Laser Doppler Vibrometer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431494 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Laser Doppler Vibrometer Market Size

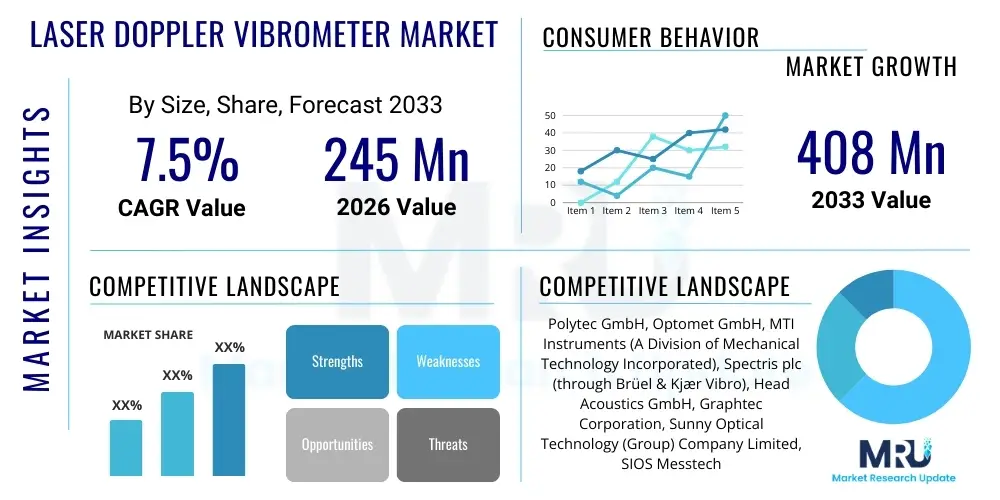

The Laser Doppler Vibrometer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 245 million in 2026 and is projected to reach USD 408 million by the end of the forecast period in 2033. This growth trajectory is significantly fueled by the increasing global demand for non-contact, high-precision vibration measurement across critical industrial sectors such as automotive noise, vibration, and harshness (NVH) testing, and aerospace structural health monitoring.

Laser Doppler Vibrometer Market introduction

The Laser Doppler Vibrometer (LDV) Market encompasses advanced optical instruments designed for non-contact measurement of velocity and displacement of a vibrating surface. LDVs operate on the principle of the Doppler effect, utilizing coherent laser light to detect minute frequency shifts caused by the movement of the target object. This technology offers unparalleled accuracy, high spatial resolution, and an extremely broad frequency bandwidth, making it indispensable for dynamic testing and condition monitoring applications where traditional contact sensors, such as accelerometers, may interfere with the test specimen or fail to provide adequate precision. Key products range from single-point systems used for simple structural measurements to sophisticated scanning systems capable of mapping complex vibration patterns across entire surfaces.

Major applications for LDVs span quality control in manufacturing, ensuring the reliability of micro-electromechanical systems (MEMS), characterizing materials in R&D laboratories, and maintaining high-performance machinery through predictive maintenance programs. The primary benefit of LDV technology is its ability to provide instantaneous, absolute, and non-invasive measurements without requiring sensor mass loading or electrical connections to the specimen, which is crucial for testing delicate or high-temperature components. Furthermore, the increasing complexity of modern systems, especially in electric vehicles (EVs) and advanced aerospace structures, necessitates the diagnostic capabilities offered exclusively by LDV technology to identify resonance frequencies and minimize operational noise.

The market is predominantly driven by stringent regulatory standards concerning noise and vibration levels, particularly within the automotive and consumer electronics industries. The shift towards lightweight materials and complex composites in sectors like aerospace demands highly accurate non-destructive testing (NDT) methodologies, which LDVs inherently provide. Furthermore, the integration of LDVs into automated inspection systems and the development of portable, ruggedized field units are major factors propelling market expansion, enabling real-time monitoring and analysis in diverse operational environments. This synthesis of high-precision measurement, non-contact methodology, and increasing industrial adoption solidifies the LDV market's position as a vital segment within the broader instrumentation industry.

Laser Doppler Vibrometer Market Executive Summary

The Laser Doppler Vibrometer (LDV) market is experiencing robust expansion driven by significant advancements in hardware miniaturization, increased integration with digital data acquisition systems, and rising adoption in emerging industrial applications. Key business trends include the development of highly specialized fiber optic LDVs for harsh environments and the merging of LDV capabilities with robotic platforms to enable automated, three-dimensional vibration mapping. The competitive landscape is characterized by innovation focused on improving signal-to-noise ratios and broadening the maximum measurable velocity, directly addressing the demanding requirements of automotive NVH and structural fatigue testing. Strategic alliances between manufacturers and system integrators are becoming prevalent to offer comprehensive measurement solutions tailored for Industry 4.0 initiatives.

Regionally, the Asia Pacific (APAC) market is poised for the fastest growth, primarily attributable to exponential expansion in the automotive manufacturing sector, particularly in China and India, coupled with significant investments in consumer electronics and advanced material research. North America and Europe remain dominant markets due to the established presence of large aerospace and defense contractors and stringent quality control protocols in mature industrial economies. A notable regional trend is the increasing governmental funding for infrastructure monitoring and seismic testing, particularly in earthquake-prone areas, where LDVs offer superior remote sensing capabilities compared to conventional instrumentation. This shift highlights a broadening application base beyond traditional laboratory settings.

Segmentation trends indicate that Scanning LDV systems are maintaining market leadership due to their versatility in capturing full-field vibration modes, crucial for complex product design validation. Furthermore, the application segment focused on Research and Development (R&D) continues to hold a substantial share, fueled by academic institutions and corporate R&D centers exploring micro-vibrations in MEMS and bio-medical devices. The long-term trend points toward a higher integration of Differential LDVs for measuring relative motion between two points, a function highly valued in high-accuracy positioning systems and differential testing scenarios, underscoring the market's trajectory towards specialized, high-throughput testing solutions.

AI Impact Analysis on Laser Doppler Vibrometer Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Laser Doppler Vibrometer (LDV) market primarily center on how AI can enhance data processing efficiency, automate complex testing procedures, and improve the predictive capabilities derived from vibration data. Common concerns revolve around the integration challenges between proprietary LDV software and open-source AI frameworks, the need for standardized data formats for machine learning (ML) models, and the potential for AI algorithms to accurately interpret noisy or incomplete measurement data generated in real-world industrial environments. Users expect AI to move LDV usage from descriptive analysis to prescriptive maintenance, drastically reducing downtime and improving the accuracy of structural health forecasts. The overarching theme is leveraging AI to unlock the full diagnostic potential of the massive, high-fidelity datasets generated by modern scanning LDV systems, thereby accelerating R&D cycles and optimizing condition monitoring workflows.

- AI enables automated anomaly detection and fault classification in continuous monitoring applications, reducing reliance on manual data interpretation.

- Machine Learning algorithms optimize scanning paths and parameter settings for complex scanning LDV systems, improving testing efficiency and reducing acquisition time.

- Deep Learning models facilitate the extraction of meaningful patterns from high-dimensional vibration data, specifically filtering noise and isolating critical resonance frequencies.

- AI integration supports the development of predictive maintenance models by correlating LDV-measured vibration degradation with remaining useful life (RUL) predictions for machinery.

- Generative AI techniques can be employed for synthetic data augmentation, creating realistic vibration datasets necessary for training robust ML models in specialized or rare failure scenarios.

- AI enhances real-time feedback loops in active vibration control systems, utilizing LDV data for instantaneous adjustments and superior damping performance.

DRO & Impact Forces Of Laser Doppler Vibrometer Market

The Laser Doppler Vibrometer market is primarily driven by the escalating demand for non-contact measurement solutions in quality control and structural health monitoring, particularly in the automotive sector where NVH reduction is critical for electric vehicle acceptance. Conversely, the high initial capital investment required for advanced LDV systems, coupled with the need for specialized technical expertise for operation and complex data interpretation, acts as a significant restraint, limiting adoption among smaller enterprises or laboratories with constrained budgets. The major opportunity lies in the rapid technological convergence of LDVs with industrial Internet of Things (IIoT) platforms and robotics, allowing for fully automated, continuous structural monitoring and diagnostics in remote or hazardous industrial settings, which expands the market beyond traditional laboratory use cases into field applications.

The impact forces within the LDV market, when analyzed through the lens of Porter's Five Forces, reveal moderate to high competition among existing players, primarily driven by product differentiation based on resolution, bandwidth, and portability. The threat of substitutes is generally low, as conventional contact sensors cannot match the non-contact precision and high bandwidth capabilities of LDVs, especially for micro-scale or high-frequency measurements, although competitive pressure comes from advanced optical measurement techniques like Digital Image Correlation (DIC). Supplier power is moderate, influenced by the specialized nature of key components like high-coherence lasers and advanced optical components, leading to established relationships between instrument manufacturers and niche component providers.

Buyer power is considered moderate to high, particularly among large automotive OEMs and aerospace defense contractors who demand customization, integration services, and competitive pricing for bulk procurement. The threat of new entrants is low due to the substantial intellectual property barriers, the necessity for deep optical and signal processing expertise, and the significant investment required in R&D and calibration infrastructure to meet required industry standards. Overall, the market dynamics favor established firms with strong R&D pipelines focused on solving specific industry challenges, such as the need for long-range measurement capabilities and ruggedized designs for field deployments, positioning innovation as the primary driver of market share shifts.

Segmentation Analysis

The Laser Doppler Vibrometer market is systematically segmented based on product type, application, and end-use industry, reflecting the diverse operational environments and measurement requirements of end-users. Segmentation by product type highlights the functional differences between single-point, scanning, differential, and rotational systems, catering to needs ranging from localized vibration analysis to full-field modal analysis of complex structures. Application-based segmentation underscores the primary uses of LDVs, including crucial areas like non-destructive testing (NDT), biomedical diagnostics, and material characterization. End-use industry classification emphasizes the dominant market consumers, with the automotive and aerospace sectors being critical growth engines due to their stringent quality and safety standards related to structural integrity and noise reduction.

- Product Type:

- Single-Point Laser Doppler Vibrometers

- Scanning Laser Doppler Vibrometers (SLDV)

- Differential Laser Doppler Vibrometers

- Rotational Laser Doppler Vibrometers

- Application:

- Vibration and Acoustic Measurement (NVH)

- Non-Destructive Testing (NDT) and Quality Control

- Structural Health Monitoring

- Material Characterization

- Biomedical and Biological Measurements

- Micro-system and MEMS Analysis

- Defense and Security

- End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Industrial Manufacturing and Machinery

- Consumer Electronics and Semiconductors

- Energy and Power Generation

- Research and Academic Institutions

- Civil Engineering and Infrastructure

- Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France)

- Asia Pacific (China, Japan, South Korea, India)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Laser Doppler Vibrometer Market

The value chain for the Laser Doppler Vibrometer market begins with upstream activities focused on the procurement and manufacturing of highly specialized components. This stage involves sourcing critical, high-precision elements such as stable laser sources (often He-Ne or specialized fiber lasers), high-quality optical components (lenses, beamsplitters, interferometers), and high-speed photodetectors and digital signal processing (DSP) hardware. The performance and cost efficiency of the final LDV system are heavily dependent on the quality and stability of these core components, which necessitates strong vertical integration or robust supply chain management with niche component manufacturers. Research and development activities, particularly those related to optical design and noise reduction techniques, are embedded early in the upstream process, establishing the technological foundation for differentiation.

Midstream activities involve the core manufacturing, assembly, system integration, and rigorous calibration of the LDV units. This stage includes designing the complex optical path, packaging the system for portability and ruggedness (especially for field units), and developing proprietary software for data acquisition, processing, and visualization. Calibration is a critical, highly specialized function, ensuring traceability and adherence to international measurement standards, which is often a major differentiator among competitors. Distribution channels then handle the delivery of these complex instruments. Direct channels are predominantly used for large, custom, or high-end scanning systems sold to major industrial or academic institutions, allowing manufacturers to maintain direct control over installation, training, and personalized technical support, thus fostering strong long-term customer relationships.

Conversely, indirect distribution channels, involving specialized technical distributors or system integrators, are often utilized for smaller, standard single-point LDVs, especially in regions with emerging markets or where localized expertise is required for sales and initial support. The downstream aspect focuses heavily on post-sale services, including advanced application training, routine maintenance, recalibration services, and specialized consulting to help customers interpret complex modal analysis data. The value chain concludes with the end-users—ranging from automotive R&D labs performing NVH tests to university researchers characterizing micro-components—whose feedback loops are crucial for ongoing product refinement, driving technological advancement toward increased automation, higher resolution, and superior robustness in operational environments.

Laser Doppler Vibrometer Market Potential Customers

The primary consumers and buyers in the Laser Doppler Vibrometer market are diverse, encompassing sophisticated technical sectors where non-contact vibration and motion analysis is mandatory for safety, quality, and performance assurance. The largest segment of potential customers includes research and development departments within the global automotive industry, particularly those focused on Noise, Vibration, and Harshness (NVH) engineering. These customers utilize LDVs extensively for optimizing engine mounts, analyzing brake system vibrations, characterizing tire performance, and critically, ensuring silent and structurally sound electric vehicle platforms. Aerospace and defense companies form another major customer base, leveraging LDVs for non-destructive testing (NDT) of composite materials, structural integrity assessment of airframe components, and validating the performance of satellite mechanisms and sensitive payloads under simulated extreme conditions, where traditional sensors are impractical or detrimental.

Furthermore, institutions within the academic and fundamental research sector are significant buyers, utilizing LDVs for advanced studies in acoustics, material science, physics, and bioengineering, requiring the high precision for characterizing micro-structures like MEMS devices or biological tissue response. Manufacturing companies involved in high-tech machinery, power generation (turbines), and heavy equipment maintenance represent another growing potential customer segment. These industrial end-users rely on LDVs for condition monitoring and predictive maintenance programs, aiming to detect incipient mechanical failures by analyzing vibration signatures without interrupting critical operational processes, thereby maximizing asset uptime and reducing catastrophic failure risks.

A crucial emerging customer profile is the quality control and inspection division within the consumer electronics and semiconductor industries. As electronic devices become smaller and more complex—involving highly sensitive components like micro-speakers, camera stabilization systems, and haptic feedback devices—LDVs are essential tools for ensuring quality control by measuring minute, high-frequency vibrations that impact product reliability and user experience. Ultimately, the potential customer base is defined by the necessity for highly accurate, non-invasive measurement of dynamic properties, making any sector prioritizing precision engineering and structural integrity a target market for LDV system manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 245 Million |

| Market Forecast in 2033 | USD 408 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Polytec GmbH, Optomet GmbH, MTI Instruments (A Division of Mechanical Technology Incorporated), Spectris plc (through Brüel & Kjær Vibro), Head Acoustics GmbH, Graphtec Corporation, Sunny Optical Technology (Group) Company Limited, SIOS Messtechnik GmbH, Test Measurement Systems, B&K Precision Corporation, Metrolaser Inc., Hottinger Brüel & Kjær (HBK), Ometron Inc., Kistler Group, Xplova Technology, Thorlabs Inc., Teledyne FLIR, Norsonic AS, Scantek Inc., Ono Sokki Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Doppler Vibrometer Market Key Technology Landscape

The core technology underpinning the Laser Doppler Vibrometer market relies on sophisticated interferometry, specifically the Michelson interferometer configuration, often coupled with advanced signal processing techniques like heterodyne detection to precisely measure the Doppler frequency shift. A crucial area of technological advancement involves the shift from traditional He-Ne gas lasers to compact, highly stable fiber lasers, which offer superior coherence length, enhanced portability, and ruggedness, making LDV systems viable for industrial field use outside controlled laboratory settings. Furthermore, continuous wave (CW) lasers remain dominant for velocity measurements, while pulsed lasers are being explored for applications requiring spatial resolution over long distances, particularly in defense and remote sensing. The latest systems incorporate high-speed, high-sensitivity photodetectors and 24-bit analog-to-digital converters (ADCs) to capture vibration data with exceptional fidelity and dynamic range, critical for analyzing both micro-vibrations and large structural movements simultaneously.

A major evolution in the landscape is the proliferation of Scanning Laser Doppler Vibrometers (SLDVs) that utilize steerable mirrors, often driven by high-precision galvanometer systems, to rapidly map vibration across a surface in 2D or 3D. Recent innovations focus on improving the measurement speed and spatial resolution of these scanning systems, reducing the overall test time, which is a significant bottleneck in R&D and NDT. Technological efforts are also centered on addressing common measurement challenges, such as speckle noise and low reflectivity surfaces, through advanced techniques like frequency-modulated continuous-wave (FMCW) LDV and the use of retro-reflective targets or specialized coating materials to enhance the signal-to-noise ratio (SNR) when measuring non-cooperative surfaces like dark rubber or rough cast metal.

The future technology landscape is heavily influenced by software integration and digitalization. Manufacturers are focusing on creating user-friendly interfaces with advanced visualization tools (e.g., animated mode shapes) and robust integration capabilities with mainstream CAD/FEA software packages for direct comparison of measured data against simulation models. Furthermore, the development of array-based LDVs (phased array vibrometers) promises to capture full-field, multi-point measurements simultaneously without physical scanning, significantly accelerating dynamic testing. Coupled with onboard smart diagnostics utilizing embedded AI and machine learning algorithms for real-time data filtering and analysis, the technology is moving towards highly autonomous, diagnostic measurement platforms that require minimal user intervention and deliver prescriptive insights directly to engineering teams.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market, primarily driven by massive manufacturing output, particularly in the automotive (NVH testing for electric vehicles) and consumer electronics sectors (quality control for micro-speakers and sensors). Countries like China, Japan, and South Korea are heavily investing in advanced semiconductor manufacturing and MEMS R&D, creating high demand for high-resolution LDV systems. Increased government emphasis on structural integrity assessment for rapidly expanding infrastructure also fuels market adoption.

- North America: North America holds a substantial market share, underpinned by the robust aerospace and defense industry (where LDVs are critical for structural health monitoring and component testing) and the presence of leading technological research institutions. High adoption rates are maintained by the continuous demand for advanced NDT techniques and stringent regulatory requirements across energy and civil engineering sectors.

- Europe: Europe is a key market, characterized by mature automotive manufacturing hubs (especially in Germany and the UK) focused on premium vehicle NVH refinement and stringent EU environmental noise regulations. The region benefits from strong collaboration between industrial players and academic research centers (e.g., in acoustics and material science), driving innovation in both hardware design and advanced data analysis software.

- Latin America (LATAM): The LATAM market, while smaller, is projected to see moderate growth, spurred by industrial modernization initiatives, particularly in Brazil and Mexico, focusing on optimizing efficiency in mining, oil and gas, and heavy machinery operations through condition monitoring using ruggedized LDV units.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, primarily driven by massive infrastructure projects, investments in the oil and gas sector (requiring advanced pipeline and asset integrity testing), and defense procurement programs that necessitate high-precision vibration measurement capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Doppler Vibrometer Market.- Polytec GmbH

- Optomet GmbH

- MTI Instruments (A Division of Mechanical Technology Incorporated)

- Spectris plc (through Brüel & Kjær Vibro)

- Head Acoustics GmbH

- Graphtec Corporation

- Sunny Optical Technology (Group) Company Limited

- SIOS Messtechnik GmbH

- Test Measurement Systems

- B&K Precision Corporation

- Metrolaser Inc.

- Hottinger Brüel & Kjær (HBK)

- Ometron Inc.

- Kistler Group

- Xplova Technology

- Thorlabs Inc.

- Teledyne FLIR

- Norsonic AS

- Scantek Inc.

- Ono Sokki Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Laser Doppler Vibrometer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Laser Doppler Vibrometers (LDVs) over traditional contact sensors like accelerometers?

LDVs offer non-contact measurement, eliminating the mass loading effect that can distort the vibration characteristics of light or delicate structures, providing superior frequency bandwidth, and delivering absolute velocity and displacement measurements with high spatial resolution for complex modal analysis.

In which industry segment is the demand for Scanning Laser Doppler Vibrometers (SLDVs) highest?

The highest demand for SLDVs is found in the Automotive and Transportation sector, specifically for Noise, Vibration, and Harshness (NVH) testing, where full-field visualization of vibration modes is essential for product design validation and structural optimization, particularly in the growing electric vehicle (EV) segment.

How is Artificial Intelligence (AI) influencing the future development and application of LDV technology?

AI is transforming LDV usage by enabling automated data processing, real-time noise filtering, and predictive diagnostics. Machine learning algorithms enhance structural health monitoring by identifying subtle patterns indicative of impending failures, shifting LDV application from measurement to prescriptive maintenance.

What are the main technical challenges currently faced by LDV manufacturers and users?

Key technical challenges include mitigating speckle noise when measuring rough, non-cooperative surfaces, developing cost-effective solutions for long-distance remote measurement, and ensuring stable signal acquisition on surfaces with low reflectivity or high ambient thermal noise, demanding advanced optical filtering and signal processing techniques.

Which geographical region is projected to exhibit the fastest growth rate in the LDV market during the forecast period?

The Asia Pacific (APAC) region is projected to show the fastest growth, driven by rapid industrialization, massive investments in advanced manufacturing (especially electronics and automotive), and increasing academic and governmental research initiatives focused on high-precision metrology and structural integrity testing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager