Laboratory Ovens and Freezers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439604 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Laboratory Ovens and Freezers Market Size

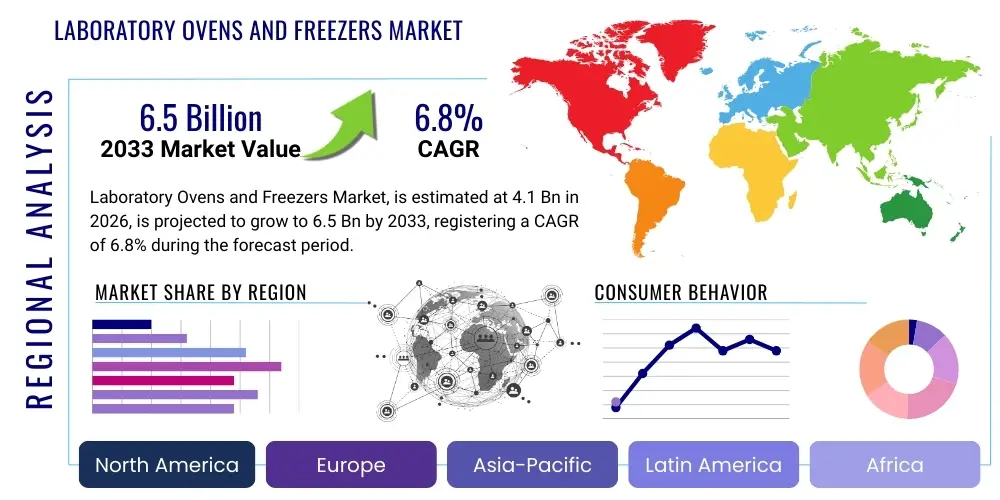

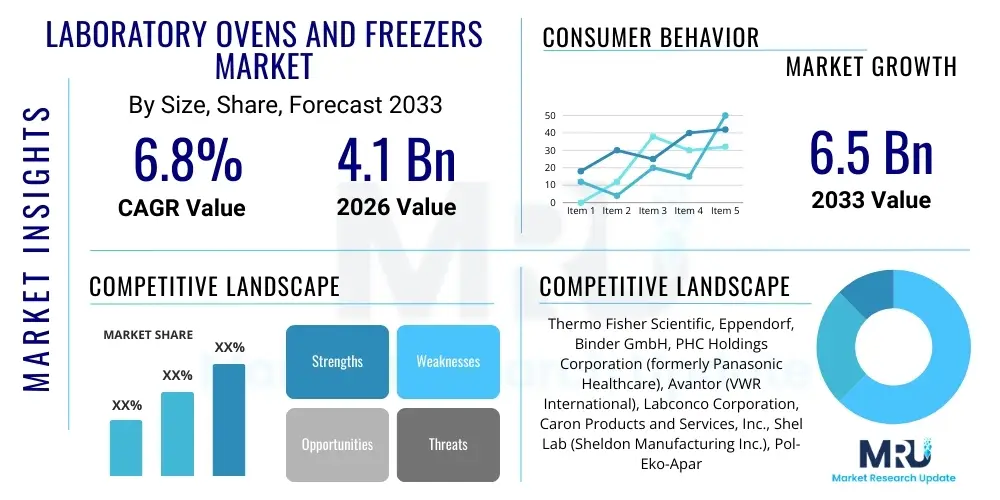

The Laboratory Ovens and Freezers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Laboratory Ovens and Freezers Market introduction

The laboratory ovens and freezers market encompasses a wide array of specialized thermal equipment essential for research, diagnostics, and industrial processes. These critical instruments are designed to precisely control temperature conditions, ranging from extremely low temperatures for sample preservation to high temperatures for sterilization, drying, and material testing. The market primarily includes various types of ovens such as vacuum ovens, forced air ovens, and gravity convection ovens, alongside a diverse range of freezers including ultra-low temperature freezers, chest freezers, and upright models, each tailored for specific laboratory requirements and applications. Their robust construction and advanced control systems ensure stability, uniformity, and reproducibility of experimental conditions, which are paramount in scientific endeavors.

Major applications for laboratory ovens and freezers span across numerous sectors, including pharmaceutical and biotechnology companies for drug discovery and vaccine storage, academic and research institutions for fundamental scientific investigations, and clinical laboratories for diagnostic sample management. Furthermore, the food and beverage industry utilizes these instruments for quality control and shelf-life testing, while the chemical and material science sectors employ them for controlled synthesis and characterization of new compounds. The inherent benefits of these products lie in their ability to provide sterile environments, precise temperature regulation, and reliable long-term storage solutions, safeguarding the integrity and viability of valuable samples and reagents.

Several driving factors contribute to the sustained growth of this market. A significant driver is the increasing global investment in research and development activities, particularly in life sciences, which necessitates advanced equipment for experimentation and data accuracy. The escalating demand for personalized medicine, biopharmaceuticals, and sophisticated diagnostic techniques further fuels the need for specialized laboratory equipment capable of handling sensitive biological materials. Additionally, stringent regulatory standards pertaining to laboratory safety, sample integrity, and product quality in industries like pharmaceuticals and food processing mandate the use of high-performance ovens and freezers, thereby propelling market expansion. The continuous technological advancements leading to more energy-efficient, precise, and user-friendly models also play a crucial role in driving adoption and market growth.

Laboratory Ovens and Freezers Market Executive Summary

The executive summary of the Laboratory Ovens and Freezers Market highlights robust business trends characterized by innovation and an increasing focus on energy efficiency and sustainability. Manufacturers are consistently introducing new models equipped with advanced features such as enhanced temperature uniformity, precise digital controls, remote monitoring capabilities, and eco-friendly refrigerants to meet evolving laboratory demands. The trend towards automation and integration into larger laboratory information management systems (LIMS) is also shaping product development, aiming to streamline workflows and reduce manual intervention. Furthermore, strategic collaborations and mergers and acquisitions among key players are common, reflecting efforts to expand product portfolios, enhance market reach, and consolidate competitive advantages in a highly specialized market. The demand for customized solutions tailored to specific research protocols or industry requirements is also driving product differentiation.

From a regional perspective, the market exhibits varied growth dynamics, with established regions like North America and Europe continuing to hold significant market shares due to well-developed healthcare infrastructure, extensive R&D investments, and stringent regulatory environments. These regions are also early adopters of cutting-edge technologies. However, the Asia Pacific (APAC) region is poised for the most rapid growth, propelled by the burgeoning pharmaceutical and biotechnology industries, increasing government funding for scientific research, and expanding healthcare access in countries like China, India, and Japan. Latin America, the Middle East, and Africa are also emerging as promising markets, driven by improving economic conditions, growing awareness of laboratory best practices, and international collaborations in scientific research. Each region presents unique opportunities and challenges influenced by local regulations, economic stability, and scientific priorities.

Segment trends underscore the increasing demand for ultra-low temperature freezers due to the rise in cell culture storage, biobanking, and vaccine development, particularly evident in the post-pandemic era. The pharmaceutical and biotechnology end-use segment remains the largest consumer, driven by continuous drug discovery efforts and bioprocessing needs. Additionally, there is a notable shift towards specialized ovens, such as vacuum ovens for delicate material processing and muffle furnaces for high-temperature applications, reflecting the diversification of research methodologies. The push for interconnected, smart laboratory equipment is also influencing segment growth, with a rising preference for devices that offer data logging, connectivity, and diagnostic capabilities, aligning with the broader digitalization trend within scientific research environments.

AI Impact Analysis on Laboratory Ovens and Freezers Market

Users frequently inquire about how Artificial Intelligence will transform the operation and utility of laboratory ovens and freezers, focusing on aspects like predictive maintenance, enhanced precision, energy optimization, and data integration. Common questions revolve around whether AI can autonomously manage temperature fluctuations, identify potential equipment failures before they occur, or seamlessly integrate with laboratory information management systems to provide real-time environmental data and optimize sample integrity. There is also a strong interest in understanding AI's potential to improve overall lab efficiency, reduce operational costs, and ensure compliance with regulatory standards through intelligent monitoring and reporting. Users expect AI to move these devices beyond simple temperature control, turning them into smart, self-optimizing, and interconnected components of a future-ready laboratory.

- AI-driven predictive maintenance can analyze historical performance data and environmental conditions to forecast potential equipment malfunctions in ovens and freezers, allowing for proactive servicing and minimizing downtime in critical research.

- Integration of AI algorithms can enable more precise and adaptive temperature control, learning from environmental factors and usage patterns to maintain optimal conditions with greater accuracy than traditional PID controllers.

- AI can optimize energy consumption by intelligently adjusting operational cycles, defrost schedules, and compressor speeds based on real-time load, ambient conditions, and pre-programmed usage patterns, leading to significant cost savings and reduced carbon footprint.

- Enhanced data analytics powered by AI can provide deeper insights into sample storage conditions, environmental stability, and equipment performance trends, facilitating better experimental design and improving data integrity for sensitive biological materials.

- AI can enable autonomous monitoring and alerting systems, detecting deviations from desired parameters, potential power failures, or door-open events, and instantly notifying lab personnel, thereby preventing sample degradation or loss.

- Integration with laboratory information management systems (LIMS) and other lab automation platforms via AI can streamline workflows, automate data logging, and ensure comprehensive traceability of samples and experimental conditions.

- AI can contribute to enhanced regulatory compliance by automatically generating detailed reports on temperature profiles, alarm events, and maintenance logs, simplifying auditing processes and ensuring adherence to stringent quality standards.

- Development of smart diagnostics for ovens and freezers, utilizing AI to interpret sensor data and identify subtle operational anomalies that might indicate component wear or impending failure, thereby extending equipment lifespan.

- Facilitating remote management and troubleshooting, allowing AI-powered systems to provide initial diagnostics and recommendations to technicians, even before they physically arrive at the laboratory.

DRO & Impact Forces Of Laboratory Ovens and Freezers Market

The Laboratory Ovens and Freezers Market is significantly influenced by several dynamic drivers that propel its growth. A primary driver is the ever-increasing investment in research and development across the pharmaceutical, biotechnology, and academic sectors. As new diseases emerge and the quest for advanced therapies intensifies, there is a continuous need for sophisticated laboratory equipment capable of precise temperature control for drug discovery, vaccine development, cell culture, and genetic research. Furthermore, the global expansion of biobanking initiatives and the growing demand for personalized medicine fuel the requirement for ultra-low temperature storage solutions to preserve biological samples with utmost integrity. Stringent regulatory mandates concerning sample storage conditions, laboratory safety, and quality control in industries such as food and beverage, chemicals, and healthcare also compel laboratories to adopt high-standard, reliable thermal equipment.

Despite the strong growth drivers, the market faces notable restraints that could impede its expansion. The high initial capital investment required for purchasing advanced laboratory ovens and freezers poses a significant barrier, especially for smaller research institutions or nascent laboratories with limited budgets. Operational costs, including substantial electricity consumption for continuous refrigeration and heating, along with ongoing maintenance and calibration expenses, add to the total cost of ownership, making these investments considerable. Moreover, the technical complexity associated with the installation, operation, and troubleshooting of highly specialized equipment demands skilled personnel, which can be a challenge in regions with limited technical expertise. The environmental impact of refrigerants historically used in freezers is also a growing concern, pushing manufacturers towards more eco-friendly but potentially more expensive alternatives.

Opportunities within the Laboratory Ovens and Freezers Market are abundant and diverse. Emerging economies, particularly in Asia Pacific and Latin America, present vast untapped potential as their healthcare infrastructure develops and R&D activities expand. These regions are witnessing increased government funding for scientific research and a rising number of academic and research institutions, creating new demand avenues. Technological advancements, such as the integration of IoT, AI, and automation into laboratory equipment, offer opportunities for manufacturers to develop smarter, more efficient, and interconnected devices that enhance user experience and data management. The growing trend of contract research organizations (CROs) and contract manufacturing organizations (CMOs) also creates a consistent demand for state-of-the-art laboratory equipment without the need for individual institutions to incur large capital expenditures directly. Furthermore, the increasing focus on sustainable laboratory practices is driving the demand for energy-efficient and environmentally friendly ovens and freezers, offering a competitive edge for innovators in this space.

Segmentation Analysis

The Laboratory Ovens and Freezers Market is meticulously segmented to provide a granular understanding of its diverse components and the varied needs of its end-users. This comprehensive segmentation allows for a detailed analysis of market dynamics, growth drivers, and challenges across different product types, applications, and end-use sectors. By dissecting the market into these distinct categories, stakeholders can gain clearer insights into specific market niches, identify emerging trends, and tailor their strategies to address particular demands within the scientific and industrial community. This approach ensures that product development, marketing efforts, and distribution channels are precisely aligned with the intricate requirements of diverse laboratory environments, from basic research to highly specialized industrial processes.

- By Type:

- Ovens:

- Vacuum Ovens: Ideal for delicate samples requiring gentle drying or heat treatment under reduced pressure.

- Forced Air Ovens: Provide rapid and uniform heating for drying, sterilizing, and baking applications.

- Gravity Convection Ovens: Suitable for general drying, baking, and sterilization where gentle air circulation is preferred.

- Muffle Furnaces: Designed for high-temperature applications like ashing, sintering, and heat treatment of inorganic materials.

- Hybrid Ovens: Combining features of different oven types for versatile laboratory applications.

- Freezers:

- Ultra-Low Temperature (ULT) Freezers: Essential for long-term storage of biological samples at temperatures as low as -80°C to -150°C.

- Chest Freezers: Offer large storage capacity and stable temperatures, often used for bulk sample storage.

- Upright Freezers: Provide convenient access and organized storage for various biological and chemical samples.

- Pharmaceutical Freezers: Specifically designed to meet stringent regulatory requirements for drug and vaccine storage.

- Blood Bank Freezers: Calibrated for precise storage of blood components, ensuring their viability and safety.

- Cryogenic Freezers: Utilizing liquid nitrogen for ultra-cold storage, often below -150°C, for highly sensitive biological materials.

- Ovens:

- By End-Use:

- Pharmaceutical & Biotechnology Companies: Major consumers for drug discovery, vaccine production, and cell line development.

- Academic & Research Institutions: Utilized in universities and research centers for fundamental and applied scientific studies.

- Clinical Laboratories: Essential for diagnostic testing, sample preservation, and pathology work.

- Food & Beverage Industry: Employed for quality control, shelf-life testing, and microbiological analysis.

- Chemical Industry: Used for material testing, synthesis reactions, and storage of chemical reagents.

- Contract Research Organizations (CROs): Companies that provide research services to pharmaceutical, biotechnology, and medical device industries.

- Hospitals and Blood Banks: For storage of blood, plasma, and other critical biological components.

- By Application:

- Sample Storage: Preservation of biological samples, chemical reagents, and cell lines.

- Sterilization: Ensuring aseptic conditions for lab equipment and media.

- Drying & Curing: Removing moisture from samples or curing materials.

- Incubation: Providing controlled environments for microbial growth and cell cultures.

- Material Testing: Assessing the properties of materials under specific thermal conditions.

- Environmental Simulation: Replicating various temperature and humidity conditions for testing product durability.

- Vaccine and Drug Storage: Maintaining stability and efficacy of pharmaceutical products.

- By Region:

- North America: United States, Canada, Mexico.

- Europe: Germany, France, United Kingdom, Italy, Spain, Rest of Europe.

- Asia Pacific: China, Japan, India, South Korea, Australia, Rest of Asia Pacific.

- Latin America: Brazil, Argentina, Rest of Latin America.

- Middle East & Africa: GCC Countries, South Africa, Rest of Middle East & Africa.

Value Chain Analysis For Laboratory Ovens and Freezers Market

The value chain for the Laboratory Ovens and Freezers Market begins with upstream activities, encompassing the sourcing and processing of raw materials and components critical for manufacturing these specialized instruments. This stage involves suppliers of high-grade stainless steel, insulation materials, refrigerants (including newer environmentally friendly alternatives), compressors, heating elements, sensors, and advanced control systems. Key components like precision microprocessors for temperature control, display interfaces, and connectivity modules are also procured from specialized electronics manufacturers. The quality and reliability of these upstream components are paramount, as they directly impact the performance, durability, and energy efficiency of the final laboratory equipment. Manufacturers often maintain long-term relationships with trusted suppliers to ensure consistent quality and adherence to strict specifications, as any compromise at this stage can have significant implications for product integrity and regulatory compliance.

Midstream activities involve the design, manufacturing, assembly, and quality control of the ovens and freezers. This stage includes sophisticated engineering processes to create energy-efficient designs, ensure uniform temperature distribution, and integrate advanced safety features. Manufacturing typically takes place in specialized facilities equipped with advanced machinery for metal fabrication, insulation injection, and precise component assembly. Rigorous quality control protocols are implemented at various stages, including functional testing, calibration, and environmental stress testing, to ensure that each unit meets stringent performance standards and regulatory requirements such as ISO, CE, and FDA guidelines. Investment in research and development at this stage is crucial for innovation, leading to the introduction of new features, improved performance, and enhanced user interfaces, thereby providing a competitive edge in the market.

Downstream analysis focuses on the distribution channels and post-sales services that connect manufacturers to end-users. Direct distribution involves manufacturers selling directly to large research institutions, pharmaceutical companies, or government agencies through their dedicated sales teams. This approach allows for direct customer feedback, customized solutions, and stronger relationship building. Indirect distribution relies on a network of authorized distributors, dealers, and scientific equipment suppliers who cater to a broader range of smaller laboratories, academic institutions, and clinical facilities. These intermediaries often provide local sales support, installation services, and initial training. Post-sales services, including maintenance contracts, calibration services, technical support, and spare parts availability, are crucial for ensuring the longevity and optimal performance of the equipment, significantly influencing customer satisfaction and repeat business. Both direct and indirect channels play a vital role in ensuring widespread market penetration and comprehensive customer support for these essential laboratory instruments.

Laboratory Ovens and Freezers Market Potential Customers

The primary potential customers for laboratory ovens and freezers are diverse and span across numerous scientific, medical, and industrial sectors, all requiring precise temperature control for their operations. Pharmaceutical and biotechnology companies represent a substantial end-user segment, consistently investing in these devices for critical functions such as drug discovery, vaccine development, cell culture, fermentation, and long-term storage of biological samples like DNA, RNA, proteins, and cell lines. Their demand is driven by the necessity for stringent environmental controls to ensure the stability, viability, and efficacy of highly sensitive and valuable materials throughout the research and development lifecycle. The stringent regulatory environment in drug manufacturing also mandates the use of reliable and validated thermal equipment.

Academic and research institutions, including universities, government research laboratories, and non-profit organizations, form another significant customer base. These entities utilize laboratory ovens and freezers for a wide array of fundamental and applied scientific investigations across disciplines such as biology, chemistry, physics, and environmental science. From drying glassware and sterilizing media to incubating microbial cultures and preserving research samples, these institutions rely on a comprehensive suite of thermal equipment to support their diverse experimental protocols. Their purchasing decisions are often influenced by grant funding cycles, institutional budgets, and the need for versatile equipment that can support multiple research projects simultaneously.

Furthermore, clinical laboratories and hospitals are vital customers, particularly for freezers used in biobanking, blood storage, diagnostic sample preservation, and pathology. The demand here is driven by the increasing volume of diagnostic tests, the growth of personalized medicine, and the critical need to maintain the integrity of patient samples for accurate results and long-term research. The food and beverage industry also represents a key segment, using ovens for quality control testing, moisture content analysis, and product shelf-life studies, while freezers are essential for microbial sample storage and maintaining ingredient quality. The chemical and material science industries also rely on these instruments for material testing, synthesis, and controlled storage of chemical compounds, making the customer landscape broad and continually evolving.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Eppendorf, Binder GmbH, PHC Holdings Corporation (formerly Panasonic Healthcare), Avantor (VWR International), Labconco Corporation, Caron Products and Services, Inc., Shel Lab (Sheldon Manufacturing Inc.), Pol-Eko-Aparatura, Esco Group, NuAire, Inc., Köttermann Einrichtungen GmbH & Co. KG, Froilabo (part of Groupe Firlabo), BMT Medical Technology s.r.o., MEMMERT GmbH + Co. KG, Angelantoni Life Science, Haier Biomedical, Helmer Scientific, Inc., Stirling Ultracold, Cole-Parmer Instrument Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Ovens and Freezers Market Key Technology Landscape

The technology landscape of the Laboratory Ovens and Freezers Market is characterized by a strong emphasis on precision, efficiency, connectivity, and environmental sustainability. Modern laboratory ovens incorporate advanced microprocessor-based temperature control systems, often utilizing proportional-integral-derivative (PID) algorithms, to achieve extremely accurate and stable internal temperatures with minimal fluctuations. These systems are frequently paired with high-resolution digital displays and intuitive graphical user interfaces, allowing for easy programming, real-time monitoring, and data logging. Forced air convection technology is widely used in ovens to ensure rapid heat distribution and uniformity, while vacuum technology is employed in vacuum ovens for delicate drying processes that require removal of moisture under reduced pressure, thereby preventing sample degradation.

For laboratory freezers, the technological advancements are particularly focused on achieving ultra-low temperatures with improved energy efficiency and reliability. Cascade refrigeration systems, employing multiple compressors and refrigerants in series, are crucial for reaching temperatures as low as -80°C or -150°C in ULT freezers. More recently, manufacturers are exploring and implementing Stirling engine technology and thermoelectric cooling (Peltier effect) in specialized freezers to offer compressor-free and environmentally friendlier alternatives with reduced noise and vibration. Insulation technology has also seen significant improvements, with vacuum insulation panels (VIPs) and advanced foam insulation materials being used to reduce heat gain, improve temperature retention during power outages, and minimize the physical footprint of units, thereby enhancing energy efficiency and storage capacity.

The integration of Information and Communication Technologies (ICT) is a prominent trend across both ovens and freezers. This includes features like Internet of Things (IoT) connectivity, enabling remote monitoring and control via web interfaces or mobile applications, real-time data acquisition, and automated alerting systems for temperature excursions or power failures. Data logging capabilities with secure storage and export functions are standard, supporting regulatory compliance and experimental reproducibility. Advanced diagnostic systems, sometimes leveraging AI and machine learning, are being incorporated to provide predictive maintenance insights, optimizing equipment uptime and reducing service costs. The shift towards greener technologies, including the use of natural refrigerants (hydrocarbons like R290 and R600a) and advanced energy recovery systems, is also a significant technological driver, addressing environmental concerns and contributing to lower operational expenditures for laboratories.

Regional Highlights

- North America: This region holds a significant share of the global market due to its robust healthcare infrastructure, substantial R&D investments in pharmaceuticals and biotechnology, and the presence of numerous leading research institutions and key market players. The United States, in particular, drives innovation and adoption of advanced laboratory equipment, supported by strong government funding for scientific research and a well-established regulatory framework.

- Europe: Europe represents another major market, characterized by advanced research capabilities, a strong pharmaceutical industry, and stringent quality control regulations. Countries like Germany, the UK, and France are at the forefront of scientific innovation, with a high concentration of academic institutions and biotech firms contributing to consistent demand. The region also emphasizes energy efficiency and sustainable laboratory practices, driving demand for technologically advanced and eco-friendly equipment.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate during the forecast period. This growth is primarily attributed to the rapid expansion of the pharmaceutical and biotechnology industries in countries like China, India, and Japan, coupled with increasing government spending on healthcare and scientific research. The rising number of diagnostic centers, contract research organizations, and academic institutions further fuels market demand in this dynamic region.

- Latin America: This emerging market is experiencing steady growth driven by improving healthcare infrastructure, increasing awareness of advanced laboratory technologies, and rising investments in clinical research. Countries such as Brazil and Mexico are leading the adoption of modern laboratory equipment as they expand their scientific capabilities and address growing health demands.

- Middle East & Africa (MEA): The MEA region is a nascent but rapidly developing market. Growth is propelled by increasing government initiatives to modernize healthcare facilities, diversify economies through investments in research, and combat infectious diseases. International collaborations and funding are also playing a crucial role in enhancing laboratory capabilities and equipment adoption across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Ovens and Freezers Market.- Thermo Fisher Scientific

- Eppendorf AG

- Binder GmbH

- PHC Holdings Corporation

- Avantor (VWR International)

- Labconco Corporation

- Caron Products and Services, Inc.

- Shel Lab (Sheldon Manufacturing Inc.)

- Pol-Eko-Aparatura Sp. z o.o.

- Esco Group

- NuAire, Inc.

- Köttermann Einrichtungen GmbH & Co. KG

- Froilabo (Groupe Firlabo)

- BMT Medical Technology s.r.o.

- MEMMERT GmbH + Co. KG

- Angelantoni Life Science S.r.l.

- Haier Biomedical

- Helmer Scientific, Inc.

- Stirling Ultracold

- Cole-Parmer Instrument Company

Frequently Asked Questions

Analyze common user questions about the Laboratory Ovens and Freezers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of laboratory ovens and freezers?

Laboratory ovens and freezers are indispensable for diverse applications including precise sample storage (e.g., biological tissues, DNA, vaccines), sterilization of lab equipment, drying of glassware and chemical compounds, incubation of cell cultures, and material testing under controlled thermal conditions. They are critical across research, clinical diagnostics, and industrial quality control processes.

How do Ultra-Low Temperature (ULT) freezers differ from standard laboratory freezers?

ULT freezers are engineered to achieve significantly colder temperatures, typically ranging from -80°C to -150°C, using advanced cascade refrigeration systems. Standard laboratory freezers generally operate at -20°C or -40°C. ULT freezers are essential for the long-term preservation of highly sensitive biological samples, such as cell lines, viruses, and nucleic acids, where even minor temperature fluctuations could compromise sample integrity.

What key factors should be considered when purchasing laboratory ovens or freezers?

Key considerations include temperature range and uniformity, capacity requirements, energy efficiency (e.g., insulation type, refrigerant choice), advanced control features (e.g., programmable cycles, remote monitoring), safety mechanisms (e.g., alarm systems, door locks), and compliance with relevant industry standards (e.g., FDA, ISO). Budget, footprint, and service support are also crucial practical factors.

How is AI impacting the functionality and future of laboratory ovens and freezers?

AI is transforming these devices by enabling predictive maintenance, optimizing energy consumption through intelligent algorithms, and enhancing precision temperature control. AI-driven systems facilitate seamless data integration with LIMS, provide real-time performance analytics, and contribute to automated compliance reporting, making lab equipment smarter, more reliable, and more efficient in managing critical samples and experiments.

Which industries are the major end-users of laboratory ovens and freezers?

The primary end-users are pharmaceutical and biotechnology companies for drug development and biobanking, academic and research institutions for scientific discovery, and clinical laboratories for diagnostics and sample preservation. Additionally, the food and beverage industry and chemical industry utilize these instruments for quality control, material testing, and reagent storage, highlighting their broad applicability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager