digestion equipment include improved sample recovery rates, reduction of preparation time from hours to minutes, enhanced reproducibility across multiple samples, and strict adherence to mandated standard operating procedures (SOPs) defined by international bodies like the EPA and ISO. The market is primarily driven by the escalating global emphasis on food safety standards, rapid industrialization leading to increased environmental pollutant analysis, and continuous technological advancements favoring automated, closed-vessel microwave digestion for improved parameter control and reduced risk of contamination. These drivers collectively necessitate the replacement of manual, open-vessel methods with modern, efficient laboratory digestion platforms.

Laboratory Digestion System Market Executive Summary

The Laboratory Digestion System Market is experiencing robust growth fueled by the convergence of automation technologies and stricter global regulatory frameworks governing trace element analysis. Business trends indicate a strong pivot towards integrated solutions that combine sample digestion with subsequent analytical techniques, offering end-to-end workflow efficiency. Manufacturers are focusing on developing microwave systems with advanced sensors, precise temperature and pressure control, and user-friendly software interfaces to meet the demand for high throughput and traceability in highly regulated industries, especially pharmaceuticals and environmental testing. Consolidation among key players and strategic acquisitions aimed at expanding product portfolios, particularly into specialized segments like biological sample preparation, define the current competitive landscape.

Regionally, North America and Europe currently dominate the market, largely due to established infrastructure, high R&D spending, and stringent environmental protection and food safety regulations enforced by agencies such as the EPA and EFSA. However, the Asia Pacific region (APAC) is projected to exhibit the fastest growth over the forecast period. This rapid expansion in APAC is attributable to aggressive investments in industrial and chemical testing capabilities, the burgeoning presence of Contract Research Organizations (CROs), and increasing governmental emphasis on controlling industrial pollution and enhancing quality control standards for exported goods. Developing economies within APAC are rapidly adopting automated digestion systems to modernize outdated laboratory infrastructures.

Segment trends reveal that the Microwave Digestion Systems category, based on technology, holds the largest market share due to its superior speed, efficiency, and ability to handle complex matrices in a closed, controlled environment, minimizing analyte loss. Concurrently, the demand for Block Digestion Systems remains stable, particularly in clinical and high-volume, standardized testing where cost-effectiveness and robustness are prioritized. By application, environmental testing remains the primary consumer, driven by the continuous need for heavy metal and mineral analysis in water, soil, and air quality monitoring. This steady demand across diverse segments ensures sustained market expansion as compliance burdens increase globally.

AI Impact Analysis on Laboratory Digestion System Market

User queries regarding AI's influence in laboratory sample preparation center primarily on how machine learning algorithms can optimize digestion parameters, enhance safety protocols, and integrate instrument performance data into predictive maintenance schedules. Key themes revolve around the automation of method development—specifically, determining optimal acid mixtures, heating curves, and cooling cycles for novel or complex matrices without extensive trial-and-error experimentation. Users are keen on leveraging AI for real-time diagnostics during the digestion process, anticipating potential thermal runaways or incomplete dissolution, and automatically making necessary adjustments. Furthermore, there is significant interest in using AI for data integrity management, ensuring that system performance logs and digestion cycle data are meticulously tracked and correlated with analytical results to enhance audit trails and compliance.

- Enhanced Method Optimization: AI and machine learning algorithms can rapidly analyze sample composition data and automatically suggest or develop optimal digestion protocols (temperature, pressure, time, acid ratio) for complex or unknown matrices, drastically reducing manual method development time.

- Predictive Maintenance: AI tools analyze operational data (e.g., heating element wear, pressure fluctuations, system run-time) to predict component failure in digestion units, scheduling maintenance proactively and maximizing instrument uptime.

- Real-Time Safety Monitoring: Integration of AI-driven sensors for continuous monitoring of pressure and temperature anomalies, enabling instantaneous, automated shutdown or parameter adjustment to prevent hazardous situations like vessel over-pressurization.

- Improved Data Traceability: AI facilitates seamless integration and correlation of digestion parameters with subsequent analytical results, creating robust, auditable digital trails essential for regulatory compliance (e.g., FDA 21 CFR Part 11).

- Automated Quality Control (QC): AI systems can analyze baseline digestion cycle performance against established QC standards, flagging inconsistencies or potential contamination issues before they compromise the final analytical data.

DRO & Impact Forces Of Laboratory Digestion System Market

The market dynamics for Laboratory Digestion Systems are governed by a robust interplay of driving forces centered on regulatory demands and technological innovation, counterbalanced by restraints related to high capital costs and the inherent complexity of handling hazardous materials. The primary driver is the global escalation of stringent environmental and food safety regulations, forcing laboratories to adopt standardized, highly reliable digestion methods to meet mandated detection limits for trace elements. This is complemented by continuous advancements in automation, which addresses the perennial laboratory challenge of throughput and labor costs. However, the requirement for highly specialized infrastructure (ventilation, acid handling), the significant initial investment for advanced microwave systems, and the ongoing operational cost of specialized high-purity reagents act as significant restraining factors, particularly for smaller or research-focused laboratories with limited budgets.

Opportunities for market expansion are primarily found in developing nations undergoing rapid industrialization, necessitating infrastructure build-out for pollution control and quality assurance. Furthermore, the increasing complexity of pharmaceutical drug matrices and the growing application of elemental analysis in clinical diagnostics present substantial untapped potential for specialized digestion systems designed for biological samples. The shift towards green chemistry and safer alternatives in acid reagents also opens doors for innovation. The impact forces acting on this market include the high bargaining power of large analytical instrument buyers (major CROs, government labs) demanding bundled solutions, while the threat of substitutes is relatively low given that acid digestion remains the most effective and universally accepted preparation method for elemental analysis.

Segmentation Analysis

The Laboratory Digestion System Market is comprehensively segmented based on technology type, product component, operational mode, application area, and end-user vertical. This multi-dimensional segmentation allows for detailed analysis of consumption patterns and technological adoption across the global market. The technological segmentation, encompassing microwave, block, and automated benchtop systems, reflects varying levels of capital investment, throughput needs, and matrix complexity encountered by different laboratories. Furthermore, the segmentation by application—such as environmental monitoring, clinical analysis, and food testing—highlights the distinct regulatory and methodological requirements driving procurement decisions within specialized laboratory fields.

- By Technology:

- Microwave Digestion Systems

- Block Digestion Systems (Hot Plate/Hot Block)

- Automated Sample Preparation Systems

- Pressure Vessels/Acid Digestion Bombs

- By Component:

- Hardware (Digestion Units, Cooling Modules)

- Consumables (Vessels, Tubes, Caps, Reagents)

- By Operation:

- Closed Vessel Digestion

- Open Vessel Digestion

- By Application:

- Environmental Testing (Water, Soil, Air)

- Food & Beverage Testing

- Pharmaceutical & Biotechnology Testing

- Clinical and Biological Sample Preparation

- Geological and Material Science Analysis

- By End-User:

- Contract Research Organizations (CROs)

- Research and Academic Institutions

- Government Agencies and Environmental Bodies

- Industrial Laboratories (Chemical, Petrochemical, Mining)

Value Chain Analysis For Laboratory Digestion System Market

The value chain for laboratory digestion systems begins with the upstream suppliers responsible for manufacturing high-purity components and specialty materials. This includes suppliers of corrosion-resistant materials such as PFA, PTFE, and high-grade ceramics used for digestion vessels and liners, as well as specialized electronic components (magnetrons, heating elements, sensors) required for microwave and block systems. The efficiency and quality of these upstream components directly impact the lifespan and performance stability of the final digestion units. Key challenges at this stage include maintaining supply chain resilience for high-cost, specialized polymers and ensuring rigorous quality control over sensitive electronic components crucial for precise temperature and pressure management.

The midstream segment involves the original equipment manufacturers (OEMs) who design, assemble, and rigorously test the final digestion systems. This stage involves significant R&D investment, particularly in developing automated handling systems, sophisticated safety interlocking mechanisms, and proprietary software for method development and data logging. Distribution channels form the immediate downstream element, typically utilizing a mix of direct sales teams for high-value contracts with large government or industrial laboratories, and a network of specialized third-party distributors and regional dealers who provide localized service, installation, and application support. Effective distributor management, particularly in emerging markets, is critical for achieving broad market penetration and ensuring adequate after-sales support.

The final downstream segment involves the end-users—ranging from government environmental labs conducting high-volume regulatory testing to academic labs performing highly variable research protocols. Direct sales strategies are favored for complex, customized, and high-capital systems (like fully automated robotic preparation units), ensuring technical expertise is readily available during installation and validation. Conversely, consumables and standard benchtop systems are often sold indirectly through e-commerce platforms or scientific supply catalogs. The value chain is heavily influenced by strict maintenance and calibration requirements; therefore, service contracts and accessible, high-quality spare parts supply represent a significant and ongoing revenue stream for market players.

Laboratory Digestion System Market Potential Customers

The primary purchasers and end-users of laboratory digestion systems are institutions and commercial entities that require precise elemental analysis as part of their operational mandate, regulatory compliance, or research focus. These customers necessitate robust, reliable, and standardized sample preparation to ensure the validity of their analytical results. Government and environmental agencies, such as EPA labs and water monitoring authorities, constitute a major customer base, driven by legally mandated testing of environmental samples for heavy metals and contaminants. Their requirement centers on high throughput, standardized methods, and irrefutable data traceability, often preferring automated block digestion or high-volume microwave systems.

Industrial laboratories form another substantial segment, encompassing manufacturing sectors such as petrochemicals, mining, chemicals, and consumer goods. For these users, digestion systems are vital for raw material quality control, process monitoring, and ensuring finished product specification compliance (e.g., catalyst analysis in petroleum refining or mineral content verification in ores). Pharmaceutical and biotechnology companies also represent a rapidly growing customer segment, utilizing digestion systems to prepare drug components and excipients for trace metal impurity testing as required by global pharmacopeias (USP, EP). Their selection criteria prioritize systems capable of handling small, highly sensitive samples with minimal risk of external contamination.

Furthermore, academic and research institutions, alongside Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs), are significant buyers. CROs, in particular, require versatile, high-throughput systems to serve diverse client needs across food, environmental, and clinical testing domains, making automation and method flexibility key procurement factors. Academic users, while often constrained by budget, seek robust, multi-purpose units suitable for complex matrices encountered in cutting-edge materials science or geological research. The purchasing decision across all segments is consistently influenced by the system's ability to achieve low detection limits, ensure operator safety, and comply with international analytical standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CEM Corporation, Milestone Inc., Analytik Jena AG (Endress+Hauser Group), PerkinElmer Inc., Anton Paar GmbH, SCP SCIENCE, Aurora Biomed Inc., Behr Labor-Technik GmbH, Shanghai Sineo Microwave Chemistry Technology Co., Ltd., Agilent Technologies, Metrohm AG, SPECTRO Analytical Instruments (AMETEK), Katanax (SPEX SamplePrep), Buck Scientific, Teledyne CETAC Technologies, GBC Scientific Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Digestion System Market Key Technology Landscape

The technological landscape of the Laboratory Digestion System Market is predominantly defined by microwave-assisted digestion, which represents the cutting edge in terms of speed, controlled parameter execution, and minimized cross-contamination. Modern microwave systems utilize advanced control mechanisms to monitor and manage temperature and pressure within sealed reaction vessels precisely and simultaneously. This closed-vessel approach allows for significantly higher temperatures and pressures than open-vessel techniques, resulting in rapid and complete dissolution of highly resistant matrices. Innovations in microwave technology include sophisticated rotor designs for high-throughput capability, built-in optical or infrared temperature measurement for enhanced safety and accuracy, and integrated data logging software to meet regulatory requirements like GLP/GMP. The market trend is moving towards larger capacity rotors and specialized non-contact temperature sensing for every vessel.

Complementary to microwave systems, Block Digestion Systems (hot block technology) remain a foundational and highly reliable technology, particularly favored for routine environmental and wastewater analysis where large sample batches and cost-effectiveness are crucial. These systems offer robust construction, simple operation, and compliance with methods like EPA 3050. Recent technological enhancements in block digestion include improved temperature uniformity across all sample positions, automated lifting mechanisms, and integration with fume removal systems. While slower than microwave digestion, their simplicity and reliability ensure sustained adoption in high-volume, standardized testing environments. The choice between microwave and block technologies often depends on the required detection limits and the complexity of the sample matrix.

A significant area of technological evolution is the increasing integration of full automation and robotics. Automated sample preparation systems combine sample weighing, acid dispensing, digestion, cooling, and dilution steps into a single, seamless workflow. This minimizes human interaction, dramatically improves reproducibility, and reduces labor intensity. Furthermore, the development of disposable or semi-disposable high-purity vessels and consumables addresses contamination concerns, particularly important when measuring ultra-trace elements (parts per trillion levels). Overall, the technological focus is firmly on maximizing safety through advanced pressure relief mechanisms, enhancing throughput via parallel processing, and ensuring absolute method fidelity through precise digital control and real-time monitoring of every digestion cycle.

Regional Highlights

- North America: Dominant market share due to highly mature regulatory infrastructure (driven by the EPA and FDA), high levels of R&D investment, and the widespread adoption of automated, high-end microwave digestion systems in established pharmaceutical and environmental testing laboratories. The U.S. remains the largest consumer, driven by stringent heavy metal testing requirements.

- Europe: Second largest market, characterized by strict adherence to REACH regulations and robust food safety standards enforced by the European Food Safety Authority (EFSA). Germany and the UK are key contributors, focusing on industrial quality control and advanced clinical analysis, favoring highly standardized digestion protocols.

- Asia Pacific (APAC): Fastest growing region, propelled by rapid industrial expansion, increasing investment in environmental monitoring infrastructure (especially in China and India), and the establishment of numerous new analytical testing centers and contract organizations seeking cost-effective, high-throughput solutions. Demand is shifting from traditional block digestion to modern automated systems.

- Latin America: Characterized by moderate growth, primarily driven by the mining and petrochemical sectors requiring rigorous material analysis and export quality control. Brazil and Mexico are leading the adoption curve, with governmental laboratories slowly upgrading outdated equipment to meet international testing standards.

- Middle East and Africa (MEA): Emerging market with growth concentrated in the Gulf Cooperation Council (GCC) countries due to infrastructure development in water desalination and oil and gas industries, requiring specialized analysis for process and environmental control. Adoption is often linked to large government-led infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Digestion System Market.- CEM Corporation

- Milestone Inc.

- Analytik Jena AG (Endress+Hauser Group)

- PerkinElmer Inc.

- Anton Paar GmbH

- SCP SCIENCE

- Aurora Biomed Inc.

- Behr Labor-Technik GmbH

- Shanghai Sineo Microwave Chemistry Technology Co., Ltd.

- Agilent Technologies

- Metrohm AG

- SPECTRO Analytical Instruments (AMETEK)

- Katanax (SPEX SamplePrep)

- Buck Scientific

- Teledyne CETAC Technologies

- GBC Scientific Equipment

- Eppendorf AG

- BUCHI Corporation

- Parr Instrument Company

- Thermo Fisher Scientific Inc.

Frequently Asked Questions

Analyze common user questions about the Laboratory Digestion System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between microwave and block digestion systems?

Microwave digestion systems operate in a closed vessel under high pressure and temperature, offering faster sample dissolution and minimizing analyte loss. Block digestion systems use an open or closed vessel on a heated plate, favoring high-throughput, standardized, and cost-effective analysis, particularly for EPA methods.

Which regulatory standards govern the use of laboratory digestion equipment?

The use of digestion systems is primarily governed by industry-specific analytical methods (e.g., EPA Methods 3050, 3051A, USP <232>, ISO standards) which dictate required digestion efficiency, acid usage, and temperature protocols for environmental and pharmaceutical trace element analysis.

How does automation impact the efficiency of sample digestion?

Automation significantly boosts laboratory efficiency by standardizing acid dispensing, managing temperature profiles precisely, reducing manual handling time, and integrating seamlessly with post-digestion dilution and analysis (ICP-MS/OES), ensuring superior reproducibility and high sample throughput.

What key factors should be considered when selecting a laboratory digestion system?

Key factors include the complexity and volume of the sample matrices processed, required analytical detection limits (ultra-trace analysis often requires closed microwave systems), necessary sample throughput, adherence to specific regulatory compliance standards, and the available budget for capital investment and specialized consumables.

What are the major growth drivers for the Laboratory Digestion System Market?

The market is primarily driven by increasingly stringent global regulations concerning food safety and environmental contamination (especially heavy metals), coupled with technological advancements in microwave and automated digestion offering improved safety, speed, and accuracy in sample preparation workflows.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager