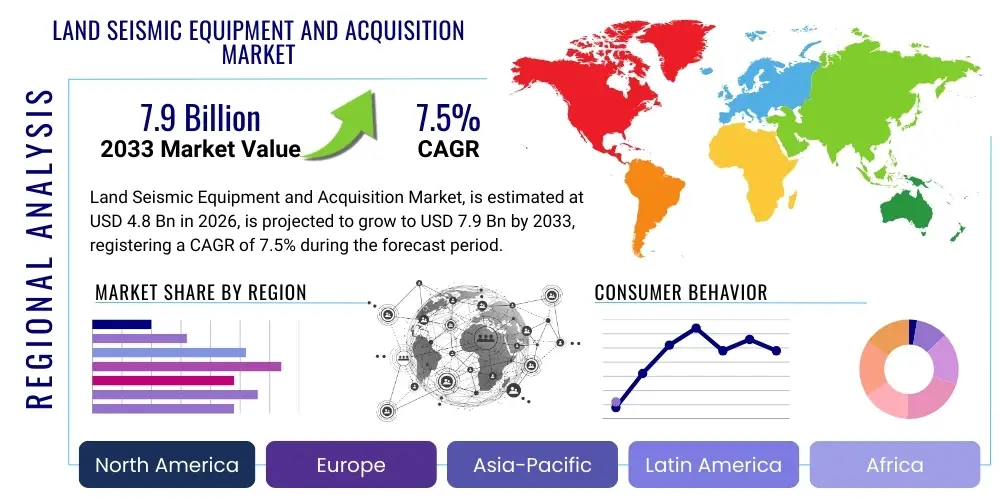

Land Seismic Equipment and Acquisition Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438662 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Land Seismic Equipment and Acquisition Market Size

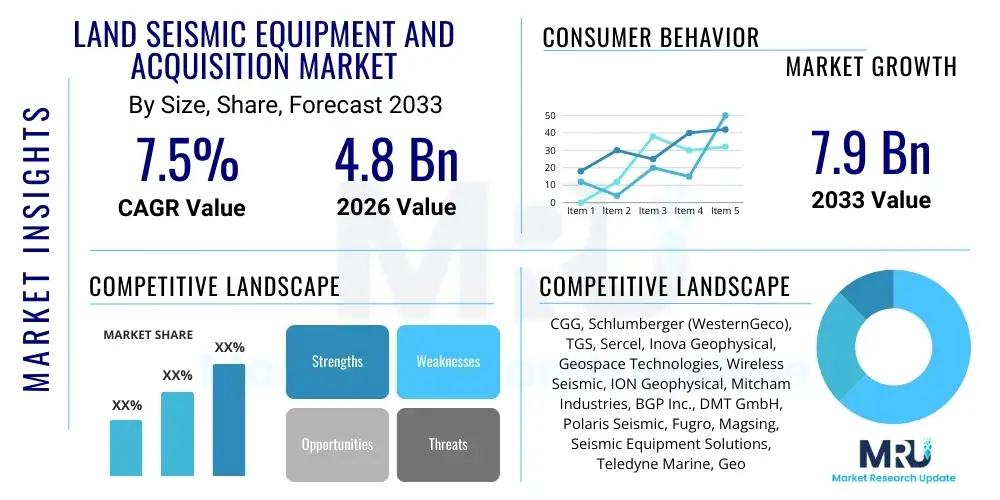

The Land Seismic Equipment and Acquisition Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Land Seismic Equipment and Acquisition Market introduction

The Land Seismic Equipment and Acquisition Market encompasses specialized hardware, software, and services utilized to generate, record, and process acoustic data from subsurface geological formations on land. This technology is foundational for understanding the Earth’s structure, primarily driven by the need to locate hydrocarbon reserves, though its applications extend significantly into mining, geotechnical engineering, and environmental studies. The core product offering includes seismic sources (like Vibroseis trucks or explosive charges), receiver systems (geophones, accelerometers, and increasingly sophisticated nodal systems), and advanced data recorders and telemetry equipment necessary to manage the vast quantities of acquired data.

Major applications of land seismic technology center around the exploration and delineation of both conventional and unconventional oil and gas reserves, particularly in challenging terrains such as deserts, mountainous regions, and transitional zones. The benefits derived from deploying cutting-edge land seismic technology include significantly enhanced imaging resolution, which minimizes drilling risk and optimizes reservoir development strategies. Furthermore, the use of highly automated and miniaturized equipment, especially wireless nodal systems, drastically reduces operational footprint and acquisition time, improving both cost-efficiency and safety standards across field operations.

The market growth is primarily driven by sustained global energy demand, despite fluctuating oil prices, prompting exploration and production (E&P) companies to invest in high-definition seismic surveys to maximize recovery factors from existing fields and unlock complex reserves. Key driving factors also include technological advancements such as the shift towards denser channel counts, higher resolution 3D and 4D surveys, and the integration of Artificial Intelligence (AI) and Machine Learning (ML) for rapid data processing and quality control in the field. Regulatory mandates encouraging safer and environmentally less intrusive exploration methods further propel the adoption of wireless and low-impact seismic acquisition technologies.

Land Seismic Equipment and Acquisition Market Executive Summary

The Land Seismic Equipment and Acquisition Market is experiencing robust technological transformation, characterized by a fundamental shift from traditional cabled systems to high-channel-count, dense wireless nodal technology. Business trends indicate a strong focus on system efficiency, miniaturization of hardware, and the development of proprietary software suites that integrate data acquisition planning, quality control, and preliminary processing in real-time. E&P operators are increasingly favoring large-scale, high-definition 3D surveys, demanding equipment that can handle extremely high data rates and operate reliably in harsh, remote environments. Consolidation among key service providers and equipment manufacturers is stabilizing pricing structures while simultaneously driving innovation towards cost-effective, multi-client seismic libraries.

Regional trends highlight the Middle East and Africa (MEA) as a primary growth engine, fueled by national oil companies (NOCs) investing heavily in onshore reserve replenishment and mega-projects aimed at maintaining global crude output capacity. North America continues to be a crucial market, particularly due to the demand for ultra-high-density surveys required for optimal placement and hydraulic fracturing in unconventional (shale) reservoirs, where detailed subsurface mapping is paramount. Asia Pacific (APAC), led by countries like China, India, and Australia, shows accelerated adoption driven by domestic energy security concerns and exploration efforts in complex interior basins, demanding rugged, versatile equipment suitable for varying geological conditions.

Segment trends underscore the dominance of the Component segment, particularly in seismic sensors and data acquisition units, reflecting the hardware intensity of the industry. Within Technology, the Wireless/Nodal Systems segment is exhibiting the fastest growth rate, rapidly displacing conventional wired systems due to superior scalability, ease of deployment, and reduced personnel requirements. The Application segment remains heavily skewed towards Oil & Gas Exploration, but the growth in Infrastructure and Geotechnical Engineering segments, particularly in densely populated regions, is diversifying revenue streams for equipment providers.

AI Impact Analysis on Land Seismic Equipment and Acquisition Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Land Seismic Equipment and Acquisition Market consistently revolve around four main themes: speed of data processing, accuracy of subsurface interpretation, automation potential during acquisition, and the resulting reduction in operational costs. Users are keenly interested in how machine learning algorithms can manage and make sense of the massive datasets generated by dense nodal surveys, moving beyond traditional workflows which often involve significant lag between acquisition completion and finalized interpretation. Key expectations center on AI's ability to denoise seismic data more effectively, identify subtle geological features previously missed by human analysts, and automate field logistics, thereby optimizing survey design and execution in real-time. Concerns often relate to data security, the need for robust cloud infrastructure, and the requirement for highly specialized data scientists proficient in both geological and computational disciplines.

- AI-driven automated quality control (QC) during seismic acquisition, reducing the need for manual data review in the field.

- Enhanced seismic data processing speeds through Machine Learning (ML) algorithms for noise attenuation and complex velocity model building.

- Accelerated interpretation timeframes by utilizing Deep Learning (DL) for automated fault, horizon, and attribute detection.

- Optimization of survey design and equipment deployment logistics using predictive analytics to minimize crew size and operational downtime.

- Improved reservoir characterization accuracy leading to reduced exploration risk and higher drilling success rates.

- Transition toward ‘smart’ seismic sensors capable of embedded pre-processing and self-diagnostics powered by edge AI.

DRO & Impact Forces Of Land Seismic Equipment and Acquisition Market

The dynamics of the Land Seismic Equipment and Acquisition Market are dictated by a delicate balance of technical necessity, global energy strategy, and financial volatility. The primary drivers include the constant global need for replacement reserves, particularly in mature basins where high-resolution seismic is essential for optimizing secondary and tertiary recovery efforts. Furthermore, the ongoing technological revolution, marked by the widespread adoption of broadband seismic acquisition and ultra-high-density nodal arrays, continually creates demand for newer, more capable equipment, necessitating capital expenditure by acquisition contractors. Investment cycles are heavily influenced by the sustained high demand for natural gas and the push towards non-conventional resources, which require intensive 3D and 4D monitoring to track fluid movement.

Restraints largely stem from the inherent cyclicality of the oil and gas industry, where fluctuations in crude oil prices directly impact E&P capital budgets, often leading to immediate cuts in discretionary spending such as seismic acquisition programs. Environmental regulations and increased public scrutiny regarding the environmental footprint of seismic surveys, especially concerning noise pollution or land access rights, pose significant operational and political hurdles, particularly in densely populated or ecologically sensitive areas. High capital costs associated with procuring state-of-the-art nodal systems and specialized Vibroseis fleets, coupled with the need for highly skilled technical personnel, also act as major barriers to market entry for smaller players and constrain rapid fleet modernization for established contractors.

Opportunities for market expansion are abundant, particularly in the realm of 4D seismic monitoring for Carbon Capture, Utilization, and Storage (CCUS) projects, where precise, repeatable subsurface imaging is critical for verifying storage integrity over decades. The growing application of seismic technology in non-E&P sectors, such as geothermal energy exploration, detailed engineering site characterization, and infrastructure monitoring (e.g., monitoring pipelines or critical geological hazards), provides diversification avenues. Moreover, the accelerating maturity of wireless technology offers opportunities for service providers to transition towards subscription-based equipment leasing models rather than outright sales, optimizing the utilization rate of expensive hardware and appealing to budget-conscious clients.

Segmentation Analysis

The Land Seismic Equipment and Acquisition Market is segmented based on the type of components utilized, the underlying technology deployed for data transmission, the methodology of survey deployment, and the end-use application driving the survey. This segmentation provides a granular view of demand drivers, revealing that investment patterns are highly dependent on the required resolution and the geological complexity of the survey area. Technological maturity and regional operational efficiency significantly influence which segments experience the highest growth, with wireless systems and processing software currently leading innovation.

The market structure is highly fragmented yet dominated by a few major integrated players that offer both hardware and acquisition services. The component breakdown highlights the intense competition in the manufacturing of sensors and data recorders, where miniaturization and power efficiency are key competitive differentiators. Analysis by deployment reveals a continuous trend towards comprehensive 3D and 4D surveys, essential for complex reservoir management, moving away from cheaper, less detailed 2D mapping which is now primarily used for initial reconnaissance surveys or academic purposes. Understanding these segments is critical for manufacturers tailoring product roadmaps to meet the increasingly stringent technical specifications of modern E&P companies.

- By Component: Seismic Sources, Seismic Sensors (Geophones, Accelerometers), Data Acquisition Systems (DAS), Software.

- By Technology: Wired Systems, Wireless/Nodal Systems, Hybrid Systems.

- By Deployment: 2D Seismic, 3D Seismic, 4D Seismic (Time-Lapse).

- By Application: Oil & Gas Exploration & Production, Mining, Infrastructure & Engineering, Environmental Monitoring & Geothermal.

Value Chain Analysis For Land Seismic Equipment and Acquisition Market

The value chain for the Land Seismic Equipment and Acquisition Market begins upstream with raw material suppliers and specialized component manufacturers producing geophones, microelectromechanical systems (MEMS) sensors, advanced semiconductors, and ruggedized electronic enclosures. This upstream segment is characterized by high technical barriers and strict quality control requirements. The midstream phase involves specialized equipment manufacturers (OEMs) who assemble these components into complete data acquisition systems, nodal units, and Vibroseis sources. These OEMs invest heavily in Research & Development to comply with strict performance metrics regarding channel density, weight, power consumption, and environmental ruggedness, providing the sophisticated technology necessary for high-channel-count surveys.

The subsequent crucial stage is the seismic acquisition phase, managed by specialized contractors or major integrated service companies. These companies own and operate the expensive equipment fleets, managing large field crews, survey design, permitting, deployment, and initial quality control (QC) data capture. This downstream service segment is highly competitive and capital-intensive, forming the primary interface with the end-users—national and international oil companies (NOCs and IOCs). Distribution channels for equipment sales are predominantly direct, involving close, long-term relationships between OEMs and seismic contractors, often including complex leasing or financing agreements due to the high unit cost of the technology.

The final phase involves seismic data processing and interpretation, which relies heavily on specialized software and high-performance computing (HPC) centers. While some integrated service companies handle this internally, many E&P firms outsource advanced processing tasks to dedicated processing centers utilizing advanced proprietary algorithms, including those incorporating AI/ML, to generate the final subsurface images. The direct channel remains essential throughout the chain, linking equipment providers directly to service companies, and service companies directly to the E&P operators, ensuring tight communication regarding technical specifications and field requirements. Indirect channels, such as third-party consultants or niche software firms, play supporting roles, particularly in regional market penetration or specialized academic applications.

Land Seismic Equipment and Acquisition Market Potential Customers

The primary consumers and end-users of land seismic equipment and acquisition services are International Oil Companies (IOCs) such as ExxonMobil, Shell, and BP, and National Oil Companies (NOCs) like Saudi Aramco, Petrobras, and CNPC. These entities utilize seismic data as a critical, non-negotiable step in the exploration and development cycle, requiring high-resolution surveys to identify commercially viable hydrocarbon traps, characterize reservoir fluid dynamics, and plan precise drilling trajectories. NOCs, especially those in the Middle East and Asia, are increasingly driving demand as they expand domestic and international exploration efforts to secure long-term energy supplies.

A second major customer category includes independent exploration and production companies (Independents), particularly those focused on specialized activities like shale gas or tight oil development in North America. These independents rely heavily on dense 3D surveys to optimize infill drilling and hydraulic fracturing programs, viewing seismic data as a crucial tool for operational efficiency and maximized recovery in unconventional plays. For these buyers, cost-effectiveness, coupled with rapid turnaround of processed data, is often a more critical purchasing factor than for the larger IOCs/NOCs.

Beyond the traditional oil and gas sector, potential customers are emerging rapidly within the sustainable energy and civil engineering domains. Geothermal energy developers require land seismic for mapping subsurface heat reservoirs and characterizing fracture networks. Mining companies use seismic imaging to delineate ore bodies and assess overburden stability. Furthermore, governmental agencies, environmental consultancies, and infrastructure developers represent a growing niche market, utilizing seismic for geotechnical surveys related to large-scale construction, natural hazard mapping (e.g., fault lines), and monitoring underground waste disposal or CCUS sites. The shift towards non-fossil fuel applications is gradually broadening the customer base, requiring more specialized, smaller-scale, and lower-impact equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CGG, Schlumberger (WesternGeco), TGS, Sercel, Inova Geophysical, Geospace Technologies, Wireless Seismic, ION Geophysical, Mitcham Industries, BGP Inc., DMT GmbH, Polaris Seismic, Fugro, Magsing, Seismic Equipment Solutions, Teledyne Marine, Geometrics, Fairfield Geotechnologies, Sinopec, China National Logging Corporation (CNLC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Land Seismic Equipment and Acquisition Market Key Technology Landscape

The Land Seismic Equipment and Acquisition Market is currently defined by a significant technological evolution centered on wireless nodal systems, high-channel-count acquisition, and the implementation of broadband seismic methodologies. Nodal systems, which are independent, battery-operated, and GPS-synchronized recording units, represent the state-of-the-art, offering vastly improved efficiency and reliability compared to traditional cabled systems. This transition minimizes logistical complexity, reduces the physical footprint of the survey, and allows for much denser sensor placement (ultra-high channel counts), which is essential for generating the highly detailed seismic images required for modern unconventional reservoir analysis. Furthermore, broadband technology, which captures a wider spectrum of low and high frequencies, improves penetration depth and resolution simultaneously, leading to better definition of deep targets and enhanced reservoir properties.

Advancements in seismic sources also form a crucial part of the technological landscape. The industry is seeing the proliferation of Digital Vibratory Source (DVS) technology, which offers enhanced control over the source signature, improving the signal-to-noise ratio and enabling more complex, simultaneous shooting techniques. Concurrent with hardware innovation is the rapid development in acquisition software and firmware. Modern acquisition systems incorporate real-time quality control (QC) and diagnostics capabilities, often leveraging cloud connectivity and edge computing to monitor sensor health, battery life, and data transmission integrity across thousands of deployed units. This operational visibility drastically reduces downtime and the necessity for manual field checks, accelerating the survey timeline.

Looking forward, the integration of distributed acoustic sensing (DAS) technology, adapted from fiber optic monitoring, is poised to impact specialized land surveys, offering a method to turn existing infrastructure (like pipelines or communication cables) into seismic receivers. However, the most transformative trend remains the increasing sophistication of data processing algorithms. Techniques such as Full Waveform Inversion (FWI) are becoming standard practice, demanding higher fidelity raw data captured by modern nodal systems. Furthermore, the commercialization of machine learning techniques for automated velocity model building and noise removal (particularly near-surface scattering noise) is accelerating the data-to-decision cycle, positioning computational efficiency alongside hardware capability as a primary competitive advantage.

Regional Highlights

The global demand for Land Seismic Equipment and Acquisition services exhibits strong geographical segmentation driven by specific exploration requirements, geopolitical stability, and governmental energy policies. North America, particularly the United States and Canada, remains a technological hub and a major demand center, characterized by high-density surveys focused on complex unconventional reservoirs (shale oil/gas). The demand here is driven by independent operators requiring continuous 3D and 4D monitoring to optimize complex hydraulic fracturing operations and maximize recovery in mature fields. The rapid adoption of high-channel-count nodal systems is highest in this region, setting global standards for acquisition efficiency and data quality.

The Middle East and Africa (MEA) region constitutes the largest growth market in terms of sheer capital expenditure and project scale. NOCs across the Gulf Cooperation Council (GCC) countries are executing multi-year, large-scale onshore exploration programs to ensure reserve replacement. These mega-surveys, often spanning vast desert terrains, demand robust, durable equipment with extended battery life and high tolerance for extreme temperatures. Key countries like Saudi Arabia, the UAE, and Kuwait are major purchasers of Vibroseis fleets and high-capacity nodal systems. Similarly, large-scale onshore projects in North and West Africa, though subject to higher political risk, contribute significantly to regional growth when they proceed.

Asia Pacific (APAC) represents a diverse market where seismic demand is rising due to domestic energy security priorities in large economies like China and India, alongside frontier exploration in regions like Australia and Southeast Asia. The market is characterized by complex terrain, necessitating versatile equipment suitable for mountainous, jungle, and transitional zones. While China and India emphasize onshore gas exploration and coalbed methane, Australia drives demand through both conventional gas exploration and increasing interest in geotechnical and mining applications. Europe, conversely, is a mature market focused primarily on specialized geotechnical engineering, environmental monitoring, and the emerging field of CCUS site characterization, resulting in demand for smaller, ultra-precise seismic systems.

- North America: Leading adopter of ultra-high-density nodal systems, driven by unconventional resource development (shale) and 4D monitoring in key basins.

- Middle East & Africa (MEA): Major growth market fueled by large-scale, long-term onshore exploration programs conducted by NOCs, demanding robust, desert-ready equipment.

- Asia Pacific (APAC): Strong growth led by domestic energy security needs in China and India, focusing on versatile equipment for complex inland basins and significant governmental investment in infrastructure seismic.

- Europe: Focus on niche, high-value applications including geothermal exploration, CCUS monitoring, and geotechnical engineering; lower reliance on traditional oil and gas seismic.

- Latin America: Characterized by sporadic, project-driven demand linked to national policies in countries like Brazil, Argentina, and Colombia, often requiring customized solutions for jungle or mountainous terrain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Land Seismic Equipment and Acquisition Market.- CGG

- Schlumberger (WesternGeco)

- TGS

- Sercel

- Inova Geophysical

- Geospace Technologies

- Wireless Seismic

- ION Geophysical

- Mitcham Industries

- BGP Inc.

- DMT GmbH

- Polaris Seismic

- Fugro

- Magsing

- Seismic Equipment Solutions

- Teledyne Marine

- Geometrics

- Fairfield Geotechnologies

- Sinopec

- China National Logging Corporation (CNLC)

Frequently Asked Questions

Analyze common user questions about the Land Seismic Equipment and Acquisition market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from cabled systems to wireless nodal technology in land seismic acquisition?

The primary driver is efficiency and resolution. Nodal systems reduce cable management complexity, lower crew requirements, minimize environmental impact, and allow for significantly higher channel counts and denser sensor layouts, which is critical for high-resolution subsurface imaging necessary for complex reservoirs.

How do oil price fluctuations specifically impact the Land Seismic Equipment and Acquisition market?

Oil price volatility directly affects E&P capital expenditure. When prices drop, seismic acquisition projects, being high-cost discretionary spending, are often immediately postponed or canceled, leading to reduced demand for both equipment sales and contract services.

Which non-oil and gas applications are creating new revenue opportunities for seismic equipment manufacturers?

Significant opportunities exist in Carbon Capture, Utilization, and Storage (CCUS) monitoring, geothermal energy exploration, and specialized geotechnical engineering surveys for large infrastructure projects, all of which require precise, repeatable subsurface characterization.

What role does Artificial Intelligence play in modern seismic data processing?

AI, specifically Machine Learning (ML) and Deep Learning (DL), is utilized to automate and accelerate tasks such as noise attenuation, velocity model building (Full Waveform Inversion), and geological feature interpretation, drastically reducing processing time and improving data quality.

What are the key technical specifications defining state-of-the-art land seismic equipment?

Key specifications include ultra-high channel count capacity, operational ruggedness (environmental durability), low power consumption, high data telemetry bandwidth, and the ability to capture broadband frequency ranges for optimal imaging depth and resolution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager