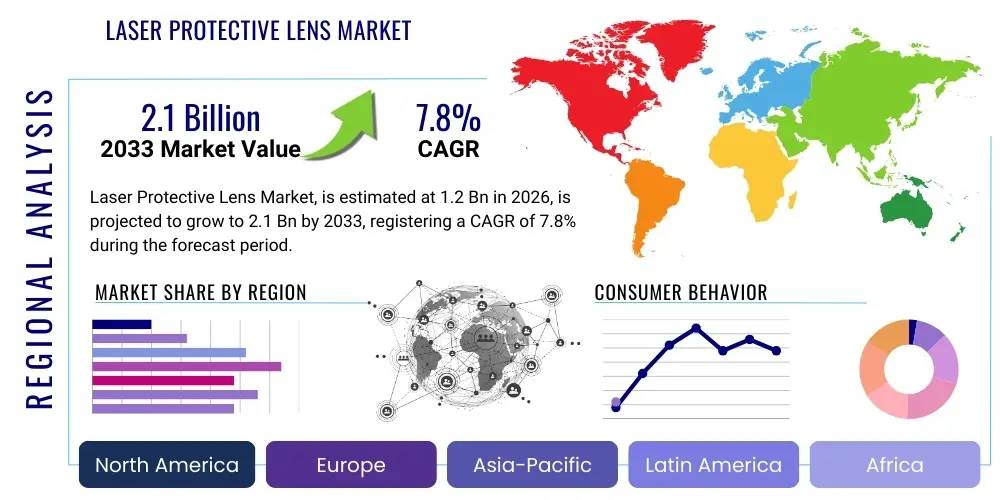

Laser Protective Lens Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440462 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Laser Protective Lens Market Size

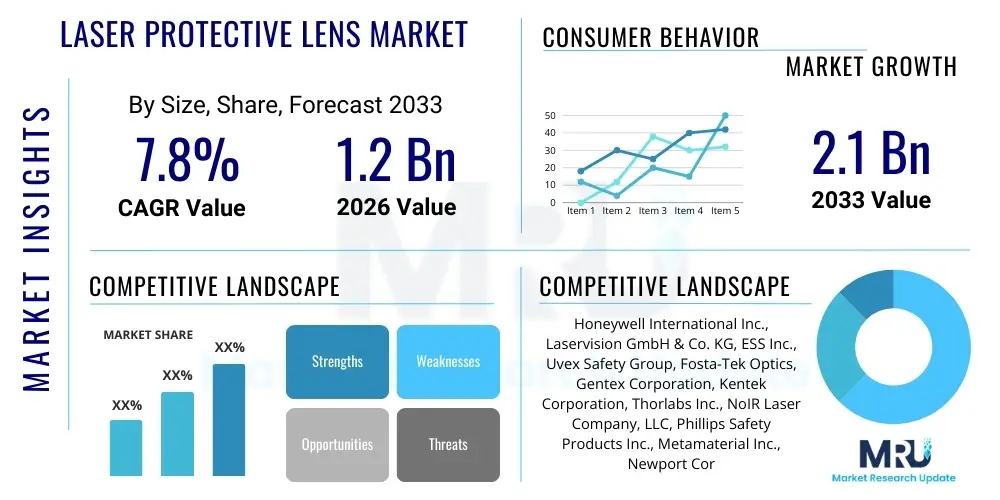

The Laser Protective Lens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.2 billion in 2026 and is projected to reach USD 2.1 billion by the end of the forecast period in 2033.

Laser Protective Lens Market introduction

The Laser Protective Lens Market encompasses the global manufacturing and distribution of specialized optical components designed to safeguard individuals, equipment, and sensitive instruments from the harmful effects of laser radiation. These lenses are engineered to attenuate or block specific laser wavelengths while allowing safe visible light transmission, ensuring operational safety and compliance with international laser safety standards. The product range includes various forms such as eyewear (goggles, spectacles), windows, barriers, and enclosures, crafted from materials like specialized glass, polymers, and crystals, often enhanced with advanced coatings. Major applications span across industrial sectors, including material processing (cutting, welding, marking, additive manufacturing), medical fields (surgery, aesthetics, diagnostics), scientific research, defense, and telecommunications. The inherent benefits include preventing eye damage, protecting sensitive electronic sensors, ensuring regulatory compliance, and enhancing overall operational safety in environments where lasers are employed. Key driving factors include the rapid proliferation of laser technology across diverse industries, increasingly stringent global laser safety regulations, and continuous advancements in laser power and wavelength diversity, necessitating ever more sophisticated protective solutions for both personnel and equipment. The market is also propelled by rising awareness regarding occupational safety and the growing investment in automation and high-precision laser-based processes globally. The demand for customized solutions tailored to specific laser parameters and application environments further contributes to market expansion, emphasizing innovation in material science and coating technologies to meet evolving safety requirements.

Laser Protective Lens Market Executive Summary

The Laser Protective Lens Market is currently experiencing robust growth, driven by pervasive integration of laser systems across industrial, medical, and scientific sectors, alongside heightened global emphasis on occupational safety. Key business trends indicate a strong move towards customization, with manufacturers focusing on developing lenses optimized for multi-wavelength protection and higher optical densities to accommodate advanced laser technologies. There is also a notable shift towards lighter, more ergonomic designs for personal protective equipment, improving user comfort and compliance, alongside the development of smart lenses integrating sensor technology for real-time hazard detection. From a regional perspective, Asia Pacific continues to emerge as a dominant market, propelled by rapid industrialization, burgeoning manufacturing sectors, and increasing adoption of laser-based production processes, particularly in countries like China, India, and South Korea. North America and Europe also maintain significant market shares, driven by strong research and development investments, advanced medical applications, and strict regulatory frameworks demanding high-quality protective solutions. Segment trends highlight increasing demand from the additive manufacturing sector, where high-power lasers are extensively used, and the medical aesthetics industry, which requires precise and reliable eye protection. Furthermore, the defense and aerospace sectors are investing heavily in protective optics for laser-based targeting, communication, and anti-missile systems, fostering innovation in durable and high-performance lens materials. Overall, the market is characterized by intense competition among established players and innovative startups, all striving to deliver superior performance, cost-effectiveness, and compliance with the ever-evolving landscape of laser safety standards, making strategic partnerships and continuous R&D critical for sustained growth.

AI Impact Analysis on Laser Protective Lens Market

The proliferation of artificial intelligence across various industrial and scientific domains is profoundly reshaping expectations for laser protective lens technology. Users frequently inquire about the integration of AI into smart safety systems, enabling real-time hazard detection and adaptive lens adjustments that automatically modify protection levels based on detected laser threats. There's also significant interest in how AI can optimize the design and material selection process for enhanced laser resistance, improved optical clarity, and reduced development cycles, ultimately leading to more effective and cost-efficient products. Furthermore, stakeholders are keen to understand AI's role in predictive maintenance for laser systems, which inherently extends to the monitoring and lifespan management of protective optics, ensuring continuous operational safety and efficiency in high-precision laser applications. The market anticipates AI to contribute to more personalized protective solutions, analyze complex laser environments for optimal lens specification, and streamline quality control processes during manufacturing.

- Enhanced Design and Material Optimization: AI algorithms can analyze vast datasets of material properties, laser parameters, and coating performance to predict optimal lens designs, accelerating the development of new, more effective protective materials and multi-layer coatings.

- Smart Safety Systems Integration: AI-powered sensors integrated into protective eyewear or barriers can detect laser emissions in real-time, trigger alerts, or even automatically adjust lens opacity or initiate system shutdowns, creating dynamic and adaptive safety solutions.

- Predictive Maintenance and Lifespan Management: AI can monitor the usage patterns and exposure history of protective lenses, predicting potential degradation or failure points, and signaling for timely replacement to maintain safety standards and extend product utility.

- Automated Quality Control: Machine learning vision systems can perform rapid and highly accurate inspections of lens surfaces and coatings, identifying microscopic defects or inconsistencies that might compromise protection, thereby ensuring higher manufacturing quality.

- Personalized Protection Solutions: AI can assist in recommending customized lens specifications based on individual user requirements, specific laser setups, and operational environments, moving beyond generic protection to highly tailored safety equipment.

- Simulation and Risk Assessment: AI-driven simulations can model complex laser interaction scenarios with protective lenses, evaluating their effectiveness under various conditions and helping to identify potential risks before deployment, thereby improving safety protocols.

DRO & Impact Forces Of Laser Protective Lens Market

The Laser Protective Lens Market is significantly shaped by a confluence of internal drivers, external restraints, strategic opportunities, and competitive impact forces. The primary drivers include the exponential growth in the application of laser technology across diverse industrial processes, medical procedures, scientific research, and defense systems, which intrinsically escalates the demand for robust protective solutions. Simultaneously, the increasingly stringent global regulatory landscape, enforced by organizations like ANSI, CE, and FDA, mandates the use of certified laser safety equipment, thereby compelling industries to adopt compliant protective lenses. Technological advancements in laser systems, leading to higher power outputs and a broader spectrum of wavelengths, constantly push the boundaries for protective lens innovation, driving demand for new materials and coating technologies capable of handling these evolving threats. Conversely, the market faces restraints such such as the relatively high initial cost associated with advanced, custom-engineered protective lenses, which can be a barrier for smaller enterprises or budget-constrained research facilities. Challenges in material science to develop lenses that offer superior optical density across wide wavelength ranges without compromising visible light transmission or durability also pose a significant hurdle. Furthermore, a lack of universal standardization across different regions and laser applications can create confusion and complexity for manufacturers and end-users, potentially slowing market penetration. Despite these challenges, significant opportunities exist in emerging applications such as augmented reality/virtual reality (AR/VR) systems incorporating miniature lasers, the burgeoning quantum computing sector, and advanced manufacturing techniques like 3D printing, all of which require specialized laser protection. The development of 'smart' or adaptive lenses with integrated sensor technology that can dynamically adjust protection levels, and the expansion into untapped regional markets, particularly in developing economies, represent promising avenues for growth. The market's competitive landscape is influenced by factors such as the bargaining power of buyers, who demand high performance at competitive prices, and the bargaining power of suppliers of specialized raw materials, which impacts production costs. The threat of new entrants is moderate due to the technical expertise and regulatory hurdles required, while the threat of substitutes, though limited for direct laser protection, could include alternative process controls or engineering enclosures that mitigate exposure. Intense competitive rivalry among existing players, driven by innovation and product differentiation, constantly pushes the market towards more advanced and safer solutions.

Segmentation Analysis

The Laser Protective Lens Market is comprehensively segmented to cater to the diverse requirements of various end-user industries and application specificities. This granular segmentation allows for a detailed understanding of market dynamics, product preferences, and technological adoption patterns across different categories. The market is primarily analyzed based on factors such as the type of protection offered, the material used in lens fabrication, the specific laser wavelength or type they are designed to protect against, their application area or end-use industry, and their physical form factor, including personal protective equipment and larger protective barriers. This multi-faceted approach helps stakeholders identify key growth areas, customize product offerings, and develop targeted marketing strategies.

- By Type of Protection:

- Absorption-type Lenses: These lenses use special dyes or compounds embedded in the material to absorb laser energy at specific wavelengths.

- Reflective-type Lenses: These lenses employ dielectric coatings that reflect specific laser wavelengths away from the eye or sensor.

- Hybrid/Combination Lenses: Integrating both absorption and reflective properties for broader or multi-wavelength protection.

- By Material:

- Glass Lenses: Known for high optical quality, scratch resistance, and suitability for high-power lasers.

- Polymer Lenses (Polycarbonate, Acrylic): Lightweight, impact-resistant, and cost-effective, suitable for various industrial applications.

- Crystal Lenses (e.g., Sapphire): Used in specialized, extreme environments for superior thermal and chemical resistance.

- By Laser Type/Wavelength:

- CO2 Laser Protective Lenses: Specifically designed for infrared CO2 laser emissions (10,600 nm).

- Fiber Laser Protective Lenses: Tailored for fiber laser wavelengths (e.g., 1064 nm).

- Nd:YAG Laser Protective Lenses: Protection against Neodymium-doped Yttrium Aluminum Garnet laser wavelengths (e.g., 1064 nm, 532 nm).

- Diode Laser Protective Lenses: Covers a range of diode laser wavelengths (e.g., 808 nm, 980 nm).

- Excimer Laser Protective Lenses: For UV excimer lasers (e.g., 193 nm, 248 nm).

- UV Laser Protective Lenses: General protection across the ultraviolet spectrum.

- Visible Laser Protective Lenses: For various visible light lasers (e.g., 400-700 nm).

- Infrared (IR) Laser Protective Lenses: Broader protection in the infrared spectrum.

- By Application/End-Use Industry:

- Industrial:

- Material Processing (Cutting, Welding, Marking, Engraving)

- Additive Manufacturing (3D Printing)

- Automotive

- Electronics Manufacturing

- Medical:

- Surgery

- Aesthetics and Dermatology

- Ophthalmology

- Diagnostics

- Research & Development:

- Laboratories

- Universities

- Photonics Research

- Defense & Military:

- Laser Rangefinders

- Targeting Systems

- Countermeasures

- Telecommunications:

- Fiber Optic Communication

- Consumer Electronics:

- LiDAR applications

- AR/VR devices

- Industrial:

- By Form Factor:

- Eyewear:

- Laser Goggles

- Laser Safety Spectacles

- Over-the-Glass Eyewear

- Windows and Panels: For machine enclosures, cleanrooms, and viewing ports.

- Barriers and Curtains: For creating safe laser work zones.

- Enclosures and Cabinets: Fully integrated protective environments for automated laser systems.

- Eyewear:

Value Chain Analysis For Laser Protective Lens Market

The value chain for the Laser Protective Lens Market is a complex ecosystem involving multiple stages, beginning with the sourcing of specialized raw materials and extending to the final delivery and installation of protective solutions for end-users. The upstream segment primarily involves suppliers of high-quality optical materials such as specialized glasses (e.g., Schott, Hoya), optical-grade polymers (e.g., polycarbonate, acrylic), and advanced crystal substrates, along with manufacturers of precision coating materials and dyes. These raw material suppliers play a critical role, as the performance and safety characteristics of the final lens are heavily dependent on the quality and specific properties of these foundational inputs. The midstream segment focuses on the manufacturing and processing of these materials into finished laser protective lenses. This involves precision optical fabrication (grinding, polishing), the application of sophisticated multi-layer dielectric coatings or absorption dyes, and often the assembly of these lenses into complete products like safety goggles, windows, or barriers. This stage requires significant investment in advanced manufacturing equipment, cleanroom facilities, and highly skilled optical engineers and technicians. Downstream activities involve the distribution channel, which can be direct or indirect. Direct sales typically occur for large industrial clients, defense contractors, or major research institutions that purchase in bulk or require highly customized solutions directly from the manufacturer. Indirect distribution channels involve a network of specialized distributors, resellers, and safety equipment suppliers who serve smaller businesses, individual researchers, and a broader range of end-users across various industries. These distributors often provide local support, inventory management, and technical consultation, playing a crucial role in market penetration and customer reach. The efficiency and reliability of both direct and indirect channels are vital for ensuring that safety-critical products reach users promptly and effectively, minimizing potential exposure risks and ensuring compliance with safety regulations. Each stage of the value chain is critical, with strong linkages and interdependencies that influence product quality, cost-effectiveness, and market responsiveness.

Laser Protective Lens Market Potential Customers

The Laser Protective Lens Market serves a broad and diverse spectrum of potential customers across virtually all sectors where laser technology is employed, ranging from heavy industrial manufacturing to delicate medical procedures and cutting-edge scientific research. The primary end-users include industrial manufacturers, particularly those in the automotive, aerospace, electronics, and precision machinery sectors, where lasers are extensively utilized for cutting, welding, marking, and additive manufacturing processes. These industries require robust protective eyewear for their personnel and protective windows or enclosures for their automated laser systems to ensure operational safety and regulatory compliance. Another significant customer segment is the medical industry, encompassing hospitals, clinics, and aesthetic centers that use lasers for surgery, dermatology, ophthalmology, and diagnostics. Medical professionals, support staff, and patients require specific laser protective lenses tailored to the particular wavelengths and power levels of medical lasers to prevent accidental eye damage. Research and academic institutions, including university laboratories and government research facilities, represent another key customer base, as they routinely work with a wide array of experimental lasers at varying power outputs and wavelengths, necessitating versatile and high-performance protective solutions. Furthermore, defense and military organizations are critical consumers, utilizing laser protective lenses for personnel operating laser rangefinders, targeting systems, and advanced directed-energy weapons, demanding extremely durable and reliable protection in harsh environments. The telecommunications sector, with its reliance on fiber optic lasers, also requires specialized protection for technicians involved in installation and maintenance. Emerging customer segments include developers and users of consumer electronics incorporating LiDAR (Light Detection and Ranging) technology or mini-lasers in augmented reality (AR) and virtual reality (VR) devices, where robust yet comfortable eye protection is becoming increasingly important. Ultimately, any entity operating laser equipment, whether for manufacturing, treatment, scientific discovery, or defense, is a potential customer for laser protective lenses, driven by the paramount need for safety and adherence to stringent industry standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 billion |

| Market Forecast in 2033 | USD 2.1 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Laservision GmbH & Co. KG, ESS Inc., Uvex Safety Group, Fosta-Tek Optics, Gentex Corporation, Kentek Corporation, Thorlabs Inc., NoIR Laser Company, LLC, Phillips Safety Products Inc., Metamaterial Inc., Newport Corporation, Rockwell Laser Industries, Inc., PermaSaf Lasers, Inc., Revision Military, Laser Safety Industries, RT Technologies, Inc., Sperian Protection (now part of Honeywell), Proteclaser, Inc., LaseSafe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Protective Lens Market Key Technology Landscape

The technological landscape of the Laser Protective Lens Market is characterized by continuous innovation aimed at enhancing protection, optical clarity, durability, and user comfort. A cornerstone of this advancement lies in sophisticated coating technologies, particularly multi-layer dielectric coatings, which allow for highly precise blocking of specific laser wavelengths while maximizing visible light transmission. These coatings are crucial for reflective-type lenses and often augment absorption-type materials to achieve superior optical densities (ODs) and broader spectral coverage. Advances in material science are equally vital, focusing on developing new glass and polymer substrates with intrinsic laser-absorbing properties or enhanced resistance to thermal and mechanical stress induced by high-power lasers. This includes specialized doped glasses, robust polycarbonate formulations, and lightweight, impact-resistant composites that meet stringent safety standards without impeding functionality. The integration of nanotechnology is beginning to emerge, with research exploring nanomaterials for ultra-thin, highly effective coatings or transparent composites that offer enhanced protection across a wider range of wavelengths. Furthermore, the development of tunable or adaptive optical elements represents a significant frontier, where lenses could dynamically adjust their optical density or filtering characteristics in response to detected laser threats, potentially through electro-chromic or liquid crystal technologies, moving towards 'smart' protective eyewear. Miniaturization and ergonomic design principles are also key technological trends, particularly for personal protective equipment, focusing on lighter frames, improved ventilation, and compatibility with other safety gear to enhance user comfort and compliance in demanding industrial and medical environments. Innovations in manufacturing processes, such as precision injection molding for polymer lenses and advanced optical fabrication techniques, are contributing to higher quality, greater consistency, and more cost-effective production of a diverse range of laser protective solutions. These technological advancements collectively aim to provide superior safety, versatility, and user experience in an increasingly laser-intensive world.

Regional Highlights

- North America: This region stands as a mature market with significant demand driven by advanced industrial automation, a robust medical device sector, and extensive research and development activities in photonics. The presence of stringent regulatory bodies and high awareness of occupational safety further fuels market growth. Key contributing countries include the United States and Canada, which lead in innovation and adoption of high-power laser systems across manufacturing, defense, and healthcare.

- Europe: Characterized by strong industrial economies, particularly in Germany, France, and the UK, Europe exhibits high demand for laser protective lenses due to widespread adoption of laser processing in automotive, aerospace, and electronics industries. Strict EU directives on worker safety and environmental protection ensure consistent demand for certified laser safety equipment. Significant investments in R&D and a focus on advanced manufacturing techniques also contribute to market expansion.

- Asia Pacific (APAC): Emerging as the fastest-growing region, APAC is propelled by rapid industrialization, burgeoning manufacturing hubs in China, India, Japan, and South Korea, and increasing investments in automation and laser technology. The region's expanding electronics, automotive, and medical sectors are major consumers. Growing awareness about occupational safety, coupled with less stringent but evolving regulations in some developing economies, presents substantial market opportunities for manufacturers.

- Latin America: This region represents an emerging market with gradual growth, driven by increasing industrialization and foreign investments in manufacturing sectors, particularly in Brazil and Mexico. While market penetration is lower compared to developed regions, rising awareness about industrial safety and the gradual adoption of international safety standards are expected to stimulate demand for laser protective lenses in the coming years.

- Middle East and Africa (MEA): The MEA region is at an nascent stage but shows potential for growth, primarily influenced by investments in infrastructure, oil & gas, and a developing manufacturing base in countries like UAE, Saudi Arabia, and South Africa. As industrialization progresses and safety regulations become more formalized, the demand for laser protective equipment is anticipated to rise, though it remains a smaller contributor to the global market currently.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Protective Lens Market.- Honeywell International Inc.

- Laservision GmbH & Co. KG

- ESS Inc.

- Uvex Safety Group

- Fosta-Tek Optics

- Gentex Corporation

- Kentek Corporation

- Thorlabs Inc.

- NoIR Laser Company, LLC

- Phillips Safety Products Inc.

- Metamaterial Inc.

- Newport Corporation

- Rockwell Laser Industries, Inc.

- PermaSaf Lasers, Inc.

- Revision Military

- Laser Safety Industries

- RT Technologies, Inc.

- Sperian Protection (now part of Honeywell)

- Proteclaser, Inc.

- LaseSafe

Frequently Asked Questions

What are the primary types of laser protective lenses available?

The primary types of laser protective lenses are absorption-type, which embed special dyes to absorb laser energy, and reflective-type, which use dielectric coatings to reflect specific wavelengths. Hybrid lenses combine both mechanisms for broader protection.

Which industries are the largest consumers of laser protective lenses?

The largest consumers include industrial manufacturing (for cutting, welding, 3D printing), the medical sector (for surgery, aesthetics), and research & development laboratories, due to widespread laser adoption in these fields.

What factors are driving the growth of the Laser Protective Lens Market?

Key drivers include the increasing global adoption of laser technology across diverse industries, increasingly stringent international laser safety regulations, and continuous advancements in laser power and wavelength diversity.

How does AI impact the development and application of laser protective lenses?

AI is expected to impact lens design and material optimization, integrate into smart safety systems for real-time threat detection, enable predictive maintenance for protective equipment, and enhance automated quality control processes.

What role do international safety standards play in the market?

International safety standards (e.g., ANSI Z136, EN 207/208, CE directives) are crucial as they mandate the use of certified protective lenses, driving demand, ensuring product quality, and shaping manufacturing compliance across the globe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager