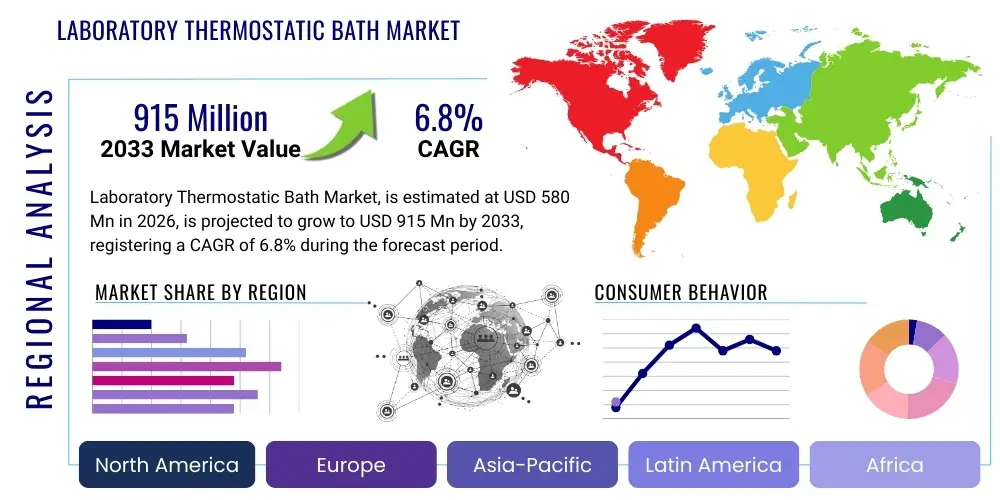

Laboratory Thermostatic Bath Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435895 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Laboratory Thermostatic Bath Market Size

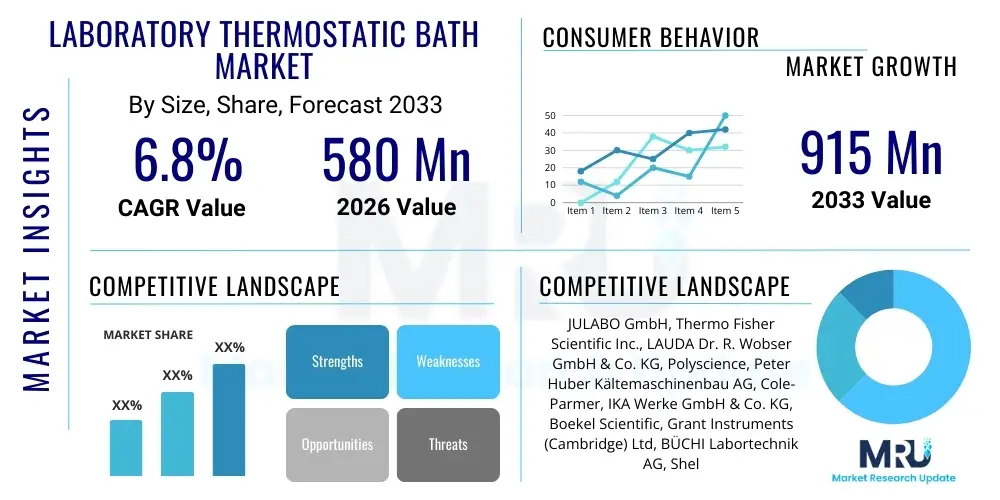

The Laboratory Thermostatic Bath Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $915 Million by the end of the forecast period in 2033.

Laboratory Thermostatic Bath Market introduction

The Laboratory Thermostatic Bath Market encompasses specialized equipment designed to maintain samples at a precise, controlled, and uniform temperature over extended periods. These devices are critical in various scientific disciplines, including biological research, chemical analysis, materials testing, and clinical diagnostics, where temperature stability is paramount for reliable experimental outcomes. Laboratory thermostatic baths, which include water baths, oil baths, and circulating chillers, are essential for processes such as enzyme reactions, incubation, sterilization, melting point determination, and viscosity testing. The fundamental mechanism involves a heated reservoir and a sophisticated temperature control system, often featuring digital interfaces and enhanced safety mechanisms to prevent overheating or evaporation.

The primary applications of these baths span across pharmaceutical R&D, biotechnology laboratories, academic research institutions, and quality control departments in food and beverage, and petrochemical industries. Their widespread adoption is driven by the increasing complexity of laboratory protocols requiring highly precise thermal management. For instance, in molecular biology, maintaining cells or reagents at 37°C for incubation requires extreme accuracy, which standard heating blocks cannot provide reliably. The benefits derived from using advanced thermostatic baths include superior temperature homogeneity, enhanced sample protection, reduced experimental error, and compliance with stringent regulatory standards like ISO and GLP (Good Laboratory Practice).

Driving factors for market expansion include the sustained growth in global pharmaceutical expenditures, the rapid advancement of biotechnological research—particularly in genomics and proteomics—and the imperative for stricter quality assurance across manufacturing sectors. Furthermore, continuous product innovation, such as the integration of advanced stirring mechanisms, touch-screen controls, and improved energy efficiency, is accelerating the replacement cycle of older, less precise units. The shift towards automated and high-throughput laboratory setups also necessitates reliable thermal control devices capable of integration into complex workflows.

Laboratory Thermostatic Bath Market Executive Summary

The Laboratory Thermostatic Bath Market exhibits robust growth, primarily fueled by massive investments in life science research and the expanding global biopharmaceutical industry. Business trends indicate a strong move towards specialized, high-precision circulation baths (refrigerated and heated) capable of handling external systems, moving away from simple non-circulating water baths for critical applications. Key manufacturers are focusing heavily on developing connected laboratory equipment, incorporating IoT capabilities for remote monitoring and data logging, which enhances compliance and operational efficiency, thereby cementing long-term customer relationships. Consolidation through mergers and acquisitions is also shaping the competitive landscape, allowing major players to gain market share in specialized application segments and geographical regions, particularly in Asia Pacific.

Regionally, North America and Europe currently dominate the market due to established R&D infrastructure, high research funding, and the presence of major biopharma companies. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by rapid industrialization, government initiatives supporting domestic pharmaceutical production (especially in China and India), and increasing foreign direct investment into regional clinical research organizations (CROs). Emerging economies in Latin America and MEA are showing steady, albeit slower, adoption rates, primarily in academic and governmental testing laboratories.

Segment trends reveal that the Refrigerated/Heating Circulating Baths segment is experiencing accelerated demand due to its versatility in providing both cooling and heating capabilities essential for complex chemical synthesis and material testing. Application-wise, the academic and research institutions segment holds the largest market share, but the pharmaceutical and biotechnology sector is the fastest-growing end-user due to the escalating need for precise temperature control in drug discovery and manufacturing processes, including cell culture and fermentation. Non-circulating water baths, while still used, are being relegated to simpler, less critical tasks, confirming the market’s orientation toward precision and circulation technology.

AI Impact Analysis on Laboratory Thermostatic Bath Market

User queries regarding AI's impact on laboratory equipment typically revolve around automation, predictive maintenance, and data integration. The primary themes summarized from this analysis indicate that users are interested in how AI can move temperature control from a passive setting to an actively managed system. Concerns center on integrating legacy hardware with new AI platforms and the required training for staff. Expectations are high regarding the ability of AI to anticipate equipment failure (e.g., pump burnout or temperature drift due to component aging), optimize energy consumption profiles based on scheduled workload, and ensure enhanced compliance through automated logging and deviation alerts. Ultimately, AI is viewed less as a replacement for the physical bath and more as a powerful tool for optimizing its performance, improving experimental reliability, and reducing operational downtime in high-throughput environments.

- AI-driven predictive maintenance forecasts component failure, minimizing unexpected downtime in critical experiments.

- Integration of AI algorithms allows for dynamic optimization of temperature stability, anticipating load fluctuations and ambient changes.

- AI facilitates automated data logging and anomaly detection, ensuring strict regulatory compliance and audit readiness.

- Energy consumption optimization through AI scheduling reduces operational costs for large laboratories.

- Integration with Laboratory Information Management Systems (LIMS) is enhanced, enabling seamless data flow between the bath and broader laboratory workflows.

DRO & Impact Forces Of Laboratory Thermostatic Bath Market

The Laboratory Thermostatic Bath Market is substantially driven by the rapid expansion of biological research and the escalating global demand for high-quality, reliable drug development tools. Restraints include the high initial capital investment required for high-precision, large-capacity circulating baths and intensifying price competition from manufacturers in emerging Asian economies. Significant opportunities lie in the development of specialized baths tailored for niche applications, such as ultra-low temperature requirements for cryo-storage maintenance or systems designed for microplate compatibility in automated screening. These market dynamics create strong impact forces, pushing manufacturers towards continuous innovation in control mechanisms and connectivity to maintain a competitive edge, especially against lower-cost alternatives.

Drivers: A major market driver is the proliferation of complex research protocols in drug discovery, genetics, and synthetic biology, all of which require extremely precise and stable temperature environments, often necessitating circulating systems capable of rapid heating and cooling. Furthermore, global adherence to stricter regulatory standards (e.g., FDA, EMA) mandates the use of calibrated, reliable equipment that provides verifiable temperature logs, thereby accelerating the demand for digitally controlled and networked thermostatic baths. Increased funding, both private and public, specifically channeled into oncology research, infectious disease control, and vaccine development globally, creates a sustainable upward trajectory for equipment procurement.

Restraints: The market faces constraints primarily due to the high purchasing cost associated with advanced refrigerated and heated circulating baths, which can deter smaller academic labs or research facilities in developing regions. Another restraint is the operational challenge posed by maintenance and calibration complexity; high-precision systems require specialized technicians and frequent calibration checks, adding to the total cost of ownership (TCO). Additionally, intense competition, leading to margin erosion, particularly in the standard water bath segment, limits the investment capability of some smaller manufacturers for advanced R&D.

Opportunities: Opportunities abound in the burgeoning field of regenerative medicine and personalized therapeutics, which necessitates specialized cell and gene therapy manufacturing environments requiring highly controlled temperature stages. Developing compact, portable, and energy-efficient models designed for use in field testing or remote laboratories also presents a significant growth avenue. Furthermore, integrating advanced sensor technology and remote diagnostic capabilities (IoT integration) addresses user pain points regarding operational monitoring and predictive maintenance, capturing higher-value service revenue streams.

- Drivers:

- Increasing R&D expenditure in life sciences and biotechnology.

- Rising necessity for accurate and stable temperature control in diagnostic and research assays.

- Strict regulatory requirements necessitating validated and traceable thermal management equipment.

- Expansion of academic research institutions and clinical laboratories globally.

- Restraints:

- High initial capital expenditure for sophisticated circulating and refrigerated models.

- Availability of lower-cost alternatives from localized manufacturers, impacting high-end market margins.

- Operational challenges related to regular maintenance, calibration, and potential water contamination.

- Opportunities:

- Technological advancements in IoT integration and remote monitoring systems.

- Growing demand for application-specific baths (e.g., high-temperature oil baths, low-temperature glycol baths).

- Expansion into emerging markets with rapidly developing healthcare and research infrastructure.

- Focus on sustainability through the development of energy-efficient and ecologically safer cooling fluids.

- Impact Forces:

- Increased focus on precision engineering and digital control systems to minimize temperature fluctuation.

- Market shift towards customizable solutions that integrate seamlessly with automated lab robotics.

Segmentation Analysis

The Laboratory Thermostatic Bath market segmentation provides a critical view of product adoption based on technology, temperature range, capacity, and end-user applications. The market is primarily segmented by Product Type into Circulating Baths (Heated, Refrigerated, and Hybrid) and Non-Circulating Baths (Water Baths). Circulating systems dominate the value segment due to their ability to maintain exceptional temperature uniformity and circulate fluid to external devices, essential for reactors and analytical instruments. Non-circulating baths, while simpler and cheaper, are predominantly used for standard thawing or incubation tasks.

Further analysis by temperature range distinguishes between low-temperature baths (often utilizing refrigeration for temperatures below ambient), ambient-to-medium temperature baths (standard water baths), and high-temperature baths (typically oil or specialized silicone fluid baths used in chemical synthesis and materials science). The capacity segmentation (benchtop vs. floor-standing industrial units) reflects the needs of various laboratory scales, with benchtop models being standard for academic and clinical labs, and floor-standing units reserved for pilot plants and large-scale manufacturing quality control.

From an end-user perspective, the segmentation reveals that the Pharmaceutical and Biotechnology companies constitute the fastest-growing sector, driven by intensive R&D activities in personalized medicine and biologics. Academic institutions and research organizations maintain the largest volume share, constantly procuring equipment for teaching and foundational research. Understanding these segments is crucial for manufacturers to tailor product features, marketing efforts, and pricing strategies to address specific user requirements for precision, capacity, and compliance.

- By Product Type:

- Circulating Baths (Heated Circulating Baths, Refrigerated/Heating Circulating Baths)

- Non-Circulating Baths (Standard Water Baths, Shaking Water Baths)

- Oil Baths

- Calibration Baths

- By Temperature Range:

- Below Ambient (Refrigerated)

- Ambient to 100°C

- Above 100°C (High Temperature)

- By Capacity:

- Small (2 Liters to 10 Liters)

- Medium (11 Liters to 30 Liters)

- Large (Above 30 Liters)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Clinical and Diagnostic Laboratories

- Food & Beverage Testing Laboratories

- Industrial Laboratories (Petrochemicals, Materials Testing)

- By Distribution Channel:

- Direct Sales

- Distributors and Resellers

- E-commerce Platforms

Value Chain Analysis For Laboratory Thermostatic Bath Market

The value chain for the Laboratory Thermostatic Bath Market begins with the upstream segment, which involves the sourcing and processing of critical raw materials and specialized components. Key upstream activities include the procurement of stainless steel (for bath reservoirs), high-precision temperature sensors (e.g., RTDs, thermocouples), heating elements, cooling compressors (for refrigerated units), and microprocessors for digital control boards. Quality control at this stage is crucial, as the reliability of the final product hinges on the accuracy and longevity of these components. Manufacturers often establish long-term relationships with certified suppliers to ensure component traceability and maintain high standards of material specification, particularly concerning corrosion resistance and thermal conductivity.

The central manufacturing stage involves sophisticated assembly, calibration, and rigorous testing. This stage demands specialized engineering expertise in fluid dynamics and thermal management to design circulating pumps and internal bath geometry that ensure maximum temperature uniformity. Post-manufacturing, the distribution channel plays a vital role. High-end, complex circulating baths are often sold through direct sales channels, where manufacturers provide specialized installation and application training to pharmaceutical and high-throughput research labs. Conversely, standard water baths are frequently distributed through large, established laboratory supply distributors and, increasingly, via specialized e-commerce platforms due to lower complexity and higher volume transactions.

The downstream segment focuses on the end-users—research labs, clinical testing facilities, and industrial quality control departments—and the essential after-sales support services. Post-sales service, including mandatory calibration, technical troubleshooting, and warranty management, represents a crucial competitive differentiator. This service network, whether handled directly by the manufacturer or through authorized service partners, is indispensable for high-value purchases, especially those requiring regulatory compliance documentation. The effectiveness of the indirect distribution channel, leveraging regional distributors, is paramount for market penetration in geographically diverse regions like APAC and Latin America, where local market knowledge is required.

Laboratory Thermostatic Bath Market Potential Customers

The primary customer base for Laboratory Thermostatic Baths consists of organizations involved in regulated research, diagnostic testing, and industrial quality control that require precise temperature maintenance for their critical processes. Pharmaceutical and biotechnology companies are high-value customers due to their constant need for advanced, high-capacity circulating baths used in drug stability testing, fermentation processes, cell culture, and rigorous quality assurance of finished biological products. These customers prioritize compliance features, precise control, and integration capabilities with automation systems.

Academic and governmental research institutions represent the largest volume segment, using a wide range of baths—from simple water baths for educational purposes to sophisticated refrigerated circulators for cutting-edge scientific investigations in fields such as polymer science, physical chemistry, and genomics. Their purchasing decisions are often influenced by grant funding cycles, reliability, and cost-effectiveness. Furthermore, clinical and diagnostic laboratories utilize these baths extensively for sample preparation, media incubation, and ensuring the accuracy of assays, requiring baths that meet stringent clinical standards for stability and sterility.

Industrial sectors, including food and beverage testing, petrochemical refinement, and materials science, constitute another significant customer base. In these settings, thermostatic baths are indispensable for processes like viscosity measurements, stability checks of oils and polymers, and standardized compliance testing required for product certification. These customers typically demand robust, high-temperature oil baths or large-capacity chilling units capable of continuous, heavy-duty operation in demanding industrial environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $915 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JULABO GmbH, Thermo Fisher Scientific Inc., LAUDA Dr. R. Wobser GmbH & Co. KG, Polyscience, Peter Huber Kältemaschinenbau AG, Cole-Parmer, IKA Werke GmbH & Co. KG, Boekel Scientific, Grant Instruments (Cambridge) Ltd, BÜCHI Labortechnik AG, Shellab, Wiggens GmbH, FALC Instruments, VWR International (Avantor), Techne (Bibby Scientific), Heidolph Instruments GmbH & Co. KG, Memmert GmbH + Co. KG, Corning Incorporated, Jeio Tech Co., Ltd., Scinco Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Thermostatic Bath Market Key Technology Landscape

The technology landscape of the Laboratory Thermostatic Bath Market is evolving rapidly, driven by the need for enhanced accuracy, automation, and user interface sophistication. Modern circulating baths increasingly rely on Proportionate-Integral-Derivative (PID) controllers, which offer superior stability by continuously calculating the error value and adjusting the heating or cooling output accordingly, minimizing temperature overshoot and undershoot. This sophistication is often coupled with high-resolution digital interfaces, frequently featuring touch screens, which allow for intuitive programming of complex temperature profiles, ramping rates, and external control sequences essential for reaction calorimetry or synthesis.

A major technological advancement involves refrigeration systems, particularly the move towards natural refrigerants (like R-290 or R-600a) in line with global environmental regulations (F-gas regulations). This transition addresses sustainability concerns while maintaining high cooling efficiency required for refrigerated circulators. Furthermore, advancements in stirring and pumping mechanisms, utilizing magnetic drives or variable speed pumps, ensure optimal fluid circulation and minimal vibration, which is crucial for sensitive biological samples or automated liquid handling systems integrated with the bath.

Connectivity and data management represent another key technological front. The integration of Ethernet, Wi-Fi, and USB ports allows for seamless connection to laboratory networks, enabling remote monitoring, data logging, and firmware updates. These connected baths can communicate directly with LIMS (Laboratory Information Management Systems) or ELNs (Electronic Lab Notebooks), automating compliance documentation and enhancing data integrity, thereby future-proofing the equipment for high-tech, regulated laboratory environments. The adoption of robust safety features, including adjustable over-temperature cut-offs, low-liquid level alarms, and fault diagnostic systems, is now standard across all leading product lines.

Regional Highlights

The global Laboratory Thermostatic Bath Market exhibits distinct consumption patterns influenced by regional research funding, regulatory frameworks, and industrial presence. North America, encompassing the United States and Canada, stands as the market leader, primarily driven by substantial government and private sector investment in pharmaceutical R&D, a high concentration of leading biotechnology firms, and stringent quality control mandates enforced by the FDA. The demand here is heavily skewed towards high-precision refrigerated and heated circulating baths necessary for clinical trials and complex drug discovery protocols.

Europe holds the second-largest market share, propelled by robust research output from countries like Germany, the UK, and Switzerland, especially within academic research and the chemical industry. The region benefits from strong regulatory bodies (EMA) and a mature infrastructure for both basic and applied sciences. European manufacturers are often pioneers in integrating energy efficiency and utilizing environmentally friendly refrigerants, aligning with strict regional environmental policies, making innovation a core competitive factor.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid expansion is attributable to the swift establishment of domestic pharmaceutical manufacturing bases, the rising number of Contract Research Organizations (CROs) establishing operations in China and India, and increasing governmental initiatives aimed at upgrading public health and research capabilities. While price sensitivity remains a factor, the increasing adoption of global quality standards is steadily driving demand for high-quality, international-standard circulating baths, often imported from established North American and European vendors.

- North America (Market Leader): Dominance due to massive spending on pharmaceutical R&D, a high density of biotech startups, and mature regulatory compliance requirements favoring advanced, traceable circulating systems. Key focus on precision and automation.

- Europe (Strong Established Market): Significant demand originating from academic research, chemistry, and materials testing sectors. Emphasis on environmental compliance, leading to high adoption of eco-friendly cooling technologies.

- Asia Pacific (Fastest Growing): Accelerated market growth fueled by government support for domestic biotech manufacturing, expansion of clinical testing capabilities, and increasing investments by multinational corporations in regional R&D centers, particularly in China, Japan, and India.

- Latin America (Emerging Growth): Steady increase in demand, primarily in Brazil and Mexico, driven by modernization efforts in academic laboratories and localized clinical diagnostics, though often favoring cost-effective solutions.

- Middle East and Africa (Niche Market): Growth tied to national strategic health initiatives, the development of specialized research universities, and limited but growing investment in petrochemical and water quality testing laboratories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Thermostatic Bath Market.- JULABO GmbH

- Thermo Fisher Scientific Inc.

- LAUDA Dr. R. Wobser GmbH & Co. KG

- Polyscience

- Peter Huber Kältemaschinenbau AG

- Cole-Parmer

- IKA Werke GmbH & Co. KG

- Boekel Scientific

- Grant Instruments (Cambridge) Ltd

- BÜCHI Labortechnik AG

- Shellab

- Wiggens GmbH

- FALC Instruments

- VWR International (Avantor)

- Techne (Bibby Scientific)

- Heidolph Instruments GmbH & Co. KG

- Memmert GmbH + Co. KG

- Corning Incorporated

- Jeio Tech Co., Ltd.

- Scinco Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Laboratory Thermostatic Bath market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between circulating and non-circulating thermostatic baths?

Circulating baths, also known as circulators, use a pump to ensure temperature uniformity across the entire bath fluid and allow for fluid connection to external devices (e.g., reactors or viscometers). Non-circulating baths rely solely on convection for heat transfer, offering less uniformity, and are suitable only for internal sample incubation or standard thawing procedures.

Which end-user segment is driving the highest demand for advanced refrigerated circulators?

The Pharmaceutical and Biotechnology sector is the primary driver for high-precision, refrigerated circulating baths. These instruments are essential for maintaining stable, often low, temperatures required for drug stability testing, complex chemical synthesis, and highly sensitive biological assays, where temperature deviation is unacceptable.

How does IoT technology improve the functionality of laboratory thermostatic baths?

IoT integration allows baths to be remotely monitored and controlled via laboratory networks. This enables proactive maintenance scheduling, real-time data logging for compliance records, automated error reporting, and integration with broader laboratory management systems (LIMS), significantly enhancing operational efficiency and data integrity.

What are the key technical specifications to consider when purchasing a high-temperature oil bath?

Critical specifications include the maximum achievable temperature and its stability (accuracy/uniformity), the type of heating fluid compatibility (usually specialized silicone oil), built-in safety features like over-temperature protection, and the material of the reservoir (stainless steel or aluminum) to ensure longevity and minimize corrosion at elevated temperatures.

Why is the Asia Pacific region projected to experience the highest growth rate?

The rapid growth in APAC is attributed to extensive government initiatives supporting domestic pharmaceutical and clinical research, coupled with rising foreign investment in regional research infrastructure and manufacturing, leading to a substantial increase in demand for standardized, reliable laboratory equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager