Large Bore Vascular Closure System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435051 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Large Bore Vascular Closure System Market Size

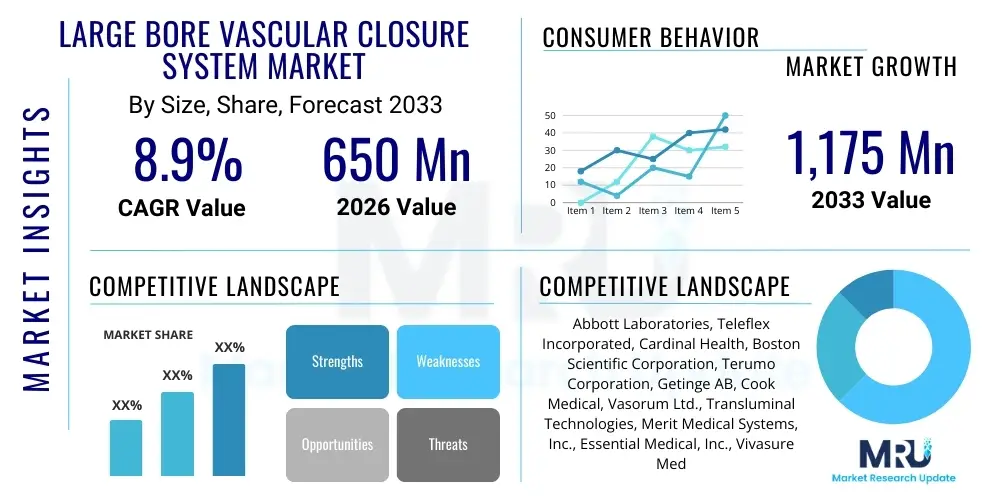

The Large Bore Vascular Closure System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,175 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the rising prevalence of structural heart interventions, such as Transcatheter Aortic Valve Implantation (TAVI) and Endovascular Aneurysm Repair (EVAR), which necessitate larger access sites, thereby increasing the demand for specialized closure technologies that minimize complications and improve patient recovery times.

Large Bore Vascular Closure System Market introduction

The Large Bore Vascular Closure System (VCS) Market encompasses devices designed specifically to achieve rapid and effective hemostasis following endovascular procedures requiring arterial or venous access sites greater than 8 French (Fr). These procedures, often related to complex cardiovascular and peripheral interventions, traditionally carried risks associated with manual compression, including prolonged patient immobilization and higher rates of access site complications like pseudoaneurysms or hematomas. Large bore VCS devices mitigate these risks by providing mechanical or bio-active closure, leading to faster ambulation and discharge, which is crucial in modern healthcare environments focused on efficiency and cost reduction.

Major applications for these sophisticated closure systems include TAVI/TAVR, EVAR, Thoracic Endovascular Aortic Repair (TEVAR), complex cardiac catheterizations, and ventricular assist device placements. The primary benefit of adopting these systems is the significant improvement in clinical outcomes, particularly reducing time to hemostasis and decreasing the overall incidence of major and minor access site complications compared to surgical cut-down or prolonged manual compression. The technological sophistication ranges from suture-mediated devices (like Perclose ProGlide) to collagen-plug systems and novel clip-based mechanisms.

Driving factors propelling market expansion include the global demographic shift toward an aging population, which inherently increases the incidence of cardiovascular diseases requiring large-bore interventions. Furthermore, continuous innovation in device design, focusing on ease of use, improved efficacy in calcified vessels, and compatibility with increasingly complex procedures, solidifies the market's growth. Regulatory approvals enabling broader adoption of minimally invasive techniques across emerging economies also contribute substantially to the expanding patient pool requiring advanced vascular closure solutions.

Large Bore Vascular Closure System Market Executive Summary

The Large Bore Vascular Closure System market is characterized by intense technological competition and a pronounced shift towards minimally invasive structural heart procedures. Business trends indicate strong emphasis on developing next-generation systems offering complete pre-closure capabilities and improved closure reliability across diverse vessel anatomies, particularly focusing on systems that handle challenging large-diameter access sites (14 Fr and above). Strategic mergers and acquisitions are common as established medical device giants seek to integrate specialized vascular closure technologies to complete their cardiovascular procedural portfolios, ensuring they offer comprehensive solutions from access to closure.

Geographically, North America currently dominates the market due to high procedure volumes, advanced healthcare infrastructure, and favorable reimbursement policies for complex interventional cardiology procedures. However, the Asia Pacific region is demonstrating the highest growth rates, fueled by increasing healthcare expenditure, rising awareness and adoption of TAVI procedures, and the establishment of dedicated cardiac centers in countries like China and India. European growth remains steady, driven by the strong clinical acceptance of established closure systems and consistent adoption of guideline-recommended practices.

Segment trends highlight the sustained dominance of suture-based closure systems, prized for their versatility and reliable mechanical closure, particularly in high-risk patients. However, plug-based systems are gaining traction due to their simpler deployment and ability to achieve rapid hemostasis. The hospital segment maintains the largest market share globally due to the resource requirements and complexity associated with large-bore procedures, though the rise of specialized Ambulatory Surgery Centers (ASCs) focused on less complex peripheral interventions is gradually impacting market distribution, demanding more cost-effective and streamlined closure options.

AI Impact Analysis on Large Bore Vascular Closure System Market

Common user inquiries regarding AI’s influence on the Large Bore Vascular Closure System (VCS) market predominantly focus on how predictive analytics can reduce access site complications, whether AI can optimize device selection based on patient anatomy (e.g., vessel calcification, tortuosity), and the potential for real-time procedural guidance to improve successful closure rates. Users also express interest in AI-driven training platforms for interventionalists learning large-bore closure techniques. Analysis reveals that key themes center on improving procedural precision, streamlining workflow, and moving from reactive complication management to proactive risk mitigation through enhanced imaging analysis and personalized closure planning. Users expect AI to reduce variability in clinical outcomes associated with operator experience in complex procedures like TAVI.

The immediate impact of Artificial Intelligence is manifesting primarily in the pre-procedural planning phase. Sophisticated AI algorithms are being integrated with CT and angiography data to create highly accurate 3D models of the access site, allowing physicians to precisely predict the optimal trajectory for catheter insertion and the most appropriate closure device size and type based on plaque burden and vessel diameter. This predictive capability minimizes the risk of vascular injury during access and optimizes the chances of successful hemostasis post-procedure. Additionally, machine learning is employed to analyze vast datasets of procedural outcomes, correlating closure success or failure with specific anatomical variables, thus refining best practices.

Furthermore, AI-enabled systems are starting to influence real-time procedural guidance. During deployment, image recognition software can assist in verifying the accurate positioning of the closure device components, ensuring proper tissue apposition and maximizing the likelihood of achieving primary hemostasis. This integrated intelligence not only enhances procedural safety but also shortens procedure times, which is a critical efficiency driver in high-volume catheterization labs. As AI tools become seamlessly embedded in imaging suites, they are set to significantly standardize and elevate the quality of large-bore vascular closure across different clinical settings.

- AI integration enhances pre-procedural planning by analyzing CT data for optimal access site and trajectory selection.

- Machine learning algorithms predict complication risk based on patient-specific vascular anatomy and procedural history.

- Real-time image analysis guided by AI assists in verifying precise closure device placement during deployment.

- AI-powered simulation and virtual reality platforms improve training and proficiency for new interventionalists using complex large-bore VCS.

- Predictive analytics optimize inventory management by correlating procedure type, patient demographics, and required closure system utilization.

DRO & Impact Forces Of Large Bore Vascular Closure System Market

The Large Bore Vascular Closure System Market is fundamentally driven by the escalating demand for minimally invasive structural heart and peripheral interventions, coupled with the proven clinical benefits of these systems in reducing access site complications and improving patient recovery. Restraints primarily involve the high cost of advanced closure devices compared to traditional manual compression methods, alongside the steep learning curve required for certain sophisticated systems. Significant opportunities lie in the expansion into emerging markets, the development of devices optimized for venous closure, and the creation of systems compatible with increasingly calcified and diseased vessels. These internal and external forces shape market competition, pricing strategies, and strategic investment decisions.

Impact forces are heavily weighted towards technological superiority and clinical evidence. The necessity for reliable, one-step closure solutions is a dominant force, pressuring manufacturers to constantly innovate and provide robust clinical data demonstrating non-inferiority or superiority to existing standards. Regulatory scrutiny and reimbursement policies act as critical external forces, dictating market access and commercial viability, particularly for premium-priced, complex devices. Competitive dynamics are fierce, driving continuous price erosion in mature segments while rewarding novel technologies that demonstrate significant value proposition in complex procedures, compelling players to maintain a high level of research and development investment.

The market also faces the continuous challenge of procedural complexity creep; as physicians attempt larger and more complex repairs (e.g., large-bore sheaths >18 Fr), existing closure systems may reach their technical limits, creating an imperative for the next generation of ultra-large bore systems. Furthermore, the rising awareness of radiation exposure during interventional procedures subtly drives demand for closure systems that minimize fluoroscopy time, aligning procedural efficiency with safety guidelines. The cumulative effect of these drivers, restraints, opportunities, and competitive pressures ensures a dynamic market focused intensely on improving patient throughput and clinical safety.

Segmentation Analysis

The Large Bore Vascular Closure System market is extensively segmented based on the type of product mechanism, the specific anatomical access site utilized during the procedure, and the end-use environment where the procedures are predominantly performed. Understanding these segmentations is critical for manufacturers to tailor their R&D and commercial strategies, addressing the specific clinical needs of interventional cardiologists, radiologists, and vascular surgeons. The product type segmentation reveals differences in efficacy, cost, and complexity, influencing preference based on operator skill and patient profile. The end-use environment, primarily hospitals versus ambulatory settings, dictates purchasing volume and price sensitivity, directly impacting market penetration strategies across different healthcare settings.

- By Product Type:

- Suture-Based Closure Systems (e.g., Perclose ProGlide)

- Plug-Based Closure Systems (e.g., Angio-Seal VIP)

- Clip-Based Closure Systems (e.g., FemoStop, MynxGrip)

- External Compression Devices (used adjunctively)

- By Access Site:

- Femoral Artery/Vein Access (Dominant segment due to TAVI/EVAR)

- Radial Artery Access (Emerging for smaller large-bore interventions)

- Other Access Sites (e.g., Subclavian, Axillary)

- By End-Use:

- Hospitals (Catheterization Labs and Operating Theatres)

- Ambulatory Surgery Centers (ASCs)

- Specialty Clinics

Value Chain Analysis For Large Bore Vascular Closure System Market

The value chain for the Large Bore Vascular Closure System market begins with the sophisticated design and material sourcing of bio-compatible polymers, titanium clips, and proprietary hemostatic agents (like collagen or PEG-based hydrogels). Upstream analysis involves raw material suppliers specializing in high-grade medical plastics and precision metal components, where stringent quality control is paramount due to the critical nature of the devices. Manufacturing involves precision engineering, sterilization, and complex assembly processes, typically performed in highly controlled environments. Key players often maintain robust in-house R&D capabilities to ensure continuous innovation and protection of proprietary technology patents, which are significant value creators.

The distribution channel is complex, relying heavily on specialized medical device distributors who possess strong relationships with hospital cath lab managers and interventional specialists. Direct sales forces are crucial for complex large-bore systems (like TAVI closure devices) to provide technical support, product training, and clinical demonstration to interventional teams. Indirect channels, including large Group Purchasing Organizations (GPOs), negotiate volume discounts, influencing purchasing decisions across vast hospital networks. Successful market penetration relies on effective training programs delivered through the distribution network, ensuring safe and effective utilization by end-users.

Downstream analysis focuses on the end-users: hospitals and specialized procedural centers. The value generated at this stage is primarily clinical—faster patient recovery, reduced complication rates, and operational efficiency (quicker turnover time in cath labs). Post-market surveillance and continuous feedback loops between manufacturers and clinicians are essential for iterative product improvements and demonstrating long-term safety and efficacy. Reimbursement policies significantly impact the final value capture, as favorable coverage for complex procedures that utilize large-bore closure devices drives demand and willingness to pay premium prices for superior technology.

Large Bore Vascular Closure System Market Potential Customers

Potential customers for Large Bore Vascular Closure Systems are primarily specialized healthcare institutions and medical professionals who routinely perform complex, minimally invasive cardiovascular and peripheral interventions requiring large arterial or venous access. The largest buyers are comprehensive cardiovascular centers and large teaching hospitals that operate high-volume cardiac catheterization laboratories and hybrid operating rooms. These facilities prioritize devices that offer high procedural success rates, minimize complications, and contribute to faster patient discharge, aligning with modern hospital efficiency metrics.

Within these institutions, the key decision-makers and users include interventional cardiologists (who perform TAVI, complex PCI), vascular surgeons (who perform EVAR, TEVAR), and interventional radiologists (who manage complex peripheral arterial disease and venous interventions). Purchasing decisions are heavily influenced by clinical efficacy data, ease of use, compatibility with various sheath sizes, and the overall cost-effectiveness, including the reduction in complication management expenses. Ambulatory Surgery Centers are emerging as important customers, especially for peripheral procedures that are increasingly moving out of traditional hospital settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,175 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Teleflex Incorporated, Cardinal Health, Boston Scientific Corporation, Terumo Corporation, Getinge AB, Cook Medical, Vasorum Ltd., Transluminal Technologies, Merit Medical Systems, Inc., Essential Medical, Inc., Vivasure Medical, Morris Innovative, Inc., BD, Medtronic, InSeal Medical, R. Bard (now part of BD), Advanced Access Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Large Bore Vascular Closure System Market Key Technology Landscape

The Large Bore Vascular Closure System market is characterized by a technologically diverse landscape dominated by three core mechanisms: suture-mediated, plug-mediated, and clip-mediated systems. Suture-mediated devices, such as the market-leading Perclose ProGlide, utilize specialized needles and delivery systems to place one or more sutures around the access site, providing reliable mechanical closure that remains effective even in calcified vessels. Recent advancements focus on refining these systems to enable ‘pre-closure’ techniques, where the device is deployed prior to inserting the large-bore sheath, ensuring immediate closure once the sheath is removed, significantly enhancing procedural efficiency and minimizing blood loss.

Plug-based systems typically utilize a bio-absorbable material, such as collagen or polyglycolic acid (PGA), which is deployed into the tissue track and against the arteriotomy wall to rapidly promote hemostasis through mechanical sealing and biological clotting cascade initiation. Technologies like Angio-Seal VIP and MYNX employ anchor mechanisms to secure the plug against the vessel wall, ensuring stability during the initial closure period. Innovation in this segment focuses on developing plugs with enhanced bio-absorption profiles and reduced foreign body reaction risk, while also improving the deployment mechanism to be more intuitive and less dependent on precise wire placement.

Clip-based systems, though less dominant in ultra-large bore cases, offer alternative mechanical closure using nitinol or other specialized alloy clips that directly cinch or secure the vessel wall. Emerging technologies are also exploring novel sealing agents, including hydrogel and sealant patches, often used in conjunction with existing mechanical closure methods to achieve a complete, watertight seal, particularly critical in high-pressure venous applications or patients on complex anticoagulant regimens. The general trajectory of technological advancement is miniaturization, improved compatibility with various vessel anatomies, and development of specialized systems for challenging access sites like the axillary or subclavial arteries, broadening the applicability beyond the traditional femoral route.

Regional Highlights

Regional dynamics heavily influence the adoption and growth rate of Large Bore Vascular Closure Systems, dictated by healthcare expenditure, prevalence of structural heart disease, and regulatory environments. North America, encompassing the United States and Canada, maintains its leadership position, primarily due to the high volume of TAVI, EVAR, and complex PCI procedures performed annually. Favorable and comprehensive reimbursement coverage for these specialized interventional procedures incentivizes hospitals to invest in premium closure technologies that demonstrate superior outcomes and reduce long-term costs associated with complication management. The presence of major market players and well-established clinical guidelines further supports continuous technological uptake.

Europe represents the second-largest market, characterized by mature healthcare systems in Western Europe (Germany, UK, France) that have rapidly adopted TAVI protocols. The European market, however, exhibits greater pricing sensitivity compared to the U.S., leading to stronger competition among manufacturers based on cost-efficacy rather than purely technological novelty. Eastern Europe is gradually expanding its utilization base as healthcare modernization allows for broader access to complex structural heart procedures. Regulatory clarity provided by the MDR (Medical Device Regulation) is also streamlining the introduction of advanced systems, although the process requires meticulous clinical validation.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is underpinned by massive investments in healthcare infrastructure across populous nations like China and India, the rising awareness of cardiovascular disease management, and the increasing affordability of complex procedures. While current procedural volumes are lower than in the West, the sheer size of the aging population susceptible to aortic stenosis and aneurysms presents an enormous untapped market potential. Latin America and the Middle East & Africa (MEA) remain smaller markets, constrained by limited healthcare access and lower reimbursement rates, focusing primarily on established, cost-effective closure solutions rather than the newest, most expensive innovations.

- North America (Dominant Market): High procedural volume of TAVI/EVAR; robust reimbursement framework; early adoption of next-generation closure systems. The U.S. drives the majority of R&D and revenue generation due to high healthcare spending.

- Europe (Steady Growth): Strong clinical acceptance of minimally invasive techniques; market growth concentrated in Western European countries; significant focus on cost-effectiveness and proven long-term clinical data.

- Asia Pacific (Fastest Growth): Rapidly expanding healthcare infrastructure; rising prevalence of chronic diseases; increased accessibility to advanced cardiovascular care in urban centers of China, India, and Japan.

- Latin America & MEA (Emerging Potential): Growth driven by expanding medical tourism and improving economic conditions; market focuses on addressing primary cardiovascular needs rather than early adoption of ultra-niche devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Large Bore Vascular Closure System Market.- Abbott Laboratories

- Teleflex Incorporated

- Cardinal Health

- Boston Scientific Corporation

- Terumo Corporation

- Getinge AB

- Cook Medical

- Vasorum Ltd.

- Transluminal Technologies

- Merit Medical Systems, Inc.

- Essential Medical, Inc. (now part of Teleflex)

- Vivasure Medical

- Morris Innovative, Inc.

- BD (Becton, Dickinson and Company)

- Medtronic Plc

- InSeal Medical

- Advanced Access Technologies

- Cardiva Medical, Inc. (acquired by Teleflex)

- PulseCath BV

- LivaNova PLC

Frequently Asked Questions

Analyze common user questions about the Large Bore Vascular Closure System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased adoption of Large Bore Vascular Closure Systems?

The primary driver is the significant rise in complex minimally invasive procedures, particularly Transcatheter Aortic Valve Implantation (TAVI) and Endovascular Aneurysm Repair (EVAR), which require large access sheaths (greater than 8 Fr). These systems reduce complications, improve patient recovery time, and enhance overall cath lab efficiency compared to manual compression.

How do suture-based systems compare to plug-based systems in clinical performance?

Suture-based systems (e.g., Perclose ProGlide) offer reliable mechanical closure, versatility across various vessel sizes, and are often preferred for challenging or calcified access sites. Plug-based systems (e.g., Angio-Seal) are typically faster to deploy and rely on bio-absorbable materials to achieve rapid hemostasis, leading to faster time to ambulation, though they may face limitations in highly diseased vessels.

Which geographical region leads the Large Bore Vascular Closure System market?

North America currently leads the market due to the high volume of advanced interventional procedures, established regulatory pathways, widespread adoption of premium closure devices, and robust reimbursement structures for structural heart interventions.

What are the key technological advancements expected in the coming years?

Future innovations will focus on dedicated venous closure systems, devices compatible with ultra-large sheaths (18 Fr and above), AI-assisted procedural guidance for optimal placement, and improved bio-absorbable materials that minimize long-term residual components in the vessel wall.

What are the main restraints impacting market growth?

The primary restraints include the high unit cost of advanced closure systems, which can limit adoption in budget-constrained settings, and the required learning curve for interventionalists to master the deployment techniques of newer, more complex mechanical systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager