Lactose-Free Yogurt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434384 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Lactose-Free Yogurt Market Size

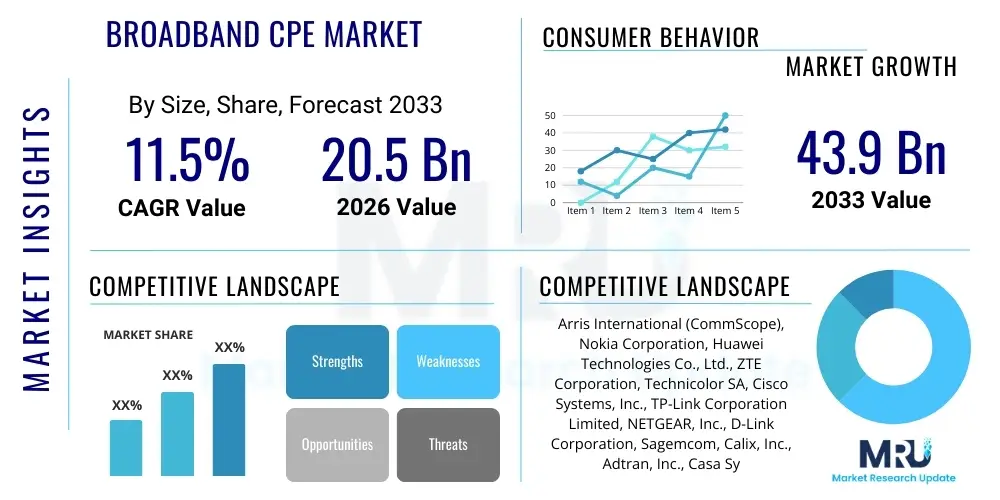

The Lactose-Free Yogurt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Lactose-Free Yogurt Market introduction

The Lactose-Free Yogurt Market is fundamentally driven by the escalating global prevalence of lactose intolerance, a condition where individuals cannot fully digest lactose, the sugar present in dairy milk. Lactose-free yogurt is produced by breaking down lactose into easily digestible sugars, glucose and galactose, typically through the introduction of the lactase enzyme during the processing phase. This modification makes the product accessible to a significant portion of the global population previously excluded from traditional dairy consumption. The increasing consumer awareness regarding digestive health, coupled with shifting dietary preferences favoring functional foods, has solidified lactose-free yogurt as a mainstream grocery item rather than a niche product. This segment offers the nutritional benefits of traditional yogurt, including high protein content, calcium, and probiotics, without the associated digestive discomfort, appealing strongly to health-conscious consumers.

Major applications of lactose-free yogurt span direct consumption, incorporation into smoothies and baking, and utilization as a healthier alternative to sour cream or other dairy bases in various culinary preparations. The primary benefit of this market lies in providing a palatable, nutritious, and convenient dairy option for the estimated two-thirds of the world’s population that suffers from some level of lactose malabsorption. Furthermore, manufacturers are increasingly innovating with flavors, textures, and added functional ingredients, such as enhanced protein or fiber, to cater to diverse palates and specific dietary needs. The product’s versatility in consumption patterns, ranging from breakfast staples to evening snacks, significantly contributes to its robust market penetration and consistent demand growth globally.

Key driving factors propelling the market forward include rapid urbanization in developing economies, leading to increased disposable incomes and a preference for packaged and health-oriented foods. Simultaneously, the robust R&D activities focused on improving the sensory attributes of lactose-free products—reducing the perceived sweetness and optimizing texture—are enhancing consumer acceptance. Regulatory support in key regions promoting clear labeling of allergenic components also builds consumer trust. The strategic expansion of retail distribution networks, encompassing supermarkets, hypermarkets, and burgeoning e-commerce platforms, ensures widespread availability, further accelerating market growth momentum.

Lactose-Free Yogurt Market Executive Summary

The Lactose-Free Yogurt Market is experiencing robust expansion, characterized by dynamic business trends centered on ingredient diversification and sustainable sourcing. A critical business trend involves the blending of lactose-free dairy bases with plant-based alternatives (such as oat or almond milk proteins) to appeal to flexitarian consumers seeking lower-sugar, high-protein options, thus blurring the lines between dairy and non-dairy segments. Furthermore, strategic mergers and acquisitions among large dairy corporations and smaller functional food startups are accelerating innovation, particularly in advanced enzymatic hydrolysis techniques and probiotic strain optimization. Supply chain resilience, focusing on cold chain logistics efficiency, remains paramount to maintaining the high quality and viability of live probiotic cultures critical to product efficacy and consumer satisfaction. Companies are also heavily investing in packaging solutions that extend shelf life while adhering to sustainability mandates, driving a preference for recyclable and biodegradable materials.

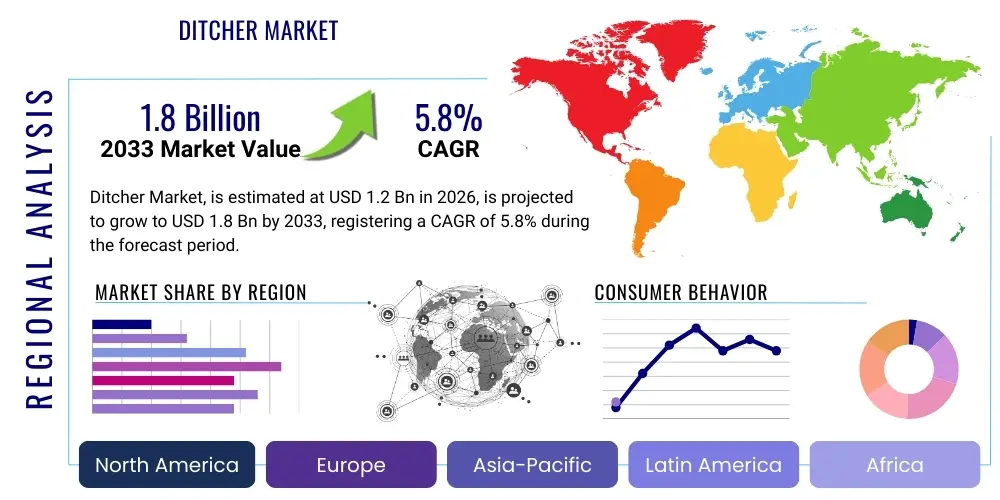

Regionally, North America and Europe dominate the market due to high consumer awareness, advanced product availability, and significant prevalence of diagnosed lactose intolerance. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial population size, increasing diagnosis rates in densely populated countries like China and India, and rising purchasing power leading to greater demand for premium, health-focused foods. Regional trends also show a distinct preference for drinking yogurt formats in APAC, while spoonable, Greek-style lactose-free yogurt maintains dominance in Western markets. Regulatory harmonization efforts, particularly within the European Union regarding labeling and health claims for digestive wellness products, influence market entry strategies and product positioning across continents.

Segment trends highlight the significant growth of the spoonable yogurt segment, which is traditionally favored for breakfast and snacking. Within this, the plain/unflavored sub-segment is gaining traction as consumers increasingly use it as a versatile ingredient base for cooking or prefer to control added sugars. The functional ingredients segment is witnessing remarkable growth, driven by consumer demand for products offering more than just lactose removal, specifically those fortified with Vitamin D, calcium, and specific gut-health promoting fibers like prebiotics. Distribution channel segmentation indicates that specialized health food stores and online platforms are growing faster than traditional retail, reflecting a targeted approach by manufacturers to reach highly engaged, health-conscious customer bases seeking detailed product information and specialized inventory.

AI Impact Analysis on Lactose-Free Yogurt Market

Common user questions regarding AI's impact on the Lactose-Free Yogurt Market often revolve around optimizing product formulation for sensory attributes, predicting ingredient supply chain fluctuations, and enhancing personalized marketing efforts targeted at consumers with specific dietary restrictions. Users frequently inquire about how AI can analyze vast consumer data sets—including genetic predispositions and purchase histories—to recommend optimal nutrient fortification levels (e.g., Vitamin D stabilization) without compromising taste or texture. Key concerns center on ensuring ethical data usage in personalized nutrition and validating AI models against real-world fermentation and enzyme efficiency data. There is also significant interest in AI's role in predictive quality control, identifying potential spoilage or inconsistencies in large-scale lactose hydrolysis processes before they impact final product batches, ensuring high regulatory compliance and minimizing waste.

AI is increasingly being utilized to refine the enzymatic process of lactose removal. By deploying machine learning algorithms to analyze parameters such as pH, temperature, enzyme concentration, and incubation time, manufacturers can achieve maximum efficiency and consistency in lactose breakdown, minimizing residual lactose levels to ensure product safety for intolerant individuals. This precision engineering reduces batch variability and optimizes production costs. Furthermore, AI-driven sensory analysis tools, using data from chemical composition and consumer panels, help developers rapidly prototype new flavors and textures that precisely mimic the sensory profile of traditional, full-lactose yogurts, overcoming one of the major historical barriers to market acceptance: the slightly sweeter taste resulting from glucose and galactose.

In the domain of market strategy, AI algorithms enhance demand forecasting by integrating real-time retail data, seasonal fluctuations, and health trend shifts (e.g., during flu season when probiotic interest surges). This predictive power allows companies to manage inventory more effectively, reducing losses from short shelf life products. AI also powers highly specific marketing campaigns, identifying individuals who frequently search for "digestive health" or "low-sugar dairy alternatives," allowing targeted product promotion that yields significantly higher conversion rates compared to traditional broad-spectrum advertising. Ultimately, AI elevates both the operational efficiency in manufacturing and the strategic effectiveness in consumer engagement within the lactose-free sector.

- AI optimizes enzymatic hydrolysis processes for consistent zero-lactose yield.

- Machine learning predicts supply chain disruptions, enhancing ingredient sourcing resilience.

- Predictive maintenance schedules for fermentation tanks reduce downtime and spoilage risk.

- AI-driven sensory analysis accelerates the development of novel, appealing flavor combinations.

- Personalized nutrition algorithms facilitate targeted marketing based on consumer health data.

- Automated quality control systems use computer vision and chemical sensors for real-time batch monitoring.

DRO & Impact Forces Of Lactose-Free Yogurt Market

The Lactose-Free Yogurt Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. The primary driver remains the pervasive global incidence of lactose intolerance and increasing diagnosis rates, coupled with heightened consumer focus on digestive wellness and gut microbiome health. Opportunities are largely concentrated in product innovation, specifically the development of hybrid products that combine lactose-free dairy with high-value functional ingredients like specialty proteins (e.g., whey isolates), novel probiotic strains, and naturally derived sweeteners, appealing to fitness and dietary enthusiasts. Additionally, geographic expansion into previously underserved regions, particularly Latin America and the Middle East, presents substantial growth avenues. These forces create a momentum favoring rapid product evolution and market penetration, requiring companies to constantly benchmark against evolving health standards and consumer preferences.

However, the market faces significant restraints. The most prominent restraint is the comparatively higher production cost associated with the enzymatic breakdown process and specialized filtration techniques required to ensure lactose removal compared to conventional yogurt manufacturing. This higher cost often translates into a premium price point, potentially limiting mass adoption in price-sensitive markets. Furthermore, the inherent challenge of maintaining sensory characteristics—the slightly altered texture and increased perceived sweetness resulting from the breakdown of lactose into monosaccharides—can deter some consumers accustomed to traditional yogurt profiles. Regulatory scrutiny regarding "lactose-free" claims and the need for stringent quality control to prevent cross-contamination also impose operational complexities.

The convergence of these DRO factors creates powerful market impact forces. The competitive intensity is escalating, forcing companies to differentiate not only on lactose removal but also on superior nutritional profiles (e.g., lower sugar, higher protein, non-GMO ingredients). Technological advancement is a core impact force, particularly in packaging innovation to extend shelf life without compromising product quality, essential for global distribution. Moreover, the increasing influence of social media and health influencers drives consumer education and demand, transforming perceived niche dietary needs into mass-market trends. Ultimately, the market favors agile manufacturers capable of balancing premium quality and taste integrity with efficient cost management and broad distribution capabilities.

Segmentation Analysis

The Lactose-Free Yogurt Market is highly segmented based on product type, flavor, distribution channel, and specific application, allowing manufacturers to precisely target various consumer demographics and nutritional requirements. Product type segmentation distinguishes between set, stirred, and drinking yogurts, with stirred and drinking varieties experiencing faster growth due to their convenience and versatility. Flavor segmentation ranges from traditional plain and vanilla to complex fruit blends and novel dessert-inspired options. The core purpose of segmentation is to analyze demand patterns related to texture preference (spoonable vs. drinkable) and dietary needs (e.g., high protein for fitness consumers vs. general wellness benefits), providing a clear roadmap for product development and marketing efforts.

- By Product Type:

- Set Yogurt

- Stirred Yogurt

- Drinking Yogurt

- By Flavor:

- Plain/Unflavored

- Vanilla

- Strawberry

- Blueberry

- Peach

- Other Fruit Flavors (e.g., Mango, Raspberry)

- Savory Flavors (Emerging)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Food Stores

- By Application/End-Use:

- Direct Consumption

- Desserts and Baking

- Dressings and Dips

- By Nutritional Content:

- Regular Lactose-Free

- High Protein Lactose-Free (Greek Style)

- Fortified (Vitamins, Calcium)

Value Chain Analysis For Lactose-Free Yogurt Market

The value chain for lactose-free yogurt begins with upstream activities, primarily involving raw milk procurement and the sourcing of critical inputs such as high-quality lactase enzymes, probiotic cultures, stabilizers, and specialized packaging materials. Raw milk quality is paramount, requiring strict adherence to hygiene standards and composition metrics (fat, protein content). Enzyme sourcing must ensure high purity and stability, as the efficiency of the enzymatic hydrolysis process directly impacts the final product's "lactose-free" claim verification. Upstream logistics are complex, demanding rapid cooling and transport of raw milk to minimize microbial growth and maintain freshness before processing. Manufacturers often establish long-term contracts with regional dairy farms to ensure consistent supply and traceability, which is a growing consumer concern.

The core processing phase involves pasteurization, homogenization, the critical step of enzymatic lactose hydrolysis (either before or after fermentation), inoculation with specific starter cultures, fermentation, and packaging. Direct channel considerations include ensuring effective cold chain management from the production facility to the consumer point of purchase. Indirect distribution relies heavily on established third-party logistics (3PL) providers specializing in refrigerated transport, which adds cost but grants broader market access. Effective inventory management is critical due to the perishable nature of the product, requiring advanced forecasting capabilities to match supply with fluctuating retail demand and promotional cycles.

Downstream activities encompass distribution, marketing, and retail. The primary distribution channels involve large-scale retail chains (supermarkets/hypermarkets) that offer volume sales, and specialty channels (online and health stores) that provide higher margins and access to health-conscious early adopters. Successful marketing emphasizes the health benefits—digestive comfort, high protein, and low sugar—using clear, educational content. The rapid growth of e-commerce necessitates investment in robust cold packaging solutions for direct-to-consumer delivery, optimizing the last-mile logistics. Consumer feedback gathered at the downstream level informs upstream R&D regarding desired flavor profiles and packaging formats, completing the feedback loop and driving continuous product refinement.

Lactose-Free Yogurt Market Potential Customers

The primary segment of potential customers for lactose-free yogurt comprises individuals diagnosed with or self-identifying as lactose intolerant or sensitive. This demographic seeks dairy alternatives that prevent uncomfortable gastrointestinal symptoms such as bloating, gas, and abdominal pain associated with consuming traditional dairy. This customer group values the functional benefit of digestive ease above all else, often prioritizing products with verified "no lactose detected" claims and those enriched with beneficial probiotic cultures to support overall gut health. Their purchasing decisions are highly influenced by physician recommendations, health blogs, and peer reviews, often leading to strong brand loyalty once a well-tolerated product is discovered.

A rapidly growing secondary segment consists of health-conscious consumers and flexitarians who are actively seeking low-sugar, high-protein food sources and perceive lactose-free products as inherently healthier or easier to digest, even without a formal intolerance diagnosis. This group includes athletes and fitness enthusiasts who rely on yogurt for post-workout recovery, favoring the Greek-style, high-protein lactose-free options. These customers are highly responsive to nutritional labeling, clean ingredient lists, and functional fortification (e.g., Vitamin D, B12). They are less price sensitive than the broader market and often overlap with consumers interested in natural, organic, and sustainably sourced food products, driving demand for premium product offerings.

The third significant customer base includes parents seeking gentle, nutritious dairy options for their children, particularly those exhibiting signs of sensitivity, and the aging population who frequently experience decreased natural lactase production later in life. For the elderly, easy digestion and high calcium content for bone health are critical purchasing motivators. These end-users look for convenient, mild-flavored, and nutrient-dense options. Overall, potential buyers span a broad demographic but are unified by a core desire for digestive comfort and the ability to enjoy the nutritional and culinary benefits of yogurt without adverse physical reactions, positioning lactose-free yogurt as a crucial component of modern dietary management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danone S.A., General Mills Inc., The Hain Celestial Group, Inc., Chobani, LLC, Arla Foods amba, Valio Ltd., Müller UK & Ireland Group LLP, Lactalis Group, Stonyfield Farm, Inc., EasiYo Products Ltd, Cabot Creamery Cooperative, Dean Foods Company, Redwood Hill Farm & Creamery, Fage International S.A., Tillamook County Creamery Association, Amul (Gujarat Co-operative Milk Marketing Federation), Yoplait, Sodiaal, Emmi Group, Tine SA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lactose-Free Yogurt Market Key Technology Landscape

The technological landscape of the Lactose-Free Yogurt Market is dominated by advanced enzymatic hydrolysis techniques, which remain the industry standard for efficiently breaking down lactose into glucose and galactose. Modern manufacturing leverages immobilized enzyme technology, where lactase is bound to inert carriers (like resin beads) within bioreactors. This method allows the enzyme to be reused multiple times, significantly reducing processing costs and environmental footprint compared to traditional batch addition. Furthermore, precision fermentation techniques are being refined to optimize the timing and temperature profiles during incubation, ensuring that the starter cultures thrive while the lactase enzyme works effectively, leading to minimal residual lactose while preserving the live and active cultures crucial for probiotic claims. Continuous flow processing systems are also being implemented to enhance throughput and maintain consistent product quality across massive production runs, critical for global market leaders.

Beyond lactose removal, technology plays a crucial role in improving product texture and stability. Ultrafiltration and microfiltration techniques are increasingly used, particularly in the production of high-protein, Greek-style lactose-free yogurt, concentrating the milk solids before fermentation to achieve the characteristic thick consistency without relying solely on thickeners. Additionally, advanced homogenization processes are employed to prevent syneresis (liquid separation) and improve mouthfeel, a common challenge in low-fat dairy manufacturing. The integration of high-pressure processing (HPP) is an emerging technology used to extend the shelf life of the finished yogurt while avoiding thermal treatment, thereby preserving delicate flavors and maximizing the viability of heat-sensitive probiotic strains, which is a major value differentiator in premium product categories.

Digital technologies are also transforming the quality control and traceability aspects. Near-infrared (NIR) spectroscopy and rapid enzymatic assays are utilized throughout the production line for instantaneous and accurate measurement of lactose levels, ensuring strict compliance with "lactose-free" regulatory standards (typically less than 0.01g/100g). Furthermore, blockchain technology is being piloted by several major players to enhance supply chain transparency, allowing consumers to trace the product from the farm (raw milk source) through the hydrolysis and fermentation steps to the retail shelf. This focus on verifiable quality and transparency meets the demand of the modern consumer who seeks reassurance regarding both the health claims and the ethical sourcing of their food products, making technological adoption a core competitive advantage.

Regional Highlights

North America is a mature and dominant market for lactose-free yogurt, characterized by high consumer awareness, strong purchasing power, and significant innovation, particularly within the functional food space. The US market, in particular, benefits from a well-established health food culture and high incidence of self-diagnosed sensitivities, leading to robust demand for premium, high-protein, and organic lactose-free options. The region's regulatory environment is conducive to product diversification, allowing manufacturers to rapidly introduce new flavors and formats, such as savory yogurts or options fortified with omega-3s and plant sterols. Competition is fierce, driven primarily by domestic giants like General Mills and Chobani, who continuously invest in marketing and distribution to maintain shelf dominance. The demand is also increasingly influenced by the clean label movement, pushing companies toward minimal ingredient lists and natural sweetness sources, further driving technological refinements in taste management.

Europe represents another cornerstone of the global market, led by countries such as Germany, the UK, and Scandinavia, where dairy consumption is traditionally very high but lactose intolerance prevalence is also notable. European consumers exhibit a strong preference for plain and drinking lactose-free yogurt formats, valuing digestive health benefits supported by specific, EFSA-approved probiotic claims. The regulatory framework, especially the EU’s strict rules on dairy naming and product composition, ensures high quality and consumer trust. Scandinavian countries, notably Finland, have been pioneers in developing lactose-free dairy technology and integrating these products into mainstream diets. The ongoing shift toward plant-based diets also influences this segment, with many European producers offering lactose-free dairy alternatives side-by-side with plant-based yogurt alternatives to capture the entire spectrum of the digestive wellness consumer.

The Asia Pacific (APAC) region is poised to be the fastest-growing market segment. While per capita dairy consumption is lower than in the West, the large population base and rapid economic growth in countries like China and India are significantly boosting demand. Lactose intolerance rates are genetically highest in many Asian populations, meaning the underlying need for these products is substantial. As diagnosis rates and health consciousness improve, the market penetration of lactose-free products is accelerating, often bypassing traditional dairy consumption patterns. Here, convenience and familiarity drive sales, with drinking yogurts being highly popular due to their portability and acceptance as a nutritious beverage. Market entry strategies in APAC often focus on localizing flavors (e.g., green tea, specific tropical fruits) and utilizing e-commerce platforms extensively to overcome fragmented retail distribution networks, leading to a dynamic and highly competitive emerging market landscape.

- North America: Market maturity, strong demand for high-protein, Greek-style variants, driven by fitness and digestive health trends. Significant investment in clean label and organic certifications.

- Europe: High regulatory standards (EFSA), strong consumer trust, significant presence of plain and drinking yogurt formats. Leading innovation in sustainable packaging and enzymatic efficiency.

- Asia Pacific (APAC): Highest growth potential due to high genetic prevalence of intolerance and rising disposable incomes. Dominated by drinking yogurt format; intense focus on flavor localization and e-commerce distribution.

- Latin America (LATAM): Emerging market characterized by increasing awareness and urbanization. Growth stimulated by multinational brand entry and improved cold chain logistics infrastructure.

- Middle East and Africa (MEA): Nascent market primarily driven by expatriate populations and upper-income segments. Opportunities exist for fortified products addressing regional nutritional deficiencies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lactose-Free Yogurt Market.- Danone S.A.

- General Mills Inc.

- The Hain Celestial Group, Inc.

- Chobani, LLC

- Arla Foods amba

- Valio Ltd.

- Müller UK & Ireland Group LLP

- Lactalis Group

- Stonyfield Farm, Inc.

- EasiYo Products Ltd

- Cabot Creamery Cooperative

- Dean Foods Company (through subsidiaries)

- Redwood Hill Farm & Creamery

- Fage International S.A.

- Tillamook County Creamery Association

- Amul (Gujarat Co-operative Milk Marketing Federation)

- Yoplait (a brand of General Mills/Sodiaal)

- Sodiaal

- Emmi Group

- Tine SA

Frequently Asked Questions

Analyze common user questions about the Lactose-Free Yogurt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary method used to manufacture lactose-free yogurt?

The primary manufacturing method is enzymatic hydrolysis. Manufacturers add the lactase enzyme directly to the milk or yogurt base, which breaks down the complex lactose sugar into simpler, easily digestible sugars (glucose and galactose) before or during the fermentation process, ensuring the final product contains negligible lactose levels.

Why is lactose-free yogurt often sweeter than traditional yogurt?

Lactose itself is less sweet than the simple sugars it breaks down into, glucose and galactose. Since the enzymatic hydrolysis process converts one lactose molecule into two simple sugar molecules, the resulting yogurt tastes naturally sweeter, even without the addition of extra sweeteners.

Does lactose-free yogurt contain the same probiotics and nutritional value as regular yogurt?

Yes, lactose-free yogurt typically retains the same high nutritional value, including calcium, protein, and essential vitamins. It also contains the necessary live and active probiotic cultures (such as Lactobacillus bulgaricus and Streptococcus thermophilus) crucial for gut health, as the lactase addition does not generally interfere with fermentation.

Which geographic region currently dominates the lactose-free yogurt market?

North America and Europe currently dominate the Lactose-Free Yogurt Market in terms of revenue share, primarily driven by high consumer awareness, advanced product availability, established distribution channels, and a significant population segment actively managing lactose sensitivity.

What are the key differences between lactose-free yogurt and plant-based yogurt alternatives?

Lactose-free yogurt is still a dairy product derived from cow’s milk, containing high-quality dairy protein and nutrients, with only the lactose removed. Plant-based yogurt alternatives (e.g., almond, soy, oat) are entirely non-dairy and derive their protein and base from vegetable sources, appealing to vegan consumers and those with dairy protein allergies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager