Laser Level Meter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434337 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Laser Level Meter Market Size

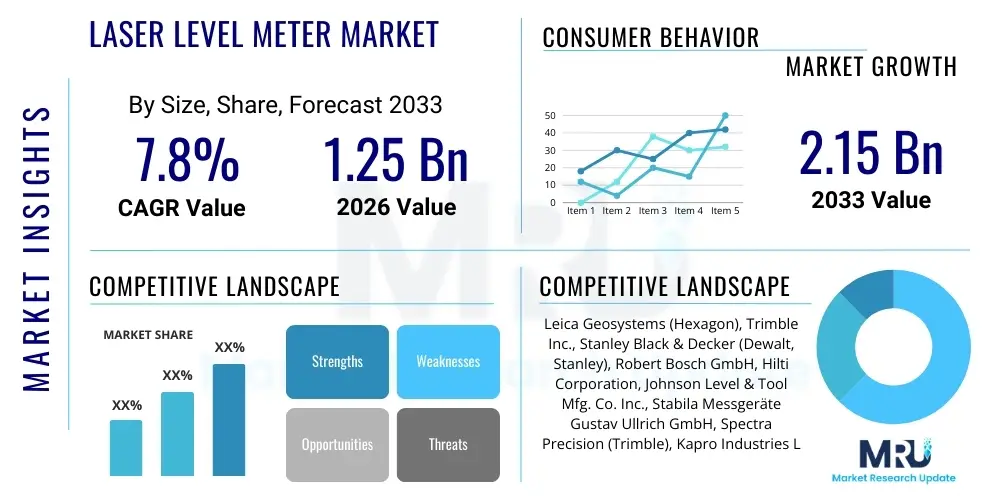

The Laser Level Meter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.15 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by global intensification of infrastructure development projects, coupled with the increasing adoption of precision measurement tools across the construction, surveying, and interior design industries. The rising demand for automated and highly accurate leveling solutions, which significantly reduces labor time and minimizes measurement errors on complex job sites, is a fundamental catalyst for market expansion. Furthermore, the continuous technological evolution, particularly the transition from traditional manual instruments to sophisticated self-leveling and connected laser devices, is accelerating market penetration across diverse geographical regions.

Market valuation reflects a strong shift towards advanced laser technology, especially within the Asia Pacific region, fueled by rapid urbanization and large-scale public and private construction activities. Investment in commercial real estate, residential housing, and critical infrastructure like roads and railways necessitates high-precision tools for quality control and project alignment, thereby boosting the deployment of professional-grade laser level meters. While red laser technology currently holds a substantial share, the market is witnessing a notable pivot towards green laser technology due to its enhanced visibility and extended operating range, particularly in brightly lit outdoor environments, contributing significantly to the overall revenue growth projected through 2033.

Laser Level Meter Market introduction

The Laser Level Meter Market encompasses highly precise measuring instruments used primarily to establish, verify, and transfer horizontal, vertical, and square reference points across various distances. These devices utilize a focused laser beam, often projected as a line, a dot, or a rotating plane, to replace traditional spirit levels and plumb bobs, offering unparalleled accuracy and efficiency on job sites. Products range from basic line lasers used for simple interior tasks like tiling and cabinet installation to sophisticated rotary lasers employed in large-scale civil engineering, land surveying, and foundation work. Major applications span residential and commercial construction, architectural design, agricultural site preparation, and industrial alignment tasks, making these tools indispensable for achieving dimensional quality and operational safety in modern construction practices.

The fundamental benefits driving the market include drastically improved speed in setting out reference lines, enhanced measurement accuracy over extended distances, and reduced requirement for large crews to perform alignment tasks, leading to substantial cost savings and project timeline acceleration. Key driving factors underpinning market growth include stringent regulatory standards mandating precision in construction quality, the global shortage of skilled labor pushing companies toward automation, and the inherent durability and user-friendliness of modern self-leveling laser systems. Furthermore, ongoing innovation, such as the integration of connectivity features (Bluetooth, Wi-Fi) for remote monitoring and data logging, solidifies the laser level meter’s position as a core component of digital construction workflows.

Laser Level Meter Market Executive Summary

The Laser Level Meter Market is poised for robust expansion, characterized by several intersecting business and technological trends. Business trends highlight increasing mergers and acquisitions among key technology providers to consolidate proprietary leveling and sensing technologies, ensuring competitive differentiation. There is a perceptible trend toward offering equipment-as-a-service (EaaS) models and specialized rental programs, which lowers the barrier to entry for small to medium-sized contractors, further stimulating demand. The market is also experiencing a heightened focus on ruggedized, IP-rated devices capable of withstanding harsh construction environments, catering to professional users who prioritize reliability and long-term asset life over minimal initial cost.

Regionally, the Asia Pacific (APAC) market, spearheaded by infrastructure spending in China and India, represents the highest growth trajectory, while North America and Europe maintain strong market shares driven by technology adoption and replacement cycles for aging equipment. Segment trends indicate a critical migration towards green beam laser levels, whose superior brightness enhances worker productivity, thereby justifying the higher manufacturing costs associated with the green diode technology. Moreover, the demand for multi-line and 360-degree laser models is skyrocketing, replacing traditional single-line devices due to their ability to project comprehensive alignment solutions from a single setup point. This technological evolution toward holistic measurement solutions is critical for efficiency in dense construction environments.

AI Impact Analysis on Laser Level Meter Market

User queries regarding the impact of Artificial Intelligence (AI) on the Laser Level Meter Market commonly center on topics such as the potential for fully autonomous surveying, the integration of real-time corrective feedback loops, and how AI might streamline Building Information Modeling (BIM) integration. Concerns often revolve around the security and reliability of AI-driven measurements, the necessity for high-level technical skills to operate complex integrated systems, and the cost implications of implementing AI-enhanced calibration and data analysis platforms. Users are keen to understand how AI algorithms can process data captured by laser scanners and levels to instantly detect deviations from design specifications, minimizing manual oversight and ensuring immediate quality assurance on large-scale projects, thereby pushing the boundaries of construction automation and error mitigation.

AI's primary influence is expected in enhancing data interpretation and predictive maintenance capabilities within high-end laser level systems, particularly those integrated with 3D scanning functionalities. Machine learning algorithms can analyze vast datasets collected during surveying operations, identifying subtle patterns of structural misalignment or foundation settling much faster and more accurately than human analysis allows. This predictive capability allows project managers to proactively address potential construction flaws, significantly reducing rework costs and project delays. Furthermore, AI facilitates autonomous calibration checks and self-correction mechanisms, ensuring that the laser meter maintains optimal accuracy even under variable environmental conditions or after physical impacts, translating directly into higher operational trustworthiness and extended device longevity, fundamentally transforming the quality control process in modern construction.

- AI enhances real-time data processing and point cloud analysis for immediate discrepancy detection.

- Machine learning enables predictive maintenance for laser level components, minimizing downtime.

- Autonomous self-calibration routines driven by AI increase measurement reliability and operational efficiency.

- AI algorithms facilitate seamless integration of laser measurement data directly into BIM models for automated progress tracking.

- Improved quality assurance through AI-driven deviation analysis, reducing human error in complex alignments.

DRO & Impact Forces Of Laser Level Meter Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO) which, together, define the Impact Forces shaping adoption trends. The primary driver is the accelerating pace of global construction and infrastructure spending, particularly in rapidly developing economies where demand for accurate and fast measurement tools is paramount to sustaining growth targets. Technological advancement, specifically the proliferation of brighter, more energy-efficient laser diodes (especially green lasers) and self-leveling mechanisms, acts as a critical enabling factor, justifying new purchases and stimulating replacement demand. However, the market faces restraints, chiefly the high initial capital expenditure associated with high-precision, professional-grade rotary and 3D laser scanners, making them inaccessible to smaller contractors or DIY enthusiasts. Furthermore, intense price competition from generic brands, especially those emerging from East Asia, pressures margins for established premium manufacturers.

Opportunities for exponential growth are concentrated in the adoption of smart construction methodologies, where laser levels are integrated into IoT ecosystems and robotic construction equipment, enabling fully automated site layout and monitoring. The growing popularity of refurbishment and renovation activities globally also presents a niche opportunity, as these projects frequently require accurate leveling and squaring within existing structures. The combined impact forces strongly favor market growth, characterized by moderate substitution threat (from traditional levels), low entry barriers for basic models but high barriers for specialized technology, and significant bargaining power held by high-volume professional end-users who demand reliability and calibration services. These forces necessitate continuous innovation in user interface, battery life, and durability to maintain competitive advantage.

The influence of standardization bodies, particularly in Europe and North America, ensures that manufacturers must adhere to strict accuracy and safety classifications, which acts both as a restraint (raising compliance costs) and a driver (assuring product quality). The need for specialized training and technical support often accompanying advanced laser systems also influences market accessibility, creating opportunities for ancillary service providers. Overall, the dominant force remains the increasing global emphasis on structural integrity and measurement precision, making laser level meters a mandatory investment rather than an optional tool for any serious construction or surveying operation seeking enhanced productivity and minimized costly errors in the structural phase.

Segmentation Analysis

The Laser Level Meter Market is comprehensively segmented based on product type, technology, application, and geographical region, providing granular insights into demand patterns and competitive landscapes. Segmentation by product type reveals distinct markets for Dot Laser Levels (used for plumbing and alignment transfer), Line Laser Levels (popular in interior fit-outs and residential construction), and Rotary Laser Levels (essential for heavy-duty civil engineering, grading, and elevation control over long distances). Technology segmentation contrasts the traditional Red Laser Levels, valued for their low cost and long battery life, against the rapidly growing Green Laser Levels, which offer significantly higher visibility and are favored for outdoor and large-area indoor applications, despite their higher power consumption requirements.

Application-wise, the market is broadly divided into Construction (which holds the dominant share), Surveying and Civil Engineering, Industrial Alignment (machine installation and precision manufacturing), and DIY/Home Improvement sectors. The construction sector’s demand is segmented further by residential, commercial, and infrastructure projects, each demanding different levels of precision and durability from the tools. Understanding these granular segments allows manufacturers to tailor features—such as IP rating, beam brightness, and self-leveling range—to meet the exact requirements of specific end-user groups, maximizing product utility and market penetration across the professional and consumer spectrums.

- Product Type

- Dot Laser Levels

- Line Laser Levels (Cross-line, Multi-line, 360-degree)

- Rotary Laser Levels

- Technology

- Red Laser Levels

- Green Laser Levels

- End-User Application

- Construction (Residential, Commercial, Infrastructure)

- Surveying and Civil Engineering

- Industrial and Manufacturing Alignment

- DIY and Home Improvement

- Sales Channel

- Direct Sales

- Distribution/Retail (E-commerce, Specialty Stores)

Value Chain Analysis For Laser Level Meter Market

The value chain for the Laser Level Meter Market begins with Upstream Analysis, focusing on the sourcing and supply of critical components. This includes high-precision laser diodes (red and green), specialized optics, micro-electromechanical systems (MEMS) sensors used for self-leveling and tilt detection, and sophisticated microcontrollers for processing and control. The cost structure is significantly influenced by the price and availability of high-quality laser diodes, particularly green diodes, which require more complex manufacturing processes. Component sourcing is often globally distributed, with critical manufacturing expertise concentrated in East Asia, making supply chain resilience and management of geopolitical risks crucial for profitability, especially in maintaining consistent product quality and meeting rigorous performance specifications required by the professional segment.

The core manufacturing and assembly stage involves integrating these components into durable, shock-resistant housings, followed by precise calibration—a highly specialized and sensitive process that determines the accuracy and quality rating of the final product. Midstream activities also include rigorous quality control, adherence to laser safety standards (Class II and Class III requirements), and packaging for transit. Downstream activities involve distribution channels, which are typically bifurcated into direct sales to large corporate clients (for rotary and high-end 3D scanners requiring training and dedicated support) and indirect sales through specialized industrial distributors, hardware wholesalers, and increasingly, large e-commerce platforms targeting professional contractors and the growing DIY segment. E-commerce facilitates broader market reach but introduces price transparency challenges.

Effective distribution management is vital for market penetration. Indirect channels rely heavily on strong relationships with localized hardware stores and equipment rental providers, ensuring product visibility and immediate availability to end-users on job sites. Direct sales models, utilized predominantly by premium brands like Leica Geosystems and Trimble, focus on providing comprehensive training, calibration services, and extended warranties, establishing long-term relationships with large construction and engineering firms. The interplay between efficient upstream sourcing of cutting-edge optical components and a robust, multi-channel downstream distribution network ultimately determines a company’s ability to maximize market share and maintain competitive pricing while delivering high-accuracy products.

Laser Level Meter Market Potential Customers

The primary End-Users/Buyers of laser level meters are diverse but share a common requirement for accuracy and efficiency in establishing planar references. Professional contractors and construction firms represent the largest customer base, spanning general contractors involved in framing, foundation work, and large commercial build-outs, as well as specialized subcontractors focusing on tiling, drywall installation, and HVAC fitting. These professionals prioritize high durability, advanced features such as remote control compatibility, and the certified accuracy necessary to meet project specifications and regulatory requirements. They typically purchase high-grade line lasers (360-degree models) and rugged rotary lasers capable of spanning hundreds of meters on large job sites, focusing on minimizing setup time and maximizing reliability under harsh conditions.

Civil engineers and land surveyors constitute another crucial customer segment, particularly for advanced self-leveling rotary lasers and integrated 3D scanning levels used in earthmoving, grading, and infrastructure development, such as road construction and utility installation. Their purchasing decisions are heavily influenced by calibration certificates, precision tolerances, and the seamless integration of measurement data with CAD and GIS software platforms. The increasing regulatory emphasis on precision mapping and digital twin creation drives this segment's demand for the most technologically advanced and connectivity-enabled laser measurement solutions available, often requiring substantial upfront investment justified by long-term project requirements and compliance needs.

Finally, the rapidly expanding DIY (Do-It-Yourself) and residential remodeling segment forms a strong growth niche. These buyers often seek user-friendly, affordable cross-line or dot laser levels for simple tasks like picture hanging, shelf installation, and basic home alignment projects. While these customers are more price-sensitive and prioritize ease of use, they are driving the demand for entry-level battery-powered green laser products that offer better indoor visibility than older red models. Retail channels and e-commerce platforms are critical for reaching this customer segment, requiring packaging and marketing that emphasize simplicity, immediate utility, and competitive pricing structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leica Geosystems (Hexagon), Trimble Inc., Stanley Black & Decker (Dewalt, Stanley), Robert Bosch GmbH, Hilti Corporation, Johnson Level & Tool Mfg. Co. Inc., Stabila Messgeräte Gustav Ullrich GmbH, Spectra Precision (Trimble), Kapro Industries Ltd., A. P. E. Engineering Inc., Toolway Industries Ltd., Topcon Corporation, Makita Corporation, Ryobi (Techtronic Industries), Fluke Corporation, PLS (Pacific Laser Systems), Zircon Corporation, Geo-Fennel GmbH, Sola-Messwerkzeuge GmbH, Laserliner (Umarex). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Level Meter Market Key Technology Landscape

The technological landscape of the laser level meter market is rapidly evolving, moving beyond simple pendulum-based self-leveling to incorporate highly sophisticated sensor arrays and digital integration. A pivotal technological shift involves the widespread adoption of Micro-Electro-Mechanical Systems (MEMS) accelerometers and inclinometers. These miniature sensors offer greater precision, faster response times, and enhanced durability compared to traditional mechanical leveling components. MEMS technology allows for instantaneous electronic calibration and tilt monitoring, significantly improving the operational speed and accuracy of line and rotary lasers, particularly when operating near vibration sources or in dynamic environments, ensuring the beam remains true to the required reference plane throughout the measurement process.

Another dominant trend is the transition from red to green laser diodes, fundamentally altering user experience and application suitability. Green lasers, operating at a wavelength closer to the peak sensitivity of the human eye (around 520–532 nm), are up to four times more visible than red lasers under the same light conditions, greatly extending the working range and improving productivity, especially in outdoor or brightly lit indoor spaces like commercial malls or airport hangars. While green laser technology historically carried higher power consumption and cost disadvantages, advancements in battery life and efficient diode manufacturing have mitigated these issues, solidifying green laser technology's premium position in professional-grade equipment, driving replacement cycles among contractors seeking maximized efficiency.

Furthermore, the integration of wireless connectivity, predominantly Bluetooth and specialized proprietary radio frequencies, is transforming device utility. Connectivity allows users to remotely control laser meter functions—such as rotation speed, line adjustments, and receiver pairing—from a smartphone application or remote control, minimizing physical interference and maximizing setup flexibility. This digital integration also facilitates Automatic Target Acquisition (ATA) and data logging, enabling real-time site monitoring, error reporting, and seamless transfer of measurement results directly into digital construction management platforms (e.g., BIM software). This convergence of high-precision optics, sensor technology, and IoT features is the core driver of innovation in the modern laser level meter market, ensuring compliance with evolving standards of digital construction.

Regional Highlights

The global Laser Level Meter Market exhibits distinct growth patterns and maturity levels across major geographic regions, heavily influenced by local economic conditions, infrastructure investment cycles, and technology adoption rates. North America, encompassing the US and Canada, currently represents one of the largest revenue segments, characterized by mature construction markets and high adoption rates of advanced, often expensive, measuring equipment. The stringent regulatory environment and the continuous focus on labor productivity compel contractors to invest in highly accurate rotary and 360-degree green laser systems integrated with construction software. This region is a hotbed for technological innovation, with high demand for premium brands offering comprehensive service and recalibration programs, ensuring compliance and maximizing equipment uptime, particularly within commercial and industrial construction projects.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period, driven by massive urbanization, large-scale public infrastructure projects (e.g., China’s Belt and Road Initiative, India’s national highway projects), and substantial investment in residential and commercial real estate development across Southeast Asia. The sheer volume of construction activity necessitates rapid deployment of efficient measurement tools. While price sensitivity remains a factor in developing APAC economies, leading to strong sales of cost-effective line lasers, there is an increasing demand for professional rotary lasers due to the complexity and scale of modern infrastructure undertakings. Local manufacturers are emerging, focusing on competitive pricing, though global players maintain a strong foothold through superior quality and established distribution networks, particularly in high-growth metropolitan areas.

Europe maintains a stable and high-value market, primarily driven by strict quality standards, sustainability mandates, and a focus on retrofitting and remodeling existing structures, which requires high-precision internal measurement tools. Western European countries, particularly Germany and the UK, demonstrate strong demand for sophisticated laser technology, including integration with augmented reality (AR) and robotics in smart construction pilot projects. The Middle East and Africa (MEA) present a burgeoning market opportunity, particularly the Gulf Cooperation Council (GCC) nations, due to significant sovereign wealth fund investment in megaprojects (e.g., NEOM in Saudi Arabia). This region demands ruggedized equipment capable of performing reliably under extreme temperature and dust conditions, making high IP ratings and battery resilience key purchasing factors for both local and international engineering firms operating in the area.

- North America: High technology adoption, mature market, strong replacement cycle, driven by commercial and industrial construction standards.

- Asia Pacific (APAC): Highest growth potential, fueled by massive infrastructure spending, rapid urbanization, and growing demand for green laser visibility.

- Europe: Stable, high-value market focused on quality, strict regulatory compliance, and adoption of specialized interior fit-out laser solutions.

- Latin America: Emerging market sensitive to economic stability, showing increasing adoption in key infrastructure sectors (Brazil, Mexico).

- Middle East & Africa (MEA): High demand for rugged, high-durability equipment due to extreme climate conditions and ongoing large-scale development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Level Meter Market.- Leica Geosystems (Hexagon)

- Trimble Inc.

- Stanley Black & Decker (Dewalt, Stanley)

- Robert Bosch GmbH

- Hilti Corporation

- Johnson Level & Tool Mfg. Co. Inc.

- Stabila Messgeräte Gustav Ullrich GmbH

- Spectra Precision (Trimble)

- Kapro Industries Ltd.

- A. P. E. Engineering Inc.

- Toolway Industries Ltd.

- Topcon Corporation

- Makita Corporation

- Ryobi (Techtronic Industries)

- Fluke Corporation

- PLS (Pacific Laser Systems)

- Zircon Corporation

- Geo-Fennel GmbH

- Sola-Messwerkzeuge GmbH

- Laserliner (Umarex)

Frequently Asked Questions

Analyze common user questions about the Laser Level Meter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Green Laser Levels over Red Laser Levels?

The primary driver is the significantly improved visibility of the green laser beam, which appears up to four times brighter to the human eye compared to red lasers, especially crucial for maximizing productivity in bright daylight or large, illuminated indoor spaces common in commercial construction. This enhanced visibility effectively extends the functional working range and reduces setup time for professional contractors.

How does self-leveling technology in laser meters ensure accuracy on construction sites?

Self-leveling technology utilizes either precision pendulums (magnetic dampening) or advanced MEMS electronic sensors (accelerometers) to automatically detect and correct minor deviations up to a specific tilt angle (typically 4 degrees). This system ensures that the laser line or plane is perfectly level or plumb within its specified accuracy tolerance without continuous manual adjustments, mitigating human error and increasing operational speed.

What are the key differences between Line Laser Meters and Rotary Laser Meters?

Line laser meters project a stationary horizontal, vertical, or cross line, typically used for alignment over shorter distances (e.g., internal fittings, tiling). Rotary laser meters project a continuous 360-degree beam by spinning rapidly, covering vast areas and extended distances (hundreds of meters) for applications like large foundation grading, excavation, and elevation control in civil engineering.

Which end-user segment contributes most significantly to the Laser Level Meter Market revenue?

The professional Construction segment, encompassing both commercial and large-scale infrastructure projects, contributes the most significant revenue share. This segment demands high-precision, durable, and often integrated rotary and 360-degree multi-line laser systems, justifying the purchase of premium, technologically advanced equipment that requires higher capital investment than DIY or residential use models.

Is the integration of IoT and connectivity impacting the future design of laser level meters?

Yes, IoT integration is profoundly impacting design, enabling features like remote control, automated data logging, and seamless transfer of measurement data via Bluetooth or Wi-Fi to mobile devices or Building Information Modeling (BIM) platforms. This connectivity enhances real-time quality control, reduces manual documentation errors, and aligns laser meters with the broader trend toward digitalized construction site management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager