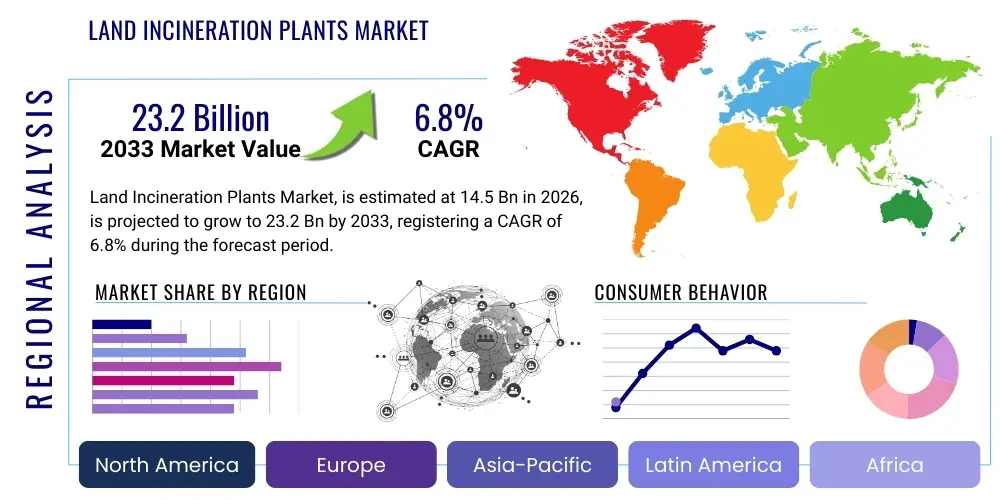

Land Incineration Plants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439861 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Land Incineration Plants Market Size

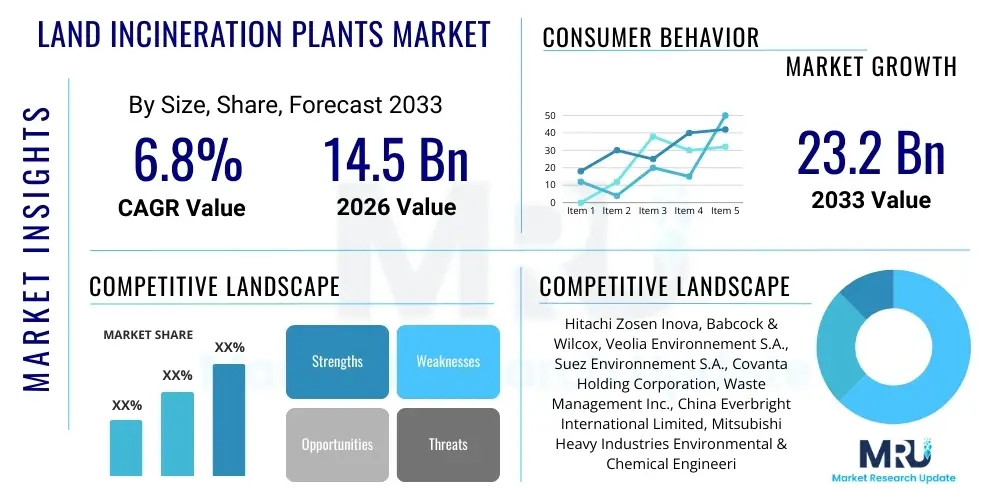

The Land Incineration Plants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 23.2 Billion by the end of the forecast period in 2033. This robust growth is primarily driven by the escalating global waste generation rates, stringent environmental regulations necessitating efficient waste management solutions, and the increasing demand for sustainable energy sources derived from waste-to-energy processes. The market's expansion is further supported by technological advancements in incineration processes, leading to improved efficiency and reduced emissions, making these facilities a viable component of modern waste management infrastructure in urban and industrial landscapes worldwide.

Land Incineration Plants Market introduction

The Land Incineration Plants Market encompasses facilities designed to thermally treat various types of waste materials, including municipal solid waste (MSW), hazardous waste, medical waste, and industrial waste, on land-based sites. These plants utilize controlled combustion processes to reduce waste volume, eliminate pathogens, destroy toxic substances, and often recover energy in the form of electricity or heat. The core objective of these plants extends beyond simple waste disposal, aiming to contribute significantly to resource recovery and environmental protection by minimizing landfill dependency and mitigating greenhouse gas emissions associated with anaerobic decomposition in landfills. The technology employed ranges from conventional grate incinerators to more advanced fluidized bed and gasification systems, each tailored to specific waste characteristics and regulatory requirements.

The primary applications of land incineration plants are diverse and critical to urban and industrial ecosystems. They serve as pivotal infrastructure for municipal waste management, offering a hygienic and efficient method for handling the ever-growing volumes of waste generated by urban populations. Furthermore, these plants are indispensable for the safe disposal of hazardous and medical waste, which requires specialized treatment to neutralize harmful substances and prevent public health risks. Beyond waste reduction, a significant benefit is the generation of energy, converting non-recyclable waste into a valuable resource, thus contributing to energy security and reducing reliance on fossil fuels. This waste-to-energy (WtE) aspect positions incineration as a crucial component of a circular economy, transforming waste into a valuable commodity.

Several driving factors propel the growth of the Land Incineration Plants Market. Rapid urbanization and industrialization across developing economies lead to increased waste generation, necessitating robust waste management solutions. Concurrently, increasing public awareness regarding environmental pollution and stricter governmental regulations on waste disposal and emissions are pushing municipalities and industries towards more advanced and compliant waste treatment methods. The rising global energy demand further incentivizes the development of waste-to-energy incineration plants, offering a renewable energy source. Additionally, the scarcity of suitable landfill sites and the associated environmental concerns make incineration an increasingly attractive and sustainable alternative, particularly in densely populated areas where land is a premium.

Land Incineration Plants Market Executive Summary

The Executive Summary provides a high-level overview of the Land Incineration Plants Market, highlighting key business trends, regional dynamics, and segmentation insights. Current business trends indicate a strong shift towards advanced waste-to-energy solutions, where incinerators are integrated with sophisticated power generation capabilities, maximizing energy recovery from diverse waste streams. There is also an increasing emphasis on modular and smaller-scale incineration units, offering greater flexibility and localized waste treatment solutions for remote areas or specific industrial needs. Furthermore, the market is experiencing significant investment in pollution control technologies, driven by ever-tightening emission standards, leading to the development of highly efficient flue gas treatment systems that minimize environmental impact and enhance public acceptance of these facilities. Companies are also exploring digitalization and automation to optimize plant operations, reduce operational costs, and improve overall efficiency and safety standards.

Regionally, the market exhibits varied growth trajectories and maturity levels. Asia Pacific is poised for substantial growth due to rapid urbanization, burgeoning populations, and increasing industrial activities that generate immense waste volumes, alongside developing regulatory frameworks pushing for modern waste management. Europe, a mature market, continues to innovate with advanced waste-to-energy technologies, stringent environmental compliance, and a strong focus on circular economy principles, driving upgrades and retrofits of existing plants. North America is experiencing a resurgence in investment in waste-to-energy projects, driven by aging infrastructure replacement needs and a growing interest in renewable energy sources, despite historical public opposition. Latin America and the Middle East & Africa regions are emerging markets, characterized by increasing awareness of waste management challenges and nascent investments in modern incineration infrastructure, often supported by international development initiatives and private sector partnerships.

Segmentation trends reveal that municipal solid waste (MSW) incineration remains the largest segment, driven by the sheer volume of waste generated by urban centers globally. However, the hazardous waste incineration segment is demonstrating robust growth, spurred by industrial expansion and stricter regulations governing the disposal of toxic and chemical waste. By technology, grate incinerators continue to dominate due to their proven reliability and versatility, but fluidized bed and gasification technologies are gaining traction for their higher efficiency, lower emissions, and ability to handle diverse waste compositions, including biomass and industrial residues. Capacity-wise, large-scale plants serving metropolitan areas constitute a significant portion, yet there's a growing demand for medium and small-scale facilities to address localized waste treatment needs and specialized industrial applications, reflecting a diversified market demand tailored to specific operational scales and waste characteristics.

AI Impact Analysis on Land Incineration Plants Market

The integration of Artificial Intelligence (AI) is poised to profoundly transform the Land Incineration Plants Market by addressing critical operational challenges, enhancing efficiency, and optimizing environmental performance. User questions frequently revolve around how AI can make incineration plants smarter, safer, and more sustainable. Key themes emerging from these inquiries include the potential for AI to improve waste classification and sorting accuracy, optimize combustion processes for maximum energy recovery and minimal emissions, enable predictive maintenance to reduce downtime, and provide real-time monitoring and control of complex plant operations. There is significant interest in AI's role in enhancing resource efficiency, reducing operational costs, and ensuring stricter compliance with evolving environmental regulations, all while navigating concerns about implementation complexity, data security, and the initial investment required for AI system integration within existing infrastructure. The expectation is that AI will move these plants from reactive to proactive operational models.

Users are particularly interested in AI's capability to transform the operational intelligence of incineration plants. For instance, questions often focus on how machine learning algorithms can analyze vast datasets from waste input, furnace conditions, and emission levels to dynamically adjust operational parameters, thereby achieving optimal combustion efficiency regardless of waste variability. This includes optimizing air flow, temperature, and residence time within the furnace, which directly impacts energy output and the formation of pollutants. Another area of inquiry concerns AI's role in identifying unusual operational patterns that might indicate impending equipment failure, allowing for proactive maintenance scheduling rather than reactive repairs. Such predictive analytics can significantly reduce unforeseen outages, extend equipment lifespan, and lower maintenance costs, contributing to a more reliable and economically viable plant operation.

Beyond operational optimization, the impact of AI on environmental compliance and resource recovery is a major point of discussion among users. Many questions address how AI can enhance the accuracy and responsiveness of emission control systems by continuously monitoring flue gas composition and adjusting treatment processes in real-time to ensure regulatory compliance. Furthermore, there's curiosity about AI's potential to improve the recovery of valuable materials from bottom ash or fly ash, or to optimize the use of recovered energy within the plant or for external distribution. By leveraging AI for enhanced data analysis, pattern recognition, and decision support, incineration plants can evolve into highly efficient, environmentally responsible, and economically robust waste-to-resource facilities, moving beyond traditional waste disposal paradigms towards smart, integrated waste management ecosystems.

- AI-driven optimization of combustion processes for enhanced energy recovery and reduced emissions.

- Predictive maintenance analytics for critical plant equipment, minimizing downtime and extending asset life.

- Real-time monitoring and advanced control systems for flue gas treatment to ensure stringent environmental compliance.

- Automated waste classification and feedstock optimization to improve incineration efficiency and energy output stability.

- Enhanced operational safety through AI-powered anomaly detection and early warning systems.

- Improved resource recovery from incinerator ash and other by-products through advanced sorting and analysis.

- Development of digital twins for simulating and optimizing plant performance under various scenarios.

DRO & Impact Forces Of Land Incineration Plants Market

The Land Incineration Plants Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces dictating its trajectory. Key drivers fueling market expansion include the exponential increase in global waste generation, particularly municipal solid waste, driven by population growth, rapid urbanization, and rising consumption patterns across developing and developed nations. Concurrently, increasingly stringent governmental regulations and international agreements concerning waste management, landfill restrictions, and environmental protection are compelling authorities and industries to adopt more advanced and environmentally compliant waste treatment methods like incineration. The growing demand for sustainable and renewable energy sources also serves as a significant driver, positioning waste-to-energy incineration as a viable alternative to fossil fuels, thus contributing to energy security and climate change mitigation efforts, making these plants a strategic asset for cities and industrial clusters seeking integrated waste and energy solutions.

Despite these powerful drivers, several significant restraints impede the market's full potential. The high capital expenditure required for the construction and commissioning of modern incineration plants, including advanced emission control systems, poses a substantial barrier, especially for developing economies with limited financial resources. Public perception, often fueled by "Not In My Backyard" (NIMBY) sentiment and historical concerns about air pollution, remains a persistent challenge, leading to community opposition and delays in project development. While modern plants are significantly cleaner, legacy perceptions can be difficult to overcome. Furthermore, competition from alternative waste management strategies, such as enhanced recycling, composting, and anaerobic digestion, particularly in regions with strong circular economy policies, can divert waste streams away from incineration, limiting feedstock availability and profitability for some plants. The operational complexities and specialized technical expertise required to manage these sophisticated facilities also contribute to operational cost and skilled labor challenges.

However, the market is rife with opportunities that can overcome these restraints and unlock further growth. Emerging economies in Asia Pacific, Latin America, and Africa present vast untapped potential for new plant construction, as these regions grapple with escalating waste management crises and developing environmental infrastructures. Technological advancements, including innovations in gasification, plasma arc technology, and carbon capture solutions for incinerators, promise to enhance efficiency, reduce emissions to near-zero levels, and broaden the types of waste that can be effectively treated, making incineration even more appealing. The integration of incineration plants into broader circular economy frameworks, focusing on maximizing resource recovery from ash and capturing CO2, offers new revenue streams and enhances their environmental credentials. Additionally, co-processing opportunities, where waste is used as an alternative fuel in industries like cement kilns, provide synergistic benefits, further diversifying the application and viability of thermal waste treatment solutions, thus expanding the market's addressable scope and promoting sustainable industrial practices.

Segmentation Analysis

The Land Incineration Plants Market is broadly segmented based on several key characteristics, including the type of waste processed, the underlying technology utilized, the capacity of the plant, and its primary application. This segmentation provides a granular understanding of market dynamics, allowing stakeholders to identify specific growth areas and tailor strategies to distinct market needs. The waste type segment distinguishes between facilities handling municipal solid waste (MSW), hazardous waste, medical waste, and industrial waste, reflecting the diverse requirements for treating different waste compositions and regulatory standards. Technological segmentation covers various combustion methods, from conventional grate systems to more advanced fluidized bed, rotary kiln, and innovative gasification technologies, each offering unique advantages in terms of efficiency, emissions, and waste flexibility. Capacity segmentation categorizes plants by their processing volume, ranging from small-scale modular units to large-scale urban facilities, while application segmentation considers whether plants are primarily for waste-to-energy generation, volume reduction, or destruction of specific waste types.

- By Waste Type:

- Municipal Solid Waste (MSW) Incineration Plants

- Hazardous Waste Incineration Plants

- Medical Waste Incineration Plants

- Industrial Waste Incineration Plants

- Sludge Incineration Plants

- By Technology:

- Grate Incineration Systems

- Fluidized Bed Incineration Systems

- Rotary Kiln Incineration Systems

- Gasification and Pyrolysis Plants

- Plasma Arc Gasification Plants

- By Capacity:

- Small-Scale (Under 100 tons/day)

- Medium-Scale (100-500 tons/day)

- Large-Scale (Over 500 tons/day)

- By Application:

- Waste-to-Energy (WtE) Generation

- Waste Volume Reduction

- Hazardous Waste Destruction

- Medical Waste Sterilization and Disposal

- Industrial Process Waste Treatment

- By End-User:

- Municipalities and Local Governments

- Industrial Manufacturers

- Hospitals and Healthcare Facilities

- Waste Management Companies

- Chemical and Pharmaceutical Industries

Value Chain Analysis For Land Incineration Plants Market

The value chain for the Land Incineration Plants Market is a complex ecosystem involving multiple stages, from equipment manufacturing and facility construction to waste collection, energy generation, and ash management. The upstream analysis primarily focuses on the suppliers of critical components and services. This includes manufacturers of high-temperature alloys and refractory materials essential for furnace construction, suppliers of specialized boilers and turbines for energy recovery, and providers of advanced pollution control equipment suchators as fabric filters, scrubbers, and selective catalytic reduction (SCR) systems. Engineering, Procurement, and Construction (EPC) firms play a pivotal role here, responsible for designing, building, and commissioning the entire plant, often requiring collaboration with technology licensors and research institutions for cutting-edge solutions. The quality and efficiency of these upstream inputs directly impact the plant's operational performance, longevity, and environmental compliance, making strong supplier relationships crucial.

Downstream analysis in the value chain involves the subsequent processes and services once the incineration plant is operational. This phase includes the robust system for waste collection and transportation, ensuring a consistent and adequate supply of feedstock to the plant. After waste processing, the recovered energy, typically electricity or steam, is fed into regional power grids or supplied directly to industrial consumers, representing a significant revenue stream. The management of incineration by-products, such as bottom ash and fly ash, is another critical downstream activity. Bottom ash, which is largely inert, can often be valorized and utilized in construction materials, thereby contributing to circular economy principles. Fly ash, containing concentrated heavy metals and pollutants, requires careful handling and specialized disposal, often in dedicated landfills or through further treatment for stabilization, highlighting the importance of responsible end-of-life material management.

The distribution channels for land incineration plants primarily involve direct engagement between plant developers, municipalities, industrial clients, and the EPC contractors. Due to the high capital investment, long project cycles, and highly specialized nature of these projects, direct sales and negotiation are the predominant models. EPC contractors often act as key intermediaries, bundling various technologies and services into a comprehensive solution for the end-user. Indirect channels can emerge through partnerships with waste management companies that operate these facilities on behalf of municipalities, or through public-private partnerships (PPPs) that involve complex financing and operational agreements. Effective project management, technical expertise, and a strong understanding of local regulatory environments are paramount for success across all these distribution models, underscoring the collaborative and bespoke nature of transactions in this sophisticated market. The interplay of these direct and indirect distribution channels shapes market access and project implementation strategies for technology providers and plant operators alike.

Land Incineration Plants Market Potential Customers

The Land Incineration Plants Market serves a diverse range of potential customers, primarily entities grappling with substantial waste management challenges and seeking efficient, environmentally sound, and often energy-recovering solutions for their waste streams. Municipalities and local governments represent the largest segment of end-users. They are responsible for managing the vast quantities of municipal solid waste (MSW) generated by their urban populations. For these entities, incineration plants offer a reliable method for reducing landfill reliance, mitigating public health risks associated with untreated waste, and potentially generating revenue from waste-to-energy initiatives, especially in densely populated areas where land for landfills is scarce and environmental pressures are high. Their purchasing decisions are often influenced by population growth forecasts, existing waste infrastructure limitations, and long-term sustainability goals, alongside stringent regulatory compliance requirements.

Industrial sectors form another significant customer base, particularly those generating large volumes of specialized or hazardous waste. This includes chemical and petrochemical manufacturers, pharmaceutical companies, pulp and paper mills, and various manufacturing facilities that produce industrial process waste, solvents, or sludges. For these industries, land incineration plants provide a secure and compliant method for the destruction of wastes that cannot be recycled or safely landfilled, ensuring environmental protection and avoiding liabilities. The ability to treat complex waste streams on-site or through dedicated industrial incineration services is highly valuable, often driven by strict corporate environmental policies, cost-efficiency in waste disposal, and the need to comply with specific industry-related waste treatment regulations, ensuring business continuity and environmental stewardship.

Beyond municipalities and heavy industry, other key potential customers include healthcare institutions, independent waste management companies, and even agricultural sectors for specific biomass applications. Hospitals and other healthcare facilities require specialized medical waste incineration plants for the safe disposal of infectious and pathological waste, preventing disease transmission and protecting public health. Independent waste management companies often invest in and operate incineration plants as part of their integrated waste management services, offering solutions to multiple clients and leveraging economies of scale. In certain contexts, agricultural waste processing through incineration can also be a niche application, especially where waste-to-energy solutions are sought for biomass residues. These diverse customer segments underscore the broad applicability and critical necessity of land incineration plants across various societal and economic functions, driven by a fundamental need for effective and sustainable waste disposal infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 23.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Zosen Inova, Babcock & Wilcox, Veolia Environnement S.A., Suez Environnement S.A., Covanta Holding Corporation, Waste Management Inc., China Everbright International Limited, Mitsubishi Heavy Industries Environmental & Chemical Engineering Co., Ltd., Martin GmbH, John Cockerill Environment, Doosan Heavy Industries & Construction Co., Ltd., JFE Engineering Corporation, Xcel Energy Inc., Indaver N.V., KEZO AG, SEMP S.p.A., Foster Wheeler (Amec Foster Wheeler), GR Value, Von Roll Inova, Urbaser, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Land Incineration Plants Market Key Technology Landscape

The technology landscape for Land Incineration Plants is continuously evolving, driven by the need for higher efficiency, stricter emission control, and greater flexibility in handling diverse waste streams. At the core of the market, conventional mass-burn grate incinerators remain widely adopted, particularly for municipal solid waste, due to their robust design and proven track record in handling heterogeneous waste. However, advancements in grate design, such as moving grates and vibrating grates, have significantly improved combustion efficiency and reduced unburnt residues. Complementing these are fluidized bed incinerators, which offer superior performance for specific waste types like sludge, industrial waste, and refuse-derived fuel (RDF) due to their excellent mixing capabilities and stable combustion at lower temperatures, leading to reduced NOx formation. Rotary kilns are typically employed for hazardous and industrial waste, known for their ability to handle solids, liquids, and sludges simultaneously, providing high temperatures necessary for the destruction of persistent organic pollutants.

Beyond traditional combustion, more advanced thermal treatment technologies are gaining traction. Gasification and pyrolysis processes, for instance, convert waste into syngas or bio-oil in an oxygen-starved environment, which can then be used as fuel for energy generation. These technologies offer advantages in terms of lower emissions and higher energy recovery efficiency, especially when integrated with combined heat and power (CHP) systems. Plasma arc gasification represents a cutting-edge approach, utilizing extremely high temperatures generated by plasma torches to break down waste into elemental components, producing a clean syngas and vitrified slag. This technology offers potential for near-zero emissions and complete waste destruction, albeit at higher capital costs. The increasing focus on resource recovery is also leading to innovations in ash treatment technologies, aiming to extract valuable materials and safely dispose of residues, enhancing the overall sustainability of incineration operations.

Crucially, the effectiveness of any incineration technology is heavily reliant on advanced emission control systems, which constitute a significant portion of plant investment and technological innovation. Modern incineration plants incorporate multi-stage flue gas treatment systems to meet stringent air quality standards. These systems typically include selective non-catalytic reduction (SNCR) or selective catalytic reduction (SCR) for NOx removal, fabric filters or electrostatic precipitators for particulate matter control, acid gas scrubbers (wet, dry, or semi-dry) for SOx, HCl, and HF removal, and activated carbon injection for heavy metals and dioxins/furans adsorption. Continuous Emission Monitoring Systems (CEMS) are integral to ensuring ongoing compliance and optimizing control parameters. Further research and development are concentrated on carbon capture and utilization (CCU) technologies for incinerators, aiming to further reduce the carbon footprint and position these plants as key components in a future net-zero economy, reflecting a holistic approach to environmental responsibility and resource management.

Regional Highlights

- North America: This region is characterized by a mature waste management infrastructure with an increasing focus on upgrading existing waste-to-energy facilities and exploring advanced thermal technologies. Stringent environmental regulations and a renewed emphasis on renewable energy portfolios are driving investments, particularly in the replacement of aging infrastructure and the adoption of more efficient emission control systems. Public acceptance, while historically challenging, is improving with transparent communication about technological advancements and environmental performance.

- Europe: As a global leader in waste management, Europe boasts a highly developed Land Incineration Plants Market with a strong emphasis on waste-to-energy and circular economy principles. High environmental standards, ambitious recycling targets, and a scarcity of landfill space continue to drive innovation in thermal treatment, including advanced flue gas cleaning and carbon capture technologies. The market is also seeing a trend towards smaller, decentralized plants and the co-processing of waste in industrial facilities.

- Asia Pacific (APAC): This region represents the largest and fastest-growing market for land incineration plants. Rapid urbanization, massive population growth, and burgeoning industrial activity in countries like China, India, and Southeast Asian nations are generating unprecedented volumes of waste. This, combined with developing regulatory frameworks and increasing awareness of environmental issues, is spurring significant investments in new plant construction and capacity expansion to address critical waste management challenges.

- Latin America: The market in Latin America is emerging, with substantial potential for growth driven by increasing waste generation, inadequate existing waste management infrastructure, and a growing recognition of the need for sustainable solutions. Governments are increasingly seeking private sector investment and technological expertise to develop modern incineration facilities, particularly in urban centers where landfill capacity is becoming constrained and environmental concerns are rising.

- Middle East and Africa (MEA): This region is also an emerging market, experiencing rapid economic development and urbanization, leading to escalating waste volumes. While nascent, the demand for sophisticated waste management solutions, including land incineration plants, is on the rise. Countries are exploring waste-to-energy projects to diversify energy sources and manage growing waste challenges, often supported by government initiatives and international partnerships focusing on sustainable infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Land Incineration Plants Market.- Hitachi Zosen Inova

- Babcock & Wilcox

- Veolia Environnement S.A.

- Suez Environnement S.A.

- Covanta Holding Corporation

- Waste Management Inc.

- China Everbright International Limited

- Mitsubishi Heavy Industries Environmental & Chemical Engineering Co., Ltd.

- Martin GmbH

- John Cockerill Environment

- Doosan Heavy Industries & Construction Co., Ltd.

- JFE Engineering Corporation

- Xcel Energy Inc.

- Indaver N.V.

- KEZO AG

- SEMP S.p.A.

- Foster Wheeler (Amec Foster Wheeler)

- GR Value

- Von Roll Inova

- Urbaser, Inc.

Frequently Asked Questions

Analyze common user questions about the Land Incineration Plants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a land incineration plant and its primary purpose?

A land incineration plant is a facility that thermally treats waste materials on land-based sites through controlled combustion. Its primary purpose is to significantly reduce waste volume, neutralize hazardous components, and often recover energy (electricity or heat), thus minimizing reliance on landfills and contributing to sustainable waste management and energy generation.

Are modern incineration plants environmentally friendly?

Modern incineration plants are equipped with advanced multi-stage flue gas treatment systems that effectively control emissions of pollutants like particulates, acid gases, and heavy metals, meeting stringent environmental regulations. While they do emit CO2, their environmental impact is significantly reduced compared to older facilities, and they can be a cleaner alternative to landfills in terms of methane emissions and leachate control.

What types of waste can be processed in these plants?

Land incineration plants are versatile and can process a wide range of waste types including municipal solid waste (MSW), hazardous industrial waste, medical waste, and various sludges. Specific technologies are often tailored to the characteristics and regulatory requirements for each waste stream, ensuring efficient and safe destruction.

What are the main benefits of investing in incineration plants?

Key benefits include significant waste volume reduction (up to 90%), generation of renewable energy (waste-to-energy), destruction of hazardous substances, reduction of landfill dependency, and mitigation of greenhouse gas emissions associated with landfilling. They provide a hygienic and sustainable solution for managing growing waste challenges.

What role does technology play in improving incineration plant efficiency?

Technology plays a crucial role through advancements in combustion control, improved energy recovery systems, and highly efficient emission abatement. Innovations like fluidized bed systems, gasification, plasma technology, and AI-driven optimization enhance thermal efficiency, reduce pollutants, increase energy output, and minimize operational costs, making plants more effective and sustainable.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager