Laser Micromachining Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436983 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Laser Micromachining Systems Market Size

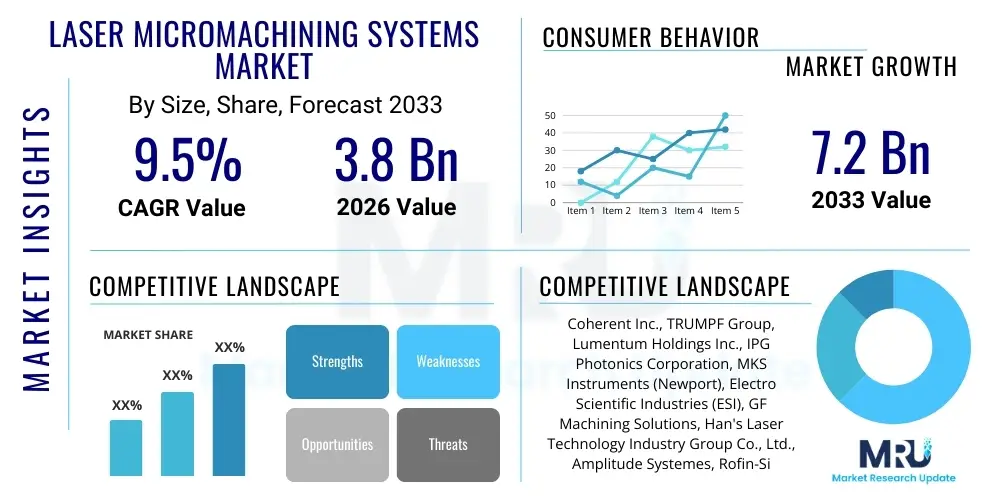

The Laser Micromachining Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Laser Micromachining Systems Market introduction

The Laser Micromachining Systems Market encompasses advanced manufacturing equipment utilizing highly focused laser beams to perform precise material processing operations—such as cutting, drilling, ablation, and surface structuring—at micro-scale resolutions (typically less than 100 micrometers). These systems leverage various laser sources, notably femtosecond, picosecond, and ultraviolet (UV) nanosecond lasers, to achieve superior precision, minimal heat-affected zones (HAZ), and the ability to process complex geometries on diverse materials, including polymers, ceramics, glass, metals, and semiconductors. The technology's core product description revolves around high-precision optical delivery systems, galvanometer scanners, motion control stages, and sophisticated software interfaces designed for automated, high-throughput manufacturing environments. The inherent non-contact nature and deterministic material removal capabilities differentiate laser micromachining from traditional mechanical methods, offering significant advantages in applications requiring ultra-fine feature sizes and high repeatability.

Major applications of laser micromachining systems span critical high-tech industries. In the semiconductor and electronics sector, they are indispensable for wafer dicing, thin-film patterning, circuit repair, and producing micro-vias in printed circuit boards (PCBs) and advanced packaging solutions. The medical device industry relies heavily on this technology for manufacturing stents, catheters, drug delivery systems, and surgical tools due to the necessity for biocompatibility and extreme dimensional accuracy. Furthermore, automotive manufacturing utilizes micromachining for fuel injector nozzles and sensor production, while the aerospace industry employs it for precision component fabrication involving demanding materials. The market growth is fundamentally driven by the continuous miniaturization trend across all electronics and medical fields, pushing the demand for processes capable of sub-micron tolerances and high throughput processing.

The principal benefits derived from adopting laser micromachining systems include enhanced product performance, reduced production costs over large volumes, and the capability to work with next-generation materials that are difficult or impossible to process using conventional mechanical methods. Key driving factors stimulating market expansion include escalating R&D investment in ultrashort pulse (USP) lasers, which deliver cold ablation characteristics, minimizing thermal damage; the explosive demand for advanced packaging technologies (like 3D ICs and fan-out wafer-level packaging); and stringent regulatory requirements in medical and aerospace sectors demanding zero-defect manufacturing. The increasing integration of automation and machine vision systems further accelerates adoption, making these systems crucial enablers of Industry 4.0 manufacturing paradigms.

Laser Micromachining Systems Market Executive Summary

The Laser Micromachining Systems Market is experiencing robust expansion, fundamentally driven by the exponential growth in the global electronics manufacturing sector, particularly in advanced mobile devices, complex sensors, and high-density memory chips requiring finer features and higher layer counts. Business trends indicate a strong shift towards the adoption of ultrashort pulse (USP) lasers—specifically femtosecond and picosecond sources—as manufacturers prioritize cold ablation capabilities to improve yield and process highly sensitive materials like OLED displays and advanced ceramic substrates. Strategic partnerships between laser source manufacturers and system integrators are becoming prevalent, aiming to provide turnkey solutions tailored for specific industrial processes. Furthermore, sustainability initiatives are influencing equipment design, favoring systems with high energy efficiency and reduced material waste, positioning laser systems as environmentally superior alternatives to chemical etching processes.

Regionally, the Asia Pacific (APAC) dominates the market, primarily due to the massive concentration of semiconductor fabrication facilities (fabs) and consumer electronics manufacturing hubs, particularly in China, South Korea, Taiwan, and Japan. APAC’s rapid technological scaling and substantial government support for high-tech manufacturing continue to solidify its leading position. North America and Europe, while representing mature markets, exhibit high growth rates focused on specialized, high-value applications such as precision medical device manufacturing, aerospace components, and advanced automotive electronics. These regions focus heavily on R&D and integrating artificial intelligence (AI) and machine learning (ML) for process optimization and quality control, ensuring they maintain technological leadership despite the high volume dominance of APAC.

Segment trends reveal that the Semiconductor and Electronics application segment retains the largest market share, consistently demanding higher performance systems capable of sub-micron precision for processing fragile wafer materials and complex interconnections. Within the Laser Type segment, femtosecond lasers are projected to witness the fastest CAGR, reflecting the industry's investment in cold ablation technology necessary for next-generation material processing where thermal damage is unacceptable. Process-wise, precision drilling and cutting operations remain critical, but surface texturing and selective material removal are rapidly gaining traction, driven by requirements in biomedical implants and specialized optical components. Overall, market segmentation highlights a continuous push towards faster, more precise, and highly automated micromachining solutions capable of handling diverse and sensitive materials.

AI Impact Analysis on Laser Micromachining Systems Market

User inquiries regarding the integration of Artificial Intelligence (AI) in laser micromachining predominantly revolve around enhancing process stability, predicting component failure, and achieving real-time quality assurance in high-volume production. Key themes center on how AI can automate complex parameter adjustments—moving beyond fixed recipe processing—and manage the inherent variability in material properties and machine drift over time. Users are particularly interested in AI's ability to interpret live sensor data (acoustic emission, optical monitoring, temperature readings) to detect defects instantaneously, minimizing scrap rates, which is crucial given the high cost of components like semiconductor wafers and medical implants. Expectations are high concerning predictive maintenance (preventing costly downtime) and optimizing the laser path and energy delivery in highly dynamic or complex 3D structures, pushing the limits of process capability and system throughput.

- AI-driven Predictive Maintenance: Utilizing sensor data to anticipate critical component wear (e.g., laser source lifetime, galvanometer drift), significantly reducing unplanned downtime and improving overall equipment effectiveness (OEE).

- Real-Time Process Optimization: Machine learning algorithms adjust laser power, pulse duration, repetition rate, and scanning speed dynamically based on immediate feedback from the material and process monitors, ensuring consistent output quality.

- Automated Quality Control (AQC): Employing computer vision and deep learning models to inspect micromachined features instantly, detecting subtle flaws (e.g., burrs, inconsistent etch depths) that are challenging for traditional vision systems.

- Advanced Recipe Generation: AI accelerates the development of complex processing parameters for novel materials by simulating and optimizing process windows faster than human experts can achieve through trial and error.

- Enhanced Throughput and Yield: By minimizing thermal damage through precise control and maximizing material removal rates without compromising quality, AI directly contributes to higher manufacturing output and reduced scrap volume, particularly critical for expensive substrates.

DRO & Impact Forces Of Laser Micromachining Systems Market

The Laser Micromachining Systems Market is characterized by strong drivers rooted in technological advancements and market demand, balanced by significant restraints related to capital investment and process complexity, yielding ample future opportunities. The primary driver is the pervasive trend of miniaturization across consumer electronics and specialized medical devices, mandating processing techniques with sub-micron accuracy that only laser technology can reliably provide. Opportunities are emerging prominently in the development of next-generation optical devices, 5G components, and microfluidic chips, requiring highly specialized laser processing capabilities. Restraints, however, include the substantial initial capital expenditure required for high-end ultrashort pulse laser systems and the requirement for highly skilled technical personnel to operate and maintain these complex, highly customized machines. These forces combine to create a dynamic market environment where technological innovation acts as the central catalyst for growth.

Key drivers include the global proliferation of advanced semiconductor packaging technologies (e.g., Heterogeneous Integration, 3D stacking) necessitating precise through-silicon via (TSV) drilling and fine-pitch patterning, alongside stringent quality standards in critical sectors like aerospace demanding precise material removal in exotic alloys. Opportunities are magnified by the transition from traditional, less precise mechanical methods (like mechanical drilling and sawing) to superior laser-based processes that offer higher yield rates and improved material integrity. This transition is particularly noticeable in processing fragile materials such as glass, sapphire, and specialized polymers where traditional methods often induce micro-cracks or unacceptable thermal stress.

The major impact force acting upon the market is the pace of ultrashort pulse (USP) laser development. As USP sources become more robust, energy-efficient, and cost-effective, they displace older nanosecond and picosecond technologies in high-precision applications. However, a significant restraint is the regulatory environment in some regions, which can slow down the adoption of new manufacturing techniques, particularly in highly regulated industries like medical devices, where validation cycles are lengthy. Market success hinges on the ability of system integrators to offer fully automated, customizable solutions that mitigate the operational complexity and high cost, thereby broadening the accessible user base beyond major corporations to specialized contract manufacturers.

Segmentation Analysis

The Laser Micromachining Systems Market is comprehensively segmented based on the type of laser source utilized, the specific process performed, the primary application industry, and the geographical region. This detailed segmentation allows market players to accurately target niches demanding specific levels of precision and throughput. The dominant segmentation factor remains the laser source, with ultrashort pulse lasers (femtosecond and picosecond) capturing increasing market share due to their non-thermal processing advantages crucial for processing sensitive high-value materials. Application segmentation clearly delineates demand drivers, with the semiconductor and medical segments requiring the highest precision and therefore driving investment in advanced system capabilities. Geographic segmentation confirms the APAC region as the powerhouse for volume manufacturing, while North America and Europe lead in high-end R&D-intensive applications.

- By Laser Type:

- Femtosecond Lasers

- Picosecond Lasers

- Nanosecond Lasers

- UV Lasers (e.g., Excimer and solid-state UV)

- Other Lasers

- By Application:

- Semiconductor and Electronics

- Medical Devices and Life Sciences

- Automotive

- Aerospace and Defense

- Solar and Energy

- Others (e.g., Optics, Watchmaking)

- By Process:

- Drilling

- Cutting and Dicing

- Ablation and Surface Structuring

- Marking and Engraving

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Laser Micromachining Systems Market

The value chain for Laser Micromachining Systems begins with the upstream suppliers responsible for core components, primarily the laser source manufacturers (e.g., fiber, diode-pumped solid-state, and gas lasers), specialized optical components (mirrors, lenses, beam expanders), and motion control hardware (galvanometers, high-precision stages). This upstream segment is highly competitive and technologically sophisticated, as the performance and reliability of the final system are critically dependent on the quality and specifications of the laser source, especially concerning pulse stability and beam quality. Key suppliers continuously invest in R&D to deliver sources with higher power, shorter pulse durations, and better efficiency, directly influencing system integrators’ ability to meet demanding market specifications. High barriers to entry exist in the laser source manufacturing segment due to complex intellectual property and specialized manufacturing processes.

The midstream of the value chain is dominated by system integrators and equipment manufacturers who design, assemble, and customize the laser micromachining platforms. These integrators combine the upstream components with proprietary software, machine vision systems, and automation tools to create turnkey solutions tailored for specific industrial applications (e.g., wafer processing, stent cutting). They are responsible for significant value addition through application engineering expertise, offering extensive customer support, process development services, and maintenance contracts. Distribution channels operate through both direct sales forces, especially for large, custom installations involving major semiconductor or medical OEMs, and indirect channels relying on regional distributors and representatives to penetrate smaller markets or specialized local contract manufacturing service providers.

Downstream analysis focuses on the end-users—Semiconductor manufacturers, Medical Device OEMs, specialized precision component manufacturers, and academic research institutions. The relationship between the system integrator and the end-user is critical, often involving long-term partnerships for process optimization and iterative machine upgrades. Direct distribution is favored when complex integration and continuous technical consultation are required, ensuring the system performs optimally within the client’s manufacturing environment. Indirect channels typically handle standard, lower-cost marking, and simpler ablation systems. The profitability across the chain is highest in the specialized upstream laser source manufacturing and the midstream integration stage where proprietary software and application know-how command premium pricing, justifying the substantial investment required for end-users.

Laser Micromachining Systems Market Potential Customers

The primary end-users and potential customers for Laser Micromachining Systems are large original equipment manufacturers (OEMs) and specialized contract manufacturing organizations (CMOs) operating within high-precision industries. In the electronics sector, major semiconductor fabrication plants (Fabs) are crucial buyers, utilizing these systems for advanced packaging (e.g., micro-drilling, thin film removal) and wafer processing where micron-level accuracy is mandatory. Similarly, globally operating medical device companies—especially those producing implantable devices like pacemakers, cardiovascular stents, and neurostimulation electrodes—represent a core customer base due to the requirement for ultra-fine features, superior surface finish, and the processing of delicate biomaterials without contamination.

Another significant group includes specialized contract manufacturers (CMOs) that offer outsourced high-precision cutting, welding, and drilling services to the automotive, aerospace, and general precision engineering industries. These CMOs invest heavily in state-of-the-art micromachining systems to maintain a competitive edge and adhere to stringent industry standards like AS9100 or ISO 13485. Research institutions and university labs focused on advanced materials science and micro-electro-mechanical systems (MEMS) development also constitute a smaller but vital customer segment, driving the demand for highly flexible and customizable R&D systems, often prioritizing the latest ultrashort pulse laser technology for experimental work.

In essence, any organization involved in the production of miniaturized, complex, or high-value components where material integrity and dimensional stability are non-negotiable constitutes a potential customer. The buying decision is usually influenced by factors such as system throughput, mean time between failures (MTBF), achievable resolution (spot size), and the vendor’s application support expertise, making the total cost of ownership (TCO) a crucial metric for evaluating system procurement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coherent Inc., TRUMPF Group, Lumentum Holdings Inc., IPG Photonics Corporation, MKS Instruments (Newport), Electro Scientific Industries (ESI), GF Machining Solutions, Han's Laser Technology Industry Group Co., Ltd., Amplitude Systemes, Rofin-Sinar Technologies (Coherent), Sumitomo Heavy Industries, DMG MORI, Jenoptik AG, 3D-Micromac AG, Posalux SA, Ekspla, Wuhan Golden Laser Co., Ltd., Light Conversion, Novanta Inc., Photonics Industries International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Micromachining Systems Market Key Technology Landscape

The technology landscape of the Laser Micromachining Systems Market is rapidly evolving, primarily centered around the dominance of ultrashort pulse (USP) lasers. Femtosecond and picosecond lasers represent the cutting edge, utilizing extremely short pulse durations (measured in 10-15 to 10-12 seconds) to achieve "cold ablation," where material is vaporized before significant heat transfer occurs to the surrounding area. This characteristic is vital for processing thermally sensitive and brittle materials such as glass, complex polymers, and silicon, minimizing the heat-affected zone (HAZ) and improving feature quality. Advancements are focused on increasing the average power of these USP sources while maintaining high beam quality and pulse stability, allowing for faster processing speeds without compromising precision, thereby addressing the industry demand for higher throughput in manufacturing environments.

Beyond the laser source itself, the market relies heavily on sophisticated beam delivery and control systems. High-speed galvanometer scanners, often incorporating advanced digital control loops, enable fast and precise beam steering across the work surface, critical for complex patterning and high-volume marking. Furthermore, integration of high-resolution machine vision and metrology tools is standard, providing real-time monitoring and closed-loop feedback control. These systems often employ multi-axis motion stages and sophisticated optics to manage beam shaping and focusing, ensuring the energy density profile meets the exact requirements for the material and process. The utilization of specialized optics for deep-UV (DUV) wavelengths is also essential for achieving the smallest spot sizes, pushing the limits of achievable micromachining resolution.

Software and automation constitute another crucial technological differentiator. Modern systems are equipped with integrated CAD/CAM software for easy job preparation and simulation, alongside advanced process control algorithms that leverage sensor data. The ongoing shift toward Industry 4.0 necessitates high levels of connectivity, allowing these systems to be integrated into factory-wide monitoring and enterprise resource planning (ERP) systems. Future technological advancements are expected to focus on integrating AI for autonomous process optimization and the development of cost-effective, high-power fiber-based USP sources, promising to lower system costs and expand market accessibility beyond highly specialized applications, making laser micromachining more pervasive across general manufacturing sectors.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market region, dominating in terms of volume consumption due to its status as the global manufacturing hub for consumer electronics, semiconductors, and displays. Countries like China, Taiwan, South Korea, and Japan host major fabrication plants and assembly lines that drive massive demand for high-throughput laser dicing, drilling, and patterning systems. Government initiatives promoting domestic high-tech manufacturing, coupled with significant foreign direct investment (FDI) in electronics assembly, cement APAC’s leading position.

- North America: North America is characterized by high adoption rates of advanced, high-value laser systems, particularly in the medical device, aerospace, and specialized R&D sectors. The focus here is less on volume and more on ultra-precision applications, such as micro-scale component fabrication for complex surgical tools and advanced material processing for defense applications. Strong presence of innovation hubs and major medical device OEMs drives continuous investment in state-of-the-art femtosecond laser technology.

- Europe: Europe is a mature market exhibiting robust growth, driven primarily by the automotive electronics sector, precision engineering (e.g., watchmaking, luxury goods), and sophisticated industrial research. Germany, as a global leader in industrial automation and optics manufacturing, plays a critical role. European manufacturers often prioritize energy efficiency, reliability, and the integration of highly automated systems compliant with stringent regional environmental and quality standards.

- Latin America: This region represents an emerging market, currently showing steady, albeit slower, growth. Adoption is mainly concentrated in localized automotive supply chains and specific medical manufacturing facilities, especially in Mexico and Brazil. Market development is generally dependent on foreign investment and the establishment of local assembly operations requiring precision tooling and processing capabilities.

- Middle East and Africa (MEA): MEA is the smallest segment but is showing potential growth, particularly in technologically advancing economies like the UAE and Saudi Arabia, driven by investments in high-tech infrastructure and diversification away from oil economies. Demand is primarily focused on repair, maintenance, and localized precision manufacturing for energy and defense sectors, utilizing systems for high-quality marking and component fabrication.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Micromachining Systems Market.- Coherent Inc.

- TRUMPF Group

- Lumentum Holdings Inc.

- IPG Photonics Corporation

- MKS Instruments (Newport)

- Electro Scientific Industries (ESI)

- GF Machining Solutions

- Han's Laser Technology Industry Group Co., Ltd.

- Amplitude Systemes

- Rofin-Sinar Technologies (Coherent)

- Sumitomo Heavy Industries

- DMG MORI

- Jenoptik AG

- 3D-Micromac AG

- Posalux SA

- Ekspla

- Wuhan Golden Laser Co., Ltd.

- Light Conversion

- Novanta Inc.

- Photonics Industries International

Frequently Asked Questions

Analyze common user questions about the Laser Micromachining Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Laser Micromachining Systems?

The primary driver is the accelerating trend of miniaturization across the semiconductor, electronics, and medical device industries, necessitating non-contact manufacturing processes capable of achieving sub-micron feature sizes and high dimensional accuracy with minimal thermal damage.

How do ultrashort pulse (USP) lasers improve processing quality?

USP lasers (femto and pico second) improve quality by enabling "cold ablation," which minimizes the heat-affected zone (HAZ). This allows for precise processing of highly sensitive materials like glass and polymers without inducing micro-cracks or melting, resulting in cleaner cuts and higher yields.

Which application segment holds the largest share in the Laser Micromachining Systems Market?

The Semiconductor and Electronics application segment currently holds the largest market share. This dominance is driven by the massive demand for precision processes like micro-via drilling, wafer dicing, and advanced packaging required for modern consumer electronics and high-performance computing components.

What is the main challenge faced by manufacturers adopting these systems?

The main challenge is the high initial capital expenditure (CapEx) required for acquiring sophisticated ultrashort pulse laser systems. Additionally, the need for highly specialized personnel for operation, maintenance, and application development contributes significantly to the overall total cost of ownership (TCO).

How is Artificial Intelligence (AI) influencing the laser micromachining process?

AI is influencing the process through real-time optimization of machining parameters, predictive maintenance to minimize downtime, and automated quality control (AQC) using advanced computer vision, ensuring process stability and significantly boosting manufacturing throughput and reliability.

The strategic expansion of the Laser Micromachining Systems Market into emerging application areas such as 5G component manufacturing and advanced sensor fabrication underscores its future potential. As device complexity continues to rise, the ability to process novel, multi-layered materials with extreme precision becomes non-negotiable. This technological imperative ensures that investment in next-generation laser sources remains robust, particularly those offering improved peak power stability and energy efficiency. System providers are focusing heavily on enhancing user interface simplicity and integrating robust diagnostics, addressing the skilled personnel constraint by making sophisticated technology more accessible to a broader range of technicians globally. This democratization of high-precision processing capabilities is essential for sustained growth across diverse industrial landscapes.

Geographically, while Asia Pacific leads in capacity and volume, the technological innovation benchmark is often set in North America and Europe, where regulatory demands, especially in medical and aerospace fields, necessitate continuous advancements in process validation and traceability. The push toward fully autonomous micromachining cells, leveraging AI for parameter drift compensation and adaptive laser delivery, is transforming factory floor dynamics. Furthermore, the rising awareness of environmental impacts favors laser processing over traditional chemical or mechanical methods, positioning laser micromachining systems as a key component in sustainable manufacturing strategies, contributing both economic and ecological benefits. This combination of precision, speed, and sustainability reinforces the long-term viability and growth trajectory of the market globally.

The segment analysis further emphasizes the crucial role of laser technology in supporting the foundational infrastructure of modern technology. The shift from nanosecond to picosecond and femtosecond lasers is not merely an incremental improvement but a fundamental change enabling processes previously impossible, such as cutting flexible OLED displays or drilling vias in ultra-thin glass substrates. These performance characteristics directly translate into competitive advantage for end-users, compelling them to invest in system upgrades despite the high upfront cost. Market resilience is demonstrated by the diverse range of applications, ensuring that demand remains stable even if specific sectors experience cyclical downturns, as robust growth in medical devices often compensates for temporary slowing in consumer electronics manufacturing cycles.

Examining the value chain reinforces the critical importance of intellectual property surrounding laser source technology. Companies that control proprietary high-power USP laser designs maintain significant leverage, ensuring strong profit margins and dictating the pace of innovation for system integrators. Downstream, the proliferation of contract manufacturing services specializing in laser micromachining is expanding, enabling smaller firms to access high-end capabilities without the capital burden. This expanding ecosystem promotes market entry and further diffusion of the technology across new industrial applications, from customized micro-optics production to surface functionalization for advanced energy storage devices. The demand for highly customized, multi-functional systems capable of sequential processing steps (e.g., cutting followed by surface cleaning) is also shaping system design, moving towards integrated platform solutions.

The continuous innovation within motion control systems is equally vital, featuring piezoelectric stages and high-accuracy linear motors that guarantee positional precision necessary for micromachining on large substrates, such as Gen 8 or Gen 10 display glass. Error correction algorithms, integrated directly into the motion controllers, compensate for thermal expansion and mechanical vibration, ensuring sustained accuracy over long operational cycles. This synergy between advanced laser sources, complex optics, high-speed beam steering, and ultra-precise motion control defines the modern laser micromachining system, enabling production tolerances measured in single-digit micrometers consistently. System reliability and minimal downtime are now key competitive metrics, driving the trend towards fiber-based laser architectures known for their robustness and extended operational lifetimes compared to traditional solid-state sources.

Furthermore, specialized laser processes like Selective Laser Etching (SLE) and laser-induced deep etching (LIDE) are emerging as critical techniques, particularly for 3D structuring of transparent materials like fused silica and glass. These methods allow for the creation of complex internal geometries necessary for microfluidic devices, integrated optics, and biomedical sensors. The ability to structure material internally without affecting the external surface is a unique advantage of high-power USP lasers, opening entirely new markets in photonics and lab-on-a-chip technologies. The regulatory environment, particularly the ISO 13485 standard for medical devices, mandates extremely high levels of process documentation and validation, compelling system vendors to provide sophisticated software tools for data logging and traceability, thereby ensuring compliance and safety in critical applications.

The role of specialized material handling within these systems cannot be overstated. High-volume semiconductor processing requires automated wafer loading, alignment, and unloading systems that integrate seamlessly with the micromachining platform. Dust and debris management are crucial, especially in cleanroom environments, necessitating specialized fume extraction and particle mitigation systems to prevent contamination of delicate substrates. Manufacturers are increasingly integrating machine health monitoring and self-calibration routines to maintain peak performance automatically, minimizing the need for manual intervention and further lowering operational costs over the system’s lifecycle. This holistic approach to system design, covering material input to final quality control, defines the market leaders and their ability to capture lucrative high-volume contracts across the global manufacturing landscape.

The anticipated evolution of the market includes a significant reduction in the cost-per-watt of high-power femtosecond lasers, driven by maturing technology and increased production economies of scale. This cost reduction is expected to broaden the economic feasibility of USP micromachining into cost-sensitive industries, potentially displacing older nanosecond technologies entirely in many precision applications. Simultaneously, the development of specialized hybrid systems that combine laser micromachining with additive manufacturing (3D printing) processes offers opportunities for the creation of components with unique material compositions and embedded functionalities at the micro-scale. These hybrid approaches are particularly appealing to research institutions and defense contractors seeking advanced prototyping capabilities. The overall trajectory suggests a highly dynamic market characterized by rapid technological refresh cycles and expanding applicability.

In summary, the laser micromachining sector is positioned for sustained high growth, underpinned by fundamental global trends in miniaturization and digitalization. Success in this market is intrinsically linked to mastery of ultrashort pulse technology, seamless integration of AI and automation for enhanced throughput, and the ability to provide robust, application-specific solutions that minimize TCO for demanding industrial users. The intense concentration of manufacturing capacity in APAC, combined with the technology leadership in North America and Europe, creates a complex, globally competitive landscape where innovation speed is the ultimate determinant of market leadership. Addressing the bottlenecks related to system cost and operational expertise will be key to unlocking the full potential of this enabling technology.

The integration of advanced metrology techniques, such as atomic force microscopy (AFM) and high-speed confocal microscopy, directly into the laser processing workflow is another area of technological emphasis. This in-situ metrology capability allows for immediate measurement of machined features, facilitating highly accurate adaptive corrections. For instance, if a drilled hole's diameter deviates from the specification due to minor material inconsistency, the system can adjust the subsequent laser pulses in real-time, maintaining tight tolerances and ensuring conformity across the entire batch. This closed-loop manufacturing paradigm is critical for zero-defect environments, particularly in the production of high-reliability medical and aerospace parts where failure is unacceptable. The synergy between high-precision material processing and immediate measurement feedback is a defining characteristic of next-generation micromachining platforms.

Furthermore, the development of specialized optics for handling high-peak-power ultrashort pulses without degradation remains a significant area of upstream R&D. Components like beam expanders, focusing optics, and galvanometers must be engineered from materials capable of withstanding extreme energy densities over millions of cycles. Failures in these components can lead to costly downtime and system damage, driving demand for optics characterized by high laser-induced damage thresholds (LIDT). Suppliers are continuously refining coating technologies and material purification processes to meet these stringent optical requirements, directly supporting the push for higher-power, higher-throughput laser systems capable of sustained industrial operation. The robustness of the optical train is as crucial as the reliability of the laser source itself in achieving industrial-grade reliability.

The proliferation of microfluidics and lab-on-a-chip devices—used extensively in drug discovery, diagnostics, and biomedical research—presents a rapidly expanding niche application. Laser micromachining is uniquely suited for creating the intricate micro-channels, mixing chambers, and reservoirs necessary for these devices, often fabricated in challenging materials like glass or fused silica. The high aspect ratio features and smooth interior surfaces achievable with USP lasers are essential for ensuring accurate fluid dynamics and preventing biological fouling within these miniaturized systems. This specialized application area is contributing significantly to the demand for multi-axis, precision-controlled laser platforms capable of processing 3D volumes with extremely fine structural details, further diversifying the market demand beyond traditional semiconductor manufacturing.

The competitive landscape is characterized by a balance between large, diversified industrial conglomerates (like TRUMPF and Coherent) offering a wide array of laser and system solutions, and specialized niche players (like 3D-Micromac and Posalux) focusing on specific high-precision applications, such as laser lift-off or advanced drilling. Acquisition activity remains a consistent feature, as larger companies seek to integrate proprietary USP laser sources or specialized application expertise into their portfolio, ensuring they remain competitive across the full spectrum of micromachining requirements, from high-volume standardized processes to highly customized R&D solutions. This consolidation and specialization indicate a maturing, yet highly innovative, market environment where technological differentiation is paramount for securing market share.

In conclusion, the fundamental drivers sustaining the laser micromachining market—miniaturization, material science complexity, and demand for zero-defect manufacturing—are structural and enduring. The continued decrease in cost and increase in reliability of USP laser technology, coupled with the sophisticated integration of Industry 4.0 elements like AI and real-time metrology, ensure that this market segment will continue its trajectory as a critical enabler of technological advancement across the global industrial base. The strategic focus must remain on application-specific engineering and total system integration to maximize value realization for end-users operating under increasingly stringent performance and regulatory requirements.

The evolution of laser micromachining software is moving toward low-code or no-code interfaces, aiming to reduce the learning curve for operators and accelerate process deployment. Instead of requiring extensive programming knowledge, operators can use graphical interfaces and predefined libraries of material parameters to quickly set up complex machining jobs. This software sophistication also includes robust simulation tools that predict material response before physical processing, minimizing expensive material waste and significantly cutting down development time for new components. The capability to seamlessly import complex 3D CAD models and translate them directly into optimized laser toolpaths using advanced algorithms for thermal management and material removal is a major technological advancement differentiating leading system providers.

Furthermore, the security and intellectual property protection features embedded in laser micromachining systems are becoming increasingly important. Since these machines often handle high-value, sensitive designs for clients in aerospace or defense, the software must incorporate advanced access control, encrypted process recipes, and secure data logging capabilities. Preventing unauthorized access or recipe manipulation is crucial for maintaining the integrity of the manufacturing process and complying with regulatory standards concerning data privacy and export controls. This focus on cybersecurity in industrial control systems represents a necessary layer of protection for high-value manufacturing assets, reflecting the high-stakes nature of the components being processed.

The environmental considerations extend beyond energy efficiency to include waste management. Laser ablation processes, while clean, generate micro-particles and fumes specific to the material being processed. Advanced filtration systems, often employing multi-stage filters and specialized air handling units, are mandatory to ensure operator safety and compliance with environmental regulations. System designers are integrating these features seamlessly, sometimes incorporating self-cleaning or automated filter replacement mechanisms to maintain high operational uptime and reduce the labor associated with hazardous waste disposal. The overall design emphasizes a cleaner, safer, and more environmentally responsible manufacturing workflow compared to older, solvent-heavy processes.

The market for refurbishment and upgrading of existing laser micromachining systems also presents a notable business opportunity. Many end-users, seeking to defer the high capital cost of purchasing entirely new equipment, opt to retrofit their existing platforms with newer generation laser sources (e.g., upgrading from picosecond to high-power femtosecond lasers) or enhanced motion control systems. System integrators who offer comprehensive upgrade packages and lifecycle management services are well-positioned to capture this secondary market demand, providing a cost-effective pathway for customers to access improved performance and maintain competitiveness without incurring full replacement costs. This service-oriented segment contributes significantly to the long-term revenue stability of key market players.

In conclusion, the modern laser micromachining system is defined by its fusion of diverse high technologies: the pure physics of ultrashort pulse generation, the engineering precision of high-speed optics and motion control, and the intelligence provided by software and AI integration. This synergy ensures that laser micromachining remains the go-to solution for the fabrication challenges presented by global trends towards smaller, more complex, and higher-performing devices across all major industrial sectors, justifying the robust investment and high growth projections for the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager