Laser Eyeware Protection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432532 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Laser Eyeware Protection Market Size

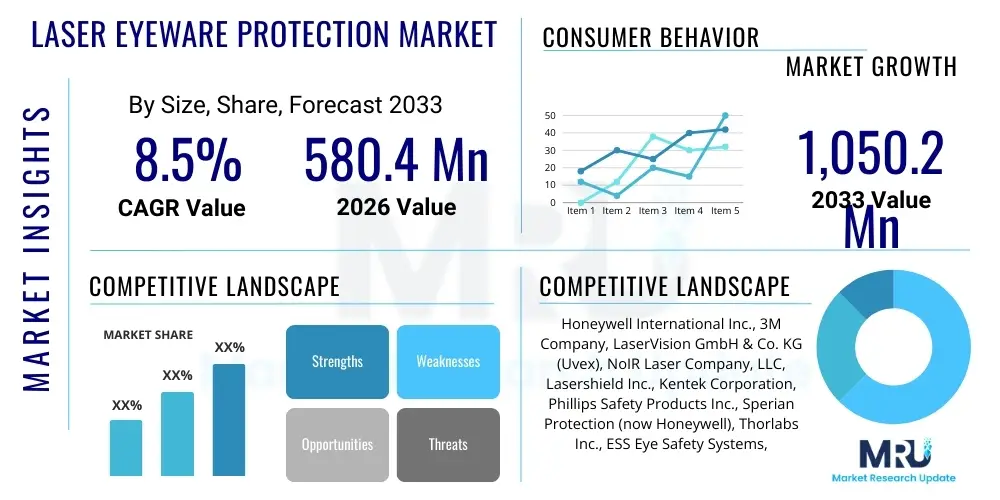

The Laser Eyeware Protection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 580.4 million in 2026 and is projected to reach USD 1,050.2 million by the end of the forecast period in 2033.

Laser Eyeware Protection Market introduction

The Laser Eyeware Protection Market encompasses the manufacturing, distribution, and utilization of specialized protective eyewear designed to shield the human eye from the harmful effects of direct or reflected laser beams across various wavelengths and power levels. These protective solutions are crucial in environments where Class 3B and Class 4 lasers are utilized, ranging from industrial manufacturing and telecommunications to advanced medical procedures and military operations. The core function of these products is based on filtering specific laser wavelengths or absorbing intense optical radiation, ensuring compliance with stringent safety standards set by international bodies like ANSI and EN.

Key products within this market include laser safety goggles, spectacles, and specialized face shields, fabricated from materials such as polycarbonate, glass, and hybrid composites integrated with specialized filters or dielectric coatings. The product differentiation often hinges on the Optical Density (OD) rating, Visible Light Transmission (VLT) percentage, and the specific wavelength range they are certified to protect against. Major applications span high-precision welding, laser marking and engraving in industrial settings, aesthetic and surgical laser procedures in healthcare, scientific research, and advanced defense systems for targeting and range-finding. The increasing deployment of high-power industrial lasers and the continuous rise in minimally invasive medical procedures utilizing laser technology are fundamentally expanding the demand base for certified protective solutions.

The principal benefits derived from utilizing certified laser protective eyewear include the prevention of acute and chronic eye injuries, such as retinal burns, cataracts, and photokeratitis, thereby ensuring occupational safety and regulatory compliance. Driving factors for market growth are primarily stringent workplace safety regulations globally, particularly in North America and Europe, mandating the use of Personal Protective Equipment (PPE) in laser-hazardous areas. Furthermore, the rapid expansion of fiber laser technology and ultrafast lasers in advanced manufacturing sectors, coupled with heightened awareness regarding laser hazards among industrial operators and medical staff, significantly contributes to market expansion and technological innovation in protective material science.

Laser Eyeware Protection Market Executive Summary

The Laser Eyeware Protection Market is characterized by robust growth, driven primarily by evolving regulatory frameworks and the increasing integration of high-power laser systems across core industrial and medical sectors. Business trends indicate a strong move toward customized and lightweight solutions, capitalizing on advancements in absorbing dye technologies and thin-film dielectric coatings that offer superior Optical Density (OD) without compromising Visible Light Transmission (VLT). Market participants are focusing on strategic partnerships with large industrial integrators and healthcare equipment manufacturers to embed protective solutions early in the equipment lifecycle. Furthermore, sustainability in manufacturing processes and the development of scratch-resistant, durable materials are key competitive differentiators, catering to high-intensity operational environments and demanding end-users who prioritize longevity and clarity.

Regional trends highlight North America and Europe as dominant markets, mainly due to strict adherence to ANSI Z136 and EN 207 standards, established industrial automation bases, and large concentrations of advanced medical facilities. The Asia Pacific region, however, is projected to exhibit the fastest growth rate, fueled by rapid industrialization, burgeoning electronics manufacturing, and significant government investments in scientific research and defense technologies, particularly in countries like China, India, and South Korea. This regional growth is spurring localized manufacturing and increased accessibility of competitive, compliant protective eyewear, although ensuring consistent quality control across all emerging markets remains a structural challenge.

Segment trends underscore the dominance of the Glass-based segment in high-power industrial applications, owing to its superior damage threshold and clarity, while the Polymer/Polycarbonate segment is rapidly gaining traction in medical and lower-power industrial fields due to its lightweight nature and cost-effectiveness. In terms of application, the Industrial & Manufacturing segment maintains the largest market share, driven by the widespread adoption of laser cutting, welding, and additive manufacturing processes. Conversely, the Scientific Research and Defense sectors are demonstrating specialized demand for ultra-broadband and highly specific narrowband protection customized for complex experimental setups and military-grade targeting systems, necessitating continuous R&D investment in filter precision and material resilience.

AI Impact Analysis on Laser Eyeware Protection Market

User queries regarding AI's influence in the Laser Eyeware Protection Market center primarily on how Artificial Intelligence can enhance safety protocols, automate risk assessment, and improve the personalized design of protective gear. Key themes users are exploring include the integration of AI-driven sensor technology into eyewear for real-time hazard detection, the use of machine learning to predict potential beam exposure risks based on operational parameters, and the optimization of material compositions using simulation techniques guided by AI algorithms. Concerns often revolve around the cost of integrating such advanced features and the reliability of AI-powered systems in critical safety situations, demanding high levels of certification and fail-safe mechanisms for any AI component deployed in PPE.

AI's influence is expected to be transformative, particularly in preventative safety management. Machine learning models can analyze vast amounts of operational data—including laser power fluctuations, environmental conditions, and user movement—to generate precise, actionable insights regarding potential safety breaches, far exceeding human capacity for continuous monitoring. This predictive capability allows safety managers to implement proactive measures, potentially reducing the frequency and severity of accidental laser exposure incidents. Moreover, AI is poised to revolutionize the manufacturing process, optimizing the coating application or dye integration process to achieve maximum Optical Density uniformity and precise spectral cutoff points, leading to more reliable and higher-performing protective solutions.

Further integration involves customizing eyewear fit and function. AI-driven scanning and analysis of the user's facial geometry can lead to the manufacturing of perfectly contoured frames and shields, minimizing gaps and maximizing comfort, thereby increasing compliance rates among workers. While the protective material itself remains governed by physical properties, AI enhances the surrounding ecosystem—from initial hazard assessment and material selection based on specific laser characteristics to continuous monitoring and automated record-keeping of PPE usage and certification status. This synergy between physical protection and digital intelligence elevates the overall standard of laser safety in high-risk environments.

- AI-driven real-time risk assessment and hazard mapping in operational zones.

- Optimization of protective material composition and coating processes using machine learning for enhanced OD and VLT.

- Integration of smart sensors into eyewear for automated detection of beam strikes and immediate user alerting.

- Predictive maintenance and quality control of laser systems, indirectly reducing accidental high-power exposures.

- Personalization of eyewear fit and design using AI analysis of biometric data to improve user comfort and compliance.

- Automated compliance monitoring and digital record-keeping of PPE usage history and inspection logs.

DRO & Impact Forces Of Laser Eyeware Protection Market

The dynamics of the Laser Eyeware Protection Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the critical impact forces steering market growth. The primary driver is the stringent enforcement of occupational health and safety standards worldwide, particularly those pertaining to laser radiation, compelling industries to invest continuously in certified protective equipment. This is synergized by the rapid technological proliferation of high-power industrial lasers, such as CO2, fiber, and diode lasers, across diverse manufacturing processes, increasing the inherent risk profile in operational environments. However, the market faces significant restraints, chiefly the high initial cost associated with premium, custom-fit, and highly specialized protective filters, especially those utilizing glass or complex dielectric coatings necessary for ultra-high power applications, which can deter adoption in smaller enterprises or cost-sensitive emerging markets.

Opportunities within the market largely revolve around material science innovations, specifically the development of hybrid protective materials that combine the high damage threshold of glass with the lightweight properties and impact resistance of polymers. Furthermore, the expanding field of advanced medical aesthetics, which utilizes specific, high-intensity pulsed lasers for dermatology and ophthalmology, presents a specialized demand niche for customized protective solutions that cater to both the practitioner and the patient. Digital integration, particularly the adoption of IoT-enabled eyewear that tracks usage and exposure, represents a significant avenue for value addition and compliance verification, shifting the industry toward smart protective equipment.

The overall impact forces are predominantly positive, favoring growth and innovation. The compelling need for safety and regulatory compliance acts as a non-negotiable demand foundation (Driver), outweighing the cost concerns (Restraint). The increasing sophistication of laser technology ensures that the demand for specialized, high-performance protection will continue to rise (Opportunity). Ultimately, the regulatory pressure and technological evolution create a powerful imperative for innovation, pushing manufacturers to develop more effective, comfortable, and affordable protective eyewear solutions that meet evolving safety mandates and industrial performance requirements globally.

Segmentation Analysis

The Laser Eyeware Protection Market is extensively segmented based on Material Type, Product Type, Application, and End-User, reflecting the specialized nature of laser technology and its diverse risk profiles across various industries. The segmentation by Material Type is crucial as it directly determines the protective capabilities, optical density, and damage threshold of the eyewear. Polymer and polycarbonate materials dominate volume sales due to their lightweight properties and high impact resistance, making them ideal for lower to medium-power industrial and general laboratory use. Conversely, glass-based filters are preferred in extreme high-power applications, such as heavy-duty metal processing and military research, where thermal resistance and superior clarity are paramount, commanding a higher price point.

Product Type segmentation distinguishes between protective goggles, spectacles, and specialized viewing windows/barriers. Goggles and spectacles represent the largest segments, catering to individual operator protection. Application analysis reveals that Industrial & Manufacturing remains the primary consumer due to the rapid adoption of automated laser processing machines. However, the Medical & Aesthetic segment shows robust growth, driven by the expansion of non-invasive surgical and dermatological treatments. Understanding these segment dynamics is vital for market participants to tailor their product offerings, focusing on compliance with application-specific safety standards (e.g., medical-grade sterilization requirements versus industrial durability needs).

- Material Type:

- Glass-based

- Polymer/Polycarbonate-based

- Hybrid Materials

- Product Type:

- Goggles

- Spectacles

- Face Shields

- Viewing Windows/Barriers

- Application:

- Industrial & Manufacturing (Welding, Cutting, Marking, Additive Manufacturing)

- Medical & Aesthetics (Dermatology, Ophthalmology, Surgery)

- Scientific Research & Laboratories (Universities, R&D Facilities)

- Defense & Military (Targeting, Range Finding, Countermeasures)

- Telecommunications

- End-User:

- Operators and Technicians

- Researchers and Scientists

- Medical Practitioners and Staff

- Military Personnel

Value Chain Analysis For Laser Eyeware Protection Market

The value chain for the Laser Eyeware Protection Market begins with upstream activities focused on raw material sourcing and the highly technical process of filter creation. Upstream analysis involves suppliers of specialized raw materials, including optical glass blanks, high-grade polycarbonate resins, and performance-enhancing dyes or nano-coatings used to achieve the necessary Optical Density (OD) for specific laser wavelengths. The core competitive advantage at this stage lies in proprietary dye formulations and advanced dielectric coating deposition techniques (e.g., sputtering, evaporation) that ensure high VLT (Visible Light Transmission) while maintaining robust OD certification. Raw material quality directly influences the final product's protective capacity and clarity, making this a critical, high-barrier entry point in the chain.

Midstream activities involve the manufacturing and assembly process, where the protective filters are integrated into durable frame designs. This stage includes injection molding of frames, cutting and shaping the filter material, integration of anti-scratch and anti-fog coatings, and crucially, rigorous compliance testing and certification (e.g., CE, ANSI Z136.1). Distribution channels, which form the linkage between midstream manufacturing and downstream deployment, are segmented into direct and indirect routes. Direct sales are common for highly customized or military-grade solutions where technical consultation is required, often involving direct engagement with large industrial integrators or governmental procurement offices. Indirect distribution utilizes specialized safety equipment distributors, medical supply houses, and e-commerce platforms, offering broader market reach and catering to smaller end-users.

Downstream analysis focuses on end-user adoption, training, and post-sale support. Given the critical safety nature of the product, robust training on proper selection, fit testing, and maintenance is essential. Potential customers, including industrial operators, medical staff, and researchers, rely heavily on distributors and manufacturers for accurate product information corresponding to their specific laser hazards. The effectiveness of the overall value chain is maximized when there is seamless communication between manufacturers and end-users regarding evolving laser specifications and safety mandates, ensuring that the deployed protective eyewear remains appropriate for the operative environment throughout its lifecycle.

Laser Eyeware Protection Market Potential Customers

Potential customers for laser eyeware protection solutions are diverse, spanning high-technology sectors, specialized medical fields, and research institutions where laser usage is integral to operations. The primary buyers are organizations and institutions mandated by regulatory bodies to provide certified Personal Protective Equipment (PPE) to their personnel who operate or are exposed to Class 3B and Class 4 laser systems. These end-users prioritize product reliability, certified compliance with international safety standards (ANSI, EN), and ergonomic design that ensures high usage compliance among staff.

The largest segments of end-users include heavy manufacturing facilities that employ high-power fiber lasers for metal processing (cutting, welding, cladding) and electronics manufacturers utilizing lasers for marking and precision soldering. In the healthcare sector, potential customers are hospitals, aesthetic clinics, and dental offices deploying laser devices for surgical, dermatological, and cosmetic procedures, where protection is required for both the practitioner and the patient. Furthermore, governmental and private research laboratories, universities, and defense contractors represent significant purchasers, demanding specialized, often custom-made, filters tailored for unique experimental wavelengths or military applications.

The procurement decision often involves the collaboration of safety managers, occupational health officers, and purchasing departments. For high-volume industrial clients, factors such as durability, long-term cost of ownership, and ease of cleaning are paramount. For the medical sector, sterilization compatibility and optical clarity are key requirements. Effective targeting of these diverse customer groups requires manufacturers to provide detailed spectral performance data, readily available certification documents, and tailored product training specific to the unique laser hazards faced by each industry segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580.4 million |

| Market Forecast in 2033 | USD 1,050.2 million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., 3M Company, LaserVision GmbH & Co. KG (Uvex), NoIR Laser Company, LLC, Lasershield Inc., Kentek Corporation, Phillips Safety Products Inc., Sperian Protection (now Honeywell), Thorlabs Inc., ESS Eye Safety Systems, Melles Griot (IDEX Corporation), Univet S.p.A., Fendall Company (3M), RS Laser AG, Shanghai Jieming Laser Technology Co., Ltd., Global Laser Protection, LLC, J. P. Sercel Associates, Inc. (JPSA), Tui Optics, Wavelength Opto-Electronic (S) Pte Ltd, Yoshida Kogyo Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Eyeware Protection Market Key Technology Landscape

The technology landscape of the Laser Eyeware Protection Market is centered around optimizing the core function: selective absorption or reflection of intense radiation while maintaining sufficient visible light transmission (VLT). Two primary technologies dominate: Absorptive Filters and Reflective/Dielectric Filters. Absorptive technology relies on specialized dyes, typically incorporated into polycarbonate or acrylic materials, which are chemically engineered to absorb specific harmful laser wavelengths. This approach is cost-effective, impact-resistant, and widely used for lower to medium-power lasers. Continuous innovation in this space focuses on developing new dye formulations that can handle higher power densities without thermal damage, thereby improving the optical density (OD) across broader spectral ranges without excessively darkening the lens.

Reflective or Dielectric Coating Technology involves applying multiple thin layers of highly reflective material onto a glass or polymer substrate. These specialized coatings are designed to reflect the specific laser wavelength, often achieving extremely high Optical Density ratings with better VLT compared to purely absorptive filters. This technology is essential for ultra-high power continuous-wave and pulsed lasers prevalent in industrial and defense applications. The complexity lies in the precise control over layer thickness (often measured in nanometers) to ensure narrowband reflection and minimize spectral side-effects. Recent technological strides involve hybrid solutions, combining absorption layers with dielectric coatings to offer robust protection across a wider range of wavelengths (broadband protection) or for ultrafast pulsed lasers, which require filters capable of handling extremely high peak power densities.

Furthermore, ancillary technologies are gaining importance, including photochromic materials that adjust their OD in response to varying light intensities, although their application in critical laser safety remains niche. Smart eyewear integration, while nascent, involves embedding micro-sensors to monitor filter integrity and detect actual beam exposure events, wirelessly communicating compliance data to safety management systems. Ultimately, the technological trajectory emphasizes balancing safety performance (high OD, high damage threshold), user comfort (lightweight, anti-fog, excellent VLT), and compliance, driving continuous R&D investment in advanced material science and precision coating techniques to meet the increasing sophistication of modern laser systems.

Regional Highlights

The global Laser Eyeware Protection Market exhibits significant regional disparities influenced by industrial maturity, regulatory strictness, and technological adoption rates across different geographies. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to highly rigorous regulatory frameworks, notably the ANSI Z136 standards, which strictly mandate laser safety protocols across manufacturing, military, and healthcare sectors. The presence of major defense contractors, leading research universities, and a robust advanced manufacturing base ensures constant high demand for certified, high-performance protective eyewear. Furthermore, the rapid adoption of specialized medical laser treatments contributes substantially to regional market revenue.

Europe represents the second-largest market, characterized by strict adherence to the EN 207 and EN 208 standards, which are legally enforceable across the European Union. Countries like Germany, France, and the UK, with their strong industrial automation and scientific research sectors, are significant consumers. The European market tends to prioritize highly certified, custom-fit, and specialized protective solutions, often favoring glass-based filters for high-power industrial applications. Regulatory harmonization within the EU facilitates streamlined market entry for compliant products, fostering intense competition and driving innovation in filter clarity and material durability.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily driven by massive government investments in industrial infrastructure and scientific research in countries such as China, India, and South Korea. The expansion of the regional electronics, automotive, and semiconductor manufacturing sectors, all heavy users of laser processing technology, significantly increases the potential laser exposure risk, thereby fueling demand for protective gear. While historically compliance standards were less stringent than in the West, growing multinational corporate presence and increasing local regulatory awareness are quickly professionalizing the market, creating substantial opportunities for both local and international manufacturers of certified eyeware.

Latin America, the Middle East, and Africa (LAMEA) collectively constitute smaller but rapidly emerging markets. Growth in the Middle East is primarily driven by defense expenditure and nascent medical tourism sectors utilizing advanced aesthetic lasers. In Latin America, the gradual industrialization and adoption of automation in sectors like automotive manufacturing are boosting demand. However, these regions often face challenges related to varied local compliance enforcement and price sensitivity, leading to a higher prevalence of standard, cost-effective polycarbonate solutions over highly specialized glass filters. Market education regarding the risks associated with non-certified eyewear remains a key challenge and a major focus area for established market leaders.

- North America: Dominant market share due to strict ANSI standards, advanced manufacturing, and significant defense spending. Key consumers include large industrial automation firms and specialized medical centers.

- Europe: High market maturity, driven by stringent EN standards and a strong focus on high-quality, certified protection in Germany, the UK, and France. Emphasis on glass filters for high-power industrial use.

- Asia Pacific (APAC): Fastest growing region, fueled by rapid industrialization (China, India), massive electronics manufacturing growth, and increasing adoption of international safety compliance norms.

- LAMEA: Emerging growth, primarily driven by defense procurement in the Middle East and early-stage industrialization in Latin America, with a focus on cost-effective, standard protective solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Eyeware Protection Market.- Honeywell International Inc.

- 3M Company

- LaserVision GmbH & Co. KG (Uvex)

- NoIR Laser Company, LLC

- Kentek Corporation

- Phillips Safety Products Inc.

- Lasershield Inc.

- Thorlabs Inc.

- ESS Eye Safety Systems

- Univet S.p.A.

- Fendall Company (3M Subsidiary)

- RS Laser AG

- Melles Griot (IDEX Corporation)

- Global Laser Protection, LLC

- Shanghai Jieming Laser Technology Co., Ltd.

- Tui Optics

- Wavelength Opto-Electronic (S) Pte Ltd

- Yamamoto Kogaku Co., Ltd.

- J. P. Sercel Associates, Inc. (JPSA)

- Hellma GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Laser Eyeware Protection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Optical Density (OD) and why is it crucial for laser protective eyewear?

Optical Density (OD) measures the amount of laser radiation attenuated by the filter material, indicating the level of protection provided. It is expressed as the logarithm of the ratio of incident power to transmitted power. A higher OD value signifies greater attenuation and is crucial because it ensures the beam power reaching the eye is reduced to a safe level, protecting against permanent vision damage across specific laser wavelengths.

How do I select the correct laser safety eyewear for my application?

Selecting the correct eyewear requires matching the filter specifications exactly to the operational laser's parameters, including wavelength (in nm), mode of operation (CW or pulsed), and maximum power or energy density (W/cm² or J/cm²). The chosen eyewear must possess a certified Optical Density (OD) sufficient to reduce the Maximum Permissible Exposure (MPE) for the laser class being used, ensuring full compliance with relevant international safety standards like ANSI Z136 or EN 207.

What is the difference between absorptive and reflective laser safety filters?

Absorptive filters utilize specialized dyes or materials to absorb the laser energy, typically offering broadband protection and good impact resistance, common in polymer lenses. Reflective (dielectric) filters use multiple thin coatings to reflect the laser light at a specific narrowband, offering very high OD with better Visible Light Transmission (VLT), often utilized in high-power applications with glass substrates. Both types require certification for their protective capabilities.

Are anti-scratch and anti-fog coatings necessary for laser protective lenses?

Yes, anti-scratch and anti-fog coatings are highly beneficial and often necessary. Anti-scratch coatings maintain the optical integrity of the lens, as any deep scratch can compromise the protective OD rating or introduce diffraction effects. Anti-fog coatings are essential for maintaining clear vision and high VLT, significantly improving user compliance and safety, especially in industrial environments or long-duration medical procedures where temperature changes occur.

Is certified laser safety eyewear required for all classes of lasers?

Certified laser safety eyewear is primarily mandated for use with Class 3B and Class 4 lasers, as these devices pose immediate and severe eye hazards from direct beam exposure or specular reflection. While Class 1 and Class 2 lasers are generally safe under normal operating conditions, protective measures, including eyewear, may still be required in controlled areas or during servicing, depending on the specific hazard assessment and local regulatory requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laser Eyeware Protection Market Size Report By Type (Glass, Polycarbonate, Others), By Application (Medical, Military, Scientific Research, & Education, Industrial Use), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Laser Eyeware Protection Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Glass, Polycarbonate, Others), By Application (Medical, Military, Scientific Research & Education, Industrial Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager