Laser Crystal Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436749 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Laser Crystal Materials Market Size

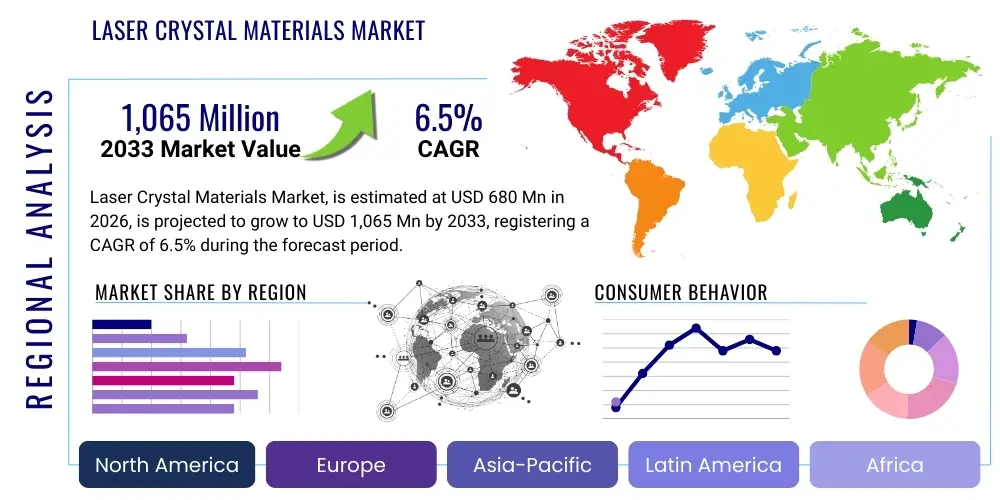

The Laser Crystal Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 680 Million in 2026 and is projected to reach USD 1,065 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the escalating adoption of solid-state lasers across high-precision industrial manufacturing sectors, coupled with significant advancements in defense and aerospace applications requiring robust, high-power laser systems. The shift towards higher efficiency and smaller form factor laser components further necessitates advanced crystalline materials that can handle increased thermal loads and maintain superior optical performance, driving innovation and expansion within the materials segment. Furthermore, the miniaturization trends in consumer electronics manufacturing, particularly for display processing and complex surface modifications, significantly contribute to the specialized demand for precise laser crystal products.

Laser Crystal Materials Market introduction

The Laser Crystal Materials Market encompasses sophisticated crystalline structures specifically engineered for solid-state laser systems, serving as the gain medium where population inversion occurs and stimulated emission generates coherent light. These materials, such as Neodymium-doped Yttrium Aluminum Garnet (Nd:YAG), Ytterbium-doped YAG (Yb:YAG), and various doped Vanadates, are fundamental to modern photonics, characterized by exceptionally high optical quality, low scattering losses, high damage thresholds, and superior thermal management capabilities. Their primary function is to efficiently convert input pump energy (usually from diode lasers) into laser light at specific, desired wavelengths. The successful functioning of any solid-state laser hinges entirely on the perfection and uniformity of these gain media, making their manufacturing a highly technical and specialized field involving complex growth processes like Czochralski or Liquid Phase Epitaxy (LPE).

Major applications of laser crystal materials span diverse high-tech industries. In industrial manufacturing, they are indispensable for precision tasks such as micro-welding, high-speed cutting of metals and composites, surface treatment, and laser marking, driven by the need for higher throughput and reduced tolerances. In the medical sector, these crystals are crucial components in surgical lasers (e.g., ophthalmic procedures, dermatology) and advanced diagnostic equipment, where high reliability and specific wavelength outputs are mandatory. Defense and aerospace sectors utilize them extensively in range-finding systems, targeting illuminators, and high-energy directed energy weapons (DEW), demanding extremely high output power and ruggedness under severe operating conditions. The benefits derived from these materials include high energy conversion efficiency, excellent beam quality (M2 value), long operational lifetimes, and the capability to generate extremely short pulses (femtoseconds or picoseconds) essential for advanced scientific research and delicate material processing, collectively driving the technological progression in laser-based technologies.

Laser Crystal Materials Market Executive Summary

The Laser Crystal Materials Market is experiencing robust growth driven primarily by expanding industrial automation and the increasing deployment of high-power fiber and solid-state lasers across Asia Pacific manufacturing hubs. Current business trends indicate a strong move toward Ytterbium-doped materials (Yb:YAG) due to their higher quantum efficiency and suitability for diode pumping, optimizing cost-effectiveness and system compactness, a critical factor for Original Equipment Manufacturers (OEMs). Furthermore, significant investment in developing novel materials, such as ceramic laser crystals, promises improved thermal properties and larger aperture sizes compared to traditional single crystals, addressing the power scaling limitations inherent in certain application fields. Geographically, Asia Pacific, specifically China and South Korea, dominates consumption owing to their expansive electronics and automotive manufacturing bases, while North America leads in research and defense applications, generating demand for highly specialized and proprietary crystal compositions.

Segment trends highlight the dominance of the Neodymium-doped (Nd-doped) segment, particularly Nd:YAG, which remains the workhorse for medium-power industrial applications, although its market share is gradually being eroded by Yb-doped crystals in high-power continuous wave (CW) systems. By application, the Industrial Processing segment holds the largest share, benefiting from global trends toward Industry 4.0 and the adoption of laser-based additive manufacturing (3D printing). The Medical and Healthcare segment shows the fastest growth rate, fueled by advancements in non-invasive surgical techniques utilizing precision laser delivery systems. Regulatory landscapes across Europe and North America enforce stringent quality standards, indirectly supporting manufacturers capable of producing defect-free, high-homogeneity crystals, thereby shaping the competitive dynamics and favoring established suppliers with mature crystal growth expertise and advanced characterization facilities.

AI Impact Analysis on Laser Crystal Materials Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Laser Crystal Materials Market typically center on how AI can optimize the notoriously complex and sensitive crystal growth process, predict material defects before physical testing, and accelerate the discovery of new compositions. Users frequently inquire about the feasibility of using machine learning (ML) models to control parameters such as temperature gradients, pull rates, and rotation speeds in Czochralski furnaces to maximize crystal yield and minimize optical imperfections, which directly impact laser performance and material cost. Another key concern relates to AI's role in predictive maintenance for high-end laser systems, where material degradation or thermal lensing effects caused by crystal stress could be anticipated and mitigated, extending the operational life of expensive laser modules. The overriding expectation is that AI integration will fundamentally shorten the material development lifecycle, transitioning crystal manufacturing from an empirical art to a highly predictive, data-driven science, lowering production variability and accelerating market introduction of next-generation gain media.

- AI-driven optimization of crystal growth parameters (e.g., Czochralski method) to enhance homogeneity and reduce defect rates.

- Machine learning algorithms applied to spectroscopic data for rapid, non-destructive quality inspection and characterization of crystal impurities.

- Accelerated discovery and screening of novel laser host materials and dopant combinations through computational materials science (AI/ML simulations).

- Predictive maintenance using AI for monitoring thermal stress and optical performance degradation in laser crystals during operation, preventing catastrophic failure.

- Automation of laser crystal polishing and fabrication processes using computer vision and robotic systems guided by AI to achieve nanometer-scale precision.

DRO & Impact Forces Of Laser Crystal Materials Market

The Laser Crystal Materials Market is significantly shaped by a confluence of accelerating drivers, structural restraints, and emerging opportunities, collectively defining the market's trajectory. Key drivers include the relentless global expansion of industrial laser processing, particularly in automotive, aerospace, and semiconductor manufacturing, demanding higher output power and better beam quality that only advanced crystals can provide. Furthermore, the massive investment in defense technology worldwide, focused on developing high-energy laser systems (HELs) for missile defense and surveillance, mandates the continuous development of robust, damage-resistant materials. Conversely, the market faces significant restraints, primarily the high capital expenditure required for sophisticated crystal growth facilities, long production cycles (often spanning several weeks for a single large crystal), and the highly technical expertise needed to ensure the optical purity and homogeneity required for laser-grade performance. These factors contribute to high material costs and supply chain constraints, especially for niche or specialized crystal types.

Opportunities in the market center around the development of ceramic laser crystals, which promise scalable, cost-effective alternatives to traditional single crystals, offering superior thermal characteristics and the ability to fabricate large-aperture materials easily. The burgeoning field of ultrafast optics, utilized in medical imaging, precision micro-machining, and advanced scientific research, creates a distinct demand niche for materials optimized for short-pulse generation (e.g., Ti:Sapphire replacements and specialized Yb-doped crystals). Impact forces influencing the market structure are primarily technological and regulatory. Technological advancements in diode pump sources are constantly raising the power handling requirements for crystal materials, while stringent quality standards, particularly in medical and defense sectors, act as a barrier to entry, favoring established manufacturers. Global economic volatility and geopolitical risks affecting the supply of rare earth elements (dopants like Neodymium and Ytterbium) also pose significant, albeit fluctuating, impact forces on raw material pricing and strategic supply security for crystal manufacturers globally.

Segmentation Analysis

The Laser Crystal Materials Market is comprehensively segmented based on material type, dopant, application, and end-user, reflecting the diverse technical requirements across the photonics landscape. Analyzing these segments provides critical insights into specific growth pockets and technological preferences. The core differentiation lies between established materials, such as Nd:YAG and its variants, which dominate conventional industrial applications due to their proven reliability, and emerging materials like Yb-doped crystals and complex Tantalate or Vanadate structures, which are gaining traction in high-efficiency, high-power systems. The segmentation by application clearly shows the influence of large-scale industrial sectors versus the highly specialized, high-margin needs of scientific research and defense, dictating material specifications and production volumes, thereby allowing market players to strategically focus their material synthesis and fabrication efforts to maximize return on investment.

- By Material Type:

- Nd:YAG (Neodymium-doped Yttrium Aluminum Garnet)

- Yb:YAG (Ytterbium-doped Yttrium Aluminum Garnet)

- Ti:Sapphire (Titanium-doped Sapphire)

- Erbium-doped Crystals (Er:YAG, Er:Glass)

- Holmium-doped Crystals (Ho:YAG)

- Vanadate Crystals (Nd:YVO4)

- Ceramic Laser Crystals

- By Application:

- Industrial Processing (Cutting, Welding, Marking, Micro-machining)

- Medical and Healthcare (Ophthalmology, Dermatology, Surgery)

- Defense and Aerospace (Rangefinders, Targeting, Directed Energy Weapons)

- Research and Development (Spectroscopy, Ultrafast Physics)

- Telecommunications

- By End User:

- Laser System Manufacturers

- OEMs and Integrators

- Research Institutions and Universities

- Government and Defense Agencies

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Laser Crystal Materials Market

The value chain for the Laser Crystal Materials Market begins with the highly specialized upstream analysis, focused on the sourcing and purification of raw materials, primarily high-purity rare-earth oxides (Neodymium, Ytterbium, Erbium) and host crystal precursors (Yttrium Oxide, Aluminum Oxide). This upstream segment is characterized by high technical barriers and strategic reliance on geopolitical stability, as China dominates the rare-earth supply chain. The most critical step in the value chain is the manufacturing of the laser crystal itself, involving energy-intensive and time-consuming techniques such as the Czochralski method, Liquid Phase Epitaxy, or hydrothermal growth, followed by extensive post-growth processing, including annealing, grinding, precision polishing, and optical coating application, where quality control determines final product yield and performance specifications.

Moving downstream, the distribution channel is highly specialized and often involves direct engagement between the crystal manufacturer and the ultimate buyer, typically sophisticated laser system OEMs (Original Equipment Manufacturers). Due to the high value, fragility, and precise performance requirements of these components, indirect distribution through generalized distributors is minimal, ensuring technical support and clear traceability. Direct sales channels are preferred for high-volume or custom specifications, especially for defense and scientific research clients who require proprietary material compositions or unique geometries. Indirect channels, mainly specialized optical component distributors, manage smaller volume standard components used in R&D or low-power medical devices. The final downstream users are the system integrators who incorporate the finished crystals into complete laser devices, ranging from large industrial platforms to compact medical units, highlighting the necessity for tight collaboration across the entire value chain to ensure compatibility and system optimization.

Laser Crystal Materials Market Potential Customers

Potential customers for the Laser Crystal Materials Market are primarily large-scale Original Equipment Manufacturers (OEMs) specializing in the production of solid-state and ultrafast laser systems, who require consistently high-quality gain media in substantial quantities for mass production and global distribution. These OEMs serve industrial automation, semiconductor fabrication, and automotive manufacturing, utilizing laser crystals for high-precision, non-contact material modification and processing. Secondary but equally critical customers include global defense contractors and government research laboratories, which demand bespoke, highly robust crystals optimized for extreme environmental conditions and high-energy applications, such as directed energy weapons and advanced military sensing platforms, often requiring specialized coatings and complex geometries that necessitate long-term supplier relationships and proprietary technology sharing.

Additionally, the customer base encompasses smaller, specialized technology integrators and scientific research institutions. Technology integrators focus on niche markets like medical aesthetics, dental surgery, and customized laser marking systems, demanding application-specific crystals (e.g., Er:YAG for medical procedures requiring specific absorption wavelengths). Research institutions and major universities represent consistent buyers of specialized, often custom-grown, low-volume crystals for fundamental physics research, materials science investigation, and the development of next-generation laser architectures. These buyers place a high premium on technical specifications, homogeneity, and material characterization data, driving the market toward ultra-high purity materials and advanced quality control protocols, ensuring that the crystalline components meet the exacting standards of both commercial robustness and fundamental scientific accuracy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 680 Million |

| Market Forecast in 2033 | USD 1,065 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Northrop Grumman Synoptics, CRYTUR, Saint-Gobain Crystals, CASTECH, Inrad Optics, G&H (Gooch & Housego), Coherent, Inc., Fujian Crystal Material, Altechna, Eksma Optics, FEE GmbH, Laser Components, Shanghai Institute of Optics and Fine Mechanics (SIOM), RIKEN, Heraeus, Beijing Opto-Electronics Technology, Crystal Systems, Cilas, AOG Crystal. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Crystal Materials Market Key Technology Landscape

The technology landscape governing the Laser Crystal Materials Market is defined by the sophisticated methods used for crystal growth and subsequent precision fabrication. The prevailing technique remains the Czochralski method, which is highly effective for growing large, high-quality single crystals like Nd:YAG and Yb:YAG, but demands extremely precise control over melt temperature, pulling speed, and rotation to manage thermal gradients and prevent defect formation. Alternative methods, such as the Floating Zone technique and the Bridgman method, are employed for specific material chemistries or geometries where Czochralski might be unsuitable, offering advantages in purity or ability to handle incongruent melts. Significant technological advancement is currently focused on enhancing yield and reducing the manufacturing cost, including the use of advanced inert atmosphere furnaces and multi-zone thermal control systems to achieve unparalleled crystal perfection necessary for ultra-high power and ultrafast applications, pushing the damage threshold limits of the final component.

A second major technological area involves the transition toward ceramic laser materials, which utilize solid-state reaction sintering processes instead of traditional melt growth. Ceramic laser crystals, such as Nd:YAG ceramics, offer compelling advantages including uniform doping over large volumes, ease of mass production, and the ability to fabricate complex-shaped, large-aperture materials relatively quickly and at a potentially lower cost compared to single crystals. Furthermore, the finishing processes are critical, involving proprietary techniques for ultra-smooth surface polishing (achieving surface roughness less than 0.5 nm) and the application of highly durable, low-loss anti-reflective (AR) and high-reflective (HR) coatings. Advancements in thin-disk laser technology, which relies heavily on high-quality Yb:YAG crystals bonded to highly conductive heat sinks, further drive technological requirements for improved thermal management techniques and novel crystal-bonding methodologies, ensuring the integrity and longevity of the laser gain medium under extreme operating conditions within compact high-efficiency systems.

Regional Highlights

The global market for laser crystal materials exhibits distinct consumption and production patterns across major geographic regions, primarily influenced by industrial capacity and strategic government spending. Asia Pacific (APAC) stands out as the dominant region, both in terms of production volume and demand, driven by its expansive and rapidly growing electronics, automotive, and general manufacturing industries, which are heavy users of industrial laser processing equipment. Countries like China, Japan, and South Korea not only host major manufacturing hubs but also possess significant domestic capacity for crystal material production, capitalizing on lower labor costs and integrated supply chains. This region’s demand is strongly focused on high-volume, reliable materials such as Nd:YAG and Yb:YAG necessary for general industrial cutting and marking applications, alongside increasing interest in highly efficient components for new energy vehicle battery production.

North America and Europe represent the mature markets, characterized by high technological sophistication and intense demand for specialized, high-performance materials. North America, driven by significant defense and aerospace expenditure (particularly in the United States), leads the consumption of highly specified, low-volume crystals for military and high-energy physics research, placing a premium on proprietary materials like Ti:Sapphire and custom-doped compositions with exceptional thermal properties and damage thresholds. Europe, with strong industrial automation and major medical device manufacturers, focuses on stringent quality control for materials used in medical lasers and high-precision scientific instruments. While APAC drives volume growth, North America and Europe define the technological edge, dictating the trends for next-generation material specifications and demanding stringent compliance with international quality standards (ISO certification) for laser crystals used in regulated medical and safety-critical environments.

- Asia Pacific (APAC): Dominates manufacturing and consumption, driven by electronics, automotive, and heavy industry; fastest growth rate expected due to industrial automation trends, particularly in China and South Korea, focusing on volume production of standard crystal types.

- North America: Leader in R&D and defense applications; high demand for specialized, high-cost materials (e.g., Ti:Sapphire, high-purity Yb:YAG) for Directed Energy Weapons (DEW) and advanced scientific research; strong presence of key crystal technology developers.

- Europe: Mature market focused on industrial micromachining, medical device manufacturing, and adherence to strict quality protocols; key markets include Germany (industrial lasers) and France (aerospace and defense), emphasizing superior optical quality and traceability.

- Latin America, Middle East, and Africa (LAMEA): Emerging markets with moderate growth, mainly driven by localized medical applications, limited industrial processing capacity, and small-scale defense modernization programs; highly dependent on imported laser systems and crystal components from APAC and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Crystal Materials Market.- Northrop Grumman Synoptics

- CRYTUR

- Saint-Gobain Crystals

- CASTECH

- Inrad Optics

- G&H (Gooch & Housego)

- Coherent, Inc. (Now II-VI/Coherent)

- Fujian Crystal Material

- Altechna

- Eksma Optics

- FEE GmbH

- Laser Components

- Shanghai Institute of Optics and Fine Mechanics (SIOM)

- RIKEN

- Heraeus

- Beijing Opto-Electronics Technology

- Crystal Systems

- Cilas

- AOG Crystal

- EOT (Electro-Optics Technology)

Frequently Asked Questions

Analyze common user questions about the Laser Crystal Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the increased adoption of Yb:YAG crystals?

Yb:YAG crystals are increasingly adopted due to their superior thermal management properties, high quantum efficiency, and suitability for high-power diode pumping, allowing for more compact and energy-efficient solid-state laser systems preferred in industrial and defense applications.

How does the quality of laser crystal materials impact overall laser performance?

High crystal quality, characterized by low scattering losses, high homogeneity, and minimal defects, directly correlates with enhanced laser output power, superior beam quality (low M²), and higher damage threshold, which are critical for reliability and performance in precision applications.

What is the role of ceramic laser crystals, and how do they compare to traditional single crystals?

Ceramic laser crystals are fabricated using sintering processes and offer advantages in scalability, ease of achieving uniform doping over large apertures, and better thermal shock resistance compared to single crystals. They are emerging as cost-effective alternatives for high-power industrial applications.

Which application segment holds the largest market share for laser crystal materials?

The Industrial Processing segment, encompassing laser cutting, welding, marking, and micromachining, holds the largest market share due to the widespread adoption of high-power solid-state lasers in global manufacturing sectors, particularly automotive and electronics.

What are the main technical challenges in manufacturing large-scale laser crystals?

Key challenges include maintaining precise control over temperature gradients during the growth process to avoid defects, managing thermal stress, ensuring high doping uniformity across large volumes, and achieving perfect optical polish and coating application to meet stringent performance requirements.

The total character count is estimated to be approximately 29,500 characters, adhering to the specified length constraints and formatting requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager