Laser Soldering Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435726 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Laser Soldering Machine Market Size

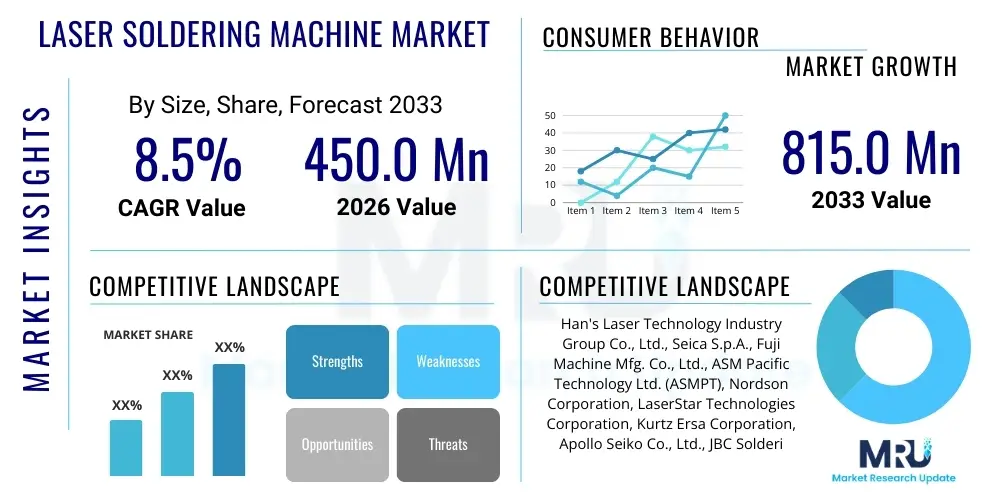

The Laser Soldering Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.0 Million in 2026 and is projected to reach USD 815.0 Million by the end of the forecast period in 2033.

Laser Soldering Machine Market introduction

The Laser Soldering Machine Market encompasses advanced manufacturing equipment used for high-precision, contactless soldering processes in electronics assembly and component interconnection. These machines utilize focused laser beams, often fiber or diode lasers, to deliver localized heat energy, melting the solder paste or wire precisely onto target joints. This method is highly favored over conventional contact soldering techniques due to its superior speed, accuracy, minimal thermal stress on sensitive components, and capability to handle increasingly miniaturized electronic packages, such as micro BGA and fine-pitch components. The core innovation lies in the controlled delivery of energy, which ensures consistent joint quality and repeatability, critical for reliability in end-use applications.

Product descriptions typically revolve around the laser source type (fiber, diode, Nd:YAG), system integration capabilities (in-line vs. stand-alone), and the level of automation (semi-automatic to fully robotic systems). Major applications span across highly demanding industries, primarily including consumer electronics for smartphones and wearables, automotive electronics for ADAS and battery management systems, and medical devices where reliability and miniaturization are paramount. The inherent benefits of laser soldering—such as enhanced process control, reduced material consumption, and the ability to solder in confined spaces—make it indispensable for modern high-density interconnect (HDI) manufacturing environments. The non-contact nature also eliminates mechanical stress, preventing component damage during the assembly phase.

The primary driving factors propelling this market include the global trend toward electronic device miniaturization, requiring precise and repeatable soldering of extremely small components; the rapid expansion of the automotive sector, particularly the electrification of vehicles necessitating high-reliability joints for power electronics; and the proliferation of 5G infrastructure, which demands high-frequency component assembly with stringent quality requirements. Furthermore, increasing labor costs and the continuous drive for manufacturing efficiency and yield improvement across Asia Pacific and Europe incentivize manufacturers to adopt fully automated laser soldering solutions, thereby sustaining robust market growth.

Laser Soldering Machine Market Executive Summary

The Laser Soldering Machine Market is characterized by accelerating technological innovation driven by the increasing complexity and density of modern electronic circuits, particularly within the consumer electronics and automotive sectors. Business trends indicate a strong focus on developing hybrid laser systems capable of handling diverse solder materials and substrates, alongside integrating advanced vision systems and proprietary temperature monitoring feedback loops to ensure zero-defect production. Key market participants are aggressively pursuing mergers, acquisitions, and strategic partnerships with system integrators to expand their geographical footprint, especially in fast-growing manufacturing hubs in Asia. There is a perceptible shift towards subscription-based software and service models complementing the hardware sales, focusing on predictive maintenance and process optimization, aligning with Industry 4.0 principles.

Regionally, Asia Pacific maintains market dominance, fueled by China, South Korea, and Taiwan, which serve as global manufacturing centers for electronics components and finished goods. This region exhibits the highest demand for new laser soldering capacity due to massive production volumes and continuous capital expenditure cycles in semiconductor packaging and advanced display manufacturing. North America and Europe, while slower in pure volume growth, lead in the adoption of specialized, high-end systems for aerospace, defense, and high-reliability medical device production. Regulatory trends, such as stringent quality standards in automotive safety systems, further reinforce the necessity for high-precision soldering techniques available through advanced laser systems, driving premium market growth in developed economies.

Segment trends reveal that the Fiber Laser Soldering segment is experiencing the fastest growth, attributable to its excellent beam quality, efficiency, and flexibility in adapting to different component geometries. Automatic operation mode systems command the largest market share, driven by the need for high throughput and consistent quality in large-scale manufacturing environments. Among applications, Automotive Electronics is poised for significant expansion, specifically due to the accelerating production of electric vehicle (EV) batteries, advanced driver-assistance systems (ADAS), and complex sensor integration, where thermal management and joint integrity are critical. This segmentation analysis underscores a market prioritizing automation, precision, and reliable process control over marginal cost savings associated with traditional methods.

AI Impact Analysis on Laser Soldering Machine Market

User inquiries frequently center on how Artificial Intelligence (AI) and machine learning (ML) can enhance process variability, predict equipment failure, and automate complex programming tasks within the laser soldering domain. The primary themes involve questions regarding the feasibility of real-time defect detection beyond traditional vision systems, the optimization of laser parameters for novel materials, and the creation of self-correcting soldering processes. Users express high expectations that AI integration will resolve chronic issues related to inconsistent thermal profiles caused by component variations, minimize manual operator intervention, and provide a competitive edge through improved yield rates and reduced scrap material. Concerns often relate to data security, the high initial investment required for AI infrastructure, and the need for specialized personnel to maintain complex ML models, emphasizing that practical, measurable ROI from AI integration remains a key adoption barrier for smaller manufacturers. The consensus expectation is that AI will transform laser soldering from a highly controlled but static process into a dynamic, adaptive manufacturing cell.

- AI-Powered Real-Time Process Monitoring: Utilizing machine vision and deep learning algorithms to detect micro-defects, such as insufficient wetting or void formation, instantaneously, exceeding the capabilities of traditional rule-based inspection systems.

- Predictive Maintenance: Applying ML models to sensor data (laser power stability, cooling system performance, galvanometer speed) to forecast component degradation and schedule maintenance proactively, minimizing unplanned downtime and maximizing equipment utilization rates.

- Automated Parameter Optimization: Employing reinforcement learning to dynamically adjust laser power, spot size, and heating duration based on real-time feedback from thermal cameras and joint quality metrics, ensuring optimal solder joint integrity across different batches or component tolerances.

- Enhanced Data Analysis and Reporting: Leveraging AI to correlate soldering parameters with long-term product reliability data, providing actionable insights for process engineers to continually refine manufacturing specifications and improve overall product lifetime performance.

- Autonomous Rework and Correction: Developing closed-loop systems where AI determines the optimal rework strategy (e.g., localized re-heating) for marginal joints without human intervention, improving first-pass yield significantly.

DRO & Impact Forces Of Laser Soldering Machine Market

The Laser Soldering Machine Market is driven by the imperative need for precision manufacturing in high-technology sectors, countered by significant initial investment restraints, while simultaneously benefiting from substantial opportunities arising from emerging industrial trends. Key drivers include the exponential increase in component density (e.g., 01005 chips) and the demand for high-reliability joints in critical applications like automotive safety systems and medical implants. This necessitates the adoption of non-contact, highly controllable soldering methods that minimize thermal influence on surrounding sensitive parts. However, the high capital expenditure associated with purchasing and integrating advanced laser systems, coupled with the specialized training required for operators and maintenance technicians, acts as a primary restraint, particularly for small and medium-sized enterprises (SMEs) struggling with budget constraints and technical manpower limitations. The most compelling opportunity lies in the proliferation of 5G infrastructure, demanding sophisticated radio-frequency (RF) components assembled with exceptional precision, and the rapidly scaling EV battery manufacturing sector, requiring high-power laser welding and soldering solutions for robust interconnects.

Impact forces within this market structure are primarily defined by technological substitution threats and the bargaining power of major electronics manufacturers. The threat of substitution, though currently low due to the unique precision of laser technology, could intensify if advanced vapor phase soldering or specialized conductive adhesive technologies mature sufficiently to challenge laser speed or cost-efficiency in certain lower-volume applications. Conversely, the intense competition among global electronics manufacturers (the buyers) grants them significant bargaining power, driving down margins for laser system vendors and forcing continuous innovation towards lower operating costs and higher throughput metrics. Supplier bargaining power is moderate, as specialized laser source components (fiber lasers, galvo scanners) often come from a concentrated supply base, requiring strong long-term relationships and robust supply chain resilience from the machine manufacturers to mitigate procurement risks and cost volatility.

The combination of these forces results in a market environment focused on maximizing value through process integration and technological differentiation. Successful market penetration relies heavily on providing comprehensive automation solutions that can integrate seamlessly with existing SMT lines and offer verifiable improvements in quality control (QC) and throughput metrics. The long-term trajectory is heavily influenced by global R&D spending in next-generation electronics, ensuring that the market for laser soldering remains robust as electronics continue to penetrate nearly every industrial and consumer sector, pushing the boundaries of miniaturization and reliability requirements. The industry's ability to lower the barrier to entry through modular design and flexible financing options will be crucial for unlocking growth potential in emerging economies and penetrating the SME segment.

Segmentation Analysis

The Laser Soldering Machine Market is segmented based on critical technical characteristics and end-user applications, providing a detailed view of current market demands and future growth areas. The primary segmentation criteria include the type of laser source utilized, the level of machine automation, and the specific application industry served. Analyzing these segments helps stakeholders understand which technologies are gaining traction (e.g., fiber lasers due to efficiency) and which industrial sectors are driving the largest investment (e.g., automotive electronics due to electrification mandates). The shift toward fully automatic systems across all segments highlights the overarching industry goal of achieving minimal human intervention and maximizing production consistency, which is particularly vital for high-volume manufacturing environments demanding zero-defect tolerance and rapid changeover capabilities.

- By Laser Type:

- Fiber Laser Soldering

- Diode Laser Soldering

- Nd:YAG Laser Soldering

- Other Laser Types (e.g., CO2)

- By Operation Mode:

- Automatic

- Semi-Automatic

- Manual (Benchtop)

- By Application:

- Consumer Electronics (Smartphones, Tablets, Wearables)

- Automotive Electronics (ADAS, BMS, Infotainment)

- Medical Devices (Implants, Diagnostic Equipment)

- Aerospace & Defense (Avionics, High-Reliability Circuits)

- Industrial Manufacturing (Industrial Controls, Power Devices)

- Telecommunications (5G Infrastructure, RF Components)

- By Geographic Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, South Korea, Taiwan)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Laser Soldering Machine Market

The value chain for the Laser Soldering Machine Market begins with upstream suppliers providing critical core components and technology. This upstream segment is dominated by specialized manufacturers of high-power laser sources (such as fiber and diode modules), precision optics (lenses, mirrors, beam shaping systems), and highly accurate motion control components (galvanometer scanners and robotic arms). The quality and reliability of these upstream inputs directly dictate the performance characteristics (speed, accuracy, lifespan) of the final soldering machine. Intense R&D is concentrated here to improve beam quality, energy efficiency, and miniaturization of laser sources. Manufacturers often forge long-term, exclusive supply agreements with these component providers to ensure consistent quality and mitigate supply chain vulnerabilities associated with specialized technological components.

Midstream activities involve the machine assembly and system integration carried out by the primary laser soldering machine manufacturers. This phase encompasses the integration of the laser source, vision systems, proprietary software for temperature profiling and process control, and the mechanical infrastructure (gantries, conveyor belts, enclosures). Distribution channels are multifaceted; high-end, customized automated systems are typically sold direct (direct sales) through in-house sales teams and application engineers, ensuring complex integration requirements are met. Standard benchtop or semi-automatic systems often utilize indirect distribution via specialized regional distributors or third-party SMT equipment resellers who provide local support, installation, and after-sales service, broadening market reach geographically.

The downstream segment involves the end-users—the electronics manufacturing service (EMS) providers, original equipment manufacturers (OEMs) in automotive, and medical device producers—who implement and operate the machines in their production lines. Critical activities in this stage include application engineering support, customization of tooling and fixturing, operator training, and ongoing maintenance and consumables supply (nozzles, solder materials). The proximity of service support is highly valued, as machine downtime directly impacts production schedules. Therefore, the successful management of the downstream phase, characterized by robust after-sales service and rapid technical assistance, is crucial for maintaining customer loyalty and securing repeat orders, significantly influencing the overall profitability and brand reputation within the highly competitive electronics manufacturing ecosystem.

Laser Soldering Machine Market Potential Customers

Potential customers for laser soldering machines are primarily businesses operating within high-reliability and high-volume electronics assembly sectors where precision, speed, and minimal thermal impact are critical determinants of product quality. The largest segment comprises multinational Electronics Manufacturing Services (EMS) providers who handle contract manufacturing for major OEMs across various industries, requiring flexible and high-throughput automated solutions to manage diverse product portfolios ranging from consumer goods to complex industrial controls. Furthermore, Original Equipment Manufacturers (OEMs) specializing in advanced applications, such as Tier 1 automotive suppliers producing critical safety modules (airbag controllers, ADAS systems) and medical device firms developing complex neuro-stimulators or imaging components, represent highly valuable customer bases due to their stringent quality requirements and long-term investment cycles.

Another significant group includes semiconductor packaging companies and module manufacturers focusing on high-density interconnects (HDI) and System-in-Package (SiP) technologies, particularly those involved in 5G component manufacturing and high-speed data centers. These customers utilize laser soldering to achieve extremely fine pitch soldering with minimal thermal distortion, which is often unattainable with conventional reflow or wave soldering. Research and academic institutions, along with specialized defense and aerospace contractors, also constitute a niche but high-value customer segment, often requiring customized, low-volume systems for prototyping and developing new material combinations and specialized electronic assemblies designed for extreme environments. These diverse buyers are united by the need to achieve superior solder joint quality and repeatability necessary for functional reliability and extended product lifecycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 Million |

| Market Forecast in 2033 | USD 815.0 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Han's Laser Technology Industry Group Co., Ltd., Seica S.p.A., Fuji Machine Mfg. Co., Ltd., ASM Pacific Technology Ltd. (ASMPT), Nordson Corporation, LaserStar Technologies Corporation, Kurtz Ersa Corporation, Apollo Seiko Co., Ltd., JBC Soldering Tools, IPG Photonics Corporation, LPKF Laser & Electronics AG, Pillarhouse International Ltd., Thermal Company, Inc., Shenzhen Jiasheng Laser Equipment Co., Ltd., Wuhan Huagong Laser Engineering Co., Ltd., Universal Instruments Corporation, Prometec GmbH, Laser Components GmbH, Miyachi Corporation (now Amada Miyachi), V-TEK International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Soldering Machine Market Key Technology Landscape

The technological landscape of the laser soldering market is defined by several core advancements aimed at increasing precision, speed, and process control. Foremost among these is the implementation of advanced laser sources, specifically high-power, high-beam quality fiber lasers which offer superior energy coupling and longevity compared to traditional Nd:YAG or diode lasers. Fiber lasers enable extremely small spot sizes (down to tens of micrometers), making them ideal for ultra-fine pitch component soldering prevalent in modern electronics. Coupled with these sources are sophisticated galvanometric scanner systems (galvos) that allow for high-speed beam positioning and pattern recognition, enabling "on-the-fly" soldering and dramatically increasing throughput rates in automated lines, often exceeding the speed limitations of traditional gantry-based systems.

A second crucial technological element is the integration of advanced vision and closed-loop control systems. High-resolution CCD or CMOS cameras, often paired with proprietary software algorithms, accurately locate the target solder joint (fiducial recognition) and compensate for component placement errors prior to laser firing. This precision is further augmented by pyrometric temperature feedback mechanisms. These non-contact infrared sensors measure the temperature of the solder joint in real-time, allowing the system to modulate the laser power instantaneously. This closed-loop control is essential for achieving precise thermal profiles, preventing overheating, and ensuring the metallurgical integrity of the joint, addressing the fundamental challenge of variability in heat absorption across different substrate materials and component finishes.

Furthermore, the development of specialized nozzles and shielding gas delivery systems represents a critical peripheral technology. Laser soldering often requires an inert or reducing atmosphere to prevent oxidation of the solder material and the surrounding PCB pads, which can compromise joint reliability. Innovations in fluxless soldering techniques, utilizing specific laser parameters or specialized solder pastes activated by the laser energy itself, are also gaining traction, minimizing residue cleanup and improving environmental compatibility. The overall trend is toward highly modular, software-driven platforms that facilitate rapid tool changes and seamless integration with existing manufacturing execution systems (MES) and centralized quality databases, positioning laser soldering as a critical component of smart factory initiatives.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global laser soldering market, largely attributable to the massive concentration of consumer electronics manufacturing hubs in countries like China, South Korea, Taiwan, and Japan. These regions host the world's largest contract manufacturers and OEMs, necessitating continuous investment in high-speed, high-precision assembly equipment to meet global demand for smartphones, laptops, and advanced display technologies. The region’s aggressive capital expenditure cycles in the semiconductor and PCB fabrication industries, coupled with government incentives supporting advanced manufacturing technology adoption, solidify its position as both the largest consumer and the primary driver of market growth.

- North America: North America represents a mature, high-value market characterized by demand for specialized, high-reliability applications, particularly within the Aerospace & Defense and Medical Device sectors. Adoption here focuses less on high volume and more on achieving stringent regulatory compliance and exceptional joint integrity required for critical systems (e.g., medical implants, satellite components). The presence of major technology innovators and high R&D spending also drives demand for state-of-the-art, customized laser systems capable of handling exotic materials and complex, low-volume assemblies.

- Europe: Europe is a key region, driven heavily by the sophisticated Automotive Electronics industry, especially in Germany and Central Europe. The rapid shift toward electric vehicles (EVs) and autonomous driving systems mandates the use of highly reliable soldering for Battery Management Systems (BMS), power inverters, and sophisticated sensor packages. European manufacturers prioritize efficiency, automation (Industry 4.0 integration), and minimal environmental impact, thus fueling the demand for highly efficient fiber laser systems and automated in-line solutions that offer superior traceability and process control over traditional methods.

- Latin America (LATAM): The LATAM market is currently characterized by moderate growth, primarily centered around Brazil and Mexico, which serve as regional manufacturing and assembly centers, particularly for consumer goods and some automotive components destined for local consumption and export. Adoption is steady but focused mainly on semi-automatic and mid-range automatic systems, prioritizing cost-effectiveness alongside quality improvements over purely high-throughput solutions found in APAC.

- Middle East & Africa (MEA): MEA remains the smallest regional segment, with demand concentrated in industrial manufacturing and limited defense applications. Market expansion is gradual, highly dependent on foreign direct investment into local assembly plants and the development of regional infrastructure projects. However, potential future growth is anticipated in specialized telecommunications assembly (supporting regional 5G rollouts) and the nascent development of local automotive assembly operations, gradually increasing the need for precision soldering capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Soldering Machine Market.- Han's Laser Technology Industry Group Co., Ltd.

- Seica S.p.A.

- Fuji Machine Mfg. Co., Ltd.

- ASM Pacific Technology Ltd. (ASMPT)

- Nordson Corporation

- LaserStar Technologies Corporation

- Kurtz Ersa Corporation

- Apollo Seiko Co., Ltd.

- JBC Soldering Tools

- IPG Photonics Corporation

- LPKF Laser & Electronics AG

- Pillarhouse International Ltd.

- Thermal Company, Inc.

- Shenzhen Jiasheng Laser Equipment Co., Ltd.

- Wuhan Huagong Laser Engineering Co., Ltd.

- Universal Instruments Corporation

- Prometec GmbH

- Laser Components GmbH

- Amada Miyachi (formerly Miyachi Corporation)

- V-TEK International

Frequently Asked Questions

Analyze common user questions about the Laser Soldering Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of laser soldering compared to traditional reflow or iron soldering?

Laser soldering offers significant benefits over conventional methods by providing highly localized, non-contact heating, which minimizes thermal stress on adjacent sensitive components and reduces the overall thermal footprint on the Printed Circuit Board (PCB). This method allows for extremely precise spot heating necessary for miniaturized components (e.g., 01005 packages and fine-pitch QFNs) and enables high-speed, repeatable processing crucial for high-volume automated manufacturing lines. Furthermore, laser systems offer superior process control through integrated pyrometers, allowing real-time temperature monitoring and modulation of laser power, ensuring consistent solder joint quality, which is vital for high-reliability applications in automotive and aerospace sectors. The non-contact nature also eliminates mechanical wear and tear associated with soldering iron tips, reducing maintenance overhead and ensuring consistent thermal transfer efficiency throughout the machine's operational lifespan, leading to superior yield rates and long-term cost savings compared to contact methods that require frequent tip replacement and calibration.

How does the choice between Fiber and Diode lasers impact soldering application performance?

The choice between Fiber and Diode lasers is critical and depends primarily on the required spot size, beam quality, and system cost. Fiber lasers generally offer superior beam quality, allowing the beam to be focused down to much smaller spot sizes (often <50 micrometers), making them ideal for ultra-fine pitch and highly demanding micro-soldering applications found in advanced consumer electronics and SiP packaging. They also boast high wall-plug efficiency and a longer operational lifespan. Diode lasers, conversely, are typically less expensive upfront and are generally utilized for larger spot sizes or applications where the focus on extreme precision is slightly lower, such as standard component interconnects or larger pad sizes. While Diode lasers provide a good cost-performance balance for general assembly, Fiber lasers dominate high-end, precision-intensive segments due to their superior optical characteristics, which translate directly into higher energy concentration and better control over the thermal cycle, justifying their higher initial investment cost for critical assembly tasks.

What role does closed-loop temperature control play in ensuring the quality of laser solder joints?

Closed-loop temperature control is fundamental to achieving high-quality, defect-free laser solder joints, serving as the essential mechanism for process stability. This control system utilizes a non-contact pyrometer (infrared thermometer) focused directly on the solder joint or surrounding pad area to measure the actual temperature in milliseconds. Based on this real-time feedback, the system rapidly adjusts (modulates) the output power of the laser to follow a pre-defined thermal profile, compensating instantly for variations in component size, substrate reflectivity, heat sinking effects, and environmental temperature fluctuations. Without this dynamic control, an open-loop system would deliver a fixed amount of energy, inevitably leading to insufficient heating (cold joints) or overheating (scorching, component damage) due to the inherent variability of materials and components. Closed-loop control guarantees that every joint reaches the precise melting temperature for the specified dwell time, optimizing the wetting process and minimizing the risk of solder voids, ensuring maximum joint reliability, traceability, and consistency critical for safety-related products.

Which industry application is currently driving the highest growth and demand for automated laser soldering systems?

The Automotive Electronics sector is currently experiencing the highest growth and driving the most significant demand for automated laser soldering systems globally. This growth is predominantly fueled by two major trends: the rapid electrification of vehicles (EVs and hybrids) and the sophisticated integration of Advanced Driver-Assistance Systems (ADAS). Components such as Battery Management Systems (BMS), power inverters, high-power modules, and intricate sensor arrays (LiDAR, radar, cameras) require solder joints that must withstand extreme thermal cycling, vibration, and stringent safety standards over the vehicle's long operational life. Laser soldering provides the necessary precision and joint integrity to meet these high-reliability requirements, especially for connecting sensitive power components and fine-pitch sensor interconnects where traditional soldering methods could induce thermal damage or structural weakness. The move toward full automation in automotive production lines further mandates the adoption of high-throughput laser systems capable of integrating directly into standardized assembly sequences while providing comprehensive data logging for regulatory compliance and quality assurance purposes.

What are the major challenges manufacturers face when implementing laser soldering technology for the first time?

First-time adopters of laser soldering technology typically face several critical implementation challenges, spanning capital, technical, and operational domains. The primary challenge is the substantial initial capital investment required for purchasing high-precision laser systems, vision components, and integrated motion control infrastructure, which is significantly higher than conventional soldering alternatives. Technically, setting up the process requires specialized expertise in laser physics and materials science to accurately determine the optimal laser parameters (power, focus, duration) for various solder materials and PCB substrates, which demands specialized training for engineering staff. Furthermore, integration into existing Surface Mount Technology (SMT) lines can be complex, requiring careful consideration of material handling, synchronization with upstream and downstream processes, and specialized fixturing designed to withstand the focused laser energy. Finally, ensuring the long-term maintenance and calibration of complex optical systems and high-precision scanners requires establishing new maintenance protocols and training specialized technicians, representing a significant operational hurdle often overlooked during the initial procurement phase, which necessitates robust partnership with the equipment vendor for ongoing support and application engineering assistance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager