Laminated Food and Beverage Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435956 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Laminated Food and Beverage Steel Market Size

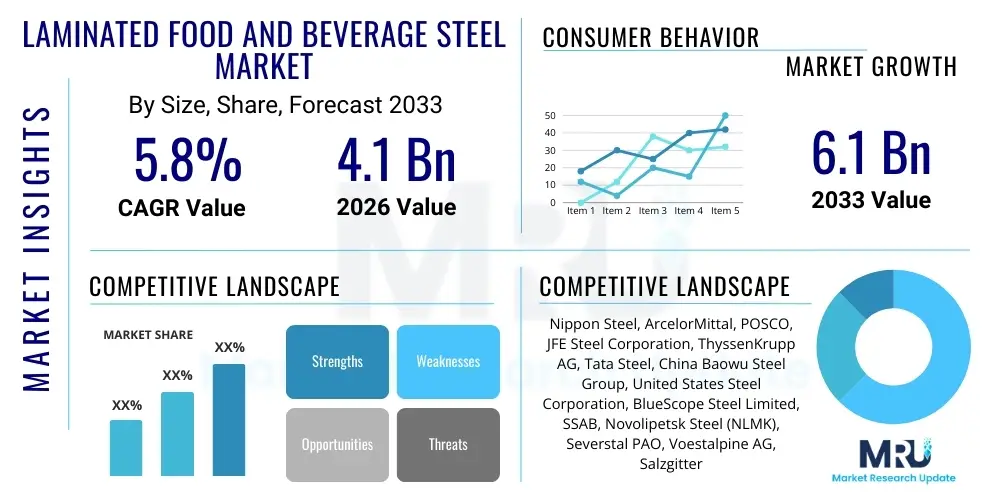

The Laminated Food and Beverage Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Laminated Food and Beverage Steel Market introduction

The Laminated Food and Beverage Steel Market encompasses the production and consumption of steel substrates coated or bonded with polymer films, primarily polyethylene terephthalate (PET) or polypropylene (PP), used in packaging applications for perishable goods. This innovative material merges the structural integrity, barrier properties, and recyclability of steel with the chemical resistance and cost-effectiveness of plastic films. Laminated steel serves as a superior alternative to traditional lacquered or varnished steel, offering enhanced corrosion resistance, improved preservation capabilities, and often eliminating the need for complex internal coating processes, particularly in highly acidic food environments. This material is central to modern packaging solutions aimed at extending shelf life and ensuring product safety.

Major applications of laminated steel include the manufacture of two-piece and three-piece cans for processed foods, carbonated soft drinks, beer, and juices, as well as complex closures and shallow trays. The material's versatility allows it to be drawn and shaped effectively without compromising the integrity of the polymer film, which is crucial for high-speed automated canning lines. A key benefit driving adoption is the reduction of Bisphenol A (BPA) risks, as the polymer film acts as a clean, inert barrier between the food contents and the steel substrate, aligning with increasingly stringent global food safety regulations, especially in developed economies like Europe and North America.

Driving factors for this market include the global shift towards packaging sustainability, as laminated steel is fully recyclable, provided adequate separation technologies are employed at the recycling stage. Furthermore, the steady growth in the packaged food and beverage sector, fueled by urbanization, changing consumer lifestyles, and demand for ready-to-eat meals, directly increases the need for high-performance, safe, and cost-efficient canning materials. Technological advancements in lamination processes, leading to thinner gauges and stronger adhesion between the polymer and steel, further enhance the material's competitive edge against aluminum and pure plastic alternatives.

Laminated Food and Beverage Steel Market Executive Summary

The Laminated Food and Beverage Steel Market is characterized by robust business trends driven by sustainability mandates and technological refinement aimed at enhancing food safety. Key industry players are focusing heavily on developing high-barrier laminates that can withstand aggressive filling conditions, such as high heat and pressure, while reducing the overall material thickness to minimize carbon footprint and logistical costs. Consolidation among steel producers and packaging manufacturers is notable, seeking to integrate the supply chain and streamline production efficiencies. The transition away from traditional epoxy coatings toward polymer films is a central theme, providing a significant competitive advantage to companies invested in advanced laminating lines, particularly those utilizing solvent-free and water-based adhesive systems.

Regionally, Asia Pacific (APAC) dominates the market in terms of production and consumption volume, primarily due to the vast and rapidly expanding processed food industry in China and India, coupled with rising disposable incomes increasing demand for canned beverages. North America and Europe, while representing mature markets, exhibit strong growth in value, driven by strict regulatory requirements mandating BPA non-intent packaging, accelerating the switch to premium laminated steel solutions. These regions are also leading the charge in implementing advanced recycling infrastructure necessary to handle complex multi-material packaging like laminated steel, thereby bolstering its circular economy credentials.

Segment trends indicate that polyethylene terephthalate (PET) remains the predominant laminate material due to its excellent barrier properties and cost-effectiveness, though polypropylene (PP) is gaining traction, especially in applications requiring higher thermal resistance. The application segment is heavily skewed towards two-piece and three-piece food cans, reflecting the indispensable role of steel packaging in long-term food preservation. Within the end-use industry, the processed foods and carbonated soft drinks sectors account for the largest shares, necessitating materials that offer both aesthetic appeal and impeccable long-term product protection, driving innovation in surface finishes and printability aspects of the laminated product.

AI Impact Analysis on Laminated Food and Beverage Steel Market

User queries regarding the impact of Artificial Intelligence (AI) on the Laminated Food and Beverage Steel Market predominantly center on optimization, predictive maintenance, and quality control. Users frequently inquire about how AI can improve the lamination process accuracy, reduce material waste during coating and slitting, and enhance the early detection of microscopic defects in the polymer layer. Concerns also revolve around the integration costs of sophisticated AI-driven vision systems and predictive modeling tools within existing, often legacy, steel production facilities, alongside the necessary workforce upskilling required to manage these autonomous systems. Expectations are high regarding AI's potential to dramatically improve yield rates and ensure compliance with complex quality standards, specifically focusing on film adhesion and uniform thickness distribution, which are critical determinants of final product performance and safety.

AI is set to revolutionize operational efficiency within the laminated steel industry by implementing sophisticated real-time monitoring and control systems. Machine learning algorithms analyze vast datasets generated by sensors along the production line—measuring temperature, tension, curing time, and adhesive application—to predict and prevent quality deviations before they materialize. This shift from reactive quality checks to proactive process adjustments ensures higher consistency in lamination quality, reducing scrap rates significantly. Furthermore, AI facilitates complex supply chain management, optimizing inventory levels of both raw steel coils and specialized polymer films, which are often procured from global specialized suppliers, mitigating risks associated with material price volatility and logistical bottlenecks.

The strategic deployment of AI extends into product innovation and material science simulation. Deep learning models are being utilized to simulate the interaction between different polymer chemistries and steel surface treatments, accelerating the development of next-generation laminated products with enhanced barrier properties against oxygen and moisture, or superior resistance to aggressive chemicals found in certain food types. This capability reduces the time and cost associated with traditional physical testing, providing manufacturers a competitive edge in introducing novel packaging solutions tailored to specific client needs. The integration of AI tools is thus transforming laminated steel production from a mechanical process into a highly optimized, data-driven manufacturing ecosystem, fundamentally altering the economics of high-volume metal packaging production.

- Enhanced quality control through AI-driven vision systems detecting microscopic lamination defects in real-time.

- Predictive maintenance algorithms optimizing machinery uptime for high-speed coating and curing lines.

- Supply chain optimization using machine learning for forecasting demand for specific laminate grades and raw steel.

- Simulation of new laminate material performance and adhesion strength, accelerating R&D cycles.

- Energy consumption reduction in furnaces and ovens via AI-managed thermal process controls.

DRO & Impact Forces Of Laminated Food and Beverage Steel Market

The Laminated Food and Beverage Steel Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its trajectory. The primary driver is the pervasive demand for BPA non-intent (BPA-NI) packaging solutions, particularly in high-acid food and beverage applications, where the polymer laminate provides a chemically inert barrier. This regulatory and consumer-driven mandate heavily favors laminated steel over traditional internally lacquered cans. Simultaneously, the market benefits from the excellent formability and cost-efficiency of steel compared to aluminum, allowing packaging manufacturers to maintain competitive pricing while adhering to increasingly stringent safety standards. Furthermore, the commitment of major global brands to adopt recyclable or sustainably produced packaging directly fuels the investment into sophisticated lamination technology.

Conversely, the market faces significant restraints, chiefly stemming from the inherent material complexity. Laminated steel is a multi-material product, posing challenges in the recycling stream compared to pure steel or aluminum. While the steel substrate is highly recyclable, the separation of the polymer film often necessitates specialized recycling infrastructure, which is not universally available, thereby occasionally undermining its sustainability narrative. Furthermore, the volatility in raw material prices, particularly steel coil prices and specialized polymer resin costs, introduces financial instability for manufacturers. Competition from alternative packaging formats, such as lightweight flexible pouches, aseptic cartons, and PET bottles, also exerts pressure, particularly in the non-carbonated beverage and ready-meal segments, forcing continuous innovation in barrier properties and cost control for laminated steel products.

Opportunities for significant market penetration lie in emerging economies where cold chain infrastructure is developing rapidly, increasing the need for shelf-stable packaged foods. Expansion into new geographic areas and applications, such as specialized pharmaceutical or aerosol packaging utilizing laminated steel's exceptional barrier properties, represents untapped potential. Crucially, technological advancement, specifically the development of biodegradable or bio-based polymer laminates, offers a pathway to completely negate the current recycling challenges, aligning the product perfectly with circular economy principles. Investment in proprietary lamination techniques that enhance film adhesion and structural integrity for ultra-thin gauge steel further promises to expand the market's addressable size by offering lighter and more resource-efficient packaging solutions, ensuring market growth across the forecast period by leveraging superior material performance and regulatory compliance.

Segmentation Analysis

The Laminated Food and Beverage Steel Market is meticulously segmented based on Laminate Material, Thickness, Application, and End-Use Industry, reflecting the diverse technical requirements and consumer needs across the globe. This structural segmentation allows market participants to tailor their offerings—whether optimizing the thermal resistance of polypropylene films for retorted foods or ensuring the deep-draw capability of PET-laminated steel for two-piece beverage cans. The analysis of these segments highlights where technological investments are yielding the highest returns, such as in the development of thinner gauges to achieve lightweight goals without compromising barrier integrity. Segmentation based on application provides clear insights into the dominant packaging formats and their material dependencies, confirming the stronghold of steel in long-shelf-life canned goods.

The Laminate Material segmentation is critical, defining the performance characteristics related to chemical inertness and resistance to various filling processes. PET dominates due to its proven barrier properties and acceptance in beverage applications, whereas PP is essential for high-temperature processed foods (retort sterilization). Thickness segmentation directly correlates with cost and sustainability efforts; the shift towards ultra-thin gauges (less than 0.2mm) is a major trend driven by mandates to reduce material consumption and lower transportation emissions. Understanding the End-Use Industry distribution is vital for supply chain forecasting, showing strong, stable demand from the processed foods sector and dynamic, innovation-driven demand from the non-carbonated drinks segment seeking high-quality, recyclable materials.

- By Laminate Material:

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- High-Density Polyethylene (HDPE)

- Other Polymers (e.g., Nylon, EVA)

- By Thickness:

- Less than 0.2mm (Ultra-Thin Gauge)

- 0.2mm to 0.5mm (Standard Gauge)

- Above 0.5mm (Heavy Gauge)

- By Application:

- Cans

- Two-Piece Cans

- Three-Piece Cans

- Closures (Lids, Caps, Easy-Open Ends)

- Trays and Containers

- Others (Aerosols, Specialty Packaging)

- Cans

- By End-Use Industry:

- Carbonated Soft Drinks (CSD)

- Processed Foods (Fruits, Vegetables, Meat, Seafood)

- Dairy Products

- Beer and Alcoholic Beverages

- Juices and Non-Carbonated Drinks

Value Chain Analysis For Laminated Food and Beverage Steel Market

The value chain for the Laminated Food and Beverage Steel Market begins with upstream activities involving the extraction and processing of raw materials: iron ore, coking coal for steel production, and crude oil derivatives for polymer resin manufacturing. Key upstream players include major integrated steel mills and specialized chemical/polymer producers. The most crucial stage is the hot and cold rolling of steel coils, followed by sophisticated surface preparation, which is essential for ensuring superior adhesion of the polymer film. Quality control at this stage dictates the success of the lamination process. Innovation in surface treatments (e.g., chrome-free passivation) is highly valued as it affects both bonding strength and environmental impact.

Midstream activities center around the actual lamination process, where high-speed coating and curing lines bond the polymer film to the steel substrate using specialized adhesives or thermal fusion techniques. This is often performed by either integrated steel producers with dedicated finishing lines or highly specialized coil coating service providers. The laminated coils are then prepared (cut, slitted) and sold directly or indirectly to packaging converters. Distribution channels are typically a mix of direct sales from large steel producers to global can makers (downstream) and indirect sales through distributors, particularly for smaller volumes or specialty products, allowing for faster localized supply and inventory management.

The downstream segment is dominated by metal packaging manufacturers who convert the laminated steel sheets into final products (cans, closures, trays) through high-speed stamping and forming operations. These converters supply the material to the ultimate end-users: the major food and beverage corporations. The demand signals originate from the brand owners (e.g., Coca-Cola, Nestlé), who enforce strict specifications regarding food safety (BPA-NI) and sustainability, driving the entire value chain. Therefore, success hinges on seamless collaboration between steel producers, polymer suppliers, and packaging converters to meet these stringent requirements, ensuring consistent quality and cost-effectiveness across the highly complex manufacturing process.

Laminated Food and Beverage Steel Market Potential Customers

The primary consumers and end-users of laminated food and beverage steel are high-volume commercial entities operating within the fast-moving consumer goods (FMCG) sector, primarily focused on shelf-stable products. These customers require materials that guarantee extended shelf life, robust protection against physical damage and corrosion, and compliance with stringent public health regulations regarding food contact materials. Major buyers include multinational corporations specializing in canned and processed foods (e.g., soups, ready-meals, preserved fruits, pet food) and large-scale beverage producers, particularly those distributing carbonated soft drinks, beer, and juices across vast geographical areas where stable packaging performance is non-negotiable for maintaining product quality over extended distribution cycles.

A secondary, yet rapidly growing, customer base includes manufacturers of specialty packaging, such as those producing high-performance closures, easy-open ends (EOE), and complex shaped containers for premium goods. These buyers value the aesthetic quality and printability of laminated steel alongside its technical performance. Furthermore, contract packaging companies that serve multiple smaller food and beverage brands also represent significant potential customers, often preferring the operational efficiency and reliability associated with pre-coated laminated steel coils over in-house lacquering processes. The critical purchasing drivers for all these customers revolve around material consistency, guaranteed chemical safety (BPA-NI compliance), and overall cost-in-use effectiveness compared to alternative packaging materials like aluminum or glass, cementing their position as indispensable buyers in this specialized steel market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Steel, ArcelorMittal, POSCO, JFE Steel Corporation, ThyssenKrupp AG, Tata Steel, China Baowu Steel Group, United States Steel Corporation, BlueScope Steel Limited, SSAB, Novolipetsk Steel (NLMK), Severstal PAO, Voestalpine AG, Salzgitter AG, Ton Yi Industrial Corp., Toyo Kohan Co., Ltd., Berlin Packaging, Silgan Holdings Inc., Crown Holdings, Inc., Ball Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laminated Food and Beverage Steel Market Key Technology Landscape

The technological landscape of the Laminated Food and Beverage Steel Market is defined by continuous advancements focused on improving material adhesion, reducing gauge thickness, and developing sustainable coatings. The primary technology employed is the high-speed coil coating process, which utilizes either thermosetting adhesives, thermal lamination (heat fusion), or solvent-free processes to bond specialized polymer films to the cleaned and pre-treated steel surface. Recent innovations focus on plasma surface treatment technologies applied to the steel substrate before lamination to enhance the chemical bond between the metal and the polymer, resulting in improved drawability and reduced risk of delamination during subsequent can-making processes, which is essential for two-piece can production.

A significant technological push involves the development and deployment of thin-film polymer technologies that provide superior barrier properties while reducing material input. This includes multi-layer co-extruded films designed to block oxygen, moisture, and UV light more effectively than single-layer films, thereby extending the shelf life of highly sensitive products like craft beers and specialized processed foods. Furthermore, the industry is heavily investing in chrome-free pretreatment technologies, often utilizing advanced titanium or zirconium-based chemistries, to replace traditional chromium-based passivation layers due to environmental regulations, maintaining high corrosion resistance while adhering to stricter manufacturing standards.

Automation and inline inspection systems represent another core technological focus. High-resolution optical scanners and electromagnetic sensors are integrated into lamination lines to perform 100% surface inspection, detecting pinholes, scratches, or uneven coating thicknesses in real-time. This emphasis on Industry 4.0 principles, including the use of robotics for handling and packing and sophisticated process control software, ensures optimal product consistency at high production speeds. These technological advancements collectively drive the market towards thinner, stronger, safer, and more environmentally compliant laminated steel products, positioning the material favorably against competing packaging substrates and ensuring long-term viability in demanding food contact applications.

Regional Highlights

Regional dynamics are pivotal in shaping the Laminated Food and Beverage Steel Market, reflecting variations in regulatory environments, consumer behaviors, and economic growth rates. Asia Pacific (APAC) stands as the largest and fastest-growing market, primarily due to the expansive population base, accelerating urbanization, and robust growth in the packaged food and beverage sectors, particularly in populous nations like China, India, and Indonesia. The demand is largely volumetric, driven by cost-efficiency and the rapid modernization of local packaging industries, transitioning from traditional materials to advanced steel solutions for both shelf-stable foods and beverages, often prioritizing local production capacity and supply chain resilience.

Europe and North America represent high-value markets characterized by stringent safety and environmental regulations. These regions have been the pioneers in enforcing mandates for BPA non-intent packaging, accelerating the adoption of premium, high-performance laminated steel. European market growth is particularly sensitive to the European Union's directives on packaging waste and recyclability, favoring materials that contribute positively to circular economy goals. North America's growth is stable, focused heavily on the carbonated soft drink and beer segments, where steel offers superior pressure resistance and shelf-life protection. The regional strategy here involves constant innovation in material lightweighting and adopting advanced lamination technologies for improved product safety and sustainability reporting.

Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting considerable potential. Latin America's market growth is tied to stabilizing economies and increasing penetration of large international food and beverage brands, necessitating reliable packaging infrastructure. MEA, while starting from a lower base, shows strong potential, driven by infrastructure development and rising demand for imported or locally manufactured packaged food to ensure safety and stability in warm climates. These regions often rely on imported high-quality laminated steel until local manufacturing capabilities mature, making global steel producers essential suppliers in these developing markets.

- Asia Pacific (APAC): Dominates market volume; driven by high consumption of canned processed foods and beverages in China and India; focus on production capacity expansion and cost-effective solutions.

- Europe: High-value market focused on regulatory compliance (BPA-NI) and sustainability mandates; leading adoption of chrome-free and advanced lamination technologies.

- North America: Mature, high-demand market; significant consumption in CSD and beer packaging; emphasis on lightweighting and superior barrier performance.

- Latin America: Emerging market with growth linked to increasing packaged food penetration and economic stability; increasing adoption of international food safety standards.

- Middle East and Africa (MEA): High growth potential due to increasing urbanization and need for shelf-stable food preservation in challenging climates; developing local processing and packaging infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laminated Food and Beverage Steel Market.- Nippon Steel Corporation

- ArcelorMittal

- POSCO

- JFE Steel Corporation

- ThyssenKrupp AG

- Tata Steel

- China Baowu Steel Group

- United States Steel Corporation

- BlueScope Steel Limited

- SSAB

- Novolipetsk Steel (NLMK)

- Severstal PAO

- Voestalpine AG

- Salzgitter AG

- Ton Yi Industrial Corp.

- Toyo Kohan Co., Ltd.

- Berlin Packaging

- Silgan Holdings Inc.

- Crown Holdings, Inc.

- Ball Corporation

Frequently Asked Questions

Analyze common user questions about the Laminated Food and Beverage Steel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is laminated steel and how does it differ from traditional tinplate?

Laminated steel is steel sheet coated with a polymer film, typically PET or PP, bonded through heat or adhesive. Unlike traditional tinplate which relies on a metal coating (tin) and often an internal lacquer, laminated steel uses the polymer film as a primary, inert barrier, ensuring superior corrosion resistance and achieving BPA non-intent (BPA-NI) status essential for food safety compliance.

Is laminated food and beverage steel fully recyclable?

Yes, laminated steel is highly recyclable. The core steel substrate is 100% recyclable, and while the polymer film historically posed separation challenges, modern recycling infrastructure and specialized processes are increasingly capable of separating and recovering both the steel and the polymer components, ensuring its circular economy credentials.

Which factors are driving the demand for BPA non-intent packaging in this market?

The primary drivers are escalating consumer awareness regarding the health risks associated with Bisphenol A (BPA) and stringent governmental regulations, particularly in North America and Europe, mandating the use of non-BPA-added or BPA non-intent materials for food contact surfaces, thereby accelerating the shift towards polymer-laminated solutions.

What role does Polyethylene Terephthalate (PET) play in the laminated steel market?

PET is the leading laminate material due to its excellent oxygen barrier properties, high clarity, good mechanical strength, and chemical inertness. It is predominantly used in high-volume applications such as two-piece beverage cans and standard food cans, offering a cost-effective and compliant barrier layer.

How does the volatility of raw material prices affect the market profitability?

The high volatility in the prices of raw steel coils and specialized polymer resins significantly impacts the profitability and pricing strategies of laminated steel manufacturers. To mitigate this risk, companies often employ long-term supply contracts, hedging strategies, and invest in process efficiencies to reduce material waste and overall production costs per unit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager