Laser Smoke Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432701 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Laser Smoke Detector Market Size

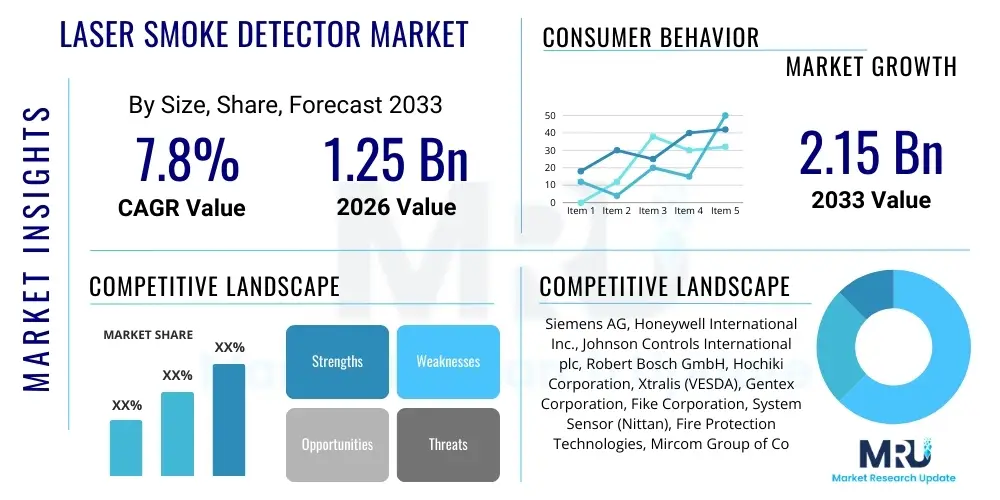

The Laser Smoke Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

Laser Smoke Detector Market introduction

The Laser Smoke Detector Market encompasses sophisticated fire detection systems that leverage high-intensity laser technology to provide unparalleled sensitivity and speed in identifying nascent fire conditions. These detectors, primarily comprising Aspirating Smoke Detection (ASD) and Laser Beam Detection systems, are designed to detect microscopic particles generated during the earliest stages of thermal decomposition, often long before traditional ionization or photoelectric detectors register any change. The market is defined by a critical need for preemptive safety measures across environments where operational continuity and high-value asset protection are non-negotiable. Laser systems are distinguished by their proactive sampling methods and highly advanced algorithms, which minimize the environmental influences that plague conventional fire safety infrastructure.

Product offerings in this segment range from highly flexible, modular ASD units, which actively draw air samples through extensive, concealed pipe networks, to robust, long-range linear beam detectors ideal for protecting large open spaces. Major applications span critical sectors including hyperscale data centers, where detecting the earliest signs of overheating is vital to prevent catastrophic downtime; specialized industrial manufacturing facilities, such as semiconductor fabs and cleanrooms, where environmental control necessitates non-intrusive detection; and institutional settings like museums and historical archives, which demand aesthetic preservation alongside maximum fire protection. The inherent benefit of using laser technology lies in its ability to provide measurable particle data, enabling facility managers to implement multi-stage warning and response protocols tailored to the specific risk profile of the environment, significantly reducing property damage and liability risks.

Market expansion is fundamentally driven by the tightening global framework of fire safety regulations, specifically those mandating ultra-early warning capabilities in mission-critical infrastructure, such as various NFPA and EN standards updates. Concurrently, the exponential growth in global data consumption necessitates continuous investment in data centers, which are primary adopters of these technologies. Technological momentum is further provided by manufacturers focusing on integrating laser detection units with comprehensive Building Management Systems (BMS) and IoT platforms, enabling sophisticated remote monitoring and diagnostics. This connectivity not only streamlines maintenance but also enhances overall system performance by allowing adaptive sensitivity profiles based on real-time operational context. Furthermore, the persistent focus on reducing false alarm incidents, a major operational inefficiency, consistently propels demand for the accurate particle discrimination capabilities offered exclusively by laser-based fire detection.

Laser Smoke Detector Market Executive Summary

The global Laser Smoke Detector Market exhibits dynamic growth trajectory, strongly correlated with global investment in sophisticated industrial and IT infrastructure. Business trends are dominated by strategic partnerships between component manufacturers and system integrators to deliver complete, certified safety solutions. A critical shift is observed towards developing detectors that feature advanced processing capabilities, allowing for on-board data analytics and AI integration to refine particle classification and achieve near-zero false alarm rates. Furthermore, competitive differentiation is increasingly achieved through providing cloud-based monitoring services and predictive maintenance packages, transforming the vendor relationship from transactional to long-term safety management partnerships. The market sees continuous pressure to reduce the complexity and cost associated with installation and lifetime ownership, spurring innovation in simplified piping design for ASD systems and increased filter longevity.

Regional dynamics highlight a bifurcated market structure. Established regions like North America and Europe maintain technological leadership and high average selling prices (ASPs) due to rigorous regulatory enforcement and a large installed base of high-value assets. North American market vitality is underscored by constant data center expansion and continuous retrofitting of older commercial buildings to meet modern safety compliance. Meanwhile, the Asia Pacific (APAC) region is the engine of volumetric growth, fueled by government-backed infrastructural initiatives and burgeoning industrial clusters in emerging economies. The APAC market emphasizes scalable, cost-effective solutions capable of protecting massive, rapidly constructed facilities, positioning it as the fastest-growing market in the forecast period.

Segment performance confirms the dominance of Aspirating Smoke Detectors (ASD) by revenue, attributing to their unmatched sensitivity required by high-risk end-users like data centers and institutional archives. This segment continues to drive technological innovation, particularly concerning ultra-high sensitivity (UHS) models. The Laser Beam Detectors segment maintains a vital niche, particularly in the infrastructure sector—airports, convention centers, and large storage facilities—where the requirement is robust, long-range coverage rather than microscopic particle detection. Application trends underscore the Data Centers and Telecommunications vertical as the highest growth sector, demanding premium products, while the Commercial and Industrial sectors remain foundational, driven by baseline regulatory compliance and facility modernization cycles. The integration capabilities across all segments, ensuring seamless interface with fire panels and BMS platforms, are now standard requirements, reflecting the move towards holistic safety management.

AI Impact Analysis on Laser Smoke Detector Market

Public and professional inquiries into the convergence of Artificial Intelligence and laser smoke detection technology reveal a clear market focus on optimizing core detector reliability and system intelligence. Users prioritize the utilization of AI for enhanced particle discrimination, aiming to solve the long-standing industry challenge of nuisance alarms caused by non-fire events like dust, vehicle exhaust, or cooking vapors. The industry is actively seeking AI solutions that can leverage the granular particle data provided by laser optics—such as particle size distribution and trajectory—to apply sophisticated machine learning models. These models are expected to accurately filter out benign events while ensuring instantaneous response to genuine fire signatures. Furthermore, significant user expectation exists regarding AI’s capacity for automating system calibration and providing real-time operational health checks, ensuring sustained peak performance without manual intervention.

AI integration fundamentally transforms the laser smoke detector from a simple sensor device into an intelligent analytic node within a safety network. By continuously processing data streams, AI algorithms establish a dynamic baseline environment profile, learning the "normal" particulate noise levels specific to a facility's operations (e.g., server thermal fluctuations in a data center or transient pollution in an industrial site). When a new, potentially hazardous particulate signature is detected, the AI uses learned feature sets to categorize the threat probability, allowing the detector to employ context-aware sensitivity adjustments. For instance, if humidity levels are high, the system compensates its sensitivity profile to prevent condensation-related false alarms, a capability impossible with static threshold systems. This adaptive intelligence is critical for maintaining high availability in sensitive environments.

The impact of AI extends profoundly into maintenance and lifecycle management, shifting the industry paradigm from reactive repair to predictive upkeep. Machine learning models continuously monitor the physical health of the laser diode, air sampling pump effectiveness, and filter cleanliness. By analyzing trends in operational degradation, the AI can precisely predict the time to failure or the need for filter replacement based on actual performance parameters rather than simple elapsed time schedules. This predictive capability minimizes system downtime, ensures continuous regulatory compliance, and optimizes maintenance scheduling, leading to substantial reductions in operational expenditure (OpEx) for end-users. The future of competitive advantage in the laser smoke detection market will heavily rely on the depth and efficacy of proprietary AI and machine learning engines embedded within the hardware and cloud services.

- AI-driven pattern recognition enhances the differentiation between true smoke particles and nuisance aerosols, drastically reducing false alarm rates by up to 95%.

- Machine learning optimizes detector sensitivity dynamically based on real-time environmental data (temperature, humidity, airflow) and historical operational context.

- Predictive maintenance algorithms analyze sensor performance data (laser stability, airflow metrics, pump efficiency) to forecast component degradation and schedule proactive servicing, maximizing system uptime.

- Integration with Building Management Systems (BMS) allows AI to correlate smoke alerts with other facility data (HVAC status, security systems) for validated incident response and improved decision-making.

- Advanced data analytics provide granular insights into air quality and potential contamination sources, aiding facility managers in proactive hazard identification and root cause analysis for transient environmental events.

- AI enables sophisticated remote diagnostics, automated system calibration checks, and performance verification routines, ensuring continuous compliance with regulatory standards (e.g., UL, FM) with minimal human intervention.

- Development of proprietary deep learning models allows for the identification of specific fire types (e.g., smoldering PVC vs. flaming wood), tailoring the response protocol immediately upon detection.

DRO & Impact Forces Of Laser Smoke Detector Market

The fundamental market dynamics are shaped by the critical balance between the increasing regulatory mandate for enhanced safety (Drivers) and the considerable complexities of deploying and maintaining specialized systems (Restraints). The primary opportunity lies in the burgeoning critical infrastructure sector, specifically the massive global build-out of data storage and processing facilities, which intrinsically require laser detection capabilities. These impact forces collectively create an environment where the perceived value and necessity of ultra-early detection systems often overcome cost hurdles, particularly in high-risk environments. The overarching trend favors technological advancement and specialized high-end solutions over generalized detection methods, ensuring sustained revenue growth for market leaders focused on innovation and compliance excellence.

Major driving forces include the non-negotiable need for business continuity across global corporations, where fire-related downtime can result in multi-million dollar losses per hour. Industries such as financial services, telecommunications, and digital cloud providers are proactively investing in laser detection to adhere to demanding Service Level Agreements (SLAs). Furthermore, fire codes globally are trending towards performance-based standards that necessitate early detection, effectively boosting the adoption of aspirating technology. Technological improvements in detector design, such as modular construction, enhanced filter technology that reduces particulate ingress, and improved laser life span, are simultaneously decreasing maintenance cycles and improving system longevity, further incentivizing adoption among end-users seeking reliability and reduced lifecycle costs.

However, significant restraints temper growth, predominantly the higher initial capital outlay required for laser-based systems compared to conventional spot detectors. This financial hurdle often limits adoption in price-sensitive commercial or residential markets. Furthermore, the installation of complex ASD piping networks requires highly specialized engineering design and certified labor, increasing deployment complexity and time. A related challenge is the requirement for expert maintenance; improper servicing or calibration can negate the sensitivity advantages of the system, leading to performance degradation or unwarranted alarms. Opportunities, nevertheless, abound in the development of streamlined, pre-engineered solutions targeting small to medium-sized critical infrastructure and the integration of sophisticated diagnostic software to remotely assist with calibration and troubleshooting, thereby mitigating some of the key logistical restraints and expanding the accessible customer base globally.

Segmentation Analysis

Segmentation analysis of the Laser Smoke Detector Market is crucial for understanding the varied demand profiles across different operational environments and technological preferences. The core technical segmentation divides the market based on the physical detection mechanism, namely Aspirating Smoke Detectors (ASD) and Laser Beam Detectors. ASD systems, representing the largest segment by value, are active devices that sample the air and provide the highest level of sensitivity, crucial for early fire warning. Laser Beam Detectors, conversely, are passive line-of-sight devices that offer cost-effective, large-area volumetric coverage, best suited for environments with high ceilings and substantial air movement, such as transit stations and large warehouses. Differentiation within these types is constantly driven by the integration of advanced optics and software algorithms aimed at enhancing sensitivity while concurrently improving immunity to nuisance sources.

The market is further delineated by sensitivity level, classifying systems as Standard, High, and Ultra-High Sensitivity (UHS). The UHS segment is highly specialized and is exclusively demanded by mission-critical environments, including Tier IV data centers, highly sensitive scientific research facilities, and nuclear power control rooms, where even the smallest particulate concentration must be identified instantly. This segment generates the highest margins due to the advanced components and specialized certification required. Conversely, Standard and High Sensitivity systems serve broader commercial and industrial applications, balancing performance with more accessible cost structures. The evolution within this segmentation highlights a trend towards multi-criteria detection, where laser sensing is combined with thermal or gas sensors, providing enhanced verification and reducing the likelihood of critical decision errors based on a single data point.

Application-based segmentation reveals the primary revenue drivers. The Data Centers and Telecommunications segment is the most technology-intensive buyer, prioritizing performance and reliability over price, driving the demand for UHS-ASD. The Commercial segment, encompassing healthcare, retail, and office infrastructure, focuses on systems that meet baseline safety codes while offering long-term reliability and minimal aesthetic intrusion. The Industrial sector, covering manufacturing, oil & gas, and mining, requires robust, contamination-resistant laser detectors, often beam types, that can withstand harsh operating conditions like extreme temperatures, dust, or high air flow. This nuanced demand profile necessitates manufacturers to maintain diverse product portfolios capable of meeting the distinct performance, integration, and environmental requirements of each major end-user group worldwide.

- By Type:

- Aspirating Smoke Detectors (ASD) - High sensitivity, active sampling, concealed installation.

- Laser Beam Detectors - Large area coverage, linear detection, high-ceiling applicability.

- By Sensitivity Level:

- Standard Sensitivity - General commercial applications.

- High Sensitivity - Advanced commercial and industrial environments.

- Ultra-High Sensitivity (UHS) - Critical infrastructure (Data Centers, Cleanrooms).

- By End-User Application:

- Commercial (Offices, Retail, Healthcare, Education, Hospitality) - Focus on compliance and aesthetics.

- Industrial (Manufacturing, Power Plants, Chemical Processing, Mining, Oil & Gas) - Focus on durability and contamination resistance.

- Data Centers and Telecommunications - Focus on zero downtime and UHS detection.

- Infrastructure (Airports, Tunnels, Transit Stations, Utility Hubs) - Focus on large area coverage and high reliability.

- By Installation Method:

- New Installations - Large projects like new data centers or industrial complexes.

- Retrofit and Replacement - Upgrading existing conventional systems to meet modern codes.

Value Chain Analysis For Laser Smoke Detector Market

The value chain for the Laser Smoke Detector Market initiates with highly specialized upstream component manufacturing, which supplies the core technological engine of the detection system. This upstream segment is characterized by specialized suppliers of high-precision optics, notably custom laser diodes (blue or infrared, selected for optimal particle interaction), sensitive CMOS or CCD arrays for light scattering detection, and advanced high-speed microprocessors necessary for complex real-time particle counting and algorithmic processing. The proprietary nature and high quality demands for these components mean that this segment often involves limited, highly strategic sourcing. OEMs focus intensely on optimizing the integration of these components into the core sensor chamber, ensuring durability and measurement stability under fluctuating environmental conditions, which is essential for maintaining certification standards like UL and EN.

The midstream is dominated by the system manufacturers (OEMs) who transform these specialized components into finished, branded detection units. This phase involves extensive research and development focused on creating proprietary software, embedded firmware for particle analysis (including AI/ML algorithms), robust enclosure design, and crucial system interfacing capabilities (BACnet, Modbus, SNMP for BMS integration). Manufacturers compete fiercely based on system performance (lowest false alarm rate, highest sensitivity), ease of installation (simplified piping design for ASD), and compliance certification breadth. Production processes must adhere to stringent quality control standards due to the life-safety critical nature of the final product. Key activities here include software intellectual property protection and achieving optimal hardware-software synergy to maximize detector longevity and stability.

The downstream sector is critically dependent on technical expertise and geographical reach. Distribution is primarily handled through authorized, highly specialized fire safety distributors who understand the technical complexities and regulatory compliance requirements of laser detection systems. Direct sales are common for very large, highly customized projects (e.g., government infrastructure, complex data center builds), allowing OEMs to maintain control over system configuration and deployment specifications. Crucially, the installation and post-sales service segments are key differentiators. Certified System Integrators (CSI) are required to correctly design, install, and commission ASD piping networks, ensuring correct air sampling is achieved. The long-term profitability of the market relies heavily on recurring revenues from maintenance contracts, system testing, filter replacements, and software update services, making the technical proficiency of the service network a vital competitive asset.

Laser Smoke Detector Market Potential Customers

The customer base for laser smoke detection systems is highly specific, comprising entities with high-stakes assets where the cost of a fire event vastly outweighs the premium paid for ultra-early detection technology. These potential customers are primarily defined by two critical factors: the sensitivity of their operational environment and the regulatory mandate for zero tolerance of fire risk. The predominant buyers are enterprises managing critical digital infrastructure, specialized high-value manufacturing, and irreplaceable cultural or informational assets. Purchasing decisions are typically centralized, risk-adverse, and necessitate long-term reliability guarantees, often requiring extensive product testing and compliance validation before procurement approval.

The largest and fastest-growing segment of potential customers is the Data Center and Cloud Services industry. Hyperscale providers (Amazon, Google, Microsoft, etc.), co-location services, and large corporate server farms are perpetual buyers, driven by the absolute necessity to prevent thermal events that could trigger a cascading failure and massive data loss. These environments require Ultra-High Sensitivity (UHS) Aspirating Smoke Detectors that can detect minute overheating particles (pyrolysis products) hours before an actual fire, allowing for automated, proactive mitigation measures like localized shutdown or inert gas deployment. For these customers, the purchasing criteria heavily favor performance metrics, connectivity (integration with DCIM software), and vendor track record in achieving robust system stability.

Other substantial potential customer groups include industrial facilities handling combustible or volatile materials, such as chemical processing plants, oil refineries, and large-scale battery manufacturing sites, which require ruggedized laser detectors capable of operating reliably in harsh, often contaminated, air environments. Similarly, institutions managing high-value assets, such as museums, national libraries, archival vaults, and high-tech cleanrooms, are core customers. For these clients, the focus is on systems that offer non-intrusive installation (concealed ASD piping) coupled with guaranteed detection speed to safeguard irreplaceable items. Procurement cycles in these sectors often involve collaboration between facility engineering, risk management, and insurance compliance teams to select solutions certified to meet stringent, often specialized, insurance underwriting standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Honeywell International Inc., Johnson Controls International plc, Robert Bosch GmbH, Hochiki Corporation, Xtralis (VESDA), Gentex Corporation, Fike Corporation, System Sensor (Nittan), Fire Protection Technologies, Mircom Group of Companies, DET-TRONICS (Emerson), Kidde-Fenwal, Inc., AirSense Technology Ltd., Safelincs Ltd., Carrier Global Corporation, Apollo Fire Detectors Ltd., Ziton (UTC Climate, Controls & Security), Tyco Fire Protection Products, Seimens Building Technologies, and C-Tec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Smoke Detector Market Key Technology Landscape

The technological core of the Laser Smoke Detector market hinges on optimizing the physics of light scattering and integrating advanced digital processing. The primary technological approach involves utilizing highly stable, monochromatic laser diodes, often operating in the blue or infrared spectrum, to illuminate air samples drawn into a carefully engineered detection chamber. The sensitivity is achieved by leveraging Mie scattering principles; when particles pass through the focused laser beam, they scatter light, which is captured by ultra-sensitive photodetector arrays. Key innovation focuses on improving the signal-to-noise ratio within the chamber to accurately distinguish minute smoke particles from electronic noise or environmental interference. This involves advanced dust filtering and patented air flow management systems within Aspirating Smoke Detectors (ASD) to ensure representative and clean air samples reach the sensing element, drastically extending the mean time between filter changes and reducing maintenance overhead.

The second pillar of technological advancement is embedded intelligence and communication infrastructure. Modern laser detectors are equipped with powerful microprocessors capable of executing complex proprietary algorithms that analyze particle characteristics—not just count, but also size, shape, and velocity—to accurately classify the threat. The incorporation of real-time diagnostics and condition monitoring systems is becoming standard, tracking parameters such as laser power output, chamber cleanliness, and air pump flow rates. Furthermore, the imperative for holistic building management drives technological requirements for seamless integration via standardized industrial protocols. Current generation detectors feature native IoT capabilities, allowing for cloud connectivity, centralized management, and real-time data streaming to facility operators and remote security centers, moving the industry towards true smart safety ecosystems.

Future technological trajectory points toward multi-criteria sensing fused with increasingly sophisticated artificial intelligence. Researchers are exploring combining laser particle detection with advanced gas sensing (CO, H2, NOx) and thermal analysis within a single unit to provide layered verification, minimizing the risk of high-speed false alarms. Miniaturization technology is also a significant area of focus, aiming to develop more compact, decentralized ASD units that retain the high sensitivity of large centralized systems but are easier and cheaper to install in smaller critical spaces, thereby expanding the market reach beyond hyperscale infrastructure. Furthermore, enhanced optical self-cleaning mechanisms and long-life solid-state lasers are being developed to eliminate manual calibration and further reduce the total cost of ownership, making laser detection systems more competitive against conventional alternatives in a wider range of industrial and commercial applications globally.

Regional Highlights

North America maintains a dominant position in the Laser Smoke Detector Market, largely attributed to the region’s mature economy, high technological readiness, and exceptionally strict regulatory environment, particularly the National Fire Protection Association (NFPA) codes which mandate advanced detection in critical facilities. The substantial presence of global technology giants and the continuous expansion of hyperscale data centers across the US and Canada generate the highest demand for Ultra-High Sensitivity (UHS) Aspirating Smoke Detectors. High disposable income levels and an entrenched culture of prioritizing proactive risk mitigation over minimum compliance further fuel the market. The regional trend is characterized by the adoption of integrated security and fire systems, demanding robust communication protocols and full compatibility with existing building automation and network infrastructure. Continuous efforts to modernize aging commercial office inventory also contribute significantly to the retrofit segment.

Europe represents a crucial, highly sophisticated market, characterized by adherence to stringent European Norm (EN) standards and a strong focus on public safety infrastructure. Countries in Western Europe, notably the UK, Germany, and France, are major consumers. Demand is driven by the necessity to protect significant historical sites, complex transportation networks (subway systems, rail infrastructure), and densely populated urban centers. European users show a high adoption rate for both ASD systems in specialized areas (museums, laboratories) and robust Laser Beam Detectors in massive industrial and logistics parks, particularly those compliant with European Union safety directives. Furthermore, the European shift towards sustainable and energy-efficient building design often requires non-intrusive and highly reliable detection methods, favoring the discreet nature of aspirating systems and providing strong underlying market support.

The Asia Pacific (APAC) region is forecasted to achieve the highest CAGR over the forecast period, representing the most dynamic growth frontier. This rapid expansion is underpinned by unprecedented levels of investment in infrastructure development, massive urbanization projects, and the establishment of new industrial and manufacturing hubs, particularly in China, India, and Southeast Asian nations. Although price sensitivity is generally higher compared to Western markets, the exponential build-out of new data centers and the strict safety mandates imposed on new manufacturing facilities (e.g., in electronics and automotive sectors) generate immense demand for high-performance laser detectors. Governmental initiatives promoting 'Smart Cities' and digital transformation also accelerate the adoption of connected, advanced fire safety solutions, positioning APAC as the key future revenue driver.

The markets in Latin America (LATAM) and the Middle East & Africa (MEA) are emerging, exhibiting accelerated growth rates driven by targeted sector investments. In the MEA region, colossal infrastructure projects—airport expansions, large commercial towers, and oil & gas facilities in the Gulf Cooperation Council (GCC) countries—adhere strictly to international fire safety benchmarks, necessitating the integration of advanced laser detection. These projects often utilize the most modern, technologically superior solutions available globally. LATAM market growth is slower but steady, propelled by multinational corporation investments in critical mining and industrial processing facilities in Brazil and Mexico, where robust fire safety is mandated by corporate policy regardless of local regulations. As regulatory frameworks in these regions gradually mature and local expertise in installation and maintenance develops, the market penetration of laser smoke detectors is expected to broaden significantly beyond the current concentration in high-value, foreign-invested enterprises.

- North America: Market leader by value, characterized by stringent NFPA regulations, large concentration of Tier III/IV data centers, and strong market maturity; high adoption of UHS-ASD and integrated solutions.

- Europe: Second-largest market, driven by EN standards, extensive use in specialized infrastructure (tunnels, historical buildings), and large-scale logistics centers utilizing high-performance Beam detectors and sophisticated ASD technology.

- Asia Pacific (APAC): Fastest-growing region (highest CAGR), fueled by rapid urbanization, massive investment in industrial parks and data center construction (China, India, Japan), and accelerating regulatory compliance adoption.

- Middle East & Africa (MEA): Emerging high-growth market concentrated in GCC states; demand dictated by international standards for mega-projects in oil & gas, hospitality, and civil infrastructure.

- Latin America (LATAM): Developing market with increasing adoption spurred by global corporate standards in mining, finance, and industrial sectors; gradually improving local technical installation capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Smoke Detector Market.- Siemens AG

- Honeywell International Inc.

- Johnson Controls International plc

- Robert Bosch GmbH

- Hochiki Corporation

- Xtralis (VESDA)

- Gentex Corporation

- Fike Corporation

- System Sensor (Nittan)

- Fire Protection Technologies

- Mircom Group of Companies

- DET-TRONICS (Emerson)

- Kidde-Fenwal, Inc.

- AirSense Technology Ltd.

- Safelincs Ltd.

- Carrier Global Corporation

- Apollo Fire Detectors Ltd.

- Ziton (UTC Climate, Controls & Security)

- Tyco Fire Protection Products

- Seimens Building Technologies

Frequently Asked Questions

Analyze common user questions about the Laser Smoke Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Laser Smoke Detectors and conventional photoelectric detectors?

Laser Smoke Detectors, particularly Aspirating Smoke Detectors (ASD), utilize high-intensity laser light to detect extremely minute, often invisible, particles at the earliest stage of pyrolysis. This provides significantly higher sensitivity—often 100 to 1,000 times greater—and much faster detection speeds than conventional photoelectric spot detectors, which react to visible smoke plumes.

In which applications are Aspirating Smoke Detectors (ASD) systems considered mandatory?

ASD systems are generally considered mandatory or highly preferred in mission-critical environments where zero downtime is essential and early warning is crucial. These applications include hyperscale data centers, server rooms, telecommunications switches, pharmaceutical cleanrooms, historical archives, and high-security vaults, often due to NFPA or insurance requirements.

How do technological advancements like AI address the issue of false alarms in laser detection?

AI integration allows the system to run complex machine learning models on the raw particle data, analyzing characteristics such as particle size, shape, and concentration patterns. By learning the facility's specific environmental 'noise' (e.g., dust, humidity, exhaust), AI dynamically calibrates sensitivity, enabling accurate discrimination between nuisance aerosols and genuine fire threats, thereby drastically reducing false alarm rates.

What are the typical deployment environments where Laser Beam Detectors are preferred over ASD systems?

Laser Beam Detectors are preferred for environments that require large-area volumetric coverage across expansive open spaces, such as convention centers, airport hangars, massive logistics warehouses, and high-ceiling atriums. They offer a cost-effective solution for long linear distances where the installation of extensive ASD piping networks would be impractical or excessively expensive.

What is the projected growth trajectory for the Laser Smoke Detector Market in the coming years?

The market is projected to experience robust growth, characterized by a CAGR of 7.8% between 2026 and 2033. This growth is primarily driven by global regulatory tightening of fire safety codes, massive infrastructural investments in data centers worldwide, and the increasing incorporation of AI and IoT technologies enhancing system reliability and integration capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager