Laparoscopy Surgical Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432325 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Laparoscopy Surgical Robots Market Size

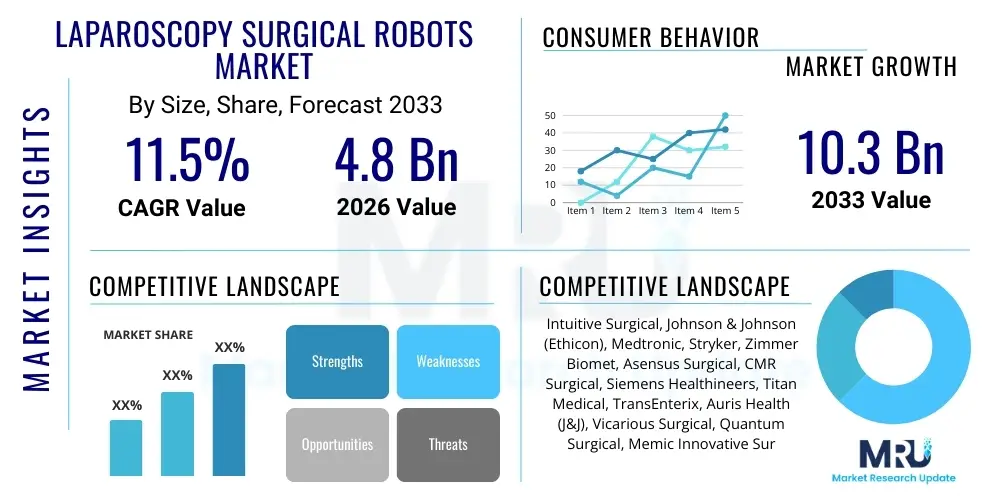

The Laparoscopy Surgical Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Laparoscopy Surgical Robots Market introduction

The Laparoscopy Surgical Robots Market encompasses sophisticated systems designed to assist surgeons in performing minimally invasive procedures with enhanced precision, dexterity, and visualization. These robotic systems utilize specialized instruments controlled remotely by the surgeon from a console, translating complex hand movements into precise, scaled movements within the patient's body cavity. Key products include multi-port and single-port robotic platforms, which are increasingly adopted across various surgical disciplines due to their significant clinical advantages over traditional open or manual laparoscopic techniques. The core components of these systems typically involve a surgeon console, a patient cart with robotic arms, and a high-definition 3D vision system, ensuring optimal operative outcomes and reduced patient recovery times.

Major applications of laparoscopy surgical robots span across specialties such as general surgery, gynecology, urology, cardiothoracic surgery, and head and neck procedures. Urological and gynecological surgeries, particularly prostatectomies and hysterectomies, have historically been the primary drivers of adoption, establishing the clinical efficacy and necessity of robotic assistance. However, the market is experiencing rapid expansion into complex gastrointestinal and pediatric surgeries, driven by the development of smaller, more flexible instruments and improved imaging capabilities. The inherent benefits, including minimized blood loss, smaller incisions, reduced post-operative pain, and shorter hospital stays, solidify the value proposition of these robotic platforms to both healthcare providers and patients.

Driving factors propelling market growth include the escalating global prevalence of chronic diseases necessitating surgical intervention, the increasing acceptance of minimally invasive surgical approaches among both patients and physicians, and continuous technological advancements leading to more cost-effective and versatile robotic systems. Furthermore, favorable regulatory environments in developed economies, coupled with growing investments in healthcare infrastructure in emerging markets, are facilitating wider access and implementation of these advanced surgical technologies. The shift towards value-based care also incentivizes the adoption of technologies that demonstrably improve patient outcomes and optimize resource utilization within the operating room.

Laparoscopy Surgical Robots Market Executive Summary

The Laparoscopy Surgical Robots Market is undergoing robust expansion, characterized by intensified competition from new entrants challenging the historical dominance of established players and a decisive shift towards single-port and miniature robotic systems designed for highly specialized procedures. Business trends indicate a strong focus on subscription-based or utilization-based revenue models, lowering the initial capital expenditure barrier for hospitals and ambulatory surgical centers (ASCs), thereby accelerating global adoption rates. Strategic partnerships between technology developers and major academic institutions are crucial for clinical validation and training, fueling the market’s penetration. Innovation is centered on incorporating advanced sensing, haptic feedback, and artificial intelligence for enhanced autonomy and decision support during complex operations.

Regionally, North America maintains its position as the largest market, driven by high healthcare expenditure, sophisticated technological infrastructure, and widespread acceptance of robotic surgery, although APAC is emerging as the fastest-growing region due to increasing medical tourism, rising surgical volumes, and government initiatives promoting advanced healthcare technologies. Europe demonstrates steady growth, balancing adoption rates with stringent regulatory pathways and varying reimbursement policies across member states. Segments trends highlight the dominance of Instrument and Accessories sales, which represent the recurring revenue stream vital for market sustainability, while the Software and Services segment is experiencing exponential growth, reflecting the critical need for integration, maintenance, and data analytics capabilities embedded within robotic platforms. The shift toward specialized application segments, such as soft tissue repair and neurological interventions, signifies market maturation and diversification beyond traditional procedures.

AI Impact Analysis on Laparoscopy Surgical Robots Market

User queries regarding AI's influence on the Laparoscopy Surgical Robots Market primarily revolve around the integration of real-time image guidance, predictive analytics for complication reduction, and the potential for increased surgical autonomy, raising questions about patient safety and the evolving role of the human surgeon. Common concerns center on data privacy, the validation standards for AI algorithms operating in critical care environments, and the economic feasibility of upgrading existing robotic systems to incorporate these sophisticated cognitive capabilities. Users expect AI to significantly enhance training through simulation, personalize surgical planning based on patient-specific anatomies, and standardize surgical quality by providing objective metrics and minimizing variations in procedural execution, ultimately leading to superior clinical outcomes and reduced costs associated with surgical errors.

- Enhanced Surgical Planning: AI models analyze preoperative imaging (CT, MRI) to create precise 3D patient models, optimizing port placement and trajectory planning for the robotic system.

- Real-time Intraoperative Guidance: Computer vision and deep learning provide overlays during surgery, highlighting critical anatomical structures like nerves and vessels, minimizing accidental damage.

- Skill Assessment and Training: AI evaluates surgeon performance in real-time using kinematic data (speed, precision, force), offering objective feedback to accelerate training curricula for robotic procedures.

- Predictive Analytics: Machine learning algorithms analyze historical surgical data to predict potential intraoperative complications and suggest preventative measures, improving safety profiles.

- Increased System Autonomy: Initial stages of autonomous tasks, such as automated suturing or tissue retraction, are being developed, gradually shifting certain repetitive actions from the surgeon to the robotic system.

- Optimization of Workflow: AI manages operating room scheduling, equipment readiness checks, and instrument tray optimization, reducing turnover time and operational inefficiencies.

DRO & Impact Forces Of Laparoscopy Surgical Robots Market

The market dynamics of Laparoscopy Surgical Robots are shaped by a strong interplay of growth drivers, inherent constraints, and significant opportunities, which collectively determine the long-term trajectory and penetration rate of these advanced systems. Key drivers include the overwhelming clinical evidence supporting superior outcomes in minimally invasive surgery, coupled with demographic trends showing an aging population requiring more surgical interventions. Restraints primarily revolve around the prohibitively high initial capital investment required for robotic systems, their substantial maintenance costs, and the need for extensive, specialized training for surgical teams, which limits adoption in smaller or less affluent healthcare facilities. However, the burgeoning opportunity lies in the development of modular, cost-effective systems specifically tailored for emerging markets and the expansion of robotic capabilities into new, underserved clinical applications, such as interventional oncology and trauma surgery. These factors generate impact forces that push the market towards innovation in miniaturization and pricing accessibility.

One of the principal impact forces driving change is technological obsolescence risk, compelling manufacturers to consistently invest in R&D to integrate features like haptic feedback, enhanced 3D visualization, and AI-driven navigation, ensuring their platforms remain competitive and clinically relevant. Conversely, the restraint imposed by complex regulatory approvals, particularly for new devices incorporating artificial intelligence, exerts a braking force on rapid product commercialization. The global competitive landscape, characterized by intellectual property battles and strategic acquisitions, also acts as a powerful impact force, driving down pricing pressure in certain segments while simultaneously pushing for greater efficiency and reliability in system design. Overall, the market is primarily driven by the imperative to improve patient care quality and reduce long-term healthcare costs associated with recovery and complications.

Segmentation Analysis

The Laparoscopy Surgical Robots Market is systematically segmented based on Components, Application, End-User, and Region, providing a granular view of market dynamics and revenue streams. Component segmentation highlights the recurring revenue generated by instruments and accessories, which are disposable or require frequent replacement, forming the financial backbone of the industry. Application analysis reveals the specialties driving current adoption (Urology, Gynecology) and the high-growth potential segments (General Surgery, Colorectal). The End-User analysis confirms that Hospitals, particularly high-volume tertiary care centers, remain the primary purchasers, though Ambulatory Surgical Centers (ASCs) are rapidly emerging as key targets due to the push for outpatient procedures. Understanding these segments is vital for strategic market entry and targeted product development, ensuring alignment with specific healthcare provider needs and reimbursement structures.

- By Component:

- Systems

- Instruments and Accessories

- Software and Services

- By Application:

- General Surgery

- Urology

- Gynecology

- Cardiothoracic Surgery

- Orthopedics

- Other Applications (e.g., Head and Neck, Colorectal)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Research and Academic Institutions

- By Technology:

- Multi-port Systems

- Single-port Systems

- Image-Guided Robotics

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (Japan, China, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Laparoscopy Surgical Robots Market

The value chain for laparoscopy surgical robots begins with upstream activities focused on highly specialized R&D, requiring expertise in robotics, sensor technology, surgical instrumentation design, and advanced software development. This phase is capital-intensive and heavily relies on intellectual property protection, as proprietary technology forms the core competitive advantage. Key upstream suppliers include manufacturers of precision motors, high-definition 3D visualization optics, and specialized alloys for surgical tool fabrication. Effective management of the supply chain is critical due to the necessity of meeting stringent quality standards (ISO 13485, FDA/CE requirements) and ensuring the integrity of complex electromechanical components used in the patient cart and console.

Midstream activities involve the intricate process of manufacturing, assembly, rigorous quality control, and system integration. This stage requires significant investment in cleanroom facilities and highly skilled engineering staff. Following manufacturing, the distribution channel plays a crucial role. Direct distribution is preferred by leading market players for major system sales, allowing for greater control over installation, post-sale service, and specialized training, which are non-negotiable aspects of robotic surgery adoption. Indirect channels, involving specialized medical equipment distributors, are often used for selling instruments, accessories, and consumables in regions where the manufacturer lacks a strong direct presence or for penetrating smaller, regional healthcare networks.

Downstream activities center on installation, comprehensive surgical team training, ongoing maintenance, and critical technical support—elements that are paramount to customer satisfaction and system utilization. The revenue cycle is sustained by the sale of high-margin disposable instruments and service contracts. Potential customers, or end-users, directly influence the value chain by demanding robust clinical evidence, interoperability with existing hospital IT infrastructure, and favorable total cost of ownership (TCO). This high-touch, service-heavy model ensures that the value created upstream is effectively delivered and supported throughout the entire lifecycle of the robotic system, distinguishing it from conventional medical device markets.

Laparoscopy Surgical Robots Market Potential Customers

The primary end-users and buyers of laparoscopy surgical robots are large-scale healthcare facilities and specialized surgical centers globally, driven by the need to offer state-of-the-art minimally invasive procedures, enhance patient outcomes, and bolster institutional reputation. Tertiary and quaternary care hospitals are the foundational customer base due to their high volume of complex surgeries, substantial capital budgets, and established programs in specialties like oncology and cardiac surgery. These institutions prioritize systems that offer versatility across multiple applications and integrate seamlessly with advanced imaging modalities. Their purchasing decisions are often based on long-term value, comprehensive service contracts, and the system’s ability to attract top surgical talent.

A rapidly growing segment of potential customers includes Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics, particularly in developed markets like the US and Western Europe. As procedural migration shifts toward outpatient settings for less complex procedures (e.g., hernia repair, simple gynecological procedures), ASCs are investing in more compact, potentially single-port or cost-optimized robotic systems. This shift is predicated on optimizing efficiency and realizing cost savings compared to traditional hospital settings. Furthermore, leading academic medical centers and university hospitals are critical customers, serving not only as high-volume surgical sites but also as vital hubs for clinical trials, technology validation, and training new generations of robotic surgeons, thereby influencing broader market adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intuitive Surgical, Johnson & Johnson (Ethicon), Medtronic, Stryker, Zimmer Biomet, Asensus Surgical, CMR Surgical, Siemens Healthineers, Titan Medical, TransEnterix, Auris Health (J&J), Vicarious Surgical, Quantum Surgical, Memic Innovative Surgery, Conmed Corporation, Microbot Medical, Moon Surgical, Smith & Nephew, Renishaw plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laparoscopy Surgical Robots Market Key Technology Landscape

The technology landscape of the Laparoscopy Surgical Robots Market is highly dynamic, marked by continuous evolution aimed at improving surgical outcomes, enhancing surgeon experience, and reducing system footprint and cost. The dominant technology continues to be the master-slave teleoperation system, where the surgeon controls the robot remotely. However, recent innovations are heavily focused on transitioning from large multi-port systems, which require several incisions, to highly specialized single-port systems. Single-port robots, such as Intuitive's Da Vinci SP and similar forthcoming products, enable all instruments and the camera to enter through one small incision, drastically minimizing trauma and improving cosmetic results, making them particularly attractive for urology and gynecological procedures.

Another critical area of technological advancement involves the integration of advanced sensory feedback mechanisms, specifically haptic feedback. While early robotic systems lacked tactile sensation, modern platforms are increasingly incorporating technology that translates forces exerted by the robotic instruments back to the surgeon’s hands through the console controls. This addition is vital for reducing tissue injury risk and improving the surgeon's ability to differentiate tissue types, a crucial factor in minimizing complications during delicate operations. Furthermore, enhanced 3D high-definition visualization systems are standard, often augmented by fluorescence imaging (e.g., ICG) to clearly delineate blood flow and tissue margins in real-time, providing an unprecedented level of intraoperative detail.

The future technology landscape is heavily invested in modular, flexible, and often miniature robotics. Modular systems allow hospitals to configure the robot based on the specific procedure, optimizing capital utilization. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is moving beyond image recognition into predictive modeling and procedural automation, where the robot can potentially execute repetitive or simple tasks autonomously under strict supervision. Micro-robotics and untethered robotic capsules are also emerging concepts, promising true scar-less surgery. These technological shifts are not merely incremental improvements but represent a fundamental redefinition of the operating room environment, aiming for complete digitization and cognitive assistance throughout the surgical workflow, ensuring high precision and reproducibility across diverse surgical disciplines.

Regional Highlights

North America, led by the United States, holds the largest market share in the Laparoscopy Surgical Robots segment, primarily attributable to early adoption rates, high per capita healthcare spending, and favorable reimbursement policies for robotic procedures. The region benefits from a robust ecosystem comprising major technology developers, leading academic medical centers that serve as primary training hubs, and a strong push towards minimally invasive techniques driven by patient demand and physician preference. Competition in the US market is intensifying, especially with new platform approvals, forcing manufacturers to focus on service contracts, system utilization rates, and advanced training protocols to maintain market leadership. The high penetration of established robotic platforms makes this region a critical benchmark for clinical application development and financial success.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth is fueled by massive investments in modernizing healthcare infrastructure, rising disposable incomes in economies like China and India, and the growing incidence of lifestyle-related diseases requiring surgical intervention. While initial adoption was slow due to high costs, government incentives and the local manufacturing of more cost-competitive robotic systems are rapidly increasing accessibility. Japan and South Korea are key early adopters, known for their technological sophistication and commitment to high surgical standards. China represents a significant growth opportunity, with massive hospital volumes driving demand for versatile and scalable robotic platforms. Localization of production and service is crucial for penetrating the diverse sub-markets within APAC.

Europe represents a mature yet steadily expanding market, characterized by varying regulatory and reimbursement landscapes across countries. Western European nations, particularly Germany, the UK, and France, exhibit strong adoption, driven by efficiency mandates and efforts to shorten patient recovery times, aligning with national health service objectives. Eastern European countries are starting to increase their investments, recognizing robotic surgery as a quality differentiator. However, the European market often demands rigorous cost-effectiveness data compared to the US, necessitating that vendors prove the long-term economic benefits beyond the immediate clinical advantages. Market expansion efforts are concentrated on integrating robotic surgery into standard cancer care pathways and demonstrating improved departmental productivity.

- North America: Dominant market share; driven by high technological integration, extensive training infrastructure, and established reimbursement policies. Focus on multi-specialty application and AI integration.

- Asia Pacific (APAC): Highest CAGR; propelled by massive healthcare infrastructure investments, expanding surgical volumes, and increasing access to competitive local robotic systems in countries like China and India.

- Europe: Steady growth, high adoption in Western Europe (Germany, UK); emphasis on demonstrating cost-effectiveness and adherence to strict regulatory standards for new technologies.

- Latin America: Emerging market; growth driven by medical tourism and private sector investment in key centers (Brazil, Mexico); high sensitivity to system cost and financing models.

- Middle East and Africa (MEA): Niche but growing segment; adoption concentrated in GCC countries due to high-quality healthcare mandates and significant government spending on medical technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laparoscopy Surgical Robots Market.- Intuitive Surgical

- Johnson & Johnson (Ethicon)

- Medtronic

- Stryker

- Zimmer Biomet

- Asensus Surgical

- CMR Surgical

- Siemens Healthineers

- Titan Medical

- TransEnterix

- Auris Health (J&J)

- Vicarious Surgical

- Quantum Surgical

- Memic Innovative Surgery

- Conmed Corporation

- Microbot Medical

- Moon Surgical

- Smith & Nephew

- Renishaw plc

- Xinzhong Medical Robot (China)

Frequently Asked Questions

Analyze common user questions about the Laparoscopy Surgical Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Laparoscopy Surgical Robots Market?

The primary driver is the accelerating clinical and patient preference for minimally invasive surgery (MIS), which offers reduced recovery times, lower complication rates, and enhanced surgical precision compared to traditional open surgery, making robotic assistance highly valuable across oncology and general surgery applications.

How is Artificial Intelligence (AI) being utilized in robotic surgical systems?

AI is primarily used for real-time intraoperative imaging guidance, surgical workflow optimization, automated performance assessment for training, and predictive analytics to minimize errors. AI enhances the system’s cognitive capabilities, improving decision support for the surgeon.

Which segment accounts for the largest revenue share in this market?

The Instruments and Accessories segment consistently accounts for the largest revenue share. This is due to the recurring nature of sales, as these components, including specialized tools, trocars, and endoscopes, are typically disposable or require frequent replacement after a defined number of procedures.

What are the main obstacles to widespread adoption of surgical robots in developing regions?

The main obstacles include the high initial procurement cost of robotic systems, substantial ongoing maintenance and service fees, and the lack of readily available infrastructure and specialized surgical training programs required to operate and maintain these complex medical devices effectively.

What is the significance of single-port robotic systems?

Single-port robotic systems represent a major technological shift, allowing surgeons to perform complex procedures through a single, small incision. This innovation significantly reduces patient trauma, minimizes scarring, and expands the application of robotic surgery to highly specialized procedures like transoral or transanal interventions, driving market diversification.

The global Laparoscopy Surgical Robots Market is intensely competitive, characterized by a few established multinational corporations holding significant proprietary technology and a growing number of innovative startups focusing on niche applications or cost-effective designs. Key competitive strategies revolve around expanding the indications for existing platforms, ensuring platform modularity to accommodate diverse surgical needs, and aggressively targeting emerging economies by offering flexible financing and robust training programs. The intensity of rivalry is high, pushing market players to continuously reduce the total cost of ownership (TCO) for hospitals and improve system efficiency, which is vital for securing long-term contracts.

Market leaders are focusing heavily on developing robust ecosystems that integrate hardware, software, instruments, and data services. This strategy locks customers into proprietary systems, enhancing revenue stability through recurring instrument and service contract sales. Furthermore, strategic acquisitions of smaller companies specializing in complementary technologies, such as advanced visualization or haptic feedback sensors, are commonplace, enabling large players to quickly incorporate next-generation features and maintain a technological lead. The regulatory pathway remains a significant barrier to entry, favoring companies with established clinical validation records and extensive resources for navigating complex global approvals, particularly in the US (FDA) and EU (CE Mark).

The influence of customer feedback, particularly from high-volume robotic surgeons, directly impacts product iteration. Manufacturers are responding by focusing on features that enhance ergonomic comfort, reduce instrument setup time, and integrate seamless data logging for quality assurance and training purposes. The increasing availability of high-quality, refurbished systems also introduces a layer of competition, particularly for smaller hospitals or facilities with tight capital budgets. Overall, success in this market is determined not just by technological superiority, but by the ability to offer a comprehensive, reliable, and economically viable solution supported by world-class service and training infrastructure.

Technological differentiation remains the central pillar of competition. New entrants are often focusing on niche surgical fields, such as orthopedic or neurosurgery, where traditional laparoscopic systems have limitations, by developing specialized robotic arms and instruments. For instance, some companies are prioritizing magnetic coupling technology for instruments, eliminating the need for bulky arms and increasing freedom of movement inside the patient. Others are concentrating on simplifying the user interface and reducing the steep learning curve associated with complex robotic surgery, aiming to make robotic assistance accessible to a wider pool of surgeons and hospitals. This continuous drive for innovation ensures that the market remains dynamic and responsive to evolving clinical demands, particularly the demand for smaller, smarter, and more integrated operative platforms.

In terms of regional competitive dynamics, while North America is dominated by established players, the APAC region is seeing fierce competition from local manufacturers in China and South Korea, who are developing platforms tailored to local price sensitivities and clinical environments. These regional players often benefit from favorable government policies and shorter regulatory approval times within their home countries, posing a serious long-term threat to global giants seeking penetration in high-growth Asian markets. Successful market penetration worldwide hinges on demonstrating clinical equivalence or superiority, backed by rigorous multi-center trials and publications, thereby addressing the evidence-based requirements of key opinion leaders and healthcare purchasing committees globally.

The ecosystem is further complicated by the entry of major diversified medical technology companies like Medtronic and Johnson & Johnson, leveraging their vast financial resources and established distribution channels in surgical instruments and devices. Their entry has intensified R&D spending across the board, forcing pure-play robotic companies to innovate faster or seek strategic partnerships. This competitive landscape ensures continuous downward pressure on the cost of instruments and accessories, benefiting end-users in the long run, and stimulating the development of open-architecture systems that are compatible with instruments from multiple vendors, challenging the historical closed-loop nature of robotic surgery platforms.

The increasing focus on value-based care models also shapes the competitive environment. Hospitals are increasingly evaluating robotic systems based on their return on investment (ROI), looking beyond clinical metrics to operational efficiency, reduced length of stay, and lower readmission rates enabled by robotic surgery. Manufacturers must therefore provide compelling economic data alongside clinical data, shifting the sales dialogue from a focus purely on technology features to a holistic discussion on total system economics and departmental throughput improvements. This strategic shift requires sales teams to be proficient not only in surgical technology but also in health economics and hospital administration processes, further segmenting the competitive skill set required for market success.

Furthermore, training and simulation technologies are becoming significant competitive differentiators. Companies that offer comprehensive, high-fidelity simulation programs and standardized credentialing pathways are preferred by hospitals, as they mitigate the risk associated with the steep learning curve of robotic surgery. Investment in virtual reality (VR) and augmented reality (AR) training modules is now essential, allowing surgeons to practice complex procedures without occupying the valuable time of the clinical robotic system. This focus on education and adoption support is critical for accelerating the utilization rate of installed systems, which directly correlates with the revenue generated from disposable instruments and accessories, solidifying the importance of the educational arm of the business strategy.

In summary, the Laparoscopy Surgical Robots Market is moving beyond initial monopolistic phases towards a highly competitive, multi-platform environment. Success is defined by a blend of technological innovation (AI, single-port systems), economic accessibility (TCO reduction, flexible financing), and robust supporting infrastructure (training, maintenance, and service). The global market share dynamics are constantly shifting as regional players gain prominence and large MedTech firms leverage their scale, ensuring a sustained period of high-intensity competition and accelerated technological advancement over the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager