Landscaping and Gardening Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437599 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Landscaping and Gardening Services Market Size

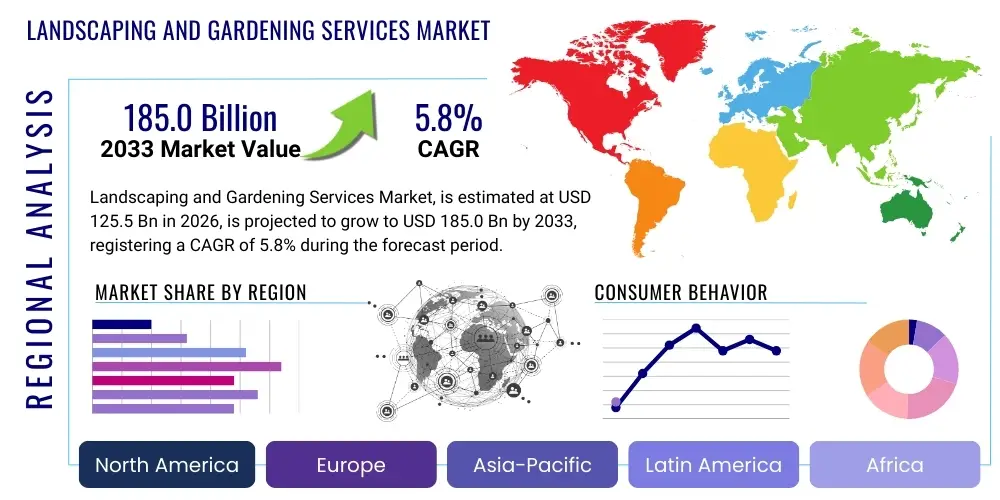

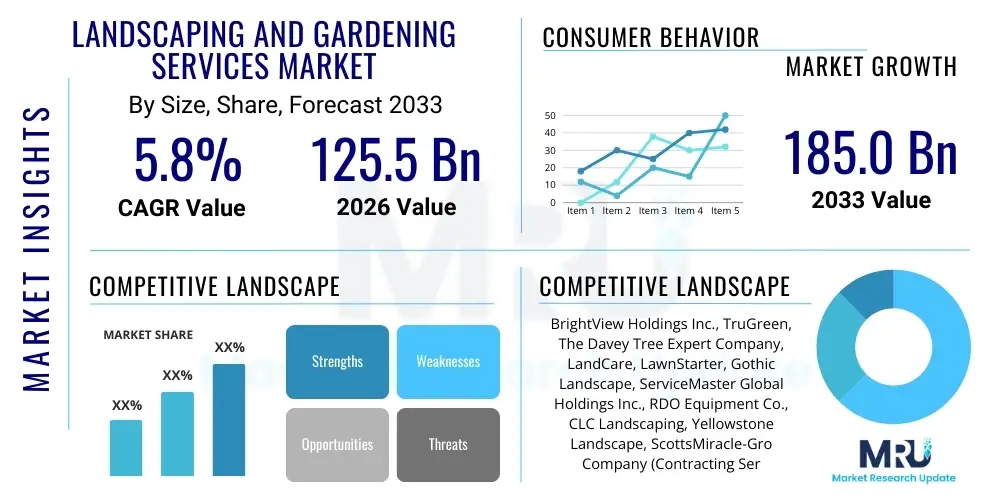

The Landscaping and Gardening Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 125.5 Billion in 2026 and is projected to reach USD 185.0 Billion by the end of the forecast period in 2033.

Landscaping and Gardening Services Market introduction

The Landscaping and Gardening Services Market encompasses a wide range of professional services dedicated to the design, installation, maintenance, and enhancement of outdoor spaces for residential, commercial, and municipal clients. These services are crucial for maintaining property aesthetics, enhancing environmental sustainability, and optimizing the functional use of exterior areas. The scope includes foundational activities such as lawn maintenance, irrigation system management, tree care, pest control, and hardscaping projects like patios, walkways, and retaining walls. The inherent complexity of managing diverse ecological requirements and client expectations drives the necessity for specialized providers.

Major applications for these services span across high-density urban areas and large suburban developments, catering specifically to homeowners seeking premium, hassle-free garden maintenance and commercial entities looking to uphold stringent corporate image standards. Institutional applications, including parks, educational campuses, and government facilities, also form a significant portion of the demand, requiring specialized large-scale landscape management solutions. The sustained demand is fueled by the recognized benefit of increased property values, improved community well-being, and compliance with local environmental regulations regarding stormwater management and biodiversity.

The primary driving factors propelling market expansion include global urbanization trends leading to higher density living requiring managed green spaces, coupled with rising disposable incomes globally that allow both residential and commercial sectors to outsource maintenance tasks. Furthermore, stringent environmental mandates promoting water-efficient landscaping (xeriscaping) and native planting are creating new service categories and driving innovation in sustainable practices, ensuring consistent market progression and technological adoption across service types.

Landscaping and Gardening Services Market Executive Summary

The Landscaping and Gardening Services Market exhibits robust growth, primarily driven by increasing commercial real estate development and heightened consumer focus on outdoor living spaces post-pandemic. Key business trends include the consolidation of regional service providers into national entities, leveraging economies of scale, and significant investment in sustainable practices like smart irrigation and eco-friendly pest management. Technological integration, particularly route optimization software and customer relationship management (CRM) platforms, is enhancing operational efficiencies, fundamentally shifting service delivery from traditional manual labor to data-driven operational models, thus stabilizing profit margins despite rising labor costs.

Regional trends indicate North America currently holds the largest market share, characterized by high consumer spending power and a mature regulatory environment that mandates professional landscape maintenance for commercial properties. However, the Asia Pacific (APAC) region is poised for the fastest expansion, fueled by rapid infrastructural development, burgeoning middle-class populations in countries like China and India, and increasing governmental investment in public parks and green urban infrastructure. European markets maintain steady, sophisticated demand, focusing heavily on aesthetic preservation, historic landscape maintenance, and strict adherence to environmental protection standards set by the EU.

Segment trends reveal that the Residential End-User category remains the foundational revenue stream, showing resilience due to customization and high frequency of maintenance services. Conversely, the Commercial and Institutional segments are driving growth in high-margin services, specifically hardscaping installation and comprehensive contract management. Within service types, the Tree & Shrub Care segment is seeing accelerated growth, driven by environmental awareness regarding canopy health and the necessity for professional hazard mitigation, signifying a shift towards more specialized and knowledge-intensive offerings.

AI Impact Analysis on Landscaping and Gardening Services Market

User inquiries regarding AI's influence in the Landscaping and Gardening Services Market frequently center on automation potential, specifically asking about robotic lawnmowers, autonomous weeding systems, and AI-driven predictive maintenance scheduling. Users are keenly interested in how AI can solve the persistent challenges of labor shortages and inconsistent service quality. Key themes emerging include concerns over the initial capital expenditure for smart machinery, the required technical training for staff, and the accuracy of AI algorithms in diverse ecological conditions, such as diagnosing specific plant diseases or optimizing water usage based on hyper-local microclimates. Expectations are high regarding AI's ability to maximize resource efficiency, enabling landscapers to offer more sustainable and cost-effective solutions while simultaneously reducing environmental impact through precise application of resources.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to forecast irrigation needs, pest infestations, or equipment failure based on historical data, weather patterns, and real-time sensor inputs.

- Autonomous Robotic Systems: Integration of AI-guided robotic mowers, trimmers, and weeding bots to automate routine, labor-intensive tasks, addressing workforce scarcity.

- Optimized Route Planning and Scheduling: AI systems calculating the most efficient routes for mobile crews, minimizing fuel consumption and increasing the number of serviced properties per day.

- Environmental Sensing and Diagnosis: Drones and ground sensors leveraging computer vision and AI to quickly identify specific plant diseases, nutrient deficiencies, or soil imbalances, enabling highly localized and precise treatment applications.

- Enhanced Customer Experience (CX): AI chatbots and automated communication systems managing basic scheduling changes, service inquiries, and billing, improving client responsiveness outside of standard business hours.

- Design and Visualization Tools: AI assisting in landscape design by generating optimized, aesthetically pleasing plans that comply with local codes and sustainability criteria (e.g., maximizing native plant usage).

DRO & Impact Forces Of Landscaping and Gardening Services Market

The dynamics of the Landscaping and Gardening Services Market are shaped by a complex interplay of internal and external forces summarized as Drivers, Restraints, and Opportunities (DRO). The primary drivers include robust growth in construction and infrastructure projects globally, particularly in commercial and institutional sectors, creating substantial demand for initial landscape installation and ongoing contract maintenance. Simultaneously, heightened public awareness concerning environmental quality, biodiversity preservation, and the aesthetic contribution of well-maintained green spaces drives both consumer and governmental spending in this area. These factors collectively create a strong foundational demand, underpinning market stability and encouraging long-term investment.

Restraints primarily revolve around the operational challenges inherent to the industry, notably the pervasive issue of labor scarcity and the seasonal nature of operations in temperate climates, which necessitates complex workforce planning. Furthermore, rising costs associated with fuel, fertilizers, and specialized machinery, coupled with increasing environmental regulations regarding water usage and chemical applications, squeeze profit margins for smaller service providers. These restraints force companies to prioritize technological adoption and process automation to maintain competitiveness and profitability.

Opportunities are significant, particularly through the aggressive pursuit of sustainable practices, such as the implementation of smart irrigation systems powered by IoT, the adoption of organic and biological pest control methods, and offering specialized services like drought-tolerant landscaping (xeriscaping) and urban farming consultation. The integration of digital tools for customer management and workforce optimization represents a major opportunity for service differentiation and scaling operations efficiently, transforming the market from purely service-based to a technology-enabled professional industry. These impact forces collectively dictate the strategic decisions of market players.

Segmentation Analysis

The Landscaping and Gardening Services Market is segmented based on Service Type, End-User, and Region, providing a detailed understanding of revenue streams and growth pockets. The segmentation highlights the diversification of service offerings from basic lawn mowing to highly specialized ecological consulting. Analyzing these segments is critical for market participants to tailor their service packages, optimize resource allocation, and target specific high-value customer demographics, thereby maximizing market penetration and profitability across different operational categories.

The Service Type segment demonstrates the complexity of the industry, encompassing routine, high-frequency maintenance services alongside complex, high-capital installation projects. Growth is increasingly concentrated in specialized areas, reflecting customer willingness to pay a premium for expert knowledge in areas like tree health management and large-scale water conservation systems. Meanwhile, the End-User segmentation clearly delineates the differing demands of residential clients (focused on aesthetics and convenience) versus commercial/institutional clients (focused on compliance, large-scale upkeep, and brand image continuity), each requiring distinct contractual and operational approaches.

- Service Type

- Lawn Care and Maintenance (Mowing, Edging, Fertilization)

- Tree and Shrub Care (Pruning, Planting, Disease Control)

- Hardscaping (Patios, Walkways, Retaining Walls, Water Features Installation)

- Irrigation and Water Management (Installation, Maintenance, Smart Systems Integration)

- Pest and Weed Control (Chemical and Organic)

- Design and Installation Services

- End-User

- Residential

- Commercial (Office Parks, Retail Centers, Hospitality)

- Institutional (Schools, Government Facilities, Parks)

- Geographic Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Landscaping and Gardening Services Market

The Landscaping and Gardening Services value chain begins with upstream activities involving the sourcing and procurement of essential inputs. These inputs include specialized horticultural materials (plants, seeds, sod), equipment (mowers, trimmers, irrigation hardware), and consumables (fertilizers, pesticides, soil amendments). Key upstream suppliers are nurseries, equipment manufacturers (e.g., John Deere, Toro), and chemical producers. Efficiency at this stage is dictated by supplier relationships, bulk purchasing power, and timely inventory management, especially for perishable plant materials. Strategic partnerships with reliable nurseries are crucial for ensuring the quality and diversity of plants used in design projects.

Midstream activities encompass the core service delivery, which involves design consultation, installation, and ongoing maintenance execution. This stage requires significant labor investment, skilled technicians (arborists, certified landscape designers), and effective logistical coordination to deploy crews and equipment efficiently across multiple client sites. Operational excellence, quality control, and adherence to project timelines define success in the midstream. Technological adoption, specifically in scheduling, GPS tracking, and mobile communication, significantly impacts the cost structure and service quality delivered to the end-user.

Downstream analysis focuses on the distribution channel and the direct interaction with the end consumer. For residential clients, distribution is predominantly direct service delivery, often utilizing digital platforms for scheduling and billing. For large commercial contracts, the channel may involve bids managed through property management firms or direct contracts with institutional procurement departments. Both direct and indirect distribution channels rely heavily on reputation, brand visibility, and highly localized marketing efforts. Indirect channels, through partnerships with real estate developers or property managers, offer scalable contract opportunities but often involve complex contractual negotiations and high compliance standards.

Landscaping and Gardening Services Market Potential Customers

Potential customers for Landscaping and Gardening Services are broadly categorized based on their scale of operation and primary motivation for outsourcing green space management. The largest segment remains the high-end Residential sector, comprising homeowners with substantial disposable income who value time savings, aesthetic superiority, and professional property maintenance to preserve and enhance home valuation. These buyers prioritize customized, reliable, and comprehensive service contracts that cover all aspects of lawn and garden care throughout the year, often seeking specialized services like seasonal flower rotations and complex hardscaping additions.

The Commercial sector represents a rapidly growing and highly lucrative customer base, including owners and managers of corporate campuses, retail parks, hotel chains, and industrial facilities. These customers treat landscaping as a critical component of their corporate image and operational safety. Their purchasing decisions are primarily driven by the need for regulatory compliance, consistent visual appeal across multiple locations, robust insurance coverage, and detailed reporting capabilities provided by professional firms. Contracts in this segment are typically large-scale, long-term, and performance-based, emphasizing consistency and efficiency.

Furthermore, Institutional and Municipal customers, such as universities, public park systems, and governmental bodies, form a stable demand pool. These buyers often require specialized services like integrated pest management, large-scale turf care, and adherence to specific ecological standards (e.g., managing public stormwater infrastructure or historic landscapes). Their purchasing process is highly formalized, usually involving detailed Request for Proposal (RFP) processes, where experience, scalability, sustainability credentials, and cost-effectiveness are paramount selection criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.5 Billion |

| Market Forecast in 2033 | USD 185.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BrightView Holdings Inc., TruGreen, The Davey Tree Expert Company, LandCare, LawnStarter, Gothic Landscape, ServiceMaster Global Holdings Inc., RDO Equipment Co., CLC Landscaping, Yellowstone Landscape, ScottsMiracle-Gro Company (Contracting Services), Weed Man, U.S. Lawns, Juniper Landscaping, Chapel Valley Landscape Company, Ferrandino & Son, Marina Landscape, Monarch Landscape Holdings, Stay Green, M&M Landscaping |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Landscaping and Gardening Services Market Key Technology Landscape

The Landscaping and Gardening Services market is rapidly adopting advanced technology to mitigate labor challenges, improve resource efficiency, and enhance client service delivery. A cornerstone of this technological transformation is the integration of Internet of Things (IoT) devices, particularly smart irrigation controllers and soil moisture sensors. These systems allow service providers to manage water usage dynamically based on real-time weather data and soil conditions, dramatically reducing waste and ensuring regulatory compliance in drought-prone areas. Furthermore, GPS and telematics are becoming standard for fleet management, providing precise location tracking for crew accountability and optimizing routes for fuel efficiency and reduced travel time between service locations.

Another crucial element of the technology landscape is the increased use of robust specialized equipment, including commercial-grade robotic mowers capable of operating autonomously in large commercial settings. While still representing a significant capital expenditure, the operational savings derived from 24/7 autonomous operation are driving adoption among large contract holders. Complementary to physical automation, sophisticated operational software, encompassing Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) tools, is essential for managing the complex interplay of scheduling, billing, inventory, and customer communication across vast service networks.

The convergence of remote sensing technologies, specifically drones equipped with multispectral cameras, is enabling advanced diagnostics. Landscaping firms utilize these tools to survey large properties quickly, identify areas suffering from disease, nutritional deficiencies, or water stress, and generate high-resolution maps for targeted intervention. This shift towards data-driven, precision horticulture minimizes the need for broad-spectrum chemical application and maximizes the efficacy of treatments, positioning technology as a key differentiator for companies focused on high-value, sustainable landscape management.

Regional Highlights

- North America (United States, Canada, Mexico): North America dominates the global Landscaping and Gardening Services Market, characterized by high levels of urbanization, a strong focus on property curb appeal, and substantial disposable income facilitating the widespread outsourcing of maintenance tasks. The U.S. market is highly mature and fragmented, featuring both large national chains like BrightView and numerous specialized local firms. Growth is robust in the commercial sector, driven by extensive new construction and the corporate commitment to sustainable, high-quality outdoor spaces. Technological adoption, especially in smart irrigation and operational software, is highest in this region, driven by the persistent skilled labor shortage and the need for efficiency.

- Europe (Germany, UK, France, Italy, Spain): Europe represents a sophisticated market heavily influenced by aesthetic traditions, strict environmental regulations, and the maintenance of historic landscapes. The demand here is stable, emphasizing organic solutions, biodiversity preservation, and high-quality tree care (arboriculture). The UK and Germany are significant markets, focusing on both residential garden design and meticulous municipal park management. The adoption of electric and low-emission equipment is significantly higher in Europe due to governmental incentives and stringent emissions standards in urban centers, shaping procurement decisions.

- Asia Pacific (China, Japan, South Korea, India, Australia): The APAC region is projected to register the highest CAGR during the forecast period. This rapid growth is directly linked to massive infrastructure expansion, rapid urbanization, and rising affluence. Countries like China and India are investing heavily in new urban green infrastructure (smart cities), creating enormous demand for large-scale landscaping design and maintenance contracts. While labor costs are historically lower, the increasing complexity of large-scale projects and demand for international quality standards are driving the adoption of advanced machinery and professional expertise, particularly in commercial centers and high-end residential communities.

- Latin America (Brazil, Argentina, Mexico): The market in Latin America is developing, with growth concentrated in major metropolitan areas and affluent residential communities. Demand is primarily driven by the residential segment and the expanding hospitality industry (resorts and large hotels) which require extensive landscape maintenance to attract tourism. Market challenges include economic instability and fragmented local competition, but opportunities exist in sustainable landscaping solutions tailored to tropical and sub-tropical climates and the introduction of modern, efficient machinery.

- Middle East and Africa (Saudi Arabia, UAE, South Africa): The MEA region is characterized by unique climate challenges, necessitating high-tech water management solutions. Demand is significant in the Gulf Cooperation Council (GCC) states, propelled by massive government spending on mega-projects (e.g., NEOM, Expo sites) and high-density urban developments that require sophisticated, climate-resilient landscaping. The focus is heavily on irrigation technology (desalination and greywater systems) and drought-tolerant planting design, making specialized consultation services highly valued. South Africa represents a mature market focusing on high-end residential and commercial estates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Landscaping and Gardening Services Market.- BrightView Holdings Inc.

- TruGreen

- The Davey Tree Expert Company

- LandCare

- LawnStarter

- Gothic Landscape

- ServiceMaster Global Holdings Inc.

- RDO Equipment Co.

- CLC Landscaping

- Yellowstone Landscape

- ScottsMiracle-Gro Company (Contracting Services)

- Weed Man

- U.S. Lawns

- Juniper Landscaping

- Chapel Valley Landscape Company

- Ferrandino & Son

- Marina Landscape

- Monarch Landscape Holdings

- Stay Green

- M&M Landscaping

Frequently Asked Questions

Analyze common user questions about the Landscaping and Gardening Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Landscaping and Gardening Services Market?

The Landscaping and Gardening Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This growth is primarily fueled by increased urbanization, rising consumer spending on property maintenance, and technological adoption in service delivery.

Which End-User segment currently holds the largest share in the market?

While the Commercial segment drives high-value contract growth, the Residential End-User segment remains the foundational and largest market segment globally. Residential clients frequently outsource routine lawn maintenance and seek complex, customized design and installation services to maximize property aesthetics and value.

How is the adoption of sustainable practices impacting market growth?

Sustainable practices, including xeriscaping, smart irrigation (IoT integration), and organic pest control, are significantly driving market expansion by creating new specialized service opportunities. These practices address environmental regulations and consumer demand for eco-friendly property management solutions, often commanding premium service pricing.

What are the primary restraints affecting the profitability of landscaping companies?

The key restraints include persistent labor shortages, which necessitate higher wages and increased training costs, and the seasonal nature of operations in many regions. Additionally, fluctuating input costs (fuel, fertilizer) and stringent environmental compliance requirements impose significant operational challenges that mandate process optimization and efficiency improvements.

Which geographical region is expected to exhibit the fastest market growth?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, driven by rapid infrastructural development, burgeoning middle-class populations, and substantial government investment in green urban planning and public infrastructure across major economies like China and India.

The preceding analysis underscores the strategic shift within the Landscaping and Gardening Services Market, moving towards high-efficiency, technology-enabled operations. The requirement for skilled labor continues to drive investment in automation, from robotic mowers to AI-powered diagnostics, fundamentally reshaping the competitive landscape. Providers who successfully integrate these technologies while emphasizing sustainable service delivery are best positioned to capture the significant growth potential available in both the commercial and institutional segments globally.

Market consolidation, particularly in North America and Europe, reflects the need for scale to manage supply chain complexities and provide standardized service quality across diverse geographical areas. Smaller firms must specialize in niche services, such as arboriculture or unique ecological restoration projects, to maintain relevance against large national competitors. Understanding regional regulatory frameworks, especially concerning water conservation and chemical usage, is paramount for sustainable market entry and long-term operational success.

Furthermore, the long-term outlook emphasizes the market's dependence on economic health and consumer confidence, particularly in the discretionary residential segment. While commercial contracts provide stability, innovation in design and digital customer engagement will be crucial for maintaining residential client loyalty. The blending of aesthetic expertise with environmental engineering capabilities defines the next generation of successful landscaping service providers.

The integration of advanced data analytics for site management is becoming non-negotiable for large-scale operations. Utilizing geospatial data to analyze plant health, monitor soil conditions, and predict required maintenance cycles allows companies to move from reactive service calls to proactive, preventative landscape management. This approach not only enhances customer satisfaction by ensuring consistently healthy landscapes but also minimizes resource waste, aligning with global sustainability mandates and improving overall operational margins.

The commercial sector's increasing focus on corporate social responsibility (CSR) initiatives directly impacts landscaping demands. Companies are increasingly seeking certification for their green spaces, requiring specialized reporting on carbon sequestration, water neutrality, and biodiversity contributions. This trend elevates the role of the landscaping service provider from a maintenance crew to an environmental consultant, demanding higher levels of expertise and specialized accreditation within the workforce.

In developing regions, particularly APAC and MEA, the challenge lies in adapting global technologies to local climatic and ecological conditions. For instance, in the Gulf region, successful landscaping services rely heavily on highly engineered sub-surface irrigation and selecting plant species resilient to extreme heat and salinity. This localization of technological expertise offers a significant competitive advantage to firms that can master these highly specific requirements, moving beyond generic service offerings.

The labor constraint remains a critical bottleneck across all mature markets. To counteract this, companies are exploring diverse recruitment channels, investing significantly in vocational training and apprenticeships, and creating career pathways that leverage technology skills (e.g., drone operation, irrigation programming). The future workforce in landscaping will require a hybrid skill set, combining traditional horticultural knowledge with proficiency in digital tools and automated machinery.

Financial volatility, particularly the rising cost of diesel fuel and chemical inputs, necessitates constant optimization of the supply chain. Large market players are increasingly entering into bulk purchasing agreements or exploring vertical integration, such as owning nurseries or equipment maintenance facilities, to gain better control over input costs and secure supply during peak seasons, further highlighting the trend toward industry consolidation and scale.

The rapid evolution of municipal regulations regarding stormwater management and non-point source pollution requires landscaping firms to invest in engineering expertise related to permeable paving, rain gardens, and bioretention systems. These high-value, environmentally critical services demand specialized certification and offer substantial revenue streams outside of standard maintenance contracts, marking a key opportunity for diversification.

Customer retention strategies are heavily leaning on digital engagement platforms. Providing clients with real-time updates on service completion, access to historical maintenance records, and personalized recommendations via mobile applications is becoming standard practice. This focus on seamless digital interaction enhances transparency and convenience, significantly boosting customer loyalty in a competitive service industry.

The market for specialized tree and shrub care continues to outperform general maintenance segments. Driven by the critical role urban trees play in air quality, cooling, and property value, professional arborists with advanced certifications are in high demand. Services such as disease diagnosis, complex pruning, and tree preservation consultancy represent high-margin revenue streams that require continuous professional development and specialized equipment investment.

In terms of competitive strategy, mergers and acquisitions (M&A) are expected to continue shaping the market structure. Larger organizations acquire smaller, regionally dominant players to instantly gain market share, specialized talent, and access to established client bases, particularly in lucrative metro areas. This consolidation is creating a more streamlined, yet highly capitalized, market environment.

The role of landscaping in climate resilience is gaining prominence. Firms are now actively involved in projects focused on urban heat island mitigation through strategic planting and designing resilient landscapes that can withstand extreme weather events (flooding, high winds). This societal demand positions the sector as a critical component of modern urban planning and environmental infrastructure.

Geographically, while North America remains the revenue leader, the long-term strategic focus is shifting towards the scalability in APAC and the high-tech requirements of the MEA market. Investment strategies are being calibrated to address the unique logistical and environmental challenges of these diverse, high-growth regions, prioritizing technology that maximizes water efficiency and minimizes resource input.

In conclusion, the Landscaping and Gardening Services Market is undergoing a transformation driven by sustainability requirements, technological infusion, and persistent labor pressures. Successful market players are those that embrace automation, invest in specialized skills, and leverage data analytics to deliver precise, efficient, and environmentally responsible services to a demanding global clientele.

The sustained demand from the commercial segment is tied closely to global economic stability and continued investment in commercial real estate. As businesses prioritize appealing and functional exterior spaces to attract tenants and employees, the long-term service contracts offered by professional landscaping firms provide a predictable revenue stream, mitigating some of the volatility experienced in the residential, discretionary spending segment. Furthermore, corporate sustainability goals often translate directly into requirements for organic lawn care or certified sustainable landscape maintenance, driving premium service demand.

The increasing complexity of hardscaping projects—integrating outdoor kitchens, specialized lighting, and complex drainage systems—requires collaboration between traditional landscaping firms and construction or architectural partners. This necessitates a broader scope of expertise within landscaping companies, moving beyond pure horticulture to encompass project management and civil engineering principles, elevating the barrier to entry for smaller, less diversified service providers.

Addressing the ecological impact of landscaping waste (grass clippings, trimmings) has become a regulatory and operational focal point. Many firms are now implementing composting or waste-to-energy programs to reduce landfill contributions, offering these green waste management services as part of their comprehensive maintenance packages. This adds value to the client while enhancing the service provider's environmental credentials in a highly competitive market.

The digitization of the sales process is another major trend. Virtual design consultations, utilizing 3D modeling and augmented reality (AR) tools, allow customers to visualize proposed landscape changes before construction begins. This not only streamlines the design phase but also significantly improves customer satisfaction and reduces costly mid-project revisions, setting a new standard for professional engagement in the residential design segment.

Finally, the security of personnel and equipment is increasingly being managed through advanced tracking and security systems. High-value equipment, including specialized trucks and automated machinery, is often fitted with sophisticated anti-theft and tracking devices, reflecting the high capital investment required in modern landscaping fleets. Operational risk mitigation, including comprehensive insurance and safety training, remains a critical component of professional service delivery, particularly when working on large commercial or public contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Landscaping and Gardening Services Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Equipment, Raw Material, Labor Service), By Application (Residential, Commercial and Industrial, Government and Institutional), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Landscaping and Gardening Services Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Landscape And Garden Desgin, Construction And Landscape Management, Gardening Maintenance), By Application (Residential, Commercial and Industrial, Government and Institutional), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager