Laminate Lithium-Ion Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436000 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Laminate Lithium-Ion Battery Market Size

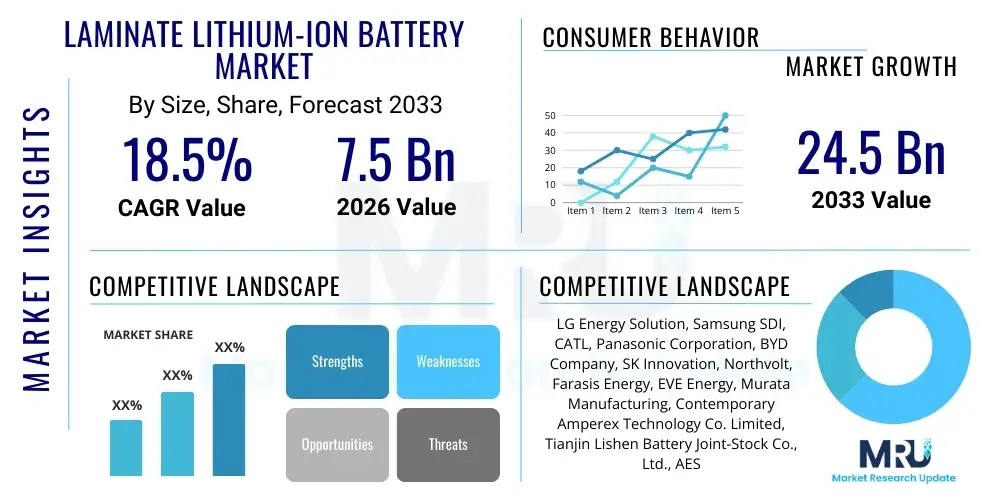

The Laminate Lithium-Ion Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $24.5 Billion by the end of the forecast period in 2033.

Laminate Lithium-Ion Battery Market introduction

The Laminate Lithium-Ion Battery Market primarily encompasses pouch cells, which utilize a flexible, heat-sealed foil casing instead of rigid metal cans, offering distinct advantages in terms of weight, energy density, and design flexibility. These batteries are crucial components in modern portable electronics and increasingly in high-performance electric vehicles (EVs) and grid-scale energy storage systems (ESS). The inherent thin profile and customizable shape of laminate structures allow for superior volumetric efficiency, making them ideal for space-constrained applications where maximizing energy capacity is paramount. Furthermore, their construction typically allows for better heat dissipation compared to cylindrical or prismatic cells, which is a critical safety and performance factor in high-power applications.

Product description highlights their composition, involving stacked or wound layers of cathode, anode, and separator material encapsulated within an aluminum-laminated polymer film (pouch). Major applications span across sophisticated consumer electronics such such as smartphones, tablets, and wearable devices, where the flat form factor is indispensable, to the rapidly expanding electric mobility sector and stationary energy storage. The superior energy density and reduced overall weight are key benefits driving their adoption across these high-growth sectors. The flexibility in design also allows manufacturers to efficiently utilize chassis space in EVs, directly contributing to increased driving range and performance metrics which are critical competitive factors in the automotive industry.

Driving factors for this market expansion include stringent global emissions regulations pushing EV adoption, continuous innovation in battery chemistry (like solid-state integration using flexible structures), and the massive deployment of 5G infrastructure and connected IoT devices requiring compact, powerful energy sources. Furthermore, the increasing demand for resilient and modular residential and commercial energy storage solutions further amplifies the need for high-performance, easily scalable laminate battery packs. Technological advancements focusing on enhanced safety features, such as improved thermal management systems and non-flammable electrolytes compatible with pouch structures, continue to bolster market confidence and widen the scope of applicability.

Laminate Lithium-Ion Battery Market Executive Summary

The Laminate Lithium-Ion Battery Market is undergoing rapid transformation, propelled by shifts in global business trends towards sustainability and high-density energy solutions. Strategic collaborations between major automotive OEMs and battery manufacturers (gigafactories) are dominating the investment landscape, driving significant capacity expansion, particularly in the Asia Pacific region. Business trends emphasize modularity and scalability, with manufacturers focusing on standardizing pouch cell dimensions while simultaneously pushing boundaries in proprietary electrode materials (e.g., silicon anodes) to enhance performance beyond current industry benchmarks. Supply chain robustness remains a critical focus area, specifically concerning raw material sourcing (lithium, cobalt, nickel) and ensuring ethical procurement practices, given the geopolitical sensitivities surrounding these critical minerals. This focus on supply chain integrity is directly influencing long-term contractual agreements and vertical integration strategies.

Regionally, Asia Pacific, led by China, South Korea, and Japan, commands the largest market share due to established manufacturing hubs and high domestic EV sales coupled with extensive consumer electronics production. North America and Europe are exhibiting the fastest growth rates, primarily driven by government subsidies (e.g., Inflation Reduction Act in the US, Green Deal in the EU) accelerating the domestic establishment of large-scale battery manufacturing capabilities geared towards servicing the burgeoning EV market. Segment trends indicate that the Electric Vehicles application segment is set to capture the maximum market revenue share by 2033, replacing consumer electronics as the primary revenue generator. This shift reflects the exponentially larger energy requirements of vehicle powertrains compared to portable devices. Technological segmentation reveals a growing focus on high-nickel cathode materials (NMC) and solid-state or semi-solid electrolyte integration within the flexible laminate structure to achieve higher energy densities and improved safety profiles.

The competitive landscape is characterized by intense R&D investment aimed at reducing costs through optimized manufacturing processes such as dry coating techniques and advanced stacking methods, which are particularly beneficial for pouch cell production. Market players are strategically acquiring intellectual property related to next-generation battery components, including thermally stable separators and advanced current collectors, to maintain a competitive edge. The overall market trajectory indicates a clear move towards higher cell-to-pack efficiency facilitated by the inherent flexibility of the laminate design, allowing for superior integration into vehicle architectures and stationary storage units with minimal wasted volume. These factors collectively underscore a robust growth outlook, positioning laminate batteries as essential for the global energy transition.

AI Impact Analysis on Laminate Lithium-Ion Battery Market

Common user questions regarding AI's impact on the Laminate Lithium-Ion Battery Market often revolve around optimizing battery lifespan, predicting failure, and accelerating materials discovery. Users frequently ask how AI can enhance the manufacturing quality control of thin laminate layers, specifically in detecting micro-defects during the stacking and sealing processes which are crucial for pouch cell reliability. Another significant theme is AI's role in refining battery management systems (BMS) to handle complex charging/discharging profiles, thereby extending the usable life of high-capacity laminate packs used in EVs. There is considerable user interest in leveraging machine learning models to simulate and predict the electrochemical performance of novel material combinations (e.g., silicon-based anodes) before expensive physical prototyping, speeding up time-to-market for next-generation laminate batteries.

AI algorithms are fundamentally transforming the design and production cycles of laminate lithium-ion batteries. In R&D, generative AI is utilized to explore vast chemical spaces, identifying optimal electrolyte and electrode compositions that maximize energy density while maintaining thermal stability, a critical factor for flexible pouch cells. In manufacturing, AI-powered vision systems are deployed on high-speed assembly lines to ensure perfect alignment and sealing integrity of the laminate packaging, minimizing yield losses associated with moisture ingress and delamination. Furthermore, predictive maintenance models, trained on operational data from thousands of battery packs, allow operators to anticipate degradation trends and schedule proactive interventions, significantly improving the overall safety and reliability of large-scale deployments, especially in demanding automotive and aerospace applications.

The application of advanced analytics and AI extends to supply chain management, optimizing the logistics and inventory control of volatile raw materials such as nickel and cobalt, factoring in geopolitical risks and fluctuating commodity prices. By creating digital twins of the manufacturing facilities and the batteries themselves, manufacturers can run complex stress tests and optimize operational parameters in a virtual environment, reducing physical testing costs and shortening development cycles. This confluence of data science and material engineering is positioning AI as a pivotal technology for achieving cost parity and performance superiority over traditional battery chemistries, cementing its role in accelerating the market penetration of laminate structures.

- AI optimizes electrode synthesis and coating uniformity, reducing defects in laminate layers.

- Machine learning algorithms enhance Battery Management Systems (BMS) for precise State of Charge (SOC) and State of Health (SOH) estimation.

- Predictive maintenance models extend battery lifespan and prevent catastrophic thermal events through early failure detection.

- Generative AI accelerates the discovery of novel, high-performance cathode and anode materials suitable for flexible pouch architecture.

- Automated quality control systems using computer vision ensure the integrity and sealing of the polymer laminate casing during mass production.

- Supply chain risk modeling uses AI to forecast material shortages and optimize global sourcing strategies for critical minerals.

DRO & Impact Forces Of Laminate Lithium-Ion Battery Market

The Laminate Lithium-Ion Battery Market is significantly influenced by a powerful combination of drivers, restraints, and opportunities, collectively forming the key impact forces shaping its trajectory. The primary driver is the global transition towards electric mobility, characterized by increasing consumer demand for vehicles offering longer driving ranges, which laminate batteries facilitate due to their superior specific energy density and efficient volumetric packaging. Additionally, the inherent design flexibility of pouch cells allows them to be integrated seamlessly into vehicle platforms (cell-to-pack and cell-to-chassis designs), minimizing dead space and maximizing energy storage capacity, a crucial competitive differentiator for high-end EVs and long-range logistics solutions. Further driving forces include the rapid expansion of renewable energy integration (solar and wind) globally, necessitating highly efficient and scalable grid-level energy storage systems (ESS), a sector where the modularity of laminate cells proves highly advantageous for deployment.

Conversely, significant restraints hinder growth. The primary concern is the vulnerability of the flexible polymer packaging to physical damage and moisture ingress, which can compromise cell performance and safety if not meticulously managed during manufacturing and integration. Furthermore, the reliance on sensitive raw materials, such as cobalt, and the volatile commodity pricing associated with lithium and nickel pose considerable supply chain risks and cost fluctuations for manufacturers. Another key restraint involves the complex thermal management requirements of high-energy-density pouch cells; while they dissipate heat well, any localized hot spots within densely packed modules can quickly escalate, requiring sophisticated and costly cooling systems, particularly in high-C-rate applications like fast charging. Addressing the recyclability challenges of the complex laminate material structure, which differs significantly from rigid metal casings, also adds to the cost burden and environmental regulatory complexity, acting as a soft restraint on mass deployment.

However, substantial opportunities exist, notably the potential for solid-state battery technology integration, which often favors the flexible, stacked architecture of laminate cells for commercialization. Further opportunities lie in penetrating emerging markets such as electric aviation (drones, eVTOLs) and advanced medical devices where lightweight, custom-form-factor batteries are mandatory. The ongoing trend of miniaturization in IoT and wearable technology also provides a persistent, high-margin market niche. Strategic investment in recycling infrastructure and closed-loop material recovery technologies presents a long-term opportunity to mitigate raw material risks and transform the current supply constraint into a sustainable competitive advantage. The impact forces indicate strong underlying demand, though moderated by critical technology and supply chain hurdles that require proactive industrial solutions.

- Drivers: Aggressive governmental policies promoting EV adoption and renewable energy storage; superior energy density and volumetric efficiency of pouch cells; design flexibility for 'cell-to-pack' integration.

- Restraints: Susceptibility of flexible packaging to external damage and moisture; high manufacturing precision required for sealing integrity; volatile pricing and geopolitical risks associated with key raw materials (e.g., Lithium, Cobalt).

- Opportunities: Integration with next-generation solid-state electrolytes; expansion into high-growth vertical markets like eVTOLs and advanced robotics; developing optimized, large-format cells for grid storage.

- Impact Forces: High competitive pressure driving cost optimization; stringent safety regulations demanding better thermal management; consumer preference shifting towards high-range, fast-charging vehicles.

Segmentation Analysis

The Laminate Lithium-Ion Battery Market segmentation provides a granular view of market dynamics, revealing key areas of growth and technological preference based on cell chemistry, application, and end-use. Segmentation is primarily driven by the specific performance demands of end-user industries. For instance, the high specific energy required by electric vehicles dictates a preference for high-nickel cathode chemistries (e.g., NMC 811), while stationary storage systems, which prioritize long cycle life and safety, often gravitate towards Lithium Iron Phosphate (LFP) chemistries, even when utilizing the flexible laminate packaging format. Understanding these differential demands is crucial for manufacturers in optimizing production lines and resource allocation.

The application segmentation clearly identifies Electric Vehicles (EVs) as the dominant and fastest-growing sector. This segment includes Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and specialized industrial vehicles. The consumer electronics segment, historically the market foundation, remains stable but is ceding revenue share dominance due to the sheer volume and capacity required by the automotive sector. Furthermore, the Energy Storage Systems (ESS) segment is experiencing exponential growth, covering utility-scale grid stabilization and commercial/residential power backup, increasingly deploying laminate cells for their modularity and ease of stacking in large configurations. The ability of laminate cells to conform to various packaging shapes also drives their adoption in specialized industrial equipment and niche applications like aerospace, where maximizing energy per unit of volume is critical.

From a product perspective, the market is differentiated by material composition, particularly the active cathode materials. Lithium Cobalt Oxide (LCO) continues to dominate high-end consumer electronics due to its extremely high energy density, though its use is restricted in larger format cells due to safety and cost concerns. Lithium Manganese Oxide (LMO) and various Nickel Manganese Cobalt (NMC) variants are central to the EV market, offering a crucial balance of power, range, and cycle stability. The ongoing development of advanced chemistries, including those integrating silicon or pure lithium metal anodes with laminate structures, promises future disruptive segmentation, potentially unlocking energy densities previously unattainable, thereby further expanding the application envelope of pouch cells across all major end-use sectors.

- By Type:

- Lithium Cobalt Oxide (LCO)

- Lithium Manganese Oxide (LMO)

- Lithium Iron Phosphate (LFP)

- Nickel Manganese Cobalt (NMC)

- Nickel Cobalt Aluminum (NCA)

- By Application:

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Electric Vehicles (BEVs, PHEVs)

- Energy Storage Systems (Grid-scale, Commercial, Residential)

- Industrial Equipment (Power Tools, Robotics, Drones)

- Medical Devices

- By End-Use Industry:

- Automotive & Transportation

- Consumer Goods & IT

- Power & Utilities

- Telecommunication

- Aerospace & Defense

Value Chain Analysis For Laminate Lithium-Ion Battery Market

The value chain of the Laminate Lithium-Ion Battery Market begins with the upstream procurement and processing of critical raw materials, including lithium carbonate/hydroxide, nickel, cobalt, manganese, graphite, and specialized polymer films for the pouch casing. This stage is capital-intensive and highly sensitive to geopolitical factors and resource availability. Upstream activities involve material refinement and the synthesis of active electrode materials (cathode and anode powders), which are then supplied to cell manufacturers. The quality and purity of these precursor materials directly influence the final performance characteristics and lifespan of the laminate cell. Manufacturers often engage in strategic partnerships or joint ventures with mining and chemical companies to secure long-term, stable material supplies, mitigating risk associated with volatile global commodity markets.

Midstream processing constitutes the core manufacturing activities: electrode preparation (slurry mixing, coating, drying), cell assembly (stacking or winding), electrolyte filling, and critically, the final sealing of the laminate pouch. The high-precision sealing process, which ensures zero moisture contamination, is a defining technological hurdle for laminate cells, requiring specialized automated equipment. Once sealed and formed, the cells are tested and integrated into battery modules and packs, typically involving complex thermal management systems and sophisticated Battery Management Systems (BMS). The distribution channel then takes over, often split between direct and indirect routes. Direct sales are predominant for large-volume customers like major automotive OEMs, where custom specifications and just-in-time delivery are essential, fostering deep integration between the battery supplier and the vehicle manufacturer.

Indirect distribution channels, involving distributors and specialized system integrators, cater primarily to the smaller-scale consumer electronics market, aftermarket replacements, and bespoke industrial applications. These integrators are responsible for final system assembly, certification, and localized support, providing value-added services such as specialized packaging and software integration. Downstream activities involve the utilization and eventual disposal or recycling of the battery packs. Given the environmental mandate, the downstream phase is rapidly evolving to include robust battery second-life applications (e.g., stationary storage using retired EV batteries) and specialized recycling facilities capable of efficiently processing the polymer-based laminate structure to recover high-value metals, closing the material loop and strengthening the overall sustainability of the supply chain.

Laminate Lithium-Ion Battery Market Potential Customers

The primary potential customers and end-users of Laminate Lithium-Ion Batteries span across high-tech sectors demanding high energy density and flexible form factors. The largest buying segment comprises global automotive manufacturers (OEMs) such as Tesla, Volkswagen, Hyundai, and other major players rapidly electrifying their fleets, specifically seeking high-performance pouch cells for mass-market EVs and luxury models where maximizing cabin space and range is paramount. These customers often enter into long-term procurement contracts worth billions of dollars, driving huge scale economies for cell manufacturers. Another critical customer group is the Energy Storage System (ESS) integrators and utility companies who require modular, scalable battery blocks for grid stabilization, peak shaving, and integrating intermittent renewable energy sources, often preferring LFP chemistry in a laminate format for longevity and safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $24.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Energy Solution, Samsung SDI, CATL, Panasonic Corporation, BYD Company, SK Innovation, Northvolt, Farasis Energy, EVE Energy, Murata Manufacturing, Contemporary Amperex Technology Co. Limited, Tianjin Lishen Battery Joint-Stock Co., Ltd., AESC, GS Yuasa International, Envision AESC, Automotive Energy Supply Corporation (AESC), CALB, Lishen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laminate Lithium-Ion Battery Market Key Technology Landscape

The technological landscape for Laminate Lithium-Ion Batteries is characterized by intense focus on achieving higher energy density, faster charging capabilities, and improved inherent safety features, all while leveraging the flexible packaging format. A primary area of R&D is the adoption of high-nickel cathode materials, particularly NMC 811 (80% nickel), which provides a substantial boost in specific energy but necessitates enhanced thermal management systems within the pouch pack due to higher reactivity. Simultaneously, silicon-based anode technology is gaining traction, replacing or supplementing traditional graphite anodes. Silicon offers a theoretical capacity ten times greater than graphite, significantly increasing the energy stored per cell, though implementation requires addressing the volume expansion (swelling) issues inherent to silicon during charging cycles, which is particularly challenging for the sensitive laminate structure. Advanced material science is therefore concentrating on developing stabilized silicon compounds and composite structures compatible with the flexible pouch format.

Manufacturing technology also represents a key competitive frontier. Dry electrode coating, a technique that eliminates the use of expensive and toxic solvents required in traditional wet processes, is being rapidly industrialized. This method significantly lowers production costs, reduces energy consumption, and streamlines the manufacturing footprint, offering substantial efficiency gains critical for large-scale gigafactory operations specializing in pouch cells. Furthermore, advanced cell stacking methods, moving beyond simple lamination to automated precision stacking and laser welding, ensure minimal internal resistance and optimize energy transfer within the flexible cell structure. These precision manufacturing techniques are vital for maintaining the integrity and consistency of the thin internal layers, preventing micro-shorts and ensuring the long-term reliability required for automotive applications.

In terms of system integration, the shift towards "Cell-to-Pack" (CTP) and even "Cell-to-Chassis" (CTC) architectures is fundamentally reshaping how laminate batteries are utilized in EVs. The flexible nature of pouch cells allows them to be directly incorporated into the structural elements of the vehicle, eliminating bulky intermediate modules. This maximizes the volumetric energy density of the entire battery pack, directly increasing the vehicle’s range. Finally, solid-state battery technology, often viewed as the successor to current liquid electrolyte systems, largely favors the stacked, laminate-like structure for its transition to mass production, as the solid electrolyte material is typically easier to layer within a pouch format than to fit into rigid cylindrical cans, positioning current laminate manufacturers favorably for the future generation of batteries.

- High-Nickel Cathodes (NMC 811 and beyond): Focus on increasing nickel content for higher energy density, requiring advanced thermal stabilization.

- Silicon Anode Integration: Utilizing silicon compounds to replace graphite, boosting specific capacity, while mitigating volume expansion within the flexible pouch.

- Dry Electrode Coating: Solvent-free manufacturing technique reducing production costs, energy consumption, and environmental impact.

- Advanced Stacking and Laser Welding: Precision assembly processes to minimize internal resistance and ensure perfect alignment of cell layers.

- Cell-to-Pack (CTP) Architectures: Integrating pouch cells directly into the module or vehicle structure to maximize volumetric efficiency.

- Solid-State Compatibility: Developing solid polymer or ceramic electrolytes that are conducive to the flexible, stacked layout of laminate cells.

- Advanced Thermal Management: Utilizing internal cooling elements and phase-change materials specific to the thin, flat geometry of pouch cells to prevent thermal runaway.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, driven by the presence of key manufacturing giants (CATL, LGES, Samsung SDI, Panasonic) and the largest consumer base for both consumer electronics and electric vehicles, particularly in China and South Korea. The region benefits from established supply chain infrastructure and aggressive governmental support for battery research and gigafactory construction. China remains the epicenter of laminate battery production capacity and technological advancement, specifically targeting the mass EV market with high-volume production capabilities.

- North America: Emerging as the fastest-growing region, fueled by significant regulatory incentives (e.g., US Inflation Reduction Act) aimed at localizing the battery supply chain and manufacturing. Major investments are being channeled into large-scale battery plants (gigafactories) dedicated to supplying the rapidly expanding domestic EV market. The demand here focuses heavily on large-format, high-energy-density laminate cells tailored for long-range automotive applications and utility-scale energy storage projects.

- Europe: Exhibits robust growth, driven by ambitious EU climate targets and legislative mandates phasing out internal combustion engines. Governments across Germany, Hungary, and Poland are heavily subsidizing domestic battery production (e.g., Northvolt, CATL’s European expansion) to secure regional supply independence. The market emphasizes sustainable sourcing, high safety standards, and integration into both premium and mass-market European EVs, with a strong focus on circular economy principles, including robust battery recycling infrastructure.

- Latin America, Middle East, and Africa (LAMEA): Currently represents a smaller share but holds strategic importance due to vast raw material reserves (especially Lithium in Latin America). Market growth is gradually accelerating, driven by local renewable energy projects requiring ESS and nascent EV adoption programs, often relying on imported technology and finished battery packs from APAC and Europe. The region offers significant opportunity for localized assembly and energy storage solutions in off-grid and remote applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laminate Lithium-Ion Battery Market.- LG Energy Solution

- Samsung SDI

- CATL (Contemporary Amperex Technology Co. Limited)

- Panasonic Corporation

- BYD Company

- SK Innovation

- Northvolt

- Farasis Energy

- EVE Energy

- Murata Manufacturing

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- AESC (Automotive Energy Supply Corporation)

- GS Yuasa International

- CALB (China Aviation Lithium Battery)

- SVOLT Energy Technology

- TDK Corporation

- Coslight Technology International Group Co., Ltd.

- Envision AESC

Frequently Asked Questions

Analyze common user questions about the Laminate Lithium-Ion Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of laminate lithium-ion batteries over cylindrical cells?

The primary advantage of laminate lithium-ion batteries, or pouch cells, is their superior volumetric efficiency and design flexibility. They eliminate the need for rigid casing material, resulting in lighter weight and higher specific energy density, allowing better utilization of limited space, particularly in electric vehicle battery packs (Cell-to-Pack designs).

Which end-use application drives the highest demand for pouch cells?

Electric Vehicles (EVs) currently drive the highest and fastest-growing demand for pouch cells. Their need for high energy density to maximize driving range, coupled with the ability of laminate cells to conform to complex chassis designs, makes them highly preferred by major automotive manufacturers globally.

What are the main safety challenges associated with laminate lithium-ion batteries?

The main safety challenges stem from the flexible polymer casing's vulnerability to physical damage and moisture ingress, which can lead to rapid degradation or internal shorts. Furthermore, their high energy density requires sophisticated Battery Management Systems (BMS) and advanced thermal management to prevent thermal runaway, especially during fast charging or excessive cycling.

How is AI impacting the manufacturing process of laminate batteries?

AI impacts manufacturing by enabling predictive quality control using high-speed computer vision systems to verify the integrity of the critical heat-sealed edges. AI also optimizes electrode coating and stacking alignment processes, reducing production defects and increasing overall manufacturing yield, which is essential for the delicate laminate structure.

What is the expected growth trajectory for the Laminate Lithium-Ion Battery Market over the forecast period?

The Laminate Lithium-Ion Battery Market is anticipated to maintain a strong growth trajectory, projected at an 18.5% CAGR between 2026 and 2033. This robust expansion is fueled by unprecedented investment in global EV production and the accelerating deployment of large-scale energy storage systems (ESS) worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager