Laboratory Water Purifier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433944 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Laboratory Water Purifier Market Size

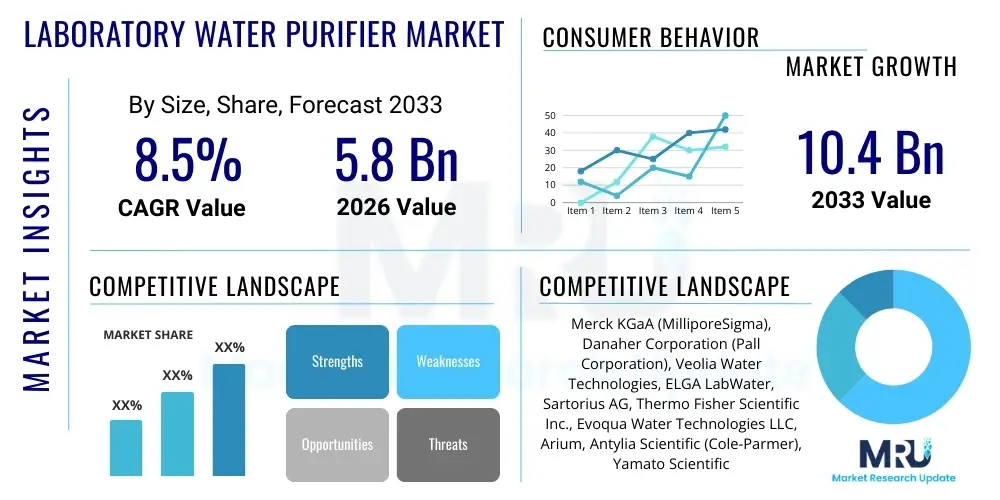

The Laboratory Water Purifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033.

Laboratory Water Purifier Market introduction

The Laboratory Water Purifier Market encompasses specialized systems and equipment designed to produce highly pure water essential for sensitive scientific, diagnostic, and industrial applications. Laboratory water quality is categorized into standards such as Type I (Ultrapure), Type II (General Laboratory Grade), and Type III (Primary Grade/RO Water), each serving distinct purposes from High-Performance Liquid Chromatography (HPLC) and atomic absorption spectroscopy to general reagent preparation and washing tasks. The necessity for reliable, contaminant-free water is paramount, as impurities can significantly interfere with experimental results, calibration processes, and media preparation, making these purification systems critical infrastructure in modern research and clinical settings.

Major applications driving demand include pharmaceutical research, academic institutions, clinical diagnostic labs, and chemical analysis laboratories. Benefits derived from utilizing advanced purification systems include enhanced accuracy and reproducibility of experimental data, compliance with stringent regulatory requirements (such as FDA and GMP standards), and protection of costly analytical instruments from scale and corrosion. These systems typically employ a combination of technologies, including reverse osmosis (RO), deionization (DI), ultrafiltration (UF), and ultraviolet (UV) sterilization, often integrated into modular and customizable units to meet specific purity specifications and volume requirements required by specialized analytical instrumentation.

Key driving factors propelling market growth include the global increase in R&D activities, particularly in biotechnology, genomics, and personalized medicine, which demand Type I ultrapure water for highly sensitive molecular assays. Furthermore, the expansion of clinical laboratories in developing economies, coupled with stricter regulatory mandates regarding water quality in both diagnostics and manufacturing processes, mandates the adoption of sophisticated purification solutions. The trend toward automating laboratory processes and the shift towards integrated, compact water systems that offer real-time monitoring and validation capabilities are also substantial market accelerators.

Laboratory Water Purifier Market Executive Summary

The Laboratory Water Purifier Market demonstrates robust growth, primarily fueled by significant investments in life sciences research and the increasing implementation of stringent water quality standards across regulated industries globally. Business trends indicate a strong move towards digitalization, where purification systems are integrated with laboratory information management systems (LIMS) for automated data logging, performance monitoring, and predictive maintenance. Key market players are focusing on developing eco-friendly systems that minimize water wastage through improved recovery rates, alongside offering modular designs that allow for easy scalability and customization based on user needs, thereby enhancing operational efficiency and reducing long-term costs associated with laboratory infrastructure.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, driven by rapid establishment of pharmaceutical manufacturing hubs, expansion of academic research infrastructure, and government initiatives promoting scientific innovation in countries like China and India. North America and Europe remain dominant markets due to the presence of leading global pharmaceutical and biotechnology companies and advanced clinical diagnostic environments, characterized by high adoption rates of cutting-edge Type I water systems. Growth in these mature markets is sustained by replacement cycles and the increasing demand for standardized, validated water purification across multisite organizational networks, emphasizing compliance and data integrity.

Segmentation trends show that the Type I (Ultrapure) segment dominates the market in terms of value, largely due to its essential role in advanced analytical techniques such as mass spectrometry and specialized cell culture. Technology-wise, integrated systems combining Reverse Osmosis (RO) followed by Electro-deionization (EDI) and final polishing steps are gaining traction over traditional methods, offering higher efficiency and lower running costs compared to conventional resin-based deionization. End-user segmentation reveals that pharmaceutical and biotechnology companies are the largest consumers, driven by rigorous regulatory requirements for drug development and quality control, closely followed by academic and government research institutes prioritizing fundamental scientific discovery.

AI Impact Analysis on Laboratory Water Purifier Market

Common user questions regarding AI's influence in the Laboratory Water Purifier Market center on how artificial intelligence can ensure continuous, compliant water quality, automate maintenance, and optimize resource usage. Users are particularly concerned about integrating AI for predictive failure analysis of critical components (like membranes or UV lamps) to minimize downtime, and using machine learning to analyze raw water quality fluctuations in real time, automatically adjusting filtration parameters for consistent output. The overarching theme is the transition from manual monitoring and reactive servicing to smart, self-optimizing purification ecosystems capable of generating validated data logs automatically, thereby reducing human error and fulfilling strict regulatory documentation requirements.

- AI-driven predictive maintenance forecasts component failure, maximizing uptime and reducing unplanned service interruptions.

- Machine learning algorithms optimize filtration parameters instantaneously based on fluctuating feed water conditions, ensuring stable output purity.

- Automated logbook generation and compliance reporting simplify validation processes for regulated environments.

- Real-time data analytics identify usage patterns and energy consumption anomalies, promoting sustainable resource management.

- Integration with cloud platforms enables remote diagnostics and software updates, streamlining fleet management for multi-site organizations.

DRO & Impact Forces Of Laboratory Water Purifier Market

The dynamics of the Laboratory Water Purifier Market are governed by a robust interplay of drivers stemming from scientific advancements and regulatory mandates, balanced by restraints related to cost and infrastructure, offering significant opportunities in emerging high-growth sectors. The primary drivers include the exponential increase in global pharmaceutical R&D spending, demanding high-purity water for complex drug discovery and manufacturing processes, coupled with increasingly stringent water quality standards imposed by international bodies like USP and EP. Furthermore, technological innovations, such as advanced electrodeionization (EDI) systems and integrated water monitoring sensors, enhance the reliability and efficiency of purification, driving adoption across diverse laboratory settings. However, the high initial capital investment required for Type I ultrapure systems and associated maintenance costs often restrain adoption, particularly in smaller laboratories or developing regions with limited budgets.

Restraints are also strongly linked to the infrastructure challenges in certain geographical areas, where poor feed water quality necessitates expensive pretreatment stages, increasing the total cost of ownership (TCO) for purification equipment. Another critical restraint is the significant water wastage associated with traditional Reverse Osmosis (RO) systems, posing environmental and cost challenges that inhibit large-scale implementation in water-scarce regions, although technological improvements are slowly mitigating this issue. Opportunities, conversely, are emerging rapidly in the genomics and proteomics research fields, which require extremely high-purity water free of trace contaminants like nucleases and endotoxins, leading to specialized system demand. The growing trend of outsourcing R&D and clinical trials to emerging economies also presents lucrative avenues for market expansion, necessitating the supply of modern, compliant purification equipment to contract research organizations (CROs) and contract manufacturing organizations (CMOs).

The impact forces within this market are predominantly shaped by regulatory oversight and technological substitution. Regulatory Impact Force dictates the minimum required water purity, consistently pushing laboratories to upgrade outdated equipment to comply with evolving quality standards, such as those related to endotoxin limits for cell culture. The Technological Impact Force centers on the rapid development of new filtration media and self-regenerating deionization techniques that improve efficiency and reduce the need for hazardous chemical regenerants. Competition among key players drives continuous innovation in features like connectivity, automation, and real-time validation, making system performance and TCO the primary decision factors for end-users. The confluence of stringent quality demands and efficiency improvements ensures a sustained, high-value trajectory for the market, making specialized purification systems non-negotiable assets in the modern laboratory ecosystem.

Segmentation Analysis

The Laboratory Water Purifier Market is systematically segmented based on product type, technology, and application, reflecting the diverse needs across different laboratory environments. Segmentation by product type (Type I, II, III) is crucial as it directly correlates with the sensitivity of the downstream analytical methods being employed. Type I water, being the highest grade, commands the highest prices and is essential for chromatography and molecular biology, while Type II and III support general lab tasks and feed water for Type I systems, respectively. Analyzing these segments helps market participants tailor product offerings and marketing strategies to specific end-user requirements, such as high volume versus high purity needs.

Technology segmentation highlights the evolution from basic distillation and conventional deionization toward advanced, integrated solutions. Reverse Osmosis (RO) is the foundational technology, frequently coupled with Ultrafiltration (UF) to remove particulates and microorganisms, and Electro-deionization (EDI) to continuously demineralize water without relying on batch chemical regeneration. This segmentation is pivotal for understanding R&D investment trends, as companies focus on increasing the efficiency and decreasing the complexity and environmental footprint of these integrated systems. The move towards sustainability is strongly influencing the adoption of membrane-based and non-chemical purification technologies across all market segments.

- Product Type:

- Type I (Ultrapure Water)

- Type II (Pure Water)

- Type III (Reverse Osmosis Water)

- Technology:

- Reverse Osmosis (RO)

- Ultrafiltration (UF)

- Deionization (DI)/Electrodeionization (EDI)

- Distillation

- UV Sterilization

- Integrated Systems

- Application:

- Pharmaceutical and Biotechnology Industries

- Academic and Research Institutes

- Hospital and Clinical Laboratories

- Industrial Laboratories (e.g., Food & Beverage, Environmental Testing)

- End-User:

- Universities and Educational Institutions

- Contract Research Organizations (CROs)

- Government and Public Health Labs

- Private Diagnostic Centers

Value Chain Analysis For Laboratory Water Purifier Market

The value chain for the Laboratory Water Purifier Market begins with upstream activities involving the sourcing and refinement of specialized components. This includes the manufacturing of high-quality semipermeable membranes (RO, UF), synthesis of specialized ion-exchange resins, development of advanced UV lamps, and production of sophisticated sensors and electronic control units. Key upstream players must maintain stringent quality control over these raw materials, as the efficiency and longevity of the final purification system depend heavily on component reliability. Partnerships with specialized material science companies are essential here to ensure continuous improvement in filtration efficacy and sustainability.

Midstream activities focus on the integration, assembly, and testing of the final purification units. Manufacturers design and assemble the complex modular systems, ensuring compatibility between different purification stages (e.g., pretreatment, RO, EDI, polishing loop). This stage also includes crucial quality assurance steps, testing the system's ability to consistently meet defined water resistivity and total organic carbon (TOC) standards. The complexity of these integrated systems often necessitates specialized engineering and customization capabilities, particularly for large central water purification loops required by major pharmaceutical facilities.

Downstream analysis involves the distribution channels, sales, installation, and crucial after-sales support. Distribution occurs through both direct sales forces for major installations (often favored by top manufacturers to maintain control over specialized installation and validation services) and indirect channels utilizing regional distributors and laboratory equipment suppliers. After-sales service, including periodic maintenance, membrane replacement, and resin exchange, constitutes a significant revenue stream and is critical for customer retention. The effectiveness of the service network directly impacts system uptime and compliance, making robust technical support a key competitive differentiator in this market.

Laboratory Water Purifier Market Potential Customers

Potential customers for laboratory water purification systems are predominantly organizations engaged in highly regulated activities requiring precise control over experimental inputs or clinical diagnostics. The primary end-users are pharmaceutical and biotechnology companies, which utilize ultrapure water extensively throughout the entire drug lifecycle—from initial discovery research and formulation development to quality control and sterile manufacturing processes. Compliance with cGMP (current Good Manufacturing Practices) mandates the use of validated purification systems, making this segment the most lucrative and high-demand consumer of Type I water systems.

Academic and government research institutes form another foundational customer base. Universities and public health laboratories rely on these systems for basic scientific exploration, environmental monitoring, and foundational clinical research. Although budget constraints might necessitate the adoption of more cost-effective Type II and Type III systems in some areas, the rapid expansion of advanced molecular biology and proteomics research ensures a steady demand for high-end polishing units. Furthermore, the burgeoning clinical diagnostics sector, including independent reference laboratories and hospital-based pathology departments, increasingly requires reliable purified water for automated analyzers and reagent preparation to ensure accurate patient test results.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA (MilliporeSigma), Danaher Corporation (Pall Corporation), Veolia Water Technologies, ELGA LabWater, Sartorius AG, Thermo Fisher Scientific Inc., Evoqua Water Technologies LLC, Arium, Antylia Scientific (Cole-Parmer), Yamato Scientific Co. Ltd., Purite Ltd., Chengdu Jingcheng Scientific Co. Ltd., BWT Pharma & Biotech, Watek Systems, Aqua Solutions Inc., Rephile Bioscience, Labconco Corporation, Avidity Science, Polymem SA, Membran-Filtrationsanlagen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Water Purifier Market Key Technology Landscape

The core technology landscape of the laboratory water purification market is characterized by synergistic systems designed to remove specific contaminants sequentially. Reverse Osmosis (RO) remains the primary pretreatment stage, effectively removing 99% of inorganic ions, large organics, and bacteria. Modern RO membranes exhibit improved flux rates and higher recovery ratios, significantly reducing water consumption compared to older generations. Following RO, the deionization stage is crucial for achieving high resistivity. Traditional DI relies on disposable resin cartridges, but there is a major shift toward Electro-deionization (EDI) technology. EDI uses electricity to continuously regenerate the ion-exchange resins, eliminating the need for hazardous chemical regeneration and providing a more sustainable and cost-effective solution for producing Type II water.

Achieving Type I ultrapure water necessitates advanced polishing technologies. This final stage typically incorporates a combination of highly pure, mixed-bed ion exchange resins, combined with Ultrafiltration (UF) and UV oxidation. Ultrafiltration modules are employed to remove large macromolecules, pyrogens, and nucleases—contaminants highly problematic for sensitive cell culture and molecular biology applications. UV oxidation, usually conducted at dual wavelengths (185 nm and 254 nm), is essential for oxidizing trace organic compounds (reducing TOC levels) and sterilizing the water before dispensing, ensuring the water meets the required standards for advanced analytical instruments.

The most significant recent technological trend is the integration of smart monitoring and control systems. Contemporary purification units feature high-resolution resistive sensors, Total Organic Carbon (TOC) analyzers, and connectivity options (Wi-Fi/Ethernet) that allow for real-time validation and data recording. This digital integration facilitates compliance with regulatory bodies requiring comprehensive water quality logging. Furthermore, the development of smaller, benchtop dispensing units connected to central purification loops minimizes contamination risk associated with storage tanks and provides highly customizable dispensing flow rates, catering to the efficiency and precision demanded by modern automated laboratories.

Regional Highlights

The global Laboratory Water Purifier Market exhibits distinct regional dynamics driven by varying levels of research investment, regulatory environments, and industrial development:

- North America (NA): Dominates the market value due to the presence of a mature and highly regulated pharmaceutical and biotechnology sector, massive private and public R&D spending, and a robust clinical diagnostics industry. The U.S. drives the majority of demand, particularly for Type I ultrapure systems utilized in advanced genomics and proteomics research. High adoption rates of cutting-edge, digitally integrated purification systems are characteristic of this region.

- Europe: Represents a stable, strong market, heavily influenced by the rigorous standards set by the European Pharmacopoeia and widespread government funding for academic research. Countries like Germany, the UK, and France are key consumers, focusing on sustainable purification technologies like advanced RO and low-TOC systems, driven by strict environmental regulations regarding water usage and waste.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. This growth is attributable to rapid industrialization, increasing governmental focus on healthcare infrastructure development, and the emergence of countries like China, India, and South Korea as global manufacturing and research hubs for pharmaceuticals and medical devices. Investment in academic infrastructure and outsourced R&D activities significantly boosts demand for all types of laboratory water purifiers.

- Latin America (LA): Characterized by moderate growth, primarily centered in Brazil and Mexico. Market expansion is steady, driven by modernization efforts in clinical laboratories and increasing foreign direct investment in local pharmaceutical manufacturing facilities. However, budget constraints and infrastructural variability often lead to higher adoption rates of Type II and Type III systems compared to ultrapure solutions.

- Middle East and Africa (MEA): This region presents nascent growth opportunities, largely dependent on major infrastructure projects in healthcare and education, particularly in the Gulf Cooperation Council (GCC) countries. Water scarcity issues in many MEA nations make high-efficiency, low-wastage purification technologies highly desirable, though political and economic stability can influence the pace of market adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Water Purifier Market.- Merck KGaA (MilliporeSigma)

- Danaher Corporation (Pall Corporation)

- Veolia Water Technologies

- ELGA LabWater (a subsidiary of Veolia)

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Evoqua Water Technologies LLC

- Antylia Scientific (Cole-Parmer)

- Yamato Scientific Co. Ltd.

- Purite Ltd.

- Chengdu Jingcheng Scientific Co. Ltd.

- BWT Pharma & Biotech

- Watek Systems

- Aqua Solutions Inc.

- Rephile Bioscience

- Labconco Corporation

- Avidity Science

- Polymem SA

- Membran-Filtrationsanlagen

- Advantec MFS, Inc.

Frequently Asked Questions

Analyze common user questions about the Laboratory Water Purifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Type I, Type II, and Type III laboratory water?

Type I (Ultrapure) water features the highest resistivity (18.2 MΩ·cm) and the lowest TOC levels (<5 ppb), mandatory for critical applications like HPLC, PCR, and cell culture. Type II (Pure) water is suitable for general lab use, microbiological media, and feeding Type I systems. Type III (RO Water) is the initial purification step, used for non-critical washing and feed for Type II/I systems.

How does the integration of Electro-deionization (EDI) technology benefit laboratories?

EDI significantly benefits laboratories by continuously producing high-purity water without requiring the addition of hazardous chemicals for resin regeneration, unlike traditional DI systems. This reduces operational costs, minimizes downtime associated with cartridge replacement, and ensures a more environmentally friendly and consistent water supply necessary for high-throughput laboratory operations.

What major factors are driving the demand for ultrapure (Type I) water systems globally?

The primary drivers include the stringent quality requirements of advanced molecular biology and chromatography techniques, particularly in genomics, proteomics, and pharmaceutical R&D. Regulatory mandates requiring highly consistent water quality for method validation and manufacturing processes also necessitate the use of highly reliable, monitored Type I water purification units.

What challenges exist in adopting laboratory water purification systems in developing regions?

Key challenges include the high initial capital expenditure for advanced systems and the subsequent cost of consumables (e.g., membranes, cartridges). Additionally, regions often suffer from poor feed water quality, necessitating expensive and complex pretreatment stages, increasing the overall total cost of ownership (TCO) and requiring specialized technical service support, which may be limited locally.

How are environmental concerns impacting innovation in the Laboratory Water Purifier Market?

Environmental concerns are driving innovation toward sustainable solutions, notably the development of high-efficiency Reverse Osmosis (RO) systems designed to maximize water recovery rates, thereby minimizing wastewater generation. Manufacturers are also focusing on non-chemical purification methods, such as EDI and improved UV sterilization, to reduce the need for hazardous chemical use and disposal within laboratory settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Benchtop Laboratory Water Purifier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Laboratory Water Purifier Market Statistics 2025 Analysis By Application (Hospital Lab, Research Lab, Industry Lab, University Lab), By Type (Point of Use Sys ems Laboratory Water Purifier, Large Central Systems Laboratory Water Purifier), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager