Laser Annealing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433416 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Laser Annealing Equipment Market Size

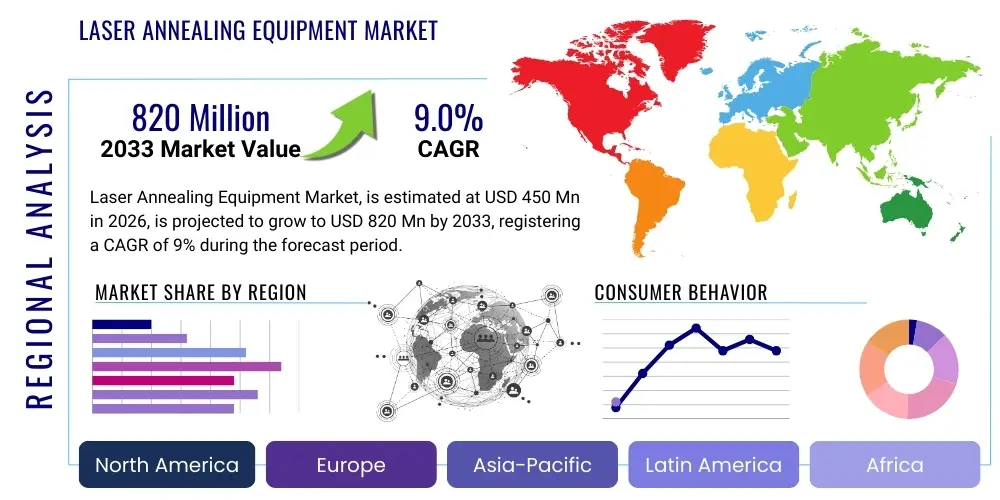

The Laser Annealing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.0% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 820 Million by the end of the forecast period in 2033.

This robust growth trajectory is primarily fueled by the accelerating global demand for high-resolution displays, particularly Organic Light Emitting Diode (OLED) screens, which heavily rely on advanced laser annealing processes for manufacturing Low-Temperature Polycrystalline Silicon (LTPS) backplanes. Laser annealing technology provides superior control over crystallization morphology and defect reduction compared to conventional thermal annealing methods, making it indispensable for next-generation display and semiconductor fabrication, ensuring high electron mobility and reduced power consumption in thin-film transistors (TFTs).

Furthermore, the persistent miniaturization trend in semiconductor devices and the necessity for precise doping activation in advanced logic and memory chips are compelling manufacturers to adopt sophisticated laser annealing systems. These systems, utilizing technologies such as Excimer Laser Annealing (ELA) and solid-state lasers, are crucial for achieving ultra-shallow junctions and repairing silicon damage induced during the ion implantation process without subjecting the entire substrate to high temperatures. The increasing investment in new fabrication facilities (fabs) across Asia Pacific, particularly in Taiwan, South Korea, and China, further solidifies the market’s expansion potential during the forecast period.

Laser Annealing Equipment Market introduction

Laser Annealing Equipment constitutes highly specialized industrial machinery designed to rapidly heat and cool material surfaces, predominantly silicon films and semiconductor wafers, using high-intensity laser pulses to modify their structural and electrical properties. The process, known as laser annealing, is essential for crystallizing amorphous silicon into polycrystalline silicon (poly-Si), activating dopants, and repairing lattice damage in semiconductor fabrication and flat-panel display manufacturing. Major applications include the production of LTPS backplanes for OLED and advanced LCD displays, the creation of ultra-shallow junctions in integrated circuits (ICs), and the improvement of efficiency in crystalline silicon photovoltaic cells. The primary benefits include precise temperature control, localized heating, minimal thermal budget impact on the surrounding substrate, and enhanced electrical performance of the fabricated devices, which are critical factors driving the adoption of this capital-intensive equipment in high-tech manufacturing environments.

Laser Annealing Equipment Market Executive Summary

The Laser Annealing Equipment Market is experiencing substantial momentum driven by fundamental shifts in consumer electronics and semiconductor technology, characterized by the mass adoption of OLED displays and the move toward sub-10nm nodes in IC manufacturing. Business trends indicate a focus on developing higher energy density and large-area processing capabilities to accommodate Gen 8.5 and Gen 10.5 display substrates and 300mm semiconductor wafers, leading to strategic collaborations between laser system providers and equipment integrators. Segment trends highlight the dominance of Excimer Laser Annealing (ELA) technology, particularly within the display sector, while Solid-State Laser Annealing (SLA) is gaining traction in specific semiconductor applications requiring continuous wave or scanned beam annealing. Regionally, Asia Pacific maintains its undisputed leadership, accounting for the vast majority of consumption and production capacity, primarily due to the concentration of major display and semiconductor fabrication hubs in countries such as South Korea, China, and Taiwan, which are aggressively expanding their manufacturing footprints to meet global electronic demand.

AI Impact Analysis on Laser Annealing Equipment Market

User inquiries regarding AI's influence on the Laser Annealing Equipment Market frequently center on themes of process optimization, predictive maintenance, and enhancing yield management in high-volume manufacturing (HVM) environments. Users are primarily concerned with how AI can minimize expensive downtime, improve the consistency and uniformity of the annealing process across large substrates, and facilitate the real-time adjustment of complex laser parameters (such as fluence, pulse duration, and scanning speed). Key expectations include the deployment of machine learning algorithms to analyze massive datasets generated by in-situ monitoring systems, enabling proactive fault detection and significantly accelerating the qualification time for new materials and processes. This integration moves laser annealing from a purely hardware-dependent operation to a highly intelligent, data-driven manufacturing step, thereby boosting overall equipment effectiveness (OEE) and reducing operational variability inherent in high-precision microfabrication.

- AI-Powered Process Control: Machine learning algorithms optimize laser parameters in real-time to ensure uniform energy delivery and crystallization across vast substrate areas, minimizing defects related to beam overlap and energy fluctuation.

- Predictive Maintenance (PdM): AI models analyze vibration, temperature, and laser output stability data from critical components (e.g., optics, power supplies) to predict potential failures, significantly reducing unplanned equipment downtime and maintenance costs.

- Yield Enhancement: Deep learning analyzes wafer map data post-annealing to correlate specific process variations with device performance, leading to closed-loop feedback systems that refine annealing recipes automatically for optimal yield.

- Automated Defect Classification (ADC): AI improves the speed and accuracy of identifying microscopic defects resulting from the annealing process, allowing for faster root cause analysis and corrective action implementation.

- Digital Twin Simulation: AI aids in creating high-fidelity digital models of the laser annealing process, allowing manufacturers to simulate complex material interactions and test new process recipes virtually before deploying them on expensive production tools.

- Supply Chain Optimization: AI integration assists in forecasting demand for consumables (e.g., excimer gas mixes, optical components) based on production schedules and predicted equipment wear rates, ensuring material availability.

DRO & Impact Forces Of Laser Annealing Equipment Market

The Laser Annealing Equipment Market is fundamentally shaped by a confluence of technological necessities, cost constraints, and rapid innovation cycles in adjacent industries. Key drivers include the overwhelming shift towards OLED displays, which necessitates LTPS crystallization achievable almost exclusively through ELA, and the persistent drive within the semiconductor industry for advanced thermal budgets compatible with high-k metal gate structures and FinFET/GAA transistor architectures. Restraints are primarily centered on the high capital expenditure required for acquiring and maintaining these sophisticated laser systems, the scarcity of highly skilled technicians capable of operating and tuning them, and the intense competition from alternative, albeit less precise, thermal processing methods. Opportunities emerge from the potential integration of laser annealing into emerging areas like flexible electronics, advanced packaging (heterogeneous integration), and the production of microLED displays. These forces collectively dictate the market dynamics, pushing innovation toward higher throughput, enhanced uniformity, and reduced operational complexity, ensuring that only specialized players can effectively meet the rigorous demands of leading semiconductor and display fabricators globally.

Segmentation Analysis

The Laser Annealing Equipment Market is meticulously segmented based on the underlying technology type, the application for which the annealing process is utilized, and the specific end-user industry procuring the equipment. Technological differentiation, particularly between Excimer Laser Annealing (ELA) and Solid-State Laser Annealing (SLA), represents a critical market divide, as each technology caters to distinct process requirements regarding energy density, penetration depth, and substrate size capabilities. Application segmentation, such as LTPS fabrication versus ultra-shallow junction formation, highlights the precision and specialization embedded in the machinery. Furthermore, the market structure is heavily influenced by the end-user landscape, where Display Manufacturing consistently holds the largest share due to continuous investment in new-generation OLED and advanced panel fabrication lines, followed closely by the high-value Semiconductor Foundries segment which mandates extreme precision for critical doping activation steps.

- By Technology Type:

- Excimer Laser Annealing (ELA)

- Solid-State Laser Annealing (SLA) (e.g., Diode-Pumped Solid-State Lasers)

- By Application:

- Low-Temperature Polycrystalline Silicon (LTPS) Fabrication

- Oxide Thin-Film Transistor (TFT) Processing

- Ultra-Shallow Junction (USJ) Formation

- Crystalline Silicon (c-Si) Photovoltaic Cell Production

- Advanced Memory Fabrication (e.g., MRAM, PCRAM)

- By End-User Industry:

- Display Manufacturing (OLED, Advanced LCD)

- Semiconductor Foundries and Integrated Device Manufacturers (IDMs)

- Research and Development Institutions

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Laser Annealing Equipment Market

The value chain for Laser Annealing Equipment is complex and highly concentrated, beginning with upstream raw material suppliers providing specialized optical components, high-power lasers (e.g., excimer gas components, solid-state laser crystals), and precision motion control systems. Midstream activities involve highly specialized equipment manufacturers who design, assemble, and integrate these components into full annealing systems, requiring significant intellectual property and engineering expertise. Downstream, the distribution channel is primarily direct, involving original equipment manufacturers (OEMs) selling and servicing their systems directly to large, captive end-users such as Tier 1 display makers (Samsung Display, LG Display) and leading semiconductor foundries (TSMC, Intel, Samsung Electronics). Indirect channels may involve third-party integration specialists or regional representatives, especially for smaller market participants or after-sales service provisioning, but direct engagement ensures technical synergy and customized solution delivery crucial for process sensitive equipment.

Laser Annealing Equipment Market Potential Customers

Potential customers for Laser Annealing Equipment are predominantly large-scale, high-technology manufacturers whose production processes mandate extremely precise material modification at the nanoscale, particularly where traditional furnace annealing is either too slow, too damaging to thermal budget-sensitive structures, or incapable of achieving the required uniformity and crystal quality. The primary buyer segment consists of panel manufacturers investing heavily in cutting-edge Gen 6, Gen 8.5, and Gen 10.5 OLED production lines, where ELA is a non-negotiable step for producing reliable LTPS backplanes that ensure high refresh rates and clarity. Additionally, leading global semiconductor foundries and Integrated Device Manufacturers (IDMs) represent crucial clientele, utilizing advanced laser annealing solutions to enable the fabrication of high-performance microprocessors, specialized memory components, and power devices, where defect management and precise dopant activation are paramount to achieving target yields and device specifications in advanced nodes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 820 Million |

| Growth Rate | 9.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veeco Instruments (formerly Ultratech), Applied Materials, Coherent Corp., DISCO Corporation, Ushio Inc., Han's Laser, Rorze Corporation, SCREEN Holdings, Hitachi High-Tech, SUSS MicroTec, EV Group (EVG), KLA Corporation, MKS Instruments, Novanta, Trumpf, IPG Photonics, JenaTec, ADT Corp, ASML (indirectly via lithography focus), Lasertec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Annealing Equipment Market Key Technology Landscape

The technological backbone of the Laser Annealing Equipment market is defined by the precise control and generation of high-energy pulsed laser beams designed to deliver thermal energy in extremely short durations (nanoseconds or picoseconds) to specific material layers. Excimer Laser Annealing (ELA), primarily utilizing Xenon Chloride (XeCl) or Krypton Fluoride (KrF) gas mixtures, remains the dominant technology for large-area crystallization in display manufacturing due to its capability to deliver highly uniform, short pulses across vast substrate sizes, crucial for high-quality LTPS formation. Conversely, Solid-State Laser Annealing (SLA) systems, often employing scanned continuous-wave or high-repetition pulsed solid-state lasers (e.g., frequency-doubled Nd:YAG), are increasingly utilized in specific semiconductor applications for ultra-shallow junction activation, offering different thermal profiles and processing speeds suitable for smaller, high-density wafer processing. Continuous innovation focuses on improving laser source reliability, enhancing beam homogenization optics for superior uniformity, and integrating advanced in-situ metrology systems for real-time process monitoring and feedback control, ensuring process repeatability and maximal yield across different manufacturing platforms.

Regional Highlights

The global market for Laser Annealing Equipment exhibits significant regional disparity in terms of manufacturing capacity, investment intensity, and technological adoption, largely reflecting the geographical distribution of the world's leading semiconductor and display fabrication facilities. Asia Pacific (APAC) is overwhelmingly the primary market for laser annealing equipment, driving both demand and technological advancements. This dominance stems from South Korea, China, and Taiwan hosting the majority of the world's advanced OLED and semiconductor manufacturing centers, which continuously invest in Gen 6 and Gen 8.5 display lines and sophisticated semiconductor fabs to maintain their competitive edge. The substantial government subsidies and private sector focus on becoming self-sufficient in advanced panel and chip production in countries like China further fuels the deployment of these capital-intensive tools across APAC.

North America and Europe constitute secondary, yet highly important, markets characterized primarily by intensive research and development activities, the presence of major equipment manufacturers, and localized high-value semiconductor production (e.g., niche memory and specialized ICs). While the sheer volume of equipment deployed in these regions is smaller than in APAC, North America remains critical for the development and supply of cutting-edge laser sources and advanced metrology components crucial to the overall ecosystem. European markets, particularly Germany, focus on precision engineering and specialized equipment manufacturing, contributing significantly to the supply chain components and innovative laser techniques applied in power electronics and automotive semiconductor sectors.

The Middle East and Africa (MEA) and Latin America currently represent nascent markets for laser annealing equipment, with demand primarily concentrated in specialized solar cell production facilities and academic research institutions. However, future growth potential exists as developing economies in these regions begin establishing localized semiconductor assembly and advanced packaging facilities, requiring precise thermal treatment capabilities. This phased regional adoption underscores the market's close correlation with global capital expenditure cycles in the display and semiconductor industries, where APAC dictates the volume and pace of growth for the foreseeable future.

- Asia Pacific (APAC): Dominates the market due to massive investments in OLED display production (South Korea, China) and advanced semiconductor fabs (Taiwan). This region is the primary consumer and technology adopter.

- North America: Key center for technological innovation and the headquarters of major equipment suppliers. Demand is driven by R&D, advanced memory manufacturing, and specialized semiconductor foundries.

- Europe: Focuses on supplying precision laser components, specialized optics, and equipment for power electronics and automotive semiconductors. Growth is stable but lower volume than APAC.

- Latin America and MEA: Emerging markets with slow adoption, primarily driven by localized photovoltaic projects and early-stage electronics assembly operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Annealing Equipment Market.- Veeco Instruments (formerly Ultratech)

- Applied Materials, Inc.

- Coherent Corp.

- DISCO Corporation

- Ushio Inc.

- Han's Laser Technology Industry Group Co., Ltd.

- Rorze Corporation

- SCREEN Holdings Co., Ltd.

- Hitachi High-Tech Corporation

- SUSS MicroTec SE

- EV Group (EVG)

- KLA Corporation

- MKS Instruments, Inc.

- Novanta Inc.

- Trumpf GmbH + Co. KG

- IPG Photonics Corporation

- JenaTec GmbH

- ADT Corp.

- Samsung Electronics (Internal manufacturing capabilities)

- Tokyo Electron Limited (TEL) (Indirect presence through thermal processing)

Frequently Asked Questions

Analyze common user questions about the Laser Anneeling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is laser annealing and why is it essential for OLED display manufacturing?

Laser annealing is a precise thermal processing technique utilizing high-energy laser pulses to rapidly heat and recrystallize amorphous silicon films into high-performance Low-Temperature Polycrystalline Silicon (LTPS). This process is essential for OLED manufacturing because LTPS provides the high electron mobility required for the thin-film transistors (TFTs) that drive the individual pixels in high-resolution, power-efficient displays.

How do Excimer Laser Annealing (ELA) and Solid-State Laser Annealing (SLA) differ in application?

ELA systems, using short-wavelength gas lasers, deliver large, uniform beams necessary for crystallizing large-area substrates (e.g., Gen 8.5 glass panels) typically used in display manufacturing. SLA, employing high-power solid-state lasers with scanning capabilities, is generally favored in specific semiconductor fabrication steps like ultra-shallow junction activation on smaller, highly dense silicon wafers, where precise, localized heat delivery is prioritized.

Which geographical region dominates the consumption of Laser Annealing Equipment?

The Asia Pacific (APAC) region, specifically South Korea, China, and Taiwan, dominates the consumption of laser annealing equipment. This is directly correlated with the concentration of the world’s largest and most technologically advanced display panel manufacturers and semiconductor foundries, which are the primary end-users of this specialized machinery.

What are the primary factors restraining the growth of the Laser Annealing Equipment Market?

The primary restraining factors include the extremely high initial capital investment required for purchasing and installing advanced laser annealing systems (CapEx), the complexity associated with their maintenance and tuning, and the persistent technical challenge of ensuring absolute beam uniformity across increasingly larger substrates without inducing localized material defects.

How does laser annealing contribute to advanced semiconductor fabrication, such as in ultra-shallow junctions?

In advanced semiconductor nodes, laser annealing is critical for activating dopant atoms implanted into the silicon lattice to form ultra-shallow junctions (USJs) in transistors. The localized, non-equilibrium heating prevents dopant diffusion, maintaining the sharp junction profiles required for high-speed performance, which traditional furnace annealing cannot achieve without compromising device structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager