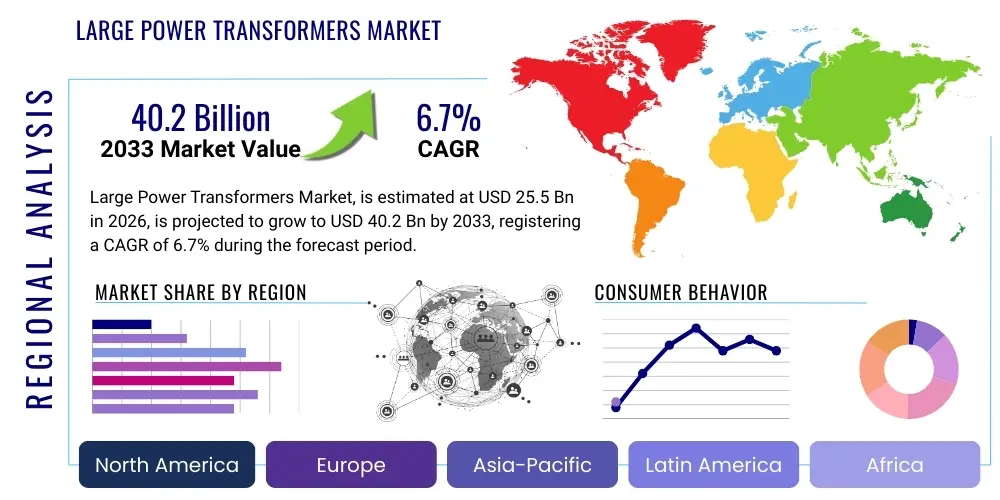

Large Power Transformers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439010 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Large Power Transformers Market Size

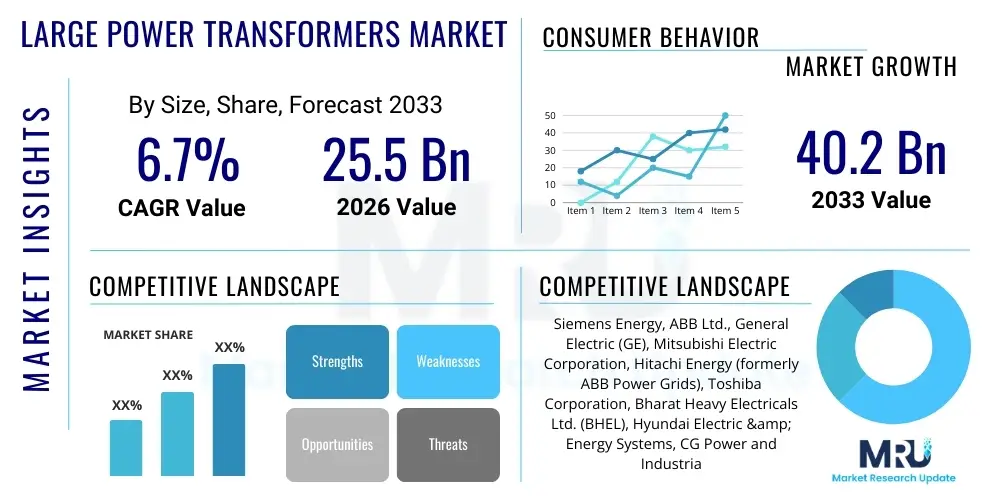

The Large Power Transformers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 40.2 Billion by the end of the forecast period in 2033.

Large Power Transformers Market introduction

The Large Power Transformers (LPT) market serves as the foundational backbone for high-voltage electricity transmission and distribution infrastructure globally. LPTs are crucial electrical devices utilized primarily in power generation stations and high-voltage substations to step up or step down voltage levels, facilitating efficient bulk transmission over long distances. These transformers typically operate at voltages above 200 MVA and are essential components for maintaining grid stability, reliability, and security across interconnected systems. The operational lifespan, stringent regulatory requirements, and high capital cost associated with LPTs make this market segment highly specialized and sensitive to macroeconomic and energy policy shifts.

The primary applications of LPTs span conventional power generation (coal, gas, nuclear), renewable energy integration (massive solar and offshore wind farms), and large industrial power consumers like metallurgical and chemical plants. Rapid industrialization, particularly in emerging economies of Asia Pacific, necessitates substantial investments in new transmission networks to meet surging energy demands. Furthermore, the global drive towards grid modernization and the replacement of aging infrastructure in developed regions, some of which utilize transformers installed decades ago, fuel replacement and refurbishment cycles, contributing significantly to market volume. The necessity to upgrade infrastructure to handle bidirectional power flow, necessitated by distributed generation, further reinforces steady demand for these high-capacity units.

The immediate benefits of deploying modern LPTs include enhanced energy efficiency through reduced core and winding losses, improved reliability, and smart grid compatibility, enabling remote monitoring and predictive maintenance. Key driving factors stimulating market growth involve massive government investments in ultra-high voltage (UHV) transmission lines to minimize transmission losses, the necessity to integrate intermittent renewable energy sources into the main grid, and the expansion of cross-border grid interconnections to optimize resource sharing and prevent blackouts. These systemic drivers ensure sustained demand for high-capacity, specialized transformer units capable of managing diverse load profiles and operating under extreme conditions and are crucial for meeting national carbon reduction targets.

Large Power Transformers Market Executive Summary

The global Large Power Transformers market is characterized by significant capital expenditure requirements, driven largely by grid expansion projects mandated by national energy security policies and the increasing penetration of renewable energy sources. Current business trends indicate a strong shift towards optimizing transformer design for reduced environmental impact, focusing on solutions such as ester fluid insulation and enhanced fire safety measures. The market structure remains highly consolidated, with key players investing heavily in smart manufacturing technologies, including IoT integration and advanced sensor deployment, to enhance product monitoring capabilities and predictive fault detection, thereby extending asset life and minimizing operational disruptions for utilities. Competition is intensely focused on product quality, reliability metrics, and the ability to deliver customized, large-scale projects within tight logistical and timeline constraints.

Regionally, the Asia Pacific (APAC) stands out as the predominant growth engine, primarily fueled by substantial infrastructure developments in China and India aimed at rural electrification and connecting vast power generation facilities to major consumption centers using UHV technology. This technological leap allows for the transmission of power over thousands of kilometers with significantly reduced line losses. North America and Europe, while representing mature markets, are experiencing stable demand driven by mandatory replacement cycles for aging equipment and the urgent need for grid hardening against physical and cyber threats, necessitating substantial investment in resilient and digitally enabled LPTs. Furthermore, the establishment of ambitious cross-continental power corridors, such as those linking the Middle East and Europe, underscore the long-term regional stability required for sustained LPT deployment and large-scale energy trading.

Segment trends reveal that the demand for transformers rated above 800 MVA is accelerating due to the proliferation of Extra High Voltage (EHV) and UHV transmission lines, designed to handle immense power flow efficiently over expansive distances. Insulation type analysis indicates a continued reliance on oil-immersed transformers due to their proven performance and cost-effectiveness in large outdoor substations, although dry-type alternatives are gaining traction in critical indoor or confined substations where fire hazard mitigation and simplified maintenance are paramount. The utility sector remains the largest consumer segment, dictating stringent quality, safety, and reliability standards, which in turn influences the manufacturing processes and the rapid adoption rates of cutting-edge technologies like digital substations and advanced asset health monitoring systems across the entire LPT supply chain.

AI Impact Analysis on Large Power Transformers Market

Common user questions regarding AI's influence in the Large Power Transformers market often center on maintenance efficiency, lifespan prediction, and grid optimization. Users frequently ask: How can AI prevent unexpected transformer failures? What role does machine learning play in optimizing transformer loading during peak demand? And how will AI affect the design and manufacturing lead times of these large, complex assets? The analysis reveals a clear expectation that AI will transition LPT management from scheduled, time-based preventative maintenance to sophisticated, predictive, condition-based maintenance (CBM). Key themes include reducing catastrophic downtime, improving asset utilization through real-time operational optimization based on complex load models, and utilizing historical operational data combined with environmental factors to forecast potential failure modes accurately, thereby extending service life and lowering the total cost of ownership (TCO) for utility operators globally.

AI and machine learning algorithms are pivotal in processing the massive influx of structured and unstructured data generated by advanced sensors integrated within modern LPTs, monitoring complex parameters such as dissolved gas analysis (DGA) profiles, localized partial discharge characteristics, winding vibration patterns, and nuanced temperature gradients within the core and oil. By establishing precise baseline operational norms and detecting subtle, multivariate anomalies that often precede catastrophic failure, AI systems enable precise, surgical, and targeted interventions, minimizing unnecessary maintenance costs, optimizing resource allocation, and maximizing grid reliability across vast, complex networks. This capability fundamentally transforms the reliability engineering aspect of LPT asset management, offering proactive resilience against unforeseen operational stress.

Furthermore, the application of AI extends into the highly specialized domains of transformer engineering and supply chain management. AI is increasingly being employed during the initial design phase through advanced generative design tools to rapidly optimize electromagnetic characteristics, thermal dissipation performance, and material usage, particularly for the core and windings. This technological integration leads to the design of transformers that are not only lighter and more energy-efficient but also quicker to produce by streamlining complex engineering iterations. In the supply chain, AI models enhance forecasting accuracy for specialized components, such as high-grade electrical steel, helping manufacturers mitigate risks associated with long lead times and volatile raw material prices, ultimately improving project delivery timeliness and cost predictability.

- AI enhances Predictive Maintenance (PdM) schedules by analyzing vast datasets from integrated sensors (DGA, thermal imagery, vibration) to precisely forecast insulation and winding deterioration rates.

- Machine learning models optimize complex transformer loading, voltage regulation, and tap changing operations in real-time, dynamically adjusting to fluctuating grid demand, weather conditions, and renewable energy input variability.

- Generative design and advanced simulation powered by AI expedite the product Research & Development cycle, leading to optimized electromagnetic design, reduced material cost, and compliance with stringent energy efficiency standards.

- AI-driven anomaly detection improves both operational safety and cybersecurity for connected LPTs by rapidly identifying unauthorized access attempts, data breaches, or critical performance deviations that could lead to cascading failures.

- Natural Language Processing (NLP) is used for efficient organization, categorization, and analysis of extensive historical failure reports, maintenance logs, and engineering documents across global utility fleets, improving knowledge sharing and fleet management strategies.

DRO & Impact Forces Of Large Power Transformers Market

The market for Large Power Transformers is strongly influenced by critical demand-side drivers, significant operational constraints, and transformative technological opportunities, all governed by impactful external forces such as stringent regulatory mandates and evolving geopolitical stability. Primary drivers include the aggressive global integration of utility-scale renewable energy projects (e.g., massive offshore wind farms requiring specialized High-Voltage Direct Current (HVDC) converter transformers) and the urgent requirement for industrialized nations to modernize and expand their aging transmission and distribution infrastructure to handle increasing power density. Concurrently, the necessity for grid resilience against severe climate events and mandatory capacity upgrades to facilitate interconnection necessitate continuous investment in new LPT units.

Conversely, the market faces considerable restraints rooted in the lengthy and inflexible manufacturing lead times, which often stretch 18 to 36 months, making utilities vulnerable to supply chain disruptions. Further constraints include the market's reliance on specialized, high-quality raw materials (such as grain-oriented electrical steel and high-purity copper), whose pricing is highly volatile and susceptible to global commodity market speculation and trade tariffs. Additionally, the extremely high capital investment required for both LPT production facilities and utility installation projects, coupled with complex regulatory approval processes, can slow down procurement cycles and make the market sensitive to prevailing interest rate environments and government fiscal policies.

Opportunities for sustained growth are concentrated around the swift development and adoption of smart, resilient grid solutions utilizing advanced materials and digitalization. Strategic opportunities involve the continued expansion into rapidly urbanizing and industrializing emerging markets requiring foundational infrastructure build-out. Specific technological opportunities include the potential commercialization of Superconducting Power Transformers (SPT) for urban areas where footprint is severely constrained, and the wholesale adoption of digitized substations utilizing standardized communication protocols (IEC 61850). The competitive landscape is shaped by powerful impact forces including stringent governmental regulations concerning transformer energy efficiency standards (e.g., EU Ecodesign directives), acute volatility in key commodity prices, and the ongoing critical shortage of highly skilled technical expertise required for the complex installation, commissioning, and servicing of these specialized assets, which poses a significant barrier to expansion for new entrants.

Segmentation Analysis

The Large Power Transformers market segmentation provides a granular view of demand based on technical specifications, voltage levels, application areas, and insulation media, enabling stakeholders to accurately forecast demand and target strategic investments. Understanding these segments is crucial as different end-users, primarily utilities and large industrial operators, have highly distinct requirements regarding capacity, physical footprint constraints, environmental resilience, and required operational reliability metrics. Key segments analyzed include voltage ratings (e.g., 200 MVA to 800 MVA, and above 800 MVA), which directly correlate with the sophistication and scale of the transmission network they serve, and insulation type, which reflects critical safety and environmental considerations required at the specific installation site, such as proximity to populated areas or sensitive ecosystems.

The segmentation by application highlights the structural shift in global investment priorities; while conventional power generation and existing grid replacement remain a foundational, steady segment, the fastest and most aggressive growth is observed in the renewable energy integration sector, demanding highly customized transformers resilient to intermittent power fluctuations, dynamic voltage conditions, and the stresses of bidirectional power flow. Furthermore, the segmentation by installation type (oil-immersed versus dry-type) remains critically important, largely dictated by stringent fire safety and maintenance regulations, especially in densely populated urban substations, complex underground installations, or industrial environments where oil spillage or fire risk must be minimized through the use of non-flammable insulation technologies.

Strategic planning requires leading manufacturers to prioritize platform designs and component standardization across these demanding segments to achieve necessary economies of scale, despite the fundamentally bespoke nature of many high-voltage projects. The segment analysis confirms that future market value creation will be increasingly concentrated in the UHV and UHVDC segments, demanding manufacturers push the boundaries of materials science and thermal management to handle immense power throughput efficiently while maintaining the 99.9% reliability required by modern grid operators navigating the energy transition.

- By Voltage Rating:

- 200 MVA – 500 MVA (High Voltage Transmission)

- 501 MVA – 800 MVA (Extra High Voltage - EHV applications)

- Above 800 MVA (Ultra High Voltage - UHV applications)

- By Installation Type:

- Oil-Immersed (Standard utility and large outdoor substations)

- Dry-Type (Specialized indoor or confined spaces)

- By Application:

- Utility & Grid (Power Generation Step-up, Transmission Substation, Distribution Bulk Feed)

- Industrial (Metals & Mining, Oil & Gas, Chemical Processing, Heavy Manufacturing)

- Renewable Energy Integration (Solar Parks, Offshore and Onshore Wind Farms, Hydroelectric Dams)

- By Insulation Type:

- Mineral Oil (Traditional and most common)

- Ester Fluids (Natural and Synthetic - increasing due to fire safety and environmental benefits)

- Silicone Fluid (Niche applications requiring non-flammability)

Value Chain Analysis For Large Power Transformers Market

The intricate value chain for the Large Power Transformers market commences with the upstream procurement of highly specialized, quality-assured raw materials, which is a critical point of potential risk and leverage. Key inputs primarily focus on high-permeability, high-quality grain-oriented electrical steel (the magnetic core material), copper or aluminum conductors (used for high-current windings), and advanced insulating materials (such as cellulosic paper, porcelain bushings, and dielectric fluid). Suppliers of these niche, technically demanding components wield significant leverage due to the strict performance and quality requirements, specialized production techniques, and often limited global capacity for high-grade electrical steel, which frequently dictates overall transformer lead times and final manufacturing costs.

The core manufacturing process constitutes the most capital-intensive segment of the value chain, involving complex engineering design, precision winding of conductors, meticulous core assembly, tanking, vacuum drying, and rigorous final type testing in specialized high-voltage laboratories. This stage requires immense investment in specialized plant equipment, advanced robotics, and highly skilled engineering labor. Direct distribution dominates the market structure, involving the sale of LPTs directly to major governmental utility companies, national transmission system operators (TSOs), or large Engineering, Procurement, and Construction (EPC) firms responsible for building large power plants and substations. This direct relationship is necessary due to the requirement for customized specifications and integrated project management.

Downstream analysis focuses heavily on sophisticated transport logistics, complex installation, commissioning, and long-term service agreements (LSAs). Given the massive size and weight of LPTs, transportation to remote substation sites often requires specialized heavy-lift rigging and transport permits, frequently facilitated and managed by the manufacturer. Post-installation, the focus shifts decisively to asset performance management, which increasingly relies on advanced condition monitoring, predictive analytics, and proactive refurbishment programs. This downstream service segment is becoming increasingly lucrative, driven by the widespread adoption of digital twin technology and the utility sector's growing preference for comprehensive lifecycle management contracts to ensure sustained grid reliability over decades, effectively locking in long-term revenue streams for manufacturers.

Large Power Transformers Market Potential Customers

The primary and largest consumers and end-users of Large Power Transformers are integrated electric utilities, national grid operators (TSOs/DSOs), and regional power authorities responsible for the generation, transmission, and distribution of bulk electricity. These governmental or quasi-governmental entities require LPTs for stepping up voltage levels at power generation sites for efficient transmission across long distances and subsequently stepping them down at Extra-High Voltage (EHV) and Ultra-High Voltage (UHV) substations near major consumption centers. Utility purchasing decisions are strategically critical, based heavily on adherence to strict national reliability and environmental standards, expected asset longevity (often 30+ years), and the availability of robust financing and maintenance support for these multi-million dollar, mission-critical capital assets.

A second major and rapidly expanding segment comprises large Independent Power Producers (IPPs) and specialized developers operating utility-scale renewable energy farms, such as expansive photovoltaic (PV) solar parks, concentrated solar thermal plants, and extensive onshore and offshore wind farms. These developers require highly robust, often customized LPTs and converter transformers to aggregate the generated power and transfer it effectively into the main national transmission grid, demanding high efficiency and resilience to dynamic power generation profiles. The demand from this sector is characterized by project-based, cyclical purchasing tied to global energy investment policies.

Furthermore, major industrial facilities requiring extremely high and dedicated power feeds also constitute significant, though localized, buyers. This includes large-scale energy-intensive complexes such as primary metallurgical smelting operations (aluminum, steel), expansive chemical and petrochemical processing plants, and mining sites with heavy-duty operational loads. These customers often demand custom-built transformers optimized specifically for continuous, heavy-duty operational cycles, tolerance to harmonic distortions, and severe environmental conditions, such as high heat, dust, or corrosive atmospheres.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 40.2 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, ABB Ltd., General Electric (GE), Mitsubishi Electric Corporation, Hitachi Energy (formerly ABB Power Grids), Toshiba Corporation, Bharat Heavy Electricals Ltd. (BHEL), Hyundai Electric & Energy Systems, CG Power and Industrial Solutions, Hyosung Heavy Industries, TBEA Co., Ltd., China XD Group, Shuntong Electric, Prolec GE, Schneider Electric, SGB-SMIT Group, VTC Transformer Corporation, Wilson Power Solutions, WEG S.A., Fuji Electric Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Large Power Transformers Market Key Technology Landscape

The technology landscape for Large Power Transformers is rapidly evolving, driven primarily by the critical need for enhanced operational efficiency, higher power density within constrained footprints, and significantly improved environmental compatibility profiles. A major and highly capital-intensive area of technological focus is the continuous development and commercialization of Ultra-High Voltage Direct Current (UHVDC) converter transformers. These highly specialized components are absolutely essential for reliably transmitting massive quantities of power over intercontinental distances with minimum resistance and loss, making them crucial for linking remote mega-scale renewable energy sources (such as desert solar or distant offshore wind) to densely populated urban load centers across continents.

Another crucial technological shift involves the comprehensive integration of advanced digital monitoring and sophisticated diagnostic systems, fundamentally transforming LPTs into 'smart assets' fully compliant with the Industrial Internet of Things (IIoT). This advanced monitoring includes the routine deployment of fiber optic temperature sensors for precise thermal mapping, continuous online Dissolved Gas Analysis (DGA) monitors for real-time fault precursor detection, and high-frequency integrated Partial Discharge (PD) measurement systems. These sophisticated technologies, often managed through standardized communication protocols like IEC 61850, enable precise, real-time operational assessment, allowing utilities to move away from disruptive, time-based maintenance models toward highly efficient, targeted predictive maintenance strategies, significantly bolstering system reliability and extending the transformer's expected operational life.

Furthermore, significant technological investment is directed toward innovations in materials science aimed at achieving sustainability and superior performance. The global adoption of alternative dielectric fluids, specifically natural and synthetic ester oils, is gaining considerable traction due to their dramatically superior fire resistance (high flash point) and complete biodegradability compared to conventional mineral oil. This addresses critical environmental liability and fire safety concerns, especially paramount in installations within densely populated urban environments or ecologically sensitive zones. Concurrent research and development efforts include the utilization of amorphous metal cores in specific designs to drastically reduce no-load losses, thereby improving lifetime efficiency, though prevailing material costs and complex manufacturing requirements currently limit widespread adoption to specific, smaller-scale distribution applications, paving the way for eventual high-MVA application breakthroughs through process optimization.

Regional Highlights

Regional dynamics play a pivotal and highly influential role in shaping the demand patterns, competitive structure, and technological focus of the Large Power Transformers market. These regional characteristics reflect fundamental differences in grid maturity, the regulatory landscape, national energy security priorities, and primary energy consumption patterns, providing essential insights into where major capital investment and infrastructure projects are currently concentrated.

- Asia Pacific (APAC): Dominates the global market in terms of volume and new installations, driven by relentless industrialization, rapid urbanization, and highly aggressive government targets for large-scale grid expansion and the integration of new renewable energy capacity. Countries like China and India are global leaders in developing and deploying massive Ultra-High Voltage Alternating Current (UHVAC) and UHVDC infrastructure, which creates immense, continuous demand for large, specialized LPTs rated above 800 MVA. The sustained push for rural electrification and the construction of new mega-cities sustains exceptionally high market growth rates and technological demand.

- North America: Characterized primarily by high replacement demand for an extensive aging transformer fleet, with many units nearing or exceeding their projected operational lifespan. The strategic focus is heavily centered on grid modernization, enhancing physical resilience against increasing extreme weather events, and securing infrastructure against sophisticated cyber threats. Regulations promoting stringent energy efficiency standards (Tier 2 and Tier 3) and the strategic placement of advanced, monitored LPTs for cybersecurity are critical regional purchasing drivers, requiring substantial, consistent capital deployment by major utilities.

- Europe: The market is fundamentally driven by the ambitious European energy transition, specifically the large-scale integration of distant offshore wind farms and the strategic development of cross-border interconnectors aimed at creating a unified, synchronized European electricity market. Strict environmental directives and safety regulations mandate the rapid adoption of eco-friendly and fire-safe solutions, such as non-mineral oil-based dielectric fluids (ester fluids), making technological compliance and sustainability metrics paramount regional purchasing criteria. Germany, the UK, and the Nordic countries are major hubs for high-capacity LPT installations supporting these green initiatives.

- Latin America (LATAM): Growth in this region is tightly tied to the development of critical infrastructure in major resource-rich areas, particularly those associated with large-scale mining operations and extensive hydroelectric power generation projects. While investment stability can be cyclical and sensitive to regional economic performance, the long-term underlying demand remains positive due to rapidly rising electricity access needs and the urgent necessity to transport power efficiently and reliably from often remote generation sites across challenging terrain to burgeoning urban centers.

- Middle East and Africa (MEA): Demand is strongly propelled by rapid population growth, substantial industrial diversification efforts (reducing reliance on fossil fuels), and ambitious, large-scale solar power and energy city projects. Countries in the GCC region are investing heavily in establishing highly sophisticated regional power grids, strengthening interconnections, and supporting complex smart city initiatives, all of which require substantial quantities of high-MVA transformers for voltage stabilization, bulk power transfer, and efficient distribution within highly temperature-stressed environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Large Power Transformers Market.- Siemens Energy

- ABB Ltd.

- General Electric (GE)

- Mitsubishi Electric Corporation

- Hitachi Energy (formerly ABB Power Grids)

- Toshiba Corporation

- Bharat Heavy Electricals Ltd. (BHEL)

- Hyundai Electric & Energy Systems

- CG Power and Industrial Solutions

- Hyosung Heavy Industries

- TBEA Co., Ltd.

- China XD Group

- Shuntong Electric

- Prolec GE

- Schneider Electric

- SGB-SMIT Group

- WEG S.A.

- Fuji Electric Co., Ltd.

- Tirupati Forge Limited

- VTC Transformer Corporation

Frequently Asked Questions

Analyze common user questions about the Large Power Transformers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Large Power Transformers market?

The market growth is fundamentally driven by global grid modernization efforts, substantial investments in Ultra-High Voltage (UHV) transmission infrastructure, and the necessity to integrate large-scale, often remote, renewable energy generation assets like offshore wind and large solar farms into existing electricity grids, ensuring stable and reliable bulk power delivery.

How does the integration of smart grid technology affect Large Power Transformer design?

Smart grid integration mandates that LPTs are equipped with advanced sensors (DGA, thermal, vibration) and digital communication capabilities (IEC 61850 protocol). This facilitates real-time condition monitoring, remote diagnostics, and predictive maintenance (PdM), drastically improving asset reliability, reducing unplanned outages, and optimizing operational efficiency for utility companies.

What are the major challenges facing the Large Power Transformers manufacturing sector?

Key challenges include maintaining highly specialized global supply chains, particularly for critical components like high-quality grain-oriented electrical steel, managing the typically long manufacturing lead times (18–36 months), and navigating intense price volatility in raw materials such as copper and crude oil derivatives used in insulation systems.

Which region holds the largest market share and why is it dominant?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly driven by rapid urbanization and aggressive infrastructure development programs in emerging economies like China and India. These nations are prioritizing the construction of new UHV transmission lines to connect their expanding generation capacity efficiently to burgeoning industrial and residential load centers across vast distances.

What role do ester fluids play in modern Large Power Transformers?

Ester fluids (natural and synthetic) are increasingly adopted as replacements for traditional mineral oil because they offer superior environmental benefits (biodegradability) and enhanced safety features, notably a much higher fire point. This makes them highly preferred for installations in environmentally sensitive areas or densely populated urban substations where fire mitigation and safety compliance are critical.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager