Laptop Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431768 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Laptop Rental Market Size

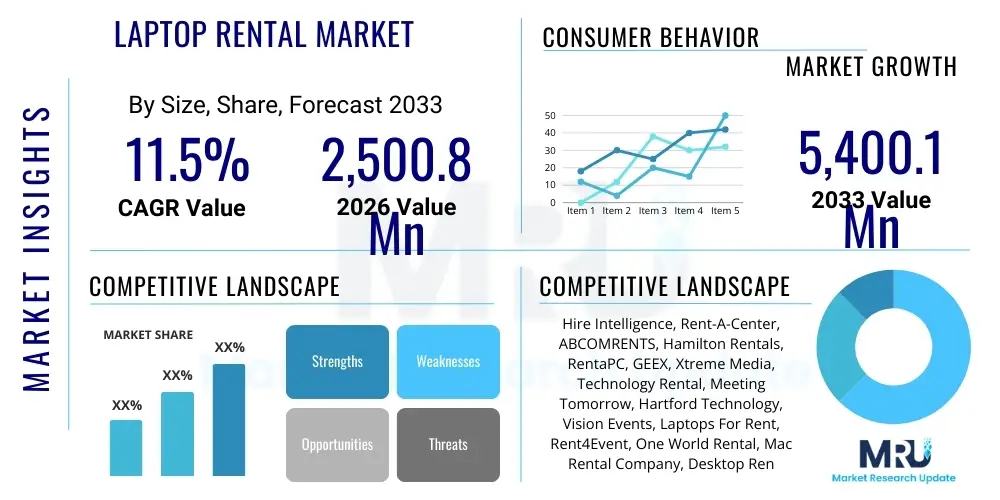

The Laptop Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $2,500.8 Million in 2026 and is projected to reach $5,400.1 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the evolving corporate landscape, marked by an increased reliance on flexible workforce models, including remote and hybrid work environments, which necessitate immediate, scalable access to high-quality computing equipment without significant capital expenditure.

Laptop Rental Market introduction

The Laptop Rental Market encompasses the provision of temporary access to computing devices for a specified duration, catering to diverse needs ranging from corporate training and event management to individual usage and startup requirements. This service model allows businesses and individuals to bypass the high initial investment associated with purchasing new hardware, offering operational flexibility, and ensuring access to the latest technological specifications critical for performance-intensive applications. The product description spans a variety of devices, including standard business notebooks, high-performance gaming laptops, and specialized workstations designed for graphic design or data processing, all offered under flexible leasing agreements that often include technical support and maintenance.

Major applications of laptop rental services include temporary office setups, large-scale educational programs, seasonal corporate demands, product launches, trade show exhibitions, and project-based staffing augmentation. The increasing trend of global companies establishing temporary project sites or needing hardware for short-term contractual employees significantly fuels demand. Furthermore, educational institutions leverage rentals during examination periods or for specialized courseware requiring specific hardware configurations, demonstrating the versatility and broad applicability of rental services across multiple sectors.

The primary benefits driving this market include superior cost-effectiveness, enhanced scalability, and the mitigation of technology obsolescence risk, as rental providers ensure their inventory is regularly updated. Key driving factors involve the accelerating pace of technological innovation, making frequent hardware upgrades financially burdensome for small and medium-sized enterprises (SMEs); the global shift towards "as-a-service" consumption models; and the increasing volatility in global supply chains, which makes immediate procurement of new equipment challenging. These factors collectively position laptop rental as a strategic operational choice rather than a mere tactical necessity.

Laptop Rental Market Executive Summary

The Laptop Rental Market exhibits robust growth propelled by major business trends centered around digital transformation and workforce decentralization. A critical trend is the burgeoning demand from the IT and Telecommunications sector, which frequently requires large batches of high-specification laptops for software development sprints and testing phases, often on short notice. Furthermore, the market is benefiting from the circular economy movement, as renting aligns with sustainability goals by extending the lifecycle of electronic devices. Businesses are increasingly integrating rental solutions into their permanent IT strategy, moving beyond traditional capital expenditure models to embrace Operating Expenditure (OpEx) strategies, improving liquidity and budgeting flexibility.

Regionally, North America continues its dominance, driven by early adoption of sophisticated rental models and a robust ecosystem of tech startups and corporate events requiring scalable IT infrastructure. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid industrialization, increasing penetration of remote work in densely populated countries like India and China, and significant governmental investment in digital education initiatives. Europe demonstrates steady growth, particularly due to stringent regulations regarding e-waste and the strong emphasis on flexible employment contracts, making equipment leasing an attractive compliance and operational solution.

Segmentation trends indicate a strong preference shift towards high-performance and business-grade laptops, especially those designed for demanding applications such as video editing, data analytics, and graphic intensive workloads. The short-term rental segment (daily/weekly) remains vital for event management and temporary assignments, while the long-term rental segment (6+ months) is seeing sustained growth driven by Enterprise subscription models offering full lifecycle management, including deployment, maintenance, and end-of-life logistics. This comprehensive service offering is cementing the rental model's competitive edge against outright purchase for corporate clients.

AI Impact Analysis on Laptop Rental Market

User queries regarding AI's influence on the Laptop Rental Market primarily focus on two dimensions: how AI applications will increase the demand for high-specification rental hardware, and how AI can optimize the rental operations themselves. Users are concerned about whether existing rental fleets can handle the computational load of emerging AI tools (like generative AI and complex machine learning models) and how AI might revolutionize predictive maintenance and dynamic pricing models within the rental sector. The synthesis of these common questions reveals a collective expectation that AI will intensify the need for performance-focused rentals (GPUs, powerful CPUs) while simultaneously enabling rental companies to achieve unprecedented efficiencies in inventory management, customer service through chatbots, and customized rental recommendations based on user project specifications.

- AI drives demand for specialized, high-performance laptops equipped with dedicated Graphics Processing Units (GPUs) essential for machine learning tasks and large data processing.

- Predictive maintenance powered by AI algorithms analyzes usage patterns to proactively service rental hardware, minimizing downtime and increasing equipment lifespan.

- AI-driven dynamic pricing models optimize rental rates in real-time based on inventory levels, market demand, geographical location, and current hardware specifications, maximizing revenue yield.

- AI enhances customer support through intelligent chatbots and virtual assistants, streamlining the booking process, technical troubleshooting, and contract management.

- Machine Learning (ML) algorithms improve inventory forecasting, accurately predicting future demand peaks for specific laptop models or configurations, thereby optimizing procurement strategies.

DRO & Impact Forces Of Laptop Rental Market

The Laptop Rental Market is governed by a critical interplay of Drivers, Restraints, and Opportunities, synthesized into powerful impact forces that shape market trajectory. A primary Driver is the increasing need for operational flexibility and cost optimization among enterprises, particularly SMEs and startups, who favor the OpEx model provided by rentals over large upfront capital expenditures (CapEx). This financial agility, coupled with the rapid evolution of technology necessitating frequent hardware refreshes, fundamentally underpins market growth. However, a significant Restraint is the prevailing security concern among clients regarding data integrity and security protocols on rented devices, necessitating robust data wiping and certification processes by rental providers. The inherent risk of hardware damage or loss during the rental period also poses a financial burden on providers.

Opportunities for growth are abundant, chiefly stemming from the untapped potential in the education technology (EdTech) sector, especially in developing economies where large-scale digital learning initiatives require temporary or subsidized equipment provision. Furthermore, the expansion of hybrid work models globally creates a continuous need for standardized, easily deployable, and managed IT equipment for remote employees. Impact Forces are concentrated around the convergence of economic pressure and technological necessity; the economic driver compels businesses to rent, while the technological driver ensures that only the latest specifications are demanded, forcing rental companies into consistent high-capital investment in cutting-edge inventory.

The overall impact forces are strongly positive, favoring market expansion. The strategic shift away from asset ownership towards access is a powerful, macroeconomic trend that transcends individual industry challenges. Rental providers that successfully mitigate the core restraint—data security—through advanced, certified sanitization protocols and comprehensive insurance offerings are best positioned to capitalize on the vast opportunities presented by globalization, workforce flexibility, and the accelerating demand for high-performance computing resources driven by AI and data analytics. The key market challenge lies in achieving efficient reverse logistics and rapid refurbishment cycles to maintain high inventory utilization rates.

Segmentation Analysis

Segmentation analysis provides a crucial breakdown of the Laptop Rental Market, differentiating demand based on hardware configuration, end-user industry, and duration of the rental agreement. Understanding these segments allows providers to tailor their inventory, pricing strategies, and service agreements to specific customer cohorts. The market is primarily segmented by Type (reflecting hardware specification), End-User (reflecting industry application), Rental Period (reflecting operational necessity), and Distribution Channel (reflecting customer access points).

The Type segment is becoming increasingly specialized, moving beyond simple consumer/business divisions to include performance metrics. For instance, the demand for gaming laptops is now paralleling corporate demand, driven by specialized fields like 3D rendering and professional esports events. Similarly, the End-User segmentation reveals the dominance of the Corporate/Enterprise segment, which demands managed services, followed closely by the rapidly growing Event Management sector, which requires bulk provisioning for short, intense durations. This diversification necessitates a sophisticated and varied inventory management system for major rental companies.

The distinction between short-term and long-term rentals is fundamental to profitability. Short-term rentals command higher daily rates but involve greater logistical complexity, while long-term rentals offer predictable recurring revenue but require more frequent maintenance cycles. Distribution channels are also evolving, with online portals gaining significant traction over traditional direct rental stores, reflecting the market’s movement towards digitally enabled, seamless booking, and delivery processes, emphasizing the role of e-commerce in service delivery.

- Type: Gaming Laptops, Business/Corporate Laptops, Standard Consumer Laptops, High-Performance Workstations (CAD/Data Analytics)

- End-User: Corporate/Enterprise (IT, Finance, Consulting), Educational Institutions (K-12, Higher Ed), Event Management & Exhibitions, Healthcare Sector, Media & Entertainment, Individual Users/Consumers

- Rental Period: Short-term (Daily, Weekly, Monthly), Medium-term (2-6 months), Long-term (6 months to 3 years)

- Distribution Channel: Online Rental Platforms, Direct Rental Stores/Outlets, Third-Party IT Resellers and Distributors

Value Chain Analysis For Laptop Rental Market

The value chain for the Laptop Rental Market is complex, involving hardware acquisition, meticulous inventory management, service provision, and end-of-life handling. Upstream analysis focuses on the procurement phase, where rental providers maintain strategic partnerships with Original Equipment Manufacturers (OEMs) like Dell, HP, Lenovo, and Apple. These relationships are critical for securing bulk discounts, ensuring prompt supply of the latest models, and obtaining favorable warranty and repair agreements. Efficiency in the upstream phase dictates the cost basis and technological competitiveness of the entire rental service, often requiring specialized contractual agreements to facilitate rapid equipment turnover.

The central phase involves operations and logistics, including device customization (software imaging, specific configurations), quality assurance testing, and warehousing. This is where significant value is added through certified data sanitization processes, which are non-negotiable for enterprise clients. The distribution channel analysis highlights the shift towards multi-channel strategies, combining direct sales teams focused on large corporate contracts with robust, user-friendly online booking portals for smaller, decentralized orders. Direct channels often handle complex, customized requests, while online platforms facilitate instantaneous price quotes and standardized rentals, driving volume.

Downstream analysis is characterized by customer service, maintenance, and reverse logistics. Maintenance is a significant value differentiator, often including 24/7 technical support and immediate equipment swap-outs. Reverse logistics, the process of recovering equipment after the rental term, is paramount for profitability. It involves meticulous tracking, thorough inspection, certified data wiping, repair, and refurbishment to prepare the device for the next rental cycle. This entire cycle is highly specialized and relies heavily on efficient supply chain management and technical expertise to minimize turnaround time and maximize the Return on Assets (ROA).

Laptop Rental Market Potential Customers

Potential customers for the Laptop Rental Market are diverse, spanning virtually every sector that requires temporary or scalable computing power. The most significant segment remains Corporate/Enterprise, including organizations in finance, consulting, and IT, which frequently require equipment for short-term projects, training programs, or managing employee onboarding/offboarding cycles. These buyers prioritize reliability, immediate availability of bulk orders, and guaranteed data security compliance, often necessitating contracts that include comprehensive IT asset management services rather than just hardware provision.

A rapidly expanding customer base includes Event Management companies and Exhibition Organizers. These end-users demand thousands of identical, pristine devices for trade shows, conferences, and large corporate meetings, typically needing them for durations of 3 to 10 days. Their buying criteria center on logistical proficiency, including delivery, setup, and on-site technical support provided by the rental company, underscoring a service-first requirement where the hardware is merely a component of a larger managed solution.

Furthermore, educational institutions and governmental bodies represent high-volume, potentially long-term buyers. Schools and universities utilize rentals to bridge the gap between permanent hardware purchases or to equip temporary learning centers, especially during shifts to remote learning mandates. Individual consumers and startup businesses also form a crucial segment, driven by budget constraints or the need for high-end equipment (like gaming laptops for development or VR projects) that they cannot justify purchasing outright. These customers primarily use online portals and prioritize competitive pricing and rapid fulfillment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2,500.8 Million |

| Market Forecast in 2033 | $5,400.1 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hire Intelligence, Rent-A-Center, ABCOMRENTS, Hamilton Rentals, RentaPC, GEEX, Xtreme Media, Technology Rental, Meeting Tomorrow, Hartford Technology, Vision Events, Laptops For Rent, Rent4Event, One World Rental, Mac Rental Company, Desktop Rental, PCH International, Computer Rental Solutions, RENT-ALL, and EZRentOut. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laptop Rental Market Key Technology Landscape

The technology landscape governing the Laptop Rental Market is multifaceted, extending far beyond the specifications of the rented hardware itself. Crucially, the focus has shifted to fleet management and service provision technologies. Advanced Asset Tracking Systems (ATS) utilizing RFID, GPS, and QR codes are essential for managing the vast, dispersed inventory across multiple locations, ensuring accurate logistical planning and minimizing loss. Furthermore, specialized enterprise resource planning (ERP) software tailored for rental operations manages the entire customer lifecycle, from contract generation and billing to maintenance scheduling and depreciation tracking, thereby streamlining operations and reducing administrative overhead.

Data security technology is paramount, driven by stringent corporate compliance requirements (such as GDPR and HIPAA). Rental providers increasingly rely on certified data wiping software (e.g., NIST 800-88 compliant solutions) to guarantee the complete and verifiable erasure of all data between rental periods. This technological assurance is a major selling point for enterprise clients concerned about proprietary information. The adoption of cloud-based inventory management tools also enables real-time visibility into stock levels, availability, and geographic distribution, allowing providers to fulfill urgent, large-scale orders efficiently across regional boundaries.

On the customer interface side, the adoption of Artificial Intelligence and Machine Learning (AI/ML) is enhancing the online booking experience. Technology is used to personalize recommendations for hardware configurations based on the stated end-use (e.g., recommending a specific GPU for a VR development project) and to optimize technical support through AI-powered diagnostics. Furthermore, the increasing requirement for Managed IT Services bundled with the rental—including Virtual Desktop Infrastructure (VDI) deployment and Mobile Device Management (MDM) solutions—necessitates that rental providers invest heavily in software integration expertise, turning them into IT service partners rather than just hardware providers.

Regional Highlights

Regional dynamics play a crucial role in shaping the Laptop Rental Market, reflecting differing economic maturity, technological adoption rates, and regulatory environments. North America maintains the largest market share, characterized by its mature business environment, high concentration of technology firms, and a culture of large-scale corporate events and trainings. The demand here is frequently centered on high-end, premium devices with complex software requirements, often driven by the robust IT and financial services sectors. The competitive landscape in the U.S. and Canada is highly fragmented, featuring both global giants and highly localized niche providers specializing in specific industry verticals.

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period. This rapid growth is attributable to fast-paced digitization across nations like India, China, and Southeast Asian countries, coupled with the establishment of new global manufacturing and R&D hubs. Governments in APAC are increasingly utilizing rental services for implementing large-scale educational and administrative digitalization projects. However, the market faces challenges related to diverse logistical infrastructures and varying levels of disposable income, leading to a strong demand for cost-effective, durable, and easily maintainable standard laptops for rental purposes.

Europe represents a stable and high-value market, primarily driven by corporate demand in Western economies (Germany, UK, France). European growth is underpinned by strict data protection laws (GDPR), which ironically favor certified rental providers who can guarantee secure data destruction, and a general emphasis on corporate sustainability, aligning with the circular economy model of renting. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, with growth concentrated around major economic centers (UAE, Brazil, Saudi Arabia). Demand in these regions is heavily influenced by the expansion of multinational corporations and the fluctuating nature of large infrastructure and energy projects requiring temporary IT setups.

- North America: Market leader, high demand for specialized and high-performance business laptops; strong growth driven by hybrid work and technology startups.

- Asia Pacific (APAC): Fastest growing region, fueled by governmental EdTech investments and corporate expansion; focus on scalability and cost-efficiency.

- Europe: Stable growth, driven by sustainability targets and regulatory requirements (GDPR); strong demand from corporate training and consulting firms.

- Latin America (LATAM): Emerging market potential, concentrated in Brazil and Mexico, linked to international business expansion and resource-intensive industries.

- Middle East and Africa (MEA): Growth driven by event hosting (e.g., expos, sporting events) and infrastructure projects, demanding short-term bulk rentals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laptop Rental Market.- Hire Intelligence

- Rent-A-Center

- ABCOMRENTS

- Hamilton Rentals

- RentaPC

- GEEX

- Xtreme Media

- Technology Rental

- Meeting Tomorrow

- Hartford Technology Rentals

- Vision Events

- Laptops For Rent

- Rent4Event

- One World Rental

- Mac Rental Company

- Desktop Rental

- PCH International

- Computer Rental Solutions

- RENT-ALL

- EZRentOut

Frequently Asked Questions

What is the primary factor driving the growth of the Laptop Rental Market?

The primary factor driving market growth is the widespread corporate shift from capital expenditure (CapEx) to operational expenditure (OpEx) models, coupled with the necessity for businesses to rapidly scale IT resources to support flexible, remote, and hybrid workforces without incurring debt associated with hardware procurement.

How does the Laptop Rental Market address concerns regarding data security?

Leading laptop rental providers mitigate data security concerns by implementing certified, multi-step data sanitization and wiping protocols, often adhering to global standards like NIST 800-88, ensuring that all client data is completely and verifiably erased before the device is released for subsequent rentals, supported by documentation of compliance.

Which segment of the Laptop Rental Market is expected to show the highest growth rate?

The Long-term Rental Period segment (six months or more) is expected to show substantial, sustained growth, driven by large enterprises subscribing to managed IT-as-a-Service models, seeking full lifecycle support—including deployment, maintenance, and regular tech refreshes—as a consistent operating cost.

What impact does Artificial Intelligence (AI) have on the future of laptop renting?

AI significantly impacts the market by increasing the demand for specialized, high-performance rental laptops equipped with dedicated GPUs needed for AI/ML development, while simultaneously optimizing rental company operations through AI-driven predictive maintenance, dynamic pricing, and efficient inventory management.

Which region currently holds the largest market share for laptop rental services?

North America currently holds the largest market share, attributed to the region’s mature economy, high concentration of technology-intensive businesses, robust corporate event ecosystem, and early adoption of flexible IT procurement strategies, focusing heavily on premium business-grade devices and high-quality managed services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager