Lanthanum Carbonate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436334 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Lanthanum Carbonate Market Size

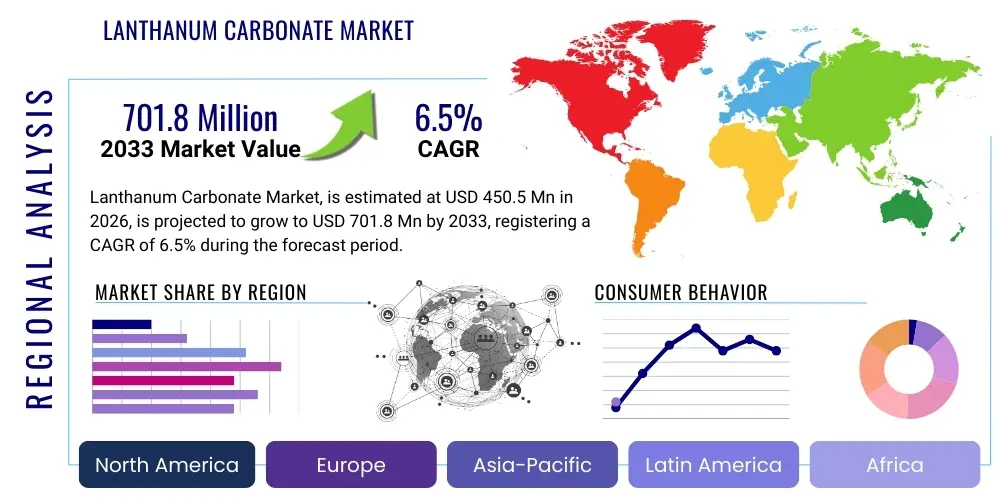

The Lanthanum Carbonate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 701.8 Million by the end of the forecast period in 2033.

Lanthanum Carbonate Market introduction

Lanthanum Carbonate (La₂(CO₃)₃), a critical compound within the rare earth elements sector, has cemented its essential role primarily within the pharmaceutical industry as a highly effective non-calcium phosphate binder. Its pharmacological efficacy in treating hyperphosphatemia—a serious complication arising from Chronic Kidney Disease (CKD) and End-Stage Renal Disease (ESRD)—is attributed to its strong affinity for dietary phosphate in the gastrointestinal tract, forming insoluble compounds that are subsequently excreted. The commercial success is fundamentally tied to its favorable side effect profile compared to older aluminum or calcium-based binders, particularly its low systemic absorption, minimizing risks associated with metal accumulation. This therapeutic niche forms the bedrock of market demand, compelling manufacturers to maintain rigorous quality control standards, including strict limits on heavy metal contaminants, adhering to international Current Good Manufacturing Practices (cGMP) guidelines.

Beyond its dominant pharmaceutical application, Lanthanum Carbonate serves as a vital component in several high-performance industrial applications. Industrially, it is crucial in the manufacturing of advanced catalysts, specifically for automotive catalytic converters and Fluid Catalytic Cracking (FCC) units in oil refining. In automotive applications, Lanthanum acts as a stabilizer and promoter, improving the thermal resistance and activity of noble metal catalysts (like platinum and palladium), thereby significantly enhancing the efficiency of converting harmful pollutants (CO, NOx, hydrocarbons) into less harmful substances. The increasing global regulatory pressure from bodies like the EPA (USA) and Euro emission standards dictates continuous innovation and sustained demand in this high-volume industrial segment. The synergy between robust healthcare demand and compulsory environmental adherence sustains the market's long-term growth trajectory and justifies specialized production capabilities across diverse technical specifications.

The market is further driven by continuous technological advancements in rare earth processing aimed at cost reduction and yield enhancement. As global incidence rates of CKD rise due to factors such as aging populations and increased prevalence of diabetes and hypertension, the requirement for effective dialysis and supportive drug treatments, including highly effective phosphate binders, escalates proportionally. Furthermore, Lanthanum Carbonate is finding niche applications in specialty glass formulations, where it enhances refractive index and radiation absorption, and in high-end electronic ceramics for its unique dielectric properties. These secondary applications contribute to market diversification, offering resilience against potential fluctuations in the primary pharmaceutical and catalyst segments, requiring suppliers to manage multiple purity tiers and volume demands simultaneously across distinct industrial timelines and stringent regulatory frameworks.

Lanthanum Carbonate Market Executive Summary

The Lanthanum Carbonate market trajectory is characterized by steady expansion, heavily reliant on the non-discretionary demand emanating from the global nephrology therapeutics sector. The principal business trend involves the strategic securing of the rare earth supply chain, with leading manufacturers increasingly pursuing vertical integration or establishing long-term procurement contracts to mitigate geopolitical risks associated with concentrated rare earth mining locations. Competition is intensifying, particularly in the pharmaceutical segment, driven by patent expiries of branded drugs like Fosrenol (Takeda), which has opened the door for generic Lanthanum Carbonate entrants, putting downward pressure on pricing while simultaneously expanding patient accessibility in underserved markets. Companies are focusing their research and development (R&D) efforts on improving drug delivery systems, such such as chewable tablet formulations that enhance patient compliance and absorption rates, thereby maintaining product differentiation in a competitively saturated landscape.

Regionally, the market presents a clear dichotomy: North America and Europe represent high-value, maturity-stage markets distinguished by premium product pricing and rigorous regulatory oversight from bodies like the FDA and EMA. Growth in these regions is incremental, largely driven by demographic shifts, high per capita healthcare spending, and the sheer volume of patients undergoing dialysis treatment. Conversely, the Asia Pacific (APAC) region is projected to be the engine of future market volume and velocity. APAC's rapid ascent is fueled by substantial industrial growth, which mandates large quantities of catalyst materials for refining and manufacturing, and a rapidly expanding healthcare infrastructure struggling to manage the escalating incidence of lifestyle-related diseases leading to CKD. Investment in localized pharmaceutical manufacturing and rare earth processing capacity within APAC is fundamentally reshaping the global production and distribution matrix, strategically shifting the center of gravity for industrial production capacity.

Segmentation analysis clearly defines the Pharmaceutical Grade as the highest revenue-generating category, reflecting the high value-add required due to strict regulatory margins, purity demands, and necessary documentation. The catalyst application segment, however, is crucial for volume throughput and maintains a predictable demand profile linked directly to global automobile production volumes and stability in oil refining operations. Trends within the form segment show a consistent preference for micronized powder, which optimizes surface area for maximal phosphate binding efficacy in medical applications and ensures uniform dispersion in catalyst slurries. The ongoing market transition involves carefully balancing the inherently high cost of rare earth inputs against the necessity for competitive pharmaceutical pricing, forcing manufacturers to innovate dramatically in processing efficiency and waste minimization across all product grades to sustain profitability and market share growth effectively.

AI Impact Analysis on Lanthanum Carbonate Market

User inquiries regarding the application of Artificial Intelligence (AI) in the Lanthanum Carbonate sector reflect a keen interest in leveraging computational power to address complex challenges inherent in rare earth chemical processing and pharmaceutical development. The primary analytical concern is how AI can significantly de-risk the supply chain by predicting geopolitical impacts on rare earth prices and optimizing complex solvent extraction protocols to maximize Lanthanum yield and ultra-purity, simultaneously minimizing the energy intensity and solvent consumption footprint associated with these resource-heavy operations. In the medical field, machine learning (ML) algorithms are being intensely examined for their potential in identifying ideal patient profiles for Lanthanum Carbonate treatment, predicting long-term adherence rates, and potentially aiding in the formulation design to optimize drug release kinetics, thus advancing personalized medicine approaches within the complex domain of nephrology therapeutics.

AI is set to revolutionize high-throughput screening and quality control throughout the manufacturing lifecycle for both industrial and pharmaceutical grades. Traditional analytical methods for high-purity rare earth compounds are often time-consuming; however, AI-driven spectral analysis (using techniques like Raman or Fourier-transform infrared spectroscopy coupled with ML interpretation) can provide instantaneous purity checks, detecting trace contaminants at far lower concentrations than conventional methods. This capability is vital for ensuring compliance in high-grade Lanthanum Carbonate API production. Furthermore, digital twins and detailed process simulation powered by AI enable manufacturers to accurately model and proactively optimize energy usage during energy-intensive processes like calcination and drying, leading to significant operational cost savings, enhanced yield stability, and contributing tangibly to corporate sustainability goals by minimizing industrial waste generation.

- AI-driven predictive modeling for raw material price volatility based on geopolitical and mining data, enabling proactive, risk-mitigated procurement strategies.

- Optimization of complex chemical synthesis parameters (including critical factors like temperature, pH levels, and reagent concentration) using machine learning to maximize Lanthanum Carbonate purity and ensure efficient manufacturing throughput.

- Accelerated clinical data analysis through ML to identify optimal dosing regimens and rapidly improve patient stratification accuracy in phosphate binder clinical trials and post-market surveillance studies.

- Implementation of advanced AI-powered computer vision systems for real-time inspection of tablet integrity, physical consistency, and packaging quality control in fast-moving pharmaceutical manufacturing lines.

- Use of generative AI models in specialized materials science research to hypothesize novel Lanthanum-based compounds with improved characteristics for next-generation catalyst formulations or advanced electronic component materials.

DRO & Impact Forces Of Lanthanum Carbonate Market

The core drivers sustaining the Lanthanum Carbonate market are deeply entrenched in global public health imperatives and compulsory environmental protection mandates. The inevitable rise in the global population affected by Chronic Kidney Disease (CKD) and End-Stage Renal Disease (ESRD), driven significantly by global lifestyle factors, necessitates the consistent and expanding availability of life-saving therapeutics like Lanthanum Carbonate binders, creating an inelastic demand curve. Simultaneously, the global shift towards stricter environmental regulations, particularly concerning vehicle emissions (e.g., EU7 standards, increasingly rigorous CAFE standards in the US), necessitates continuous adoption and upgrading of high-performance catalytic converters, sustaining robust, non-cyclical demand for Lanthanum-based catalyst components across the automotive sector. These stable, systemic drivers create a favorable demand environment, allowing manufacturers to invest strategically in process improvements despite the inherent volatility in rare earth inputs.

Major restraints revolve around intrinsic supply chain fragility and protracted regulatory headwinds. The highly concentrated global supply of rare earth ores, with a few nations dominating the initial mining and processing stages, creates significant geopolitical risk, often leading to unpredictable price spikes and supply interruptions—a critical constraint, particularly for high-volume industrial users dependent on price stability. Furthermore, the pharmaceutical sector faces lengthy, capital-intensive regulatory approval pathways (e.g., Investigational New Drug (IND), New Drug Application (NDA) submissions), which restrain the speed of market entry for new formulations or generic versions. The highly anticipated emergence of next-generation, non-lanthanum based phosphate binders, perceived potentially as superior in terms of enhanced patient compliance or reduced side-effect profiles, represents a long-term substitutional threat to the existing market dominance of Lanthanum Carbonate.

Opportunities for market growth are significant and remarkably multifaceted. There is immense potential in diversifying product applications into high-tech fields beyond traditional uses, notably in green energy technologies such as advanced solid oxide fuel cells (SOFCs), high-performance magnetic materials, and specialized battery electrolytes, capitalizing on Lanthanum's unique ion-conducting and magnetic properties. Geographically, expanding market penetration in emerging economies within the Asia Pacific and Latin America, which are rapidly improving healthcare access, represents a high-growth opportunity for pharmaceutical application. The collective impact forces indicate that the irreplaceable therapeutic role in CKD treatment provides a High Impact stabilization factor, guaranteeing core baseline revenues. However, external factors like rare earth geopolitics and regulatory stringency exert a persistent Medium-to-High Impact force that necessitates sophisticated risk management, strategic sourcing diversification, and contractual stability throughout the entire supply chain to ensure consistent profitability across all operational segments.

Segmentation Analysis

Segmentation analysis of the Lanthanum Carbonate market is crucial for understanding the intricate differences in purity requirements, application specificities, and inherent pricing sensitivities across the entire spectrum of end-use industries. The demarcation between Pharmaceutical Grade and Industrial Grade is the single most critical distinction, directly impacting manufacturing complexity, cost of goods sold, and compliance overhead. Pharmaceutical grade requires capital-intensive, multi-stage purification to eliminate all traces of toxic heavy metals and achieve specifications over 99.9%, adhering rigorously to global pharmacopeia standards (USP, EP), which results in premium pricing and high margins. Industrial grade allows for slightly lower purity tolerances but demands extremely consistent specifications for particle size and specific surface area for optimal kinetic performance in catalytic converters and refinery processes, reflecting a high-volume, lower-margin segment driven by large contracts. Understanding these granular differences enables strategic resource allocation and optimization of production line capacity.

Further breakdown by physical form—Powder, Granules/Pellets, and Aqueous Suspension—reflects specific end-user processing needs and delivery mechanisms. Micronized powder is the ubiquitous base product, serving as the raw API for solid oral dosages and the precursor for industrial catalyst coatings, valued for its high reactivity and maximized surface area per unit mass. Granules or pellets are often preferred in industrial handling, utilized specifically to minimize airborne dust during transfer, improve material flowability in bulk mixing operations, and ease transport logistics. The Application segment breakdown highlights the enduring dominance of the healthcare sector, which commands the highest value share due to regulatory premium pricing, while the Catalyst segment contributes the largest overall volume share globally. The growing interest in water treatment applications, leveraging Lanthanum Carbonate’s superior ability to sequester phosphate from municipal and industrial effluent, presents a niche but high-growth market driven by escalating environmental regulatory requirements, particularly addressing widespread eutrophication issues.

The End-User classification details the primary purchasing entities and their distinct procurement drivers. Pharmaceutical companies are the defining buyers, placing intense focus on quality assurance, stringent supply chain documentation, and regulatory compliance, driving innovation in drug delivery formats (e.g., improved chewable formulations). Chemical manufacturers and refiners, in sharp contrast, prioritize high-volume bulk purchasing, supply reliability, and comprehensive technical support for large-scale catalyst regeneration cycles, where downtime is prohibitively expensive. The complexity of these segmented demands necessitates specialized marketing and highly technical teams capable of addressing both rigorously technical industrial specifications and painstakingly regulated pharmaceutical documentation requirements, ensuring that market offerings are perfectly aligned with specific end-user critical performance indicators and maximizing long-term customer retention across diversified verticals.

- By Grade/Purity:

- Pharmaceutical Grade (High Purity >99.9%): Essential for API manufacturing; subject to mandatory cGMP compliance and strict heavy metal limits.

- Industrial Grade (Standard Purity): Utilized widely in catalysts, specialty ceramics, and technical applications; focused primarily on performance parameters like optimized surface area and thermal stability.

- By Form:

- Powder: Dominant form; used for API base material and high-reactivity catalyst precursors.

- Granules/Pellets: Preferred in industrial settings for ease of handling, bulk transport, and minimizing dust generation during large-scale industrial blending applications.

- Aqueous Solution/Suspension: Utilized in certain specialized catalyst coating processes, research applications, and advanced experimental drug formulations.

- By Application:

- Pharmaceuticals (Phosphate Binding): Highest revenue generator; driven directly by global nephrology care expansion and chronic disease management.

- Catalysts (Automotive, FCC): Highest volume segment; driven by mandatory environmental emission standards and global oil refining stability and output requirements.

- Specialty Glass and Ceramics: Niche applications requiring unique material properties, such as high refractive index or specific dielectric constants for optical components.

- Water Treatment: Rapidly growing segment for advanced phosphorus removal from municipal and industrial wastewater streams, driven by anti-eutrophication mandates.

- Electronics and Magnetic Materials: High-purity segment supporting the development of advanced capacitors, sensors, and other critical electronic components.

- By End-User:

- Pharmaceutical Companies: Primary buyers of API; focus intensely on quality audits and securing long-term supply agreements.

- Chemical Manufacturing: Major producers of finished catalyst products and specialized chemical compounds.

- Automotive Industry: Procurement, direct or indirect, for the large-scale manufacturing of high-performance catalytic converters.

- Water and Wastewater Utilities: Emerging buyers for advanced chemical systems dedicated to phosphorus sequestration.

- Oil and Gas Refining: Large-scale, consistent consumers for enhancing Fluid Catalytic Cracking (FCC) performance and yield metrics.

- By Region:

- North America: Mature, high-value market with premium pricing structures.

- Europe: Stable market with a strong focus on catalyst R&D and supply chain sustainability.

- Asia Pacific: Fastest growth region, major source of raw materials, and expanding consumer base for both industrial and pharma segments.

- Latin America: Emerging healthcare market with increasing pharmaceutical expenditure.

- Middle East & Africa (MEA): Growth linked to industrialization, particularly oil refining and infrastructure development projects.

Value Chain Analysis For Lanthanum Carbonate Market

The upstream segment of the Lanthanum Carbonate value chain is defined by the resource-intensive process of rare earth element extraction and concentration. This demanding phase involves initial mining of rare earth ores, typically followed by complex physical separation and chemical leaching processes to produce a rare earth oxide mixture. Subsequent processing requires highly specialized and technically sophisticated hydrometallurgical techniques, primarily solvent extraction or continuous ion-exchange chromatography, which are essential for the effective isolation and purification of Lanthanum from chemically similar rare earth elements like Cerium and Neodymium. This initial phase is highly concentrated among a limited number of global suppliers, lending these entities significant leverage over initial pricing, supply stability, and overall cost structure. Consequently, many leading Lanthanum Carbonate producers are increasingly adopting vertical integration strategies or entering strategic joint ventures with rare earth refiners to fundamentally de-risk the supply chain and ensure guaranteed feedstock quality and volume.

The midstream phase centers intensely on the chemical synthesis of Lanthanum Carbonate from the separated oxide precursor, followed by rigorous purification and tailoring the physical form (e.g., micronized powder, fine granules). Achieving Pharmaceutical Grade purity involves multiple, energy-intensive crystallization, filtration, and drying steps under strictly controlled conditions to meet demanding specifications for ultra-low heavy metal content, requiring specialized cleanroom facilities and adherence to Current Good Manufacturing Practices (cGMP). Distribution channels for the final product are highly specialized and segmented. Direct distribution is crucial for securing large contracts with major industrial consumers (like multinational refiners or catalyst majors) and primary pharmaceutical API purchasers, facilitating bulk supply under continuous quality control monitoring. Indirect distribution, leveraging specialized chemical distributors and wholesalers, is essential for reaching smaller specialty chemical buyers, academic research institutions, and achieving wide geographical penetration into fragmented international markets, requiring specialized partners capable of managing complex regulatory and hazardous materials handling requirements.

Downstream market dynamics are principally dictated by the highly divergent end-user demands across the two main application sectors. For the pharmaceutical market, demand is fundamentally predictable based on global CKD incidence rates and established health insurance coverage models, but is critically subject to rigorous quality audits, comprehensive documentation, and long-term procurement agreements spanning multiple years. For the industrial catalyst market, demand is intrinsically correlated with global industrial output, volatile oil refining utilization rates, and the cyclical nature of automotive sales and manufacturing, often involving large, intermittent purchase orders. The pharmaceutical end-users exert the greatest pressure for documented quality assurance and complete vertical traceability, while industrial end-users prioritize maximizing cost-efficiency and technical performance metrics (e.g., surface area optimization, thermal resistance). The strategic flow of information and end-to-end traceability, from the initial ore source to the final finished product, is becoming paramount due to increasing consumer and regulatory emphasis on sustainability, ethical sourcing, and environmental impact mitigation, forcing market participants to adopt advanced digital tracking and ledger solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 701.8 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Takeda Pharmaceutical Company Limited (Shire/Vifor Pharma), Merck KGaA, Wuhan Boli Medical & Chemical Co., Ltd., Shandong Luba Chemical Co., Ltd., China Northern Rare Earth (Group) High-Tech Co., Ltd., Chengdu Jinke Rare Earth Industrial Co., Ltd., TCI Chemicals (India) Pvt. Ltd., Strem Chemicals, Inc., Alfa Aesar (Thermo Fisher Scientific), Hunan Rare Earth Metal Materials Co., Ltd., Rushun Rare Earth Co., Ltd., Ganzhou Jinlun Rare Earth Co., Ltd., Nanjing Chemical Plant, Zibo Wanzhong Chemical Co., Ltd., Reagent Chemical & Research Co., Inc., American Elements, Midwest Rare Earths, LLC, Guangdong Rare Earth Industry Group Co., Ltd., Beijing RARE Chemical Co., Ltd., Inner Mongolia Baotou Steel Rare Earth (Group) Hi-tech Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lanthanum Carbonate Market Key Technology Landscape

The core technology landscape governing the Lanthanum Carbonate market is heavily invested in refining and advancing separation and purification techniques to consistently meet the extremely stringent quality benchmarks demanded by the global pharmaceutical industry. A primary technological focus remains on significantly improving the efficiency and sustainability of solvent extraction and continuous ion-exchange processes specifically designed for separating Lanthanum from chemically complex rare earth mixtures. Innovations in this area are increasingly geared toward utilizing less toxic and more easily recyclable extraction solvents, aiming to substantially reduce the overall environmental footprint, while simultaneously lowering the per-unit cost of producing ultra-high-purity Lanthanum Oxide precursor. Advanced analytical instrumentation, particularly high-resolution ICP-MS (Inductively Coupled Plasma Mass Spectrometry) and X-ray diffraction techniques, plays a crucial technological role, ensuring ultra-trace level detection of contaminants (such as Thorium or heavy metals) required for safe Active Pharmaceutical Ingredient (API) production, often exceeding typical industrial standards by orders of magnitude.

In the crucial sphere of pharmaceutical formulation, technological advances are primarily concentrated on particle engineering and micronization techniques aimed at enhancing the performance characteristics and improving user compliance of the final drug product. Controlled crystallization techniques are precisely employed to achieve specific crystal polymorphs and particle size distributions of Lanthanum Carbonate, which directly influence critical factors such as solubility, dissolution rate in the gastrointestinal tract, and overall maximal phosphate binding capacity. The ongoing development of advanced, non-chalky chewable tablets or orally disintegrating tablets (ODTs) utilizes specialized binder and excipient technologies to effectively mask the gritty texture and associated metallic taste often linked with rare earth compounds, a critical factor for ensuring high, long-term patient adherence to therapy for chronic conditions like ESRD.

For high-performance industrial applications, particularly in catalyst production, technology development is focused intensely on synthesis methods that yield high surface area materials with exceptional thermal and chemical stability. Precipitation and precise calcination technologies are rigorously fine-tuned to create Lanthanum Carbonate precursors that, upon final conversion, exhibit superior textural properties when incorporated into essential catalyst supports such as zeolite and alumina matrices. Furthermore, the burgeoning field of rare earth recycling, involving advanced pyro- and hydro-metallurgical approaches to efficiently recover Lanthanum from spent magnets, fluorescent lamps, and obsolete catalytic converters, represents a pivotal technological investment area. This recycling technology aims not only to bolster supply security and mitigate geopolitical risks but also to align manufacturing practices with global circular economy objectives, thereby reducing reliance on primary mining and stabilizing long-term input costs in the face of ongoing global supply constraints and market volatility.

Regional Highlights

North America currently maintains a commanding dominant position in terms of overall market value and expenditure, largely driven by its mature, highly regulated, and heavily reimbursed healthcare system. The alarmingly high prevalence rates of diabetes and hypertension contribute significantly to the large and growing patient pool requiring long-term treatment for End-Stage Renal Disease (ESRD), ensuring robust, non-cyclical demand for premium-priced pharmaceutical-grade Lanthanum Carbonate. Regulatory frameworks enforced by the US Food and Drug Administration (FDA) mandate compliance with the absolute highest purity standards, favoring established suppliers with integrated, rigorous quality control processes. Additionally, the region’s strong, albeit transitioning, automotive manufacturing base continues to utilize sophisticated catalysts incorporating Lanthanum components to meet increasingly strict federal and state-level emissions standards, particularly for heavy-duty vehicles and the vast existing internal combustion engine (ICE) fleet requirements.

The Asia Pacific (APAC) region is indisputably the high-growth engine of the market, projected to exhibit the fastest Compound Annual Growth Rate (CAGR) over the entire forecast period. This rapid expansion is underpinned by a powerful combination of two parallel growth vectors. Firstly, the region serves as the global epicenter for rare earth processing and refining, controlling the critical upstream supply chain and associated intellectual property. Secondly, the rapidly expanding access to dialysis treatment and improved CKD diagnosis, especially in economic powerhouses like China, South Korea, and India, dramatically increases the accessible patient population requiring long-term phosphate binder therapy. Localized pharmaceutical production, often spurred by aggressive government incentives and favorable regulatory regimes, is creating massive demand for domestic supply of API, strategically shifting procurement away from traditionally expensive imports. Moreover, extensive government-led infrastructure development and burgeoning industrial activities amplify the necessity for FCC catalysts and environmental remediation applications across diverse sectors.

Europe represents a stable and highly sophisticated market, characterized by comprehensive environmental protection legislation (such as the widespread implementation of Euro emissions standards) that consistently drives the adoption of high-efficiency catalytic systems. The pharmaceutical sector in Europe, regulated by the European Medicines Agency (EMA), demonstrates similarly high standards for API quality and efficacy. The European market is also increasingly sensitive to ethical and sustainability issues, leading to higher scrutiny regarding the ethical sourcing and environmental impact of rare earth materials used in production. Latin America and the Middle East & Africa (LAMEA) are currently categorized as smaller, emerging markets but collectively hold substantial untapped long-term potential. Growth in these regions is intrinsically dependent on socio-economic development, focused investment in public health infrastructure improvement, and the strategic expansion of domestic oil refining and petrochemical industries. Strategic investments targeting CKD awareness campaigns and establishing reliable, specialized pharmaceutical distribution networks are crucial prerequisites for substantially unlocking latent demand in these developing geographical areas.

- Asia Pacific (APAC): Leads in volume production and projected growth rate; characterized by vast rare earth reserves and dominant refining capacity; exhibits strong dual demand from industrial catalysts and a rapidly expanding CKD patient population in populous nations.

- North America: Commands the highest average selling price (ASP) market; driven by comprehensive health insurance coverage for CKD treatments and strict regulatory adherence; demand is sustained by both established branded and high-quality generic drug usage patterns.

- Europe: Stable market with extremely high regulatory barriers for entry; strong strategic focus on R&D for catalyst performance optimization and rare earth supply chain sustainability; influential in shaping global rare earth sourcing policies and promoting circular economy initiatives.

- Latin America: Developing market with gradually expanding healthcare accessibility; initial growth opportunities are highly focused on key metropolitan areas and major urban centers; often prone to currency fluctuations that impact the import costs of critical finished pharmaceutical products.

- Middle East & Africa (MEA): Growth potential closely linked to national investments in expanding oil refining capacity (particularly within GCC nations) and gradual, sustained improvements in clinical diagnostics and the availability of specialized healthcare services for non-communicable diseases across major urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lanthanum Carbonate Market.- Takeda Pharmaceutical Company Limited (Shire/Vifor Pharma)

- Merck KGaA

- Wuhan Boli Medical & Chemical Co., Ltd.

- Shandong Luba Chemical Co., Ltd.

- China Northern Rare Earth (Group) High-Tech Co., Ltd.

- Chengdu Jinke Rare Earth Industrial Co., Ltd.

- TCI Chemicals (India) Pvt. Ltd.

- Strem Chemicals, Inc.

- Alfa Aesar (Thermo Fisher Scientific)

- Hunan Rare Earth Metal Materials Co., Ltd.

- Rushun Rare Earth Co., Ltd.

- Ganzhou Jinlun Rare Earth Co., Ltd.

- Nanjing Chemical Plant

- Zibo Wanzhong Chemical Co., Ltd.

- Reagent Chemical & Research Co., Inc.

- American Elements

- Midwest Rare Earths, LLC

- Guangdong Rare Earth Industry Group Co., Ltd.

- Beijing RARE Chemical Co., Ltd.

- Inner Mongolia Baotou Steel Rare Earth (Group) Hi-tech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lanthanum Carbonate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary medical application of Lanthanum Carbonate?

Lanthanum Carbonate is primarily used as an oral phosphate binder to treat hyperphosphatemia, a severe condition characterized by abnormally high phosphate levels in the blood, most commonly observed in patients suffering from chronic kidney disease (CKD) and end-stage renal disease (ESRD). Its efficacy stems from its strong binding affinity for dietary phosphate in the GI tract.

Which factors are driving the growth of the industrial Lanthanum Carbonate segment?

The industrial segment growth is fundamentally driven by increasing global automotive production volumes and the rigorous implementation of stricter environmental regulations requiring advanced catalytic converters to minimize atmospheric pollutants, alongside consistent high-volume demand from the global oil and gas sector for specialized Fluid Catalytic Cracking (FCC) additives.

Which region dominates the global supply chain for Lanthanum Carbonate raw materials?

Asia Pacific, particularly the People's Republic of China, maintains a significant, dominant position over the global supply chain for rare earth elements, including Lanthanum precursors. This strategic concentration of mining and refining capacity fundamentally influences global pricing, strategic sourcing, and long-term supply stability for downstream Lanthanum Carbonate manufacturers worldwide.

How does the purity grade affect the commercial use and pricing of Lanthanum Carbonate?

Purity grade directly correlates with commercial application and final price. Pharmaceutical Grade requires ultra-high purity (>99.9%) and strict cGMP compliance, leading to premium pricing due to complex, mandatory purification processes, while Industrial Grade is utilized in bulk applications like catalysts, prioritizing specific technical specifications (e.g., surface area) for cost-efficient performance.

What are the key technological challenges in manufacturing pharmaceutical-grade Lanthanum Carbonate?

The key technological challenges involve achieving consistently rigorous purity standards, specifically the mandated elimination of trace heavy metals and other rare earth contaminants, which necessitates the use of sophisticated and capital-intensive separation techniques like continuous ion exchange. Additionally, optimizing particle size distribution for enhanced drug formulation and improved patient bioavailability remains a persistent technological focus for innovation.

How is the market addressing the environmental concerns related to rare earth processing?

The market is addressing environmental concerns by strategically investing heavily in technological innovations such as advanced closed-loop processing systems, implementing highly sustainable solvent extraction methods, and developing pyro- and hydro-metallurgical recycling processes aimed at economically recovering Lanthanum from spent catalysts and electronic waste, supporting circular economy principles.

What is the role of AI in optimizing Lanthanum Carbonate production?

Artificial Intelligence is strategically employed to enhance production efficiency through predictive maintenance analytics, optimizing complex chemical synthesis parameters (e.g., pH, concentration) via machine learning models to maximize overall yield and purity, and significantly accelerating quality control procedures through automated spectral analysis systems for real-time impurity detection.

What impact does the patent status of branded phosphate binders have on the market?

The expiration of patents for key branded Lanthanum Carbonate drugs, such as Fosrenol, has catalyzed the rapid entry of numerous generic manufacturers, which intensifies market competition, drives down the average treatment costs for patients, and significantly improves geographical patient access, particularly in cost-sensitive emerging markets globally.

In the industrial segment, how does Lanthanum Carbonate enhance Fluid Catalytic Cracking (FCC) processes?

In the highly technical FCC processes utilized by refineries, Lanthanum is strategically incorporated as a powerful stability promoter and structural enhancer within the zeolite catalyst component, demonstrably improving the catalyst matrix's thermal resistance, which ultimately results in higher volume yields of valuable products like gasoline and LPG, alongside improved octane ratings.

What potential opportunities exist outside of the pharmaceutical and catalyst sectors?

Significant opportunities are currently emerging in specialized advanced materials science, including novel use in high-performance electronics (e.g., dielectric materials, sensors), specialized optical glass (high refractive index lenses), and critical environmental applications, such as large-scale municipal and industrial water treatment systems for highly effective phosphate sequestration from effluent streams, driven by regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lanthanum Carbonate Market Size Report By Type (1000mg, 750mg, 500mg, Other), By Application (Hospital, Pharmacy, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Lanthanum Carbonate Market Statistics 2025 Analysis By Application (Hospital, Pharmacy), By Type (1000mg, 750mg, 500mg, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager