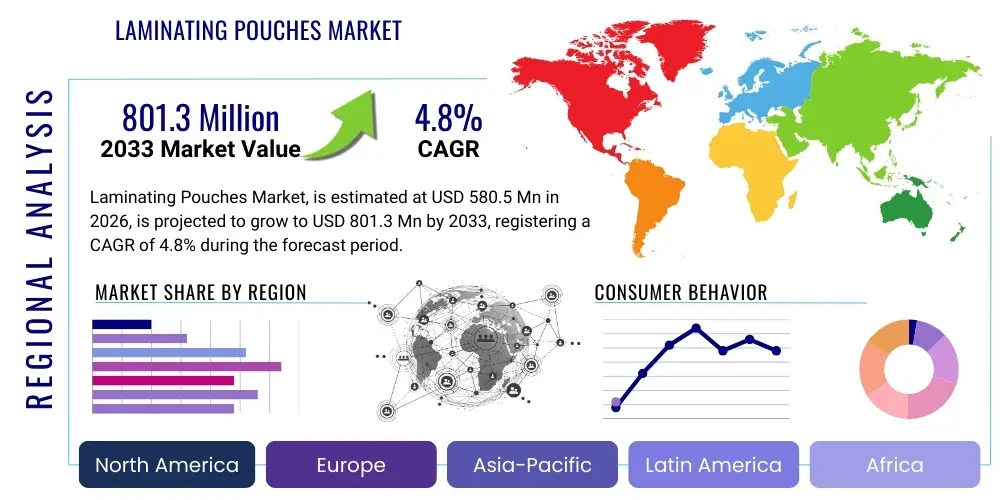

Laminating Pouches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438726 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Laminating Pouches Market Size

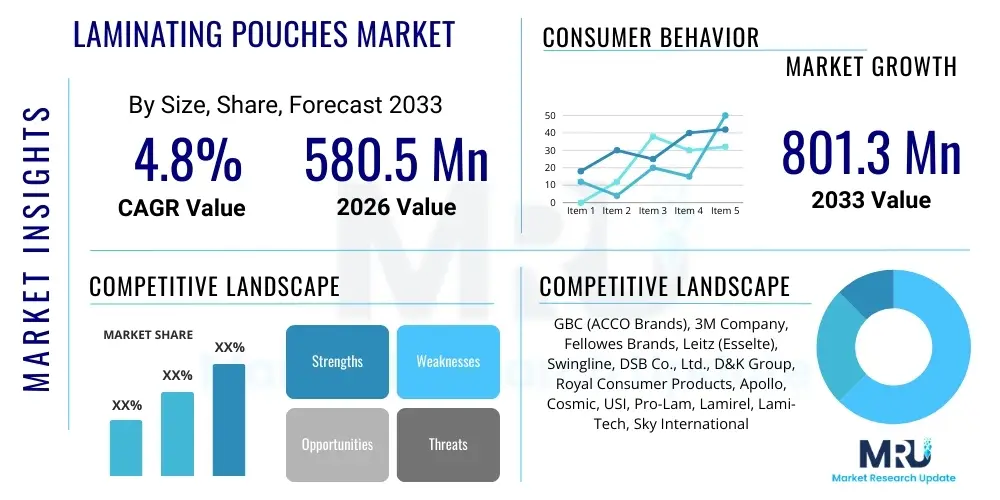

The Laminating Pouches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 580.5 Million in 2026 and is projected to reach USD 801.3 Million by the end of the forecast period in 2033.

Laminating Pouches Market introduction

The Laminating Pouches Market encompasses the global trade of pre-cut, sealed plastic sheets, typically made from polyethylene terephthalate (PET) or polyvinyl chloride (PVC), designed for use with heat-activated laminating machines. These pouches function by encapsulating documents or materials, providing protection against moisture, abrasion, fading, and general wear and tear, significantly extending the lifespan and durability of the content. Essential characteristics driving market adoption include the simplicity of the lamination process, the high degree of clarity offered by modern polymers, and the cost-effectiveness compared to alternative protective coatings or mounting solutions. Product variations are defined primarily by thickness (measured in mils), finish (glossy or matte), and size (ranging from credit card size to letter or legal formats), catering to diverse consumer and professional requirements.

Major applications of laminating pouches span across educational institutions, corporate offices, commercial print shops, and governmental organizations. In educational settings, they are indispensable for preserving teaching aids, flashcards, and student IDs. Corporate environments utilize them for protecting important signage, presentations, security badges, and compliance documentation. The recent surge in remote work and the increasing emphasis on archival quality in small office/home office (SOHO) setups have further expanded the demand base for user-friendly thermal laminating solutions. This widespread utility highlights laminating pouches not merely as a protective material but as a fundamental tool for document management and professional presentation.

Several factors are currently driving robust growth in this mature market. The increasing global literacy rates and the corresponding rise in printed materials requiring preservation are foundational drivers. Furthermore, advancements in laminator technology, making machines more compact, faster, and affordable, have lowered the barrier to entry for small businesses and households. The ongoing need for physical security and identification documents, particularly in industries undergoing stringent regulatory oversight, necessitates the use of laminated materials for enhanced tamper resistance and durability. The benefit derived—enhanced document integrity and professional aesthetics—continues to solidify the market's trajectory.

Laminating Pouches Market Executive Summary

The Laminating Pouches Market is characterized by steady, predictable growth, underpinned by robust demand across the educational and corporate sectors, particularly in emerging economies experiencing rapid infrastructure development and expansion of commercial activities. Key business trends indicate a shift towards sustainable and eco-friendly pouch materials, driven by increasing regulatory scrutiny and consumer preference for reduced environmental impact. Major manufacturers are focusing on optimization of supply chains and material sourcing to manage input cost volatility, while simultaneously diversifying product lines to include specialized features such as anti-microbial coatings and high-security holography options for niche applications like government identification. The competitive landscape remains fragmented, dominated by a few global players and numerous regional manufacturers, necessitating strategic mergers and acquisitions to consolidate market share and operational efficiencies.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive public and private investment in the education sector and the rapid proliferation of small and medium-sized enterprises (SMEs) requiring cost-effective documentation solutions. North America and Europe, while mature, maintain strong market demand, driven by stringent regulatory compliance documentation and the consistent replacement cycle of protective materials in professional environments. The Middle East and Africa (MEA) and Latin America are poised for accelerated growth, reflecting the infrastructural modernization projects and increasing demand for official, durable documentation in public services and banking sectors. Pricing strategies across regions are highly localized, reflecting differing import duties, labor costs, and distribution network complexities.

In terms of segment trends, the '3 mil' and '5 mil' thickness categories continue to dominate volume sales due to their versatility and affordability for standard office and school use. However, the '10 mil' segment is experiencing rapid value growth, catering to premium applications requiring maximum rigidity and durability, such as outdoor signage and permanent archival documents. By application, the Commercial and Corporate Office segment retains the largest market share, directly correlated with global business activity and the need for standardized internal documentation. Technology integration, though minimal, is observed in coating innovations aimed at improving UV resistance and chemical stability, positioning products for high-end industrial uses. The long-term outlook remains positive, supported by the inherent value proposition of document preservation.

AI Impact Analysis on Laminating Pouches Market

User queries regarding the impact of Artificial Intelligence on the Laminating Pouches Market primarily center on the potential for digitalization to render physical documentation obsolete, questioning the long-term relevance of lamination materials. Users often ask if AI-driven document management systems (DMS) will completely eliminate the need for physical records, or if AI can be used to optimize the manufacturing and distribution processes of the pouches themselves. A major theme is the concern over the shrinking physical footprint of offices due to increased remote work, which might reduce bulk purchasing of supplies like laminating pouches. Conversely, there is interest in how AI could potentially identify niche applications where physical protection is still critical, such as industrial schematics, historical archives, or high-security government IDs, where digital vulnerability remains a concern. The consensus among analysts is that while AI accelerates digital transformation, it also drives the need for highly secure, tamper-evident physical backups and professional presentations, mitigating total market erosion.

AI's influence is largely indirect, affecting upstream and downstream activities rather than the product itself. In manufacturing, AI and Machine Learning (ML) are being integrated to enhance production efficiency, predict machinery maintenance needs, and optimize material utilization, specifically reducing polymer waste during the pouch sealing and cutting process. Furthermore, AI-powered predictive analytics help manufacturers forecast regional demand fluctuations with greater accuracy, optimizing inventory levels and reducing warehousing costs. In the competitive distribution phase, AI algorithms are crucial for sophisticated inventory management, route optimization for global shipping, and personalized pricing strategies based on B2B customer historical purchasing patterns, enhancing supply chain responsiveness and profitability for key market participants.

- AI-driven optimization of polymer extrusion and cutting processes to reduce manufacturing waste.

- Predictive maintenance analytics applied to laminating machinery, ensuring consistent production quality and uptime.

- Enhanced supply chain forecasting using ML models to predict localized B2B demand for various pouch sizes and thicknesses.

- Increased demand for secure physical documents (laminated IDs, compliance forms) as a robust, non-hackable backup in highly digitized environments.

- AI-facilitated digital workflow integration that paradoxically increases the need for high-quality, professional physical outputs for client presentations or legal archiving.

- Targeted marketing and sales strategies developed using AI to identify high-value niche applications (e.g., archival, museum displays, industrial labeling).

DRO & Impact Forces Of Laminating Pouches Market

The Laminating Pouches Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive environment and long-term viability. The primary drivers revolve around the continuous need for durable document preservation in education and corporate settings, coupled with the increasing affordability and accessibility of thermal laminators globally. However, the market faces significant restraints, most notably the persistent trend toward digital document archiving and paperless office initiatives, alongside volatility in raw material prices, particularly petrochemical-derived polymers (PET and PVC). The primary opportunity lies in the development and mass production of eco-friendly, biodegradable laminating materials, aligning with global sustainability mandates and appealing to environmentally conscious consumers and corporations, potentially opening new premium market segments. These forces dictate strategic direction for market players, emphasizing cost management and innovation in material science.

The key impact forces exerted on the market structure are predominantly related to technological substitution and environmental regulations. The rapid adoption of digital tools and cloud storage solutions exerts a powerful downward pressure on demand for physical archival supplies, forcing market participants to innovate in niche areas where physical records remain indispensable. Simultaneously, evolving environmental policies, especially in Europe and North America, demanding higher recyclability and biodegradability in plastic products, impact manufacturing costs and material formulation. These external pressures necessitate substantial Research and Development investment in sustainable polymer alternatives and optimized production techniques to maintain competitiveness and compliance. Furthermore, the standardization requirements for official documents across various international jurisdictions act as both a driver for security-focused lamination and a barrier against non-compliant or low-quality products.

The market structure is also impacted by the intensity of competition and the power of buyers. Since laminating pouches are largely standardized commodity items, the intensity of rivalry is high, leading to continuous price competition, especially in the volume segments (3 mil and 5 mil). Large corporate and educational procurement organizations possess significant buyer power, often negotiating large contracts at thin margins. Therefore, successful market navigation relies heavily on establishing robust, efficient supply chains and differentiating through superior product performance (e.g., enhanced clarity, anti-static properties, or specialized material compositions), effectively neutralizing the pure commodity status through added value propositions and superior brand recognition.

Segmentation Analysis

The Laminating Pouches Market is systematically segmented based on material type, thickness, finish, and end-use application, allowing for precise market analysis and targeted strategic planning. Segmentation provides crucial insights into the diverse requirements of end-users, ranging from highly cost-sensitive educational institutions to quality-focused professional printing services. The material segment highlights the dominance of PET due to its superior clarity and rigidity, although alternative polymers are gaining traction based on specialized application needs. Thickness segmentation is vital, as it directly correlates with the required durability and price point, dictating usage scenarios from temporary signs (3 mil) to permanent identification cards (10 mil). Understanding these segments enables manufacturers to optimize production capabilities and align product features with specific commercial opportunities and consumer expectations across different regional markets.

- By Material Type:

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Others (Biodegradable Polymers, Specialty Films)

- By Thickness:

- 3 Mil (Standard Document Protection)

- 5 Mil (Enhanced Durability)

- 7 Mil (Semi-Rigid Protection)

- 10 Mil (Maximum Rigidity and Protection)

- By Finish:

- Glossy

- Matte

- By Size:

- Credit Card/Badge Size

- Letter/A4 Size

- Legal/A3 Size

- Menu/Specialty Sizes

- By Application/End-Use:

- Corporate Offices and Businesses

- Educational Institutions (Schools, Universities)

- Government and Public Services

- Commercial Print Shops and Services

- Home and Small Office/Home Office (SOHO)

Value Chain Analysis For Laminating Pouches Market

The value chain for the Laminating Pouches Market begins with the upstream procurement and processing of petrochemical raw materials, primarily polymer resins such as PET, PVC, and EVA (Ethylene-Vinyl Acetate) adhesive layers. This initial stage involves intense relationships with major chemical and polymer suppliers, where pricing volatility and geopolitical factors heavily influence input costs for manufacturers. Critical upstream analysis focuses on securing long-term contracts and adopting efficient resin compounding techniques to ensure consistent film quality and cost control. Laminating pouch manufacturers then process these films through extrusion, coating, cutting, and sealing processes to produce the final, standardized product. Efficiency in manufacturing scale and precision cutting are key determinants of profitability in this highly commoditized intermediate stage of the value chain.

The downstream section of the value chain focuses on distribution and consumption. Distribution channels are highly diversified, leveraging both direct and indirect routes to reach the broad end-user base. Direct channels often involve large, bespoke contracts with governmental bodies, major educational districts, or large multinational corporations, providing steady, high-volume revenue streams. Indirect channels are far more pervasive, utilizing complex networks of wholesalers, office supply distributors (like Staples or Office Depot), e-commerce platforms (Amazon, Alibaba), and specialized retail outlets. The effectiveness of the downstream strategy is heavily reliant on efficient logistics and inventory management, ensuring pouches are available in the correct sizes and thicknesses across various retail and commercial points of sale.

Distribution channel dynamics are critical, with e-commerce experiencing rapid acceleration, offering manufacturers direct access to SOHO and individual consumers, thereby bypassing traditional retail markups and offering competitive pricing. However, traditional brick-and-mortar office supply stores remain essential for B2B procurement, providing bulk purchasing options and immediate availability. The indirect model relies heavily on distributor relationships, requiring strong incentive programs and marketing support to ensure priority placement and promotion. Successful navigation of the value chain requires manufacturers to exert control over quality from raw material sourcing, optimize manufacturing output through advanced automation, and establish flexible distribution networks capable of fulfilling both large B2B orders and fragmented B2C e-commerce demand.

Laminating Pouches Market Potential Customers

The potential customer base for laminating pouches is remarkably broad, primarily segmented into three major categories: institutional, commercial, and individual/SOHO users, all seeking document protection, preservation, and enhancement. Institutional customers, encompassing educational bodies (K-12 schools, colleges, universities) and governmental agencies (DMVs, public health departments, defense sectors), represent massive volume consumers driven by mandatory compliance, security requirements for identification, and the need for durable, long-life instructional materials. These customers often procure through formalized tender processes, prioritizing material thickness, tamper resistance, and consistent quality over the lowest possible price, focusing on long-term cost of ownership and archival integrity.

Commercial customers form the largest value segment, including corporate offices, financial institutions, healthcare providers, and specialized commercial print and signage businesses. Corporate utilization is centered around preserving important notices, creating durable internal signage, producing professional marketing materials, and securing personnel badges. Specialized print shops purchase high-volume, wide-format pouches to service external clients requiring durable menus, maps, posters, and display graphics. For this segment, speed of delivery, availability of diverse sizes, and compatibility with high-speed professional laminators are critical purchasing factors, reflecting a focus on operational efficiency and client satisfaction.

Finally, the individual and Small Office/Home Office (SOHO) segment has grown substantially, driven by the democratization of affordable home laminators and the increase in remote work. These users require smaller pack sizes and standard thicknesses (3 mil or 5 mil) for personal document protection, children's artwork preservation, temporary home signage, and project organization. Purchasing decisions in this segment are highly influenced by brand recognition, competitive pricing via e-commerce channels, and ease of use. Targeting this customer group requires strong digital marketing presence and availability through major online retail platforms, focusing on convenience and accessibility rather than bulk purchasing scale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580.5 Million |

| Market Forecast in 2033 | USD 801.3 Million |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GBC (ACCO Brands), 3M Company, Fellowes Brands, Leitz (Esselte), Swingline, DSB Co., Ltd., D&K Group, Royal Consumer Products, Apollo, Cosmic, USI, Pro-Lam, Lamirel, Lami-Tech, Sky International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laminating Pouches Market Key Technology Landscape

The technology landscape for the laminating pouches market primarily focuses on material science innovation and manufacturing process optimization, rather than revolutionary digital components. A core technological area involves the development of specialized polymer formulations designed to enhance performance characteristics such as clarity, UV resistance, and anti-static properties. Modern pouch manufacturing utilizes advanced multi-layer co-extrusion technology, allowing precise control over the thickness and composition of the film layers—typically a structural polymer (PET) backed by a heat-sensitive adhesive (EVA). Recent technological advancements concentrate on optimizing the adhesive melting point for faster lamination cycles and improved adhesion quality, critical factors for professional-grade laminators and high-volume commercial users.

Another significant technological focus is directed toward sustainability. Manufacturers are actively investing in R&D to formulate and scale production of recyclable and biodegradable laminating pouches. This involves utilizing bio-based polymers or incorporating additives that accelerate degradation without compromising the protective functions of the pouch during its service life. Furthermore, proprietary manufacturing techniques are being developed to create specialized finishes, such as low-glare matte coatings or writable surfaces, expanding the functionality of the laminated material beyond mere protection. The integration of specialty films, including those with enhanced security features like embedded holographic elements, caters to the growing government and banking sectors requiring high-security identification solutions.

In terms of process technology, automated, high-speed slitting and sealing equipment defines the competitive edge in large-scale production. These automated systems ensure high dimensional accuracy and consistency, crucial for standardized document sizes like A4 or letter formats, while minimizing material waste. Quality control utilizes non-contact measurement systems to monitor film thickness and detect defects, ensuring that the critical temperature requirements for activation are consistent across batches. The technology landscape is thus defined by incremental but crucial improvements in material efficiency, environmental performance, and enhanced functional features demanded by increasingly sophisticated end-users.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market in terms of volume and exhibits the highest growth rate, driven primarily by massive investments in education infrastructure, rapid industrialization, and the proliferation of SMEs in economies like China and India. The region's high population density necessitates extensive use of physical identification and standardized documentation, ensuring persistent demand for laminating solutions. The competitive landscape in APAC is characterized by a mix of large global manufacturers and numerous low-cost local producers, intensifying price competition, particularly in the standard thickness segments.

- North America: North America represents a mature, high-value market driven by corporate demand, stringent compliance regulations requiring physical document retention, and a strong presence of the SOHO sector. Demand focuses heavily on premium products, specialty films, and higher thickness pouches (7 mil and 10 mil) for durable signage and archival records. The market is defined by established brand loyalty, advanced distribution networks through major office supply retailers, and early adoption of innovative products, including eco-friendly alternatives.

- Europe: The European market maintains stable growth, heavily influenced by strong environmental regulations which push manufacturers towards sustainable and recyclable material inputs. Demand is robust in governmental and educational sectors, particularly in Western European countries like Germany and the UK. Product specialization, such as anti-microbial pouches for healthcare settings and high-security options for identification cards, is a major regional trend. The market growth is also supported by the need for multi-lingual signage and standardized documentation across the EU.

- Latin America (LATAM): LATAM is emerging as a significant growth region, propelled by infrastructure development, rising literacy rates, and formalization of businesses leading to increased administrative documentation requirements. Key markets include Brazil and Mexico, where affordability and accessibility of basic laminating technology are primary drivers. The market faces distribution challenges but presents considerable long-term potential as institutional and commercial sectors modernize their document management practices.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated in urban centers and oil-rich economies where large-scale government and educational projects are underway. Demand is particularly strong for official ID card lamination and archival purposes in the public sector. Market expansion is sensitive to regional economic stability and the pace of regulatory standardization regarding official documentation, requiring robust, heat-resistant pouch materials due to environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laminating Pouches Market.- GBC (ACCO Brands)

- 3M Company

- Fellowes Brands

- Leitz (Esselte)

- Swingline

- DSB Co., Ltd.

- D&K Group

- Royal Consumer Products

- Apollo

- Cosmic

- USI

- Pro-Lam

- Lamirel

- Lami-Tech

- Sky International

- Suntek

- Plexon Group

- Seal-It-Systems

- Vivid Laminating Technologies

- Dry-Tac

Frequently Asked Questions

Analyze common user questions about the Laminating Pouches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for 10 mil laminating pouches?

The primary factor driving demand for 10 mil pouches is the need for maximum document rigidity, durability, and professional-grade protection, typically utilized for ID cards, permanent outdoor signage, menus, and heavy-duty archival documents where resistance to bending and moisture is paramount.

How is the shift towards paperless offices impacting the long-term Laminating Pouches Market outlook?

While digitalization poses a constraint, the market outlook remains stable because laminating pouches fulfill a distinct role: providing physical, tamper-proof, and aesthetically enhanced protection for high-value documents, security IDs, and public signage that cannot be fully substituted by digital storage.

Which region currently dominates the global Laminating Pouches Market share?

The Asia Pacific (APAC) region currently dominates the global market share in terms of volume, primarily due to large governmental and educational sector consumption, coupled with rapid commercial growth in key economies like China and India.

Are biodegradable laminating pouches commercially available, and what material are they typically made from?

Yes, biodegradable options are emerging in the market. They are often made using bio-based polymers or standard polymers treated with specific additives (e.g., bio-degradable PLA or specialized oxo-degradable additives) to comply with increasing environmental regulations and corporate sustainability mandates.

What is the difference between PET and PVC material in laminating pouches?

PET (Polyethylene Terephthalate) is typically preferred for its superior clarity, rigidity, and resistance to chemicals, making it the standard choice. PVC (Polyvinyl Chloride) is often more flexible and cost-effective, sometimes used in specialized flexible applications or as a cheaper alternative for high-volume, low-criticality uses.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager