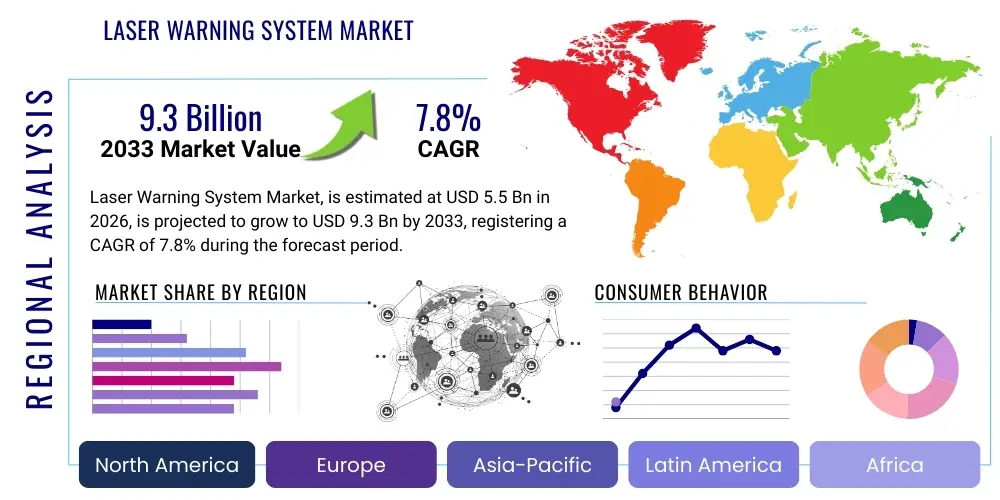

Laser Warning System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436262 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Laser Warning System Market Size

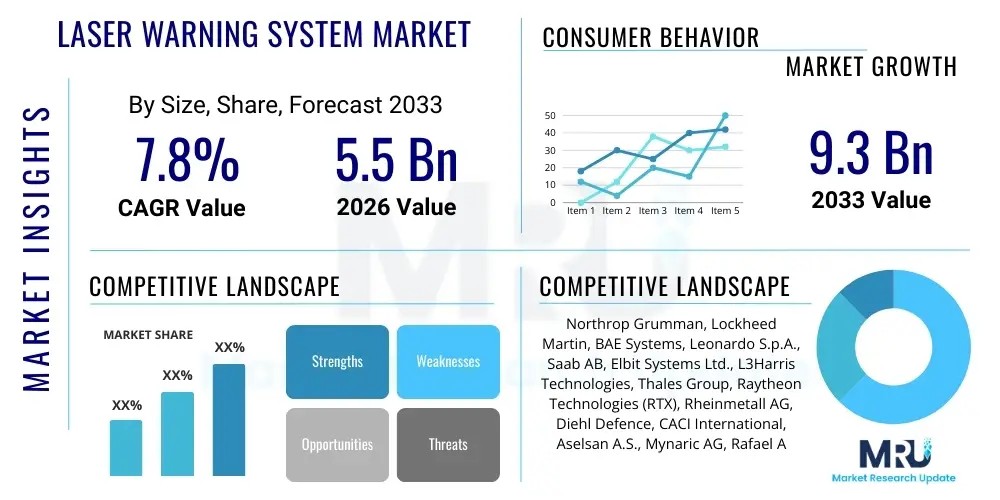

The Laser Warning System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 5.5 Billion in 2026 and is projected to reach USD 9.3 Billion by the end of the forecast period in 2033.

Laser Warning System Market introduction

The Laser Warning System (LWS) Market encompasses advanced electronic countermeasures designed specifically to detect, classify, and localize the presence of laser radiation targeting military platforms, including fighter jets, heavy-lift helicopters, armored personnel carriers, and surface naval combatants. These systems are an indispensable component of integrated electronic warfare (EW) suites, providing timely, high-fidelity situational awareness regarding potential threats originating from laser rangefinders, laser designators used for target illumination, and laser beam riders employed for missile guidance. The core requirement of LWS is to provide a rapid, actionable alert that allows the platform to initiate defensive protocols, whether through maneuvering, the deployment of smoke screens or chaff, or the activation of more sophisticated hard-kill or soft-kill countermeasure systems. The evolution of LWS technology is directly proportional to the increased sophistication and proliferation of asymmetric laser threats used in modern conflicts.

The operational profile of a typical LWS includes a set of distributed sensor heads—often multiple units strategically positioned around the platform—connected to a central processing unit and a crew interface. These sensors utilize highly sensitive photodetector technology, capable of covering wide spectral bands (from ultraviolet to mid-infrared) to ensure comprehensive detection against diverse laser sources. Product performance is measured critically by sensitivity, angular accuracy, and, most importantly, the ability to maintain a low false alarm rate (FAR) in complex operational environments characterized by environmental noise and non-threat laser sources. Major applications span comprehensive protection against advanced anti-tank guided missiles (ATGM) that rely on laser guidance, air defense against Man-Portable Air-Defense Systems (MANPADS), and enhancing the survivability of strategic surveillance platforms. The inherent benefits include drastically increased platform survivability, improved operational tempo, and reduced logistical costs associated with combat losses.

Market growth is predominantly driven by continuous global defense modernization cycles, particularly the transition toward networked and highly protected combat platforms. Geopolitical instability across key regions necessitates continuous investment in defensive EW capabilities to counter peer and near-peer adversaries employing sophisticated targeting technologies. Furthermore, technological drivers such as the miniaturization of sensor technology (enabling integration onto smaller UAVs and tactical vehicles) and the adoption of advanced signal processing algorithms—often incorporating artificial intelligence—are enhancing system reliability and capability. These factors, combined with established defense spending policies in major economies like the US, China, and India, underpin the projected robust growth trajectory throughout the forecast period. The requirement for standardized interoperability within allied forces also contributes to centralized procurement decisions and upgrades.

Laser Warning System Market Executive Summary

The Laser Warning System market is characterized by technological maturity combined with relentless innovation, primarily focused on improving spectral coverage, response speed, and false alarm rejection capabilities. Current business trends indicate a strong move toward integrated sensor suites, where LWS functionality is packaged alongside Missile Warning Systems (MWS) and Hostile Fire Detection (HFD) into single, unified electronic warfare systems (EWMS). Key players are heavily invested in R&D to develop multi-spectral detectors (UV, visible, and IR) and advanced data fusion techniques. The market remains strictly government-dominated, meaning long procurement timelines and substantial capital expenditure requirements are standard, emphasizing performance and reliability over cost optimization. Consolidation among prime contractors continues to shape the competitive landscape.

From a regional perspective, North America maintains its position as the largest market, driven by the sheer scale of the US defense budget and the constant upgrade cycle for its extensive military inventory, particularly in airborne assets. However, the Asia Pacific region is rapidly expanding its market share, representing the highest Compound Annual Growth Rate (CAGR). This expansion is a direct result of ambitious military build-ups and fleet renewals across key APAC nations responding to rising regional tensions. Europe’s growth is stable, underpinned by NATO requirements for interoperable, advanced self-protection systems for ground and air platforms deployed in expeditionary operations, with an increased focus on counter-UAS capabilities which often incorporate LWS technology.

Segmentation trends confirm that the Airborne platform segment continues to dominate revenue generation due to the necessity of protecting expensive and strategically vital aircraft assets. However, the Ground-based segment, driven by the increasing deployment of Armored Fighting Vehicles (AFVs) in hostile urban environments, is exhibiting faster deployment rates, often integrated with automatic smoke dispensing systems (ASDS). Component analysis highlights signal processing and detector technology as the leading areas of investment, as speed and accuracy are non-negotiable performance parameters. The application emphasis remains overwhelmingly focused on Missile Defense, where LWS acts as the crucial trigger for subsequent layered countermeasures, ensuring platform survivability against precision-guided munitions.

AI Impact Analysis on Laser Warning System Market

The analysis of common user questions regarding AI's influence on the Laser Warning System Market reveals significant interest in how machine learning can transform LWS from a passive detection system into an active, cognitive defense asset. Users are most concerned with how to practically implement AI to handle the increasing complexity of modern threat signals, which often utilize sophisticated modulation techniques to evade traditional detection thresholds. Central inquiries address the feasibility of using neural networks for instantaneous signature analysis, the ability of AI to differentiate between deliberate military illumination and unintentional environmental clutter (such as reflected sunlight or friendly sensors), and the crucial need for AI to maintain ultra-low latency despite massive data throughput.

The primary transformative impact of AI lies in its ability to enhance the intelligence residing within the LWS processing unit. Conventional LWS relies on comparing detected energy characteristics against a static library of known threat parameters. AI algorithms, particularly deep learning models, allow the system to perform real-time pattern recognition on complex, noisy spectral and temporal data, identifying subtle, evolving, or entirely novel laser threats that have never been seen before. This capability shifts the LWS paradigm from reactive warning to predictive intelligence. Furthermore, AI facilitates sophisticated sensor fusion, seamlessly integrating LWS data with inputs from radar warning receivers (RWR), missile warning systems (MWS), and inertial navigation systems (INS) to generate a high-confidence, unified tactical threat assessment, thereby maximizing the efficiency and timing of countermeasures.

Crucially, AI addresses the chronic problem of high False Alarm Rates (FARs), which often plague traditional LWS, leading to the wasteful depletion of expensive countermeasures or, worse, distracting the crew during critical moments. Machine learning models trained on millions of hours of operational data can effectively categorize benign occurrences—like reflections, accidental illumination from friendly assets, or even natural phenomena—as non-threats, significantly improving system trustworthiness. Furthermore, AI enables the development of cognitive countermeasure strategies. Instead of deploying a fixed response, the AI can rapidly select the optimal countermeasure (e.g., a specific smoke formulation or a coordinated maneuver) based on the calculated probability of hit, the threat's angle of attack, and the remaining platform resources, thereby optimizing survivability in multi-threat scenarios.

- Enhanced Threat Classification: AI utilizes deep learning to analyze spectral and temporal data patterns, drastically improving the accuracy of distinguishing threat types (designators vs. rangefinders) and identifying novel, previously unknown laser signatures.

- False Alarm Reduction: Machine learning filters ambient noise and environmental clutter, minimizing false alarms which can prematurely deplete countermeasures and reduce crew trust in the system.

- Cognitive Countermeasures: AI enables autonomous, optimized deployment of countermeasures based on calculated threat severity, impact point prediction, and remaining platform resources.

- Predictive System Diagnostics: Algorithms monitor sensor health and signal processing performance, utilizing anomaly detection to forecast maintenance needs and ensure high operational readiness of the system components.

- Data Fusion and Situational Awareness: AI integrates LWS data seamlessly with other EW sensors (e.g., Radar Warning Receivers) to create a unified, real-time tactical picture, crucial for complex battlefield environments.

- Adaptive Learning: Systems can learn from new threat encounters in the field (e.g., new laser wavelengths or pulse repetition frequencies), updating their detection models without requiring immediate physical hardware replacement or extensive manual reprogramming.

- Improved Angular Accuracy: Advanced AI image processing assists in precisely localizing the source of the laser, which is essential for cueing directional countermeasures such as DIRCM systems.

DRO & Impact Forces Of Laser Warning System Market

The dynamics of the Laser Warning System (LWS) market are fundamentally driven by the escalating pace of military technology development globally, where the need for superior platform survivability (Driver) constantly butts against the economic and technological complexities of high-performance sensor integration (Restraint). The overarching Impact Force remains the continuous strategic competition among global powers, pushing defense contractors to develop LWS capable of detecting increasingly subtle, high-power, and often multi-spectral threats. This forces perpetual research cycles, ensuring sustained spending, provided the threat perception remains elevated. Opportunities arise primarily from integrating LWS capabilities into the rapidly growing segment of unmanned systems and moving toward standardized, modular EW architectures that reduce integration complexity and cost for fleet-wide deployment.

Key drivers cementing market demand include the proven efficacy of LWS against both legacy and modern laser-guided munitions, making their incorporation a mandatory requirement for nearly all new military platform acquisitions, particularly for rotary-wing and ground combat vehicles operating at low altitudes or in urban conflicts. The global focus on expeditionary warfare necessitates robust self-protection capabilities that function autonomously and reliably in diverse environments. Technological drivers include the falling cost and increased capability of microprocessors, allowing for more complex algorithms to be run closer to the sensor head, improving response time. Conversely, the high technological barrier to entry and the specialized expertise required to develop robust photodetectors sensitive enough across the necessary wavebands act as significant restraints. Additionally, the lengthy, multi-year government qualification and certification processes required for defense systems often slow down the deployment of new, innovative LWS solutions.

The market finds significant opportunity in the transition toward open architecture systems, allowing different LWS components from various manufacturers to interoperate seamlessly. This modular approach reduces vendor lock-in and facilitates easier upgrades, appealing to governments managing diverse fleets. Furthermore, the emerging requirement for detection against Directed Energy Weapons (DEW) presents a massive, high-value opportunity, as LWS must evolve to warn against potential lethal laser illumination, not just guidance beams. The primary impact force—technological change—dictates that manufacturers must continually invest in advanced materials science (for better detectors) and advanced computational science (for better classification algorithms). Failure to keep pace with adversarial laser technology renders defensive systems obsolete quickly, maintaining high pressure on R&D budgets and procurement cycles worldwide.

- Drivers:

- Increasing proliferation of laser-guided munitions and surveillance technologies globally, necessitating immediate defensive measures.

- Mandatory platform survivability requirements enshrined in military procurement specifications across major defense economies.

- Growth in defense budgets specifically allocated for electronic warfare (EW) and layered integrated self-protection suites.

- Requirement for reliable, low-false-alarm detection in complex operational environments (urban and electronic clutter).

- Restraints:

- High cost associated with the research, development, and complex integration of advanced, multi-band sensor arrays and high-speed processors.

- Technical challenges related to reliably mitigating high False Alarm Rates (FARs) caused by environmental noise and non-threat sources.

- Strict international export control regulations (e.g., ITAR, Wassenaar Arrangement) limiting global market access and technology transfer.

- Long lifecycle testing and validation processes mandated by defense ministries delay product deployment.

- Opportunities:

- Integration into rapidly expanding fleets of Unmanned Aerial Vehicles (UAVs) and ground robotic systems due to increased miniaturization (low SWaP).

- Development of integrated multi-function systems combining LWS, MWS (Missile Warning Systems), and HFD (Hostile Fire Detection) into single units.

- Modernization programs for legacy military platforms requiring retrospective fitting of advanced survivability systems.

- Focus on developing LWS capabilities specifically tailored for detection and warning against emerging Directed Energy Weapons (DEW).

- Impact Forces:

- Technological advancement in adversarial laser ranging, targeting, and emerging high-energy laser capabilities demanding rapid LWS spectral evolution and power handling capacity.

- Geopolitical instability and regional conflicts driving urgent, mission-critical procurement cycles for defensive EW solutions.

- Strict government regulations and military standards influencing design, manufacturing reliability, and testing protocols for military hardware.

- Industry consolidation among prime defense contractors affects competition and innovation pace.

Segmentation Analysis

The Laser Warning System (LWS) market segmentation provides a granular view of spending priorities across different defense sectors, analyzing demand based on where the system is mounted (Platform), the technical constituents of the system (Component), the defensive mission it supports (Application), and the primary acquiring entity (End-User). Platform segmentation is critical as it dictates the environmental and physical constraints imposed on the LWS design; for example, airborne systems require highly ruggedized, lightweight, and aerodynamically optimized sensor heads, while ground-based systems prioritize resilience against shock and dust exposure, often with 360-degree coverage requirements for convoy protection.

The Component segmentation highlights the areas receiving the heaviest R&D investment. Detectors, which are the core sensing mechanism, are constantly being refined for higher quantum efficiency and wider spectral bandwidth to cover novel laser threats. Processors and Control Units are evolving rapidly through the adoption of faster FPGAs and specialized ASICs (Application-Specific Integrated Circuits) to handle the increased data volume generated by high-resolution sensors and complex AI algorithms. This segmentation reveals a push for modularity, allowing militaries to upgrade processing units and software independently of the physical sensor heads, thereby maximizing system lifespan and reducing total cost of ownership over decades of operation.

Application-wise, the market is overwhelmingly centered on Missile Defense and Countermeasure Dispensing. LWS acts as a non-emitting, passive cueing system that provides the initial and most critical warning before a missile or projectile strikes. The secondary, but growing, application is Situational Awareness, where LWS data is used to inform tactical commanders about enemy positions and targeting activities, allowing for strategic repositioning or the suppression of hostile targeting assets. End-User analysis confirms that the Military and Defense Forces segment represents nearly 100% of the market, necessitating that vendors align their sales strategies and product certifications exclusively with demanding government procurement standards and classified military requirements.

- By Platform:

- Airborne (Fixed-wing, Rotary-wing, Unmanned Aerial Vehicles (UAVs)) – Largest segment by value.

- Ground-based (Armored Fighting Vehicles (AFVs), Main Battle Tanks (MBTs), Personnel Carriers) – Fastest growing segment by volume.

- Naval (Surface Combatants, Aircraft Carriers, Frigates, Patrol Vessels)

- By Component:

- Detectors (Electro-optic Sensors, Photodetectors, Multi-spectral Arrays)

- Processors and Control Units (FPGAs, DSPs, Central EW Management)

- Display and HMI (Human-Machine Interface) and Warning Modules

- Software and Algorithm Suites (Threat Classification and Fusion Software)

- By Application:

- Missile Defense and Countermeasures Dispensing (Soft-kill and Hard-kill cueing)

- Situational Awareness and Surveillance (Hostile Targeting Identification)

- Target Acquisition and Tracking Cueing for Defensive Systems

- By End-User:

- Military and Defense Forces (Army, Navy, Air Force)

- Homeland Security and Specialized Government Agencies (Niche Market)

Value Chain Analysis For Laser Warning System Market

The value chain of the Laser Warning System market begins with highly specialized upstream activities centered on the fabrication of mission-critical raw materials and components. This stage involves the procurement of specialized semiconductor materials (like InGaAs, Cadmium Telluride, and Gallium Arsenide) necessary for manufacturing high-performance photodetectors and specialized optical coatings to handle military laser power densities. Upstream suppliers are typically boutique firms or divisions of major defense conglomerates that possess proprietary knowledge in military-grade sensor manufacturing and ruggedization processes. This stage is characterized by low volume but extremely high value due to the stringent quality requirements, technological complexity, and intellectual property associated with military-specification hardware.

The core of the value chain is the midstream activity, dominated by Prime Defense Contractors and Original Equipment Manufacturers (OEMs). These entities integrate the specialized sensors, high-speed processors, and complex system software. Key activities include advanced algorithm development (for threat recognition and localization), system packaging, electromagnetic compatibility (EMC) testing, and rigorous environmental qualification to military standards (MIL-STD). Distribution channels in this market are predominantly direct: LWS solutions are sold directly from the OEM to the defense ministry or are sold as a subsystem integrated into a larger platform (e.g., a new fighter jet or tank) managed by the same prime contractor. Indirect channels are limited, typically involving authorized maintenance, repair, and overhaul (MRO) partners responsible for long-term support and system upgrades globally.

Downstream analysis focuses heavily on deployment, post-sale support, and continuous capability sustainment. Due to the rapid evolution of laser threats, LWS require frequent software and firmware updates throughout the platform’s lifecycle. End-users (defense forces) demand comprehensive training programs, robust field service support, and secure access to system diagnostics and maintenance tools. The financial value generated downstream includes lucrative long-term maintenance contracts, modernization contracts for mid-life upgrades, and recurring revenue from software license renewals incorporating new threat libraries. The defense customer maintains substantial leverage in the downstream segment, often requiring OEMs to transfer specific maintenance technologies and data rights to ensure national self-sufficiency in defense sustainment.

Laser Warning System Market Potential Customers

The primary customer base for Laser Warning Systems is strictly limited to military and defense organizations globally, encompassing the acquisition branches of the Air Force, Army, and Navy. These buyers are characterized by high purchasing power, extremely long procurement cycles, and a non-negotiable requirement for adherence to stringent performance, reliability, and security standards. Potential customers are those nations that possess or are actively acquiring sophisticated military platforms such as modern tactical fighter aircraft, state-of-the-art Main Battle Tanks (MBTs), or high-value naval assets like destroyers and frigates, as LWS are essential components of the survivability suite for these platforms.

Geographically, the most significant potential customers are found in established defense markets: the US Department of Defense (DoD), NATO member nations, and key Western allies. These customers drive demand through their continuous modernization programs, seeking to replace older analog LWS with advanced digital, multi-spectral systems. Simultaneously, emerging high-growth customers are concentrated in the Asia Pacific region, notably India, Japan, South Korea, and Australia, where massive capital investments are being made to establish regional air and sea superiority. These nations are focused on acquiring platforms equipped with the latest integrated EW suites, thereby creating high volume opportunities for LWS vendors.

Furthermore, specialized governmental agencies involved in sensitive operations, such as special forces units or critical infrastructure protection agencies operating in high-threat environments, represent niche but high-value buyers. Their requirements often focus on ultra-low SWaP systems suitable for rapid deployment on small, non-traditional platforms. All potential customers share the fundamental need for systems that offer maximum probability of detection (Pd) and minimum false alarm rates (FAR), translating operational necessity into a high willingness to pay for validated, high-performance technology capable of autonomous operation in contested electronic environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 9.3 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Northrop Grumman, Lockheed Martin, BAE Systems, Leonardo S.p.A., Saab AB, Elbit Systems Ltd., L3Harris Technologies, Thales Group, Raytheon Technologies (RTX), Rheinmetall AG, Diehl Defence, CACI International, Aselsan A.S., Mynaric AG, Rafael Advanced Defense Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Warning System Market Key Technology Landscape

The modern Laser Warning System (LWS) technology landscape is dominated by the requirement for ultra-fast, multi-spectral detection coupled with advanced computational intelligence. A key technological cornerstone is the deployment of sophisticated Wide Field-of-View (WFOV) sensors strategically distributed around the platform to provide hemispherical or full spherical coverage. These sensors often employ specialized photodetector materials—such as high-speed silicon avalanche photodiodes (APDs) for the visible and near-infrared bands, and Indium Gallium Arsenide (InGaAs) detectors for the extended short-wave infrared spectrum—to ensure comprehensive detection across all wavelengths utilized by military lasers (e.g., 1.06 µm, 1.54 µm). The challenge lies in minimizing sensor size while maximizing the light-gathering capability and spectral purity.

Central to system functionality is the utilization of ultra-high-speed signal processing hardware. Modern LWS rely heavily on state-of-the-art Field-Programmable Gate Arrays (FPGAs) and specialized Digital Signal Processors (DSPs) optimized for parallel computation. These processors must execute complex threat classification algorithms, including pulse-width analysis, pulse repetition frequency (PRF) decoding, and spectral signature matching, all within microseconds to ensure a timely response. The integration of high-bandwidth fiber optic interconnects allows for rapid data transfer from multiple remote sensor heads to the central processing unit without compromising signal integrity or introducing latency, which is non-negotiable in time-critical countermeasure deployment scenarios. Furthermore, the adoption of open system architectures (OSA) based on commercial standards is becoming critical, allowing for seamless hardware and software integration and faster upgrade cycles.

Emerging technology trends are driving the convergence of LWS with other electro-optical systems. For instance, LWS are increasingly being integrated into Distributed Aperture Systems (DAS) found on advanced tactical aircraft, utilizing the same fused sensor inputs for both visual situational awareness and threat warning. Furthermore, research focuses on passive ranging techniques, such as triangulation or advanced photometric analysis, which allow the LWS to estimate the distance to the laser threat without requiring an active emitter, enhancing tactical decision-making without revealing the platform's presence. Finally, the incorporation of AI/machine learning remains a high priority, enabling the creation of cognitive LWS systems that adapt their detection thresholds and classification protocols based on real-time battlefield data and historical engagement archives, ensuring superior performance against increasingly agile and modulated laser threats.

Regional Highlights

- North America, specifically the United States, represents the market leader due to sustained, substantial defense spending and a powerful industrial base comprising major defense primes. This region is characterized by high demand for cutting-edge, integrated LWS solutions for next-generation platforms and mandates continuous upgrades for legacy air and ground assets, driving innovation in AI-enhanced detection and low SWaP solutions.

- Europe maintains a significant market presence, driven by geopolitical concerns on its eastern flank and cooperative defense programs, such as those within NATO. European nations prioritize the development of LWS that ensure interoperability and standardization across allied forces, with heavy investment directed towards protecting helicopters, transport aircraft, and armored convoys deployed in high-threat environments.

- Asia Pacific (APAC) is recognized as the fastest-growing region globally, primarily fueled by the rapid expansion and technological modernization of military capabilities in large economies like China, India, and South Korea. Increased maritime and territorial disputes necessitate the procurement of large volumes of modern aircraft and naval vessels, all requiring advanced, localized LWS technology, often procured through Foreign Military Sales (FMS) or domestic production initiatives.

- The Middle East and Africa (MEA) region constitutes a crucial market segment where procurement is driven by immediate, acute threats, particularly the persistent use of MANPADS and laser-guided Anti-Tank Missiles in regional conflicts. High demand is seen in countries like Saudi Arabia, UAE, and Israel for proven, highly reliable LWS solutions integrated with advanced countermeasure systems to ensure asset protection in ongoing volatile scenarios.

- Latin America currently holds the smallest market share, with defense spending generally focused on internal security and maritime patrol rather than high-end conventional warfare systems. LWS procurements in this region are primarily targeted at selective upgrades to existing naval assets and high-value transport aircraft involved in peacekeeping or counter-narcotics missions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Warning System Market.- Northrop Grumman Corporation

- Lockheed Martin Corporation

- BAE Systems plc

- Leonardo S.p.A.

- Saab AB

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Thales Group

- Raytheon Technologies (RTX Corporation)

- Rheinmetall AG

- Diehl Defence GmbH & Co. KG

- CACI International Inc

- Aselsan A.S.

- Rafael Advanced Defense Systems Ltd.

- Hensoldt AG

- Textron Inc.

- Chemring Group PLC

- Israel Aerospace Industries (IAI)

- Kongsberg Gruppen

- Terma A/S

Frequently Asked Questions

Analyze common user questions about the Laser Warning System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Laser Warning System (LWS) in modern defense?

The primary function of an LWS is to instantly detect, classify, and localize hostile laser sources (such as rangefinders or designators) targeting a military platform, providing immediate auditory and visual alerts to the crew and cueing countermeasure systems for rapid deployment, thereby maximizing platform survivability.

Which platform segment holds the largest share in the LWS market?

The Airborne platform segment, covering fixed-wing tactical aircraft, fighters, and rotary-wing helicopters, currently holds the largest market share due to the immense strategic and financial value of these assets and the critical need for protection against laser-guided air defense systems.

How is Artificial Intelligence (AI) influencing LWS technology?

AI, specifically machine learning algorithms, enhances LWS performance by improving spectral data processing, enabling faster and more accurate threat classification, significantly reducing false alarm rates (FARs), and optimizing autonomous countermeasure deployment based on threat assessment.

What are the key technological challenges currently faced by LWS manufacturers?

Key challenges include achieving wide spectral coverage and high sensitivity across all relevant laser wavelengths, ensuring real-time processing capabilities to counter high-speed threats, integrating LWS seamlessly with DIRCM systems, and maintaining low Size, Weight, and Power (SWaP) consumption.

Which region is expected to exhibit the fastest growth in the LWS market?

The Asia Pacific (APAC) region is projected to register the fastest market growth, driven by substantial military modernization efforts, escalating regional geopolitical tensions, and large-scale procurement of new combat platforms requiring integrated electronic warfare and survivability systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laser Warning System Market Statistics 2025 Analysis By Application (Ground Force, Maritime Force, Air Force), By Type (Spectral Recognition LWS, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Laser Warning System Market Statistics 2025 Analysis By Application (Ground Force, Maritime Force, Air Force), By Type (Passive Laser Warning System, Active Laser Warning System), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Spectral Recognition Laser Warning System Market Statistics 2025 Analysis By Application (Air Force, Maritime Force, Ground Force), By Type (Laser Warning Receiver, Laser Warning Transmitter), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager