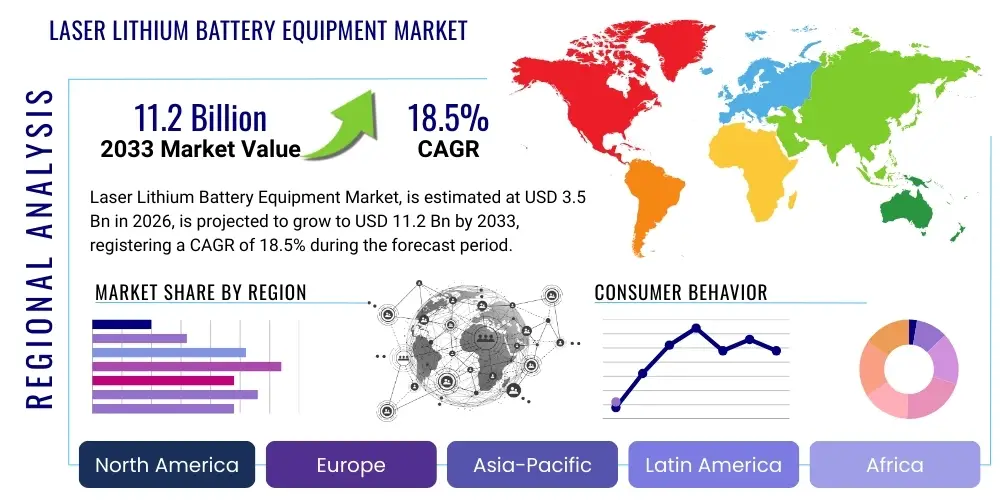

Laser Lithium Battery Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437215 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Laser Lithium Battery Equipment Market Size

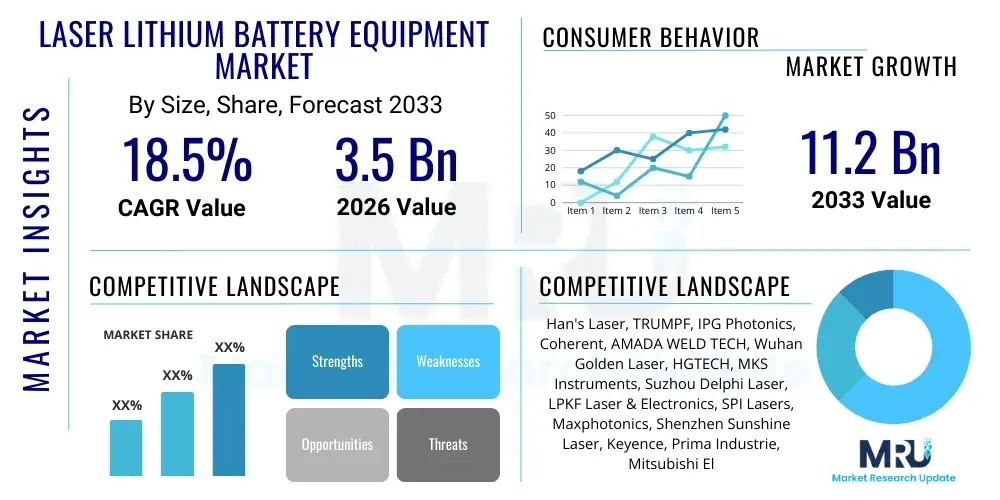

The Laser Lithium Battery Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Laser Lithium Battery Equipment Market introduction

The Laser Lithium Battery Equipment Market encompasses specialized, high-precision industrial machinery utilized for critical processes within the manufacturing lifecycle of lithium-ion cells, ranging from electrode fabrication to final cell assembly and sealing. These robust systems, primarily incorporating high-power fiber lasers, ultra-short pulse lasers, and sophisticated beam delivery optics, are indispensable for achieving the stringent quality, speed, and geometric accuracy required for modern battery production, particularly in high-volume settings like Gigafactories. The equipment is vital for tasks such as intricate foil cutting, high-integrity tab welding, internal structure connection, and robust sealing of prismatic, pouch, and cylindrical cells. Adoption of laser technology mitigates defects, enhances energy density, and ensures the long-term safety and performance of the batteries.

The core product description covers several categories, including laser cutting and slitting systems for anode and cathode foils, high-speed laser welding machines for cell tabs and busbars, laser cleaning systems for surface preparation, and laser marking equipment for traceability and quality control. Major applications are overwhelmingly concentrated in the Electric Vehicle (EV) sector, catering to the unprecedented global demand for high-capacity power sources for cars, trucks, and two-wheelers. Secondary applications include grid-scale Energy Storage Systems (ESS), requiring large format cells, and advanced consumer electronics demanding precise, miniaturized battery packs. The inherent benefits of laser processing—non-contact operation, minimal heat-affected zones (HAZ), superior precision, and ultra-high processing speeds—are key enablers for next-generation battery designs and manufacturing efficiencies.

The market is fundamentally driven by the global transition towards sustainable transportation and renewable energy storage solutions, necessitating enormous scale-up in battery production capacity worldwide. This expansion fuels demand for highly automated and reliable manufacturing tools. Key driving factors include escalating governmental mandates supporting EV adoption, massive capital expenditure by automotive original equipment manufacturers (OEMs) and dedicated battery manufacturers, and continuous technological refinements in laser sources that enhance processing capabilities for increasingly sensitive and complex battery chemistries. Furthermore, the persistent push for higher energy density and faster charging capabilities mandates the precision offered uniquely by laser-based processes, solidifying its essential role in the contemporary battery value chain.

Laser Lithium Battery Equipment Market Executive Summary

The Laser Lithium Battery Equipment Market is experiencing substantial growth propelled by transformative business trends centered on global Gigafactory proliferation and the intense focus on manufacturing automation (Industry 4.0 standards). Business trends indicate a shift towards modular, integrated laser processing lines capable of handling multiple cell formats and chemistries with minimal downtime, emphasizing full traceability and predictive maintenance capabilities enabled by sophisticated sensor technology. Strategic collaborations between laser manufacturers and battery cell producers are intensifying, driving co-development of application-specific solutions, such as remote laser welding for ultra-high-speed sealing and advanced galvanometer systems for precise electrode cutting. Furthermore, sustainability requirements are promoting the development of laser processes that minimize material waste and energy consumption.

Regional trends highlight Asia Pacific (APAC), led by China, South Korea, and Japan, as the dominant manufacturing and consumption hub, hosting the majority of the world's operational Gigafactories. However, North America and Europe are rapidly gaining momentum, backed by significant governmental funding (e.g., US Inflation Reduction Act, EU Green Deal) aimed at localizing the battery supply chain and reducing reliance on APAC imports. This localization effort is catalyzing massive investments in new European and American laser equipment, particularly for advanced processes needed for high-nickel cathode materials and future solid-state electrolytes. Competition is heightening in these developing regions, pushing technology providers to establish local service and support infrastructures.

Segmentation trends reveal significant traction within the Electric Vehicle (EV) segment, which commands the largest share due to volume requirements, particularly favoring high-power fiber laser systems for critical welding applications. Technologically, there is an increasing adoption of ultra-short pulse (USP) lasers, including picosecond and femtosecond systems, within the Electrode Processing segment for cleaner, burr-free cutting of sensitive materials that minimizes micro-shorts, crucial for high-performance batteries. The Prismatic cell format segment is exhibiting strong growth, especially in large-format cells for commercial vehicles and ESS, demanding large-scale, automated laser sealing equipment. This continuous innovation across process stages and cell types is fragmenting the equipment demand landscape, favoring specialized vendors offering specific solutions over generalized machinery.

AI Impact Analysis on Laser Lithium Battery Equipment Market

Common user questions regarding AI’s impact on the Laser Lithium Battery Equipment Market frequently revolve around its practical implementation in enhancing quality control, improving process efficiency, and enabling predictive maintenance in high-volume manufacturing environments. Users are keen to understand how AI algorithms can interpret complex sensor data—such as real-time optical coherence tomography (OCT) feedback during welding, or vision system data during cutting—to automatically adjust laser parameters on the fly, thereby ensuring zero-defect production at Gigafactory speeds. Key concerns include the investment required for integrating sophisticated AI inference engines into existing machinery and the necessity for robust, large datasets (spanning material variations, environmental conditions, and processing errors) to effectively train accurate machine learning models. The expectation is that AI integration will fundamentally shift battery manufacturing from reactive quality checks to proactive process optimization.

- AI-driven real-time quality assurance: Utilizing machine vision and deep learning to identify and classify microscopic defects (e.g., porosity, microcracks) immediately during laser processing (cutting or welding).

- Predictive Maintenance (PdM): AI algorithms analyze vibration, temperature, and power consumption data from laser sources and motion stages to predict component failure, significantly reducing unplanned downtime in continuous operation lines.

- Process Parameter Optimization: Machine learning models optimize laser power, pulse duration, focus position, and scanning speed based on material variations and desired weld geometry, maximizing throughput and weld integrity.

- Automated Trajectory Planning: AI enhances the efficiency of complex 3D welding paths and highly dense electrode stack geometries, improving path accuracy and cycle time.

- Data Aggregation and Traceability: AI systems correlate laser process data with final cell performance data, ensuring comprehensive, tamper-proof quality records for regulatory compliance and supply chain transparency.

- Yield Enhancement: Continuous learning from production runs allows AI to refine process control limits, leading to higher manufacturing yields and reduced scrap rates, critical for expensive battery materials.

DRO & Impact Forces Of Laser Lithium Battery Equipment Market

The market dynamics are defined by powerful driving forces centered on electrification mandates and technological necessity, balanced against significant capital expenditure constraints and the high complexity of laser integration, while vast opportunities arise from the next generation of battery technology. Drivers include the exponential growth in EV production, stringent requirements for high energy density and safety that only precision laser processing can meet, and governmental subsidies supporting domestic battery supply chain development across major economies. However, restraints involve the extremely high initial cost of sophisticated ultra-short pulse laser systems, the need for specialized technical expertise for operation and maintenance, and the rapid pace of battery chemistry evolution (e.g., transition from liquid to solid-state electrolytes) that demands frequent and costly equipment retooling or replacement.

Opportunities are strongly linked to the industrialization of novel battery designs, such as solid-state batteries (SSBs), which require entirely new laser micro-processing techniques for handling ceramic or polymer electrolytes and complex multilayer structures. Furthermore, the integration of advanced automation capabilities (Industry 4.0, IoT) into laser equipment, facilitating seamless data exchange and remote diagnostics, presents substantial potential for productivity gains. The key impact forces dictating market velocity involve the pricing pressures exerted by high-volume APAC manufacturers, forcing global competitors to adopt the fastest and most efficient laser systems available, and the continuous innovation cycle in laser physics (e.g., increasing power and beam quality of green and blue lasers for copper processing) that constantly redefines manufacturing possibilities.

The confluence of high demand (Drivers) and high barrier to entry (Restraints) results in a highly competitive market where technological superiority and application-specific expertise are paramount. The long-term trajectory is overwhelmingly positive (Opportunities) as laser technology is foundational to achieving the next level of performance and cost reduction targets (e.g., USD 100/kWh pack cost) mandated by the EV industry. The primary impact forces thus prioritize precision and speed—if a laser system cannot offer nanometer-level precision at speeds commensurate with Gigafactory output, it risks rapid obsolescence. This dynamic pushes equipment manufacturers towards continuous R&D into integrated process monitoring and adaptive control systems.

Segmentation Analysis

The Laser Lithium Battery Equipment Market is systematically segmented across various dimensions, including the type of equipment utilized, the specific stage of the battery manufacturing process, the physical format of the cell being processed, and the ultimate end-use application. This segmentation provides a granular view of demand patterns, indicating that requirements differ vastly between the high-volume, high-precision demands of electrode processing and the high-power needs of final cell sealing. The most significant revenue contributor remains the laser welding segment, due to the high number of critical welding points required within each cell, particularly for high-energy density prismatic and pouch cells used in electric vehicles.

- By Equipment Type

- Laser Cutting Equipment (Slitting, Die Cutting)

- Laser Welding Equipment (Tab Welding, Collector Welding, Housing Sealing)

- Laser Cleaning Equipment (Pre-welding surface treatment)

- Laser Marking Equipment (Traceability and identification)

- By Process Stage

- Electrode Processing (Cutting, Cleaning, Notching)

- Cell Assembly (Stacking/Winding, Tab Welding, Pouch/Case Welding)

- Post-processing (Module/Pack Integration, Inspection)

- By Battery Type

- Prismatic Cells

- Pouch Cells

- Cylindrical Cells (e.g., 4680 format)

- By End-User

- Electric Vehicles (EVs)

- Consumer Electronics (CE)

- Energy Storage Systems (ESS) and Grid Applications

- Industrial and Specialized Applications

Value Chain Analysis For Laser Lithium Battery Equipment Market

The value chain for laser lithium battery equipment begins with upstream raw material suppliers and laser source manufacturers, extending through equipment integrators, and culminating with downstream battery cell producers and end-users. Upstream activities involve high-purity material provision (e.g., rare earth elements, specialized optical components, semiconductor materials) and the manufacturing of core technology, specifically high-power fiber lasers, disk lasers, and advanced galvanometer scanners. The performance and reliability of these upstream components directly dictate the final equipment's speed and precision. Key suppliers like IPG Photonics, TRUMPF, and Coherent hold significant leverage through proprietary laser source technology and patents, creating high barriers to entry.

Midstream activities are dominated by specialized equipment integrators and automation companies (e.g., Han's Laser, Suzhou Delphi Laser). These entities are responsible for designing, assembling, and programming the complex, multi-axis automated systems that incorporate the laser sources, robotics, vision systems, and proprietary processing optics necessary for battery manufacturing tasks. This stage involves intense customization based on the specific cell format (prismatic vs. cylindrical) and the chemistry being processed (LFP vs. NMC). Distribution channels typically follow a direct-sales model for large-scale Gigafactory contracts, leveraging deep technical consulting and long-term service agreements due to the high-value, complex nature of the machinery.

Downstream analysis focuses on the buyers—the battery cell manufacturers (e.g., CATL, LG Energy Solution, Samsung SDI) and automotive OEMs (e.g., Tesla, Volkswagen) that operate these Gigafactories. Direct distribution channels are paramount, ensuring technical support, rapid installation, and integration into existing manufacturing execution systems (MES). Indirect channels are negligible, utilized primarily for consumables or smaller, less critical peripheral equipment. The value chain is characterized by strong technological partnerships between midstream integrators and downstream customers, ensuring the equipment meets evolving production scale and quality metrics, making after-sales service and process consulting crucial competitive differentiators.

Laser Lithium Battery Equipment Market Potential Customers

The primary consumers and end-users of Laser Lithium Battery Equipment are large-scale industrial entities deeply invested in the electric mobility and renewable energy sectors. These include the massive multinational corporations operating Gigafactories, where demand is driven by the necessity for maximum throughput and minimum defect rates. Automotive OEMs are increasingly becoming direct customers, establishing in-house battery production facilities to secure supply chains and integrate battery design with vehicle architecture, necessitating customized high-speed equipment for module and pack assembly alongside cell production.

A second major customer segment comprises specialized battery manufacturers and start-ups focused on next-generation technologies, such as solid-state batteries or unique flexible battery formats. These customers require highly flexible and precise laser systems, often involving ultra-short pulse lasers, for delicate micro-processing tasks that standard fiber lasers cannot handle. Furthermore, integrators supplying turnkey solutions to emerging battery regions also act as critical indirect buyers, consolidating demand for multiple smaller facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Han's Laser, TRUMPF, IPG Photonics, Coherent, AMADA WELD TECH, Wuhan Golden Laser, HGTECH, MKS Instruments, Suzhou Delphi Laser, LPKF Laser & Electronics, SPI Lasers, Maxphotonics, Shenzhen Sunshine Laser, Keyence, Prima Industrie, Mitsubishi Electric, Chizhou Anhui Laser, Tianhong Laser, Alpha-Tek, Novanta |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Lithium Battery Equipment Market Key Technology Landscape

The technological landscape of the Laser Lithium Battery Equipment market is defined by the necessity for highly reliable, fast, and precise energy delivery systems tailored to the unique physical and chemical properties of battery components. The dominant technologies include high-power continuous wave (CW) and quasi-continuous wave (QCW) Fiber Lasers, typically in the kilowatt range, used extensively for critical welding applications such as housing sealing, tab welding, and busbar connection, capitalizing on their high efficiency and robust beam quality. These lasers are often paired with advanced galvanometer scanners (galvo systems) and complex beam shaping optics to maximize speed and ensure precise energy distribution across the weld joint, minimizing spatter and ensuring structural integrity.

A rapidly expanding technological area involves Ultra-Short Pulse (USP) Lasers, specifically picosecond and femtosecond systems, which are increasingly critical in electrode processing. USP lasers offer ‘cold’ ablation, dramatically reducing the heat-affected zone (HAZ) and material degradation when cutting highly sensitive thin foils and coated electrode materials. This technology is superior for notching and micro-cutting, providing burr-free edges essential for preventing internal short circuits, especially as manufacturers move towards thinner foils and higher stacking densities. Furthermore, there is significant research focused on Green and Blue Lasers, as these shorter wavelengths offer superior absorption characteristics for highly reflective materials like copper (anode collector), significantly enhancing the efficiency and quality of copper welding compared to traditional infrared lasers.

Beyond the laser source itself, the market heavily relies on integrated process monitoring technologies. These systems, often incorporating Optical Coherence Tomography (OCT) or sophisticated thermal cameras, provide real-time feedback on weld penetration, porosity formation, and surface quality. This data is essential for enabling adaptive process control, where machine parameters adjust instantaneously to material variations, ensuring consistent quality in high-speed production. The adoption of smart automation, coupled with IoT sensors and advanced robotics for material handling and alignment, is paramount, transforming individual laser machines into fully integrated, flexible manufacturing cells compatible with the demands of Industry 4.0 and future battery generations, including solid-state concepts requiring hermetic glass-to-metal or ceramic sealing.

Regional Highlights

- Asia Pacific (APAC): APAC, particularly China, dominates the global market both in terms of manufacturing capacity and equipment consumption. Governments in China and South Korea heavily subsidize domestic battery production, driving immense demand for localized, high-throughput laser equipment. Leading manufacturers in the region focus on high-speed, cost-effective fiber laser solutions for massive-scale EV and ESS production, maintaining a technological lead in overall installed base and rapid expansion capability.

- Europe: Europe is characterized by aggressive localization strategies, referred to as the "Gigafactory race," aiming to build a self-sufficient EV supply chain. This region exhibits high demand for advanced, flexible manufacturing equipment, often prioritizing precision and automation standards over sheer volume throughput initially. European adoption is trending towards highly sophisticated, process-monitoring-equipped laser systems supplied by established Western vendors like TRUMPF and Coherent, driven by stringent quality and sustainability regulations.

- North America: Driven by supportive legislation (e.g., Inflation Reduction Act - IRA) and significant investment by major automotive OEMs, North America is witnessing rapid establishment of greenfield Gigafactories. The market here demands proven, highly automated laser equipment capable of scaling quickly. There is strong emphasis on integrating advanced data analytics and AI for yield management, resulting in demand for the latest USP and high-power fiber laser systems for both cell and pack assembly.

- Latin America, Middle East, and Africa (MEA): These regions represent emerging markets for laser battery equipment, with demand primarily focused on smaller-scale assembly operations, specialty vehicles, and niche ESS projects. While infrastructure investment is slower than in Tier 1 regions, future growth potential lies in local assembly plants supported by global suppliers seeking diversified manufacturing footprints. Equipment procurement is often focused on reliability and ease of maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Lithium Battery Equipment Market.- Han's Laser

- TRUMPF

- IPG Photonics

- Coherent (now II-VI Incorporated)

- AMADA WELD TECH

- Wuhan Golden Laser

- HGTECH

- MKS Instruments

- Suzhou Delphi Laser

- LPKF Laser & Electronics

- SPI Lasers (part of TRUMPF)

- Maxphotonics

- Shenzhen Sunshine Laser

- Keyence

- Prima Industrie

- Mitsubishi Electric

- Chizhou Anhui Laser

- Tianhong Laser

- Alpha-Tek

- Novanta

Frequently Asked Questions

Analyze common user questions about the Laser Lithium Battery Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of using lasers for lithium battery manufacturing over traditional methods?

Lasers offer superior precision and speed, minimizing the Heat-Affected Zone (HAZ) during cutting and welding, which is critical for maintaining the electrochemical integrity and safety of sensitive battery materials, reducing defects like micro-shorts and enhancing energy density.

Which specific type of laser technology is becoming essential for processing sensitive electrode materials?

Ultra-Short Pulse (USP) lasers (picosecond and femtosecond) are increasingly essential for electrode processing (notching and cutting) due to their ability to perform ‘cold ablation,’ resulting in burr-free edges and negligible thermal damage, crucial for high-performance battery life.

How is the growth of Gigafactories globally affecting the laser equipment market?

The exponential growth of Gigafactories mandates massive scale-up, driving demand for highly automated, high-power, and multi-functional laser processing lines that can operate continuously at maximum throughput with integrated process monitoring and AI-driven quality control.

Which geographical region currently dominates the consumption and manufacturing of laser battery equipment?

Asia Pacific (APAC), particularly driven by China, currently dominates both the manufacturing base and the consumption volume of laser lithium battery equipment, although North America and Europe are rapidly increasing their market share through localization efforts.

What is the most significant financial restraint impacting the adoption of advanced laser battery equipment?

The high initial capital investment required for purchasing and integrating advanced laser systems, especially ultra-short pulse and specialized high-power fiber lasers, represents the most significant financial restraint for new market entrants or smaller-scale producers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager